Thus, drawing up a promissory note is legal when transferring a car and other movable or immovable property to another person. Moreover, a correctly drawn up receipt essentially constitutes an agreement.

The main purpose of the receipt (only if drawn up correctly) is the possibility of returning the debt with the help of the court when the debtor has not returned it within the specified period or refuses to do so at all.

Types and features of promissory notes

It is common among citizens to confirm their obligations with a receipt. Moreover, this concerns not only money, this includes the absence of claims, as well as the receipt of documents.

Debt receipts are conventionally divided into several types. For this, different criteria are used, which can serve as.

By transfer object:

- Monetary - if the amount, in accordance with the amendments to the Federal Law dated July 26, 2017 N 212-FZ, Article 808, paragraph 1., exceeds no less than 10 times the minimum amount of remuneration fixed by law (for individuals).

- Property - transfer of valuables or valuable property on debt.

Depending on the availability of payment for the loan application:

- Interest - the lender has the right to receive interest from the debtor in the order and amount determined by the agreement (Federal Law of July 26, 2017, Article 809, paragraph 1.);

- Interest-free - Federal Law dated July 26, 2017 N 212 art. 809 clause 3: the loan agreement will be without interest rate, unless it expressly states otherwise.

By return date:

- Urgent.

- According to the creditor.

By purpose:

- For child support due to one of the parents living with the child.

- To receive valuable documents or papers.

- Debt - about the transfer of a specific amount of money that must be returned within a specified period.

The most common type is a promissory note. It is drawn up in one copy and left to the creditor.

If the loan is provided for a short time (urgent), the repayment date is indicated in the promissory note. It is envisaged to formulate conditions for the repayment of the debt - in parts with the frequency specified in the contract.

In the case of issuing a loan in cash equivalent to a legal entity in accordance with Federal Law dated July 26, 2017 N 212-FZ Art. 809 paragraph 1., the debtor’s receipt is a mandatory condition, regardless of the amount.

Why and in what cases is it used?

A receipt is a universal way to simply and quickly record a legal fact. It is used, if necessary, not in words, but on paper to state that goods, money have been transferred, services have been provided, or debts have been repaid.

The specified document is drawn up in the following cases:

- when receiving money;

- refusal to make claims;

- confirmation of paid debt;

- for opening and developing a business;

- as evidence of the transfer and receipt of money or other item.

The presented list is not exhaustive; the legislation does not limit the right to draw up a receipt in any situation. Therefore, there is a wide variety of situations when it is appropriate to enter into a written agreement.

The receipt is actively used as evidence in legal proceedings. Sometimes the court refuses to consider the receipt as significant evidence. Such cases occur when the form is filled out incorrectly; it happens that the persons who compiled the sample receipt do not indicate their names, do not leave a signature, make mistakes when describing the subject of the receipt, or do not indicate the amount of money or its currency.

In order to earn income, citizens borrow money at interest. The Civil Code of the Russian Federation provides the opportunity for the lender to receive a refund of the amount with accrued interest. The parties can independently, of their own free will, choose the amount of interest, the period and procedure for their calculation.

Writing at a minimum will help at least return the principal amount of money; the interest calculated on the use of funds is a more nuanced issue, unlike the actual amount of the loan.

Correct promissory note. Compilation requirements

The need for documentary evidence is noted in the Civil Code of the Russian Federation, Art. 808 “Form of loan agreement.” Paragraph 2 states that confirmation of the borrower's obligations may be a receipt or other document confirming the transfer of the loan.

The fact that the document is drawn up in writing is indicated in the first paragraph of Article 808 of the Civil Code of the Russian Federation. This is the main feature of a debt obligation.

The basic rules for drawing up a document when a borrower receives a loan include the following requirements:

- compliance with the receipt form;

- reliable data that can be identified, passports are important;

- the amount of debt, which implies not only the accuracy of the numbers, but also the currency;

- the document must indicate that the document is confirmation of the loan agreement;

- the receipt may include information about the intended purpose of using the money (amendments to the Federal Law dated July 26, 2017, Article 814 of the Civil Code of the Russian Federation);

- it is advisable to provide for interest, but it is not recommended to overestimate it so that the court does not recognize the transaction as enslaving;

- the date of return will speed up the return of funds to the creditor, although the period may not be indicated (clause 1 of Article 810 of the Civil Code of the Russian Federation).

Correct IOU and witnesses

In relation to term loans, the date is a mandatory point. If it is not indicated, the money must be returned within 30 calendar days from the date of the lender’s request.

When a debt agreement is drawn up, witnesses may be present. This is not a mandatory rule, but is highly recommended. The number of witnesses from two people who also sign the document. Such circumstances will be beneficial for both parties to the transaction.

Legal validity of the receipt

Any receipt has legal force. Based on Art. 807.808, 434 of the Civil Code of the Russian Federation, the receipt can be considered a loan agreement. The legislation allows for the preparation of such a document in any form, including in writing, in the form of a promissory note. In order to serve as evidence of the rights of the lender, the document must be correctly executed and contain the circumstances of the transfer of money or valuables to the borrower, as well as the fact of their receipt by the debtor. After repaying the loan, the lender also gives the borrower a receipt for the repayment of funds.

Advice from Sravni.ru: If the debtor does not return the money or property, before filing a claim in court, it is worth sending the borrower a claim in which you need to substantiate your demands. This often helps resolve the issue out of court.

Contents of the receipt

A promissory note between individuals acts as a kind of confirmation of an agreement to borrow money. Provided it is properly maintained, it is valid. Using such a document in court will help you get your money back.

The form of the promissory note is written (Article 808 of the Civil Code of the Russian Federation), and includes the following mandatory items:

- From above by .

- The locality where the loan transfer will take place.

- The date of signing the agreement and receiving the loan is “DD-MM-YYYY”.

- Full name of the person who is the borrower and the lender. Abbreviations are prohibited so that passport data can be verified.

- Details – address, telephone/mobile numbers and other similar information.

- The exact loan amount including kopecks; it is recommended to duplicate the numbers in words.

- At the end, the obligatory point is the borrower’s signature. It must correspond to its true appearance under normal conditions.

When drawing up a document, it is important to check the data with your passport for errors. At the request of both parties, two additional conditions can be included:

- The repayment period for the borrowed money and the payment procedure - the entire amount at once or in installments with a certain frequency. The return date must be specific – “DD-MM-YYYY”. Such requirements are typical for urgent promissory notes. (Clause 1 of Article 810 of the Civil Code of the Russian Federation).

- The interest rate for the use of money, the monthly interest rate is practiced. Another option for calculating interest is also possible. You should also indicate a fine in case of late payments or violation of the terms of repayment of the loan (clauses 1, 2 of Article 809 of the Civil Code of the Russian Federation).

The terms of registration can be chosen by one of the parties. The legislation does not provide for requirements for drawing up a receipt. Such an agreement requires the mutual consent of both parties to the contract.

At the time of signing the contract, it is necessary to think about how the lender will receive the money after the loan expires.

Civil legislation art. 810 paragraph 3 provides that the loan amount is considered repaid when it is transferred to the creditor or credited to his bank account. Documentary proof of receipt should also be drawn up so that the borrower, if necessary, can prove the fact of return.

Who writes the receipt?

It is considered legally correct for the recipient of the money to draw up a receipt and write the entire text of the document in his own hand.

It is possible to transfer cash to a representative if he is vested with such powers in accordance with the power of attorney. For example, the owner sells a residential building through a trustee. The document must include powers not only for sales and representation in the Rosreestr body, but also for receiving money. Only then does he have the right to take funds from the buyer and issue him a receipt on his behalf. The receipt contains the details of the authorized person and the details of the power of attorney.

Do I need to have the receipt certified by a notary?

Notarization is not mandatory, since a receipt in handwritten form already has legal force, which is confirmed by Art. 808 of the Civil Code of the Russian Federation. A correct promissory note certified by a notary also has many advantages:

- The document will be checked for legality.

- It serves as strong evidence for the court.

- The notary will immediately confirm the identity of the borrower.

However, do not forget that such services are paid. This factor is often the reason for refusing the notary's intervention. You can judge its necessity by how serious the deal is. Notarization is a voluntary decision of the parties to the agreement.

Article 163 of the Civil Code of the Russian Federation, clause 2, provides for mandatory notarization of transactions in two cases:

- If required by law.

- When both parties express such an intention.

However, there are no such obligations in relation to the receipt. And yet Art. 163 of the Civil Code of the Russian Federation obliges contracts to be certified. If you want to protect yourself, you need to draw up a loan agreement, where this document will be part of the agreement. Thus, the document will be notarized.

Do you need a notary?

To answer this question, you will need to figure out in what situations it is really needed and how it will help. The notary helps to certify the transaction; during certification, compliance with the written text and legal norms is checked.

Before signing, each party provides an identification document, the notary identifies the person, superficially assesses the legal capacity and sanity of the person, each citizen explains that he understands all the conditions. These measures provide additional guarantees of the inviolability of the receipt; the possibility of challenging the validity of the document is reduced to a minimum.

The feasibility of notarization with a small monetary turnover is significantly reduced. Certification services are paid, there is no obligation to certify a receipt, a document drawn up in writing and signed by the parties is already legally significant. All of the above pushes aside the need for certification and indicates that there is no need to contact a notary.

In the case where the transaction amount includes a lot of money, contacting a notary is justified. Having a notary's certification is a good way to get additional guarantees that the money will be returned and the terms of the promissory note will be met.

Correct promissory note certified by a notary

Obtaining a loan may also require notarization, which is provided for in Art. 160 Civil Code of the Russian Federation. Paragraph 3 of this article states that it is necessary to certify the promissory note by a notary if a trusted person signs instead of the borrower.

In this case, the conditions for using proxies should be taken into account:

- physical disabilities that do not allow you to sign a receipt with your own hand;

- illness;

- illiteracy of the borrower.

The signature of the authorized representative must be certified by a notary or another person having similar authority.

In addition, the law provides for two cases when notarization is necessary:

- A joint decision between the lender and the borrower.

- When the loan amount is ten times the minimum wage, notarization will be a good reason for legal action if the borrower does not comply with the terms of the agreement. (Federal Law dated June 19, 2000 N 82-FZ).

A certified document inspires more confidence, which encourages you to use the services of a notary.

How to transfer money correctly?

Lending is always a risk. And here you will never guess: both friends and relatives - everyone can change in an instant and go into denial. To protect yourself from non-returns, keep the following guidelines in mind:

- Always check the borrower’s passport: look at the photo. Check the data in the Ministry of Internal Affairs databases;

- Please write the receipt by hand. This is important because graphical expertise may be required in the future;

- Do not forget to familiarize the debtor with the rules for issuing promissory notes;

- Take the original promissory note for yourself;

- Remember that you cannot take any documents as collateral. This will result in criminal liability.

Remember that the terms of the promissory note are dictated by the lender. It is he who must determine the date of return of the money and the interest rate. If you do not specify the deadline for repaying the debt, it will be considered indefinite - in order to hurry the borrower, you will need to send notifications. If you do not indicate the percentage for using money, then in the future you will be able to count on the rate of the Central Bank of the Russian Federation. And this is not profitable.

Correct promissory note for receipt of money, not certified

The promissory note is written directly by the borrower. It will be valid if the requirements of Art. 808 of the Civil Code of the Russian Federation.

Provide reliable passport data and details if you have a passport. The date is in full format, since the document is valid for three years. Amount in written and Arabic format.

Penalties should be provided for in case of failure to comply with the conditions on the part of the borrower. Only if all conditions are met when writing the document, it comes into legal force.

A promissory note for the transfer of property, in particular a car, for temporary use is drawn up in approximately the same way. Be sure to indicate all the data on the car available in the passport and indicate its estimated value. The last mandatory condition. This is the only way a correctly drawn up promissory note will be valid in court.

Drawing up a receipt with the participation of witnesses

Witnesses during registration are a fairly common occurrence in practice. According to the legislation of the Russian Federation, the presence of witnesses is not a mandatory requirement. Therefore, even if they involve third parties, they will not be able to certify the transfer of money.

But if difficulties arise with paying money and going to court, the testimony and confirmation of such witnesses will greatly simplify the matter.

Third parties will help confirm additional circumstances related to the transfer of a certain amount - by whom it was drawn up, whether the debtor was forced to draw up a receipt, etc.

If notarization is expensive, bringing in witnesses will not take much time or effort. Therefore, it is recommended to use this method when issuing a receipt.

back to menu ↑

Presence of witnesses when drawing up a promissory note

The legislation of the Russian Federation does not oblige the involvement of witnesses to draw up a loan agreement - a promissory note. Their involvement is a voluntary desire of the borrower or lender. As a result of litigation, these individuals may become a key factor in resolving the dispute.

The recommended number of witnesses involved is two or more people. Their signature would be a welcome addition. In court, such persons can confirm the fact of transfer of the loan and clarify the circumstances of the transaction.

To avoid the use of perjury in court, the creditor has the right to require that the data of witnesses and their signatures be included in the document. Thus, a correct promissory note will protect you from wrongful accusations.

What if the debtor is not going to repay me?

A receipt is a document that implies the repayment of a monetary debt by a certain date. It confirms the fact of transfer of funds. If the debtor refuses to voluntarily fulfill his obligations, this piece of paper will help defend his rights in court. The most important thing is that the receipt is drawn up correctly. With this agreement, you will be able to file a claim that will help restore justice.

Keep in mind that a receipt is enough to protect yourself in court. It confirms the existence of a monetary debt. The creditor will only need to pay a fee, which he can apply to a higher authority. They will start a trial there. The bailiffs will study the case and schedule a trial. Usually the debtor immediately admits the debt and explains why he cannot pay his obligations on time. The fact of the loan is recognized if he does not appear in court within 1-2 months.

But there are situations when debtors try to deny the fact of transfer of money. He disputes the receipt and points out that there was no transfer of money. This is especially easy to prove if errors were made in the receipt: the date, amount, percentage, and borrower’s information were incorrectly written. The presence of such an error may cause the document to be canceled - the legal process will drag on for a long time. A graphical examination will be required to prepare evidence. Witnesses may be required who can confirm the transfer of money.

Keep in mind that a positive outcome of the trial does not mean a refund. Very rarely do debtors pay off their debts quickly. Lenders have to turn to bailiffs: they describe the property, write off funds from the account, and withhold from salaries. You can submit a writ of execution to the borrower’s place of work or to the bank. It is best to contact the FSSP: employees will not only withhold payments from your salary, but will also create a ban on traveling abroad and, if necessary, put the debtor on the wanted list.

Mistakes made when drawing up debt receipts

Competent writing is the key point of composition. At the same time, many make mistakes, as a result of which the document may be declared invalid (enslaving).

The most common mistakes in an incorrect promissory note:

- There is not enough information about the debtor. This happens when no attention is paid to passport data, and there is no identification control on the part of the lender.

- Invalid form. Article 808 of the Civil Code of the Russian Federation - the handwritten form has legal force. The court may well not recognize what was typed on a computer as evidence.

- There is no deadline for repayment of debt.

- Incorrect description of the goal or its absence as such.

- The loan amount is written only in numbers.

- The phrase “I received the money personally” is missing.

- There are no signatures of witnesses who were present during the signing of the document.

- When a loan is taken out in a foreign currency, it is necessary to indicate the equivalent in rubles, as well as the exchange rate. This is often neglected.

- The legal consequences of late payment or lack thereof as such are not specified.

- For an interest-bearing loan, the agreement must include information about the interest rate.

These factors should be taken into account, as one discrepancy could prevent the lender from getting their own money back.

How to make a receipt correctly?

- The receipt is usually written by hand . If an examination is carried out, it will be possible to identify the debtor's handwriting.

- First you need to create a document name . IN .

- Then the text of the document begins, which, as a rule, is written with the pronoun “I”, where it is noted:

- Full name, place of work, passport details, as well as the actual address of the person who writes the receipt.

- Full name, place of work, passport details, as well as the actual address of the person to whom the receipt is issued.

- What exactly does the contract say? In this part, it is worth very carefully compiling the exact name of material assets, things or the exact amount of cash. Moreover, the amount must be written both in digital form and in words.

- For what purpose is cash or any items provided?

- The period within which it is agreed to return the money, things or securities is indicated.

- The borrower signs as in a passport and indicates his initials.

- The date the receipt was written must be indicated on the left side of the sheet.

- The document is signed by the lender.

- The receipt indicates that the borrower received the funds on the day the agreement was signed.

- It is advisable to have several witnesses or have the receipt certified by a notary. This procedure helps to avoid conflicts.

The receipt is created in two units, and remains with both the lender and the debtor.

What should be included in a receipt for borrowing money?

When borrowing a sum of money, in an agreement that talks about the transfer of money from one person to another, it is necessary to indicate:

- Last name, first name, patronymic of the borrower and lender, their passport details (date of birth, address of registration and actual residence, series, number, date of issue of passport).

- The exact amount of cash transferred, both in figures and in writing.

- Currency of the cash transferred.

- A specific date for repayment of the debt.

- The purpose for which the funds are given. This point is very important. A document that does not contain the purpose of issuing cash will not be the basis for claiming the debt through the court.

- Date of writing the receipt.

- Interest on the use of cash, as well as penalties if the refund period expires. If the loan is without interest, this should be written on the receipt.

What can you get from a receipt?

There are several categories that can be borrowed:

- Cash;

- Securities;

- Material values;

- Things.

Legal force of a correctly drawn up receipt

The possibility of certifying the event of cash transfer from the lender to the borrower is established by law.

In order for a receipt (agreement) to have legal force, it must be drawn up according to the following rules:

- Indicate the passport details of both parties (date of birth, series, number, date of issue, by whom, registration address).

- The exact amount in rubles, in equivalent to hard currency (at the exchange rate of the Central Bank on the day of drawing up the receipt and transfer of cash).

- The amount is entered both in words and in numbers.

- If the loan is issued in a foreign currency, then according to Russian law, monetary obligations must be expressed on paper in rubles.

- Interest is established for the use of cash, otherwise it is accrued in the amount of the bank interest rate. This fact may become disadvantageous for the borrower. The loan can be without interest, this is specified in the contract.

- The receipt must indicate the place and date of the conclusion.

- The receipt states that the borrower receives funds at the time of signing the document. This point will be important if it is necessary to prove the fact of transfer of money in court.

- The term of use of the loan is specified by the lender in the receipt. In the absence of such a period, the money is returned by the debtor within thirty days from the date of the request for the return of the amount of money by the lender.

- According to the Civil Code of the Russian Federation, a person providing money for temporary use has the opportunity to receive profit as interest when transferring it to the borrower. An important feature is that the rate must be no higher than in the Central Bank. Otherwise, the court has the right to challenge the criteria for loaning funds.

- If the prescribed cash return period is overdue, penalties may be imposed in accordance with Russian legislation. Experts advise you to be puzzled and include this item in the agreed conditions. Penalties do not have to be written in the terms of the receipt, but this clause encourages the borrower to repay the debt on time.

- In order to avoid any problems with the debtor, it is better for the lender to clarify that if it is necessary to file an application in court, the claim will be considered at the place of residence of the lender (Article 32 of the Civil Code of the Russian Federation). Otherwise, the claim will be considered at the debtor’s place of residence, which will subsequently entail additional expenses.

- The goal is indicated by agreement of both parties. When specifying a specific direction of funds, the lender has the right to control the use of money, and in case of non-compliance, request an early return of funds.

Why do you need a receipt?

Experts urge you not to forget that a receipt written according to the rules is a document drawn up according to legal standards . Only in this case does he have the authority and can contribute to the return of funds or other valuables in court. The most important thing is that the borrower signs the document. Otherwise, proving that anyone owes you anything will become problematic.

The main thing is not to forget that the receipt is an important agreement that must be kept until the money or things are returned.

Is it worth certifying the receipt?

The receipt can be legally certified by a specialized person. In the Russian Federation this is a notary. This procedure is optional and is a paid service. But in the event of a conflict, a notarized receipt will ensure the return of the money, and if necessary, help return the funds through the court.

Nuances

- There is a receipt option, when cash will be released not when the contract is drawn up, but later. In this case, the transfer of something must be formalized in a separate document or an additional entry must be made in the contract itself.

- If there are witnesses, their passport details are listed (date of birth, series, number, date of issue, by whom, registration address). Witnesses put their signatures on the contract.

- In accordance with Russian legislation, a loan can be interest-free (Article 809 of the Civil Code of the Russian Federation).

- According to Article 808 of the Civil Code of the Russian Federation, a loan agreement between citizens must be concluded on paper in writing.

Among other points, it is also recommended to include the following phrase in the receipt : about the occupier’s understanding of the legal consequences of issuing the receipt and agreement to all the conditions.

- The existence of such a part in the document, which is handwritten by the debtor, in the event of conflicts, will provide the lender with an indication at that time. That the borrower, having taken funds from him on the terms established in the receipt, was aware of the result of his actions.

Suspicious or fake receipt

When drawing up debt agreements, violations often occur. There are unintentional mistakes that a person makes purely mechanically or due to ignorance of the intricacies of the law. However, it happens that a person deliberately falsifies a document in order to avoid paying a debt.

A suspicious, forged receipt is an illegal act, which is very common in civil relationships. Punishment for such actions is provided for by the Criminal Code of the Russian Federation of June 13, 1996 N 63-FZ Art. 303. The culprit may get away with a fine, compulsory labor, correctional labor, or imprisonment for a period decided by a court decision.

To confirm the falsification of a signature or handwriting, an expert examination is used. The petition for an examination is submitted by the plaintiff, it is written in his own hand and paid for by him. If this dispute is won, all costs will be reimbursed in full.

When the examination is powerless or in doubt, the right to question the person acting as the creditor can be used. However, it is necessary to involve a competent lawyer who will professionally identify the shortcomings of the receipt as a result of inconsistencies in the testimony.

If falsification is discovered or if the evidence appears suspicious, a case of fraud must be initiated. This is the right decision if you do not want to become a victim of wrongful accusations.

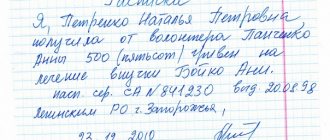

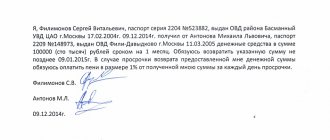

Example of a receipt

A promissory note, an example of which we will look at below, is not notarized. Therefore, the very fact of transfer of funds must be certified by the signatures of at least two witnesses, who at the end must indicate their passport details, full name, registration address and put personal signatures.

RECEIPT

I, Petr Antonovich Frolov, born in 1963, live in the village. Zabugornoye Kanavinsky district (identification number 00000000, passport SI No. 000000, issued by the Kanavinsky RO Department of the Ministry of Internal Affairs on October 15, 1986), I give this receipt to US citizen Phil Jones, born in 1961, a native of Newcastle, that I, Frolov P. A., received a loan from Phil Jones in the amount of 100 (one hundred) US dollars. The loan is interest-free. I undertake to repay the loan in full by March 25, 2013.

Written by hand on May 30, 2011, signature - Frolov P. A.

Attendees:

1. Lazarenko Yuri Viktorovich, living in the village. Zabugornoe, st. Bulyzhnaya, 12. May 30, 2011, signature 2. Drygina Anastasia Arkadyevna, living in the village. Zabugornoe, st. Bulyzhnaya, 14. May 30, 2011, signature

This document can be a clear example of how a promissory note with witnesses is drawn up.

How is the debt on the receipt returned?

Standard activities that lead to partial or full repayment of missed payments by the debtor begin with telephone calls, letters and visits to management. The presented scheme of action is effective when the debt is short-term. In more severe situations, debt collection is carried out through claims proceedings.

Each stage has its own characteristics and takes a certain time. Coordination of actions with government agencies and arbitration judges can be carried out. The main goal of all these activities is to achieve a court decision in favor of the plaintiff.

To do this, the latter submits documents to the court. Having accepted them, the secretary, who is present at the reception along with the judge, and the clerk must sign, indicating the incoming number, and stamp your copy of the claim. The secretary is also required to give you a receipt stating that he received an application from you indicating all the papers you provided. Mediators, in turn, must objectively judge the parties, since they are the ones responsible for ethical and legal standards.

promissory note