Is it possible to give money under a gift agreement?

Money can serve as a gift, since the Civil Code of the Russian Federation (Clause 2, Article 130) regards it as a thing constituting movable property.

When the owner of such property changes, it is not necessary to re-register ownership, i.e. it can be transferred as a gift according to a simplified option. The disinterested transfer of money is prohibited by law only in a limited number of cases (Article 575 of the Civil Code of the Russian Federation). These are situations of donation in the amount of more than 3 thousand rubles, when the gift:

- on behalf of a minor or incapacitated person is made by his representative;

- made to an employee of an educational, medical or social service organization by a person served by such an organization or his relatives;

- intended for a civil servant in connection with his official duties;

- makes a legal entity of a commercial nature to another legal entity also engaged in commerce.

Read about possible options for gratuitous relations between legal entities in the article “What are gratuitous agreements between legal entities?”

Thus, with the above exceptions, donation between individuals, as well as from a legal entity to an individual, has no legislative obstacles. Children have the right to receive gifts from the age of 6, since the Civil Code of the Russian Federation (subclause 2, clause 2, article 28) allows them to participate in transactions that bring gratuitous benefits and do not require notarization or state registration. And children aged 14 to 18 years can become donors themselves, since they have the opportunity to manage personal income (subclause 1, clause 2, article 26 of the Civil Code of the Russian Federation).

Income generated by an individual who is the recipient of donated money is not subject to personal income tax if the donor is:

- by an individual - regardless of the amount of the donated amount (clause 18.1 of Article 217 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated May 16, 2018 No. 03-04-05/32813);

- a legal entity or individual entrepreneur, and the amount donated to them does not exceed 4 thousand rubles. (clause 28 of article 217 of the Tax Code of the Russian Federation).

Amount over 4 thousand rubles. when donated by a legal entity or individual entrepreneur, the recipient-individual will be subject to income tax at a rate of 13% (clause 1 of Article 224 of the Tax Code of the Russian Federation).

For information on organizing gift accounting for such situations, read the material “When to pay personal income tax on gifts?”

Accounting for gifts as expenses

If tax authorities treat the very fact of giving gifts by organizations leniently, since the law does not prohibit such donations, then with the possibility of taking into account the cost of gifts in the expenses of the organization, everything is much more complicated.

The fact is that, in accordance with the current rules, expenses for profit tax purposes are recognized as justified (economically justified) and documented expenses incurred to carry out activities aimed at generating income (Article 252 of the Tax Code of the Russian Federation).

At the same time, the Tax Code of the Russian Federation directly establishes a rule according to which, when determining the tax base for corporate income tax, expenses in the form of gratuitously transferred property and expenses associated with such transfer cannot be taken into account (Clause 16, Article 270 of the Tax Code of the Russian Federation).

Since the giving of gifts is precisely a gratuitous transfer of property, from the position of the inspectors, the costs of purchasing these gifts cannot be included in the tax base for corporate income tax (letter of the Ministry of Finance dated September 18, 2017 No. 03-03-06/1/59819). Moreover, this rule is true not only for OSNO, but also for the simplified tax system.

However, an organization can still, at its own peril and risk, classify gift costs as hospitality, advertising and labor costs. In this case, expenses for gifts must be properly confirmed and justified.

For example, an organization for advertising purposes can present branded souvenirs to its clients, potential buyers and partners.

In order to take into account the cost of such products as part of advertising expenses, the organization must have not only primary documents for the purchase of such products, but also a document confirming that these products were used specifically as part of the advertising event (letter of the Federal Tax Service dated 05/08/2014 No. GD-4- 3/8852).

That is, the organization must prove that the donated souvenirs are given to potential buyers and partners for a reason, namely with the aim of increasing the customer base and, as a result, generating income.

As for gifts given to employees, in order to reduce taxable profit, they must be directly related to the production activities of the employees, and even better, be an integral part of wages.

Moreover, such gifts as incentive payments must be specified in local regulations or in the regulations on bonuses (resolution of the Arbitration Court of the Ural District dated December 17, 2014 No. A50-2698/2014).

But in any case, the organization must be prepared for the fact that it will have to defend its case in court, since tax authorities, as a rule, do not consider the costs of gifts to be economically justified expenses.

If an organization wants to avoid possible additional taxes and litigation with tax authorities, then the presentation of gifts should be made at the expense of net profit. That is, after paying tax and without taking into account the cost of gifts as expenses.

Money donation agreement - sample and nuances of application

When transferring money free of charge, you can do without drawing up a donation agreement for funds (clause 1 of Article 574 of the Civil Code of the Russian Federation), the obligation to draw up which arises only in two situations (clause 2 of Article 574 of the Civil Code of the Russian Federation):

- the gift is made by a legal entity, and its amount exceeds 3 thousand rubles;

- the donation occurs with a delay in time (after a certain period has passed after the execution of the contract).

Based on this rule, an agreement for the gift of funds between individuals, implying the transfer of money immediately, need not be concluded in writing. A verbal agreement will be sufficient. A gift agreement concluded in writing can be notarized, but this action is not mandatory. Hiring a notary will require payment of a state fee for his actions.

There is a situation where it is better to make an agreement in writing, especially if we are talking about a large amount. This is the case of a gift to a person in a registered marriage. The absence of an agreement in which a specific recipient of the gift is indicated gives grounds to consider the amount received as a gift by one of the spouses as jointly acquired property. The last circumstance will play a role:

- when purchasing common property of the spouses with this money and its subsequent division;

- transfer by the spouse who received the money as a gift to someone else as a gift.

Can an agreement for a targeted donation of funds be concluded, i.e., for the purchase of any specific property? There is no prohibition on establishing such a condition in the current legislation. However, in reality, problems usually arise in connection with proving the fact that the money that was donated was spent on the acquisition of the property specified in the contract. Therefore, in such situations, it is better for the donor to purchase this property himself and make it the subject of a gift.

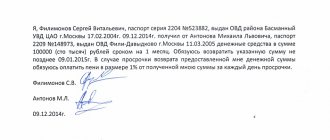

The text of the donation agreement must include:

- Information about the donor and recipient. For an individual, you will need to indicate here: Full name;

- date of birth;

- passport details;

- location.

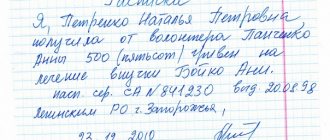

The very fact of transfer of money is formalized by an act signed by the parties to the agreement and witnesses to this event, or by a receipt.

A sample donation agreement is available for download on our website.

To learn how you can forgive an employee’s loan debt through a gift, read the article “Loan forgiveness agreement with an employee—sample.”

Does an employer need to withhold personal income tax if he gives an employee money and a gift agreement has been concluded? Find out the answer to this question in the Ready-made solution from ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

When does a deed of gift become legally valid?

For a gift deed to become an official document, it must be registered. You can do this in two ways:

- Have the donation agreement certified by a notary;

- Register with Rosreestr;

Read about registering a deed of land in Rosreestr here.

Read about whether it is possible to do without a notary and Rosreestr in the next section.

Possible actions with a cash donation agreement

An agreement drawn up in writing obliges the donor to fulfill it (Clause 2 of Article 572 of the Civil Code of the Russian Federation). However, in relation to the contract of donation of funds, termination is possible on the initiative of:

- The donee (Article 573 of the Civil Code of the Russian Federation), who has the right to refuse the gift before receiving it. If there is a written contract, he will have to do it in writing. The donor has the right to demand compensation for damage from such an act.

- The donor (Article 577 of the Civil Code of the Russian Federation), if, due to changed circumstances, the execution of the contract will significantly worsen his standard of living or if the donee has committed actions against him or his loved ones that threaten life or health. In this case, the donee has no right to claim compensation for losses.

Cancellation of the contract may result (Article 578 of the Civil Code of the Russian Federation):

- intentional deprivation of life of the donor through the fault of the donee;

- bankruptcy of the donor-legal entity or individual entrepreneur, if funds intended for business activities were used for the gift, and the donation occurred within six months before bankruptcy;

- death of the donee that occurred before the death of the donor.

The gift agreement can provide for the inheritance of the rights of the donee and the absence of the obligation of the donor's heirs to fulfill the promise of the gift. Without such reservations, the heirs of the donee have no right to claim the gift, and the heirs of the donor will have to make the donation (Article 581 of the Civil Code of the Russian Federation).

Which relatives are considered close?

To date, legislative norms have not established a single concept of what “close relatives” are.

According to the Family Code (FC) of the Russian Federation, the term “close relatives” is defined in Art. 14 of the RF IC, where it is determined that the list of immediate relatives can include:

- Father, mother and their children.

- Grandparents and grandchildren.

- Brothers and sisters.

- According to Art. 137 of the RF IC, close relatives also include adoptive parents and relatives of adoptive parents.

According to the Civil Code of the Russian Federation in Ch. 63 of the Civil Code of the Russian Federation establishes a list of relatives who have the right to the inheritance of the deceased in the absence of a will. In this legislative act, the order of inheritance is based on blood ties and marriage ties. So, in Art. 1142 of the Civil Code of the Russian Federation stipulates that the heirs of the first priority are spouses, parents and children. That is, according to the Civil Code of the Russian Federation, close relatives are precisely the listed categories of persons.

Who can you give money to in 2021?

As noted above, the DDDS can be drawn up orally or in writing, where the donor undertakes to give the recipient money.

At the same time, the legislative norms do not indicate who is allowed to donate funds. Therefore, you can give money to anyone:

- To parents.

- Spouse to wife.

- Minor children, including grandchildren.

- Sisters or brothers.

- To unauthorized persons.

Legislative norms do not establish any restrictions in this regard, since finances are considered the personal property of individuals. The main feature of this agreement is the voluntary nature of the transaction. At the same time, a transaction between individuals and legal entities is possible. persons, regardless of the status of the donor or recipient.

It should be borne in mind that:

- Agreements with children over 14 years old are carried out with their participation, but with the permission of their parents.

- If the child is under 14 years of age, a deed of gift is drawn up with one of the adults acting as the child’s trustee.

There are no restrictions on the amount of funds – you can donate millions of rubles. However, at the same time, it is required to certify their origin, which proves the legal acquisition of such funds by the donor.

At the same time, donation is prohibited to the following categories of persons:

- To employees of departments related to education, social security, medicine and other similar structures - from persons who are in the listed departments for treatment, maintenance, training or other services.

- Employees of government agencies and or municipal departments, banks, if the agreement is relevant to their official duties.

- Between commercial enterprises.

Note. Gifts of up to 3,000 rubles to civil servants or bank employees are allowed at official events. For larger amounts, the deed of gift is considered the property of government departments, with registration of their ownership under a deed.

Results

Money can become the subject of a gift.

Gifts between commercial organizations in the amount of over 3 thousand rubles. are prohibited. For large amounts, donations usually occur either between individuals or from legal entity to individual. In the first case, a written contract may not be drawn up (the exception is the situation of deferred execution of the contract), and in the second it is mandatory if the amount of the gift exceeds 3 thousand rubles. The contract can be terminated at the initiative of the donee (if he did not manage to receive the gift) or the donor (if the fulfillment of the contract leads to a deterioration in his living conditions, or the donee committed an act towards the donor or his relatives that results in a threat to life or health). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reasons for compilation

There may be several reasons:

- Such an agreement is most often drawn up in a situation where parents want to make such a serious gift to their child specifically for the purchase of their own apartment. Naturally, none of the parents would want their children (thanks to the substantial amount of money they now have) to be involved in some risky enterprise. An agreement makes it possible to protect them from rash actions and the temptation to spend money on something else. After all, it can clearly state the purposes for which the money should be spent.

- Another important reason that worries many parents is how to protect the property of their child (married) after a divorce, if such a situation suddenly arises. Indeed, thanks to a targeted donation, which is documented, one of the spouses disposes of the apartment purchased (with this money) absolutely independently. He can sell it, donate it or rent it out, the permission of the second spouse is not required for this. In the event of a divorce, an apartment purchased with money received under a trust deed of gift will not be divided.