The transfer of cash from one person to another must be accompanied by the preparation of a special receipt. Most often, this document is used in relations between individuals, but sometimes it can also be used between ordinary citizens and organizations (for example, when it comes to banks or microfinance companies).

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

Basic terms and definitions

A receipt for borrowed money is a personal document that is needed to protect the rights of both parties.

Debt documents are allowed to be used in situations where the parties to the transaction are:

- Only individuals.

- One individual and one legal entity between whom the transfer takes place.

Each case has its own characteristics associated with filling out promissory notes. But the legislation has not yet established a single, unified form of the document. Therefore, it is permissible to simply fill it out in free form.

Typically receipts are small pieces of paper. They contain the main positions relating to debt at a particular point in time. The more nuances are described, the greater the likelihood of a problem-free transaction.

Document contents and features

The promissory note has a wide scope of application. It is used not only when transferring money, but also when it comes to goods and other types of material assets. Therefore, you need to take care of the availability of your personal data.

It’s just that in the case of money, this type of documentary support is used most often. After all, drawing up a standard loan agreement takes a lot of effort and time. Both parties require certain knowledge and skills. Or monetary costs for the services of experienced lawyers. They can be specified separately.

But receipts for the transfer of funds are a simple way to manage finances. And the document has properties in legal terms. For example, they allow you to go to court and prove that the debt has not been paid. If the information provided is true.

The creditor may sell the IOUs to debt collectors if the other party is in serious delinquency. In this case, the penalties will be more severe than those of banks. Even if you indicate that the money is used to solve serious material problems.

MFOs and banks often charge penalties in this case. And private creditors have the right to make demands for early return of funds. For example, he may require payment for a maximum of one month. Otherwise, the case will end in court hearings, and then there will be forced collection of debts. The return conditions allow this.

The main purpose of the receipt is to confirm that the loan transaction has been completed. It serves as a kind of report between the lender and the borrower. That is why the residential address is indicated.

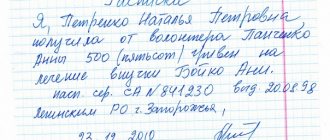

Example of a receipt

Our services and prices

Free consultation

0 ₽

- You talk about your problem, ask questions;

- The lawyer clarifies the necessary information, analyzes the situation, tells options for the development of events;

- Together you choose a profitable option - bankruptcy, refinancing, just a complaint against debt collectors or a bank;

- The lawyer tells you how to prepare, where to get documents, and what to do in your case.

Read more

Out-of-court bankruptcy in MFC on a turnkey basis

25 000 ₽

- Verification and recording of debts and proceedings in the FSSP, assessment of property and contestability of transactions for 3 years

- Drawing up an application and list of creditors

- Filing a bankruptcy application to the MFC by proxy

- Working with banks and collectors - notification of refusal to cooperate, complaints to the prosecutor's office and the FSSP in case of violations

- Representation of interests by a lawyer in case of objections from creditors

- Six months later, you receive a decision from the MFC to declare you bankrupt and write off your debts.

Read more

Turnkey bankruptcy of an individual

from 8,000 ₽/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

More details

Types of receipts

Specific types are not established by law; they can only be determined in practice, when money is borrowed against a receipt.

Documents are:

- Subject, with and without interest.

- Pointless, on bail.

Both versions of the debt obligation have legal force, although they do not have official status.

The types of debt guarantees to another person also depend on who exactly is involved in drawing up the documents. And what are the conditions - with a monthly payment, without interest, and so on.

What is a receipt and why document it?

A receipt is a document whose purpose is to record the fact of a transaction to provide funds from one party to another. With the condition that the funds in question are loaned and must be returned by a certain point. The document may also indicate other conditions for transferring money, not as a loan, but on other grounds.

It is not always possible to draw up a document as a means of repaying a debt. Typically, a receipt is required if the monetary debt is over a thousand rubles. It is in the paper in question that it is necessary to indicate exactly what amount is transferred from one party to the other. The receipt also indicates the conditions under which the monetary debt is formed, that is, when the funds must be repaid.

This document is necessary if disagreements arise between the parties regarding the timing of repayment and the amount of the debt. To resolve the conflict correctly, it is enough to read the contents of the paper. If you cannot resolve the disagreement on your own, you can go to court with a receipt, which will carefully study the document and, on its basis, find a solution to the conflict situation.

Sometimes you can do without drawing up a receipt, since the document in question is optional . But still, for your own safety, if you have to go to court to get your money back, having such a document significantly speeds up and simplifies the procedure. If there is no receipt, it is very difficult to officially prove the fact of the debt, as well as its size and terms of the agreement.

If the debt is small and there is confidence in the integrity of both parties, the receipt can be drawn up using a simplified template. But if there is any doubt that the transfer of funds has been completed, the document certifying the receipt of money should be additionally supported by the services of a notary and the testimony of witnesses. This is especially true for situations where the transferred amount of money is large.

How to write correctly?

Lending money is a very risky step. Trust is the main thing. Only if you draw up an agreement correctly will you be able to count on a peaceful resolution of issues.

Each following paragraph must be written:

- Complete information regarding the person who is the debtor. This applies to full name and other similar data from the identification document. If available, a list of contact telephone numbers and addresses should be provided.

- Applicant's passport details. They are formatted without abbreviations.

- Why do they deal with a document confirming a transaction? Debt amounts are indicated both in words and as a combination of numbers.

- Indication of the date when the money was actually received by the borrower, with or without the participation of a notary.

- It is also necessary to formalize the date when the money should be returned, depending on the agreement with the other party.

- The debtor needs to write for what purposes the amounts in the amount of this or that assistance are taken.

- If the debtor's signature is missing, the document will not be considered valid. The signature in the passport and here are the same. Mandatory requirements for drafting are decoding of the signature.

- A prerequisite is the presence of witnesses. Their passport details along with telephone numbers are also indicated. The document ends with the signatures of witnesses.

Are witnesses needed?

Witnesses are not required to be present when the money is transferred and when the receipt is written. Their presence is an initiative of one of the parties. However, if the lender-borrower relationship progresses to litigation, witness testimony will become an important element of support.

If the lender decides to involve witnesses in the financial transaction, then only uninterested adults can act in their role. Personal data of witnesses (full name, passport data, actual residence address) are written down in the text of the document.

The receipt is signed by witnesses (in this case they act as persons who certify the transaction).

By hand

The requirements are the same as when following the general rules. It is important that the debt against receipt is drawn up with the data of each party. Only under such circumstances will the document be valid. Notarization is not required.

But it is permissible to carry out the procedure if both parties to the transaction agree with such a requirement. Then the written document is sent to a specialist. If a dispute arises with the citizen who wrote, a special handwriting examination is carried out.

Write all important information regarding the parties and the amount of money itself. Otherwise, it will not be able to become evidence in court proceedings. The form of writing does not matter.

Sample handwritten receipt

What to do if the debtor refuses to pay money

There are cases when the borrower, due to circumstances or his own reluctance, refuses to return the funds. In this situation, the lender has the right to go to court.

You must provide the court with a statement of claim, a passport or other document confirming your identity, as well as a receipt for receipt of funds.

There are two types of legal proceedings for the return of funds: easy (the borrower agrees with the debt and admits that he is unable to fulfill his obligations in a timely manner) and complex (the defendant does not recognize the debt, refuses his obligations and denies signing a receipt for receipt of funds) .

- In the first case, the court will be on the side of the plaintiff. In this situation, the lender can independently (without involving a lawyer) cope with all the complexities of the legal process.

- In the second case, it is better to seek the help of a lawyer. If the receipt was made in writing, the court will order a handwriting examination. All additional financial costs will be borne by the plaintiff. However, if the court makes a positive decision, the defendant will have to cover all costs.

You can get legal assistance on issues of drawing up a receipt for receipt of funds on our website.

Common mistakes when compiling

Among the main requirements is the individualization of the borrower performing the function of a participant in the transaction. If this is not done, then the other citizen does not receive the money within the agreed period. It will be difficult to prove that the transaction took place.

For example, receipts that simply state the fact of accepting funds from one citizen to another do not have legal force.

Personalization usually includes:

- Passport information;

- Date of actual transfer of funds;

- Description of the borrower’s place of residence along with the type of activity;

- The exact time when the money is returned.

Without such information, the court will not accept receipts for consideration. Such mistakes are usually made by people who are in close family relationships. Then they try to simply forget about the possible negative consequences.

It would be incorrect to indicate only the intention to transfer funds. Then it is considered that there is no evidence.

Citizens often forget about the conditions under which funds are returned. Under such circumstances, the receipt is accepted as a donation agreement. And going to court becomes meaningless.

Do not confuse the concepts of bills of exchange and promissory notes.

This will only bring confusion into the very essence of the existing relationship. A promissory note is a strictly formal type of business document used by those engaged in commercial activities. The main purpose is to confirm the very fact of transfer of funds in large amounts.

A promissory note is similar only in the sense that it becomes evidence that the amount has been transferred. But the form and content have a completely different look.

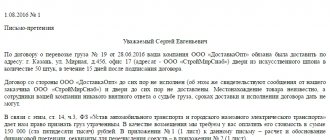

Judicial practice of debt collection under a loan agreement

Not long ago, in the practice of civil proceedings, a fact was recorded of incorrect interpretation of the legislative norms of the Civil Code of the Russian Federation regarding evidence of non-fulfillment of debt obligations by the borrower.

The reason for the high-profile paperwork was the fact of debt collection under a cash loan agreement on the basis of a promissory note.

Since the parties did not enter into a standard loan agreement, the court refused to satisfy the plaintiff’s claims.

Legal justification for non-fulfillment of a promissory note

According to the Supreme Court, the presence of a promissory note from the lender fully confirms the borrower’s non-compliance with debt obligations. This legislative norm is enshrined in paragraph one of article one hundred and sixtieth of the Civil Code. In addition, this legal act stipulates that any transaction is concluded in writing by drawing up a document with a clear description of its content and the presence of signatures of the parties or their authorized persons. Inappropriate evidence to confirm any transaction is only the testimony of witnesses.

Let us recall that the court of first instance and the appeals considered that the promissory note cannot be considered a supporting document, since it does not reflect complete information about the lender and the borrower’s obligations regarding the return of funds.

Failure to pay a promissory note

Even notarization and compliance with all rules does not guarantee that funds will be returned on time. Delay when there is a debt against receipt cannot be avoided. There is a possibility of no payment. The borrower cannot do without help. Otherwise the consequences will only get worse.

The problem in our country is the low level of development of the system for pre-trial collection from the debtor. The only exceptions to the rule were banks with relevant departments. But such services are not available to most individuals.

Collection agencies were supposed to fill an empty niche, but their actions often still go beyond the law. And the organization’s activities lack strict regulation. Although you can contact them.

Judicial collection is the only way to count on timely repayment of the debt if the other party decides not to repay it. A claim is filed that the other party has violated the terms of the current transaction. An IOU is used as an attachment. Interest and fines must be included in it.

The general limitation period for a document is three years. The time is counted from the date of the initial debt repayment procedure. Many people think about how to avoid paying debts.

If the use of other people's money is associated with interest, this is written about in the promissory note. The interest rate is set as clearly as possible. But there are circumstances under which non-payments are forgiven, even in court:

- When the loan amount is less than fifty times the minimum wage. Existing cases and judicial practice confirm this.

- If the receipt does not contain interest or additional conditions. Then it doesn’t matter to whom the citizen owes money. The rule on requirements is general.

Regulatory regulation of receipts for receipt of funds

In accordance with paragraph 2 of Art. 808 of the Civil Code of the Russian Federation, a receipt confirms the loan agreement and its terms. This document can be drawn up as a supplement to the above agreement or be an independent element of the transaction.

The law does not provide for a clear form for drawing up a mortgage. No federal regulation regulates the contents of the receipt. Therefore, the parties to the transaction have the right to rely on their own beliefs.

It is not necessary to notarize the receipt. However, clause 1 of Article 163 of the Civil Code of the Russian Federation provides participants in a financial transaction with the opportunity to certify a document, thereby confirming the legality of the transfer and receipt of funds.

Important: a notary has the right to certify a receipt only if it is an attachment to the loan agreement.