What are the survivor benefits?

Benefits (pensions) for the loss of a breadwinner are established by Russian legislation in 3 types:

1. Insurance payments are regulated by the Law “On Insurance Pensions” dated December 28, 2013 No. 400-FZ. They are appointed if the deceased breadwinner had an insurance period according to which the insurance pension can be calculated.

2. State payments are regulated by the Law “On State Pension Provision” dated December 15, 2001 No. 166-FZ. Appointed if the deceased breadwinner was:

- conscript soldier;

- astronaut;

- victims of a radiation or man-made disaster.

3. State payments for the families of deceased military personnel (employees of law enforcement agencies) who served under a contract are regulated by the law “On pensions for military personnel” dated February 12, 1993 No. 4468-I.

Social benefits for the loss of a survivor - in fact, they can be considered a subtype of government payments, since they are regulated by the same regulation. They are appointed if the deceased breadwinner had no work experience or if his death was a consequence of the criminal actions of his relatives (Clause 11, Article 10 of Law 400-FZ), and are provided only to citizens specified in subparagraph. 3 p. 1 art. 11 of Law 166-FZ.

Is it possible to receive payments on different grounds?

Laws 166-FZ and 400-FZ do not contain provisions allowing citizens to receive payments under two specified regulations simultaneously. The Law of the Russian Federation “On pension provision for military personnel” dated February 12, 1993 No. 4468-I allows persons entitled to survivor benefits under this legal act and other federal regulations at the same time to choose which specific regulation will be applied when assigning payments (Article 7 of Law No. 4468-I).

There are certain categories of citizens who are entitled to simultaneously receive:

- survivor benefits;

- ordinary pensions (old age, disability).

For example, such categories of citizens are discussed in:

- clause 3 art. 3 of Law 166-FZ - these include parents of deceased military personnel, family members of deceased astronauts, etc.;

- Art. 7 of the Law of the Russian Federation 4468-I - these include spouses and parents of deceased military personnel.

The funded pension is paid separately from payments for the loss of a breadwinner (Clause 4, Article 3 of Law 166-FZ, Clause 3, Article 5 of Law 400-FZ). Other payments within the framework of state social support are independently assigned - for example, those enshrined in Art. 41 of the Law of the Russian Federation “On social protection of victims of the Chernobyl Nuclear Power Plant” dated May 15, 1991 No. 1244-1.

Let us study in more detail the grounds for receiving the payments in question, as well as how the amount of survivor benefits is calculated in 2017-2018.

Who receives insurance benefits?

The type of payment in question is entitled to receive (Article 10 of Law 400-FZ):

1. Disabled and dependent members of the deceased breadwinner (financially dependent on him) members of his family.

2. Regardless of the presence or absence of financial dependence - one of the parents, spouse or disabled family member who is the deceased breadwinner:

- a minor close relative (up to 23 years of age in full-time education in educational institutions, without age limit - if the relative studying full-time has been disabled since childhood);

- a parent, spouse, grandfather, grandmother or adult brother, sister or child (if they support minor close relatives of the deceased breadwinner under the age of 14 years, do not work and have the right to apply for survivor benefits);

- grandfathers and grandmothers at retirement age who have disabilities, provided that there is no one to support them.

Minor close relatives (brothers, sisters and grandchildren) are considered disabled if they do not have able-bodied parents.

The following are recognized as dependents of the deceased:

- all members of his family who lived primarily at his expense;

- all minor children.

Non-financially dependent disabled parents and the spouse of the deceased breadwinner have the right to receive the payments in question if they have no means of subsistence.

Unable-to-work family members receiving an old-age pension, disability pension (or other pension not related to survivor's benefits), who lived primarily at the expense of the deceased, have the right to switch to an insurance payment for the loss of a breadwinner (Clause 6, Article 10 of Law 400-FZ).

What's new in the legislation on insurance pensions in 2020

The changes will affect several aspects: the method of pension indexation, the age of the pensioner, the size, and the conditions for receipt.

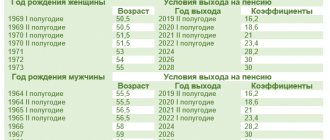

Firstly, the age of parents, grandparents, and the spouse of the deceased breadwinner applying for an insurance pension will increase from 60 to 65 for men and from 55 to 60 for women. Secondly, if disabled parents, grandparents, or the spouse of a deceased breadwinner apply for a social pension, then their age must be 70 years for men and 65 years for women.

Thirdly, starting from 2021, in accordance with Law No. 49-FZ of 04/01/2019, the pension will be indexed differently. For clarity, let’s look at 2 examples of how the pension was indexed according to the old rules and how it is now.

For example, in the family of the deceased breadwinner Ivanov from Moscow there are 2 children. The spouse works, so only these children receive a pension. One child is entitled to 9,000 rubles.

| Calculation according to the old rules | Calculation according to the new rules |

| Pension – 9000 ₽ | Pension 9000 ₽ |

| Indexation in 2021 is 6.6%, so 9,000 ₽ * 6.6% = 564 ₽ | Living wage in Moscow: 12,487 ₽ |

| Total size with indexation: 9,000 ₽ + 564 ₽ = 9,564 ₽ | Additional payment before PM: 12,487 ₽ – 9,000 ₽ = 3,487 ₽ |

| Living wage (LM) in Moscow for a pensioner: 12,487 ₽ | Indexation in 2021: 9,000 ₽ * 6.6% = 564 ₽ |

| The pension will be increased to PM: 9,564 ₽ + 2,923 ₽ = 12,487 ₽. The pensioner does not feel indexation. | Total payment amount: 9,000 ₽ + 3,487 ₽ (Additional payment) + 564 ₽ (Indexation) = 13,051 ₽ |

What government payment is assigned to the families of military personnel under a contract?

If the breadwinner served in the army under a contract (was an employee of the security services), then payments to his family members are assigned in accordance with Law 4468-I. The following have the right to such benefits (Articles 28, 29 of Law 4468-I):

- disabled dependents of the deceased breadwinner;

- disabled children, parents, spouse of the deceased breadwinner, if they have no means of subsistence;

- disabled parents and spouse of a breadwinner who passed away due to a military injury;

- a spouse, one of the parents or another close relative caring for a minor and non-working close relative of the deceased breadwinner.

The right to payments for the specified categories of citizens is recognized if the breadwinner died during service or no later than 3 months after its completion, or later, but as a result of an injury during combat or a disease received during service.

Separate norms - prescribed in Art. 33, 34 of Law 4468-I - the right to the payments in question is established for adoptive parents, adopted children, stepfather, stepmother, stepson, stepdaughter of the breadwinner (or persons having such status in relation to the breadwinner).

Payments to the families of fallen conscripts

If the deceased breadwinner was a conscript soldier, then benefits to his family will be assigned according to Law 166-FZ - in accordance with Art. 3.

An incapacitated (in general case) family member of the deceased breadwinner is entitled to receive the payments under consideration if he was:

- a minor close relative (for full-time education - up to 23 years of age or older, if the relative studying full-time has a disability since childhood);

- one of the parents, spouse, grandfather, grandmother, brother, sister (even able-bodied, but provided that they are caring for children under 14 years of age who are entitled to the benefits in question and do not work);

- the father, mother (over the age of 55 and 50 years, respectively, or having a disability) of the breadwinner in the status of a military man who died during military service or died as a result of a military injury after service;

- father, mother, spouse who has reached retirement age or has a disability;

- grandfather, grandmother (at retirement age or with a disability), if there is no one to support them;

- a widow (over 55 years of age and not previously married) of a breadwinner in the status of a military personnel who died as a result of a military injury received during the conscription period.

In this case, the father, mother and spouse of the deceased breadwinner have the right to receive the payment in question if they are retired or have a disability.

Benefits and additional payments other than pensions

In addition to monetary support, children who have lost a parent are entitled to various benefits and support measures:

- up to 2 years - milk and formula;

- up to three – free medications;

- travel on a national vehicle is free;

- ticket-free visits to state parks, museums, zoos until the age of seven;

- from 7 to 18 discount on the above events;

- two meals a day at school and provision of educational literature;

An additional payment to the pension is possible provided that the amount is below the established level for living.

Orphans are provided with housing under a social tenancy agreement, as well as the possibility of non-competitive enrollment in a university or secondary education institution upon passing school exams with positive grades.

Payments to the families of deceased cosmonauts and liquidators of the Chernobyl accident

Benefits for the loss of a breadwinner who died while performing duties to support a space flight are entitled to be issued (Article 7.1 of Law 166-FZ):

- children of the breadwinner (up to 18 years of age in any case, up to 23 years of age with full-time education);

- parents of the breadwinner who have reached retirement age or are disabled, and were also dependent on the breadwinner;

- husband of the deceased breadwinner.

The benefit for the loss of a breadwinner who died as a result of the Chernobyl accident or who was a liquidator of the Chernobyl accident is assigned (clause 4 of article 10 of law 166-FZ, clause 3 of article 29 of law 1244-1):

- disabled parents of the breadwinner;

- minor children of the breadwinner (up to 25 years of age with full-time education);

- spouse of the breadwinner caring for children under 14 years of age;

- spouse upon reaching 55 years of age (spouse upon reaching 50 years of age).

In this case, payments are assigned regardless of whether the recipients have the right to a regular pension.

Age characteristics

When assigning the compensation under comment, the age of the applicant is taken into account. At the age of 18, accrual stops, which can be restored if certain conditions are met. Then it is possible to extend the pension.

Child payments

A young child who has lost one or both parents has a preference for receiving pension payments - labor and social. Payments will be made until he reaches adulthood. The amount of labor compensation depends on the length of service of the deceased and is assigned on an individual basis. Social compensation is determined annually at the legislative level.

Children also have a different list of benefits, which regional authorities can expand.

After 18 years

If you turn 18 years old, in order to extend your payments, you must study in educational institutions on a full-time basis. That is, a newly minted student, according to the requirements of the educational organization, needs to attend classes every day. In this situation, the student will not be able to provide for himself and he will be assigned maintenance again.

To renew accruals, you must contact the Pension Fund and provide a certificate from your place of study. Moreover, the educational organization must have state accreditation.

Continuation of studies can be at different levels - primary vocational, secondary, higher.

Up to 23 years old

Up to this age, full-time students of absolutely all levels of education have preference for receiving. The essential conditions here are a ban on official employment, and if you were expelled from an educational institution, you should not count on further receipt of compensation.

If training ends before the age of 23 and it does not continue further, then financial support is no longer paid.

Many people wonder whether they will be able to qualify for financial support if, due to compelling circumstances, they have to take an academic leave during full-time study. Not a single law or legal norm contains a provision for suspending compensation payments in this situation. Since an academic leave is a short-term stop in studies associated with the birth of children, marriage, illness, or the need to care for immediate family.

Another no less interesting situation is conscription into the army. Will a survivor's pension be paid? No, it will not. Since the employee is no longer considered disabled and is fully supported by the state.

After 23 years

In exceptional cases, the state continues to pay a survivor's pension after the age of 23, namely:

- Disabled persons who were supported by the deceased.

- Close relatives of the deceased who care for the children and grandchildren of the deceased who are under 14 years of age.

How is the insurance payment calculated?

Insurance payments for the loss of a breadwinner are calculated:

1. If the breadwinner did not receive a pension - according to the formula:

PAYOUTS = COEFFICIENT × COST,

Where:

KOEF - individual pension coefficient;

COST - the cost of a unit coefficient per day from which survivor benefits begin.

If the breadwinner did not receive a pension because he did not apply for it (refused it), although he could, then the COEF indicator is multiplied by an increasing coefficient, the value of which is determined in accordance with Appendix No. 1 to Law 400-FZ.

The amount of survivor's benefit, which corresponds to the value of the PAYMENT indicator, is assigned to everyone who is entitled to it in the same amount.

If the recipient of payments is a child who has lost both parents, then when calculating the PAYMENT indicator, the COEF indicators for the calculated pension of both parents are used. If the recipient is a child who lost her mother, who had the status of a single mother, then the COEF indicator for her calculated pension increases by 2 times.

2. If the breadwinner received an old-age or disability pension, then the amount of the survivor benefit is determined by the formula:

PAYOUT = COEFF / CV × COST, where:

COEF - the individual coefficient of the deceased breadwinner, according to which his pension was calculated as of the day of his death;

KV - the number of citizens entitled to receive payments.

Each recipient of payments is assigned an equal amount - corresponding to the PAYOUT indicator.

At the request of the recipient, the survivor benefit can be calculated using the first formula.

Separate formulas - established in paragraphs. 7 and 8 art. 15 of Law 400-FZ - are provided for calculating payments for the loss of a breadwinner for children who have lost both parents or a mother. In the manner specified in paragraph 2 of Art. 16 and paragraph 8 of Art. 17 of Law 400-FZ, a fixed additional payment to the benefit is established.

How is it calculated?

The survivor's pension in 2021 is accrued to the local post office, which is located at the place of residence or to the balance of organizations involved in organizing the delivery of pension payments to your home. In the case of mail, delivery of benefits to the apartment is carried out on the basis of a schedule according to which an individual date of receipt is assigned, while payments can be transferred within the delivery period.

It can be transferred to a bank account or a card issued to it for the convenience of withdrawing funds. The pension is delivered on the day the funds are received, transferred by the territorial representative office of the pension fund. Money is available for daily withdrawal, but after it is credited. Financial receipts coming to a pensioner’s account at a credit institution are not subject to a commission fee.

The choice of the method of calculating benefits or changing it is carried out by notifying the Pension Fund (PFR) using two methods:

- by writing a request to the territorial body of the Pension Fund that assigned the pension and filling out a form to choose the method of calculating funds;

- electronic notification sent through your personal account on the pension fund website.

If the recipient of the pension is a minor child, then the pension under 18 years of age can be transferred both to his personal bank account, registered by an official representative (adoptive parent or trustee), and to the balance of the guardian’s card. Upon reaching 14 years of age, he has the right to independently receive the established pension at the post office or to a bank account.

- Pressure injections - intravenous and intramuscular drugs for hypertensive crisis

- How to get rid of corns on feet at home

- How to cook khinkali correctly. Cooking recipes and how many minutes to cook khinkali in water and steam

Additional payments up to the cost of living

This type of compensation is provided to pensioners who are disabled and whose total financial support is below the level of the subsistence level (SMP) or (SMG) - a citizen and the average salary in the region of residence. There are two types of surcharges:

- federal surcharge. It is accrued by local branches of the pension fund when the amount of total material support is below the subsistence level, which is established in the region and does not reach the PMP (the subsistence level of a pensioner) in the country.

- regional. Accrued by a representative of the social protection committee with a slight increase in the PMP in a constituent entity of Russia compared to the same indicator for the country, but in total lower than the regional PMP.

For the working-age population who is eligible to receive benefits, adjustments to additional payments are made based on the average salary.

What is the amount of state payment assigned according to Law No. 166

The size of the payment in question depends on where the deceased breadwinner worked, what status he had, and who he was related to as disabled persons entitled to payment.

If he was a conscript soldier and passed away due to a military injury, then each disabled member of his family is entitled to payments in the amount of 200% of the social payment, the amount of which is established by subsection. 1 clause 1 art. 18 of Law 166-FZ. If a serviceman died as a result of a disease that was acquired during conscription service, then the amount of payment for the loss of a breadwinner will be 150% of the social payment (clause 4 of article 15 of law 166-FZ).

If the deceased breadwinner was injured as a result of a radiation disaster, then the survivor payment will be:

- 250% of the social benefit, if its recipients are children who have lost their parents or a single mother;

- 125% of the social benefit, if its recipients belong to other categories of disabled family members of the deceased breadwinner.

These rules are the same for survivor benefits for students under 23 years of age and for children.

Let us now study how the social pension is calculated - as the basis for calculating the state pension and as an independent payment for the categories of recipients we considered earlier.

Payment in the capital

Moscow is one of the most prosperous regions in Russia in terms of the care of local authorities for the needs of the population living in the city. Thus, Moscow supplements to the survivor's pension (as well as other types of pensions) have been made since 2013 up to an amount of 17,500 rubles. True, for this, a pensioner must have permanent registration in the city, the duration of which must be at least ten years. If he is registered in the capital for a shorter period, then the city supplement to the survivor’s pension will only amount to the amount of the monthly minimum established in the region, which in 2021 is equal to 8,703 rubles. Payments are indexed during the same period as at the federal level. Therefore, Moscow’s additional payment to the survivor’s pension is allocated at the same time.

How much is the payment to the families of deceased contract servicemen?

The survivor's payment to the relatives of deceased servicemen under the contract is (Article 36 of Law 4468-I):

- 50% of the allowance of a breadwinner who died as a result of injury while on duty - for each disabled recipient;

- 40% of the allowance of a breadwinner who died due to illness or accident during military service - for each recipient.

The pension should not be less (Article 37 of Law 4468-I):

- 200% of the social pension established by law 166-FZ - for family members of the breadwinner who died due to injury;

- 150% of the social pension - for family members of the breadwinner who died due to illness or accident.

The provisions of Art. 38 of Law 4468-I provides for various supplements to the payment in question. For example, a supplement of 32% of the social pension is received by a disabled child who has lost his parents or a single mother.

Size and calculation procedure

The amount of pension provision depends directly on its type, since separate calculation methods are provided for each of them. Let's take a closer look.

Insurance part

The amount of material support in this case is not the same for all its recipients. It directly depends on the volume of accumulated pension rights of the deceased citizen.

Thus, the insurance pension for the loss of a breadwinner consists of two parts - a fixed payment and the insurance part itself . If, for example, a minor has lost one breadwinner, then he is entitled to 50% of the fixed payment, and if both, then 100%. The payment amount in 2021 is 6044.48 rubles.

The insurance part depends on the accumulated points and their value. In 2021, the cost of 1 point is 98.86 rubles.

Example of calculation for a child:

Let's simulate a situation where in a complete family a child lost his father, who was officially employed. Accordingly, over the entire period of his working life he accumulated 40 pension points. The calculation procedure will be as follows:

(6044,48*0,5)+(98,86*40) = 6976,64.

Thus, the amount of the pension paid to the child will be 6976 rubles 64 kopecks.

Social view

The size of the social pension for the loss of a breadwinner is uniform and is set at 5,796.78 rubles. This amount doubles if both breadwinners die.

State military pension

In this case, the form of military service and the circumstances of death play a role.

Thus, dependents of conscripts have the right to count on benefits in the amount of 200% of the social pension (11,593.56 rubles) if death occurred from a military injury, and 150% (8,695.17 rubles) if the soldier died from a disease.

Accordingly, dependents of contract servicemen receive an amount equal to 50% of his salary in his last position in circumstances of death related to injury, and at least 40% of the salary if the military man died of illness.

Pivot table

For convenience, below is a summary table indicating the types of pension benefits and their amounts:

| Type of security | Collateral amount |

| Insurance pension | 50% of FV+IPK*number of points (on average 6500 rubles) |

| Social pension | 5796.78 rubles |

| State pension | If the breadwinner is a conscript:

If the breadwinner is a contract worker:

|

Note : If the child is a complete orphan (lost both breadwinners or only parent), then the amount of the insurance (in terms of financial support) or social pension is doubled. \

All types of survivor's pensions are subject to periodic indexation.

What is the amount of the child's (dependant's) benefit?

Social benefits in case of loss of a breadwinner - for a child or student are calculated according to the formula:

PAYOUT = BASE × INDEX, where:

BASE - basic payment;

INDEX - annual indexation coefficient of the base payment.

The BASE indicator is (Clause 1, Article 18 of Law 166-FZ):

1. RUB 3,626.71 in general, and applies if the recipient of the payment is a child who has lost one of the parents.

2. 7,253.43 rub. if the recipient of the payment is a child who has lost both parents or a single mother.

The INDEX indicator is determined based on the indexation coefficient established by the Russian Government. It should be applied taking into account all previous coefficients (by which the BASE indicator is sequentially multiplied).

The survivor's benefit in 2017-2018 (in 2018 - before new coefficients are established) is calculated using the BASE indicator in actual values (Resolution of the Russian Government dated March 16, 2017 No. 307):

- 5,034.25 rubles, if the recipient of the payment is a child who has lost one of his parents;

- RUB 10,068.53 if the recipient of the payment is a child who has lost both parents or a single mother.

You can learn more about pension indexation in the article “Indexation of pensions for working pensioners after dismissal.”

The PAYMENT indicator, calculated using the first version of the BASE indicator, is used when calculating state pensions for the loss of a breadwinner and minimum pensions for family members of contract military personnel.

Who else is entitled to state pension

Disabled relatives of cosmonaut pilots and citizens injured as a result of man-made disasters or exposure to radiation have the right to claim the following payments:

| Who is entitled to receive state PPC | Payment amount for 2021 |

| Children left without both parents or who were raised by a deceased single mother | 250% social pension |

| The rest, who are fully supported by the deceased, are relatives | 125% of the social pension for each disabled family member |

| Disabled family members of cosmonauts and cosmonaut candidates | 40% of DD for each dependent |

What are the grounds for increasing the payment?

How to receive increased survivor benefits?

If the calculated social pension is less than the subsistence minimum, then a social supplement is added to it - in the manner established by Art. 12.1 of the Law “On State Assistance” dated July 17, 1999 No. 178-FZ. In this case, the cost of living in a specific region is taken into account.

You can learn more about the use of the subsistence minimum when calculating various payments in the article “The minimum wage in 2002–2017 in Russia (table).”

In all the cases we considered, the payment (insurance, state, social) is increased in the prescribed manner by the regional coefficient if its recipient is a citizen living in the Far North or an equivalent territory (clause 5 of article 15, clause 4 of art. 17, paragraph 7 of article 17.1, paragraph 2 of article 18 of law 166-FZ, paragraphs 4-7, 9, 10 of article 17 of law 400-FZ, article 48 of law 4468-I).

You can learn more about the use of regional coefficients in the article “The size of the northern allowance in the Far North regions - 2016.”

How to receive (how to process) payment: documents?

How to apply for survivor benefits? First you need to prepare:

- application in the prescribed form;

- identification documents;

- death certificate of the breadwinner;

- documents certifying the breadwinner's experience;

- documents certifying the relationship of the applicant and the breadwinner;

- passport or other document confirming the age of the breadwinner;

- SNILS.

Depending on the type of survivor benefit you are applying for, you may need to provide other documents. For example, confirming:

- the fact that the applicant is financially dependent on the deceased breadwinner;

- the applicant does not have able-bodied parents;

- the applicant has no means of subsistence;

- the value of the individual pension coefficient of the deceased breadwinner;

- cause of death of the soldier.

These documents must be submitted to the Pension Fund, where they are reviewed within 10 days. But as soon as the applicant submits the specified documents, the survivor benefit begins to accrue.

If the applicant applied to the Pension Fund within 12 months after the death of the breadwinner, then the pension is assigned from the date of death of the breadwinner. If applying later, the payment is assigned from the day 12 months earlier than the day of application to the Pension Fund (subparagraph 3, paragraph 5, article 22 of law 400-FZ, article 53 of law 4468-I).

The benefit is paid as long as the disabled person has grounds to receive it. The payment period may be indefinite if such grounds remain the same.

Documents required to apply for a pension

The package of documents for different types of pensions is different. To be assigned an insurance pension you must present:

- pension application

- applicant's passport, foreigners present a residence permit

- death certificate of the breadwinner or a court decision that the breadwinner has disappeared;

- a child’s birth certificate, which states that there is no father - this is how single mothers confirm their status;

- documents proving the family ties of the deceased with pension recipients. These could be: birth certificates, marriage certificates, adoption certificates;

- breadwinner's work book. It must be filled out correctly, certified with seals and signatures, and the owner’s full name and date of birth indicated. If all periods of work are not recorded in the work book, then you can additionally submit a written employment contract, a collective farmer’s work book, a certificate from the employer, an extract from the order, a military ID, a personal account or a payroll statement. If a civil contract was drawn up with the employer, then you need to submit its original, the work acceptance certificate and the document confirming the payment of mandatory payments;

- a certificate of the average monthly salary of the breadwinner or copies of personal accounts from archival organizations;

- certificate of family composition,

- a certificate confirming that a disabled family member is caring for children, grandchildren, or sisters until they reach 14 years of age.

- a certificate from an educational institution confirming that the future pensioner is studying full-time;

- certificate of disability;

- guardian's certificate or adoption certificate.

Pension Fund employees may also request other documents, in which case they will explain where and how to obtain them.

The package of documents for assigning a social pension for the loss of a breadwinner is the same, but documents confirming the income of the breadwinner and his insurance record are not needed.

To assign a pension to family members of a deceased military man, documents must be added to the application and to the above list that contain information about:

- reasons for the death of a serviceman;

- that death was due to military injury or illness

- about the period of service;

- that the widow of the deceased did not marry.

Relatives of cosmonauts or test pilots submit documents confirming the Russian citizenship of the deceased, his work activity, and the fact of death during the performance of official duties. You also need a certificate about the amount of the deceased’s allowance.

Results

Survivor benefits in 2017-2018 can be insurance, state and social. Combining the first two payments is not allowed. The social pension is a subtype of the state pension (and the calculation of the second when paying benefits is carried out on the basis of the value of the first). If the social pension is below the subsistence level, then a social supplement is transferred along with it to the disabled person. The age up to which survivor benefits are provided and under what conditions is established by several regulations. The main ones are laws 166-FZ and 400-FZ.

You can learn more about existing methods of social support for citizens - both with the participation of government agencies and with the participation of the employer - in the articles:

- “Compensation payments under the social security system”;

- “Financial assistance and insurance premiums in 2017.”

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.