Types of pensions for loss of a breadwinner

With the death of the breadwinner, the family's income decreases, and in some cases stops altogether. The state does not leave such families in trouble and provides them with a pension. There are 3 types of these payments:

- Insurance It is provided to the relatives of the working citizen for whom insurance premiums were paid. It doesn’t matter how much he worked and for what reason he died;

- State Entitled to the family of a deceased military man, astronaut, or people affected by man-made disasters;

- Social One of the types of state. Entitled to relatives of citizens who have not had 1 day of service. Also, the deceased breadwinner could be disabled or retired. There are situations when such a pension is assigned to military personnel. But this is possible if he himself committed an offense or was killed by one of his dependents;

What kind of pension for the loss of a breadwinner and in what amount the family will receive depends on whether the deceased breadwinner worked, in what field his work activity took place, whether he had insurance coverage and on other nuances. The amounts for these types of payments also differ.

Benefits and additional payments other than pensions

The availability of additional benefits depends on the status of the person receiving them. For example, children of a breadwinner can count on free:

- travel around the city;

- visiting cultural sites;

- dairy products (up to 2 years);

- medications (up to 3 years);

- meals at school (at least 2 times a day);

- school textbooks.

Relatives of the deceased serviceman will receive:

- a one-time payment of 3 million rubles;

- benefits for housing and communal services;

- free home repairs every 10 years;

- treatment in a sanatorium.

Orphans can count on:

- free education;

- salary for internship;

- money for clothes, shoes, office supplies, holidays in health camps;

- benefits for food and treatment.

Who is assigned an insurance pension upon the death of the breadwinner?

There are 2 categories of relatives who are entitled to this payment:

- family members who were dependent on the deceased, if they are disabled. These are: children, grandchildren, brothers, sisters and grandchildren, one of the parents, spouse, grandfather, grandmother of the deceased. But there are certain restrictions here. About them below;

- family members who were not dependent. This includes a parent or spouse or grandparent.

Let's take a closer look at these categories.

Who is classified as dependent and disabled?

Children and other relatives belonging to the first category of recipients must meet 2 criteria at once:

- be disabled;

- be dependent on the breadwinner if they were fully supported, and his financial assistance was the only source of money.

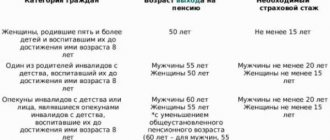

In the table we have described family members who are considered disabled.

The law determines the circle of persons who have the right to apply for state assistance after the death of the head of the family. All of them must meet certain requirements: some pensioners must not be over 18 years old, others must be disabled, and others are allowed to be able to work, but they are not allowed to work.

In the table we have described family members who are considered disabled.

| Relation degree | Condition for recognizing incapacity for work |

| Children, natural and adopted |

|

| Brothers, sisters, grandchildren, but only on condition that they do not have able-bodied parents | |

| Parents |

Or |

| Spouse(s) | |

| Grandfather or grandmother (only if there are no persons who must support them) |

That is, all of these relatives, in order to claim the right to a pension, only need to be disabled and dependent.

Important!

Children under 18 years of age do not have to provide additional evidence of being a dependent. But after reaching adulthood, in order to receive a pension, you need to submit to the Pension Fund office a certificate of full-time study at an educational institution.

Non-dependent relatives

They also have the right to receive pension benefits. By law, this may be one of the following relatives:

- one of the parents;

- spouse;

- grandfather;

- grandmother;

- Brother;

- sister;

- son or daughter of the breadwinner, if they are over 18 years old.

All these family members can receive a payment if 2 important conditions are met:

- they care for children and other young relatives of the deceased who have not reached 14 years of age;

- does not work.

In this case, the age of this category of relatives and their ability to work are not taken into account. That is, the wife of the deceased does not have to be 60 years old (at the time of the death of the breadwinner) to receive the payment. It is enough that she does not work and takes care of children. But if she gets a job, the payment stops.

There is another important point: Law No. 400 of December 28, 2013 states that if a disabled spouse or parents of the deceased who were not his dependents are deprived of their source of livelihood, then they have the right to an insurance pension regardless of how much time has passed from the death of the breadwinner. F This provision can be understood as follows: the only source of livelihood for this category of relatives is a pension - insurance or disability. It is impossible for a person to cancel a well-deserved insurance pension, but for disability it is completely impossible. Therefore, if, for example, the father of the deceased is denied disability at the next MSEC re-examination and he is deprived of his pension, then he can apply for a survivor’s pension.

Important!

If the dependent was the recipient of some type of pension, for example, for disability, then he is entitled to a survivor's pension only on the condition that he refuses it.

If a spouse gets married, the pension will not be canceled if he is disabled and does not work.

Blood relationship with the deceased is not an important factor. For example, a pension is due to adoptive parents, stepmother or stepfather. But only on condition that the breadwinner was on their support for 5 years. Blood relationship is also unimportant for children - even if they are adopted or are a stepdaughter (stepson), they are entitled to a pension.

Conditions of appointment and who is eligible

We can talk about the loss of a breadwinner when a person passes away or goes missing, and part of his relatives are deprived of their main source of income because of this.

Death registration goes through the following stages:

- Obtaining a medical certificate. It is issued to family members within 24 hours by the medical institution that established the cause of death.

- Contacting the registry office at the place of death, obtaining a medical certificate or the latest registration of the deceased. You need to take this certificate and passports with you: yours and the deceased’s.

- Obtaining a death certificate from the registry office on the day of application. It is required to file a survivor claim.

Registering a missing person involves:

- Submitting a missing persons report to the police department, after which the authorities immediately begin search operations.

- Applying to the court to declare a person missing.

The court decision is also an important document for proving your right to a pension.

Here is a list of family members of the deceased or missing who are entitled to a pension:

- mother, father, stepmother, stepfather;

- sister brother;

- child (including adopted child);

- grandson, granddaughter;

- grandmother grandfather;

- husband, spouse.

It will narrow depending on the type of pension, but in no case expand.

All these relatives can receive a pension with one caveat, they do not have other breadwinners, namely:

- the brother, sister or grandchildren must not have able-bodied parents;

- Grandparents should not have other able-bodied children.

Payments in the event of the loss of a survivor are assigned if the applicant provides the Pension Fund with a package of documents confirming his right to receive a specific type of pension for the loss of a survivor.

Payments to students

If dependents are full-time students at a Russian or foreign educational institution, then benefits will be paid while they are studying. They can graduate from one educational institution and enroll in another - their pension will not be cancelled.

But as soon as the student turns 23, payments will stop, regardless of whether the studies are ongoing or have ended. True, if such a student received disability before the age of 18, then a pension will be assigned either until the end of his life or the date the disability is removed.

Is it possible to receive 2 types of pensions?

Yes, this is possible. For example, relatives of a military man may be eligible for payments if he dies in service. If the breadwinner died after dismissal, then he is also entitled to a pension. But for this to happen, the disease that caused his death must develop as a result of a war injury.

Also, families of astronauts and citizens who died from man-made disasters can apply for two types of pensions.

Persons entitled to 2 types of payments are presented in the table.

| Recipient | Type of second pension | |

| Military parents | - old age insurance; - social; - for length of service; - on disability; - for length of service. | |

| Military widows | - insurance; - for length of service, according to Federal Law No. 12.02.1993 N 4468-1; - on disability; - social; | Should not remarry |

| Disabled relatives of citizens affected by the disaster at the Chernobyl nuclear power plant: in person; - parents: - children under 18 years of age, or children under 25 years of age studying full-time; — spouse; | - old age insurance; - social. | |

| Relatives of the astronaut | Any other |

Amount of pension in case of loss of a breadwinner

How much a pensioner will receive depends on many factors: why the breadwinner died, what type of payments he will be assigned, and the category of the recipient himself.

| View | Who will receive | Cause of death of the breadwinner | Pension |

| State | Family of sailors, sergeants, foremen, soldiers | War trauma | 200% social Pensions, that is: 5,034.25 ₽ * 200%= 10,068.5 ₽ |

| Illness arising in service | 150% of social penny. or 7,551.375 RUR | ||

| Military family | Due to war trauma | 50% of the salary, but not less than 200% of the social pension | |

| Due to illness | 40% of the salary, but not less than 150% of the social allowance. pensions | ||

| Children of victims of a man-made disaster (if both parents or a single mother died) | 250% of social or 12,585 ₽ | ||

| Other family members of the man-made disaster victim | 125% or 6292 ₽ | ||

| Dependents of deceased astronauts | 40% of salary | ||

| Children | 5 034, 25 ₽ | ||

| Social | Orphans | 10 068, 53 ₽ | |

There is a formula by which Pension Fund employees calculate the amount of insurance pension payments:

SP = IPC * SPK + FB

Where, SP – insurance payment upon death of the breadwinner; IPC – individual pension coefficient of the deceased breadwinner; SPK – the value of the pension coefficient on the day from which the pension is assigned;; FB – fixed payment.

The IPC is calculated in connection with the survivor's insurance premiums. This parameter can be found out from Pension Fund specialists, and the cost of the pension coefficient can be found in this table.

Cost of one pension coefficient (IPC)

| Date of increase in coefficient value | Size in rubles |

| 01/01/2020 | 93,00 ₽ |

| 01/01/2021 | 98,86 ₽ |

| 01/01/2022 | 104,69 ₽ |

| 01/01/2023 | 110,55 ₽ |

| 01/01/2024 | 116,63 ₽ |

Fixed payment towards pension

The size of the fixed payment in 2021 will increase and amount to 5 686,25 ₽.

Fixed payment to survivor's pension

is half of this amount, that is: 5 686,25 ₽ /2 = 2 843,1 ₽.

Dependents who have lost both parents or dependents of a single mother receive a fixed payment of 100%, that is 5 686,25 ₽.

The state pension for families living in the Far North or in regions with a harsh climate is increased by the regional coefficient. If the relatives of the deceased breadwinner leave these areas for permanent residence in other regions, then the regional coefficient is canceled.

Accrual of SPK

To calculate how much the survivor's insurance pension will be, you need to multiply the amount of pension points (IPC) by the cost of the point. In 2021, 1 point is equal to 87.24 rubles. This is how the insurance part of the pension benefit is recognized.

Calculation formula: SPK = IPC x point value

The number of IPCs is determined by the length of the insurance period and working periods (until 2002), the size of the salary of the deceased breadwinner and the size of the transferred insurance premiums.

50% of the fixed payment (FB) is added to the insurance part of the pension. In 2021, the PV is 5334 rubles, respectively, 50% = 2667 rubles.

Insurance IPC for orphans is calculated taking into account 100% of the PV and the summarized IPC of the deceased parents. The IPC for the loss of a single mother is calculated taking into account the double IPC.

The size of the survivor's pension in 2021

In 2021, the survivor's pension will increase due to 2 factors:

- This year the cost of living will increase in the regions. Therefore, the survivor benefit will be increased to this minimum;

- annual indexation. Insurance will increase by 6.6% from January 1, 2020, social – it is still unknown, but it is expected that by 7%.

An example of calculating a survivor's insurance pension:

- The Ivanov family from Moscow consists of 5 people. In 2021, the father of the family died. The wife does not work and is raising children.

- Before his death, the head of the family worked and had insurance coverage.

- In this case, the insurance pension for the loss of a breadwinner is provided to: the wife and three children.

- The IPC of the head of the family is 73. It can be calculated using the Pension Fund of Russia online calculator.

- Next, look at the table: in 2021, the SPK is 93 ₽.

- We calculate: SP = IPK * SPK + FV = 73 * 93 ₽ + 2,843 ₽ = 9,632 ₽. Remember this amount.

- This pension should be raised to the minimum subsistence level for a pensioner in a particular region. For Moscow it is equal to 12,487 ₽. Therefore, the difference will be: 12,487 ₽ – 9,632 ₽ = 2,855 ₽. The pension should be increased by this amount.

- Now let’s calculate the pension amount taking into account indexation for 2021: 9,632 ₽ * 6.6% = 636 ₽.

- Let's calculate the final amount, taking into account indexation and additional payments: 9,632 ₽ + 636 ₽ + 2,855 ₽ = 13,123 ₽ - this is the payment due to each family member.

Now all that remains is to multiply the resulting number by the number of family members and calculate the income: 13,123 ₽ * 4 = 52,492 ₽.

Special cases

- A survivor's pension can be applied for regardless of whether the child was dependent on the breadwinner, or whether the breadwinner lived separately and did not support the child financially.

- When applying for a survivor's pension, adopted children have equal rights with their natural children.

- If the mother of a child receiving a survivor's pension decides to officially get married, the child will continue to receive monthly payments. The right to payments remains even after adoption.

- The marriage of a person who receives a pension is not grounds for its cancellation. Even if after the wedding a woman takes her husband’s surname.

- Children who are entitled to a survivor's pension should not be officially employed. If a child is a full-time student at a university and works part-time, he is deprived of the right to receive a pension. The exception is the children of law enforcement officers.

Emergency hotline for the population : we provide free consultations to pensioners, parents and beneficiaries of any category from legal experts over the phone.

What's new in the legislation on insurance pensions in 2020

The changes will affect several aspects: the method of pension indexation, the age of the pensioner, the size, and the conditions for receipt.

Firstly, the age of parents, grandparents, and the spouse of the deceased breadwinner applying for an insurance pension will increase from 60 to 65 for men and from 55 to 60 for women. Secondly, if disabled parents, grandparents, or the spouse of a deceased breadwinner apply for a social pension, then their age must be 70 years for men and 65 years for women.

Thirdly, starting from 2021, in accordance with Law No. 49-FZ of 04/01/2019, the pension will be indexed differently. For clarity, let’s look at 2 examples of how the pension was indexed according to the old rules and how it is now.

For example, in the family of the deceased breadwinner Ivanov from Moscow there are 2 children. The spouse works, so only these children receive a pension. One child is entitled to 9,000 rubles.

| Calculation according to the old rules | Calculation according to the new rules |

| Pension – 9000 ₽ | Pension 9000 ₽ |

| Indexation in 2021 is 6.6%, so 9,000 ₽ * 6.6% = 564 ₽ | Living wage in Moscow: 12,487 ₽ |

| Total size with indexation: 9,000 ₽ + 564 ₽ = 9,564 ₽ | Additional payment before PM: 12,487 ₽ – 9,000 ₽ = 3,487 ₽ |

| Living wage (LM) in Moscow for a pensioner: 12,487 ₽ | Indexation in 2021: 9,000 ₽ * 6.6% = 564 ₽ |

| The pension will be increased to PM: 9,564 ₽ + 2,923 ₽ = 12,487 ₽. The pensioner does not feel indexation. | Total payment amount: 9,000 ₽ + 3,487 ₽ (Additional payment) + 564 ₽ (Indexation) = 13,051 ₽ |

Documents required to apply for a pension

The package of documents for different types of pensions is different. To be assigned an insurance pension you must present:

- pension application

- applicant's passport, foreigners present a residence permit

- death certificate of the breadwinner or a court decision that the breadwinner has disappeared;

- a child’s birth certificate, which states that there is no father - this is how single mothers confirm their status;

- documents proving the family ties of the deceased with pension recipients. These could be: birth certificates, marriage certificates, adoption certificates;

- breadwinner's work book. It must be filled out correctly, certified with seals and signatures, and the owner’s full name and date of birth indicated. If all periods of work are not recorded in the work book, then you can additionally submit a written employment contract, a collective farmer’s work book, a certificate from the employer, an extract from the order, a military ID, a personal account or a payroll statement. If a civil contract was drawn up with the employer, then you need to submit its original, the work acceptance certificate and the document confirming the payment of mandatory payments;

- a certificate of the average monthly salary of the breadwinner or copies of personal accounts from archival organizations;

- certificate of family composition,

- a certificate confirming that a disabled family member is caring for children, grandchildren, or sisters until they reach 14 years of age.

- a certificate from an educational institution confirming that the future pensioner is studying full-time;

- certificate of disability;

- guardian's certificate or adoption certificate.

Pension Fund employees may also request other documents, in which case they will explain where and how to obtain them.

The package of documents for assigning a social pension for the loss of a breadwinner is the same, but documents confirming the income of the breadwinner and his insurance record are not needed.

To assign a pension to family members of a deceased military man, documents must be added to the application and to the above list that contain information about:

- reasons for the death of a serviceman;

- that death was due to military injury or illness

- about the period of service;

- that the widow of the deceased did not marry.

Relatives of cosmonauts or test pilots submit documents confirming the Russian citizenship of the deceased, his work activity, and the fact of death during the performance of official duties. You also need a certificate about the amount of the deceased’s allowance.

How to apply for a pension through State Services

In order to apply for a survivor's pension through “State Benefits, Pensions and Benefits”.

3. Follow the link and click on the item “Assignment of insurance pensions, funded pensions and state pensions”

4. Fill out an application electronically.

5. Check the accuracy of all information entered in the form and, if necessary, make corrections.

6. Save and send the application and the required documents attached to it (in scanned electronic form).

A day later, a response will be given stating that the application has been accepted for processing and registered in incoming correspondence. After another 10 working days, specialists will send a constructive response on the decision: granting a pension or refusal for motivated reasons. After eliminating them, you can apply for a pension as many times as you like.

Where to go to apply for a pension

The insurance pension is assigned from the date of application. It is submitted at any time, after the death of the breadwinner, to the Pension Fund department or to the MFC. Employees can review the application within 10 days. Persons applying for a pension may be:

- the future pensioner himself;

- pensioner's representative.

The application may be submitted in person, by mail, or through your personal account on the Pension Fund website. In this case, the date of filing the application is:

- the day the application is received by the MFC or Pension Fund;

- date of sending the letter with documents by mail;

- date of submission of an electronic application through your personal account.

Those citizens of the Russian Federation who went abroad for permanent residence must send a package of documents to the address: Moscow, st. Shabolovka, 4.

Deadlines for granting pensions

The insurance pension is assigned from the date of application. But there are situations when it can be prescribed earlier:

- when the applicant does not apply immediately after the death of the breadwinner, but within 12 months from this date. Then it is appointed from the day of the death of the breadwinner;

- if the applicant is late and exceeds the 12-month period, then 12 months earlier than the date of application. For example, the breadwinner died on January 5, 2019. If you applied for a pension within 12 months, it will be assigned from January 5, 2021. If you applied, for example, on April 10, 2021, then you will be appointed from April 10, 2021.

State and social pensions are assigned from the first day of the month in which the applicant applied for it.

Grounds for receiving benefits

Russian pension legislation distinguishes three forms of survivors' pensions, the procedure for assigning them has its own specifics. Let's look at it in more detail.

- Insurance pension. It can be claimed by persons who were supported by a citizen who had insurance experience, that is, officially carried out labor activities with contributions transferred to the state pension fund for him. It should be noted that the work experience of the deceased in this case is not a fundamental condition for the assignment of benefits, but directly affects its size.

- Social pension. This type of pension is paid to the dependents of the deceased, if the latter had no insurance experience at all, that is, he never worked within the framework of labor legislation. When determining the type of appointment, only the periods of transfer of insurance premiums are taken into account. If the deceased breadwinner worked “unofficially,” this does not give the right to receive an insurance pension, the amount of which is higher than that of a social pension.

- State pension. Persons who were dependent on a deceased serviceman (or an employee of another structure equivalent to the army) can apply for it. It is calculated in a special manner, and payments are made from the federal budget.

The basis for assigning any type of pension provision from the above is the fact of the death of the breadwinner and being dependent on him.

Attention! Dependency should be understood as complete financial dependence on the breadwinner, coupled with the inability to find a job or otherwise obtain means of subsistence.

Such dependents must include relatives of the deceased. This circumstance largely specifies the circle of possible recipients of survivor benefits.