It is not easy for a large family - parents work, trying to provide for their children, but the costs are high, so the state has developed support measures for such people. Improving the condition of the housing stock is one of the policy priorities, especially important when small children live in a dilapidated house. Then housing subsidies are given to large families.

What kind of assistance from the state at the federal level can parents of a third child expect?

In order to raise a child, and especially a third one, huge expenses are required.

Our state has provided for this moment and, in order to simplify the life of parents with many children, has established various types of benefits and allowances. One of the most important benefits for a large family is the opportunity to receive a plot of land from the state. This plot can be registered as the property of all children without exception, as well as their parents.

In addition, the government periodically develops and improves measures to provide state support in expanding the living space of young parents. Help here usually comes in the form of lowering mortgage rates for large families. For example, from January 1, 2018 to December 31, 2022, Russia has a federal program of preferential mortgage lending with government subsidies at a rate of over 6%.

Parents of the third child can apply for maternity capital if this did not happen after the birth of the second child. Maternity capital, unfortunately, is not issued in one lump sum; it can only be used for purposes approved by the state.

Another important feature for mothers who have given birth to three children or more, in light of the reform of the pension system, is that they will be able to retire a little earlier than mothers of one or two children or childless women.

We will talk about all possible benefits provided for families where a third child was born in the next section.

Queue order: how long to wait

There is no exact definition of the time limits for waiting, because...

Receipt of an apartment occurs in the order of priority. Considering the significantly increased number of large families and the speed of construction and allocation of apartments for social needs, we have to wait for years. Only one fact can change the order of a family in the accounting and move it to the first position - the presence of a child with a disability group. Such a situation is considered exceptional, allowing one to count on quick assistance from the state.

Based on the above, obtaining housing from the state for a large family is quite achievable. However, it should be taken into account that there must be official recognition of large families and low income. In addition, it will take a lot of time to complete the task.

What payments for the 3rd child in 2021 are provided for by Russian legislation?

In Russia, for the third child in a family, payments in 2021 for young parents (most often the recipient of benefits is the baby’s mother) provide the following:

- Maternity benefit (M&B) - paid only to officially employed mothers; unemployed people have no right to claim it.

- The benefit related to the fact that the expectant mother went to a medical institution during pregnancy up to 12 weeks and registered there is also defined only for a working mother.

- A one-time benefit for the birth of a third child - both employed and unemployed parents are entitled to it.

- A monthly allowance for caring for a third child is also given to everyone: both working and non-working mothers and fathers; other relatives of the child can also receive it.

It can be seen that officially employed citizens have the right to claim a wider range of benefits for the 3rd child.

The Social Insurance Fund makes payments to the above mentioned benefits in favor of working citizens. Payments to non-working parents are made by the Social Security Department.

When applying to social security, it is possible to receive child benefits until the child reaches adulthood, payments for breastfeeding for up to a year, etc. However, the amount of such payments is often insignificant, and they are made only when the income of each family member is below the subsistence level established in the region.

Negative aspects of housing programs

The lender does not give concessions; it is important for him that payments are made on time.

The client's social status is not particularly important. With a low income, a single mother will not receive a loan. To provide a mortgage, the bank will have to offer real estate or other valuable property as collateral.

Disadvantages of participating in mortgage programs:

- very strict conditions for participation in preferential mortgage programs;

- limiting the maximum loan amount due to the borrower’s low income;

- Under some preferential mortgage programs, it is impossible to purchase secondary housing.

How much is the BiR benefit paid for a third child to employed parents?

While expecting a third child, a working mother, on the basis of a certificate of incapacity for work, must receive a B&R benefit from her employer. It is issued once, usually when going on maternity leave.

This benefit is calculated on the basis of wages and other payments in favor of the employee (we will denote briefly - salary), on which contributions for insurance in case of temporary disability and in connection with maternity (VNiM) were calculated for the previous two calendar years. Calculation of the B&R benefit in 2021 is carried out as follows:

Allowance for BiR 2021 = ((salary 2021 + salary 2019) / 731) × 140 days.

The legislation defines the lower and upper limits of this type of benefit.

The minimum is associated with the calculation of benefits based on the minimum wage (minimum wage):

BIR allowance min. = ((minimum wage × 24) / 730) × 140 days.

The minimum wage is set to the value in which it was fixed by regulations at the beginning of maternity leave.

The maximum benefit is calculated based on the limits for contributions to VNiM. For 2021, this limit was 912 thousand, for 2021 - 865 thousand rubles. Thus, the maximum for BiR in 2021 will be equal to 340,795 rubles.

In the calculation formula, the number of days is equal to 140 - this is the duration of leave according to the BiR, but sometimes this number can be greater, for example, during a multiple pregnancy. This will definitely be taken into account in the certificate of incapacity for work.

You will find ready-made instructions for receiving maternity benefits in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

One-time benefits for a third child in 2021 - what types are they?

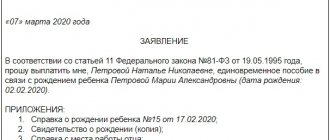

The Law “On State Benefits...” dated May 19, 1995 No. 81-FZ established the following lump sum payments for children:

- Allowance for registration in the early stages of pregnancy - is issued to a working mother, usually simultaneously with the B&R benefit on the basis of a sick leave certificate and a corresponding certificate from a medical institution. It is indexed annually. From 02/01/2021, the amount of the benefit is determined as 708.23 rubles. It will be valid until January 31, 2022, and will increase from February 1.

- A benefit paid to either parent at his choice upon the birth of a child. Like the previous benefit, it is indexed annually based on inflation data. Currently (from 02/01/2021 to 01/31/2022) its amount is RUB 18,886.32.

Let us note that both benefits are provided for the 1st, 2nd, 3rd and subsequent children.

Monthly payments for a third child in 2021 - for employed and unemployed citizens

After completing the BiR leave, the mother, and in some cases the father or other relative, has the right to go on leave to care for the baby until he reaches one and a half years old with the payment of the appropriate benefit. Calculation of parental leave is based on earnings data for the previous two years.

When going on maternity leave in 2021, the benefit is calculated as follows:

- Average daily earnings 2021 = (salary 2021 + salary 2020) / 730.

- The amount of the benefit is determined based on 40% of the average daily earnings according to the formula:

Monthly benefit 2021 = Average daily earnings 2021 × 40% × 30.4.

There are also upper and lower limits for this benefit. The maximum can be found by substituting into the formula the maximum values of the base for contributions to VNiM, which we noted above. We will find out everything regarding the minimum in the next section.

What is the smallest benefit amount for the 3rd child up to one and a half years old in 2021?

The minimum amount of benefit for caring for a third child until he reaches the age of one and a half years is established by Law No. 81-FZ. It is indexed every year. From 02/01/2021 its amount is 7,082.85 rubles.

If two children are cared for at the same time, i.e. both of them have not reached the age of one and a half years, the amounts of monthly benefits are summed up; however, the amount should not exceed one hundred percent of the average earnings of the parent to whom benefits are paid. But the minimum of this amount will be 14,165.70 rubles. (RUB 7,082.85 × 2) - for the second and third, third and fourth children, etc.

The minimum amount of benefit for the third child is provided to unemployed parents and parents who had low earnings over the two previous calendar years.

You will find ready-made instructions for receiving benefits for a child under 1.5 years old in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

Nuances

The federal program operating in the country provides assistance to citizens with many children, such as providing them with an apartment. However, federal law does not stop there. According to it, a large family can get an apartment for the fourth child.

However, like any other law, this one has one significant limitation, which is the following: such a privilege can only be used by a family whose members have continuously resided in the territory of the state for the last ten years. Other citizens will have to wait some time , but at the same time, it is worth remembering that all children at the time of receiving an apartment should not be older than the age established by legislative acts of eighteen years. This is a key nuance that must be observed, otherwise the family will not be able to obtain any living space.

Of course, each regional body can make appropriate changes to the current legislation, if such a possibility is provided. However, these changes should in no case aggravate the situation and make the procedure for obtaining an apartment for large families practically impossible. On the contrary, a fairly large number of regions of the country are planning to increase the age at which a child can be considered when taking into account minor children in the family. The most common age is 21, but 23 is also occasionally found.

Expert opinion

Roman Efremov

5 years of experience. Specialization: all areas of jurisprudence.

What tax breaks are available for families with three children?

As for tax benefits at the federal level for parents with many children, they are not provided as such. Tax breaks are associated with payments for children, regardless of how they were born into the family. Thus, all benefits related to the course of pregnancy, the birth of babies, and their care are completely exempt from personal income tax and insurance premiums for compulsory insurance.

IMPORTANT! From benefits for temporary disability that are not related to procreation and raising children, income tax is withheld by the tax agent in full and transferred to the budget. Find details here.

In addition, the amount of financial assistance given to the parent(s) by the employer at his own request and available capabilities, in the amount of up to 50 thousand rubles, is also not subject to personal income tax. for one child.

Regional and local regulations may establish tax benefits for transport tax and property tax for families where three or more children were born.

How much do children get an apartment for?

A family with three or more children is considered to have many children (own children, those from previous marriages, and adopted children living together with applicants for a new living space are taken into account). This is the average requirement for the country, but in regions with high birth rates the bar is higher. For example, in Ingushetia, a family with more than 5 children is considered such.

If a child has reached the age of majority, then by law he cannot be taken into account for recognition of a large family. Therefore, it is impossible from a legal point of view to obtain the right to free housing of your own. However, if the eldest child is studying full-time at a university on a budgetary basis, then the status of having many children can be assigned to the family until he turns 23 years old. To do this, a corresponding application is sent to the social support authority for the population.

What regional benefits and benefits exist for families where a third child was born?

Not only at the federal, but also at the regional and local levels, various measures are being established to assist families with the birth of a third child. Let's list the benefits for the birth of a 3rd child in 2021:

- priority right to receive places in kindergartens;

- the opportunity to take advantage of subsidies for utility services or return funds paid for housing and communal services through social security;

- receiving free meals in schools and secondary vocational education institutions;

- the opportunity to receive free medications for children under 6 years of age;

- issuing free travel documents for minors.

Citizens need to carefully study regional and local legislation so as not to miss important points in applying for benefits.

What payments are due to families for the 3rd child in Moscow, read in ConsultantPlus. If you do not have access to the K+ system, get a trial online access for free.

Required documents

To get in line to receive the required housing, you will have to be patient and collect a fairly large package of documents.

The main documents that must be submitted to the municipal authority to carry out such a procedure include:

- Copies and originals of parents' passports.

- Copies and originals of birth certificates of all minor children who have not reached the age established by current legislation in the country.

- Certificates of income received by all working family members.

- To carry out such a procedure, a document is also required that confirms that the family is large.

- A document that confirms that the family has low-income status and can count on receiving housing.

- A certificate of the full composition of a specific family that expects to receive real estate. This document can be obtained at the passport office.

- A document that confirms information about what property is owned by a member of this family at the time of filing the application.

Results

So, in the article we found out what payments are due at the birth of a third child. Among them: a benefit for the BiR, for early registration of a pregnant woman, a benefit for the birth of a child, and for caring for a child up to one and a half years old. In addition to them, there are other types of benefits and benefits for large families, many of which are established by regions. The state exempts from personal income tax almost all benefits associated with the expectation of the third baby and the birth of it. There are also ongoing programs for preferential purchase of housing for families with three or more children.

Sources: Federal Law of May 19, 1995 No. 81-FZ

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.