A SNILS card containing an eleven-digit individual code is an insurance certificate of registration of a Russian citizen with the Pension Fund.

Securing your future pension worries every working person. It is not easy for people to sort out their pension savings, especially in modern conditions, when the pension system has been undergoing serious reforms over the past few years. The principles by which savings are calculated have already been changed several times:

- The pension was divided into two parts – insurance and funded.

- It has become possible to invest not only in state pension funds, but also in alternative pension funds.

- Funds for pensioners who continue to work are accounted for as a separate item.

There are many innovations, and if a person gets lost in them, trying to understand what funds and where exactly are being accumulated for his future pension, SNILS can come to the rescue.

So, first things first.

What is taken into account when calculating

The amount of pension payments is calculated based on the following factors:

- The amount of official income. This information is provided by the employer. You won't be able to get them online through any website. Unless the employee receives information about his salary in the form of an extract, for example, by email.

- Length of work experience. This information is taken from the work record book.

- Number and duration of insurance periods. This is the time when a citizen did not work for good reasons.

- The age when a citizen retires and ends his working career.

Based on this information, points and pension coefficients are awarded, which are then used to calculate pension payments to Russians.

How is the old age pension formed?

A pension is formed during a person’s work experience throughout his life until he reaches a certain age. Errors in calculations of such benefits are found everywhere. The reasons can be very different:

- failure to provide information by the citizen himself;

- errors by fund employees;

- failures in the PF computer support system, etc.

Legislation controls the issue of pension accruals. The conditions for assigning old-age benefits are contained in Federal Law-400. It follows from this that the calculation of pension benefits takes into account several factors:

- Amount of length of service - for example, before 2015 it was enough to work for 6 years, now - 9 years, and from 2024, to assign a pension benefit, you need to work for 15 years.

- Dial IPK. For 2021, the threshold is 13.8.

- The cost of the pension coefficient, which is indexed annually.

Accounting is carried out only based on official salaries. Gray payments are not taken into account.

Indexation and calculation of pension payments

You can calculate the amount of payments yourself, or you can get the data on the Pension Fund website or the State Services portal. If incorrect pension information is identified, you can submit an application to the employer to provide documents on income received and deductions made from them.

You can use your personal account on the Pension Fund website since 2015. The website contains information about pension savings; you can also specify the method of calculation and type of social security. payments for:

- Old age.

- Disability.

- Loss of a breadwinner in a family.

Every year while a citizen works, he is awarded points. When it comes time to calculate the social payments, add up all the points for years of legal work. The document used to confirm official employment is a work book. Depending on the information that employers provide to the fund, the system calculates the most accurate number of points.

Where to file a complaint if an error is discovered

If a citizen is sure that the assigned pension benefit is erroneous, then it is necessary to send an application to the management of the district PF department. State your complaints in writing, ask for information on what data were used to make previous calculations. If the applicant is not satisfied with the response received, write a complaint to the regional office of the Pension Fund.

If it was not possible to achieve the truth there, then it is recommended to use the services of a lawyer who will help draw up a statement of claim to the judicial authorities. The claim must indicate the reason for disagreement with the assigned pension.

Video on the topic:

Information on calculating pensions online

The PF portal contains information about the official salary and length of service of employees. You can track the duration of work for any working period, as well as non-insurance periods of time: parental leave, army, periods of incapacity.

Obtaining information about pension accruals through the website is the most convenient way. When registering, a notification will be sent to your email or mobile phone number. After that, on the state website. services you will need to enter personal information and provide passport and SNILS data.

An important parameter when calculating a pension is the number of points earned. You can find out their number in several ways:

- on the State Services portal;

- in a branch of the Pension Fund during a personal visit;

- in the personal account on the Pension Fund website.

When calculating points, you may encounter an incorrect number of points or a short work history. The Pension Fund receives information from employers, so inaccuracies are associated only with deliberate misrepresentation of facts, fraud or erroneous data entry. In these cases, fund employees recommend checking information about the length of service with your boss.

If you need to obtain data for a certain working period, you will need to write a free-form application, send it by mail to your manager or hand it in person. The application must indicate the contacts where the employer should send the information. According to the law, within 3 days the boss must send copies of documentation of work activity with all data on vacations, dismissals, and income certificates. The employer must stamp the copy. There is no need to pay for preparing and submitting papers.

If the company where you worked for a certain period no longer exists, you can contact a higher organization or request documents in the archives. When the necessary papers have been collected, contact the Pension Fund office to verify the data.

You can also send a request to the fund to clarify data on your work activity online. This method will save time and you won’t have to wait long in line.

Find out the pension amount on the PF website

To find information about pension contributions on the Pension Fund website:

- Open the official website of the foundation.

- Log in to your account. To do this, enter the phone number you specified during registration, SNILS number or email and password.

- On the menu .

- Fill out an application for data provision.

The received documents can be printed. But if you send data electronically, then this is not necessary. To prevent data from getting lost, it is advisable to keep a copy of the electronic version of the documents and one copy on paper.

Find out the amount of payments at the fund branch

To find out information about old-age pension payments at the institution’s branch:

- contact the Pension Fund branch with all the necessary documents;

- fill out the application for data provision.

The data will be prepared in the form of a certificate. It will indicate the duration of the work periods and the points earned.

Calculation of pension data through the state website. services

On the government services website, fill out the calculation form:

- Please indicate your gender and age. Those citizens who were born before 1967 cannot choose what to allocate funds to: the insurance part or the savings part. Those born after 1967 can do both. This gives 10 and 6.25 points annually, respectively.

- Enter information about your military service. For each year of service, 1.8 points are awarded. This period is added to the total working period.

- Indicate the number of children and the duration of parental leave. For children, 1.5 years are added to the length of service. Number of pension points for children:

| Amount of children | Number of points |

| 1 | 1.8 points |

| 2 | 3.6 points |

| 3 or more | 5.4 points each |

- Enter the deadline for applying for pension payments. The later Russians apply for pension accrual, the more pension points they can accumulate.

- Enter information about the expected length of work experience.

- Indicate the official amount of income excluding personal income tax.

- Click "Calculate".

The exact amount of the pension is not indicated on the portal, but along with data on insurance and savings contributions, an algorithm for calculating the pension will be shown.

Where to check the accuracy of the accrual

You can find out whether your old-age pension has been calculated correctly in several ways:

- contact the relevant authorities personally or through an authorized representative;

- via the Internet;

- submit a written application (petition) by registered mail.

Where to go

Checking the accrual of old-age pensions is possible in the following organizations:

- Regional branch of the Pension Fund of Russia . You need to come to the customer service and write a corresponding statement. Among the documents you need to have with you, you must have a passport and SNILS.

- Multifunctional center (MFC) . Here you will be asked to fill out an application, to which you will need to attach your passport and SNILS.

- The bank where your pension is deposited. You need to go to the nearest branch at your place of registration. There you will be asked to write an application to gain access to this service in your personal account. You should have your passport and SNILS with you. Please note that this method is suitable if the bank has an agreement with the Pension Fund of Russia. Such institutions include Sberbank, VTB, Uralsib.

- Place of work. To obtain the correct information, you need to contact the accounting department.

- Non-state pension funds. Here, when you apply, you will be provided exclusively with information on the funded pension, which you form yourself or your employer does for you.

Application to verify the correctness of pension calculation

When you contact the Pension Fund or MFC, you will be given an application form. It must contain your personal information correctly. Next, ask to check the correctness of the pension calculations made. The specialist must make a note about acceptance of the application, after which it is sent for consideration.

5 days are allotted for this. You must be notified of the results of the inspection in the manner specified in the application. The amount is revised automatically if discrepancies are identified.

- Shellac kit at home

- 5 cases when you need to apply for pension recalculation

- What can hugging cats lead to?

Formula for calculating pension

The formula for calculating the old-age pension in 2021 looks like this:

SPS = FV * PK1 + IPKobshch * SPB * PK2 + NChP.

| Abbreviation | Meaning |

| THX | Old age insurance pension |

| FV | Fixed payment amount |

| PC1 and PC2 | Increasing factor. You can find out about them in Federal Law No. 400 on insurance pensions |

| NPP | Cumulative part of pension |

| St. Petersburg | Pension point cost |

| IPKobshch | Total number of pension points collected |

The cost of a point for pension payments is indexed every calendar year by the inflation factor approved by the government of the Russian Federation. In 2021, 1 point equals 87.24 rubles. Fixed payments also change annually. From January 1, 2021, the standard minimum payment is RUB 5,334.19. The fixed payment also depends on the category to which the citizen belongs. If this is a preferential category, for example, disabled people of groups 1 and 2, then the fixed payment will be higher.

The IPC was calculated in different ways in different periods. According to the new law, it is necessary to separate these periods and determine the overall score.

If all the parameters are known, then using the formula you can calculate the amount of the old-age pension yourself.

Is it possible to recalculate a pension after it has been assigned?

The old age insurance pension consists of two parts. The first is a fixed payment. Its size is reviewed annually on January 1. The second part is insurance. It is calculated individually for each pensioner. The size of old-age payments is influenced by the value of the individual pension coefficient (IPC) - the total number of pension points (PB) for the entire length of service.

When calculating pensions, employees of the Pension Fund (PFR) may make mistakes. Errors often occur due to human factors.

There may be malfunctions in the operation of the software installed on the computers of employees of territorial offices. All the data provided for the years of Soviet service or the transition period may not be taken into account.

If you suspect that the amount of old-age pension payments is not determined entirely correctly, you can request an adjustment. Both non-working pensioners and those who continue to work can request a calculation. If a pension accrual certificate has not been provided, you can file a complaint with the Pension Fund management.

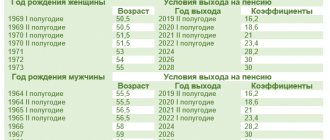

Social pensions

If a citizen does not have time to accumulate the required length of work experience in order to receive an insurance pension, he is assigned a social pension. Social pensions begin to accrue to Russians 5 years later than insurance ones. Therefore, a working and non-working citizen of the same year of birth will receive government payments at different ages.

Indexation also occurs annually, but from April 1, and not in January. In 2021, the average amount of social payments is 9 thousand rubles. In each region, the figure may vary due to different premiums and increasing factors. Social additional payments are made if the amount of material support does not reach the subsistence level established in a given federal district.

Increased odds

In some cases, citizens may receive bonuses when calculating their pension salary. So, people who raised children are given additional IPC points:

- 1.8 - for the first child;

- 3.6 - for the second;

- 5.4 - for the third and fourth.

The size of the pension also increases when applying for payments later. If a person has come close to retirement age, but has not immediately exercised his right to pension benefits, the amount of payments will increase by bonus factors:

- five years of waiting will lead to an increase in the fixed payment by 36%, and the IPC by 45%;

- ten years - to an increase in the fixed payment by 2.11 times, and the amount of IPC - by 2.32 times.

There are also increased coefficients that can be claimed by those who worked in the extreme conditions of the Far North and equivalent territories. “Northerners” can also switch to pensions early. If, in addition, they turn out to be holders of “harmful” professions from List 1 and List 2, the benefits for early assignment of payments are summed up. However, when moving to regions with a milder climate, a person loses the right to additional coefficients, although he retains the “northern” pension.

Example of pension calculation

Conditions for an example of calculating pension payments:

- A man who was born in 1958. The retirement date is 2019.

- Work experience is 37 years. Of these, the army from 1976 to 1978, education from 1978 to 1983, work in several periods: 1983-1992, 1996-2009, 2010-2021.

- Income data: from 1985 to 1989, salary certificate for 60 months - 286 rubles, from 1996 to 2001, salary certificate for 60 months - 1,425.25 rubles. the average salary for 2000-2001 was 1,752.14 rubles.

- Insurance payments. 2002-2014 - 422,584.8 rubles. 2015 - 135,960 rubles. 2021 — 135,960 rub. 2021 — 135,960 rub. 2021 — 135,960 rub.

Calculation example:

- Seniority coefficient. Option 1 - 0.55 for up to 25 years of experience. Option 2 - 0.55+(26-25)*0.1=0.56.

- Average income to the average for the Russian Federation. Method 1 - 286/223.18=1.28. Method 2 - 1425.25/945.15=1.51. We take into account the indicator 1.2.

- Estimated pension. Option 1 - 0.55*1.2*1671=1102.86. Option 2 - 0.56*1752.14=981.20. Method 1 is more profitable, since the second method only takes into account 555 rubles.

- Pension capital until 2001. (1102.86-450)*144=94011.84

- Valorization amount according to the most suitable option. 94011.84*(0.1+0.16)= 24443.08.

- Total capital and valorization amount until 2001. 94011.84+24443.08=118454.92.

Procedure for checking pension amounts

You can check your IPC not only by contacting the Pension Fund; other methods are also provided. For example, a citizen can carry out calculations independently. In this case, you will need to have information from your work book, a certificate showing your income for the last 5 years and a calculator.

The sequence of actions is presented as follows:

- the length of the experience coefficient is initially set;

- calculations of average monthly income are made;

- information regarding the average salary for one month is clarified (the period for which the calculation is carried out is taken into account);

- pension capital is calculated;

- the resulting value is multiplied by the inflation rate;

- the number of contributions made for insurance is added (the funds contributed to the fund on the date of calculation of the pension are taken into account);

- the amount of insurance payment from the funds is added.

The formula is presented like this:

P = (Sk+Sd+Sz+Pk)*I+Kv+Ss , where:

- P – amount of pension benefit;

- Sk – length of service coefficient;

- SD – average monthly income;

- Сз – average salary per day;

- Pk – pension capital;

- I – inflation rate;

- Kv – the amount of contributions made to the Pension Fund;

- Сс – insurance payments from the fund.

After completing these steps, you will be able to find out the amount of your pension benefit.

Indicators taken into account when calculating pensions

When calculating odds, 55% is used as a basis. For female representatives, this indicator is established if they have 20 years of experience ; for men, 5 years more work is required. If a citizen continues to work, the coefficient increases by 1%. The maximum value of the additional indicator is set at 20%.

To calculate the average income, you will need to divide the entire amount of money earned by the number of months for which it was received.

Once the average daily salary has been established, you will need to calculate the ratio of the average earnings to this indicator. If a citizen did not work in the Far North, then the ratio will be 1.2 or less . To calculate the amount, the length of service coefficient is multiplied by the resulting ratio and the average daily salary in the country.

Calculation of pension capital

To calculate this indicator, you will need to perform several sequential actions.

Including:

- the basic part of the pension benefit is subtracted from the amount received in the calculations reflected above;

- the resulting indicator is multiplied by the period during which payments will be made.

The formula used is:

Pk = ((Sk + Sm+Sd) – Bch)*S

- Pk – pension capital;

- Sk – length of service coefficient;

- cm – average monthly income;

- SD – average salary per day;

- BC – base part;

- C – the period during which payments are made.

The basic component of the pension changes every year. This must be taken into account when making calculations. To check the inflation rate set for a specific period, you can turn to various electronic resources. The insurance portion of the accrual is equal to the figure obtained by dividing the pension capital by the approximate time during which the pension is paid.

Calculation features

Only old-age pensions are calculated in this way. For other payments, different coefficients are used. In this case, increasing coefficients were not taken into account:

- When retiring a year later, the fixed amount becomes higher by 5.6%, by 2 years - by 12%, by 3 years - by 19%. Retirement 10 years later - 111%.

- The cost of points when deferred for 1 year increases by 7%, 2 years - by 15%, 3 years - 24%, 10 years - 132%.

Recommendations for those retiring:

- Collect all certificates of confirmation of work, change of company name before 2002.

- Select the most profitable 60 months for reference until 2002.

- Check with the Pension Fund for the list of required documentation at least 9 months before retirement.

- Collect certificates confirming your studies as work experience.

Be sure to pay insurance premiums based on your income, since without them pension points will not be calculated.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Personal appeal to the Pension Fund of Russia

If a person has doubts about the correctness of the accrual of pension payments to him, he can contact the Pension Fund employees. The exception is military personnel. They will have to apply through the law enforcement agency that issues payments.

You need to take the following documents with you:

- passport;

- pensioner's ID;

- SNILS;

- application for pension recalculation.

If the application is sent by mail, then not the original documents, but their certified copies are attached to the letter.

The application is completed on a special form, which can be obtained from the Pension Fund or the MFC. On this form, you must write your personal data and state your request to check the accuracy of the calculations of your old-age pension salary. It is also necessary to indicate exactly how the applicant would like to receive the results of the verification (by letter or email).

The verification takes five days. Upon completion, the applicant is notified of its results in the method chosen by him.

The notice must contain the following information:

- confirmation of the fact of the inspection;

- the result of the calculations performed;

- the state of the personal account at the time of the audit.

If during the audit, errors in the calculation of pensions are revealed, its amount is revised. This happens automatically, that is, no other applications need to be submitted to the Pension Fund. Recalculation will be made from the first day of the month following the date of submission of the application.

If the results of the verification are still not satisfactory to the applicant, he can recheck them by submitting a new appeal.

If after 5–10 days the pensioner does not receive any notification, he can contact the regional branch of the Pension Fund. If this fund body does not give an answer, you can contact the prosecutor’s office to exercise prosecutorial supervision over the activities of Pension Fund employees. An extract on the accrual of pension must be attached to the application. If the prosecutor's office does not help, you should go to court.

Comments: 4

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Anonymous

09.13.2021 at 23:25 Hello, 35 years of experience from 1969 to 2004 continuous A Information about the status of the individual personal account of the insured person is indicated The value of the individual pension coefficient (hereinafter referred to as IPC) 0.000 including the amount of the fixed payment to the insurance pension (with taking into account increases in fixed payment): 6,044 rubles.

48 kopecks. Amount of insurance pension. They don’t recalculate, help me figure it out Reply ↓ - Igor

08/10/2021 at 00:00hello..explain the situation if you can..I retired at 52 years old (working in hazardous conditions), and I have 34 years of insurance experience..and the length of service taken into account for granting a pension was 26 years..I served in the police from 1995 to 2010.. the time from 2002 to 2010 (8 years) was not included in the deadline for assigning a pension..

Reply ↓

Anna Popovich

08/10/2021 at 22:49Dear Igor, for military service a military pension is formed, for which the length of service in a certified position is taken into account. It is not included in the total length of service.

Reply ↓

07/25/2021 at 22:03

I really liked the article, clear, understandable, professional. I would like to ask a couple of questions personally to one of the specialists.

Reply ↓

How to find out the status of your retirement account online

It would be correct to constantly check whether your employer is making contributions to the Pension Fund for you. As reviews indicate, not all employers treat this issue in good faith. You can track information online:

- on the Pension Fund website in your personal account;

- through the State Services service.

After completing all the steps, you will be able to view the following information online:

- number of years of experience;

- the number of pension savings and who manages them;

- all employers and how much money they transferred during your employment;

- number of PB.

On the Pension Fund website

In order to find out your pension on the Pension Fund website and check the data online, you need to have a computer, tablet or mobile phone at hand. You can check whether your pension has been calculated correctly in the following way:

- Go to the foundation’s website at www.pfrf.ru.

- Log in to your personal account. For authentication, the correct mobile phone number, email address or 11-digit SNILS number, and password specified during registration are used. If you are not logged in, you must follow the link at the bottom of the form.

- After logging in, select .

- Order information by filling out a request to receive a notification.

- Study the information.

Check pension contributions on the State Services portal

You can view contributions to the Pension Fund via the Internet on the State Services portal:

- Go to the website www.gosuslugi.ru.

- Click the “Personal Account” button.

- Go through authorization by entering the correct mobile phone, email or SNILS number and password. If you are not yet a user of the portal, follow the provided link. Fill out the standard form.

- Follow the link “Obtaining information about the status of an individual personal account.”

- Click on the “Get service” button.

- Information about your pension will appear on the screen, which you can view online, save or print.

Clarification of the amount of pension benefits

Errors occur due to a software glitch or incorrect data entry.

The calculation system is complex, not every pensioner is able to understand it - hence the doubts about the correctness of setting the amount of the benefit. Ways to check old age pension calculations:

- Visit the Pension Fund or MFC with a written request for review. Completion – 5 days.

- Fill out an electronic application on the State Services website. To register you need SNILS.

- Request information from NPF - Non-State Pension Fund.

- Request a certificate from the bank servicing the account to which the pension is transferred.

- Contact a law firm or a private expert. The service is paid.

All methods are applicable to checking old age, survivors and disability insurance benefits. The law establishes regulations according to which the Pension Fund is obliged to increase the amount of payments to people with disabilities. Recalculation is carried out depending on groups 1, 2, 3, information about which is received by the fund automatically.

Union of Pensioners of Petropavlovsk-Kamchatsky Urban District

When calculating the amount of an old-age insurance pension, pension points earned by a person for official work are taken into account. They are determined using special formulas, so errors may be made during calculations. You can check for yourself whether your old age pension has been calculated correctly.

Is it possible to recalculate a pension after it has been assigned?

The old age insurance pension consists of two parts.

The first is a fixed payment. Its size is reviewed annually on January 1. The second part is insurance. It is calculated individually for each pensioner. The size of old-age payments is influenced by the value of the individual pension coefficient (IPC) - the total number of pension points (PB) for the entire length of service. When calculating pensions, employees of the Pension Fund (PFR) may make mistakes. Errors often occur due to human factors.

There may be malfunctions in the operation of the software installed on the computers of employees of territorial offices. All the data provided for the years of Soviet service or the transition period may not be taken into account.

If you suspect that the amount of old-age pension payments is not determined entirely correctly, you can request an adjustment. Both non-working pensioners and those who continue to work can request a calculation. If a pension accrual certificate has not been provided, you can file a complaint with the Pension Fund management.

Where to check the accuracy of the accrual

You can find out whether your old-age pension has been calculated correctly in several ways:

- contact the relevant authorities personally or through an authorized representative;

- via the Internet;

- submit a written application (petition) by registered mail.

Where to go

Checking the accrual of old-age pensions is possible in the following organizations:

Regional branch of the Pension Fund of Russia. You need to come to the customer service and write a corresponding statement. Among the documents you need to have with you, you must have a passport and SNILS.

Multifunctional center (MFC). Here you will be asked to fill out an application, to which you will need to attach your passport and SNILS.

The bank where your pension is deposited. You need to go to the nearest branch at your place of registration. There you will be asked to write an application to gain access to this service in your personal account. You should have your passport and SNILS with you. Please note that this method is suitable if the bank has an agreement with the Pension Fund of Russia. Such institutions include Sberbank, VTB, Uralsib.

Place of work. To obtain the correct information, you need to contact the accounting department.

Non-state pension funds. Here, when you apply, you will be provided exclusively with information on the funded pension, which you form yourself or your employer does for you.

Application to verify the correctness of pension calculation

When you contact the Pension Fund or MFC, you will be given an application form. It must contain your personal information correctly. Next, ask to check the correctness of the pension calculations made. The specialist must make a note about acceptance of the application, after which it is sent for consideration.

5 days are allotted for this. You must be notified of the results of the inspection in the manner specified in the application. The amount is revised automatically if discrepancies are identified.

How to find out the status of your retirement account online

It would be correct to constantly check whether your employer is making contributions to the Pension Fund for you. As reviews indicate, not all employers treat this issue in good faith. You can track information online:

- on the Pension Fund website in your personal account;

- through the State Services service.

After completing all the steps, you will be able to view the following information online:

- number of years of experience;

- the number of pension savings and who manages them;

- all employers and how much money they transferred during your employment;

- number of PB.

On the Pension Fund website

In order to find out your pension on the Pension Fund website and check the data online, you need to have a computer, tablet or mobile phone at hand. You can check whether your pension has been calculated correctly in the following way:

- Go to the foundation’s website at www.pfrf.ru.

- Log in to your personal account. For authentication, the correct mobile phone number, email address or 11-digit SNILS number, and password specified during registration are used. If you are not logged in, you must follow the link at the bottom of the form.

- After logging in, select .

- Order information by filling out a request to receive a notification.

- Study the information.

Check pension contributions on the State Services portal

You can view contributions to the Pension Fund via the Internet on the State Services portal:

- Go to the website www.gosuslugi.ru.

- Click the “Personal Account” button.

- Go through authorization by entering the correct mobile phone, email or SNILS number and password. If you are not yet a user of the portal, follow the provided link. Fill out the standard form.

- Follow the link “Obtaining information about the status of an individual personal account.”

- Click on the “Get service” button.

- Information about your pension will appear on the screen, which you can view online, save or print.

How to calculate your pension yourself

You can personally try to determine the amount of due old age pension payments if you think that your pension has been calculated incorrectly. For this you will need a calculator.

It is important to understand that the calculation will only be approximate.

Only a Pension Fund specialist can tell you the exact amount of the old-age pension after studying the payment file.

Payments are calculated by age, taking into account the following data:

- Salary data. You can get them from your employer. If the company is liquidated, you should order a certificate from the archives. To do this, you need to personally contact the appropriate organization. It is impossible to obtain such information on the Internet.

- Duration of official work activity. You can check the information using your work record book.

- The presence of non-insurance periods - times when you did not work for objective reasons. For example, they were on maternity leave or served in the army.

- Retirement age.

Old age pension formula

When calculating the old age pension, the formula is used:

- SPS = FV x PC1 + IPCtot. x SPB x PK2 + NChP, where:

- SPS – the amount of accrued old-age insurance pension.

- FV - the amount of the fixed payment at the time of calculation of the pension (in 2021 - 5,334.19 rubles).

- PC1 and PC2 are increasing coefficients. Rely on later retirement. You can view them in Law No. 400-FZ “On Insurance Pensions” (December 28, 2013). When a pension is assigned at the generally established age, they are equal to 1.

- IPKobshch. – the number of pension points for the entire period of work.

- SPB - the cost of one SP at the time of recalculation of the old-age pension (in 2021 - 87.24 rubles).

- NPE is the funded part of the pension, if you formed it.

In order to calculate the pension according to the IPC, you need to know that in different periods different formulas were used to determine the number of PB. This is due to the ongoing pension reforms. Conventionally, working time is divided into 3 periods:

- until 2002;

- from 2002 to 2015;

- after 2015.

Based on this, IPKobshch. can be defined as:

IPKobshch. = IPK2001 + IPK2002–2014 + IPK2015 + IPKnon-insurance, where:

- IPK2001 - the number of PB earned during Soviet times and up to January 31, 2001 inclusive;

- IPK2002–2015 – number of points from January 1, 2002 to December 31, 2014 inclusive;

- IPK2015 – the number of PB accrued starting from 2015. IPC non-insurance – the number of pension points for non-insurance periods.

Calculation of points for calculating pensions

You can view your pension points online. To get started, you should go to the Pension Fund website. There you can use a special calculator. To independently determine the amount of your old-age pension, adhere to the following formulas:

- Until 2002. The amount of pension capital is divided by the cost of 1PB as of January 2015 (64.10 rubles).

- From 2002 to 2015. The insurance part of the pension is divided by the cost of 1PB as of January 2015 (64.10 rubles).

- Since 2015. All insurance contributions from your paycheck are automatically converted into points. To do this, the received amount is divided by the standard amount of contributions to the insurance pension. It is 16% of the maximum contributory earnings, which is determined by the Government of the Russian Federation annually). The total value is multiplied by 10.

Please note that the maximum IPC is limited by law. Regardless of your accrued salary, you are entitled to no more than:

- 7.39 PB for 2015;

- 7.83 for 2021;

- 8.26 for 2021;

- 8.70 for 2021;

- 9.13 for 2021

For each full year related to non-insurance periods, 1.8 PB must be accrued for the following circumstances:

- compulsory military service;

- caring for a disabled person of group I, a pensioner over 80 years old or a disabled child;

- detention if the citizen is subsequently rehabilitated;

- being with a military spouse in an area where it is impossible to get a job in your specialty (maximum 5 years);

- residence outside the borders of Russia, if the spouse is a representative of embassies, diplomatic missions (no more than 5 years).

The number of PB accrued for each year of caring for a child until the child turns 1.5 years old depends on the child’s birth order:

- for the first - 1.8;

- for the second – 3.6;

- for the third and fourth – 5.2.

Step-by-step calculation algorithm

The procedure for calculating an old-age pension consists of several stages:

Stage 1. Find out how much PB was accrued before 2002:

- The experience coefficient (SC) is determined. By default it is 0.55. If a man has more than 25 years of experience, and a woman has 20 years, for each year in excess an additional 0.01 must be accrued. The maximum value cannot exceed 0.75.

- The average monthly earnings coefficient (AMC) is calculated. You need to take the average salary for any 60 consecutive months (or for 2001–2002) and divide it by the average monthly salary in Russia for the same period. The limit value cannot exceed 1.2. For persons with “northern experience” it varies between 1.4–1.9.

- The estimated pension (RP) is determined.

If SC is greater than 0.55. RP = SK × KSZ × 1671 – 450. Regardless of the result, the minimum value is 210 rubles.

If SC is 0.55. For men, the formula is used: RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 25). For women - RP = (SC x KSZ x 1671 - 450) x (length of service in years before 2002 / 20). Remember, the minimum value (SC x KSZ x 1671 – 450) is 210.

- Valorization (one-time increase) is applied to the RP amount. If you were not officially employed before 1991, the RP increases by 10%. If you have experience, an additional 1% is added to 10% for each full year.

- To calculate the pension capital, the result obtained is multiplied by 5.6148 - the product of the indexation coefficients for each year from 2002 to 2014.

- Determine how much PB was earned before 2002.

Stage 2.

Find out the number of PB accrued from 01/01/2002 to 12/31/2014. (inclusive):

- Receive information about the status of your personal account. This can be done by sending a written request to the Pension Fund, via the Internet on the State Services website, or during a personal visit to the Pension Fund.

- The numbers indicated in the statement must be multiplied by the appropriate indexation coefficient . For each year it is different:

- 2014 – 1,083;

- 2013 – 1,101;

- 2012 – 1,1065;

- 2011 – 1,088;

- 2010 – 1,1427;

- 2009 – 1,269;

- 2008 – 1,204;

- 2007 – 1,16;

- 2006 – 1,127;

- 2005 – 1,114;

- 2004 – 1,177;

- 2003 – 1,307.

- Add the indexed numbers . Divide the final figure by the survival age determined as of January 1, 2015. It is equal to 228 months.

- The number of PB accumulated from 2002 to 2015 is determined.

Stage 3. Calculate PB accumulated since January 1, 2015.

Stage 4. PB for non-insurance periods is summed up.

Stage 5. IPCtotal is determined.

Stage 6 . The resulting amount is multiplied by the cost of 1 PB (87.24 rubles).

Stage 7. The PV is added to the result. It will be different for each group of applicants. For example, if you are over 80 years old, the base value doubles. If there are dependents, an additional 1/3FV must be charged for each.

If your old-age pension is small and does not reach the subsistence level established in your region of residence, you should be assigned a social supplement:

- From the federal budget , if the PMP in the region is lower than the federal value (8,846 rubles). Payments are made through the Pension Fund.

- From the regional budget , if the PMP is higher than the federal value. Paid through social security authorities.

Checking the accrual of preferential pensions

You can calculate early retirement pension for workers in hazardous industries or with northern work experience using the above scheme. In this case, it is necessary to take into account this application of the regional coefficient. It is used if you live in areas with difficult climatic conditions. The value varies from 1.15 to 2. When you change your place of residence, the value of the regional coefficient is revised.

In addition, for citizens who have a certain length of work experience in the Far North (FN) and equal territories (EKS), the PV in the formula for calculating the old-age pension has an increased significance. It does not decrease even when moving to another area:

- RUB 8,001.29 – citizens under 80 years of age, if they have worked for the RKS for 15 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

- RUB 16,002.58 – citizens over 80 years of age, if they have worked for the RKS for 15 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

- RUB 6,934.45 – citizens under 80 years of age, if they have worked in the PKS for 20 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

- 13868.90 rub. – citizens over 80 years of age, if they have worked in the PKS for 20 years or more, and their total insurance experience is at least 25 years for men and 20 for women.

If there are dependents, an additional payment to the old-age pension must be accrued in the amount of:

- for the first – 1/3 of the established fixed payment amount (FPV);

- for the second – 2/3 UVV;

- for the third - 1 UVV.

Source: sovets24.ru/2384-kak-proverit-pravilno-li-vam-nachislili-pensiyu.html

Conclusions and recommendations for doubters

Innovations in pension provision occur annually at the instigation of the authorities. The Pension Fund makes amendments to the calculations automatically, without requiring applications from the pensioner. But mistakes do happen, you can check them in the order that is often noted by people who have achieved justice:

- Set the pension amount online and request a calculation.

- Find evidence of the error and contact a lawyer.

- Be prepared to defend your case in court.

The decision is not always made in favor of the applicant. Such an outcome also cannot be ruled out.

Sources

- https://opensii.info/strahovye/po-starosti/kak-proverit-pravilnost-nachisleniya/

- https://buhguru.com/pensiya/moya-pensiya-zanizhena-kak-legko-proverit-raschet.html

- https://aif.ru/dontknows/file/kak_proverit_pravilnost_nachisleniya_pensii

- https://sovets24.ru/2384-kak-proverit-pravilno-li-vam-nachislili-pensiyu.html

Have the reasons for increasing the size of the fixed pension payment been taken into account?

The size of the pension can be increased due to socially significant circumstances, among which the presence of a disability group for a pensioner, a dependent dependent, or documented special work experience (rural or northern period of work) stands out.

The above circumstances must be taken into account when calculating the pension.

If it turns out that the amount of payments was indeed calculated with errors, then correction and recalculation must be made immediately in accordance with current legislation.

How many full years are counted in the work (insurance) period?

This important indicator is the basis for deducing the so-called length of service coefficient (pension points), which is taken into account in the pension formula. Entries in the work book and certificates from the archives will confirm periods of work activity.

Due to the fact that pension legislation has been reformed several times in recent years, now, in order to calculate a pension, work activity must be considered in the context of three periods:

- pension points earned from Soviet times until January 31, 2001 inclusive;

- pension points from January 1, 2002 to December 31, 2014 inclusive;

- number of points awarded since 2015.

The longer the period of work experience at the end of 2001, the higher the length of service coefficient will be, and therefore the size of the pension.

The basic value of the coefficient - 0.55 - is established with 25 years of experience for men and 20 years for women. For each additional year of work, the coefficient increases by 0.01 points and in total increases to a maximum value of 0.75.

Since January 1, 2002, the insurance premiums that the employer managed to transfer for his employee are taken as a basis. If the salary of the current pensioner was high, then the contributions will determine the high IPC (the number of pension points).

When receiving an answer to this question, you need to make sure that there are no errors in the calculation of the total length of service and in the data on the amount of wages.