The right to a pension is an inalienable right of every citizen, but its specific size and purpose are different for everyone.

This is explained by the fact that the main parameter in this case is the length of service of an individual employee.

In addition, it is of no small importance for receiving other payments and benefits: additional leave, bonuses or compensation. More details about the role and types of work experience below.

More information about work experience

Work experience is the time that a person devoted to working in an organization, as an individual entrepreneur, or for socially useful work. Citizens of all ages need to know their length of service.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

For young people it is necessary to receive payments for sick leave and to receive maternity funds. For middle-aged people, the benefit is the size of their pension contributions.

Work experience according to Federal Law

According to the Federal Law, the concept of seniority is regulated by Article 20 of July 21, 2014 under number 216 of the Federal Law. This concept is also included in the law on pension payments of December 17, 2001 under number N 173 Federal Law.

Concept and history of occurrence

The broadest concept of work experience is to define it in the form of the time of an employee’s work activity, his life at work.

If we specify this concept, we can say that it also includes the period of any other activity useful to society, equated by law to labor.

The main document by which this period is determined is the work book. It first appeared in 1918, and a year later it became a mandatory document for all persons over 16 years of age. It was necessary precisely to record the place and duration of a citizen’s work, and subsequently to determine his work experience.

As part of the reform of the pension system, which began in 2015, the importance of work experience began to recede increasingly into the background.

Now a new type of insurance plays a much larger role - insurance experience.

Types of work experience

There are several types of working time. Let's take a closer look at each of them and see the differences.

General

This type of length of service includes the time that a person was an employee and worked under a contract until the beginning of 2002. For work after this date the concept is not used.

Work breaks and activities do not matter.

The concept includes:

- service under contract with the employer. Work in the Russian Federation and the USSR is taken into account;

- service in a military body;

- paid public work;

- individual entrepreneurship;

- any activity during which contributions were made to the Pension Fund.

The concept does not include:

- full-time, part-time and correspondence courses at universities, secondary specialized institutions;

- caring for an adult or child with a disability.

Special

Experience refers to people working in certain settings or organizations with specific working conditions:

- northern work with harsh climate conditions and low temperatures;

- working in hazardous occupations;

- state special service.

For this type of service, citizens are entitled to one or more benefits:

- recalculation of length of service with an increasing factor;

- the opportunity to claim additional special deductions;

- salary bonus for length of service.

Continuous

This term implies service in one company without interruption. In most cases, the length of service is interrupted a month after dismissal and failure to find a new job. But there are exceptions:

- if the contract has expired and the citizen worked in difficult climatic conditions, continuous work experience is maintained for 3 months;

- I give a limit of 2 months to a person whose spouse is sent to another city or region.

It’s easy to find out about continuity; just read the work book data and subtract the time between places of work.

What it is

The official definition of special length of service for assigning a pension is given in Art. 27 Federal Law “On Labor Pensions”. It is accrued when working in hazardous conditions that negatively affect the health of the hired specialist. Additionally, this includes work with intense loads. In order for a person to count on early retirement based on special service, certain conditions must be met.

These include:

- specific duration of work in difficult conditions;

- the presence of documents that confirm that the citizen worked under the right conditions.

Attention! According to PP No. 1015, official documentation of the work is required, therefore other types of certificate are not considered.

A special feature of special experience is that it refers to periods of work under special conditions. This does not take into account how many insurance premiums were paid by the employer for the employee.

Differences between work experience and insurance

Total experience is a concept for work before the beginning of 2002. The meaning of this concept is work regardless of the size and fact of contributions to the Russian Pension Fund.

Insurance experience is a necessary concept for determining the amount of pension payments to a citizen. Only those time periods in which deductions were made are taken into account. A person does not have to be an employee of the organization; the insurance period also includes:

- receiving disability payments;

- receiving deductions if you are on the labor exchange;

- maternity leave for a period of up to 1.5 years for a child, but not more than 4.5 years for each person;

- care for adults and children with disabilities.

Thus, we can briefly highlight:

- an employment contract is required for general length of service;

- For the insurance period, insurance contributions are important, not necessarily from the place of work.

How long do you need to work for an insurance pension?

The old-age insurance pension is established and paid under the following conditions:

- Men reach the age of 60, women - 55 years. Certain categories of citizens have the right to apply for early pension payments (some of them are listed above). The age for men in civil service has now been increased to 61 years, for women - to 56 years. Thereafter, the age should be increased every 12 months (until 2032) until reaching 65 (for men) and 63 years (for women).

- Having CC in the current 12 months is a minimum of nine years, with subsequent increases every 12 months up to 15 years in 2024.

- The value of the individual pension coefficient in 2021 is at least 16.2, with a subsequent increase every 12 months up to 30 points in 2025.

You should read more about the conditions for assigning such payments in Art. 8, 35 Federal Law dated December 28, 2013 No. 400.

To calculate this payment, the easiest way is to use the appropriate online calculators on the official website of the Pension Fund and on government services. The calculation formula is given in Art. 15 Federal Law dated December 28, 2013 No. 400.

| Retirement date | Minimum experience | Minimum points |

| 2019 | 10 | 16,2 |

| 2020 | 11 | 18,6 |

| 2021 | 12 | 21 |

| 2022 | 13 | 23,4 |

| 2023 | 14 | 25,8 |

| 2024 | 15 | 28,2 |

| 2025 | 15 | 30 |

FAQ

Many people are confused about the concepts and terms of calculation. We have prepared for you answers to the most popular questions from Internet users.

Working for an individual entrepreneur

Question : is working for an individual entrepreneur taken into account when calculating length of service?

Answer : yes, it is taken into account, provided that the employer makes contributions to the fund. If this did not happen and you worked under a contract, you should go to court.

Maternity leave

Question : why didn’t the three-year parental leave count?

Answer : the first 1.5 years are counted as experience, but not more than 4.5 in total.

Russian Pension Fund personal account data

Question : why may the data from your personal account differ from those calculated independently?

Answer : The PF system is based on work book data, and manually there is a risk of making mistakes in the calculations.

Self-calculation

Question : When manually subtracting and counting on a calculator, there is a shortage of days.

Answer : Most likely, when subtracting the total terms of hiring dates from dismissal dates, you did not take into account the last days of work. You should add one day for each shift of service.

The need for continuous service to receive a long-service pension

Question : if work at school took place with a break of more than 3 months, is there a bonus?

Answer : to receive an additional part of the pension, you must have worked in an educational institution for more than 25 years; continuity is not taken into account.

Work without a contract

Question : if a person worked without an employment contract, does he have the right to include this period in his insurance period?

Answer : no, it does not. We recommend that you try to prove the fact of work through the court and, based on the results, prove your right to include the period in the insurance period.

Self-payment of fees

Question : can a person independently make contributions to the Pension Fund and thereby increase the period of insurance coverage.

Answer : yes, it can, but subject to conditions. The minimum payment per month must be from 5 thousand rubles, and per year at least 38 thousand rubles.

Rules for calculating years worked

To determine the duration of special service, the total number of days of production is calculated. To receive an early pension, you must work in the Far North or under dangerous conditions.

If a woman works under such conditions and is pregnant, she is transferred to safe work, but the entire period is counted as special work experience.

In order to correctly perform the calculation, special lists approved by the Government of the Russian Federation, as well as those available in the provisions of Federal Law No. 400, are taken into account.

During the calculation, the following rules are taken into account:

- the retirement age is reduced for a period of 5 to 10 years;

- usually more favorable conditions are offered for women;

- for some positions, special rules are provided for the influence of special experience on reducing the retirement age;

- to confirm the harmfulness of work, it is necessary to focus on the results of a special assessment, which is carried out annually after 2012;

- Work that is carried out in the Far North or other areas equated to northern conditions has a huge impact on the length of service.

Before the adoption of Federal Law No. 400 in 2013, slightly different rules for calculating special service were applied, which are still used in determining the current retirement age.

Characteristics

Legislatively, total work experience is divided into qualitative and quantitative. Quantitative characteristics mean the total number of hours worked, while qualitative characteristics mean working conditions. For hazardous and unhealthy working conditions, special calculation standards are established, where periods are added (for example, a year of work is equal to three). Not every dangerous or harmful production provides such increases. A complete list of professions and jobs is contained in Resolution of the Cabinet of Ministers of the USSR No. 10 dated January 26, 1991, which is relevant and is still in use.

Types of special working conditions

Special work experience includes periods of work (Articles 30 and 31 of the Law of the Russian Federation dated December 28, 2013 No. 400-FZ):

- underground, in harmful conditions, in hot workshops;

To learn about what working conditions should be considered harmful, read the material “What refers to harmful working conditions (nuances)?”

- in difficult conditions;

- women - drivers of special (construction, road and loading and unloading) equipment;

- women workers in the textile industry with hard and intensive work;

- for direct transportation by rail, in the subway, as well as on freight transport used for the removal of minerals from their mining sites;

- on field geological exploration, survey, forest management and other similar work;

- in logging and timber rafting;

- machine operators for loading and unloading operations in ports;

- seafaring crews of long-distance vessels;

- drivers of urban passenger transport;

- on underground and open-pit mining and construction of mines and mines;

- for the extraction and processing of sea products on fishing fleet vessels;

- in the flight crew of civil aviation vessels;

- for direct flight control of civil aviation vessels;

- maintenance personnel of civil aviation vessels;

- rescuers of professionally functioning emergency rescue services who actually took part in the liquidation of emergency situations;

- with convicts serving sentences in places of deprivation of liberty;

- in fire services;

- teachers of children's institutions;

- in healthcare institutions;

- creative nature in theaters and other entertainment organizations;

- test pilots of all types of aircraft.

How is special experience calculated (with example)

To understand how to calculate special experience, you should focus on the Rules established in Decree of the Russian Federation No. 665 of July 16, 2014. To calculate bonuses for certain categories of professions, for example, for doctors, teachers, employees of budgetary organizations, take into account local industry agreements, collective agreements, and internal regulations.

Here's how to calculate special length of service for early retirement: add up the periods of work activity in calendar order. Remember that the deadline includes several circumstances:

- the period when the citizen worked full time;

- performed job duties at the main place of work;

- paid social security contributions regularly.

If a person worked part-time, then the actual duration of the activity is taken into account, and special work experience is calculated in proportion to the hours. If a person performed functions alternately in ordinary and dangerous work, then only the time spent in a dangerous occupation will be included in the length of service. This includes days when the citizen was on sick leave or on vacation.

For example, Sergey Sergeyevich served in military service under a contract from November 11, 1995 to November 11, 2007, and from November 14, 2009 to November 15, 2021 - in the Federal Security Service. Thus, service in the military reached 12 years, in the FSB - 10 years and 1 day. The length of service reached 22 years and 1 day.

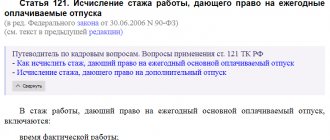

To determine how to calculate special length of service for additional leave for hazardous working conditions, only the time actually worked in hazardous work is included (Article 121 of the Labor Code of the Russian Federation). In this case, annual leave, maternity leave, and temporary disability are excluded.

The employer has the right to extend the vacation of such employees by at least 7 calendar days (Article 217 of the Labor Code of the Russian Federation). The specific duration is specified in employment contracts, industry agreements or collective agreements. For some categories, the additional term is regulated by their professional laws - for judges, doctors, pilots, etc.

Documents for confirmation

When applying for an early pension, it is necessary to prepare evidence of special experience.

for this :

- a work book designed to record all places of employment of a citizen;

- salary transfer invoices, which can be replaced by pay slips;

- labor agreements drawn up and signed with employers;

- extracts made from orders of the leadership of various organizations;

- certificates from institutions that contain information about the terms of work, position held and other relevant data.

The need to obtain certificates and other documents arises if PF employees, for various reasons, do not have information about all places of employment of a citizen applying for early retirement. Therefore, if a citizen is previously denied a payment, he will have to collect the necessary documentation within 5 days.

If the organizations in which the citizen worked are already closed, then you will have to use the services of the archive. The certificates must contain information not only about the periods of work and the name of the organization, but also about the position held, as well as about the dangerous or difficult conditions under which labor duties were performed. These documents confirm that the work was indeed dangerous and difficult. Job descriptions and employment agreements may be used for this purpose.

If the company where the citizen worked was not an official enterprise with special conditions, then such length of service is not considered special. In this case, even the testimony of other workers is not taken into account.