Not everyone can decipher the concept of an old-age pension, despite the active advertising of the Pension Fund about the need to ensure a decent life in the future. Considering that there are several types of pension payments, it is worth understanding in more detail what the type that is issued upon reaching a certain age means.

You can read about property taxes for pensioners in our article here.

Calculation of old age pension

It is necessary to understand what an old-age pension is and when it is possible to receive it. Today there is no concept of pension payments upon reaching a certain age, but there is a distinction between:

- state old age pension;

- labor pension;

- social pension.

It is worth considering these concepts in more detail to understand who has the right to them.

State payments are provided to persons who possess insignia. These are Heroes of the USSR, Russia and cosmonauts. They are also available to citizens who took part in eliminating the consequences of man-made disasters. State payments are provided for the loss of a breadwinner, but for this it is necessary to prove that the income of the deceased made up the majority of the family budget.

A labor pension is exactly what citizens receive upon reaching a certain age. According to current legislation, it is divided into insurance and savings. The insurance part is assigned by the state, based on the length of service and the number of points, and the funded part is the one that the citizen himself has managed to accumulate through contributions to a state or non-state pension fund.

Russian Pension Fund

Important! Today, the funded part of the pension, which is located in the Pension Fund, is frozen. It is impossible to obtain it on the basis of a moratorium. So that citizens can receive relatively decent payments from the state, annual indexation occurs. Also, one-time additional payments are now being made to achieve the living wage.

Social benefits are available to disabled people from childhood. That is, they could not work due to various diseases, but they need a means of subsistence. It is possible to receive it upon reaching adulthood. Until the age of 18, all payments are made to the account of the guardian or parents.

You can .

Conditions for granting an old-age pension

It is necessary to consider when a citizen is entitled to receive a particular pension. According to current legislation, you cannot receive two payments from the Pension Fund. Thus, if you have the right to two or more types, then you need to choose which one is more profitable. To do this, you need to consult with a Pension Fund employee. He will make a calculation and tell you where the amount will be greater.

Extract from Federal Law-173

Table 1. Conditions for calculating various types of old-age pensions

| Type of pension | Requirements for candidates |

| State | — elimination of man-made disasters; - achieving the required length of service for retirement; - loss of a breadwinner; - having the title of Hero of the USSR or Russia. |

| Social | — disability of any group; — inclusion in the peoples of the north upon reaching 50/55 years of age (women/men); — assignment of a labor pension, which is not enough to meet the subsistence level. |

| Labor | - reaching a certain age; — availability of the required number of pension points. |

Thus, you need to make sure that you can receive the type of payment you are interested in before contacting the Pension Fund employees.

You can .

Federal Law “On State Pension Provision in the Russian Federation”. Article 3

Is there a pension for those living abroad?

There is a peculiarity in calculating pensions for citizens who went to live abroad. They are entitled to receive payments if they have retained their citizenship. After obtaining citizenship or citizenship of another country, the Pension Fund stops payments.

There are also several important features when calculating payments. To provide them, it is necessary to provide evidence in addition to the standard package of documents that the citizen permanently resides outside the Russian Federation. This may include papers confirming the availability of real estate abroad, a valid international passport and a green card. You can also provide an analogue of an extract from the home book that the Russian is registered and permanently resides in another country.

Then, to assign a pension, you will need to open an account in any bank in Russia and provide details for the transfer. After this, you need to provide information every year that the citizen is alive. If the death occurs in Russia, the registry office provides appropriate notification. But foreign services do not perform these functions. Thus, in order to continue receiving money, you need to come in person and present a certificate certified by a notary that the citizen is alive. The same can be done through a third party, but he must have a power of attorney.

Russian pensioners abroad

Is it possible to refuse a pension after it has been assigned?

The law allows a citizen to voluntarily refuse monthly payments from the Pension Fund. This is usually done to accumulate a large amount. For example, when a citizen goes on vacation, they are assigned less than the minimum subsistence level, so an additional lump sum payment is awarded in order to achieve it. However, a person feels the strength to continue working. Then he can do the following:

- write an application for renunciation of a pension;

- get officially employed, and the employer will make contributions;

- receive indexation annually and save accumulated funds in the account.

When a person realizes that he can no longer work and it’s time to rest, he can again turn to Pension Fund employees to receive monthly payments. For example, if this happened in five years, then his income could increase by 10% - 20%. This does not take into account income from the funded part of the pension, which by that time may be unfrozen.

Thus, today citizens receive various types of payments from the Pension Fund. There is no old-age pension; instead, there are three other types that are issued to citizens based on a number of factors. You can switch from one pension to another, but receiving both is unacceptable. Interestingly, there is a limit to the points you can accumulate in a year. This is done to limit the maximum payments to those earning high salaries.

Pensioner's ID

Pension legislation is constantly changing, so you need to keep a close eye on it. However, everything is heading towards the fact that the state will abandon its social guarantees. More than once, officials at various levels have spoken about the need to abandon pensions, motivating citizens to save money on their own. For this purpose, non-state pension funds have been created where residents can transfer money. When they reach a certain age, they will receive them. And if they don’t live to see retirement, their heirs will receive the money. NPFs index funds in citizens’ accounts based on the size of their own profits. That is, companies manage money by reinvesting it. An important feature of non-state management is the inability to assign debts to NPF clients. But if the Pension Fund incurs losses, it can legally distribute them among all citizens.

A funded pension from the Pension Fund of the Russian Federation is a separate type that allows you to not depend on insurance payments and the economic situation in the country. However, you need to choose a fund that has a high level of reliability. Today, many non-state pension funds are affiliated with banks. Such companies are more credible because they can compensate for the lack of liquidity at the expense of subsidiaries, if necessary. There is also an expanded list of tools for reinvesting and making a profit.

You can .

Financial foundations of the Russian pension system

A set of income and expenses that provide financing for the pension system of the Russian Federation. The budget of the Pension Fund of Russia (PFR) is a completely autonomous financial system from the state budget at all levels of the federal structure of the Russian Federation (federal, constituent entities of the Federation and local).

The PFR budget must be balanced in terms of income and expenses by regulating the size and terms of payment of insurance premium rates for various categories of payers, as well as through direct reimbursement of funds from the federal budget to cover the current PFR budget deficit.

Indexation of pensions in 2021 for pensioners

According to the decree signed by the president, in 2021 all pensioners, regardless of the type of payments they receive, will be indexed by 7.05%. They received it in two stages, the last of which occurred on April 1, 2021. However, the increase did not come from the amount that citizens received.

The increase involves indexation of the basic part of the pension, without taking into account one-time payments. Thus, citizens actually increased the insurance part of their pensions, while reducing other payments. Taking this into account, a new decree was issued on the return of lump sum payments, since citizens were unable to see a real increase in their income. Thus, indexation made it possible to additionally receive from 500 to 1,100 rubles.

However, not everyone is entitled to an increase in pension payments. If a citizen continues to work officially, then he was not indexed. To increase his income, he needed to quit his job. Therefore, many citizens left work for a couple of months to receive a recalculation, and then returned to their work duties.

Putin talks about indexing pensions in 2021

Persons entitled to an insurance pension

Insured citizens who comply with the conditions specified in Federal Law No. 167 can receive an insurance pension. Persons with temporary or permanent registration in the territory of the Russian Federation, as well as foreign citizens ( including stateless ones ) are considered insured:

- carrying out labor activities under a contract;

- who are self-employed ( individual entrepreneur, lawyer, notary, etc. );

- who are members of family communities engaged in traditional farming ( as well as farming );

- representatives of the Church ministry;

- other categories covered by pension insurance.

What is the size of pensions in 2021

Everyone is interested in how much they can get when they retire. The amount depends on a number of factors:

- what payments the citizen is applying for;

- what is his work experience;

- what were the contributions to the Pension Fund;

- how many points he managed to accumulate.

It is worth noting that upon reaching a certain age, it is not necessary to contact Pension Fund employees to receive payments. If you write an application for their registration a couple of years later, you can increase your income. Thus, the modern pension system motivates citizens to apply for the exercise of their right later to ensure a decent old age.

Receiving payments from the Pension Fund of Russia

Table 2. Amount of social pension in 2019

| Category of citizens | Amount (rub.) |

| Residents of the Far North of pre-retirement age. Disabled people of group 2 (not since childhood). Children without one parent. | 5284 |

| Disabled people of group 1. Disabled since childhood. Orphans studying full-time. | 10568 |

| Disabled people of 3 groups | 4492 |

| Disabled children of group 1 | 12682 |

It is necessary to provide the Pension Fund employees with a complete package of documents to prove the possibility of receiving money.

Important! The payments shown above do not take into account the regional coefficient. If it is applied in the region, then the citizen will be paid more, since it is taken into account when calculating the amount of payments.

Labor and state pensions are assigned based on a number of factors indicated above. Therefore, it is impossible to say in advance what the amount of payments will be.

Funded pension

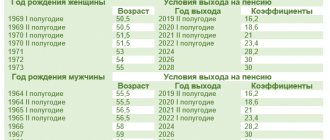

This type of pension, unlike the insurance one, is formed at the request of the citizen. Russians who were born after 1966 are given the opportunity to choose - to direct all contributions only to insurance coverage or to transfer some of them to a funded pension.

People who are employed for the first time retain the right to make this choice for 5 years. The decision to allocate part of the contributions to the formation of a funded pension must be formalized by submitting an application to the Pension Fund.

Can an old-age pension be denied?

The law provides for a vacation if a citizen has a sufficient number of points. They are formed through contributions to the Pension Fund from salaries. That is, the employer transfers part of the money to the Pension Fund for its employees, and the specialists of this fund award points. At the same time, the payments that the Pension Fund receives go towards fulfilling social obligations to existing pensioners.

Today, many manage to accumulate the necessary work experience (20 for men and 15 for women). However, few people have time to accumulate points. If you receive a salary equivalent to the minimum wage, then they will not be enough. Thus, you need to make additional contributions yourself or purchase the missing number of points upon retirement. It's legal, you just need to find out how many are missing.

A citizen is denied a pension

Table 3. Cost of pension points

| Year | Cost in rubles |

| 2019 | 87.24 |

| 2020 | 93 |

| 2021 | 98.86 |

| 2022 | 104.69 |

| 2023 | 110.55 |

| 2024 | 116.63 |

Thus, based on the cost of one point and the shortfall for assigning a pension, you can understand how much you need to transfer to the Pension Fund account to receive monthly payments from it. It is worth noting that along with the document package you must provide a payment receipt. You can make a payment through an operator at a bank or online banking.

How to apply for an old-age pension - step-by-step instructions

To receive payments from the Pension Fund, you must meet certain requirements and provide a complete package of documents. It is worth considering in more detail how payments are assigned.

Step 1

Make an appointment with a Pension Fund employee. This step is not mandatory, but it will save time since you won’t have to wait long for your turn. Registration is made through the State Services portal or on the official website of the Pension Fund. To do this, you need to select a free date and time, indicate the reason for contacting the Pension Fund employees and enter your personal data. The system is not perfect, so sometimes two people are signed up for one time. But they accept both.

Make an appointment with a Pension Fund employee

Step 2

Providing the necessary documents. You also need to fill out an application to receive monthly payments.

Provide the required documents

Step 3

Waiting for payment and receiving a pensioner's certificate.

Expect payment

After this you can receive money. However, if there are not enough points, you will need to purchase more or continue working. At the same time, the funded part remains untouched on the basis of the moratorium. That is, a citizen receives only insurance and one-time payments so that he has enough to reach the subsistence level.

Important! If the funded part of the pension is in the Pension Fund, then it is possible to receive it upon reaching a certain age, regardless of whether the Pension Fund refuses payments or provides them. Accruals will occur monthly or in a lump sum every five years, based on the wishes of the NPF client. Money stops flowing when the citizen’s individual account runs out. If he dies before his funds run out, his heirs can receive the funds for him. To do this, you will need to write a corresponding application and provide documents confirming the client’s death and relationship with him.

Federal Law “On Insurance Pensions”

Like many other areas of human activity, pension provision is regulated by a certain set of laws. The conditions for receiving the corresponding payments are established by the Fed. by law of December 28, 2013 No. 400-FZ “On insurance pensions”.

Changes and additions in 2021

From the beginning of 2021, the amount of the fixed benefit to the insurance pension is 6044.48 rubles. , and the monetary amount of the pension point is 98.86 rubles.

The changes also affected the retirement dates of citizens engaged in professional activities in the following areas: medicine (doctors), education (teachers), including additional centers, etc. For the presented categories, a 5-year deferment is introduced.

From 2021, additional payments will be made in the amount of 1,333 rubles. 54 kopecks pensioners who carried out activities related to agriculture.

Documents for assigning an old-age pension

The Pension Fund employee will need documents to assign a pension. There is a standard and an extended list of them. The standard ones include:

- passport;

- SNILS;

- work book.

These papers will be required to receive your retirement pension. However, there is an additional list that includes:

- confirmation of work in hazardous production;

- serving in the Navy, strategic forces or hot spots;

- papers confirming work in the medical, educational or other field, which makes it possible to retire 2 years earlier and in which there is increased length of service for each day worked;

- confirmation of disability and disability certificate.

Extract from Article 17 of Federal Law-173

Important! If a serviceman is killed and a woman plans to apply for survivor benefits, then you need to contact the military registration and enlistment office at the place of registration rather than the Pension Fund employees. You will need a military ID, proof of family ties, your spouse's file and information about his income. However, military registration and enlistment offices usually refuse to make payments. Then it is necessary to restore the right to them through the court. Practice shows that citizens win such cases, after which they begin to transfer the money they are entitled to.

Voluntary pension insurance

A non-state provision system that provides for voluntary payment of insurance premiums. Both from employers and from citizens themselves for their own benefit or the benefit of another individual. Paid in the form of a funded pension.

Example 1. An employer voluntarily transfers additional funds in the amount of 2,000 rubles monthly to an employee’s funded pension in order to improve social guarantees.

Example 2. Since 2012, every year a husband transfers voluntary insurance contributions to his wife’s personal account in the amount of 10,000 rubles. Due to the fact that voluntary transfers began before 2015, the state, as part of the co-financing program, doubles this amount and by 2021, its amount of pension savings will increase by 120,000 rubles.

Thus, we examined the three-tier pension system in the Russian Federation and all main types of pensions. This should give a general idea of pension payments and under what circumstances we can count on state assistance.

After all, it happens that life presents us with not very pleasant surprises, and in these situations we should not despair and rely only on ourselves. You may also have the right to assistance from the state. And here, as they say, forewarned is forearmed.