It is simply impossible to predict an accident in advance, but they are happening more and more often. The damaged car requires high-quality repairs, and the driver needs compensation for injuries caused to health. All this should be fully covered by the MTPL policy, because most of the driver’s financial problems in a collision with another vehicle should be solved by a mandatory motor vehicle policy; it was created precisely for these purposes. But often it is very difficult to receive full fair compensation from the insurance company, and sometimes it is simply impossible if, for example, the culprit has a false compulsory motor liability insurance policy or simply does not have one. What to do in these and similar circumstances; is it possible to obtain compensation for damage caused from the culprit of an accident in 2021 in such situations?

Normative base

The legal settlement for compensation for damage caused by road accidents in 2021 is contained in the Civil Code (Articles 15, 1064, 1083 and 1094), Law No. 40 “On Compulsory Motor Liability Insurance” (Article 4, defining civil and administrative liability to other road users) and in CASCO insurance rules.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

The degree of guilt and measures of compensation for injured persons are based on the norms of the Administrative and Legal Framework of the Code of Administrative Offenses; Article 12 describes in detail all the consequences for the driver who violated the Traffic Rules; here you can also learn about the set of rules for various types of violations, the extent of punishment and the amount of compensation for them.

As for the particularly serious consequences from the actions of an incompetent driver when performing maneuvers on highways, resulting in serious injury or death to road users, in 2021 they are being considered by the Criminal Legislation of Russia.

Explanations

Any traffic accident inevitably leads to monetary losses, sometimes harm to health, life or personal property. Based on the legal provisions of the Civil Code of the Russian Federation, a person who has suffered material losses in 2021 has the right to claim full compensation for damage from the culprit of the accident.

The provisions of the law on compulsory motor liability insurance oblige vehicle owners to prevent possible civil liability in advance and enter into a compulsory insurance agreement. This serves as a guarantee of compensation payments for damage caused from the culprit of the accident, and the victim has the right to receive compensation:

- For damaged personal property.

- Received injury that affected the ability to work or a normal lifestyle.

- For lost wages due to disability as a result of an accident.

- Compensation for funeral costs or loss of the sole breadwinner.

In 2021, the MTPL policy is intended for compensation payments to the victim of an accident, and not to the person responsible for the accident. The culprit can apply a CASCO policy to compensate for his losses.

Compensation procedure

The sequence of actions of an injured pedestrian who seeks compensation for harm largely depends on whether the car owner is insured for liability. If liability is insured under a compulsory motor liability insurance contract, the victim can contact both the insurance company and directly the person responsible for the harm. Based on the MTPL agreement, the insurance company must make insurance payments to victims of road accidents.

According to the MTPL Law, each participant in an accident is obliged to inform other participants of information about their insurance contract (insurance company, contract number). The victim will need this information when contacting the insurance company.

The owner of a source of increased danger is released from liability (in whole or in part) only in the following cases:

- if he proves that the damage arose due to force majeure, he is completely released from liability. In this case, force majeure are extraordinary and unpreventable circumstances under given conditions (flood, natural disasters, military actions, etc.). Such circumstances do not include, in particular, violation of obligations on the part of the debtor’s counterparties, lack of goods on the market necessary for execution, or lack of necessary funds from the debtor;

- if he proves that the harm arose as a result of the intent of the victim, he is completely released from liability. In civil legislation, the concept of intent is not disclosed as fully as in criminal legislation, so, in accordance with Art. 25 of the Criminal Code of the Russian Federation, intent is understood as unlawful behavior of a person in which he is aware of the social danger of his actions (inaction), foresees the possibility or inevitability of the occurrence of socially dangerous consequences and wants them to occur, or does not want them, but consciously allows these consequences, or is indifferent to them ;

- if the gross negligence of the victim himself contributed to the occurrence or increase of harm, depending on the degree of guilt of the victim and the causer of harm, the amount of compensation should be reduced (clause 2 of Article 1083 of the Civil Code of the Russian Federation). Negligence is such unlawful behavior of a person, which is committed by him through negligence (when the person foresees the possibility of socially dangerous consequences of his actions (inaction), but without sufficient grounds for this he arrogantly hopes to prevent these consequences) - gross negligence, or due to frivolity or negligence (when a person does not foresee the possibility of socially dangerous consequences of his actions (inaction), although with the necessary care and forethought he should and can foresee these consequences) - simple negligence (Article 26 of the Criminal Code of the Russian Federation). In case of gross negligence of the victim and the absence of guilt of the harm-doer in cases where his liability occurs regardless of guilt, the amount of compensation should be reduced or compensation for harm may be refused, unless otherwise provided by law (clause 2 of Article 1083 of the Civil Code of the Russian Federation).

If harm is caused to the life or health of a citizen, refusal to compensate for the harm is not allowed .

In accordance with paragraph 1 of Article 1064 of the Civil Code of the Russian Federation, damage caused to a citizen’s property is subject to compensation in full by the person who caused the damage. The person who caused the harm is released from compensation for harm if he proves that the harm was not caused through his fault. Thus, the following conditions must be present: the pedestrian’s guilt, the wrongfulness of his behavior, the occurrence of harm, and the existence of a causal connection between them. Consequently, if all these conditions for the occurrence of a traffic accident are established, then, according to paragraph 1 of Article 1064 of the Civil Code of the Russian Federation, the harm caused to the owner of the vehicle in the form of mechanical damage to the car is subject to compensation in full.

Is it possible to recover damages without contacting the insurance company?

It is important for any victim of an accident to receive compensation for damages from the inept actions of the guilty party as soon as possible; for this, in 2021, the law provides for several standard methods:

- Try to negotiate in-kind compensation in cash with the person responsible for the accident, and if agreement is reached, then formalize the legal relationship in writing. This involves signing receipts confirming the transfer/receipt of funds and the absence of claims on the part of the injured party.

- Send a registered letter with justified claims to the permanent registration address of the person responsible for the accident. Define in it the deadlines for fulfilling your obligations to compensate for damage from an accident, and after their expiration, if there is no response, send claims to the court.

- A radical way is to apply to a judicial authority to protect your interests.

What additional documents should be attached to the claim?

The statement of claim contains a list of attached documents on the basis of which the plaintiff bases his claims and confirms certain actions. The list is not closed, so the plaintiff has the right to provide any document relevant to the case, confirming his legal position.

Among the required documents attached to the claim are the following:

- receipt of payment of state duty;

- a document confirming the sending of copies of documents to persons participating in the case;

- a claim confirming the pre-trial procedure for resolving a dispute.

For legal entities it is mandatory to provide:

- extracts from the Unified State Register of Legal Entities;

- registration certificates;

- confirmation of the authority of the person who signed the application.

Depending on the circumstances of the case, the statement of claim of the victim in an accident is supplemented with the following documents:

- expert opinion;

- procedure for calculating the amount of recovery;

- documents regarding the insured event;

- certificate of accident;

- medical report on the nature of the injuries caused;

- documents confirming lost labor income.

Before filing a claim in court for compensation for material damage from an accident, special attention should be paid to filing a pre-trial claim. The fact of sending should be confirmed with a shipping receipt or notification of delivery of the letter. We recommend making an inventory of the attachment and recording a list of the shipment indicating the number, date and subject of the document.

Methods for collecting damages

Standard order

Law No. 40 on compulsory motor liability insurance (Articles 11, 12) provides for the following procedure for obtaining compensation for damage from the culprit of an accident in 2021:

- Documentary recording of an accident with the involvement of a traffic police officer or independent registration using the European protocol (GD of the Russian Federation dated October 23, 1993 No. 1090).

- Mandatory notification to your insurance company about what happened, explaining all the circumstances of the accident. All further actions are carried out according to the recommendations received from the employee.

- Collection of a set of documentation. The full list of securities is contained in clause 3.10 of the Rules for Compulsory Motor Liability Insurance, approved by the Central Bank of the Russian Federation on September 19. 2014 For No. 431-P.

- Registration of damage compensation through your insurer at the company’s office.

- Receiving directions for repair work.

Such actions are possible if the perpetrator also has a valid contract for compulsory civil liability insurance, and the policy must not be false. The insurance company, if compulsory motor liability insurance is issued, will only be able to pay up to 500 thousand rubles. for costs associated with restoring health, and 400 tr. for compensation for loss of property. Damage in excess of this amount in 2021 is paid by the culprit of the accident.

For the pre-trial (second) option of collecting damages from the culprit of an accident in 2021, you will be required to take a number of mandatory actions:

- Receive the accident report. It must contain information about all persons involved in the accident, registration addresses, car brands, dates and location of the accident.

- Contact your insurance company and ask for a certificate about the amount of possible compensation or an official refusal to pay.

- Set a day for the independent examination and notify the guilty party about it 3 days before the date of inspection by the expert.

- Write a detailed claim, specifying the payment period and method of payment, the final amount.

Attach photocopies:

- A certificate from the traffic police about the incident.

- A report from the insurance company about the occurrence of an insured event.

- Protocol of a traffic police officer on the fact of identifying an offense under the Code of Administrative Offenses.

- Mail notifications with the text of notifying the guilty party.

- Payment receipts for carrying out expert work, paying for parking and other expenses related to the accident.

- Expert opinion on the condition of the car and the cost of restoration work.

If the actions did not produce a positive result, then in 2021 you should contact the judicial authority at the place of residence of the guilty person.

You must wait 7 days for a response to your claim; only after this period can you file claims.

Some legal points:

- Requests for recovery of damages from the person responsible for the accident must be drawn up legally competently; if you do not have at least initial legal knowledge, then you simply cannot do without the help of an auto lawyer.

- The limitation period for filing legal claims expires after three years from the date of the accident (Civil Code of the Russian Federation, Art. 196)

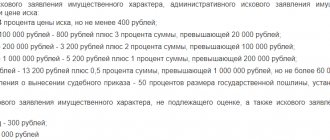

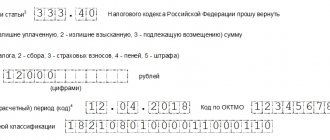

- When filing a claim, a state fee must be paid based on the amount of compensation.

- If the damage is estimated to be no more than 50 thousand rubles, then the application is submitted to the magistrate; to compensate for a larger amount, they apply to the district court.

Lawyer for compensation for road accident damage in Yekaterinburg

A traffic accident almost always entails losses, sometimes very serious ones. The injured party usually expects that the guilty party or the insurance company will cover all costs associated with repairing the vehicle, as well as compensation for damage caused to the health of the citizen.

But it is important to remember that compensation for damage in an accident is a solvable procedure. It can take a long time, and there is no guarantee that its result will please the injured party. Therefore, to avoid risks, we recommend that you contact us.

Necessary evidence to recover damages from the culprit of an accident in 2021

In connection with the new regulations for the preparation of documentation in case of an accident (based on Order of the Ministry of Internal Affairs dated August 23, 2017 No. 664), the employee is not required to issue a certificate of the incident; all information is contained in a protocol that displays all important information about the accident: date and time, place, list participants, a list of violations and their connection to administrative legislation.

In addition to the protocol, the participants in the accident agree on:

- Traffic pattern during an accident: the location of each participant in the accident is indicated.

- Photo or video recording of the accident site is carried out.

- Witness testimony is taken that may explain the event.

- All material evidence is attached to the protocol and entered into the inventory.

- A traffic police officer has the right to describe in a report his vision of all the circumstances that resulted in the traffic incident.

In 2021, the protocol must contain a footnote with all the listed violations for which the perpetrator is brought to administrative and civil liability. But, if there are no grounds, then the case is not initiated, which is also indicated in the protocol.

In 2021, instead of the usual traffic police certificate, participants in road accidents will be issued the following documents:

- Procedural refusal or decision to initiate administrative proceedings regarding an accident.

- The original report drawn up at the scene of the accident.

- Management decision on the fact of committing an offense in accordance with administrative regulations.

Explanations of witnesses to an accident must contain detailed descriptions of the following events:

- The approximate speed of the car at the time of the collision.

- The approximate distance to the car moving in front when the victim discovered the danger.

- At what specific moment did the driver take protective measures: when the braking or steering began, what was the route after these measures before the collision.

- Presence of passengers, heavy cargo, etc.

- Opinion of witnesses about the correspondence of the accident site with the traffic pattern.

- Which vehicle components were damaged, their degree of damage.

In addition to this list of evidence, when applying to court to recover damages from the culprit of an accident in 2021, you should file a petition to request an administrative case initiated upon the accident.

But the main evidence for a claim for damages is an expert opinion, with an assessment of the breakdown of components and the cost of restoration work.

How to file a claim

When drawing up an application, an official style of presentation is chosen. The law does not officially establish a sample claim, so you should be guided by the provisions of Art. 131, 132 Code of Civil Procedure of the Russian Federation and Art. 125, 126 Arbitration Procedure Code of the Russian Federation.

It is recommended to adhere to the following principles when writing a claim:

- Brevity. The maximum volume is no more than 5 pages. You must clearly define the boundaries of the dispute and indicate only the circumstances that are relevant to the case.

- Validity. A claim for compensation for damage as a result of an accident must contain references to the rules of substantive and procedural law - articles of law that you believe the defendant violated.

- Accuracy and conciseness of citations. Use the names of legal acts and laws in abbreviation: after you have fully indicated the name of the legislative act for the first time, subsequently limit yourself to writing its number.

- Acceptable formatting. Throughout the text, you should stick to the same font size and type, avoid excessive use of word highlighting, the recommended size is 14, the spacing is at least 1.5.

Please include the following information in your application:

- the name of the court to which the claim is sent;

- name of the plaintiff and defendant;

- the essence of the dispute: what is the violation of rights;

- references to applicable or violated rules of law;

- requirements for the defendant;

- list of attached documents.

Recommended requirements for a claim are published on the official websites of arbitration courts. For example, on the official resource of the Arbitration Court of the Leningrad Region and St. Petersburg or on the website of the Arbitration Court of the Pskov Region.

Step-by-step instructions for reimbursement

Until the judicial authority establishes the true culprit of the accident, there can be no talk of any recovery of damages. The protocol only establishes the fact of a violation committed by a person, and only a court can admit guilt.

After court proceedings, a decision is made, which determines the degree of responsibility and measures applied in execution of the court decision to the defendant’s side in the claim. This can be either cash compensation in kind or full payment for service work to restore the car.

In 2021, the court gives 10 days to file a cassation appeal if the second participant in the process does not agree with the decision. After all the deadlines for appeal have expired, the decision comes into legal force, and only after that can the procedure for collecting damages from the culprit of the accident begin:

- If the defendant voluntarily does not hurry to pay the amount of damage due, then the plaintiff goes to court to initiate compulsory enforcement proceedings for monetary compensation.

- The bailiffs give the defendant another 10 days to voluntarily repay the debt; if this does not happen, they can confiscate part of the personal property to cover the debts to the plaintiff. But usually payments are compensatory from all types of earnings of the guilty person.

- The funds are transferred to the bank account previously specified in the application to initiate enforcement proceedings.

After the execution of the court order to recover damages from the culprit of the accident, the proceedings are terminated, and the case against the owner of the at-fault car is closed.

How to compensate for losses after an accident

On average, more than 1.6 million Russian drivers get into accidents per year. The main tool for compensation for losses is insurance. An alternative option is to seek compensation directly from the person at fault. Let's look at what kind of compensation you can expect and how to get it correctly.

Who receives compensation and how much?

The easiest thing is for the owner of a comprehensive insurance policy: he can restore the car at the expense of the insurer, regardless of whether he is the injured party in the accident or is himself to blame for the accident. The insurance company will repair the car even after natural disasters or unlawful actions of third parties, if the corresponding risks are specified in the insurance contract. Casco covers all expenses minus the franchise (more on this below).

In the absence of comprehensive insurance, the culprit of the accident does not receive anything, and the injured party has the right to compensate for the loss under compulsory motor liability insurance. If the accident is registered with the involvement of the police, then the maximum amount of compensation under the “automobile license” is 400,000 rubles. When using the Euro protocol, the compensation limit is limited to 100,000 rubles. Participants in an accident whose fault is recognized as mutual can count on half of the accrued compensation. The only condition for receiving compensation under compulsory motor liability insurance is that a valid policy must be issued for the car of the person responsible for the accident.

If several cars were damaged in an accident, then in order to process the payment under the “automobile insurance”, the participants need to be divided into pairs “the culprit - the victim”. Moreover, in a situation where cars standing behind each other collide, the culprits and victims will be different in all pairs. And if one driver lost control and dented several cars, then only he will be the culprit, and there will be several victims. For each couple, a separate insurance case is issued, and the payment is calculated according to general rules.

How does the refund work?

To apply for payment under compulsory motor liability insurance, you must contact your insurance company or the insurance company at fault within five days after the incident. You can usually find out what package of documents is required on the company’s website or by phone.

For comprehensive insurance, as a rule, confirmation of the occurrence of an insured event from the traffic police or the Ministry of Internal Affairs is required (although the contract may indicate that, for example, one body element per year can be repaired without certificates). A similar document will be required to receive compensation under compulsory motor liability insurance if the damage exceeds 100,000 rubles or if more than two vehicles were involved in the accident or the property of third parties was damaged. If all the conditions of the European protocol are met, then the notification of the accident completed by the participants is sufficient. Moreover, starting from 2021, it is not even necessary for both drivers to agree with the circumstances of the accident. They simply indicate their differences on the form.

The insurance company can provide compensation either in cash or in the form of a referral for free repairs. In fact, it depends on the operating conditions of a particular insurer and depends little on the client’s wishes. Repairs are most often offered in the case of comprehensive insurance. You just need to deliver the car to the specified service at the appointed time and pick it up after all the work has been completed. The insurance company will pay all expenses.

If the payment is expected to be in cash, then to calculate the due amount you will need to submit the car for examination. It can be carried out by an employee of the insurer or an independent appraisal company that has an agreement with the insurance company. The insurer has 20 days to pay the compensation (or 30 days to issue a referral for repairs).

If the insurer considers that the damage is so significant that the car cannot be restored (the damage is “total”), then under comprehensive insurance either the full insurance will be paid and the car will be transferred to the insurer, or the insured amount minus the residual value of the car, and then the owner will leave the car to yourself. Often, a comprehensive insurance contract provides for a deductible - a certain amount of damage that the insurance does not cover. For example, expenses within 20,000 rubles. paid by the owner himself. If the damage is greater, the insured receives the entire amount of damage minus the deductible.

If the insurance company refuses to pay

The insurer may refuse to pay if the car owner violated the terms of the contract or the accident was accompanied by violations of the driver: he was drunk, fled the scene of the accident, he did not have a valid license, etc. Another common reason for refusal is failure to meet the deadline for submitting documents (five workers days after the accident), lack of a document confirming the occurrence of an insured event or failure to provide the vehicle for inspection. All these conditions of refusal must be specified in the insurance contract, and if the car owner believes that he has not violated anything, then he can try to get compensation through the court.

If the insurance company underpaid

Such cases have become less common, since all compensation calculations are carried out on the basis of a single methodology and using uniform price guides. They take into account both the age of the car and its mileage. If the car owner is not satisfied with the amount received, he can request the results of the inspection and examination and receive copies of damage assessment reports. If, in his opinion, the underpayment amounted to 10% or more of the actual damage, then an increase in payment can be demanded. You should first make a claim to the insurance company, and then, if you receive a refusal, go to court.

Difficulties can arise if this or that damage was not included in the accident notice and police documents (for example, the true extent of the damage was discovered only during repairs). It is important to check the completeness of the damage listed at the scene of the accident and, if in doubt, indicate the possibility of “hidden damage.” Some insurers have no problem accommodating the client if, after repairs, the insured asks to pay for previously undetected breakdowns (by providing confirmation from the service station). Others require that you provide evidence from the scene of the accident (photo or video), make changes to the notification of the accident and have it signed by another participant, and ask traffic police officers to correct the information in the protocol and resolution. This is all extremely difficult to do, since edits must be made to all copies.

Another reason for reducing the payment is the exclusion of a part for damage to which compensation was already accrued for a previous accident under this insurance contract. To avoid such a situation, after restoring the car, you need to provide it to the insurer for inspection. If this has not been done, then it is possible to prove the occurrence of harm in a specific insured event by conducting an independent technical examination and providing its results to the insurer. If he does not agree to supplement the payment, you need to go to court.

If the restoration is done poorly

All claims regarding the quality of repairs must be indicated in the acceptance certificate. If the repairs were carried out under comprehensive insurance, then claims should be addressed either to the insurer or to the service station (this depends on the terms of the contract). Most often, guarantees for repairs performed are given under normal conditions, and in case of violation, disputes are resolved on the basis of the Consumer Protection Law.

In the case of compulsory motor liability insurance, the insurance company is responsible for all shortcomings, which itself deals with the contractor. The warranty period for repairs is six months (for work related to the use of paints and varnishes - a year).

If the restoration work was carried out poorly and neither the insurer nor the service is ready to eliminate the shortcomings, you need to go to court.

If the actual damage is greater than the insurance payment limit

With comprehensive insurance, this is not possible, since such insurance assumes that the maximum payment is equal to the full cost of the car. There are exceptions, but they are agreed upon in advance with the car owner, and he does not have the right to claim more under the terms of the contract.

In the case of OSAGO and DSAGO, the limit may indeed not be enough to restore the car. In this case, you can only get what you need from the person who caused the accident—the insurance company has nothing to do with it. First you need to try to come to an agreement, and then through the court.

If the culprit does not have compulsory motor liability insurance or the policy is fake

In recent years, due to rising insurance prices, more than 10% of car owners do not take out MTPL at all or buy fake policies to “excuse” the traffic police. It is better to immediately check the insurance number of the culprit at the scene of the accident using the database of the Russian Union of Auto Insurers.

If there is no compulsory motor liability insurance, then the culprit of the accident will compensate for the damage caused. There are times when he offers to compensate everything on the spot or as soon as possible by providing a deposit - and this is the ideal option. You just need to be prepared for the fact that you will have to write a receipt stating that there are no claims against him. But if the at-fault driver does not have money or does not plead guilty, then most likely the case will have to be resolved somehow differently. The legal way is through the court. But in order to be ready to file a claim, you need to get as much information as possible from the culprit: passport, residence permit or place of registration, driver’s license, mobile number (it’s better to check right away), and also register the accident with the traffic police.

Going to court

Regardless of who you are seeking compensation from - the insurance company or the person at fault for the accident, you must follow the pre-trial procedure for resolving disputes, that is, first submit a written claim. It must list all demands against the future defendant and attach copies of evidence and the basis for the claim, as well as indicate the period allotted for voluntary compensation for damage. If nothing happens at the suggested time, you will have to go to court.

The injured car owner has three years from the date of the accident (or the discovery of a payment violation) to file a claim against the culprit or the insurance company. In case of claims under comprehensive insurance – two years.

The statement of claim is filed with the district court of general civil jurisdiction at the location of the defendant (the culprit or the insurance company). The claim describes all the circumstances of the case, starting with the accident and ending with the refusal to pay. The claim must be supported by the results of an independent examination or documented expenses for repairs, a vehicle inspection report, an appraiser’s conclusion, as well as evidence of an insured event. The amount of the claim must include not only full compensation, but also compensation for all costs for the examination, tow truck, representative (car lawyer, if there was one), state duty, interest for late payment, penalties and compensation for moral damage, loss of marketable value (this is not taken into account when claim against the auto insurer).

If the case is won, then at the end of the entire process (there may be several court hearings), the judge makes a decision in favor of the injured car owner with the obligation of the defendant to compensate all his losses. Based on this decision, a debt arises, which the culprit of the accident or the insurer pays off voluntarily or under duress in compliance with the norms of enforcement proceedings.

If the culprit of the accident is not the owner

If, when registering an accident, it is revealed that the car was not driven by the owner, but the culprit has legal grounds for this, for example:

- The owner of the vehicle included it in the MTPL policy.

- Transferred the car to management under a leasing or long-term lease agreement.

In this case, all responsibility for compensation for damage falls on the culprit of the road accident.

Although there is no direct reference to this circumstance in civil legislation, judicial practice shows that courts find the person driving the vehicle at the time of the accident guilty (Part 2 of Article 1079 of the Civil Code of the Russian Federation) regardless of who actually is its owner.

Is it possible to recover damage caused in an accident if OSAGO did not cover car repairs?

If an accident occurs on the road, then in any case the car is a source of increased danger. Then the harm is compensated by the culprit of the event, regardless of the presence of his intent in everything that happened.

In order to compensate for the costs of an accident, it is necessary to prove the presence of fault. This can be done through a court decision in an administrative offense case.

When the consequences of the incident are more serious, the culprit may be sentenced in a criminal case.

As a result of an accident, it is possible to compensate for both property and health damage. Moreover, both of these types of damage are compensated independently of each other.

Expert commentary

Vladimir Roslyakov

Lawyer. More than 12 years of experience.

Ask a question

If the MTPL payment was not enough to repair the car, the difference is recovered from the person responsible for the accident. If there were victims and if there are grounds, they file a claim to recover compensation for the death of the breadwinner in an accident.

Taking into account wear and tear

The new version of the MTPL Law stipulates that the insurer will not issue cash to the victim for the restoration of the car, but will use it for repair work. Their cost is set based on the degree of wear and tear of the damaged vehicle components and cannot exceed 400 thousand rubles. Moreover, the older the car, the less the insurer will allocate funds for repairs (Article 12 of the SAGO Law).

But it is impossible to actually repair damaged parts for this money; the victim has to pay for new units from his own funds. Therefore, it is advisable to calculate the recovery of damage from the difference between the amount of money actually spent by the owner and allocated by the insurance company.

The injured owner has the right to recover the overpayment amount in court. To do this, you will need certificates from the insurer about the allocation of funds for repairs and from the service center foreman about the actual cost of completely restoring the car.

(Resolution of the Constitutional Court of the Russian Federation dated March 10, 2021 No. 6-P).

What else do you need to know

- When filing a claim in court, payment of a state duty is required, while the recovery of moral damages is not subject to state duty. The amount of the state duty must be included in the final price of the claim.

- All additional expenses incurred by the victim as a result of an accident can be recovered from the culprit of the accident, including payment for the services of an appraisal company, a lawyer, a tow truck, and more.

- The statute of limitations for filing a claim for compensation for damages in case of an accident is 3 years, that is, you can reimburse the money spent on repairing and restoring the car at any time before the expiration of this period.

Recovery of damages from the culprit of an accident in excess of the limit under compulsory motor liability insurance

If the amount established by the insurance law in 2021 (no more than 400 thousand rubles) is not enough to fully replace damaged parts, then you can receive the rest of the compensation in full from the person at fault. In practice, the price of repair work can increase significantly if, for example, the owner needs to repair an expensive imported car: original parts will have to be ordered abroad at the expense of the owner of the damaged car, postal services and the work of the repair team will also have to be paid.

All claims for additional compensation of a property nature in excess of the limit insurance amounts are recovered from the culprit of the accident in 2021 only in court, if there is no amicable agreement between the parties (clause 1 of Article 935, 931 of the Civil Code of the Russian Federation).

As evidence to the claim for compensation, the applicant must attach all financial documents: the cost of the supply kit from the manufacturer, the price list for the equipment sent by the manufacturer, the cost of restoration of damaged units and additional equipment.

Since claims of a material nature are being filed, the plaintiff is obliged to pay a fee on the amount of compensation, which can also be recovered from the defendant.

Claim procedure

Experts in road accident cases advise going through the pre-trial compensation procedure before filing a claim. At the same time, the legislation does not prohibit skipping the stage of filing a written demand and immediately after the occurrence of a road accident, going to the district court (we remind you that in the case of claims sent to the insurance company, the pre-trial procedure is considered mandatory). Practice shows that often those responsible for road accidents simply ignore the letters of claim sent to them. If you nevertheless decide to take the opportunity to resolve money issues out of court, it will be useful to know the following:

- the claim must be clear and understandable;

- it should contain: a description of the accident that resulted in losses, a reasoned conclusion about the need for compensation (you should indicate why you intend to receive payment for the costs from this person);

- circumstances for which no recovery is made from the insurance company;

- do not allow demands in a rude, harsh, emotional form;

- the letter must indicate damage (both obvious and hidden), as well as a document confirming their list;

- the final amount you intend to receive: the cost of repair work, reduction in commodity value, evacuation costs, storage costs, appraisal costs, etc.

It is advisable to attach everything that the author of the claim refers to in copies (for greater persuasiveness and reliability, copies can be certified by a notary). It can be:

- a document confirming the fact of the accident;

- proof of vehicle ownership;

- paid bills for the cost of repairs, evacuation, storage, etc.;

- conclusion of the appraisal examination;

- other documents.

The completed claim is sent to the culprit of the accident at his place of residence by registered mail with notification or with a valuable list of the contents. It is possible to deliver a letter via courier service - this issue is decided at the discretion of the sender.

Sample claim

The following sample claim can be used in the event of a complete lack of compensation for damage by the insurance company of the person responsible for the accident:

Ivanov Ivan Ivanovich registration address: 100000 Moscow, st. Lenina, 1, apt. 1 Petrov Petr Petrovich, registration address: 200000 Moscow, st. Lenina, 2, apt. 2

PRE-TRIAL CLAIM TO THE culprit of an accident

Dear Ivan Ivanovich!

01/01/2021 at 13:40 on the street. Khoroshevskoe highway in Moscow there was a collision with a Lada Priora car, state registration number A 000 AA/197, which was driven by me, P.P. Petrov. with a FORD car, state registration number U 000 УУ/197, which was driven by you, I.I. Ivanov.

The Lada Priora car, state registration number A 000 AA/197, belongs to me by right of ownership (a copy of the technical passport is attached).

The accident occurred through your fault, as a result of violation of clause 1.4 of the traffic rules, which is confirmed by the expert’s conclusion dated 01/02/2021, the protocol on an administrative offense, the road accident diagram, the resolution in the case of administrative offense 00AA 000000 dated 01/01/2021.

As it became known, the risk of your civil liability was not insured, since you did not take timely measures to extend the MTPL agreement.

In accordance with the conclusions of the examination of Expert-Auto LLC No. 0000000 dated 01/05/2021. (copy attached), the cost of restoration work on the Lada Priora car, state registration number A 000 AA/197, amounted to 45,000 rubles. In addition, I incurred additional expenses:

- 5000 rubles - the amount spent on the tow truck (I enclose a copy of the service provision certificate);

- 5,000 rubles – the amount spent on replacing a security alarm system damaged as a result of an accident (certificate attached).

Total, total amount of losses: 55,000 rubles.

I propose that you voluntarily, within 15 days from the date of delivery of this claim, pay me the cost of expenses incurred as a result of an accident for which you are the culprit. To transfer funds, I provide the details:

Sberbank PJSC, account 000000000000 or to Sberbank card No. 1111111111111.

If you intend to pay the required amount, but for some reason cannot do it within the period specified in this claim, you can call my phone number 8926000000 on weekdays from 18-00 to 22-00, on weekends from 10 -00 to 21-00, for negotiations.

In case of failure to comply with the requirements, I reserve the right to apply for compensation to the court, in which case I will additionally make demands for legal costs.

APPLICATION:

- a copy of the vehicle's passport;

- a copy of the resolution in the case of an administrative offense;

- a copy of the certificate confirming the replacement of the electronic auto protection system;

- a copy of the expert's opinion dated 01/02/2021;

- copy of the expert's opinion dated 01/05/2021.

01/15/2021 Ivanov I.I. _____________signature

So, if, after the expiration of the established period for repayment of damage, the addressee has not made attempts to voluntarily compensate for your losses, there is nothing left to do but go to court.

What determines the amount of damage?

The legal grounds for calculating compensation amounts in 2021 are contained in Federal Law No. 40, Art. 7 defines the concept of the sum insured, in Art. 12 – its size and payment procedure.

The calculation of compensation payments in the event of an accident in 2021 depends on many interrelated factors; experts take into account:

- The cost of damaged parts, taking into account depreciation + the work itself to restore the car, will be contained in clause 19 of article 12.

- The amount of payment for conducting an expert assessment of all damage to the car (Article 12.1 of the Law)

- In case of complete loss of property, compensation for the price of the car specified in the contract, also taking into account depreciation, and not the cost of a new car (Article 7)

Other material costs incurred are regulated by Civil Legislation, since the specified legal act does not regulate the property relations of the parties in any way (Articles 15, 1064, 1072 of the Civil Code of the Russian Federation). The following may be included in compensation for damage:

- Compensation for the cost of medical services and treatment courses to restore lost health and rehabilitation after an accident, purchase of medicines.

- Cost of tow truck and parking services.

- To transport victims to a medical facility.

- Compensation of wages during the period of restoration of working capacity.

- In case of death, payment for all funeral services.

But the insurance company will only be able to pay up to 500 thousand rubles. for costs associated with restoring health, and 400 tr. for compensation for loss of property.

Everything that was spent in excess of the specified amounts, including the moral suffering of the person injured in the accident, is compensated by the perpetrator in court if there is no agreement to voluntary payments.

Types of compensation for road accidents

The victim has the right to recover all types of damage, including physical, financial and moral. When compensating for material damage after an accident, the culprit pays for:

- repair and purchase of spare parts;

- purchasing a car of a similar make, model and technical condition;

- vehicle evacuation and independent examination;

- legal costs.

Harm to health is various injuries, exacerbation of chronic diseases and the emergence of new diseases as a result of an accident. Compensation for health damage after an accident involves compensation for:

- cost of medicines;

- expenses for surgery, rehabilitation, sanatorium treatment;

- loss of earnings during the period of incapacity.

Moral damage after an accident is compensated only through the court. In this way, the victim compensates for the negative psycho-emotional consequences of the accident: stress from deteriorating health, death of loved ones, etc. You can file for moral damages after an accident, even if the perpetrator voluntarily compensated for material damage.

Court decisions to recover damages from the culprit of an accident without compulsory motor liability insurance

Basically, general and supervisory courts protect the rights of policyholders and make decisions on the payment of compensation. True, if all pre-trial and judicial formalities are met.

But insurance companies often make counterclaims against the culprit of the incident if he committed an offense while drunk or on drugs (regression).

Also, similar demands can be made by the RSA if it paid compensation to the injured citizen for the guilty person who did not have compulsory insurance.

Courts will automatically find a driver guilty of an accident in 2021 if it is established:

- Lack of a license to drive a car, or failure to pass an exam on knowledge of traffic and driving rules.

- The driver's license was issued for a different category of vehicle.

- A citizen who has been deprived of a driver's license is allowed to drive.

In case of deliberately fleeing the scene of an accident, the driver is also found guilty.

Courts of all instances note that if the culprit is not included in the insurance, then a counterclaim for damages must be applied to him.

But in relation to a specific person to whom a penalty can be applied (the owner or driver driving the car at the time of the collision), the courts sometimes make contradictory decisions.

He who is guilty pays

Everyone knows that with the introduction of compulsory motor liability insurance, the obligation to pay for the damage incurred lies with the insurance company of the one who is at fault, or with “their” insurance organization (this is called direct compensation), if only vehicles that are insured under compulsory motor liability insurance were damaged. It would seem that everything is clear and simple. At the same time, there are often situations when it is necessary to present demands directly to the culprit of an accident:

- when the insurance company did not fully satisfy the claims of the injured party. Thus, civil liability can be insured for an amount not exceeding 400,000 rubles: if the amount of costs for car repairs turns out to be greater, the difference must be recovered directly from the person responsible for the incident;

- if the car was damaged in a parking lot, parking lot, that is, not while moving (the car was not in use, the driver was not driving it, and there was no other car that was moving and made a collision, but, let’s say, a person scratched the car with a nail). This is no longer an accident as such, but property damage;

- when it is necessary to obtain payment for causing moral damage;

- the insurance organization refused to pay (in whole or in part) and appealing such actions did not bring a positive result;

- the insurance organization went bankrupt or was liquidated without making payment under a judicial act adopted in favor of the victim;

- if the driver at fault for the accident does not have a concluded contract with any insurance company, or such contract is expired.

Property claims cannot always be made against the person driving. So, if the car is listed on the balance sheet of a certain organization, then this organization is obliged to compensate for losses (as a rule, victims demand compensation jointly from both the legal entity and the driver in order to avoid unnecessary proceedings with shifting the blame onto each other).

If a person has an accident while driving a vehicle on the basis of a power of attorney, a lease agreement, etc., then such driver will be the debtor, however, these circumstances must be reliably confirmed by the owner of the vehicle. A similar rule applies if the car was driven by a thief.

If the burden of guilt in the listed situations was borne by the owner, then he can subsequently make recourse claims against the citizen who committed the collision.

Nuances of the procedure

All claims for recovery of damages from the culprit of an accident in 2021 can be satisfied if it is established:

- All grounds are legal.

- The damage exceeds the amount stipulated by the policy.

- The cost of completely restoring a car exceeds the amount established by law.

And for the second party there are several ways to refuse to cover damages:

- Documentarily prove that the demands made against him are illegal.

- Agree to reduce the final cost of coverage.

Therefore, it is quite possible to receive full funds due from a citizen who caused moral or material harm, but this will require legal knowledge and time.

Situations in which you can claim damages

The person responsible for the accident must independently provide funds to cover losses in the following cases:

- The driver left the scene of the accident. This cannot be done.

- The person does not have an insurance policy.

- The accident does not fall under the criteria of an insured event.

- The victim wants to receive compensation for moral damage.

- The damage is so great that the insurance company is not obliged to pay compensation in such a large amount. The insurer is obliged to compensate up to 400 thousand rubles if damage is caused to a car and other property, and up to 500 thousand if harm is caused to human health. In other situations, the insurance company is obliged to pay damages for the person at fault for the accident.