- When can you demand money?

Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised August 25, 2021

Reading time 13 minutes

A receipt confirms that a person has lent money to someone else. But the mere presence of a document does not guarantee timely repayment of the loan. If the money is not returned, or the debtor denies the fact of its transfer, then collection will have to be carried out. To collect a debt from an individual against a receipt, you can use out-of-court methods, either file a lawsuit or obtain a court order, or act through bailiffs. We will tell you in the article how to properly prepare documents when transferring money, and how to collect a debt.

Rules for drawing up a receipt

A receipt is a document confirming that an amount of money has been lent. A receipt is an analogue of a loan agreement; the terms of the transaction can be stated in it:

- return period (for example, one-time, in parts);

- the amount of interest, the procedure for their payment;

- the method in which the money should be returned (for example, cash, bank transfer);

- other conditions agreed upon by the parties.

A loan agreement or receipt need not be drawn up if the amount of debt is less than 10 thousand rubles. However, if you are lending cash, it is better to get a receipt for this for any loan amount. The debtor will know that you have proof of the loan.

Repayment of the debt on the receipt depends on the correct completion of the document. Below we will talk about the nuances that need to be taken into account when preparing the document and transferring money.

What should the receipt look like?

The receipt must be made in writing. The document must bear the signature of the borrower confirming receipt of money in a certain amount. However, often both parties sign the receipt. If the transfer of money is carried out in the presence of witnesses, the details of their passports and signatures are also indicated in the document.

— 14 KB

When is a notary needed?

It is not necessary to contact a notary to certify the receipt. But notarization gives an advantage to the person who lends money:

- when issuing a receipt, the notary will check the legal capacity of the parties and passport details, make sure there is no fraud or threats;

- the notary will record the transfer of money, and the debtor will not be able to challenge this fact;

- with a notary receipt, you can receive a court order; with a loan agreement, you can collect money according to a notary’s writ of execution without a trial (if extrajudicial collection is provided for in the agreement).

The disadvantage of registering a document through a notary is the fee, which is calculated as a percentage of the transaction.

How to transfer money

Borrowing money is always a risk, even if you lend it to a relative or someone you have known for a long time. To minimize the risks of non-refund, use the recommendations of our lawyers:

- personally check the original passport, get it stamped through the online service of the Ministry of Internal Affairs, do not give money using a copy or documents of someone else;

- ask to write a receipt by hand, since if you dispute the fact of transfer of money, a handwriting examination may be required. If the receipt has already been printed, ask the borrower to sign with his full name and write the date by hand;

- accurately indicate the passport details in the receipt, decipher the amount of money being transferred - in numbers and in words;

- keep the original receipt for yourself, or make two copies for both parties;

- do not take the debtor’s passport as collateral, as you may be held accountable for this.

The terms of the promissory note are determined by the parties. We advise you to specify the exact date of return of the money and the amount of interest. If you do not specify a date, a notice will have to be sent to the borrower. Without specifying the amount of interest, you will be able to recover through the court only the minimum - at the rate of the Central Bank of the Russian Federation, which is significantly less than the market conditions of the loan.

How to transfer money correctly

Usually, money is transferred in cash based on a receipt. The parties recalculate them, after which the borrower confirms the amount in numbers and words.

If you are transferring money to a card, indicate the purpose of the transfer in the payment purpose

: “in debt to Ivan Ivanovich Ivanov until May 5, 2021.” It is almost impossible to challenge a payment document and account statement. This will be 100% proof in court.

Are witnesses needed?

To collect a debt under a receipt, it is not necessary that the transfer of money occur in the presence of third parties.

If you decide to apply for a loan with the participation of witnesses, they must see the counting of money and its receipt by the borrower, and certify this fact with their signatures. The passport details of those present must also be written down in the document. If it comes to litigation, witnesses will be called to the trial and questioned on record.

When is it necessary to go to court to get money back on a receipt?

An application to the court is a written demand to the defendant to repay the debt, in fact, the return of funds transferred under the loan agreement to the debtor.

The evidence attached to the claim is a loan agreement or a receipt for receipt of money.

Written documentation is required if a loan is made between citizens in an amount exceeding 10 minimum wages, corresponding to the amount accepted on the date of its signing (Article 808 of the Civil Code of the Russian Federation).

Expert commentary

Roslyakov Oleg Vladimirovich

Lawyer, specialization civil law. More than 19 years of experience.

Ask a question

In the absence of an agreement or receipt for the transfer of money, the parties in the application for debt collection do not have the opportunity to refer to the testimony of witnesses. Thus, the return of funds loaned can sometimes turn into a real problem for the lender.

Collection methods

If the borrower treats his obligations in good faith, you will be able to receive money on a receipt without litigation or reminders.

If your debt is not repaid, use the following methods of influencing the defaulter:

- pre-trial options: claims, calls, messages on social networks;

- recovery by order or claim through the court;

- transfer of documents to the FSSP for forced retention or forwarding to the debtor’s employer or to a credit institution where he has accounts.

Collectors will not help in repaying a debt on a receipt without going to court. They buy out debt from banks and microfinance organizations in large portfolios, since otherwise they cannot count on profit. The debt of a private person, even confirmed by a court decision, is not interesting to collectors.

Using a receipt, you can declare your claims in case of bankruptcy of the debtor. To do this, you need to timely submit an application to arbitration for inclusion of claims in the register. For the creditor (creditor), bankruptcy is not the best scenario. If the debtor does not have property and money to pay creditors, his debts will be written off. After this, any form of collection is impossible.

What kind of receipt should there be to collect a debt through court?

In a debt obligation, its design and content components have legal significance.

READ Collectors sued: how to protect your rights if the bank sold the debt

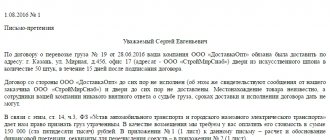

How to make a receipt

A debt obligation of an individual must include:

- name of the city or other municipality where the document is drawn up, the date of writing;

- Full name of the participants in the process, their addresses of residence (registration), information from the passport;

- terms of the loan and other circumstances (if the money is given at interest, this must also be indicated), the time of the planned repayment;

- confirmation of receipt of money by the borrower;

- in addition, the borrower can indicate that he is capable - has a sound mind and a solid memory, borrows without coercion - is not under psychological or physical pressure, and is not in difficult circumstances.

Otherwise, a receipt for receipt of money borrowed can be drawn up arbitrarily or according to a sample. The court will take its presence into account in any case.

If the receipt does not indicate the deadline for repayment of the debt

A written obligation without a repayment period implies its repayment at the request of the lender. In such circumstances, the borrowed amount must be repaid within thirty calendar days from the date of the request, unless otherwise specified in the receipt by the parties. After thirty days you can go to court.

A receipt will help you repay the debt, even if it does not contain the required details. It is valid even when it does not contain a literal indication of the obligation to return the amount received, and only “received” is written, and also when there is complete absence of information about the return period.

How to prove the existence of a debt if there was no receipt

Debt recovery without debt documents has its own specifics. There is no need to hide that the absence of a receipt complicates the debt collection procedure. The following evidence will help you repay the debt faster without a receipt through the court:

- confirmation of the actual transfer of money to the borrower - for example, bank or postal transfer in the name of the borrower;

- the presence of an audio recording of the conversation;

- correspondence - postal, SMS, online.

Does the receipt have legal force?

Let's figure out which receipt has legal force in court. A receipt that is not certified by a notary (notary) also has legal force. The main thing is to write the receipt correctly so that it is valid in court when filing a claim. A handwritten version and a receipt typed on a computer according to a sample are also acceptable.

But notarization will significantly simplify the collection procedure, since the notary is obliged to check the voluntary expression of the will of the parties, their legal capacity, the correctness of the document between individuals, and the actual transfer of money.

Our services and prices

Free consultation

0 ₽

- You talk about your problem, ask questions;

- The lawyer clarifies the necessary information, analyzes the situation, tells options for the development of events;

- Together you choose a profitable option - bankruptcy, refinancing, just a complaint against debt collectors or a bank;

- The lawyer tells you how to prepare, where to get documents, and what to do in your case.

Read more

Out-of-court bankruptcy in MFC on a turnkey basis

25 000 ₽

- Verification and recording of debts and proceedings in the FSSP, assessment of property and contestability of transactions for 3 years

- Drawing up an application and list of creditors

- Filing a bankruptcy application to the MFC by proxy

- Working with banks and collectors - notification of refusal to cooperate, complaints to the prosecutor's office and the FSSP in case of violations

- Representation of interests by a lawyer in case of objections from creditors

- Six months later, you receive a decision from the MFC to declare you bankrupt and write off your debts.

Read more

Turnkey bankruptcy of an individual

from 8,000 ₽/month.

- Filing a bankruptcy petition

- Collection of necessary documents

- State duty and remuneration of the arbitration manager

- Representation of interests by a lawyer at a court hearing on the introduction of bankruptcy proceedings

- Full support of bankruptcy proceedings by financial managers

More details

State duty

Filing a claim of a property nature is accompanied by the payment of a state fee, the amount of which depends on the price of the claim itself (the volume of material claims):

- ⩾ 20 thousand rubles — 4% of the claim price, but not less than 400 rubles;

- ⩾ 20 thousand 1 rub. up to 100 thousand rubles — 800 rub. + 3% of the amount more than 20 thousand rubles;

- ⩾ 100 thousand 1 rub. up to 200 thousand rubles — 3 thousand 200 rub. + 2% of the amount over 100 thousand rubles;

- ⩾ 200 thousand 1 rub. up to 1 million rub. — 5 thousand 200 rub. + 1% of the amount over 200 thousand rubles;

- > 1 million rub. — 13 thousand 200 rub. + 0.5% of the amount over 1 million rubles, but not more than 60 thousand rubles.

The amount of the state duty directly depends on the volume of financial claims (the loan amount specified in the statement of claim when collecting by receipt). The total claim price is the amount of the claims.

How to repay a debt using a receipt

Below we will tell you step by step how to return money according to a receipt, without missing the statute of limitations.

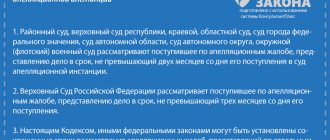

When can you demand money?

You can sue a debtor on a receipt from the date of violation of debt obligations. Depending on the terms of the transaction, the right of claim will arise:

- from the day following the date of return of the entire amount;

- from the day following the date of repayment of part of the loan, if the parties agreed on a phased settlement;

- after the debtor refuses to return the money within a reasonable time, if the exact date of return is not indicated in the receipt.

The last point deserves special attention. If you do not specify the exact return date, the transaction is concluded for an indefinite period. This means that the demand for repayment must be sent to the debtor in advance, within a reasonable time. Judicial practice considers 30 days a reasonable period. If you submitted a claim and after a month the borrowed funds have not been returned to you, you can begin collection.

Pre-trial settlement

If you refuse to return the money, you can immediately submit documents to the court. Pre-trial and pre-claim collection is not necessary.

- 11.6 KB

However, a simple written complaint can help, and you won't have to pay a fee or waste time and stress in litigation. At the pre-trial recovery stage, you can proceed as follows:

- a few days before the repayment date, remind the borrower about yourself

, send an SMS or message on social networks, in instant messengers - the debtor’s responses or his reaction to messages will show whether he plans to return the money on time; - send a written notice or claim as soon as the return date has passed

- we recommend sending documents by registered mail with notification or handing them over in person against signature; - discuss with the debtor options for extending the loan terms

, if this suits you - it is better to give a few more weeks or days to repay the loan if you know for sure that the debtor will soon receive the money and pay off; - keep a record of your personal or telephone communication with the defaulter

- the record can be used not only as evidence in court, but also if you are possibly accused of threats or extortion.

If the debtor categorically denies receiving the money, immediately go to court and avoid personal meetings. The fact is that many debtors try to seize the initiative and accuse the lender of extortion, especially if the fact of transfer of money is not confirmed by a receipt. Threats and showdowns on your part will only worsen the situation. It is better to act in the legal field and with the support of a lawyer.

Preparation of documents for going to court

The main evidence for going to court is a receipt. A copy of the specified document must be attached to the statement of claim, and the original must be submitted to the court hearing. The documents may also include:

- calculation of the amount of claims;

- copies of claims, notices or demands addressed to the debtor, evidence of receipt;

- answers to your demands, other correspondence with the debtor.

You also need to pay the state fee and attach a receipt. Our lawyers will help you determine the list of documents that will be required for recovery through the court.

When can you get a court order?

You can apply for a court order if you have a notarized receipt and the total amount of the debt does not exceed 500 thousand rubles.

important!

An application for an order to collect a debt must be submitted to the magistrate at the debtor’s place of residence.

— 40 KB

Procedure in writ proceedings:

- based on the received documents, the judge issues an order and sends a copy of it to the debtor;

- from the moment of receiving a copy of the order, the debtor has 10 days to file objections;

- if no objections are received, the order comes into force, the claimant receives an order certified by the court;

- the document can be sent directly to the FSSP, or it can be sent to the bank where the debtor has an account - the order is binding, the money will be written off and transferred to you.

If the debtor files objections, the order will be canceled. Then you need to file a claim, participate in meetings, wait for the court decision to come into force, and receive a writ of execution.

How to draw up a statement of claim and submit documents to court

To file a claim, you need to correctly determine the jurisdiction, calculate and pay the fee.

The amount of the fee depends on the amount of the claim; it can be calculated using an online calculator.

Jurisdiction is determined as follows:

- with a debt of up to 100 thousand rubles. you need to contact the magistrate;

- if the debt exceeds 100 thousand rubles. - to the district court.

The court of first instance will notify the parties, hold meetings, consider the receipt, and, if necessary, call witnesses.

— 15.5 KB

- 11.7 KB

The court's decision to collect the debt on the receipt will take effect after 30 days unless the defendant files an appeal. After entry into force, you need to obtain a writ of execution. If a complaint is filed, the sheet will be issued after the case has been reviewed on appeal.

Important!

The losing party is obliged to reimburse the winning party for legal costs. Therefore, in addition to the debt and interest, it is possible to recover from the defendant

- state duty

- postage,

- legal expenses.

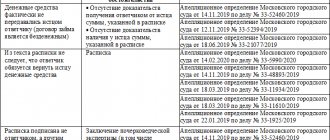

Why does the court refuse to collect a debt on a receipt:

- the statute of limitations for going to court has expired (3 years);

- the fact of transfer of money has not been proven (there is no receipt, or there are serious errors in it);

- the defendant presented evidence that he had already paid off the lender.

Also, the defendant may request a reduction in the amount of the penalty (interest) if it is disproportionate to the principal debt.

For example.

According to the receipt, you calculated the debtor 200% per annum, which is clearly disproportionate to the amount of the main loan. But if the defendant does not submit an application to reduce the penalty, the judge cannot independently reduce the amount of interest.

We won the trial, what to do next?

Issuance of an order or issuance. the sheet does not guarantee that you will quickly receive your money. Only in rare cases do debtors pay voluntarily and quickly. Typically, plaintiffs have to turn to bailiffs, seek deductions from wages, from accounts, or demand the sale of property.

You can apply for a writ of execution or court order:

- directly to the bank to debit money from the debtor’s account;

- at the borrower’s place of work for deduction from salary if the debt is less than 100 thousand rubles;

- to the FSSP so that the bailiffs can handle the collection.

FSSP specialists will also be able to send documents for retention to the employer or to the bank. But they also have many additional powers, from imposing travel bans, temporary deprivation of rights to declaring physical restrictions. wanted persons

We recommend submitting documents to the bank if you are sure that there is an account there with the amount of money to be written off.

Receipt for receipt of borrowed funds: legal force

Practice shows that success in debt collection largely depends on the correct preparation of the receipt. What should be in it?

Of course, this is the name of the document, as well as the date and place of its preparation. This is followed by information about the citizen who borrows money and about the person providing the loan. Here you need to provide both the addresses of the parties and their passport details.

We recommend! How to collect a debt from OJSC ChMK

Next, you need to indicate the amount of the loan (in numbers and in words), the period for its repayment, as well as the amount of interest, if any. If the loan repayment period is not specified, then the debtor must first send a written request for payment of the due amount of funds.

The receipt must be completed by the signatures of the parties with a decoding of their initials. If there were witnesses present when drawing up the debt document, then information about them should also be mentioned.

The loan can also be obtained from a notary. Then he will seal the debt obligations with his signature.

The procedure for collecting debt by receipt through bailiffs

The law obliges bailiffs to promptly execute any court decision. But if you have already applied to the FSSP, you know that it is difficult to count on this.

Application for initiation of execution production - 23 KB

To speed up the refund process, we recommend:

How bailiffs work - law and reality 2021 Related article

- monitor the progress of the case, submit requests to the FSSP or through the government services website;

- take the initiative - inform the bailiff about the debtor’s known accounts, electronic wallets, file a petition for a ban on traveling abroad and temporary deprivation of a driver’s license;

- immediately file complaints about the inaction of the FSSP representative if he did not request information about accounts and property, did not impose a seizure, or carry out enforcement actions;

- demand that the debtor be put on the wanted list if the person has moved, and the bailiff claims that nothing can be done.

If the defaulter’s property, accounts or place of work are not found, the FSSP can finish the case and return the documents. This is not a reason to stop collecting and say goodbye to your money. The statute of limitations for enforcement is 3 years, and it is interrupted for the duration of enforcement proceedings. If you find out that the debtor got a job or acquired property, contact the FSSP again with the documents.

Deadlines for filing and consideration of a claim

In accordance with paragraph 1 of Art. 196 of the Civil Code of the Russian Federation, the plaintiff has the right to go to court to protect his rights within three years after:

- receiving information about a violation of his rights;

- expiration of the period for fulfilling obligations, if it has been established.

Three years is the general statute of limitations for legal recourse in civil proceedings. It is during this period that it is permissible to file a claim to collect funds under debt documents.

The countdown of the limitation period for this category of cases begins not from the moment the money is transferred, but from the day the demand for repayment of the debt is made.

The court decision regarding the collection of debt under debt acts is made before the expiration of 2 months from the date of acceptance of the application by the district/city court, 1 month - by the magistrate court.

Interest on late repayment of loan on receipt

When borrowing, it is possible to charge interest for late repayment. This refers to interest for non-fulfillment or delay in fulfilling the obligation to repay borrowed funds (Clause 1, Article 395, Article 811 of the Civil Code of the Russian Federation). They are collected without taking into account contractual interest in the amount determined by the contents of the receipt. This is a penalty for late repayment by the borrower of the borrowed amount.

If the debt deed does not contain such information, interest is payable on the borrowed amount in the amount provided for in paragraph 1 of Art. 395 of the Civil Code of the Russian Federation, from the moment when it was subject to return until the period of its return to the lender separately from the payment of interest specified in paragraph 1 of Art. 809 of the Civil Code of the Russian Federation (clause 1 of Article 811 of the Civil Code of the Russian Federation) - on a receipt with interest.

The penalty is calculated independently. The penalty amount is collected exclusively in court and can be included in the statement of claim for collection of the principal debt. A sample of such a claim can be found on specialized web resources, including our website.