Writing off funds from a salary card is always unexpected, unpleasant and causes a storm of indignation. But at this moment it is important not only not to panic, but also to act as quickly as possible to minimize the damage.

Can a salary card be seized? On what basis do the bailiffs write off funds from her? How to get your salary back, and are there ways to protect money from the actions of performers? Taxation and accounting expert Alla Semenova FAN journalist about this .

photo from the personal archive of Alla Semenova /

Can a salary card be seized?

Debt collection is carried out by the Federal Bailiff Service. Its employee opens enforcement proceedings and then imposes restrictions on the debtor’s accounts or property. The bailiff is obliged to notify the debtor of the fact of the opening of proceedings. They do this in writing by sending a notification by registered mail.

Having received such a letter, the debtor can pay off the debt voluntarily - the law allows five days for this. If the debt is not repaid, the bailiff initiates forced collection of funds.

It also happens that the debtor deliberately does not receive a letter from the FSSP, and it is returned to the sender. Despite the fact that the notification was not received, this does not limit the capabilities of the FSSP employee. It works in exactly the same way, but only with a slight delay: production is opened after the letter is returned, usually after 30 days.

Advice. It is worth receiving letters from the FSSP. First of all, in order to understand the origin of the debt and contact the bailiff in time to indicate accounts and funds that, according to the law, cannot be collected.

“The seizure of a salary card is possible for several reasons,” notes tax and accounting expert Alla Semenova. — This happens if there is a debt on loans, car fines or taxes have not been paid. Also, the reason may be court decisions taken not in your favor, debts for utilities and evasion of alimony payments.”

You can find out the reason for the retention using government portals. On the Gosuslugi website you can find out debts on taxes and car fines, but only if you have a verified account. You can clarify debts regarding alimony and other legal disputes on the website of the court where the case was heard. It will not be possible to find out the utility debt electronically, but you can contact the nearest MFC and check the amount there.

Regardless of the reason for the debt, the bailiff will collect it by all means available to him. And seizing and withdrawing money from a bank account is one of the fastest and most effective, which is why it is used most often by FSSP employees.

Federal News Agency /

The procedure for returning money from bailiffs

How to proceed so that the bailiffs return the money?

- Prepare an application for a refund.

- Submit or forward an application to the appropriate unit of the bailiff service.

- Clarify information about the receipt of the application by the bailiffs, if the application was not submitted in person with a mark on the applicant’s copy.

- Contact the bailiff or come on the reception day to clarify the information on your application and when the refund will be made.

- In a situation where the bailiff refuses to return the money, ask to give you a written refusal or wait 30 days from the date of filing the application.

- If a response from the bailiffs is not provided, file a complaint with the prosecutor's office about the violation of the deadlines for considering your appeal, as well as the non-return of funds.

- Wait for the results of the prosecutor's investigation.

- You can appeal the bailiffs' refusal in court.

In a situation where the bailiffs agree to return the money, they must do this as soon as possible. The law does not specify such deadlines, but, as a rule, transfers from the bailiffs’ deposit are made within 5 business days.

Why doesn't the bank report restrictions?

According to the law, the bank is not obliged to do this; this is the task of the FSSP employee. However, the position of banking institutions is usually determined by their ethics towards customers. Some not only inform the client about the arrest of the account, but also provide information about the bailiff who imposed the arrest and the amount of the penalty. Others do not do this, and provide information only when the client calls or comes to the branch to find out where his salary disappeared from the card.

No bank will act contrary to a lawful court decision or hide client accounts from the FSSP, no matter how “valuable” it may be. The concept of “bank secrecy” does not work here. The law obliges banks to provide information about the accounts of debtor clients. And since the information is transferred to a government agency, there is no violation of bank secrecy. There is no point in blaming a financial institution for this.

Can bailiffs remove debt from a salary card?

They can, but there are several nuances here. The main thing is that according to the law, the bailiff does not have the right to withhold wages in full. There are limits set by the state on how much you can do this. As a rule, the maximum should not exceed half of the official monthly income. That is, if an employer credits 70 thousand rubles of wages to the card every month, then only 35 thousand can be withheld from this amount, but not all the funds.

Recovery rates may vary depending on the type of debt. If we are talking about alimony or compensation for health damage caused to another citizen, they may withhold a larger amount - in the amount of 70% of income. The same rule applies if the debtor has committed a crime and is obliged to compensate for the damage associated with it, as well as if the death of the family breadwinner has occurred through his fault: the injured family will have to compensate for the damage in the amount of 70% of the salary.

In some cases, the amount can be reduced to one quarter of your own income. The law allows compensation in the amount of 25% if the debtor has a difficult financial situation, is raising young children or has become disabled. Each of these circumstances must be documented. The bailiff must bring certificates: about disability, pensioner status or birth certificates of children. In this case, the amount of the penalty will be reduced. But until the documents are submitted, the state executive will act “on a general basis.”

pixabay.com/Gerd Altmann

Debt collection

"You have money? Then we come to you to be friends..."

Probably, every first borrower thinks this way, every second thinks that - “he takes someone else’s, but gives his own,” every third - “I have the right to take, and I have the right not to give back.”

In general, there are a million situations... but since you are in this section of the site, your money was not returned.

Debt collection is not an easy task in our country.

Many, still remembering the crazy 90s, come to their debtors and “ask” to give what they have, after which some of them go to other sections of this site - “Criminal Cases”, and seek protection from charges of extortion.

Any actions to force the debtor to repay the debt must be thought through, and in no case

Don't act on emotions!

Therefore, money must be given - having completed the paperwork correctly, and returned - having completed the paperwork correctly.

When giving money you need to get from the borrower and/or:

- receipt,

- loan agreement,

- loan agreement,

- if you transfer money to an account, then do not forget to leave a receipt/payment (in extreme cases, you can get a Statement of your account from the bank) that the money was sent... and most importantly, to whom,

- Court verdict (which establishes the amount of material damage caused to you by the crime).

Why did I list all this?

And in order to explain - if you don’t have any of these documents in your hands - then civil (or arbitration) proceedings are not for you, the court will not help you, then either file a statement with law enforcement agencies or forgive...

If you “knock out” the debt on your own, you will go to jail yourself.

Where should you start? No hysterics over the phone to the debtor or threats of court if we are talking about a large amount - your opponent can prepare for a future trial, for example: transfer all property from himself, take other actions... (see the section of the website “Protection of Debtors”).

You must be smarter and more cunning.

With your opponent, before filing a lawsuit, you need to play “friendship”, because you already know that he deceived you... the question comes down to only one thing - “How to take back what’s yours?”

It is important for you that before the trial your opponent is well-fed, healthy, and has as much as possible of everything that could be taken from him by court decision; you should not irritate him, much less threaten him...

You better prepare for the trial:

- collect information about what he is and who he is,

- what property is on it,

- what companies does he own?

- where does he have accounts?

- what he owned

- and so on.

and then go to a lawyer (if you cannot collect the necessary information, a lawyer from open sources can help you obtain this information and/or check/suggest where such information can be found and legally request it...).

A lawyer will help you competently draw up a claim, prepare applications for seizure of property, money, shares, shares and quietly... file a claim in court.

After the arrests are made - you are the master of the situation, then it is possible that they will immediately agree with you on the return of money, on the reduction of penalties and fines, and most importantly - no one will prosecute you for extortion, because you are acting according to the law!

Even if the debtor has nothing now, should he forgive?

Your right, but what if you don’t forgive?

Then go to court, get a court decision, block him from traveling abroad and, through the bailiffs, torment him for the rest of his days with summonses, arrests and the inability to acquire anything for himself (now through the portal of STATE SERVICES you can write endlessly to your to the bailiff - What did he do regarding your enforcement proceedings? demand reports from the bailiff, write complaints there against the bailiff, etc., TESTED - EFFECTIVE), do not have an official salary, be always under the gun of bailiffs and law enforcement officers,

You will make him constantly think that they can call his parents, wife, work, acquaintances and tell him that he is a loser,

When applying for a loan, banks will look at whether he owes money to someone and how much (information about outstanding debts and initiated enforcement proceedings against specific individuals is open: on the website of bailiffs by full name and on the websites of courts), many will deny him loans and treat him as a second-class citizen, etc.

And one more pleasant nuance...

If the debtor, according to the court decision, does not return the money or returns it extremely slowly, then the amount of the debt can be increased indefinitely through the court:

through the indexation mechanism (inflation - an increase in the amount of debt due to the depreciation of money) and through the collection of another interest - for the use of other people's money (more about the methods and mechanisms of quietly hunting for the debtor's money in my article: “How to punish a debtor”).

Example: You have a court decision to collect from the debtor the amount of 1,000,000 rubles. You submitted documents to the FSSP (bailiffs) and enforcement proceedings were initiated on 01/01/2015. The debtor does not pay either you or the bailiffs.

Alternatively, 3 years have passed... (or earlier, in a year), you have the right to go to court for debt indexation based on the consumer price index in your region (about 4-5% per annum) and what do we get?

5%+5%+5% = 15% on top. The debt grows to 1,150,000 rubles... Interesting?

Contact us, we will index and collect other interest... Anyway, sooner or later the person will retire and try to inherit (and this is at least...).

Separately (again, after the court decision on debt collection), you can go to court to collect additional interest from the debtor for the use of funds that have not been returned to you... And this is another 7.5% per annum.

And what happens?

On average, you can increase the amount of the debtor’s debt by 12-13% per year...

And this is better than interest on a deposit.

So the court decision to collect the debt is just the beginning, but we need to start. Otherwise, your money will forever remain with your deceiver.

Remember just one thing - the statute of limitations for going to court to collect a debt is 3 years, it begins to run (calculate) from the date indicated - as the date of repayment of the loan: missed it? Then consider that the debt has been forgiven.

Of course, you can try to restore the deadline for filing a claim through the court, but this is not easy and is not always possible. In case of refusal, the court will return the documents, the money will remain with the debtor and nothing will happen to him. If the loan repayment date is not specified, call us and we will sort it out...

The above period is 3 years, does not apply to indexation!!! You can index the amount of debt for 10 years after the entry into force of the Court Decision, and at the same time collect interest for the use of your money (here the statute of limitations is different). So:

there IS light at the end of the tunnel.

MORE: the law on bankruptcy of individuals is now in effect...

Making a person bankrupt is like burning a mark on him for the rest of his life.

and running away from you in ANY case will not be so pleasant for him, not so easy, and the consequences of his behavior may be completely different (you can challenge all his transactions with property within the framework of a bankruptcy case, allocate the spouse’s share in the property registered in the name of his wife/husband etc.).

If you have questions and want to repay the debt, write or call: we’ll talk, and then, if you wish, we will work according to the law on your debtor.

If you want to declare your debtor bankrupt, please contact me, not every ambitious debtor wants to be a REAL bankrupt FOR EVERYONE.

Lawyer phone number

Call to make an appointment or send your question through the feedback form.

Why did the bailiffs withdraw all the money from the salary card?

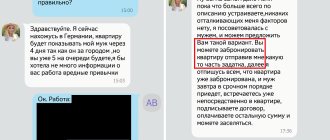

“The peculiarity of collecting funds from the debtor’s accounts is that for the bailiffs they are all impersonal,” clarifies Alla Semenova. — The bank only provides information that certain accounts have been opened in the client’s name, but does not specify their purpose. The bailiff does not know whether the account is used to store funds or to receive wages, pensions, or child benefits. The debtor himself is obliged to report this.”

If he does not notify the bailiff about the purpose of the accounts, he has the right to seize them all and use all the funds on them to pay off the debt. This means that if the amount of collection is greater than what is stored on the salary card, every penny of money will be written off from it, and at the next deposit they will continue to be written off until the debt is repaid.

If the bailiff sends the documents not to the bank, but to the accounting department of the enterprise where the debtor works, the recovery percentage does not exceed that established by law. Exactly half or 70% of the income will be withheld from the salary, and only the remaining portion will be sent to the employee. This is one of the features of the salary card; you can find out more about them in a special FAN review.

What to do if the bailiffs seized your salary card

In this situation, it is important to understand why funds are being collected, and you need to act quickly.

Contact your bank

Ask the employee to explain the reason for debiting funds from the card. If this happens at the request of the FSSP, find out the details of the specialist who imposed the penalty.

Contact a FSSP specialist

You can find his data on the FSSP website, where there is information about all enforcement proceedings. Enter your first and last name and region of residence in the search. Information about the amount of debt and the bailiff who seized the card will appear in the results.

Call the bailiff, or better yet, go to him for an appointment. If this is not possible, prepare the application in writing and send it by mail. The application must be accompanied by documents confirming that a specific account or card is used by you as a salary account. To do this, you need to provide a certificate from your job with card details and confirmation that your salary is being transferred to it. You will also need a bank statement, which will indicate the same amounts of regular payments.

Having received these documents, the bailiff will remove the seizure from the account. Funds will not be written off from it in full, but only within the “limit” established by law.

pixabay.com/Chronomarchie

Methods of notifying the debtor

According to Law No. 229-FZ “On Enforcement Proceedings”, bailiffs can notify the debtor in the following ways:

- A summons to appear before a bailiff with notification of receipt;

- By telephone message, telegram, email;

- Sending a notification by courier against signature of receipt;

- Other possible types of communication.

If you received a letter from the bailiffs, then most likely it will be marked “Registered,” which means that the fact of receipt of the letter was recorded by the Russian Post, and in court it will be easily proven by the bailiffs using the information provided by the post office.

If you ignore the letters, the bailiffs may come to your home and seize the property without warning. The only time limit until which they can come to the debtor is until 22:00. They will be required to notify about the compulsory actions taken, but must do this the next day after they were committed.

Bailiffs send letters to the following addresses:

- Address/Metro of the debtor's registration;

- Address/Metro of actual location or residence:

- They can also send a letter to work; the law allows them to do this.

First of all, the bailiffs send letters to the address indicated in the writ of execution. Most often, this is the address that the plaintiff indicated when filing the application. Accordingly, if the debt arose from an unpaid loan from a bank, then it most likely has all the addresses. Individuals may not know the debtor's address or may have outdated information. In case of non-payment of debt and non-receipt of letters, the bailiffs will look for other ways to contact the debtor, including other addresses.

In a situation where a letter from bailiffs has arrived at work, this may affect the image and reputation of the employee, so it makes sense, if the debtor knows about the proceedings, to provide the address to which he prefers to send correspondence.

Persons participating in the proceedings must inform the bailiffs about changes in their addresses if they occur during the process.

Try to keep it within five days

When a bank receives a request from a government enforcement agency, it acts quickly: funds can be debited from the card within a few hours. They are sent to a special deposit of a FSSP employee, where they remain for five days, after which they are sent to the claimant.

While the money is on the bailiff’s deposit, there is a possibility of returning it. After receiving the documents, the specialist has the right to return the part to the debtor if it is proven that it is impossible to foreclose on these funds. But if five days have passed and the tranche has been sent to the creditor, you will have to say goodbye to this amount: all of it will be used to repay the debt.

Receiving installments

When the amounts are significant, the borrower has the right to do everything to achieve installment payments. You can get this opportunity by going to court within five days, but you must go to the judicial authority that issued the initial verdict. Every debtor has this right. The application must contain the date the decision was made, the amount of the amount collected, as well as the date on which the decision comes into force. The person must state that a one-time execution of the court decision is impossible due to a specific reason:

- Having a dependent;

- Alimony obligations;

- Payment of utility services;

- Payment under the lease agreement.

If the bank wins the case and demands compensation, the most important thing is to prove its own financial insolvency. The installment period varies. It is advisable to indicate the amount of the monthly payment in the application.

Removal of arrest by bailiffs from a salary card

Part of the salary will continue to be withheld until the debt is repaid in full. When this happens, the bailiff will issue a termination order and send a notice to the bank that no money needs to be written off. After this, the salary will be calculated in full.

“The most obvious solution in this situation is to pay off the debt,” notes Alla Semenova. — When a card is seized, you cannot remain indifferent; you must approach this problem responsibly. Find out the reasons, try to restructure the debt, discuss its repayment schedule with a FSSP employee. In this case, the consequences will not be as critical as when the account is seized and all proceeds are written off from it.”

Conclusions from the situation

After this incident, I don't feel like my money is safe at the bank. If they can be so easily removed from the deposit and its terms can be changed to suit the bank, then why use deposits at all? Instead, I plan to buy cash dollars and euros. I believe that this way my savings will be safer.

Read on the topic: Personal experience: I closed my deposit via the Internet, and the money was gone

Removal of arrest imposed by mistake

It also happens that a salary card is seized unreasonably. Such situations, according to Alla Semenova, are not uncommon. The reason is that bailiffs use only “basic” data to identify debtors: first and last name, date and place of birth. If this information is the same for several people, the full namesake may well suffer due to a technical error.

In this case, you need to find out the details of the bailiff on the FSSP website and contact him personally with a statement. In this application, you should indicate the fact of the error and provide information that allows you to accurately identify you: passport data, SNILS number. A copy of the application should be sent to the main and regional departments of the FSSP.

After reconciliation of the data, the decision regarding the “namesake” will be canceled, and the money written off will be returned. How quickly this will be done depends on whether the bailiff managed to transfer the funds to the collector or whether they are still on his deposit.

pixabay.com/stevepb

How to write

There is no single form for writing to bailiffs about debt payment. However, in order to avoid confusion and the letter to achieve its stated purpose, you need to follow some general rules for formatting such correspondence.

In the header of the letter you must indicate:

- The name of the FSSP unit and the name of the bailiff;

- Number of enforcement proceedings against the debtor;

- Last name, first name, patronymic of the debtor, address and telephone number for contacting him;

- Details of other participants in enforcement proceedings.

The main part of the letter contains information about debt payment with a list of the amounts paid. To confirm payment, copies of payment documents confirming repayment of the debt (both in terms of the principal debt under the court decision and in terms of payment of the enforcement fee) must be attached to the letter.

Next, the letter must be signed by hand and dated.