Standard

The new rules are due to the adoption of several regulations.

- Federal Law No. 12-FZ of February 21, 2019 “On Amendments to the Federal Law “On Enforcement Proceedings”;

- Directive of the Central Bank No. 5286-U dated October 14, 2019 “On the procedure for indicating the type of income code in orders for the transfer of funds,” registered with the Ministry of Justice on January 14, 2020;

- Letter of the Central Bank No. 45-1-2-OE/8224 dated 06/08/2020.

conclusions

The payment, through which tax/non-tax debts are collected by bailiffs, is drawn up according to the typical form of an order to transfer money from a bank account.

However, when filling it out, you should always follow certain rules. It is recommended that the details required to be reflected in such a payment order be clarified in advance with the FSSP authorities.

This will avoid problems with the correct formation and timely execution of the payment document.

Codes

Law 12-FZ establishes that persons paying a citizen a salary or other income, in respect of which Article 99 FZ-229 (on enforcement proceedings) establishes restrictions or for which, in accordance with Article 101 229-FZ, cannot be levied, are required to indicate in the payment documents the corresponding code for the type of income.

What is it for? The fact is that the bank needs this information in order to understand whether it is possible to write off funds from the amount received on the card according to the executive document or not.

Central Bank Directive No. 5286-U regulates the procedure for indicating the code in the payment order. The code of the type of income is indicated in detail 20 “Name. pl." payment order.

List of codes and cases of their use:

When transferring funds that are not income, for which restrictions are established by Articles 99, 101 of Federal Law No. 229-FZ, the type of income code is not indicated.

What are the features of a payment order to bailiffs of the 2021-2022 model?

The procedure for filling out payments to the bailiffs will be different for tax deductions and for non-tax payments of the employee (for example, alimony, court penalties).

If you are transferring tax debts for an employee, in the payment order in the section about the payer you must indicate (clauses 4, 10 of Appendix No. 1, Appendix No. 5 to Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n, Appendix 1 to the Regulations of the Bank of Russia dated June 29, 2021 No. 762-P):

- in field 101 - code 19;

- field 60 - INN of the employee for whom you are transferring the tax (not yours!!!);

- field 102 - “0”;

- field 8 - your data: by organization - full or abbreviated name; for an individual entrepreneur - full name, in brackets the status is “IP”, then - the registration address (the address is marked with “//” signs). For example, “Sergeev Alexey Alekseevich (IP) // 115419, Moscow, st. Donskaya, 28A, apt. 76 //";

- fields 9-12 - your payment details.

The recipient's details must be taken from the document from the bailiffs.

Payment information must be filled out as in a tax bill - indicating the UIN, KBK, OKTMO, etc. More details about this are written in the ready-made solution from ConsultantPlus. You can view the material for free by signing up for trial access to the system.

A similar procedure for filling out the section on the payer has been in effect since July 17, 2021 in relation to going to the budget , for example, administrative fines, etc. (Order of the Ministry of Finance dated September 14, 2020 No. 199n, letter of the Federal Treasury dated April 29, 2021 No. 01- 00-07/9973). Such payments indicate:

- in detail 60 TIN of an individual whose obligation to pay other payments is fulfilled by the organization (until July 17, it was possible to indicate the TIN of the company);

- in the checkpoint field - 0;

- in detail 108 “Document number” - identifier of information about an individual (this can be a SNILS number, series and number of a passport or driver’s license, etc.).

Until July 17, there were no special rules, as well as official instructions on the procedure for issuing payments to bailiffs for non-tax debts of employees to the budget. Therefore, a regular payment order was issued using them, without filling out the “tax” fields. In this case, all information identifying the payment was provided in the “Purpose of payment” field, where the type of deduction, details of the writ of execution, etc. were indicated. The specific composition of the information could be clarified with the bailiffs.

For more information about the details indicated in the payment document, read the material “Basic details of a payment order” .

You can view a sample of filling out a payment order to bailiffs for the transfer of an employee’s tax debt with expert comments in K+ by signing up for a free trial access:

Purpose of payment

Federal Law 12-FZ introduced another innovation for accountants.

Persons paying wages or other income to the debtor by transferring them to the debtor’s bank account, from June 1, 2021, were required to indicate in the payment order the amount collected under the writ of execution.

The Central Bank explained how to do this in letter No. IN-05-45/10 dated February 27, 2020.

When transferring income from which amounts were withheld under executive documents, in the “Purpose of payment” details you must indicate:

- symbol "//";

- combination of letters “VZS”, that is, the amount collected;

- symbol "//";

- the amount collected in numbers (rubles from kopecks must be separated by a dash sign “-„, if the collected amount is expressed in whole rubles, then after the dash sign “-” “00” is indicated);

- symbol "//".

For example, when withholding alimony in the amount of 10,000 rubles, the following is indicated: //VZS//10000-00//.

What is it for? The fact is that executive documents also come to banks where employees have accounts. And it turns out that the bank does not know that some income has already been withheld within the amount established by law.

Payment order to bailiffs for other debts of employees

If the employer received a writ of execution from the bailiffs to withhold the employee’s non-budgetary debts (alimony, loans, etc.), the payment slip is filled out a little differently: obviously, the tax fields are not filled in, and all information about the debt is given in the purpose of the payment.

As for fields 60 and 102 (remember, this is the payer’s tax identification number and checkpoint), there is currently ambiguity and two points of view:

1. In this situation, the rules introduced from July 17, 2021 for non-tax debts paid to the budget also apply; after all, FSSP accounts are opened in the UFK, and this is the budget. That is, in field 60 the employee’s TIN is indicated, and in field 102 a 0 is entered.

For a sample payment order filled out in accordance with this item, see K+ by signing up for a free trial access:

2. In fields 60 and 102, the employer’s (not the employee’s) TIN and his checkpoint are given. Her explanation is as follows. The requirement to indicate the TIN of the debtor (individual) is expressly established only for cases when the funds withheld from him go to repay debts on payments to the budget. The fact that this other debt is paid to the FSSP account does not make it a debt to the budget, since the final recipient here is non-budgetary (an individual for alimony, a bank if it is a loan, etc.).

We believe that this issue will have to be resolved with the bailiffs and the bank.

If you need to fill out a payment order for the transfer of alimony from an employee’s income, then a ready-made solution from ConsultantPlus experts will help you. Get trial online access to K+ for free and proceed to the sample.

Example 3

Child benefit was transferred to the employee

By the way, the payment card for transferring child care benefits has one more feature. The Central Bank indicated this in a letter dated August 14, 2019 No. 45-1-2-07/22917.

The fact is that some benefits, including child care benefits up to 1.5 years old, must be transferred to a bank account attached to the Mir card. This applies to payments assigned after May 1, 2021.

In this case, the payment slip must indicate code 1 in the “110” field.

When is a payment made to the FSSP?

To ensure the collection of certain payments ordered by the court, the bailiffs send the payer - the obligated person - a corresponding order, which contains the appropriate requirement and indicates the necessary details.

In essence, this order is a writ of execution, which gives it the necessary legal force.

A document demanding repayment of obligations under a court decision can be sent to the payer either at the place of his employment (in this case, the debt will be officially deducted from the payer’s earnings), or to the address of his actual residence (if the obligated person is not employed).

In the practice of bailiffs, it is customary to divide writs of execution into the following types:

- collection of tax debts;

- repayment of non-tax debt (loan obligations, housing and communal services payments, penalties, alimony payments, other penalties).

If, for example, a sum of money ordered by the court for payment is withheld according to a writ of execution from the salary of the obligated person (payer), the accountant of the employing organization draws up and sends a special payment to the bailiffs to the servicing bank.

As a rule, an authorized FSSP employee who supervises (conducts) a specific enforcement proceeding officially provides the employing organization with a sample of such an order, already containing all the necessary details.

Thus, the financial institution carries out the designated payment transactions according to these orders, transferring the money directly to the FSSP authorities.

Bailiffs accept the appropriate payment, register it in the prescribed manner, and then forward it to the actual (target) recipient, who is the beneficiary of the enforcement proceedings.

The funds from this payment can be sent to a budgetary structure, an economic entity, another organization or a specific individual.

How to transfer insurance premiums

According to the new rules, control over the correctness of payment of insurance premiums has been transferred to the hands of the Federal Tax Service, so you should be guided by its requirements. The recipient of contributions for injuries continues to be the Social Insurance Fund.

It is important for accountants to be careful; the recipient's details and payer codes have changed. The payment form must be filled out in chronological order, otherwise the payment will not be accepted by the Treasury.

The transfer is made no later than the 15th day of each month; if it falls on a weekend, it is transferred to the following working day.

Termination of enforcement proceedings

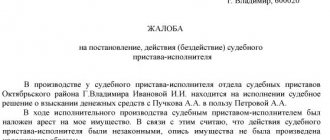

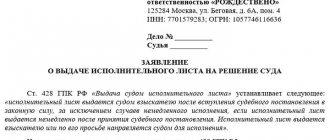

How to submit a writ of execution to bailiffs in 2021 In addition to this document, an application for a writ of execution to bailiffs , also known as an application for the need to initiate enforcement proceedings. You can find out in what form it is filled out by looking at a sample at a stand in the advisory department of the Federal Bailiff Service of the Russian Federation or on government Internet resources. The standard form is presented as follows: 3 days are given to transfer documents to the bailiff. He has the same amount of time to consider and make a final decision. As a result, he issues a so-called resolution to initiate enforcement proceedings, or to refuse to implement the process. No later than 1 day after the decision is made, a copy of the document is sent to all participants in the process:

- 1 year - sheets containing a demand to return a child whose transportation to Russia was carried out in violation of current legislation, or the child is forcibly detained on the territory of the country;

- a period during which it is necessary to make periodic payments of a certain amount in favor of the creditor.

Many people may be faced with a situation where they need to make a payment to the state budget, but they have no idea about it, or, on the contrary, they deliberately do not make this payment, delaying it in all possible ways. Such situations occur mainly when some administrative offense has been committed, but the offender does not want to pay the fine for it. How is KBK 3220000000000000180 used in such situations according to the writ of execution, and also where does this document come from? Let's look at it in this article.

At the place of work

Writ of execution for alimony: sample 2021 At the moment, no new standards for the execution of this document have been adopted. An approximate sample application for alimony to bailiffs (2020):

- performance list. Issued after the court decision has entered into legal force;

- court order. Issued upon application by magistrates;

- notarized agreement. Contains the terms of payments: amount, frequency, possible circumstances of termination of obligations, etc. Such an agreement, not notarized, has no legal force.