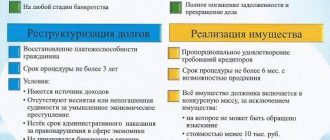

The procedure for declaring an individual bankrupt may involve one of the following procedures: bankruptcy proceedings (sale of the property of the individual debtor) or debt restructuring. The latter procedure is one of rehabilitation and helps the citizen to restore solvency with minimal costs.

Restructuring the debt of an individual can be used not only in bankruptcy cases, but also serve as a preliminary stage for the debtor to initiate this procedure. The borrower always has the right to contact the creditor bank with a request to revise its debt repayment schedule in order to reduce monthly payments. At the same time, the bank may not agree to revise the loan agreement.

Law on debt restructuring of individuals

The procedure for restructuring the debts of individuals is now subject to Federal Law No. 127 on insolvency. According to it, if a citizen has a certain level of monthly income, then before initiating the bankruptcy procedure itself and selling the property under the hammer, a restructuring process is scheduled. The debtor's monthly income must be enough not only to pay monthly tranches to pay off the debt, but also for a normal existence (food, clothing, child support, etc.).

This rehabilitation procedure is quite beneficial for the debtor: it allows him not only to pay off loans with the bank without fines, penalties and at a reduced interest rate, but also to avoid the extremely unpleasant stage of selling property.

In 2021, it was also planned to introduce the opportunity for individuals to go bankrupt using a simplified procedure for debtors with relatively small outstanding loan amounts (within 900 thousand rubles). A similar initiative was taken by the Ministry of Economic Development to expand the availability of bankruptcy for those who find the standard process financially unfeasible. After all, it will cost the debtor at least 50 thousand rubles. (this includes 6 thousand rubles of state duty for opening a case, 25-30 thousand rubles - remuneration to the manager and legal and court costs).

The basic distinguishing feature of this procedure is the absence of a financial manager and the limited time frame of the process. In essence, simplified bankruptcy excluded the stage of selling property and would involve exclusively debt restructuring.

A simplified procedure would solve the problem of people with relatively small debts of 50-100 thousand rubles. or mired in microloans and unable to get out from under enslaving interest rates.

But so far this law is at the initiative stage and has not reached official discussion in the State Duma. Initially, the Ministry of Economic Development planned that simplified bankruptcy would begin to operate in March 2021, then in June, now the timing is completely unknown.

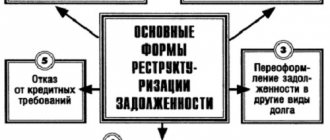

What is restructuring?

Restructuring is, first of all, a rehabilitation procedure. Its goal is to restore the debtor’s solvency and proportionately satisfy the creditor’s claims.

Restructuring is not aimed at writing off debt, but at returning it. In fact, it is the opposite of bankruptcy

_

More videos on our channel, subscribe!

In fact, restructuring is the process of revising the terms of debt repayment: the court can write off part of the interest, remove fines and penalties, reduce the payment amount, while extending its term. During restructuring, a list of property to be sold is not compiled. The latter is relevant only for the bankruptcy process.

—

The procedure for restructuring a citizen's debt

The decision to introduce bankruptcy proceedings against a debtor individual is made exclusively by a judge during the consideration of an application received to declare him financially insolvent.

If the court makes a ruling to approve a restructuring schedule in relation to a citizen, then it will indicate the date of the meeting to consider the bankruptcy case and the name of the financial manager.

For your information

The key criterion for introducing a restructuring schedule in relation to the debtor is that he has a sufficient level of income to repay the entire debt in 36 months or return to the previous loan schedule after three-year tranches.

The court can approve this procedure only if the applicant has regular income in such an amount that after making the monthly payment, the debtor has money left in the amount of the subsistence level for his decent existence and the maintenance of dependents. Typically, a debt restructuring schedule for an individual is approved by the bank with income of more than 25-30 thousand rubles. depending on the region .

At the same time, the approval of the bank itself for restructuring is not required, which is an undoubted advantage of this procedure. By the way, if the debtor does not own valuable property, then creditor banks may agree to partial repayment of the debt by the borrower for three years, and simply write off the rest.

After the start of restructuring, the debtor acquires significant advantages:

- interest and penalties (fines and fines) cease to accrue on all his debts, loans and tax debts;

- a moratorium on satisfying loan requirements is introduced;

- banks and collectors are prohibited from calling and visiting the debtor (they must submit all demands through the court or manager);

- the debtor is provided with a “debt holiday” (when it is allowed not to pay the loan) until the court approves the detailed plan (but not more than 4 months);

- bailiffs suspend work on enforcement cases (this does not apply to alimony debts).

Important

At the request of creditors or the administrator, the court has the right to impose restrictive measures against an individual. Thus, he is prohibited from selling property for more than 50 thousand rubles. (real estate, shares in the authorized capital, shares, etc.), make it as contributions to the authorized capital, purchase shares or shares. The transfer of property as collateral is also prohibited. During the period under review, the debtor will not be able to issue guarantees and sureties, assign claims, or take out new loans and credits.

What does bankruptcy mean for a citizen?

When filing a claim with the Arbitration Court, many citizens with unsustainable debt obligations think little about the consequences of the insolvency procedure. Tired of calls from collectors and reminders from banks, defaulters perceive only one phrase - legal relief from debts.

However, before the court makes a decision and declares the debt cancelled, the debtor will lose almost all of its property. Plus, the arbitration manager will check the agreements regarding property concluded by the bankrupt in the last three years, and is guaranteed to challenge those that cause him doubts.

If the property owned by the bankrupt was not enough to pay off the debts, creditors have the right to petition the court to foreclose on the property of the debtor’s spouse, if it was acquired during marriage. After the sale, half the value of the valuable object must be returned to the spouse. But given that the auction price is much lower than the market price, losses can be significant.

During the trial, the citizen against whom the procedure is applied loses the right to dispose of his property, cannot take out new loans, or act as a guarantor.

In addition to the procedure for selling property, bankruptcy carries a number of restrictions. A person will not be able to take a promising job, since he is subject to a ban on managing organizations for a period of 3 to 10 years. This immediately reduces the chances of getting a normal job. It will be extremely difficult for a bankrupt to take out a loan from a bank, since the law obliges him to report insolvency in such cases. If an individual was declared insolvent as an individual entrepreneur, in the next 5 years the tax authorities will refuse to register a new business for the citizen.

Individual debt installment plan

Once a decision has been made to restructure the debts of an individual, a detailed plan must be developed. It must contain provisions on the procedure and timing of proportional repayment of creditor claims, the amount of monthly payments (consisting of principal and interest). This plan must be developed for a certain period, but this period should not exceed 3 years.

Both the debtor himself and his creditors can propose a debt restructuring plan. If the financial manager has received several versions of this document, he submits them to the creditor meeting for consideration.

Important

Let’s assume that the remainder of a citizen’s income after monthly debt payments is below the subsistence level. This is not a criterion, but one of the consequences of insolvency that can be brought to the attention of the court.

The draft plan received by the financial manager is sent to all creditors and the debtor within 10 days after the closure of the register. Information about this is published in the Federal Register.

The project is subject to approval at a creditors' meeting. Its participants can approve or refuse approval of the document. Such a decision is made by a majority vote. If approval is not obtained, the court may give a reasonable time to correct the deficiencies.

In order for the court to approve a debt restructuring plan, it must be economically feasible; did not violate the interests of minors; left the debtor and his family the means to live in the amount of the subsistence level; its execution did not prevent the debtor from repaying his obligations.

Information

It is worth noting that the court can approve the plan even if the creditors do not approve it. To do this, the following condition must be met: execution of the plan will make it possible to repay the debt in a larger amount than would be possible if the property were sold. In this case, the amount of debt repaid must be at least 50% of the stated claims.

The manager must report on its results one month before the end of the plan.

Analytics Publications

Features of initiating a bankruptcy case for an individual

A debtor, a creditor or an authorized body may apply to the court for bankruptcy of an individual if there is an obligation in the amount of more than five hundred thousand rubles that has not been fulfilled within three months. The law provides for the debtor's obligation to file for personal bankruptcy if satisfying the claims of one creditor makes it impossible to fulfill other obligations. These rules duplicate the general provisions of the Bankruptcy Law, which also apply to legal entities.

As a general rule, a bankruptcy case for an individual can be initiated at the request of a creditor if there is a debt confirmed by a judicial act that has entered into legal force. Meanwhile, paragraph 2 of Art. 213.5 of the Federal Law “On Insolvency (Bankruptcy)” provides for exceptions, in particular, initiation of a case is possible if claims are based on documents submitted by the creditor and establishing monetary obligations that are recognized by the citizen, but are not fulfilled.

Judicial practice, recognizing the possibility of initiating bankruptcy proceedings against a citizen upon presentation of the specified documents, recommends that courts check the validity of the creditor’s claims, such as the financial ability to provide a loan, perform work or supply goods. When agreeing with the debt, the citizen must also confirm, and the court must verify, what purposes the fulfillment of the stated obligation is aimed at.

An illustration of this is the high-profile bankruptcy case of Telman Ismailov. The court of first instance, considering the bankruptcy case of Mr. Ismailov, recognized the claim of the creditor as justified, the debt to which was confirmed by a receipt for receipt of funds in the amount of 15 million rubles. During the hearing on the appeal, the judicial panel overturned the ruling of the first instance court and left the creditor’s application without consideration, pointing out the lack of proof of the actual execution of the loan agreement based on the fact that the applicant did not provide evidence of labor activity and receipt of income from it, tax returns, evidence of receipt of funds on loan or credit, evidence of deposits, and the debtor did not indicate for what purpose the funds received were spent. (Resolution of the Tenth Arbitration Court of Appeal dated March 10, 2016 in case No. A41-94274/15)

Thus, when considering the application of a creditor initiating bankruptcy in the absence of a judicial act that has entered into legal force, the duty of the court is to determine the presence or absence of signs of an imaginary transaction (Determination of the Supreme Court of the Russian Federation dated December 15, 2016 No. 305-ES16-12960).

Debt restructuring procedure

When considering the validity of a citizen’s bankruptcy application, the court has the right to introduce a procedure for restructuring his debts.

Debt restructuring is a procedure aimed at restoring the debtor's solvency. To do this, a restructuring plan must be drawn up, which is approved by the meeting of creditors, the debtor and the arbitration court hearing the bankruptcy case. In the restructuring plan, it is necessary to determine the timing and procedure for the citizen to repay his debts.

Within two months from the date of official publication of information about a citizen’s bankruptcy, creditors have the right to present their claims against the debtor.

Considering that control over the bankruptcy procedure is carried out by a meeting of creditors, the votes at which are distributed in proportion to their claims included in the register, judicial practice proceeds from the inadmissibility of unreasonable consideration of creditors’ claims.

When considering claims, the court must not only verify the actual fulfillment of the obligation by the creditor, but also exclude attempts to abuse the right in order to gain control over the bankruptcy procedure.

On March 30, 2021, the Supreme Court of the Russian Federation adopted a number of rulings in the framework of a citizen’s bankruptcy case, satisfying the creditor bank’s complaints against the rulings of the court of first instance and subsequent appeal and cassation decisions on inclusion in the register of creditors’ claims.

The Supreme Court of the Russian Federation, referring disputes for consideration to the economic board, considered the applicant’s arguments that the creditors’ interest in the debtor to be justified and requiring verification that the creditors’ interest in the debtor calls into question the independence of the surety, and therefore his right to receive a claim by way of subrogation (Articles 384, 387 Civil Code of the Russian Federation), (Definitions of the Supreme Court of the Russian Federation dated March 30, 2017 No. 306-ES16-17647 (1) and No. 306-ES16-17647 (2)).

These conclusions of the Supreme Court form judicial practice, which allows minimizing the ability of unscrupulous bankruptcy participants to control the procedure.

As already mentioned, the restructuring plan must be approved by the meeting of creditors, the debtor and the arbitration court hearing the bankruptcy case.

The court has the right to approve a plan for restructuring a citizen’s debts even in the absence of approval from a meeting of creditors, if its implementation makes it possible to fully satisfy the claims of bankruptcy creditors for obligations secured by a pledge, other claims of creditors in an amount significantly greater than the creditors could receive as a result of the immediate sale of the citizen’s property and distribution his average monthly income for six months, and the specified amount is no less than 50% of the amount of claims of such creditors and the authorized body (clause 4 of Article 213.17 of the Federal Law “On Insolvency (Bankruptcy)”.

When approving a restructuring plan, the courts proceed from the need to maintain a balance of interests of the parties, even if creditors insist on introducing a procedure for the sale of property.

Thus, the Arbitration Court of the Moscow Region, in its Resolution dated February 16, 2021 in case No. A72-11885/2015, refused to satisfy the appeal against the decision of the court of first instance to approve the debt restructuring plan, indicating that the implementation of the plan will make it possible to fully satisfy the claims of the secured creditor , as well as more than 50% of the claims of other creditors, will thus achieve the goal of the procedure for restructuring a citizen’s debts.

The Plenum of the Supreme Court of the Russian Federation, in its Resolution No. 45 dated October 13, 2015, indicates that the court hearing a bankruptcy case approves a debt restructuring plan (both approved and not approved by the meeting of creditors) only if it is approved by the debtor, since the debtor is a direct participant and the execution of the plan is usually carried out by himself, and also since the debtor has the most complete information about his financial condition and its prospects.

Meanwhile, the Plenum of the RF Armed Forces, as well as its duplicating judicial practice regarding the approval of a debt restructuring plan, are based on the inadmissibility of abuse of law, including by the debtor. The debtor's actions to disapprove the restructuring plan may be aimed at completing the bankruptcy procedure as quickly as possible and freeing him from debts, which is not the purpose of bankruptcy. In this case, the presence in the actions of the debtor of signs of abuse of rights must be proven. This position is set out in the Resolution of the Seventh Arbitration Court of Appeal dated February 22, 2017 in case No. 07AP-479/2017.

The maximum period for implementing the debt restructuring plan is three years.

Based on the results of consideration of the implementation of the citizen’s debt restructuring plan, the court makes a decision either to complete the debt restructuring, or to cancel the restructuring plan, or to declare the citizen bankrupt.

Thus, the procedure for restructuring a citizen’s debts is aimed at the most complete satisfaction of creditors’ claims; when applying it, a balance of interests of the parties must be maintained, and issues of abuse of rights by participants in a bankruptcy case must be investigated.

Procedure for selling a citizen's property

The arbitration court makes a decision to declare a debtor-citizen bankrupt if the debt restructuring plan is not approved or canceled by the court, as well as if, when considering the validity of the bankruptcy application, the debtor filed a petition to declare him bankrupt due to his non-compliance with the requirements for introducing a debt restructuring procedure.

The introduction of a procedure for the sale of property without applying the restructuring procedure to the debtor caused some disagreements in practice, however, after a year and a half, a fairly clear position was formed according to which declaring a citizen bankrupt, bypassing the introduction of a debt restructuring procedure, is possible if the court is provided with evidence of the deliberate impossibility of satisfying the creditors' claims. The court examines not only the financial situation of the debtor, but also the level of his professional training, skills, marital status, as well as measures taken by the debtor to improve his financial situation. Only providing the court with sufficient evidence of the existence of obstacles to debt restructuring is the basis for introducing a procedure for the sale of property in accordance with paragraph 8 of Art. 213.6 Federal Law “On Insolvency (Bankruptcy)”. (Resolution of the Arbitration Court DO dated October 10, 2016 in case No. A10-2655/2016).

The sale of the debtor's property is carried out in accordance with the provisions of the Bankruptcy Law, taking into account the provisions of the current civil procedural legislation.

Based on the foregoing, the procedure for selling the debtor’s property is aimed at satisfying the claims of creditors; upon its completion, the citizen is subject to release from debts.

Freeing a citizen from debts

The law provides for the release of a citizen from debts upon completion of the procedure for the sale of the debtor’s property.

However, the provisions of paragraph 4 of Art. 213.28 of the Federal Law “On Insolvency (Bankruptcy)” provides for a number of restrictions, in the presence of which the unfulfilled obligations of a citizen are preserved.

When deciding not to apply the rule on the release of debts to the debtor after the completion of the property sale procedure, the courts proceed from the following:

Release from debts is not allowed if there are signs of abuse of rights on the part of the debtor, that is, actions aimed at accepting obviously unfulfillable obligations, which is the cause of insolvency. On March 24, 2016, the Arbitration Court of the Novosibirsk Region completed the procedures for the sale of the debtor’s property without applying the rules on debt write-off to the debtor. The court came to the conclusion that, working as a loader and having a monthly income of about 20 thousand rubles, the debtor, abusing his right, deliberately increased the amount of debt without the goal of further repayment. The debtor, as well as the financial manager, having disagreed with the said judicial act, appealed the ruling through appeal and cassation proceedings. However, higher courts found the conclusion that there were signs of abuse of rights to be justified and refused to write off the debts to the debtor. (Determination of the Supreme Court of the Russian Federation dated February 13, 2017 No. 304-ES16-19557).

Unfair actions of the debtor in bankruptcy proceedings

The courts include such actions as failure to comply with judicial orders on the presentation of documents, failure to participate in the procedure for the sale of property, or failure to take measures to repay the debt. Considering the issue of completing the procedure for the sale of property, the court did not apply the rule on writing off debts to the debtor, citing the debtor’s dishonest behavior in the procedure, namely: the debtor did not comply with court orders on the presentation of documents, did not show any participation in the procedure for the sale of the debtor’s property, did not receive correspondence from the court, did not take measures to repay the resulting debt, taking into account the non-payment of debt on taxes and fees for five years, maliciously evaded payment of debt on taxes and fees, accounts payable. This conclusion of the court of first instance was supported by the court of appeal and the district court (Resolution of the Arbitration Court of the UO dated September 12, 2016 in case No. A50-16058/2015).

Meanwhile, going to court in order to release a citizen from obligations in itself is not an unconditional basis to consider the actions of the applicant-citizen as unfair. When making a decision to not write off a citizen’s debts, sufficient evidence must be presented and examined to confirm the intentionality and illegality of the debtor’s actions in the bankruptcy procedure. (Resolution of the Fourth Arbitration Court of Appeal dated September 1, 2016 in case No. A78-13259/2015).

Conclusion

The law enforcement practice of the provisions of the Law on Bankruptcy of Individuals is formed and follows the path of minimizing opportunities for unscrupulous participants in bankruptcy to gain control over the procedure, and is aimed at maintaining a balance of interests of the parties. When considering cases of bankruptcy of citizens, the positions of the courts formed when considering cases of bankruptcy of organizations are applied.

Documents for obtaining loan restructuring

To obtain loan debt restructuring, you will need the following documents:

- certificate of income in form 2-NDFL or other documented income (for 6 months);

- data on accounts payable;

- employment information: copy of the employment contract/work book;

- certificate of no criminal record for economic crimes;

- information about existing property;

- information about credit history;

- a statement from the individual regarding approval or objection to the plan;

- documents confirming the absence of bankruptcy status for the last 5 years and a restructuring plan for 8 years.

Installment plan for an individual's loan

Loan borrowers have three options for obtaining restructuring:

- through your own creditor bank;

- through a third-party credit organization - this type of lending is called refinancing;

- through bankruptcy.

Let's consider what the key features and distinctive features of these procedures are.

| Peculiarities | Restructuring | Refinancing | Restructuring through bankruptcy |

| Interest rate | In accordance with bank tariffs, on average – from 20% | Possibility of reducing the current interest rate | The current key rate of the Central Bank is now 10% |

| Who provides | Your bank is a lender | Third party bank | Court |

| Essence | Possibility of revising the payment schedule, reducing monthly payments by increasing the terms | Possibility of reducing payment by reducing the interest rate or extending the terms | A comfortable debt repayment schedule may not cover the full amount of the debt, but only part of it |

| Amount of credits | One | Several possible, limited by lender | Not limited. May include not only loans, but also other debts: for taxes and housing and communal services |

| Maximum term | At the discretion of the bank | At the discretion of the bank, usually within 60 months. | No more than 36 months. |

| Requirement | Good CI, no delays | Good CI, no delays | Availability of stable income in sufficient volume, arrears of at least 3 months are required. |

It’s difficult to say which of these options is more profitable. On the one hand, in the event of bankruptcy, borrowers with a damaged credit history and in arrears can receive the right to restructuring. Also noteworthy is the fact that interest in insolvency cases is calculated on the basis of a reduced interest rate.

But do not forget about the high cost of the bankruptcy procedure and the additional expenses that the borrower will have to bear. Although they pay off well for debt amounts of more than 500 thousand rubles.

For your information

Going through the bankruptcy procedure of an individual on a loan will also require reporting this fact to banks over the next 5 years when applying for loans, which minimizes the possibility of receiving funds. Whereas restructuring through a bank does not spoil your credit history and does not reduce the chances of loan approval in the future.

What debts are not discharged upon completion of bankruptcy?

Once the bankruptcy process is completed, outstanding debts are written off.

There are obligations that do not end after the bankruptcy case is completed. The citizen will be required to pay the following debts:

- arising in connection with compensation for harm to life and health;

- for wages not paid on time to employees (if a citizen goes through bankruptcy proceedings as an individual entrepreneur);

- current payments arising in the bankruptcy case (remuneration of the financial manager, postage and others);

- child support for minor children;

- compensation for moral damage;

- debt collected from a citizen in connection with bringing to subsidiary liability.

If a citizen decides to launch a new bankruptcy procedure, the listed claims will not be paid. The citizen will have to pay all debts in full.

Mortgage debt restructuring

It will not be possible to obtain restructuring of secured loans in bankruptcy cases. The mortgagee has the legal right to foreclose on the collateral; it can be a car or, as in the case of a mortgage, an apartment. Moreover, foreclosure in mortgage lending can be imposed on the debtor’s only home.

Many mortgage debtors mistakenly believe that the promised termination of foreclosure in enforcement proceedings also applies to collateral lending. In fact, this is not so and the bankruptcy procedure does not deprive the bank of the right to seize the apartment from the borrower.

For your information

But borrowers today have a good alternative to obtaining installment plans for their mortgage or “credit holidays” through AHML. The mortgage loan restructuring program developed by the Government has been in effect for the second year and is aimed at providing support to borrowers who find themselves in difficult financial situations.

Thanks to it, borrowers can write off up to 20% of the amount of mortgage debt (in the amount of up to 1.5 million rubles) through a one-time write-off or a reduction in monthly payments. Families with one or two children, military veterans and some other categories can apply for state support.

Is it possible to avoid the negative consequences of bankruptcy proceedings?

Given the negative consequences of bankruptcy, precautions should be taken.

We suggest that you adhere to the following rules:

- not falsify documents for the purpose of creating deliberate bankruptcy;

- not to be in collusion with the arbitration manager for the purpose of concealing property from creditors;

- carefully monitor the work of the financial manager, get acquainted with all documentation;

- take part in all legal proceedings;

- do not give preference to one lender.

Thus, it is worth analyzing the state of your account, carefully monitoring the expenditure of funds, and studying all documents related to bankruptcy. If you follow these guidelines, bankruptcy can help resolve your financial difficulties in a legal way.

Advice! In order to preserve the property of the debtor's spouse, it is necessary to conclude a marriage contract and define in it a list of things that are part of the personal property of the husband or wife of the bankrupt. It is important that the contract be concluded more. Than three years before the bankruptcy case began. This will avoid challenging the transaction.

Feedback on debt restructuring

Since the bankruptcy procedure for individuals is relatively new, there are few reviews from debtors on the issue of restructuring a citizen’s debt. So far, according to the established practice of bankruptcy of individuals, those who managed to obtain approval for an installment plan from the court are few. Creditors are usually more interested in the sale of the debtor's property, and the debtors themselves are not strong in the laws and cannot independently develop such a plan.

As for restructuring loans from banks, most credit institutions refuse applicants such a request. Banks are not required to explain the reasons for refusal, so borrowers can only guess about the reasons. The majority believes that banks are deliberately pushing the borrower into overdue payments in order to gain additional profit from penalties.

According to reviews from borrowers, many managed to find support from third-party banks and receive approval for refinancing. In this way, banks strive to attract bona fide borrowers and improve the quality of their loan portfolio.