Bankruptcy Application

Most people who are thinking about or have already decided to declare personal bankruptcy have little understanding of how to correctly draw up the appropriate application and where to submit the completed document. The first and most important requirement is that the completed application complies with the rules and regulations of domestic legislation. Correct completion will ensure timely acceptance of the document and increase the chances of its approval. The application must indicate the reasons for the deterioration in the financial condition of the individual and the justification for the appearance of a large amount of debt.

Filing for bankruptcy

Before submitting the application, you must correctly fill out its “header”, which indicates the address of the Arbitration Court at the place of residence to which the document is sent. It is mandatory to indicate the full name of the future bankrupt, his date of birth, place of residence and registration, passport details, as well as contact numbers and address for correspondence. The bankruptcy application must also indicate the total amount of debt. Sometimes the amount of debt is disputed by the borrower and the lender, in which case only the undisputed amount must be indicated in the application.

Debtor's bankruptcy petition

Filing a bankruptcy application to the court on behalf of an individual is available from 10/01/2015. The document is sent to the arbitration court located at the place of residence. Technically, the procedure looks like applying to the office and presenting a passport, on the basis of which a bankruptcy application is filed. A certain number of copies must be provided, which must correspond to the number of creditors. Submission of an application is possible not only by the debtor directly, but also by his authorized representative on the basis of the relevant document.

Bank accounts and deposits

Provide a list of open bank accounts and attach copies of agreements.

The bankruptcy application for individuals must contain information about all accounts, so if you have personalized electronic wallets, report them too. If they discover that you are hiding money, the debt will not be written off. The financial manager verifies the debtor's banking and financial information by requesting information about accounts with the tax office. He will see accounts in Russian banks and non-bank financial organizations, and if creditors complain, he will also find accounts abroad.

One of the disadvantages of bankruptcy is that if you have money, the court will oblige you to cover your debts with it. But by hiding accounts, you risk being denied bankruptcy. The discovered money will be taken away, and the deception will negatively affect the court’s attitude towards the debtor, and it will not be possible to get rid of the debts.

Consult a lawyer on how to deal with electronic currency before bankruptcy - anonymously and free of charge! To get a consultation.

Bankruptcy petition by creditor

The citizen himself, his creditor or a government body with the appropriate powers has the right to initiate the initiation of bankruptcy proceedings for an individual. But assigning bankrupt status is the competence of the court. If, after the debtor is declared bankrupt, there is not enough property in his property to repay the debt, in accordance with the court decision, the obligations are recognized as repaid automatically.

The law provides for three consequences of declaring a citizen bankrupt:

- When applying for a loan or cash credit, you must report the procedure for the first five years.

- Initiating a second bankruptcy procedure during the first five years is prohibited.

- For three years, an individual who has been declared bankrupt does not have the right to hold positions in the management structures of legal entities.

Sale of property in case of insolvency of citizens

The final stage of the step-by-step instructions for the bankruptcy procedure for an individual is the sale of property. Its main goal is to satisfy creditor claims through the sale of all the citizen’s property. After which the bankruptcy process comes to its logical conclusion and the court issues a verdict on its completion.

The bankruptcy stage is introduced in relation to the debtor in exceptional cases when one of the following conditions is met:

- the bankruptcy rehabilitation procedure is impossible due to the citizen’s insufficient income or lack thereof;

- the individual has committed repeated gross violations of the restructuring schedule or settlement agreement;

- the parties did not have time to develop a restructuring schedule or it was not approved by the court;

- the creditors' meeting voted against the restructuring;

- After the restructuring, there were outstanding debts.

The process of selling property in the event of bankruptcy of individuals is multi-stage, its step-by-step instructions include the following components:

1. Inventory of an individual’s property

The debtor himself submits to the court an inventory of all property when filing a claim for the first time. It contains information about his apartment, dacha, land plots, car, securities, shares in an LLC, etc.

For your information

There is no point in hiding any property: this information will be checked. And if the fact of concealment is discovered, the debtor faces liability.

2. Formation of the bankruptcy estate

The arbitration manager checks the actual availability of the listed property and, if necessary, adjusts the bankruptcy estate. Property that cannot be foreclosed on is excluded from the list: the only dwelling, land, property worth less than 10 thousand rubles, clothing, shoes, food, money within the minimum wage, etc. Collateral property (a mortgaged apartment or land) is subject to sale, even if we are talking about the only home of an individual.

3. Analysis of transactions of an individual over the last three years

At this stage of the step-by-step instructions, the financial manager requests information about all transactions made by the citizen over the past three years from the registering authorities. If necessary, he takes measures to cancel transactions and return property to the bankruptcy estate.

4. Assessment activities

The manager is responsible for carrying out the assessment of the property. If an individual considers that the assessment of the bankruptcy estate was carried out incorrectly and the value is underestimated, then he has the right to involve an independent appraiser in the procedure (and pay for his services out of his own pocket).

For your information

But you need to understand that the manager himself is not interested in lowering the valuation, because he receives a percentage of property sales.

5. Publication of information about the place and time of the auction in the media

6. Registration of auction participants

7. Bidding

Trading under the new rules is carried out exclusively in electronic format. Initially, all property is sold based on the market price in increments. If it was not possible to sell it, the procedure ends with an auction with a downward step. Property that cannot be realized may be transferred to creditors or returned to the bankrupt.

8. Repayment of creditors' claims

All proceeds are sent to an account specially opened for this purpose. After the bankruptcy estate is finally formed, the manager begins to repay creditor claims. Also, part of the money is used to pay off legal costs or pay remuneration to the manager.

9. Reporting of the manager to the court, termination of the case

Typical situation: the proceeds were not enough to pay off all debt obligations. In this case, the citizen is declared bankrupt, and the remaining debt must be written off.

Application for bankruptcy of individuals

In accordance with the federal bankruptcy law, the following procedure is provided:

- An individual debtor submits a correctly drawn up application to the Arbitration Court at his place of residence.

- If the court makes a positive decision, a debt restructuring procedure is introduced for a period of three years. The approved payment schedule is drawn up taking into account the debtor's income.

- The absence of the plan described above or the impossibility of its implementation automatically leads to the declaring of the debtor bankrupt.

- In parallel, a procedure for the sale of property is initiated, based on the results of which a decision is made on the need to release the debtor from fulfilling obligations in the future.

Why do you need a financial manager and who appoints him?

In the application for declaring himself insolvent, the citizen indicates the name of the self-regulatory organization of arbitration managers (SRO), from among whose members a financial manager must be appointed. The list of SROs can be viewed on the EFRSB website.

The task of the financial manager is to accompany the bankruptcy procedure of a citizen. His powers include:

- organizing a meeting of creditors;

- taking measures to search for and protect the debtor’s property from its sale by the debtor without the consent of the financial manager, theft by other persons;

- maintaining a register of creditors' claims;

- control over the spending of citizen funds;

- organizing auctions for the sale of property to pay off debts.

When accepting documents for proceedings, the court sends a request to the SRO to provide candidates for insolvency practitioners. By the first meeting, a response is received indicating the names of several candidates. The judge randomly selects one of the arbitration managers and appoints him as financial manager.

Important! The financial manager works on a remuneration basis. The amount of remuneration for one bankruptcy procedure is 25,000 rubles. The required amount for the first procedure must be deposited by the debtor with the court as a guarantee that the funds will be paid. Additionally, 7% of the amount of repaid claims of creditors in the process of debt restructuring or the amount of property sold as part of the sale procedure may be paid.

Sample statement from a debtor declaring himself bankrupt

In order to competently prepare a debtor’s application for declaring himself bankrupt, it is necessary to fully comply with the requirements for the form and content of such an application, listed in the relevant regulations. Please note that the law of December 28, 2002 quite clearly lists the entire range of information that the applicant is required to provide in this document. When filling out a debtor’s application for declaring himself bankrupt, it is best to use samples of such documents posted on official legal/banking resources. Remember that an illiterately completed application, lack of required attachments, certificates, certificates, errors and inaccuracies in the document can delay the case of declaring a person/legal entity financially insolvent.

How to file a bankruptcy petition

In order to draw up an application for declaring bankruptcy competently, it is necessary to indicate a whole range of necessary data:

- The name of the arbitration court to which the application is being prepared.

- The amount of financial obligations for which your creditors are willing to collect debts from you. The amount indicated is only that which the debtor at this stage is not contesting in other instances.

- The amount of debt at the current time. This includes not only current debts, but also, in accordance with the requirements of creditors, debts under copyright agreements, amounts of compensation for damage caused, amounts of arrears in payments, wages, etc.

- It must be indicated why the debtor is unable to satisfy the creditors' demands.

- Data on all executive documents.

The bankruptcy claim of a legal entity also indicates the amount of remuneration of the arbitration manager. All information that is also related to the bankruptcy case must be included in the application.

How much will self-filing cost?

So, the usual calculation:

- State duty – 300 rubles.

- Postage and office expenses.

This paragraph deals with sending correspondence to credit organizations or government agencies. Already at the first stage of bankruptcy (when collecting the necessary documentation for filing an application with the court), it is necessary to send many registered letters and notifications. This will cost the debtor at least 2 thousand rubles.

In the future, when the bankruptcy court procedure is launched, it will be necessary to notify creditors again about the meeting of creditors, its results, the results of the sale of property, etc. The amount of postal correspondence, and, accordingly, their payment depends on the complexity of the case, the amount of property, the number of creditors, etc. Thus, various types of correspondence (registered letters, notices, etc.) will ultimately cost the debtor up to 10 thousand rubles.

- Remuneration to the financial manager – 25 thousand rubles.

As mentioned earlier, when going through a bankruptcy court procedure, 25 thousand rubles are deposited with the arbitration court. This is a federally mandated fixed fee for the financial manager. - Publication expenses.

This includes:

- publication in the Kommersant magazine - from 8 thousand rubles. The final price of the publication will depend on its size, i.e. The larger the publication, the more expensive the cost of its publication. It is also important to note that there may be one or two such publications (with 2 stages of bankruptcy: debt restructuring and sale of property).

- publication in the Unified Federal Register of Bankruptcy Information (EFRS).

The cost of each of them is 451 rubles. 25 kopecks. The average number of such publications is 8–10.

Having carried out a simple calculation of all the listed expenses, we come to the conclusion that the minimum cost of carrying out the bankruptcy procedure will be at least 40 thousand rubles. But, we repeat once again, this “price tag” is minimal. As the complexity of the case increases, the number of creditors, the amount of property, the number of stages of bankruptcy, etc., this amount increases significantly.

Get a free consultation

Documents for bankruptcy application

The following list of documents is attached to the bankruptcy application:

- documents that confirm that all participants in the bankruptcy case have been notified of the submitted application;

- documents confirming that the state duty has been legally paid (if there are benefits for paying the duty, documents confirming this are attached);

- documents that prove the existence of debts from the person declaring his bankruptcy, as well as documents confirming the inability to make payments on his financial obligations.

- a list of all creditors of the debtor, documents deciphering the amounts of accounts payable and receivable, data on creditors, including the address;

- balance sheet of a legal entity, documents assessing the value of the applicant’s property and the composition of this property;

- information on the founders of the applicant, on the appointment of a representative to the owner of the applicant’s property.

Required conditions when submitting an application

In order to draw up and file a bankruptcy petition for an individual or legal entity, certain conditions must be met. One of them concerns the debt minimum. For enterprises, limited liability companies and other legal entities, this minimum is 100 thousand rubles. The exception is credit organizations. For them, the debt minimum is measured at 1000 minimum wages. For individuals, farms, and individual entrepreneurs, the minimum amount of debt can be 10 thousand rubles. At the same time, the period of delay in debt repayment for credit institutions must be at least 14 days, for legal entities and individuals - at least 3 months. If these conditions are met, you can prepare an application.

Application to the court for bankruptcy of a legal entity

An application to the court for bankruptcy of a legal entity can be filed directly by the general director of the organization in the case where circumstances indicate the impossibility of fulfilling the financial obligations assumed on time. It is necessary to take into account that the head of a company, organization or individual entrepreneur can apply to the arbitration court if:

- creditors' claims cannot be satisfied in full;

- the decision to liquidate the debtor is made by the body authorized to make such a decision in accordance with the constituent agreement;

- the debtor does not have enough property to pay off the debts and is insolvent;

- in accordance with current Federal legislation.

Who reviews the bankruptcy application and case?

The debtor's application and bankruptcy case are considered by the arbitration court in accordance with the applicant's registration method. There is an Arbitration Procedural Code that guides the court when considering such cases. The application is filed like any other standard claim. It is sent to the debtor, and the state fee for filing it is paid. If the debtor's representative signs the application, the power of attorney addressed to the representative must contain information that he is authorized to conduct the bankruptcy case. Those lawyers who will subsequently take part in meetings of the arbitration court must also have a similar note in the power of attorney.

What else is needed to start bankruptcy proceedings?

One application and its annexes are not enough to begin the insolvency procedure of a citizen. There are some expenses that are needed first, including:

- state duty in the amount of 300 rubles;

- initial payment for the services of an arbitration manager in the amount of 25,000 rubles.

It is also necessary to prepare evidence that the application and necessary documents were transferred to other participants in the process. Most often, papers are sent by mail, registered letters with an inventory of the contents. Accordingly, you will need a copy of the inventory and a receipt for sending the envelope, as well as an extract from the Russian Post website and tracking of this shipment.

The application will be considered by the court within a period not exceeding five working days from the date of its receipt . Within this time period, the court will determine what to do next: consider the case, suspend the process, or completely refuse to accept the person.

After considering the application, the court issues a ruling on scheduling a court hearing (or refusing to accept it). In case of a positive decision, the parties are notified of the start date of the process, they are invited to express their objections and prepare a position. If necessary, data is requested in various structures.

Read: What are the consequences of deliberate and fictitious bankruptcy of an individual

What decision can the court make following the consideration of a bankruptcy petition?

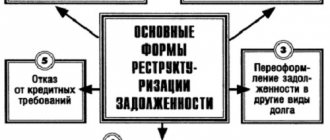

Based on the results of consideration of the bankruptcy application, the court may make a decision in accordance with the norms of current legislation. Namely:

- Declare the debtor bankrupt. Simultaneously with such recognition, the court must determine when bankruptcy proceedings in this case will be opened.

- Decide that in a particular case there are no signs of bankruptcy and, accordingly, do not declare the debtor bankrupt.

- Determine the procedure for financial recovery of the debtor.

- Determine an external manager for a legal entity/individual.

It is up to the debtor to satisfy all parties to the conflict and come to an amicable agreement on this issue.

Advice from Sravni.ru: The procedure for declaring an individual bankrupt is an extreme measure in relations with creditors, to which it is better not to go. An unpaid debt is considered repaid automatically only if the debtor is unable to fulfill his obligations. In all other cases, a procedure is provided for debt restructuring in accordance with the debtor’s income, as well as the sale of valuable property, with the exception of the main home.

How to file for bankruptcy yourself?

There are currently 2 ways to file for bankruptcy:

Judicially.

An individual is declared bankrupt in court by filing a corresponding application with the arbitration court. The debtor can take advantage of this opportunity if:

- The minimum amount of debt is not actually established; if a citizen is unable to fulfill his obligations, then he can declare himself bankrupt for any amount of debt.

- The property available to the debtor will not cover all of his financial obligations to the creditor/creditors.

- The debtor is in arrears on monthly payments or he understands that, given the current financial situation, they will begin soon.

- The debtor's income is not sufficient to both pay his debts and provide for his family.

In order to better understand the whole picture, let’s take a closer look at the bankruptcy procedure in court:

- Preparatory stage.

At this stage of the bankruptcy procedure, the debtor collects a list of documents required as an appendix to the application for financial insolvency to the arbitration court. Without providing this package of documentation, it is impossible to submit an application, therefore, obtaining bankruptcy status is impossible.

The list of required documents includes:

- personal documents of the debtor: passport, TIN, SNILS;

- documents confirming the debtor's marital status: marriage certificate, divorce certificate, decree on division of property (if any), birth certificates of children. The same list can include a marriage contract between spouses, one of whom is a debtor. As you know, a marriage contract concluded between spouses regulates the property rights and obligations of the spouses. If it exists, the property status of each spouse is clearly defined, which may have its own legal consequences during the bankruptcy procedure.

- a list of the debtor's property with attached certificates of ownership for each of them.

- information about bank accounts and cards of the debtor;

- information about the debtor’s employment: certificate of employment, certificate of income. If the debtor is not employed, then in this case he provides a certificate of registration from the employment center, or he can be a pensioner, providing a pension certificate, or in self-employed status he provides a certificate of registration with the tax office.

- documentation confirming the presence of financial debts and late payments: credit agreements, loan agreements, etc. Court decisions are also attached here, as well as orders of bailiffs (if court hearings were held to collect debts from a citizen).

- documentation confirming the fact of deterioration of the debtor’s financial situation. For example, as a result of job loss, long-term illness, disability, etc.

- filing an application with the arbitration court to declare an individual bankrupt.

A citizen’s application (with attached documents) about his financial insolvency is submitted to the arbitration court either at the place of residence or at the place of registration.

At the same stage, the citizen must pay a state fee of 300 rubles, and also deposit 25 thousand rubles with the court. for the work of the financial manager. A financial manager is a specially authorized person who will handle a citizen’s bankruptcy case.

In accordance with federal law, it is possible to defer payment for the work of a financial manager. To do this, the debtor must submit a petition of the appropriate form. However, to pay the financial reward. The citizen is obliged to the manager until the first court hearing on declaring him bankrupt.

— Judicial consideration of a citizen’s bankruptcy case.

After several weeks, usually 6–8 weeks, after an individual submits an application for recognition of his financial insolvency, the first court hearing is scheduled. It determines the reasons for the debtor's insolvency, the reasons for bankruptcy, and the court also appoints a financial manager.

During the first court hearing, the court decides which of the two prescribed bankruptcy procedures to introduce:

- debt restructuring, i.e. a set of measures aimed at the rehabilitation and improvement of the financial situation of a citizen. When the arbitration court approves the debt restructuring procedure, a debt repayment plan is drawn up. Its execution period is 3 years. This procedure has a number of important advantages: the possibility of reducing the interest rate, reducing the monthly payment by increasing the payment terms, etc.

- sale of property, i.e. sale of the debtor's property to pay his debts to creditors. However, not all of a citizen’s property can be sold at auction. Article 446 of the Code of Civil Procedure of the Russian Federation contains a list of the debtor’s property that is not subject to sale (for example, the only housing, household items, ordinary home furnishings, personal awards, etc.). The duration of the procedure under consideration is 6 months, however, it can be extended if necessary.

The latter procedure is used much more often.

At this stage of the bankruptcy procedure (and until its completion), the debtor loses the ability to manage his finances (with the exception of specially allocated money) and dispose of his property. The financial manager will deal with the entire financial side of the issue. The debtor is obliged to facilitate the work of the manager: provide access to property; if necessary, provide the necessary documentation, etc.

— Writing off a citizen’s debts.

In the event of a successful outcome of the case (namely: upon passing the financial and property verification of the debtor, the distribution of funds between creditors from the bankruptcy estate), the arbitration court judge writes off the debts.

In an out-of-court (simplified) procedure.

The opportunity to undergo bankruptcy proceedings out of court became available to our citizens quite recently, from September 1, 2020. Based on the name, you can understand that there is no need to go to court to declare your financial insolvency. So what is the essence of the simplified bankruptcy procedure and how does it differ from the judicial procedure we discussed earlier? Let's figure it out.

Distinctive features of the bankruptcy procedure are as follows:

- the process of declaring a citizen financially insolvent is formalized through a multifunctional center (MFC);

- it is free (even there are no state fees);

- The duration of the out-of-court bankruptcy procedure is 6 months;

- the amount of debt to creditors can be from 50 thousand rubles. up to 500 thousand rubles. If the maximum amount of debts exceeds half a million rubles, the out-of-court bankruptcy procedure becomes unavailable to the citizen.

- Enforcement proceedings on a citizen's debt obligations must be completed. The debtor does not have the money and property to pay off his debts, which is confirmed by the decision of the bailiffs.

The procedure for bankruptcy of individuals in an out-of-court (simplified) procedure is as follows:

- a citizen applies to the MFC at the place of registration or permanent residence with an application to declare him bankrupt. The application contains a list of all creditors, as well as the amount of debt of each of them.

- MFC employees conduct an investigation based on a citizen’s appeal. The MFC makes an electronic request to the Federal Bailiff Service to confirm information about the termination of enforcement proceedings against the person who applied.

- Based on the results of the inspection, the MFC publishes information about the bankruptcy of an individual in the Unified State Register.

- in the next six months, the debtor’s creditors are given the authority to search for property through requests to government agencies (Rosreestr, Federal Tax Service, credit organizations, etc.). From this moment, the accrual of financial sanctions (fines, penalties, interest) stops

Get a free consultation