- Bankruptcy procedures

- Observation

- Financial recovery

- Bankruptcy proceedings

- Beginning of bankruptcy proceedings

- Advantages of contacting a law office

Bankruptcy is a legal process whose main purpose is to declare a debtor insolvent. As a result, creditors lose the legal right to demand that he fulfill his obligations to repay debts. This requires certain stages and a number of actions that determine the specific nature of bankruptcy as a way to solve debt problems. Our specialists offer comprehensive support for bankruptcy procedures, including step-by-step bankruptcy of individuals.

Bankruptcy procedures

Cases in this category are considered exclusively by arbitration courts, which is approved at the legislative level. In accordance with the provisions of Federal Law No. 127-FZ of October 26, 2002 “On Insolvency (Bankruptcy),” the bankruptcy procedure includes certain stages, each of which is carried out by a specific entity:

- supervision – performed by a temporary manager;

- financial recovery – carried out by the administrative manager;

- external management – carried out by an external manager;

- bankruptcy proceedings – carried out by the bankruptcy manager.

Each of the listed stages has its own individual specifics, which are determined by different purposes.

End of observation stage

We found out that the observation period is 7 months. maximum. What happens after such preliminary activities are completed? How does this stage end? Detailed actions of the court are described in Art. 75 of the Law, which states that a court decision is made only after the first creditors’ meeting. There are two options for the development of events - either a determination is made on the use of financial recovery (or external management), or the debtor is immediately declared bankrupt and bankruptcy proceedings begin to sell off assets in order to cover debts. It is also possible, as at any other stage, to sign a peace agreement.

But it may also be that the creditors’ meeting, for some reason, is unable to come to a consensus and postpones approval of the decision. This is not excluded, then the legislation provides a deferment, but taking into account the deadline under the statute. 51, that is, again within 7 months. If the re-allotted deadlines expire and the meeting has not made a decision, the court has the right to independently:

- Make a decision on the transition to reorganization, that is, financial recovery - in this case, there must be petitions from the founders of the debtor company, or the owners of the assets of the unitary enterprise, or government agencies, or third parties. In addition, the fulfillment of obligations must be ensured according to the debt repayment schedule, and the start of payments will take place no later than a month from the introduction of reorganization.

- Make a decision on the transition to an external determination - such a measure is taken if there are opportunities to rehabilitate the debtor and restore his solvency.

- Make a decision on the final recognition of insolvency - such extreme measures are taken if there are no opportunities for the recovery of the debtor.

Observation

This procedure applies to the debtor organization, its main task is to ensure the safety of its property, analysis of its financial situation, formation of a complete register of creditors’ claims, organization and holding of the initial meeting of creditors. Monitoring is a mandatory procedure that is carried out in the event of bankruptcy of any legal entity.

To introduce a monitoring procedure, creditors' claims are analyzed and their validity is determined. The exception is situations when the debtor independently files an application for declaring himself bankrupt - under this condition, the monitoring stage begins from the day the application is accepted by the arbitration court.

During the monitoring procedure, a temporary manager is appointed, acting in parallel with the main manager of the company, who at this stage does not retain all of his powers.

The main restrictions and responsibilities imposed by the surveillance procedure include the following:

- the possibility of conducting transactions related to the acquisition or alienation of property worth more than 5% of the valuation of the company’s assets, only upon receipt of the written consent of the manager;

- a similar restriction on the issuance and receipt of credits/loans, guarantees and sureties, the organization of trust management of the property of the debtor company, the transfer of debt and the assignment of claims;

- prohibition on making managerial and organizational decisions.

The main pros and cons of surveillance

Carrying out an auxiliary observational stage has both its advantages and disadvantages. First of all, the judicial authorities can legally correctly assess the reasons for initiating bankruptcy by considering reliable information about the financial situation of the company. In turn, the debtor receives guarantees of the inviolability of assets, being under the protection of the state. On the other hand, business activities are suspended, transactions are limited, and the value of business is significantly reduced.

Each individual case has its own pros and cons, which must be assessed as a whole, taking into account the specifics of the enterprise. An audit observation procedure can help here - it represents an expert assessment of the current state of affairs of the organization. Formally, it is at this preliminary stage that the first attempts are made to bring the parties to the process to a compromise that would suit all participants and would avoid further lengthy measures to declare the debtor officially bankrupt.

Financial recovery

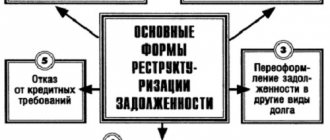

The main goal of financial recovery is to restore the debtor’s solvency and pay off debts in accordance with the established schedule. For this purpose, special conditions are created that contribute to the normalization of the financial stability of the debtor company. For this purpose, funds from the founders, participants and shareholders, and third parties are used. This stage of the bankruptcy procedure is approved by a meeting of creditors; the maximum duration of the financial recovery stage is 2 years.

The introduction of a healing procedure can be initiated by:

- constituent body;

- a third party authorized by the owner;

- interested third parties.

To initiate the stage of improvement of the debtor’s financial situation, a special action plan, a debt payment schedule, and minutes of the meeting of founders or participants are required. The beginning of this stage is established by the relevant ruling of the arbitration court and is carried out under the control of an administrative manager appointed by the court.

The manager's responsibilities include the following tasks:

- accounting for creditors' claims;

- organization of creditors' meetings;

- providing information about ongoing health improvement;

- debt repayment control.

Analysis of the debtor's financial condition

This analysis is carried out in order to determine the sufficiency of the property owned by the debtor to cover the costs of the bankruptcy case, including the costs of paying remuneration to the arbitration managers, as well as to determine the possibility or impossibility of restoring the debtor’s solvency.

The analysis of the financial condition is carried out on the basis of accounting documents and financial (accounting) statements of the debtor, the accuracy of which is confirmed by the auditor.

The temporary manager, based on an analysis of the financial condition of the debtor, including the results of the inventory of the debtor’s property, if any, analysis of documents certifying the state registration of property rights, substantiates the possibility or impossibility of restoring the debtor’s solvency, substantiates the feasibility of introducing subsequent procedures used in the bankruptcy case.

Bankruptcy proceedings

Bankruptcy proceedings are the final stage of the bankruptcy process of an organization. Its main goal is to adequately satisfy the requirements put forward by creditors.

The basic features of bankruptcy proceedings are the following:

- appointment of a bankruptcy trustee who manages the property owned by the debtor

- deprivation of the debtor organization of the right to manage property;

- suspension of paperwork on individual claims of creditors;

- possible challenge of the debtor's transactions that were made before the introduction of the bankruptcy proceedings stage;

- creation of a bankruptcy estate from property owned by the debtor;

- use of property included in the bankruptcy estate, claims of creditors.

Bankruptcy proceedings can be scheduled for 1 year and extended by court decision for a maximum of 6 months.

The powers of the bankruptcy trustee begin from the moment of his appointment by the judicial authority and end only with the end of the entire stage of bankruptcy proceedings. For this period, he receives an exhaustive list of powers to dispose of property belonging to the debtor organization.

To whom surveillance cannot be applied?

A similar stage is necessarily carried out when considering insolvency cases. But there are also exceptions. Thus, the introduction of supervision is unacceptable in relation to debtors who are already in the process of liquidation; absent for various reasons; conduct business illegally (without obtaining official status); are not legal entities or individual entrepreneurs. The bankruptcy regulations for individuals are regulated by a separate paragraph of the Law. While the supervision is being carried out, the debtor continues to function, but with a number of restrictions and under the control of a (temporary) manager. The rights and responsibilities of this official are given in stat. 65-67 of the Law.

Conclusion - in this article we figured out for what period the monitoring stage can be introduced by the courts in relation to the debtor company and what consequences it leads to. The maximum period is 7 months. The countdown begins from the moment the application is submitted to the court to initiate an insolvency case. The exact regulations for the observation stage and other mandatory stages are described in Law No. 127-FZ.

Beginning of bankruptcy proceedings

In order to begin the bankruptcy procedure, a number of mandatory conditions must be met:

The debtor must have outstanding debt obligations in the amount of at least 300 thousand rubles, and in some cases a minimum 3-month delay in repaying debts or paying wages is required.

The presence of these circumstances is confirmed by a court decision that has entered into force, an administrative court opinion, or a writ of execution, according to which the Arbitration Court obliges the debtor to fulfill its financial obligations.

In individual situations, the necessary conditions for starting bankruptcy proceedings may differ. In particular, it is not always necessary to comply with the requirement of having an overdue debt in the amount of 300 thousand rubles - the debt may be of a different size or absent. Regardless of the conditions and circumstances, as well as the status of the debtor, all bankruptcy cases are considered exclusively by the arbitration court. In order for this process to go as smoothly and calmly as possible, it is recommended to entrust the management and support of the bankruptcy procedure to qualified lawyers. You will receive such assistance by contacting Legal Bureau No. 1.

Recovery through bankruptcy proceedings (Filing and monitoring procedure)

Come to us for a consultation on bankruptcy! Collection through the bankruptcy procedure consists of the following stages: 1. Filing an application for bankruptcy 2. Observation procedure 3. Bankruptcy proceedings Now let’s look at the stages in more detail.

After the court decision on the claim enters into legal force, you and I immediately submit the creditor’s application to declare the debtor bankrupt.

We will do this because the court decision now gives us the right to do this, and we cannot hesitate here. In our practice, there was a case when events developed literally like in an action movie and we managed to get ahead of the debtor with such a statement by only a few hours. The fact is that bankruptcy is the most effective way to collect debt, but at the same time the most effective way for the debtor to evade responsibility. There is no contradiction here.

The main active force in the bankruptcy procedure is the arbitration manager, he leads it, and the position of this person will determine the result of the procedure in favor of the creditor or debtor.

Who exactly will be the manager is indicated in the bankruptcy application, so the result depends on whose application is submitted to the arbitration court first. It's time to recall the example of CJSC Trading House Severstal-Invest. It is clear that if all of a large company’s creditors present demands for debt repayment at once, it will not be able to cope. So a debt of 300 thousand rubles can really bankrupt a large company. A decent company will not allow such an end and will pay the debt even before the introduction of surveillance; it has a month to repay the debt. But this is a decent company, and we mostly deal with ordinary ones. Let's take a closer look at the observation procedure.

A month after filing the application, the first bankruptcy procedure will be introduced against the debtor - observation and its important consequences will begin. For example, the register of creditors will be open for a month and all creditors will have the right to submit their claim for debt repayment, even if the normal repayment period has not arrived and will not occur soon. Work plan of the temporary manager in the monitoring procedure: • Requests the debtor's accounting documents, information about property. • Makes a financial analysis of the enterprise and, based on it, identifies signs of deliberate bankruptcy. • Brings managers and founders to criminal liability. • Conducts a meeting of creditors. According to the law, the monitoring procedure is introduced in order to ensure the safety of property until the fate of the debtor is decided and to analyze its financial condition. In order to preserve property, a number of restrictions are introduced on the actions of the debtor and third parties. For example, the debtor must now obtain written permission from the manager to complete a transaction, its management bodies cannot make decisions on the reorganization and liquidation of the enterprise, the collection of funds and property under writs of execution is suspended, and so on. These measures are effective if the debtor still has property, but it probably no longer exists. Well, in this case, we will prepare a surprise that he will not like.

I always like this moment - when the debtor finds out that he is obliged to provide the manager with all the company documents.

If he provides it, he will sign his own death warrant, and if he does not provide it, he will also sign it. Usually such a prospect is very clear to him and unacceptable. Most likely, at this point in the project he will pay off the debt, we will not go through his laundry, and the bankruptcy will end peacefully at the “educational” stage. Most, but not all, projects will go according to plan, so let's see what might happen next. Suppose they try not to give us documentation or not all of it. Well, failure to provide documentation is a “sentence” for the debtor, since this is a direct basis for bringing to subsidiary liability in accordance with clause 10 of the Bankruptcy Law. As can be seen from judicial practice, this basis is one of the two most popular - it is easy to prove and difficult to refute.

Active failure to submit accounting and accounting documentation also entails criminal liability under Article 195 of the Criminal Code of the Russian Federation.

For the “savvy”, I also inform you that the loss of documentation by the debtor, for example, as a result of a fire or flood, will not be considered an excuse by the court even if there is official confirmation of this fact. According to the court, it was the debtor's duty to restore it. We've already been through this. As a matter of fact, if the debtor does not provide the necessary documents and information about the company’s activities, you and I will receive them in another way.

In accordance with Federal Law No. 127 “On Insolvency (Bankruptcy),” the manager has the right to receive any information and documents relating to the debtor’s activities.

Information about the debtor is requested by the arbitration manager from individuals, legal entities, government agencies, and local governments. This information is provided by the specified persons and bodies within seven days from the date of receipt of the request without charging a fee. That is, banks, counterparties of the debtor, the Federal Tax Service, registers and other government bodies will be required to provide us with information about the activities of the debtor. So, for example, if the debtor fails to submit financial statements, the arbitration manager will receive them from the tax service, and if there is doubt about the reliability, he will conduct an independent audit and restore the picture. It is important that all information obtained in this way is evidence.

The debtor sometimes loses sight of the fact that the arbitration manager is essentially a professional “investigator” who knows how to search for information and collect evidence.

The manager, by virtue of his status, has the necessary connections and powers. His qualifications in controversial issues of entrepreneurial activity are head and shoulders above those of employees of the tax service and law enforcement agencies. At this stage, the manager collects information and evidence to solve two problems. The first is to challenge the debtor’s previous transactions through the court and return the assets under Article 61 of the Federal Law “On Insolvency (Bankruptcy)”. Second, bring the persons controlling the debtor to subsidiary liability under Articles 195, 196, 199 of the Criminal Code of the Russian Federation. Let's talk about the first one. To remove assets in a legally sound manner, the debtor needs time, resources and preparation. This is not always the case and then the debtor makes mistakes. In this case, Federal Law No. 127 “On Insolvency (Bankruptcy)” contains a list of suspicious transactions with a statute of limitations for each when it can be challenged. It is possible to return assets in this way if little time has passed or the debtor “slept.”

If the asset has passed into third hands to a “bona fide purchaser,” then even if you challenge the transaction, it will not be possible to return it.

Then we move on to the second task and transfer the debt from a legal entity to an individual. First of all, we have reasons to believe that the debtor decided to withdraw assets and ditch the creditors, as they say in business. This decision resulted in the debtor being insolvent now and his assets being insufficient to satisfy the claims of all creditors later. This is the basis for bringing controlling persons to criminal liability for deliberate bankruptcy under Article 196 of the Criminal Code and we will be able to collect the necessary evidence. Our actions will depend on the specific debtor and the asset withdrawal scheme he has chosen. He could have used a sale at a reduced price, an unequal exchange, the purchase of a non-existent product, a bad receivable, or another method, but no matter what method he chose, it was very difficult not to leave traces for objective reasons. Therefore, for a manager, such an activity is like an open book.

Criminal liability is not the whole responsibility for intentional bankruptcy. For this, we will bring the director and founders to subsidiary liability if there is not enough property to pay off the debt.

There is one more sin that you and I will suspect the debtor of - tax evasion. Companies use different schemes and most often make payments to shell companies. The punishment under Article 199 of the Criminal Code for tax evasion is strict. When the “book of sins” of the debtor has been collected by the manager and there is evidence, we must sit down at the negotiating table. The chances of repaying the debt peacefully are now greater than ever. In our experience, if we have reached this point in the project, everything will end there. The debtor will pay, and the arbitration manager will withdraw from the bankruptcy procedure.

Advantages of contacting a law office

By contacting us, you receive comprehensive support and protection of your interests:

- individual analysis of your situation;

- objective assessment of the prospects of the case;

- assistance in choosing SRO insolvency practitioners;

- preparation of necessary documents;

- sending documentation to the court;

- representing the client's interests during arbitration proceedings.

We adhere to the principle of honesty and openness in working with each client. You will be aware of all the actions taken, the main goal of which will be to achieve the result you require. We also offer the most favorable prices on the market, which are free from the influence of third-party factors. Each request is assessed individually, so if we take on your case, the probability of achieving the result we voiced is 99%

Leave your application on our website or call us and get answers to all your remaining questions!

Introduction of bankruptcy of individuals

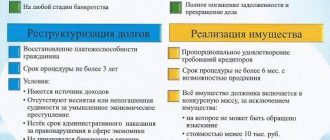

According to the legislation of the Russian Federation, the bankruptcy procedure consists of the following stages:

- Debt restructuring is a kind of rehabilitation of the debtor, which is used for a citizen to restore his solvency and pay off debts to the creditor. The terms can last up to three years. Restoring solvency is the main goal of the procedure.

- sale of property - used to satisfy the demands of lenders whose rights and interests have been infringed. If a citizen is declared insolvent, the court comes to a decision on the sale of his property. Initially, the period is set for six months, but if necessary, it can be extended in court.

- settlement agreement - can be concluded at any stage of the procedures by concluding an agreement between the defendant and the creditor.

Signs of bankruptcy of a legal entity

The status is not given to all companies; it is intended only for those who really cannot cope with debt obligations. These can be any problem debts: to banks, counterparties, government agencies.

The law says that a legal entity can become bankrupt if it does not fulfill the demands of creditors, cannot pay wages to employees, or make mandatory payments. The lifespan of problem obligations is at least 3 months. The total amount of debt must exceed 300,000 rubles.

Who can initiate bankruptcy of an LLC:

- The company itself.

- A creditor to whom a company owes a debt.

- An employee to whom the company has a debt.

- Competition creditor.

- Authorized bodies, for example, the Federal Tax Service.

Regardless of who the initiator is, the bankruptcy procedure for a legal entity will be identical. Cases are considered by the arbitration court.

In addition, Article 8 of Federal Law No. 127 states that a debtor company has the right to file a bankruptcy petition with the Arbitration Court in advance, when a difficult financial situation is only in the future. But provided that it is clearly inevitable: for example, the company does not and will not have the resources to pay the counterparty or pay wages to employees in the next period.

Specifics of recognition of insolvency

Recognition of insolvency has its positive and negative sides. When a person is officially declared bankrupt, the court has the right to make a decision to restrict the citizen’s travel abroad. All property of the debtor, which is available on the date of introduction of the bankruptcy procedure, is a bankruptcy estate and can be sold in the process of debt restructuring. From the moment a person is declared financially insolvent, all actions regarding his property will be carried out by a financial manager. All transactions that a citizen makes personally without the involvement of a manager are considered void.

Consequences of introducing bankruptcy

Every citizen who plans to declare bankruptcy should be familiar with the consequences of introducing bankruptcy proceedings:

- For 5 years from the end of the process of selling property, a bankrupt has no right to apply for new loans or enter into loan agreements without notification of the fact of his financial insolvency

- For 5 years, a citizen declared bankrupt does not have the right to re-initiate insolvency proceedings

- A citizen declared bankrupt does not have the right to occupy leadership positions or manage a legal entity.