A spouse who is married and who supports a minor offspring at his own expense has the right to apply to the court to collect alimony.

People are often afraid to apply for alimony while in a registered relationship, fearing that the other spouse—usually the husband—might take away their son or daughter. But going to court will serve as the best documentary evidence that the father does not financially support the children, and the marriage has long been of a formal nature.

Is it possible to apply for alimony without a divorce?

Question:

“We have a six-month-old child, so naturally I don’t work. The husband works, he has a normal salary, but “for the family” he brings mere pennies - only enough for groceries. The rest is put into his own deposit account. The child benefit is barely enough for my child to eat (he is artificial). For every pack of diapers, clothes, toys, you have to beg, and they don’t always give. I’m already silent about my needs. I’m not dying of hunger, of course, but I can’t buy myself literally anything, not even small things.

The husband is against divorce. I also don’t want to get a divorce yet, especially since they say it’s difficult and time-consuming with a small child, and if my husband doesn’t agree. Are there any ways to force my husband to give more money to me and the child? Is there alimony when living together?

Answer:

Yes, and not only for the maintenance of the child, but for the maintenance of the mother who is on leave to care for him. Article No. 89 of the RF IC regulates the financial responsibilities of both parents in relation to minor children.

The parent who has direct responsibilities for caring for the child can demand from the other the necessary funds for this in court. The presence or absence of a marital relationship between the child’s parents does not matter.

You can prepare a statement of claim in court to collect alimony from your husband. The court will satisfy your request, despite the fact that you and your husband are married and run a joint household. Moreover, you can also claim child support because you cannot support yourself while on maternity leave (until the child turns 3 or you go back to work).

Is it possible to collect alimony payments in a civil marriage?

The answer to this question is given by Art. 53 RF IC. It says that children born to a father and mother who are not in an officially registered marriage have the same rights as children born in a legal union. Therefore, collection of alimony is possible – both voluntarily and in court.

In this case, the condition that paternity must be documented must be met. Such confirmation may look like:

- certificates of establishment of paternity issued by the civil registry office;

- a court decision that recognized the fact of paternity;

- certificate of adoption of a child.

In other words, if the father does not appear in the documents or is indicated in them according to the mother, then in order to obtain alimony outside of marriage it is necessary to carry out the procedure for establishing paternity. If it is voluntary, then it is carried out in the registry office, if not, in court.

The second condition for receiving alimony for a child who was born in a civil marriage must be the parent’s self-removal from supporting the minor, regardless of whether the father lives with him or not.

Who is eligible to claim spousal support?

According to the Family Code, spouses have certain financial responsibilities to their children and each other. According to the previously mentioned article No. 89 of the RF IC, the following have the right to receive alimony without divorce:

- Common minor child

- Group I disabled child before and after adulthood

- Wife during pregnancy and caring for a child under 3, as well as when caring for a disabled child

- Husband, if he is caring for a child under 3 years of age or a disabled child

- Disabled husband or wife

ATTENTION! It is absolutely not necessary to file a divorce in order to receive alimony. The presence or absence of a marital relationship will not in any way affect the amount of alimony that is collected from the father or mother for the maintenance of children or each other.

Grounds for termination of payments

The grounds for termination of alimony obligations are specified in Art. 120 IC RF. This is possible in the following cases:

- Death of the recipient child or paying parent.

- Child's coming of age.

- Onset of legal capacity, removal of disability.

- Adoption.

- Emancipation of the child.

Alimony obligations are not inherited. But if the payer has accumulated a debt and he dies, the heirs will have to repay it within the limits of the value of the inherited property (Article 1175 of the Civil Code of the Russian Federation).

How to collect alimony while married?

There are two legal ways to pay alimony, regardless of the presence or absence of a marital relationship between a man and a woman:

- Alimony agreement

- Judgment or order for collection

A voluntary agreement on the payment of alimony must be drawn up by the spouses and certified by a notary. In this case, it acquires the force of a writ of execution and becomes a full-fledged replacement for a writ of execution, according to which the FSSP can collect alimony from the debtor.

Alimony agreements are often concluded by divorcing spouses. But when collecting “marriage” alimony, they are almost never used. After all, if a husband and wife can agree on the procedure for incurring material expenses for children and each other, they have no need to enter into such an agreement. And if disagreements in this area within the family cannot be overcome, then the only way to resolve it is through litigation.

The trial, of course, is much more troublesome and emotionally unpleasant. After all, no matter how you look at it, it is also “washing dirty linen in public,” and this is always traumatic.

But it happens that an irresponsible spouse and parent simply leaves their partner no other choice; the survival of the child or himself is at stake.

Some consolation may perhaps come from the fact that court fees are not collected from the plaintiff when considering such cases. The alimony payer will pay it.

How to receive money

If you have drawn up an agreement, the defendant can make payments voluntarily. He can transfer them to your card or to the child’s account. He also has the right to hand over money to you personally. In this case, be sure to draw up receipts so that there are no problems later.

If the decision is made by the court, you must receive a writ of execution. This can be done at the court office. Contact the bailiff service with the writ of execution. They will begin proceedings in this case.

You can also take the writ of execution to the accounting department of the company where the debtor works.

| Calculator of penalties and alimony debt: | |

| Amount of debt today: | rubles |

| Start date of delay: | |

| Until what date are penalties calculated? | |

Penalties at the rate of 0.1% per day for 0 days: 0 rubles

Amount of penalties for all debts: 0 rubles

Total amount of debt (penalty + principal): 0 rubles

How and where to apply for alimony without divorce?

The reason for the fact that the procedure for collecting alimony in marriage is considered rare and complex is due to ordinary legal illiteracy, which, unfortunately, is typical for Russia, which is just emerging as a legal society. In fact, “marital” child support is no different from those issued after a divorce.

The exact same statement of claim and accompanying documents are required. The procedure for judicial review and execution of a decision is not just similar, but even simpler. Child support during a marriage is collected faster than at the same time as a divorce.

The application is submitted to the magistrate's court at the place of residence of the family. We will tell you what documents you will need below.

Responsibility for non-payment of alimony

If the alimony holder fails to fulfill his obligations in full, the court has the right to consider this as malicious evasion. Such a decision is made by the court in the following cases:

- non-payment of alimony for 3 or more months;

- putting the child support worker on the wanted list;

- Concealment by the alimony provider of information about his own whereabouts.

In such cases of judicial practice, the defendant may be brought not only to administrative, but also to criminal liability under Article 157 of the Criminal Code of the Russian Federation, of which the defendant is notified by the bailiff.

Claim or writ proceedings?

The requirement of one parent to another regarding participation in providing for the child is classified as indisputable and does not require proof of necessity. Therefore, it can be considered by the courts in a simplified order. In this case, what is required is not a lawsuit, but an application to collect alimony from the father or mother. You can find a similar application form on the Internet and write a similar one with your data.

Order proceedings are preferable for all parties - it allows the case to be resolved quickly and does not require the mandatory participation of the participants in the process. Since in the case of “marriage” alimony the alimony payer does not have to search for or prove paternity, almost all such cases are resolved by order. The court issues an order, it is sent to the place of work of the alimony payer, after which the accounting department begins to transfer the required amounts to the second spouse.

Claim proceedings are used only in complex, complicated disputed cases, for example, when a spouse files a counterclaim, challenging his paternity, or presents evidence according to which the amount of alimony should be reduced (illness, difficult financial situation, disabled parents whom he supports, etc.) .d.).

Practical examples

To understand the specifics of collecting alimony, it is enough to familiarize yourself with practical examples.

In marriage, a mortgage has been issued or the person obligated to pay alimony pays loans

If the payer has credit obligations, this does not exempt him from paying alimony - the interests of the child are taken into account first. The amount of alimony is calculated from earnings or other income after withholding personal income tax and other government contributions, but excluding loan payments. A man earns 30,000 rubles, 15,000 rubles. transfers monthly to pay off the mortgage. There is one child. Alimony was collected in the amount of 25% of income, i.e. 7,500 rubles. After payments to the child and the creditor, 7,500 rubles remain in hand.

Wife on maternity leave

A man earns 50,000 rubles and has two children. The youngest is 2 months old, his wife on maternity leave filed for alimony. For children, payments are calculated as follows: 50,000 x 33% = 16,500 rubles. Alimony for a wife is established taking into account the subsistence level. The PM is 11,163 rubles, the claim indicates a demand for the recovery of half of the PM, i.e. 5,581.5 rubles. The plaintiff is supported financially by his parents, which the defendant was able to prove. The claim was partially satisfied, payments were assigned - 4,000 rubles. to the spouse.

Child support is already paid for the first child

The man has one son from his first marriage. In the second marriage a daughter is born. Earnings are 30,000 rubles. 30,000 x 25% = 7,500 rub. - child support for my son. The wife files a claim to recover payments to her daughter in the amount of 25% of her income. In total, the man has to pay 50% instead of the established 33%, which is the basis for reducing payments. The payer files a claim to reduce the amount of alimony. The court assigns the legal 33% or 16.5% of income for each child.

How to prove that the husband does not support the child

When applying for a court order, no evidence is required. It is the spouse who will have to prove that your demand is not justified, and he supports the child. If a claim is filed, everything becomes more complicated. The law places the burden of proof on the applicant. Therefore, in order to collect alimony from a spouse, the plaintiff must prove that he does not participate in the maintenance of the child. The following can be presented as evidence:

- an extract from the house register at the place of residence of the mother and child (if the spouse lives separately);

- testimony of witnesses (relatives, neighbors, friends);

- checks confirming expenses for the child.

Where to submit documents?

As stated earlier, alimony cases are considered by magistrates' courts in all cases where there is no serious disagreement about the legality of alimony claims or the need to determine the whereabouts of the alimony payer.

ATTENTION! According to the rules, the application is submitted at the place of residence of the alimony payer. In a marriage, most often the entire family is registered at one address. But even if this is not the case, you can also submit an application to the territorial magistrate court at your place of residence - this is allowed.

Claim: Don't miss anything

Despite the fact that there is no single form of claim, the application must be completed with the utmost care, guided by the second part of Article 131 of the Code of Civil Procedure, which describes what should be included in the claim. It may be better to use the help of a lawyer to avoid having your application returned if irregularities are discovered in it. Of course, this is not an obstacle to re-applying, it will just waste time.

So, be sure to indicate in your claim:

- where are you filing it (name of the court);

- information about yourself: last name, first name, patronymic, place of residence, passport details. If you intend to use the services of a lawyer, then his data is analogous;

information about the spouse from whom alimony is expected to be collected: last name, first name, patronymic, place of residence, passport details;- indicate in detail what the violation is or there is a threat of violation of the rights or interests of the plaintiff spouse, as well as the circumstances in support of your claims and evidence confirming these circumstances;

- the amount of alimony collected, indicating the calculation;

- list of documents to be attached to the claim.

The list of documents attached to the claim varies depending on the circumstances of the case and the evidence presented, so it does not vary much.

Useful information for the current year can additionally be viewed in the constantly updated information and legal databases. [video_lightbox_youtube video_id=»-RPEdcWj9Pk» width=»800" height=»450" auto_thumb=»1"][video[video_lightbox_youtube video_id=»n85cIxbm5co» width=»800" height=»450" auto_thumb=»1"]_light [video_lightbox_youtube video_id="XL4dnXTspYw" width="800" height="450" auto_thumb="1"]so, the document must contain the following information:

- Name of the specific magistrate's court to which the application is being filed

- Full name, place of residence, contact details of the applicant and respondent

- Information about the marriage (when and how the registry office is registered)

- Information about children for whom child support is being collected (full name, date of birth)

- Information about the place of work of the parent from whom child support is being collected

- A concise and clear description of the circumstances: the fact of living together or separately, the absence or insufficiency of material support, the inability to independently provide for children.

- Demand to collect alimony. Its essence should be stated clearly and specifically, for example: “I ask you to collect from (full name) alimony for the maintenance of (full name) in the amount of a percentage of earnings (the percentage depends on the number of children) until the child (children) reaches adulthood.”

- List of attached documents (more about them below)

- Personal signature of the applicants and date of filing the application or claim

ATTENTION! The full package of documents is submitted in two copies (one of them the court will send to the defendant for review). If demands for child support and a needy second parent are submitted at the same time, there must be two applications - a separate one for the children, and a separate one for oneself.

The necessary conditions

As with any application, the court can respond positively to a claim for payment of alimony in marriage, accepting it for consideration or rejecting the applicant.

Therefore, a spouse applying for alimony without a divorce must describe in detail in the application the reasons that prompted him to do this. Each fact must be supported by documents.

Each case of alimony payment without divorce has individual characteristics, but there are certain conditions on the basis of which one of the spouses can initiate the collection of alimony:

- the spouse does not provide adequate financial assistance to the family, does not provide for minor children and the spouse;

- the spouse is incapacitated and does not have the opportunity to earn money due to illness or disability;

- there is a disabled child in the family, and additional material investments are needed for the purchase of medicines, rehabilitation, etc.;

- the family has a young child under 3 years of age;

- The wife is pregnant and on maternity leave.

This list is mandatory, that is, if one of the points is the reason for filing an application for alimony, the court will accept the case for consideration.

How can I find out the amount of alimony debt? The answer is presented in the article “Where lists of alimony debtors are available.” You can find out how alimony is withheld from sick leave here.

What documents are needed?

The documents required for the court can be divided into two categories:

- Confirming the legal grounds for receiving alimony:

- Birth certificates of children indicating the names of parents

- Marriage certificate

- A certificate from the housing office confirming that the applicant lives with the child (this is a necessary condition for receiving alimony)

- Demonstrating the income level of family members:

- Documents about the applicant's income: salary certificate from the place of work, sick leave for pregnancy, document confirming being on leave to care for a child up to 3 years old, document on pension or receipt of social disability benefits

- Documents on the defendant’s income: salary certificate from the place of work, documents on additional income (lease agreement for real estate owned by the defendant, deposit agreements, tax returns, etc.)

The applicant’s task is to document to the court that the second parent does not provide for the child’s needs, despite the fact that he has such an opportunity. And also your need for additional funds to provide for your children.

If we are talking about a fixed amount, it can be justified by attaching a set of receipts and checks confirming monthly expenses for the child: purchase of clothes, shoes, medicines, baby care products, food, payment for clubs, sections, additional education.

Professional lawyers recommend approaching the issue of preparing the second category of documents with particular seriousness. Each “piece of paper” works for you and can affect the final amount of alimony collected.

Special situations

The payer has a mortgage or other loan

It must be taken into account that the court first of all takes into account the interests of persons under the age of majority, and then the debt obligations of the alimony provider. Therefore, if the alimony holder (it doesn’t matter whether the former spouse or the current one) has income sufficient to repay a mortgage or other types of loan, as well as pay alimony, he will not be able to escape responsibility.

The balance of funds in the hands of the defendant after paying the mortgage (loan) and alimony must be greater than the subsistence level established in the region of residence of the defendant. If this is not the case, the defendant has the legal right to challenge the court's decision and reapply to the court for a review of the case.

Pregnant wife

Let’s not be unfounded and turn to the relevant article of legislation that regulates the situation described: according to Article 89 of the RF IC, a pregnant woman (including one on maternity leave) is not required to prove the fact of her need for financial support from her husband. She just needs to provide a marriage certificate (issued by the registry office) and a certificate from the clinic confirming the fact of pregnancy.

Payments for another child

Article 81 of the RF IC obliges a parent to provide for his child, regardless of the marriage into which this child was born. All percentage values of alimony payments collected remain at the general level. Children born in different marriages have equal rights and one does not have any priority over the others. The defendant may also adopt children, who will have similar rights.

How much can you collect alimony while married?

Alimony is calculated in two ways:

- As a percentage of salary

- As a fixed amount

When calculating alimony in a marriage, any of the methods can be used, depending on which method is more in the interests of the child or the disabled, needy spouse.

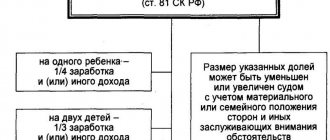

The interest rate of child support is regulated by Article No. 81 of the RF IC:

- A quarter of an adult's income per child (25%)

- A third of an adult’s income goes to two children (33%)

- Half of an adult's income for three or more children (50%)

This type of calculation is used when the alimony payer is officially employed, receives a “white” salary, and does not give reason to suspect that, in addition to the official one, he has a hidden source of income.

The calculation of a fixed alimony amount is regulated by Article No. 83 of the RF IC. It is used if the parent does not have a permanent income, or the income is difficult to routinely calculate (for example, the salary is paid in foreign currency or in natural products). The amount is set by the court, based on the minimum wage and minimum wage, and is calculated based on the financial capabilities of the parents and the needs of the child.

For a disabled spouse in need, alimony is established exclusively in the form of a fixed amount.

Calculation procedure

When applying for alimony in a marriage without a divorce, you should know that there are certain limits and restrictions on the amount of payments collected from the alimony. The sources and amounts of these penalties are clearly defined by current legislation . This applies to both alimony payments under a notarized agreement and those established by the court.

What income is charged?

The full list of types of income from which alimony payments are withheld is defined in Decree of the Government of the Russian Federation No. 841 of July 18, 1996. This Resolution indicates the following types of income:

- severance pay;

- vacation payments;

- income from rental of movable and/or immovable property;

- income received as a result of equity participation in organizations (dividends);

- income from business activities, excluding expenses incurred for its implementation;

- wage;

- financial assistance (all types);

- pension (all types except the one paid for the loss of a breadwinner);

- scholarships (categories of students from whose scholarships alimony may be charged are listed in this Resolution);

- benefits paid in connection with temporary disability or unemployment (from these sources of income, alimony can be collected solely on the basis of a court decision);

- other payments made by the employer under labor legislation.

Item 4 of the list given in this Resolution indicates that the collection of alimony payments is carried out only after the removal of all taxes provided for by law from the corresponding type of income.

Amount and forms of payments

The amount of alimony payments under a notarized agreement is negotiated by the parties to this agreement and is stated in it. However, there is one exception, which was mentioned above: if a minor child is the recipient of alimony, the law establishes the minimum amount of alimony payment in the amount of 25 percent of the salary of the alimony provider for one minor child.

If there is no agreement on the payment of alimony between the parties, these payments are recovered from the alimony provider through the court. The amounts of such penalties are determined by paragraph 1 of Article 81 of the Family Code of the Russian Federation:

- 1 child - 25% of salary or other type of income;

- 2 children - 30% of wages or other type of income;

- 3 children or more - 50% of salary or other type of income.

These shares (their size) may be increased or decreased by court decision, taking into account the financial or marital status of the parties or other noteworthy circumstances specified in paragraph 2 of Article 81 of the RF IC.

Paragraph 1 of this article also stipulates the possibility of establishing alimony payments not as a percentage of the income of the alimony provider, but in the form of a fixed amount specified by the court.

Judgment (court order)

As mentioned above, writ proceedings are the easiest way of legal proceedings. The time interval between filing an application and making a decision on collection is only 5 days.

Plus, the court does not summon the applicant and the defendant to the hearing, but considers the submitted documents independently. By the way, this is another reason to take the most responsible approach to collecting documents justifying the amount of payments. The documents will “speak” for you.

If the court finds the claims to be justified, it makes a decision, determines the amount or percentage of the income, and notifies both parties of its verdict.

Methods

Methods for paying alimony without divorce between spouses are similar to those assigned after divorce:

- By mutual agreement - assigned in a fixed amount. This applies to cases where the payer does not have a stable salary. Spouses agree on the amount of payments themselves.

- According to a court ruling, they are assigned as a percentage of the payer’s income in accordance with legislative norms.

The amount of payments is determined based on the amount of wages or other income of citizens, as well as in accordance with the financial situation of the family.

Voluntary

The ideal way to assign alimony payments is to voluntarily draw up an agreement in essence.

This option is possible if the spouses maintain a good relationship when material problems arise. This option is used in judicial practice less often than the consideration of alimony cases in court, but, nevertheless, the legislation regulates this issue.

Agreement

The agreement on alimony payments is concluded in writing. Its contents are checked by a notary for compliance with the law and certified with a signature. After this, the document acquires legal force and is equivalent to a writ of execution. It must specify the amount of payments, frequency, and procedure for receiving money.

If the payer violates the terms of the agreement, the other party can go to court or the bailiff service. This method of collecting alimony is considered the most civilized way to solve the problem.

The agreement is attractive for those who do not want to advertise themselves as alimony payers at the enterprise, being the father of the family. According to the agreement, the payer transfers the agreed amount personally to the recipient or transfers it to a bank account or card.

Judicial

At the moment when a spouse decides to collect alimony from the father of her children, being legally married to him, it is necessary, first of all, to decide on the collection procedure.

If it is not possible to reach an agreement, then the only acceptable way to split up what you want is to go to court.

The law distinguishes between two options for going to court:

- Filing a claim.

- Filing an application for a court order.

The options differ from each other radically. The first involves a trial, the participation of not only both parties, but also witnesses, if such a need arises. In the second case, the judge makes a decision alone within 5 days without the participation of the parties based on the content of the application.

The calculation of alimony begins from the moment the application is filed with the court.

ATTENTION! The parent designated as the child support payer has 10 days to appeal the court's decision. If this happens, the court order is canceled and the consideration of the case continues, but in a lawsuit.

If the alimony payer has not appealed the order, after 10 days it comes into force. By court order, alimony can be collected forcibly through the FSSP. The start date of collection begins to be considered not the day of contacting the bailiffs, and not even the day the verdict comes into force. Alimony will begin to be calculated from the day you go to court - the date specified in the application.

Execution of the court order is mandatory. Otherwise, the alimony payer may be brought to administrative and even criminal liability.

When payments stop

The termination of alimony payments is regulated by Article 99 of the RF IC. If an agreement is reached between the parties, payments may be terminated on the following grounds:

- the agreement between the parties has expired;

- death of the alimony holder or recipient of alimony;

- the occurrence of special circumstances specified in advance in the agreement;

If alimony was appointed by the court, then the basis for its termination can only be a corresponding court decision or the occurrence of circumstances previously specified in the court decision.

Results

So, let’s highlight the main points of the topic presented in this article:

- To receive alimony from a parent who evades financial support for a child, it is not necessary to officially dissolve the marriage

- In addition to the child, a spouse who is disabled or in need of financial support has the right to alimony in marriage

- Alimony can be obtained either voluntarily (by agreement) or through the court (by receiving a court order or having achieved satisfaction of a claim)

- To obtain a court order, you need to submit a certain set of documents to the magistrate's court.

- The applicant does not pay the state fee

- Consideration of a case by order does not require the presence of the parties in court

- The case is considered within 5 days after filing the application

- The court order can be appealed within 10 days. If there is no appeal, after these 10 days the order comes into force.

- The start date of alimony payments is the date of filing the application with the court

- If the alimony payer refuses to voluntarily comply with the court decision, the order may be transferred to the FSSP

- For non-payment of alimony, a court decision provides for administrative or criminal liability.

If you have any questions or require clarification of this or that point in relation to a specific situation, please contact the lawyers of the Prav.io portal.

If the collection of alimony in marriage requires legal proceedings, you can find a family lawyer on the portal who will help you win the case in court.

Lawyer's answers to private questions

Where to apply for alimony without marriage to support a pregnant woman?

By law, payments are assigned only to the current or former spouse during pregnancy and for three years after childbirth. If the marriage has not been registered, alimony is not due. They can be claimed for a child if paternity is established voluntarily through a joint application. If not, the relationship can be established through the court and the money can be immediately recovered (Article 49 of the RF IC).

How to apply for spousal support for a disabled, needy wife?

In general, a woman can file a claim with the district court at her place of residence or the address of the defendant. To confirm incapacity for work, you must provide medical certificates and a rehabilitation program. Need is confirmed by a certificate of the amount of pension or salary, checks for the costs of treatment and food.

Is it possible to file for child support while married?

Child support can only be recovered from an adult able-bodied child (Article 87 of the RF IC). The court will take into account the plaintiff's need. For example, if the applicant is on disability but has a spouse with a good income, and the respondent earns little and supports other dependents, minimum payments may be imposed or denied.

What should you do if you apply for alimony while you are married and your husband does not pay?

Marital relations do not exempt the alimony obligee from paying the debt. In addition, the creditor may demand a penalty in the amount of 0.1% of the debt amount for each day of delay (Article 115 of the RF IC). The debt itself does not need to be collected separately; it will continue to accumulate until full repayment. If the delay is more than two months, you can submit an application to the bailiff to bring the debtor to administrative responsibility under Art. 5.35.1 Code of Administrative Offenses of the Russian Federation. Also, the bailiff is obliged to take measures provided for in Chapter. 7 Federal Law dated 02.10.2007 No. 229-FZ “On Enforcement Proceedings”, if there are grounds.

My wife filed for child support in the marriage, but I don’t work - I can’t find a decent job. Am I required to pay?

Yes. Lack of work does not relieve one from the obligation to support children. Even if you are not employed, you can still be charged a fixed amount. If you fail to pay, the debt will accumulate and you may be subject to administrative and then criminal liability.

Amount of alimony

The court determines the amount of financial payments by assessing the financial situation of the family. Also, alimony for minor children in a marriage without a formalized divorce is determined by their quantity:

- a quarter of income – one child;

- one third of income – two children;

- half of the income is three or more.

If the defendant hides his income and it is impossible to understand how much he earns because he does not want to pay the money, then the court can simply assign a fixed amount that he will have to pay.

Taxable income

Withholding of alimony is carried out from:

- salaries;

- bonuses;

- fee;

- scholarships;

- pensions;

- sick leave;

- allowances;

- dividends and other income from securities;

- other income that is regulated by Government Decree No. 841.

The amount of the penalty is determined by the authorities and depends on specific factors (for example, the income of one of the parents).

Non-taxable income

However, there are those types of wages and other income from which the law prohibits the withholding of funds:

- business trips;

- social benefits;

- maternal capital;

- other income that is regulated by Federal Law No. 229.

Sometimes the amount of alimony is adjusted depending on the financial situation of both parties. The court always tries to maintain the standard of living that the children had before the end of their life together (divorce) or the parents’ separation.

Alimony can be withheld from specified income during a marriage without the need for a divorce.