The procedure for declaring a debtor bankrupt begins after filing an application for recognition of financial insolvency and involves the consideration of cases of various constituent entities of the Russian Federation. The main and other persons in a bankruptcy case are citizens directly or indirectly associated with the process of declaring a citizen insolvent. Let us consider in more detail the list and rights of the main parties involved in a bankruptcy case, as well as the duties and rights of persons participating in the insolvency arbitration process.

Definition of insolvency

The concept is explained in Art. 2 Federal Law No. 127. This is a situation when the debtor is unable to fully satisfy the creditor’s demands. It can be:

- mandatory payments (for example, to a bank)

- payment for work activities and/or severance pay for employees

- any financial arrangements

Another name for the term, according to Art. 2, – bankruptcy. That is, from a legal point of view, these words are interchangeable.

An important condition is that insolvency must be recognized by an arbitration court.

According to the law of the Russian Federation, bankruptcy proceedings can be initiated against the following entities:

- legal entities (except for state-owned enterprises, religious associations, political movements and parties)

- IP

- heads of farms

- ordinary citizens

At the level of international law, even a state that cannot pay its obligations can be declared insolvent.

Bankruptcy also refers to the insolvency procedure itself, when the financial condition of the debtor is assessed and certain support measures are developed.

There is the concept of “self-bankruptcy” (another name is planned bankruptcy), when the debtor himself initiates the process of his own insolvency.

Mortgage and collateral in bankruptcy

A mortgaged apartment or a car pledged to secure the repayment of a loan, owned by a debtor citizen, cannot be recovered until the end of the bankruptcy procedure.

The debtor has the right to perform actions with a pledged car or apartment and other property only with the consent of the creditor.

The terms of the sale of collateral and the distribution of funds received from the sale must be contained in the restructuring plan.

If the restructuring plan does not contain information about how the collateral is sold and how debts are repaid, then the sale of the collateral is carried out by the auction organizer. The auction organizer is a financial manager or a specialized organization engaged by him for these purposes, payment for the services of which is carried out from the proceeds from the sale of the collateral. The specified organization should not be an interested party in relation to the debtor, creditors, or financial manager.

For the sale of collateral, the initial sale price is set at 80% of the market value of the property. An independent appraisal is carried out to determine the price. After the sale, the debts are repaid using the proceeds from the sale of the property. The amount exceeding the debts is paid to the debtor. If the property is sold for a price less than the amount of the debt, the remaining claims of the creditor are satisfied at the expense of other property in the third priority.

If the auction fails twice, the lender has the right to keep the property at a price 10% lower than the original cost.

If the creditor did not vote for the restructuring plan, he has the right to apply to the court to foreclose on the collateral, if such a requirement does not contradict the financial plan.

Bankruptcy legislation

The legal basis is the Federal Law of the same name No. 127. Until 2015, it regulated only the insolvency of legal entities. Since 2015, the procedure has become available to individuals.

This Federal Law regulates the following relations:

establishing reasons and grounds for recognition- regulation of the procedure and conditions for choosing preventive measures

- regulation of the rules for the procedure itself

The latest changes to the law were made in December 2018.

According to Art. 1 The Federal Law applies not only to Russian citizens, but also to foreigners (unless otherwise stated in international treaties signed by Russia). Insolvency decisions made by foreign courts are recognized in the Russian Federation on the basis of the same international treaties.

To initiate insolvency proceedings, certain characteristics must be present. Namely, debt for a certain time - more than 3 months (clause 2, article 3 of Federal Law No. 127).

Consequences of bankruptcy of a legal entity

After the end of the last stage of bankruptcy proceedings and the final sale of all property, the arbitration court ends its work by issuing a resolution recognizing the insolvency (bankruptcy) of the legal entity. The bankruptcy trustee resigns his powers, and the statutory and accounting documents are transferred for storage to the state archive. Based on a court order, the enterprise is liquidated, and the corresponding closure records are entered into the unified register of bankruptcy of legal entities. Besides:

- All accrual of fines and penalties ceases;

- The founders lose their shares in the authorized capital;

- The staff is completely disbanded.

A final write-off of remaining debts and loans is also carried out if the funds from the sale of the bankruptcy estate were not enough for a full settlement.

Who initiates the case

The following entities may take the initiative to initiate bankruptcy proceedings:

- the debtor himself (citizen, organization, etc.)

- authorized bodies

- government agencies

- bankruptcy creditor

To begin insolvency proceedings, you need to write an application. The basis for excitement is duty.

If the debtor initiates the process on his own, then the amount of debt does not matter.

The main thing is that the supposed bankrupt has no opportunity to repay the debt. Other entities can initiate a case only if the amount of debt exceeds the threshold specified by Federal Law No. 127. For individuals it ranges from 500 tr., for legal entities and individual entrepreneurs - from 300 tr.

Considers a bankruptcy case, in accordance with Art. 6 Federal Law No. 127, arbitration court.

Responsibilities

The debtor learns about his financial bankruptcy problems much earlier than other persons. In order to prevent losses from his creditors, he is obliged, at an early stage of ruin, to apply to the arbitration court with an application for recognition of financial insolvency.

Important

A person declaring his own bankruptcy is obliged to provide evidence and reliable facts confirming the impossibility of fulfilling previously given obligations to the creditor.

In order to prevent charges of fictitious bankruptcy in the future, it is necessary to prove to the court that during the period of filing the procedural application, the debtor did not have a real opportunity to repay the monetary debt to creditors.

List of bankruptcy participants

The Federal Law on Insolvency clearly identified 2 groups of participants:

- persons participating in the case (Article 34 of Federal Law No. 127)

- participants in the arbitration process in the case (Article 35 of Federal Law No. 127)

In addition, there are two more categories:

citizens sharing subsidiary liability with the debtor (can be brought on the basis of a petition)- persons who notarize the owners (a special case in case of insolvency of a unitary enterprise)

This separation is important because each group of participants has different rights. Persons participating in arbitration have only the rights specified in Federal Law No. 127. While the participants in the case have a much wider scope of rights (in addition to the Federal Law on insolvency, they are subject to all the rights specified in the Arbitration Procedure Code of the Russian Federation).

Main participants in a bankruptcy case

According to paragraph 1, art. 34 Federal Law No. 127, persons who take part in a bankruptcy case include:

debtor (individual or legal entity)- person providing credit rehabilitation

- bankruptcy creditors

- arbitration manager

- authorized and state bodies (executive branch of government of the center and regions of Russia)

These persons do not correspond to the composition prescribed in the APC. Namely: parties, applicants, third parties, prosecutor and government agencies (Article 40 of the Arbitration Procedure Code of the Russian Federation). But at the same time, the procedural rights specified in Art. 41, apply to all persons participating in the case.

Each of the listed subjects is described by Art. 2 Federal Law No. 127 as concepts used in the law. Let's take a closer look at them.

How to start bankruptcy proceedings

According to the current Russian legislation, those persons who are in a position of insolvency and meet the main criteria of bankruptcy can submit documents for consideration to the arbitration court. It is important to understand that bankruptcy takes into account the minimum amount of debt, the period when the citizen did not make payments and other factors. Among the main signs for starting an insolvency case are:

- When starting a bankruptcy procedure, the minimum total amount of debt that a person has must be 500,000 rubles.

- Over the past three months, the demands of creditors have not been met in any way - the person has not transferred even the minimum amounts to repay the debts.

It is necessary to collect the documents provided for by law, support them with evidence of financial insolvency, write an application and submit them to the executive authorities.

Debtor

The term itself is used in various branches of law. But the concept occupies a special place in civil law.

According to Art. 2, a debtor is a citizen who is unable to fulfill his financial obligations (salaries to employees, debt to the bank, etc.).

Who is a debtor and how to challenge a case, watch the video:

The debtor may be:

- any citizen of Russia or a foreign country

- IP

- legal entity (firm, organization, company)

Only an arbitration court has the right to declare an insolvent borrower bankrupt, based on compelling reasons (debt exceeding 300-500 rubles for three or more months). In this case, recognition will not take place if the debtor has paid some part of the agreements undertaken (unless otherwise specified in the contract).

Bankruptcy creditor

Persons who have the right to demand from a citizen the fulfillment of the monetary obligations he has assumed for payment are called creditors in the legislation of the Russian Federation.

A bankruptcy creditor is a creditor who has monetary claims against a certain person associated with him with certain obligations (Article 2 of the Federal Law 127). These include:

- alimony

- benefits

- other obligatory payments

The difference from an ordinary creditor is the right to initiate proceedings regarding the insolvency of the debtor.

The following may act as a creditor:

individuals who have financial claims against another ordinary citizen or legal entity- legal entities (firms, organizations, enterprises, etc.) to individuals or other legal entities

- government agencies

All creditors have one thing in common - a financial obligation. If a citizen demands compensation for damage to health, and an organization for violation of the building’s operating procedures, then they are not creditors in this area of law.

Based on his interest in returning the debt, the creditor is obliged to independently confirm in court the existence of the debtor’s obligation to him. In this regard, Federal Law No. 127 gives certain rights to this subject of the arbitration case.

If there are many creditors, they can unite in a committee or meeting. And also choose a representative who will defend their collective interests.

Peculiarities

The current law on debtor insolvency provides for the specifics of recognizing bankruptcy of various categories of legal entities:

- strategic enterprises;

- financial institutions;

- agricultural enterprises;

- city-forming organizations.

A city-forming organization is an enterprise where the number of employees is at least 5,000 people or 25% of the working population of a particular locality.

During the procedural proceedings of the case of the ruin of a city-forming enterprise, the relevant state bodies of local self-government are considered responsible. For the financial obligations of such a debtor, the Russian Federation, represented by state authorized bodies, has the right to provide its guarantee.

In relation to a city-forming institution, the period of external management or financial recovery may be increased by the court to one year. For other categories of debtors, such an opportunity is provided for up to six months; the law does not provide for an extension of financial recovery.

Until the completion of financial rehabilitation or external management of the city-forming organization, state authorized bodies have the legal right to pay off all debts or satisfy the financial claims of creditors in any other way provided for by law.

For your information

An important condition in the contract when selling a city-forming enterprise remains the safety of jobs for at least 50% of employees.

Agricultural organizations are institutions where the main activity is the processing or production of agricultural products.

One of the important features of the procedure for declaring bankruptcy of agricultural organizations is taking into account climatic natural conditions, as well as other factors important for agriculture, when analyzing the financial condition of the debtor.

When selling the property of such an enterprise, the priority legal right to purchase it is given to persons who are engaged in similar activities and own a land plot adjacent to the debtor's land plot.

Financial institutions - credit, insurance organizations.

Having considered a claim to declare a financial institution insolvent, the arbitration judicial body has the right to make a procedural decision to declare the credit organization bankrupt or to refuse to initiate legal proceedings. There are no other options for bankruptcy procedures for financial institutions.

During the procedural proceedings of the insolvency case of an insurance company, the Ministry of Finance of the Russian Federation, an authorized state body whose responsibilities include supervision of insurance activities, is recognized as a person endowed with legal status in arbitration proceedings.

Strategic organizations and enterprises:

- Federal state joint-stock companies and institutions whose shares are directly owned by the state. Enterprises providing services and work that are of great strategic importance for protecting the health, legitimate interests, rights of the population of the Russian Federation, ensuring state security and the defense capability of the country.

- Defense-industrial institutions are research, design, scientific-production, scientific-testing and other enterprises that provide work to ensure and fulfill defense government orders.

Authorized bodies for special requirements

These are government agencies belonging to the executive branch. The Government of the Russian Federation authorizes them to be an attorney in the case and all related insolvency procedures. In addition to the feds, local government structures can also act as commissioners.

The representative may be:

- Labour Inspectorate

- tax service

- customs

- Russian Pension Fund

- social insurance (FSS RF)

- department for ensuring bankruptcy procedures (division of the Federal Tax Service)

- supervisory authorities

The main task of executive bodies is to represent the interests of the state. It is not the body itself that takes part in the arbitration case, but a specific official.

Authorized persons can act as initiators who launch an insolvency procedure. As a rule, these are bodies whose functional purpose is related to the calculation and collection of mandatory payments (tax, pension fund, social insurance). Generally obligatory payments include:

- taxes and fees

- various contributions

Since such bankruptcy initiators have every opportunity to provide the financial side of the process.

In addition, the commissioners are developing a set of measures to improve the financial situation and prevent the insolvency of an economic entity.

Participants in bankruptcy of individuals on video:

Despite the fact that the executive bodies are not bankruptcy creditors, their claims are satisfied first.

Arbitration manager

This is the person who manages:

- actions of an insolvent citizen within the framework of the case

- establishing his financial insolvency

This is a citizen of the Russian Federation who is a member of the SRO organization. This definition is enshrined in Art. 2 Federal Law No. 127.

Appointed by the court independently or at the request of one of the parties. The manager may be a professional lawyer or a business owner. The main thing is that during the trial the work does not interfere with the arbitration case. There are a number of significant requirements placed on the manager.

Its functional purpose is:

- establish the debtor's inability to pay obligations

- determine the circle of creditors

- monitor compliance with the rights and agreements of the insolvent entity at all stages of the process

The activities of an arbitration manager (AM) are a paid service provided on a reimbursable basis. His reward comes first in line for reimbursement. Paid from the debtor's funds.

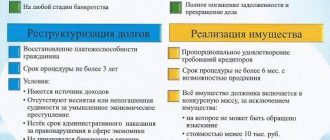

Declaring a citizen bankrupt

The court declares a citizen bankrupt if there is no restructuring plan or the meeting of creditors does not approve the restructuring plan, the court cancels the previously adopted plan.

The citizen is declared bankrupt and his property is sold. The period for selling the property is 6 months. A citizen may be limited by the court in the right to leave the Russian Federation; such a restriction, at the request of the citizen, can be canceled ahead of schedule.

After declaring a citizen bankrupt, the financial manager disposes of all the debtor’s property, funds in bank accounts, the financial manager conducts cases in the courts on behalf of the citizen about collecting debts in favor of the citizen, about challenging the citizen’s transactions. Transactions made by a citizen personally are void.

Who cannot be appointed as manager

The selection and appointment process itself is strictly regulated by Russian legislation. A candidate can be proposed by the entity to which the application for insolvency consideration was submitted. Only the arbitration judge has the right to approve the manager.

Before approval, the candidate is thoroughly checked through a request to the SRO. This is a non-profit organization that coordinates the work and all actions of arbitration managers. Art. 22 clearly states the rights and obligations of this self-regulatory organization. Within 2 weeks, the SRO must provide the court with all the necessary information about the applicant.

There are a number of requirements for the arbitration manager:

- be a citizen of the Russian Federation

- have no criminal record for intentional offenses

- have a higher economic or legal education

- additionally pass the exam for the position of manager (theoretical part)

- do an internship as an assistant

- have experience as a manager

- be a member of the SRO

- don't be bankrupt

Failure to meet at least one of the listed requirements may be a reason for non-appointment.

In addition, a person who:

- disqualified from work (there is deprivation of the right to hold a leadership position)

- interested either by the creditors or the debtor

- did not insure its liability against the possibility of causing loss to a third party

- does not have access to state secrets (if the process requires this)

And also a person who is himself a debtor, i.e. did not reimburse the assumed obligations (or partially reimbursed).

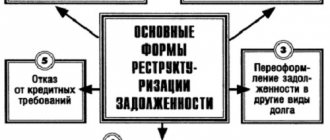

Restructuring plan

A citizen has the right to have a debt restructuring procedure carried out against him if he has income, does not have a criminal record under an economic offense, has not been subject to administrative punishment for petty theft, or has not previously been declared bankrupt.

The draft restructuring plan is developed by the citizen-debtor, creditor or authorized body. The debt restructuring plan is sent to the financial manager within 10 days from the end of the 2-month period allotted for holding a meeting of creditors.

If there are 2 or more draft restructuring plans, the financial manager submits the drafts to the meeting of creditors.

If there are no projects, the financial manager develops a draft plan for restructuring the citizen’s debts.

After 20 days and no later than 60 days, from the date of sending the restructuring plan to creditors, the first meeting of creditors is held. The financial manager provides a draft debt restructuring plan, information about the financial position of the debtor, a report on his work, objections and proposals for the restructuring plan. Also, the financial manager may propose to declare a citizen bankrupt and sell his property without restructuring.

The restructuring plan must contain provisions on how the debt will be repaid. The repayment period of debts is no more than 3 years. As well as provisions on the procedure and timing of the sale of property. Debts must be repaid in proportion to the amount of claims.

For mortgage loans and car collateral, the restructuring plan provides for priority satisfaction of creditors' claims upon the sale of collateral.

The restructuring plan must be accompanied by a statement from the debtor's citizen regarding approval or objection to the plan. To the approved debt restructuring plan, a citizen can submit proposals for changes. Proposals are sent to the financial manager. Which raises the question of making changes at the meeting of creditors. The final form of the changes is approved by the court.

Creditors approve the debt restructuring plan at a meeting by a majority vote. Creditors can submit proposals for amendments to the already approved debt restructuring plan.

The court approves a plan for restructuring a citizen's debts. If creditors do not agree with the restructuring plan, the court may, at the request of the persons participating in the case, postpone the consideration of the case for up to 2 months. The court may approve a restructuring plan against the will of creditors if such a plan provides for the full repayment of the citizen's debts.

Judicial acts can be appealed.

The restructuring plan can be canceled by the court at the request of creditors if the documents contain false information and the debtor citizen does not fulfill his obligations.

Direct participants in bankruptcy arbitration proceedings

According to paragraph 1 of Art. 35 Federal Law No. 127 these include representatives of participants. Attorneys can act on behalf of:

- employees of the debtor (in this case, the individual entrepreneur or legal entity is insolvent)

owner of a unitary company (has the right not only to act on behalf of the owner of the property, but to appeal the actions and decisions of arbitration, creditors and judicial acts relating to external management)- founders of the debtor (the authorized person has all the rights of participants in procedural legislation)

- from the meeting of creditors (that is, a person who is authorized to take full part in the process on behalf of all creditors)

- federal bodies (applies to the area of security, if the case concerns access to information related to state secrets)

Persons who may also become participants in the process:

- representing the interests of authorities (regional or local) in the field of bankruptcy

- other subjects provided for by the Arbitration Procedure Code of the Russian Federation (experts, specialists, prosecutor, etc.)

Video about the benefits of the procedure for individuals:

In addition to the above representatives, the following have the right to take part in the process (clause 2 of article 35 of Federal Law 127):

- SRO of arbitration managers (to provide a candidate)

- supervisory authorities (in the situation of approval of the AU)

- current creditors (when their rights are violated)

According to the amendments dated June 29, 2015, all specified in Art. 35 Federal Law No. 127 subjects have the same rights under the Federal Law.

Rights of persons participating in a bankruptcy case

Rights are specified in several articles of Federal Law No. 127 - Art. 7, art. 8, art. 20.3, art. 22, art. 34 (clause 2, 3), art. 35 (clauses 3, 4), art. 61.14 and 61.15. All rights are aimed at making it possible for any person to organize his own defense.

Basic rights of participants:

- a number of persons have the right to file for existing or impending bankruptcy

- all participants have the right to get acquainted with the case materials (read, make an extract or photocopy), as well as request the necessary information about the insolvent entity

get acquainted with the available evidence and provide your arguments- ask questions to other persons directly involved in the case (strictly on the topic of possible insolvency)

- petition for the implementation or challenge of any actions (or persons), as well as object to someone else’s petition

- make a complaint

- be aware of the complaints of other persons involved towards each other

- receive and appeal acts

The legislation of the Russian Federation in the field of bankruptcy gives participants in the case not only rights, but also responsibilities, the main one of which is the liability of all parties for failure to comply with the law.

Responsibility

According to paragraph 1 of Art. 61.13, if the debtor, property owner, founder, or other person violates the provisions of Federal Law No. 127, then they are obliged to compensate for the losses caused by this act.

Clause 2 Art. 61.13 describes liability in fictitious or fraudulent bankruptcy. If an entity files an application for insolvency when all necessary measures have not been taken to satisfy the demands of creditors and prevent bankruptcy, then it undertakes not only the payment of all existing monetary obligations, but also the losses incurred by the participants in the initiated case.

Clause 3 indicates that if the debtor does not challenge the untenable claims of the lenders, the same sanctions are applied to him as in the cases described in the previous paragraph.

The arbitration manager is also liable for failure to fulfill obligations:

- removal from this process

- exclusion from SRO

- professional disqualification

- bringing to financial responsibility

It is precisely because of the last point that the manager must insure against possible damage to third parties.

Arbitrage practice

When the Federal Law on bankruptcy of individuals was added in 2015, there was a disappointing forecast that there would be a rapid boom in claims from ordinary citizens, and a heavy burden would fall on the Arbitration Courts. But judicial practice over the past years has shown different statistics. The work of the courts in insolvency proceedings is gradually gaining momentum.

By the end of 2015, more than 2 thousand applications were submitted. For comparison, 13 thousand cases of insolvency of legal entities were considered.

In 2021, already in the first 6 months, the figures exceeded last year (almost 3 thousand cases). In the second half of the year, the number of applications from individuals exceeded the volume of cases from legal entities by 1.5 times.

In 2021, a significant increase in persons declaring their financial insolvency occurred in the 3rd-4th quarter. Almost 19 thousand Russians have gone through bankruptcy proceedings.

2021 also saw an increase in debtors. In the first half of the year alone, more than 19 thousand cases were opened. In total, more than 28 thousand bankruptcies were considered.

Statistical calculations include not only ordinary Russians, but also individual entrepreneurs.

If you study the numbers from the position of debts written off/not written off, then the picture is as follows (table below).

| Years | Number of people whose debts were written off (thousands) | Debts were not written off despite the fact that the bankruptcy procedure was completed | Non-write-off percentage (%) |

| 2015-2016 | 4,1 | 35 | 0,85 |

| 2017 | 18,5 | 280 | 1,44 |

| 2018 | 28,5 | 580 | 1,99 |

In total, over the 4 years of the law, the debts of more than 51 thousand people were written off. The average non-write-off percentage is 1.72%. This suggests that bankruptcy law in Russia is working. However, this is less than 10% of the estimated bankruptcies.

That is, the forecast about the load on the Arbitration did not come true. Experts question not the very fact of the bankruptcy law, but its effectiveness. There are a number of reasons why debtors are not interested in turning to Arbitration Courts:

- financial (the procedure itself and associated expenses are expensive, not everyone reaches the debt threshold of 300-500 rubles)

- legal illiteracy and poor awareness

- low percentage of practicing lawyers in this area of law

- negative reviews and other “scaremongers” in the media

- search for a manager

Video with amendments to laws:

The last point needs clarification. In the case of consideration of the case of an individual, the manager’s remuneration is the fixed amount that is provided for by law as payment. In the case of legal entities, they receive an additional percentage from the sale of the bankrupt’s property. Since bankrupt individuals do not have property to sell at auction, the insolvency administrator has nowhere to get decent payment.

So, the institution of bankruptcy is an element of the financial and economic sphere of the state. Insolvency is regulated not only by the procedure and order of conduct of the case. The law clearly defines the participants: concepts, roles, rights and responsibilities.

Top

Write your question in the form below

Responsibility of the borrower in insolvency proceedings

An unjustified application to an arbitration court, given a real financial opportunity to pay off debts and satisfy all stated financial claims of creditors, is considered by law as a fictitious bankruptcy, which carries with it criminal, civil, and administrative liability.

In this case, the person declaring his financial insolvency is obliged to fully compensate for the damage and losses caused to creditors by the legal proceedings on the statement of claim.

The court has the right to bring to administrative, criminal and civil liability citizens who deliberately caused major damage to an enterprise, thereby provoking its insolvency and subsequent liquidation.

Creating and increasing the insolvency of a debtor is an unlawful action or inaction of certain persons who deliberately led an enterprise or individual entrepreneur to partial or complete ruin.