- Mandatory documents

Home /Articles on bankruptcy of individuals

Author of the article: Konstantin Milantiev

Last revised March 07, 2021

Reading time 7 minutes

To go through the bankruptcy procedure yourself, you need to understand what is included in the list of documents for bankruptcy of individuals. persons First, we will look at the documents for bankruptcy of an individual in court, then we will look at what is needed for free bankruptcy through the MFC.

The bankruptcy procedure for an individual in court should begin with the collection of documents, and not with writing an application.

Firstly, it is much easier to write an application when you have all the materials on hand that you will refer to in the text of the application, and secondly, the application must provide a list of attachments, i.e. those same documents to the court for bankruptcy of individuals. the faces you collected.

Margarita Kholostova

financial manager

If you do not use the services of lawyers, but collect documents for filing bankruptcy of an individual yourself, do not copy the lists of documents from the templates that you find on bankruptcy websites. Application templates and lists of documents for filing bankruptcy for individuals. faces are given only as an example, and not as instructions for action.

Why is a certificate needed?

Those who organize auctions, courts, business partners, banking organizations, and notary offices can request an official certificate of the absence of a bankruptcy case. This information will confirm that the company is not undergoing bankruptcy proceedings, it is solvent and reliable. A certificate of absence of bankruptcy proceedings will often be in the list of documents if the company:

- will take part in tenders for any government contracts;

- conducts transactions with property that will need to be registered in notary offices;

- a legal entity wants to get a loan;

- plans to enter into major transactions in the near future.

What else is included in the package of documents

The application is not all that is needed to initiate bankruptcy proceedings. In addition to this, this includes:

- constituent papers of the company;

- legal registration certificate persons and tax registration;

- Bank statements;

- written confirmation of debts;

- accounting and tax reporting.

In addition, other documents may be required - this must be clarified directly when preparing the package of documents.

It is important to keep in mind that if the application is not submitted in full or if any documentation is missing, the claim will remain without progress until the situation is corrected. In addition, in some cases, neglect of the requirements of the law regarding bankruptcy proceedings can lead to the imposition of a fine on the management of the company and the enterprise itself.

Where can I get a certificate of absence of bankruptcy?

A commercial organization, at the request of a counterparty, has the right to provide a letter on company letterhead confirming its reliability. The type of document is not unified, so it is drawn up legally. person in any form, after which it is signed by the head of the company. A citizen's counterparty or potential creditor has the right to request an official certificate of absence of bankruptcy.

The law does not assign the issuance of this document to a specific executive body, so it can be obtained in various ways:

- Contact the Federal Tax Service at the location of the person in respect of whom the request is being made - an individual entrepreneur or company. At the stage of bankruptcy proceedings and the appointment of an external administrator by the court, information about this is entered into the Unified State Register of Individual Entrepreneurs, as well as information about the sale of the debtor’s property. After the liquidation of the company as a result of bankruptcy, data on the removal of legal entities. persons registered are entered into the Unified State Register of Legal Entities.

- Request an extract from the Unified Federal Register of Bankruptcy Information. Data on insolvent debtors, physical. individuals and companies are published on the EFRSB portal. To search for information, enter the full name of the citizen or individual entrepreneur and the name of the organization into the search bar. If you need to clarify your request, the applicant can use the advanced search.

- Study the file of arbitration cases, which contains information about the conduct of bankruptcy proceedings. The search is carried out by company name or tax identification number. After processing the request, the service will provide a case number and a card with all judicial acts. Their analysis will allow us to understand at what stage the debtor’s bankruptcy process is.

- Check the availability of information in the Kommersant newspaper based on the citizen’s full name, TIN or OGRN of the organization, as well as its name. All arbitration managers must publish on this resource information about the bankruptcy in which they took part.

- Request information using the Transparent Business platform, which is the contact center of the Federal Tax Service of the Russian Federation.

Important. If there is no information about bankruptcy in the listed sources, it can be argued that the procedure was not carried out in relation to an individual entrepreneur, citizen or legal entity. This means that the potential borrower or counterparty is reliable.

Obtaining extracts from registers, Unified State Register of Individual Entrepreneurs and Unified State Register of Legal Entities costs from 200 to 400 rubles. depending on the urgency of the service. Other certificates are issued free of charge. When requesting information from the Federal Tax Service, the response is provided in the form of an electronic document. When receiving data from the Arbitration Court Case File, you will have to take a screenshot of the page containing information about the debtor. To give official status, the photograph can be certified by a notary.

Why is the procedure needed?

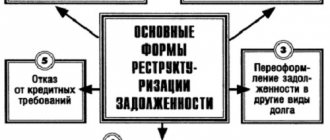

Bankruptcy is a process that takes place in a certain order and is strictly regulated by law.

It makes it possible to either liquidate the organization in accordance with established rules or restore its normal effective activities.

If bankruptcy follows the second option, then recovery may take several months, or even years. In some cases, during this procedure, a settlement agreement may arise between the debtor and creditors - and this is the most preferable outcome for all parties to the case.

During the bankruptcy process, if a legal entity still has some financial capabilities, and there is property on its balance sheet (equipment, machinery, transport, etc.), first of all, debts to the organization’s employees, as well as debts owed to the state, are repaid (mainly in terms of tax deductions), then there are payments to creditors who promptly submitted their claims to the debtor.

Where can they demand it?

There are a considerable number of authorities that may require a certificate of absence of bankruptcy. Here is an approximate list of most of them:

- Arbitration, in the event of any litigation.

- The counterparty is in the process of concluding an important transaction.

- Various government bodies, if the company participates in government procurement.

- Bank, to open a current account as confirmation of the authority of the head of the organization and the solvency of the enterprise.

- Notary office, when carrying out operations and transactions with real estate.

Also (in rare cases), a certificate of absence of bankruptcy may be requested by tender organizers to approve the admission of an enterprise to participate in tenders.

In what cases is bankruptcy carried out?

Bankruptcy of an enterprise is a procedure that can lead to a variety of circumstances. Among them:

- financial crisis of the organization;

- ineffective leadership;

- lack of demand for products;

- loss of suppliers or customers;

- problems in production, etc.

However, regardless of the reasons, one of the main conditions for bankruptcy is the inability to cover the company's monetary obligations from its assets within three months from the moment they arose.

At the same time, to whom there are debts does not play a special role: these can be employees of the enterprise, government agencies, counterparties, a bank lending institution, etc.

The amount of debt must be at least three hundred thousand rubles (over time it may change upward).

Where to apply for a bankruptcy certificate and where to see a sample?

As already mentioned above, there is no approved form of the document.

The free form is based on the custom of including the necessary details, while by analogy with law, you can use a sample of another certificate. Concerned with strategic enterprises, in 2009 the state provided a sample of guarantees for them in Rosreestr Order No. 23. You can use the sample from the order or make a certificate in any form. It is important to take into account the nuances.

There is no insolvency department in Russia, and the corresponding Moscow committee was abolished in 2007. However, creditors and business counterparties require guarantees of the enterprise's solvency. The concept of bankruptcy and insolvency is explained in detail in the previous article.

Contacting the registration authorities is the first thing that comes to mind for interested parties. The Tax Service is authorized to provide extracts from the unified registers of taxpayers - the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs.

Extracts contain complete information about the subject, are issued to all interested parties and are compiled on the basis of:

- Federal Law No. 129 “On state registration of legal entities and entrepreneurs” dated 08.08.2001;

- Government Decree No. 462 “On the amount of fees for providing information” dated May 19, 2014.

According to this Government Resolution, an enterprise receives an extract about itself free of charge. Other persons must pay a state fee.

Registration deadlines

The document is issued within the following terms (clause 3 of article 6 of Federal Law-129 of 08.08.2001, clause 1 of clause 18 of the Regulations, clause 5 of the Appendix to Order of the Ministry of Finance of Russia No. 121 of 05.08.2019):

- in the usual manner - within five working days from the date of receipt of the request;

- An urgent statement is provided no later than the next business day.

The validity period of the statement is not established, but certain requirements apply to it:

- when filing a statement of claim with the arbitration court, certificates about the plaintiff and defendant are received no earlier than 30 days before the application (clause 9, part 1, article 126 of the Arbitration Procedure Code of the Russian Federation);

- to submit an application for participation in an open competition (closed auction) for the conclusion of a state or municipal contract - six months before the date of posting the notice in the Unified Information System or before the date of sending the invitation (clause “b”, clause 1, part 2, article 51, clause "b" clause 1 part 2 article 88 FZ-44 as amended on 08/02/2019).

legal consultation is free

Sources

- Zhalinsky A.E. Selected works. Volume 3. Criminal political science. Comparative and International Law; RSUH - Moscow, 2015. - 929 p.

- Ivan, Nikolaevich Solovyov Public finance: criminal defense. Textbook / Ivan Nikolaevich Solovyov. - M.: Prospekt, 2021. - 456 p.

- State policy of combating corruption and the shadow economy in Russia. Volume 1 / Team of authors. - Moscow: Russian State University for the Humanities, 2008. - 150 p.

- Practical accounting. Official materials and comments (720 hours) No. 4/2017; RSUH - Moscow, 2021. - 367 p.

- Conformity assessment methods No. 3 2010; Standards and quality - M., 2010. - 457 p.

What does it look like

It is necessary to understand that this certificate must be supported in the form of evidentiary forms. It is used to ensure that the other party ascertains the reliability of the LLC or individual entrepreneur.

The document does not have a single accepted and approved sample, so it can be drawn up in free form, indicating the information requested by the interested party. It is necessary to indicate the basic information of the LLC. The document must be supported by supporting data. A paper that is not supported by documentation that proves the absence of bankruptcy is deprived of legal force.

What is bankruptcy?

In legal literature and legislative acts, the concept of bankruptcy is interpreted as the inability of the debtor to pay all current financial obligations. These include:

- loans, mortgages, private loans;

- taxes and fees;

- debts for utility bills;

Signs of financial insolvency include:

- overdue payments for current payments by more than 3 months;

- the amount of debt for all debts is more than 500 thousand;

- the debtor does not have property or its value does not cover debt obligations in full.

After the procedure is initiated, all debts are frozen: creditors or regulatory authorities cannot charge interest on loan obligations, impose fines and penalties.

conclusions

- Bankruptcy documents are needed to prepare an application. It is also accompanied by a list of all papers collected by the debtor.

- A package of documents for bankruptcy of an individual must be attached to the application (in regular, non-certified copies). It is impossible to start the process without documents, and the sooner you can collect them, the better.

- It is quite possible to quickly collect the necessary documents if you know where and what to take.

Do you want to entrust the management of your bankruptcy case to experienced lawyers? We will help! Contact us via the feedback form or by phone - we will provide competent support at all stages of the procedure and help you write off all debts.