Every day the number of Russians2n who are freed from debt through the bankruptcy procedure for individuals is growing. Let's look at what, besides money, they had and will have to pay for freedom from debt.

There are many myths about the negative consequences of bankruptcy for the debtor. Here are the most popular ones:

- A bankrupt citizen will be prohibited from traveling abroad for 5 years (or for life);

- You cannot hold any leadership position in the organization (for example, head of a department);

- The bankrupt will not be able to register any property for himself for 5 years;

- You will still have to pay the bills; no one will forgive your debts.

What is bankruptcy

Bankruptcy is an opportunity to legally write off debts through the court or restructure them. However, simply declaring your insolvency to the bank and waiving your debt obligations will not work. Bankruptcy must be confirmed by a court decision. You will have to prove your difficult financial situation. Such cases are considered in arbitration court. This process is not easy.

Several parties can declare bankruptcy of an individual:

- the citizen himself;

- creditor (bank or other financial institutions);

- government body - (most often the Federal Tax Service).

It is important to note that submitting an application does not guarantee that upon completion of all procedures, debts will be written off.

According to the law, the borrower has the right to file an application with the court if:

- actually unable to fulfill monetary obligations on time;

- signs of insolvency and insufficient property are obvious;

- the amount of debt exceeds the value of the debtor's property.

Consequences of bankruptcy through the MFC

On September 1, 2021, Law No. 127-FZ came into force. It gives individuals and individual entrepreneurs the opportunity to go through a simplified bankruptcy process - without going to arbitration, without hiring a financial manager and - what is important - for free.

You can file for bankruptcy through the MFC with overdue debt for a relatively small amount - from 50 to 500 thousand rubles. During the simplification, all the same debts that are written off in arbitration courts are written off - credits, borrowings, debts on receipts and housing and communal services. And those that will not be forgiven even in court - for example, alimony - are not written off.

The consequences of out-of-court settlement are the same as those of a standard arbitration process - this is a complete write-off of the debts specified in the bankruptcy application. True, in this case the process will take place without the sale of property, since simplified bankruptcy through the MFC is possible only for those persons in respect of whom the bailiffs have already closed enforcement proceedings due to the impossibility of repaying the debt.

That is, the bailiffs must establish that the person does not have property that could be sold. It is logical that no one will seize your accounts and cards either, since if you had the funds to pay off the debt, the bailiffs would have found them and written them off.

There is another disadvantage of free bankruptcy - you cannot apply for it if your debt exceeds 500 thousand rubles. Even if the creditor has already sued you, you are recognized as a hopeless debtor, and the bailiff could not find your property.

There is one more disadvantage - the time allotted for the bankruptcy procedure through the MFC is given to creditors in order to challenge your right to go through the “simplified” procedure. They will look for your assets and see if your wealth has improved, such as if you received an inheritance or a high-paying job.

The remaining consequences of bankruptcy through the MFC are similar to those that await the debtor in the judicial version of bankruptcy. This is a possible ban on traveling abroad, the obligation to inform about the bankrupt status when applying for a loan. The prohibition on holding leadership positions is the same for judicial and extrajudicial procedures.

It will be possible to go through extrajudicial bankruptcy again only after 10 years (unlike the classical procedure - you can file a bankruptcy claim through the court once every 5 years).

There is one more disadvantage of the procedure carried out through the MFC - you will not be written off those debts that you forgot to indicate in the application, since the MFC employee simply accepts the application from your hands, but he is not obliged to look for your creditors.

Despite the fact that the stated duration of the out-of-court procedure is only 6 months, in some cases this process may turn out to be longer than the standard procedure, since there is now a high percentage of applications being returned - they are not compiled correctly by debtors, and a repeated application can be submitted only after a month.

The most important advantage of going through bankruptcy is getting rid of debts.

Even if a month after being declared bankrupt you get a well-paid job or receive an inheritance, none of the former creditors and collectors will dare demand repayment of the debt from you.

Bankruptcy of an individual: is it worth the risk?

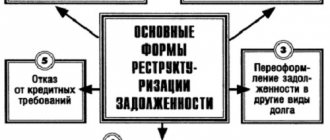

Undoubtedly, many people are attracted to the bankruptcy procedure by the possibility of canceling debts that cannot be paid off by selling all their property. But what are the consequences of bankruptcy of an individual? Is bankruptcy status so beneficial for a person or is it worth looking for other ways to solve problems? Most people associate bankruptcy with complete write-off of debts. But it is not so. There are two scenarios for solving financial problems:

- debt restructuring;

- sale of property.

If the debtor has property

The introduction of the property sale stage means that all assets of the debtor that are found by the administrator are subject to inclusion in the bankruptcy estate. They are sold at auction, and the funds received are distributed among creditors.

Only two types of assets are not included in the bankruptcy estate:

- property worth up to 10 thousand rubles. – by a court decision based on a petition from interested parties;

- property that is not subject to seizure during bankruptcy proceedings. The list of such assets is regulated by law. It makes sense to consider it in more detail.

The essence of restructuring

Restructuring makes it possible to restore payment discipline and pay off debts on fairly favorable terms. But for this, the borrower must have the opportunity: a good official income, which is enough to return to the previous payment schedule for 3 years. At the same time, there should be money left “for the life” of the family. Therefore, in practice, the restructuring procedure is rarely used. In addition, when considering this option, one must take into account the serious restrictions that are imposed on the daily life of a citizen:

- The borrower will be prohibited from making transactions worth more than 50 thousand rubles. without the consent of the financial manager.

- Lenders will receive information about the availability of valuable property and transactions with it in recent years.

- Within 5 years after completion of the procedure, it will be necessary to notify the new creditor about the completion of the debt restructuring procedure.

- The maximum restructuring period is 36 months.

If your debt is held by the EOS agency, then perhaps cooperation with the company will be more profitable than restructuring on such terms.

How can a debtor avoid negative consequences?

Some consequences of recognizing financial insolvency are inevitable and cannot be avoided. An individual can avoid negative consequences only in accordance with established legal norms. To do this, the debtor will need to follow certain rules.

What every borrower needs to remember:

- Do not falsify documents.

- Do not carry out any fraud with your property and income.

- Don't just focus on a specific lender.

- Do not try to bribe the manager who will manage your business.

- Monitor with the greatest care how the matter is carried out.

The procedure is closely monitored by all persons interested in it. For this reason, it is better not to give unnecessary reasons for any conflicts to arise and not to bring them to trial.

Features of the bankruptcy procedure

As practice shows, there are many hidden disadvantages in the bankruptcy procedure for individuals, which become obvious already in the process. What is the threat of bankruptcy to a borrower who finds himself in a difficult financial situation?

Lack of experience

Many people have no idea how this procedure happens, where to start, what documents are needed. Without good legal preparation, when registering on your own, there is a risk of making mistakes, which in the future will result in loss of time and finances. And professional legal assistance is not cheap.

Price

The bankruptcy procedure is not free. You'll have to spend money. The cost of financial manager services is fixed and amounts to 25 thousand rubles. Another 300 rubles. there will be a state fee. But these are only official expenses. In reality, citizens have to pay considerable amounts of extra money, otherwise finding a competent manager and a good lawyer becomes problematic. And if you try to save on the services of experienced specialists, you may encounter other risks. For example, the borrower's property may be sold for much less than its actual value.

Duration

The bankruptcy procedure is a rather lengthy process. After all, arbitration managers need time to find and sell property. Sometimes the procedure itself can drag on for years, and the associated problems will only increase.

Invalidation of transactions

Property alienation transactions completed over the last 3 years may be challenged. For example, the debtor sold an apartment at a suspiciously low price. The financial manager will definitely check all your recent transactions for signs of deliberate and fictitious bankruptcy - if they are found, the debts will not be written off, but the case will be closed.

Sale of property

Anyone who decides to start bankruptcy proceedings must understand that all of his property, except for his only home, will be sold to pay off the debt. Even if this property is registered in the name of his close relatives, to whom he sold or donated it in less than 3 years. If the only housing is an apartment taken on a mortgage, the debtor may lose it too, since it is pledged.

Not all debts are written off

This may come as a surprise to the borrower, but payments for alimony or for housing and communal services will remain.

All funds from the sale of property are placed at the disposal of the financial manager.

You can call the EOS agency anonymously; there is no need to rush to start the bankruptcy procedure. In almost all cases, we will be able to tell you what to do.

WILL THE APARTMENT BE TAKEN DURING BANKRUPTCY?

No need to worry: the only housing is not subject to sale. How does a judge determine what exactly cannot be alienated? Let's give an example.

You have a registered right to an apartment; you and your family are registered in it at your place of residence - it is your only home. But if you own a dorm room or a house, then you will have to sacrifice something and choose a property that you will protect with the “immunity of your only home” - the second property must be sold.

But there are exceptions to any rule - if the only home is pledged to the bank, then, regardless of whether you have somewhere to go, it will be sold if the bank is included in the register of creditors and declares the collection of mortgage debt from you.

Restrictions on rights during bankruptcy

Here the difficulties arise in the following:

- During the procedure, access to all monetary transactions on accounts and cards is blocked, all bank cards will be under the control of the financial manager;

- an individual no longer disposes of his property without the approval of the manager: it is impossible to sell a house or buy a car while in bankruptcy;

- All transactions of alienation and donation of property in favor of relatives are prohibited;

- the bankrupt is obliged to transfer all bank cards, passwords from “Personal Accounts” of online banks and electronic accounts to the arbitration manager;

- travel abroad is prohibited at the discretion of the court.

Limitations at the implementation stage

If at the restructuring stage an agreement between the debtor and creditors is not reached or is canceled by the court, the procedure for the sale of property begins, and the debtor himself is officially declared bankrupt. This leads to the introduction of the following group of restrictions, which include:

- transfer of bank cards to the manager;

- prohibition on opening or closing personal accounts;

- prohibition on managing money in accounts and deposits;

- a ban on any actions with property, regardless of its value;

- prohibition on repayment of debts or fulfillment of other obligations in relation to the debtor - all such actions are carried out exclusively before the manager.

The bankrupt is allowed to receive and dispose of half of the salary or other permanent income (pension, benefits). This amount may be increased if there are dependents.

How long does the bankruptcy process take?

After all the necessary documents have been collected and submitted to the court, and the state duty and remuneration for the manager have been paid, the court considers the documents, recognizes the decision as justified, and appoints a financial manager. The bankruptcy procedure itself begins with the sale of property and the distribution of funds to creditors. On average, bankruptcy lasts about 6–8 months. However, the procedure may take longer if:

- the borrower has expensive property that can take quite a long time to be sold through auction;

- there are controversial transactions that the financial manager decides to check;

- a court decision is being challenged.

Sometimes bankruptcy lasts 1-2 years.

HOW WILL BANKRUPTCY AFFECT YOUR JOB?

No way. There is no legal basis for an employer to fire you because you become insolvent. The question of how to solve the financial difficulties that have arisen concerns only you, especially if you have chosen a legal way to get rid of problems.

Most often, problems at work arise for debtors when unscrupulous debt collectors begin to use illegal methods of “knocking out” debt, including calling the employer.

You should not take the situation to the extreme point when the employer, after communicating with collectors, decides that you are ruining his reputation and “offers” to leave of your own free will - make the right choice and initiate bankruptcy proceedings.

Bankruptcy of a citizen is a well-developed and understandable legal mechanism, and its algorithm is quite easy for a person with experience to predict. If you have problems with debts, can’t pay the loan, or have insoluble financial difficulties, contact our company, and during a free consultation, we will answer any questions and help you legally get rid of your obligations.

Consequences of declaring a citizen bankrupt

Unfortunately, the borrower will encounter difficulties and restrictions not only during the process, but also after the bankruptcy of an individual. What are the consequences of obtaining this status in the future:

- within 5 years, a citizen is obliged to notify about his bankruptcy when applying for a new credit or loan, when purchasing goods in installments;

- for 3 years, a citizen does not have the right to occupy managerial positions in organizations, which means problems may arise if he already holds the post of manager and if he has employees subordinate to him;

- limitation on bankruptcy in the next 5 years.

More detailed information can be found in Article 213.30 “Consequences of declaring a citizen bankrupt.”

Services and cost

Free consultation on bankruptcy of individuals 0 ₽

More details

Selection and appointment of a financial manager from 15,000 ₽

More details

Preparation and commencement of personal bankruptcy. persons from 15,000 ₽

More details

Legal support for bankruptcy of individuals. turnkey persons from 120,000 ₽

from 80,000 ₽

More details All services

Criminal liability and a prison sentence threaten a bankrupt if he caused damage in the amount of more than 1.5 million rubles, administrative liability and a fine - if the amount was less than one and a half million.

If you are experiencing difficulties in making payments to creditors and are thinking about declaring your insolvency, contact the specialists! Our credit lawyers will advise and help you achieve bankruptcy recognition in a short time.

Dangerous advice from unscrupulous lawyers

A person who decides to go bankrupt usually turns to the appropriate company. Where do unscrupulous lawyers suggest starting the case? First of all, they advise preparing for bankruptcy, namely, formally getting rid of all movable and immovable property, except for the only home, since all this is subject to sale at auction. But they often do not inform the client that, according to the Federal Law “On Bankruptcy”, articles of the Criminal Code of the Russian Federation 195 “Illegal actions in bankruptcy” and 196 “Intentional bankruptcy”, he may become the subject of a crime. If law enforcement agencies establish that a citizen, before filing an application, intentionally sold property in order to hide it from creditors, a criminal case will be initiated against him. Also, persons who, having large debts and hiding real income, deliberately created the conditions for filing a bankruptcy petition in court, may be brought to criminal liability. Bankruptcy is not such a simple process, it is better to think several times before starting it. Our company employs competent specialists who will help you deal with difficulties.

It is expensive

Paradoxically, declaring yourself bankrupt is very expensive. To get rid of debts, you will have to spend a lot of money. This is largely why most potential bankrupts do not go to court to obtain status - they simply do not have the money to do so.

And this despite the fact that it was decided to reduce the state fee for considering the case. Previously it was 6,000, now it is 300 rubles. The reduction was made specifically to make the procedure more accessible. But this didn’t really play a role, since there are other important costs.

What you will have to spend on:

- state duty for consideration of the case - 300 rubles;

- the salary of the financial manager who definitely gets involved is at least 25,000 rubles, and then everything depends on the situation;

- if the financial manager is ultimately involved in the sale of the debtor’s property, he receives 7% of the “revenue”;

- reporting a citizen’s upcoming bankruptcy in the media - about 10,000 rubles, mandatory;

- entering information about bankruptcy into a special register - about 4,000 rubles;

- expenses for postage, various related expenses, for example, for assessing property, etc. You can also include approximately 5,000 rubles here.

That is, without taking into account the fee for the sale of property, the process will cost the applicant at least 45,000 rubles (in practice, more). And this does not even take into account the payment for the services of a law firm, which few people can do without.

What to do with overdue loans

Of course, each case is individual. A citizen, when starting a bankruptcy procedure, must take into account all the risks that he will incur. Be careful and honest. By resorting to the bankruptcy procedure, instead of the expected “quick debt write-off,” you can get a number of painful prohibitions and restrictions and lose all your property. Yes, bankruptcy is an opportunity to legally write off debts through the court, however, as you can see, this is not the most pleasant procedure, which also has many pitfalls. Moreover, this is not the only option to get rid of your debt burden. Often, for citizens who find themselves in a difficult situation when their income has sharply decreased, it is much more profitable and easier to start cooperating with a collection agency and continue their activities, gradually paying off the debt. Professional agencies can offer you even more favorable repayment terms than banks; they will help you return to your payment schedule and cope with accumulated obligations, no matter how hopeless the situation may seem.

What debt cannot be written off?

Many people are mistaken in believing that financial insolvency writes off absolutely all debts. The legislation provides for a certain number of obligations from which it will be impossible to get rid of.

Such obligations include the following:

- Failure to pay alimony payments.

- Current debt that arose during the insolvency procedure.

- Compensation for causing moral damage.

- Compensation for personal injury.

- Compensation for damage to property.

- Delays in payment of wages to employees.

- Delay in payment of severance pay.

In practice, there are also cases where the debtor, during the bankruptcy procedure, was unable to evade utility bills, taxes and other obligatory payments. If the arbitration court discovers the presence of fictitious/deliberate bankruptcy, the debt will not be reset.

Why you should trust a collection agency

If you have accumulated debt that you cannot cope with, your loan has been transferred to collectors, or perhaps you are facing legal proceedings, do not despair! You can always consult with collection agency specialists on issues of repayment of obligations, clarify the availability and conditions of the most common programs and promotions that facilitate debt repayment. The EOS agency, as a company with many years of experience in dealing with financial obligations, always takes an individual approach to solving the problems of its clients and can help cope with credit problems even in difficult life circumstances. We are interested in giving you the opportunity to pay off your obligations on the most comfortable terms. The agency really helps people cope with debt obligations with minimal losses. There is always a way out!

Section 213.30. Consequences of declaring a citizen bankrupt

See Encyclopedias and other comments to Article 213.30 of this Federal Law

1. Within five years from the date of completion of the procedure for the sale of property in relation to a citizen or the termination of bankruptcy proceedings during such a procedure, he has no right to assume obligations under credit agreements and (or) loan agreements without indicating the fact of his bankruptcy. Paragraph 1 of paragraph 2 (as amended by Federal Law No. 154-FZ of June 29, 2015) does not apply to citizens declared bankrupt before October 1, 2015, if at the time of applying to the court, an arbitration court with a declaration of recognition bankrupt since October 1, 2015, there are obligations in the amount of at least five hundred thousand rubles specified in Part 10 of Article 14 of the Federal Law of June 29, 2015 N 154-FZ

2. Within five years from the date of completion of the procedure for the sale of property in relation to a citizen or the termination of bankruptcy proceedings during such a procedure, a bankruptcy case cannot be initiated at the request of this citizen. Paragraphs 2 - 4 of paragraph 2 (as amended by Federal Law No. 154-FZ of June 29, 2015) do not apply when considering a bankruptcy case initiated from October 1, 2015, in relation to the obligations of a citizen declared bankrupt before October 1, 2015 ., which are not related to entrepreneurial activity and from which the citizen was not released upon completion of bankruptcy proceedings due to failure to declare them in the bankruptcy case in accordance with paragraph 2 of Article 25 of the Civil Code of the Russian Federation (as amended until October 1, 2015) B If a citizen is repeatedly declared bankrupt during the specified period at the request of a bankruptcy creditor or an authorized body during a newly initiated bankruptcy case of a citizen, the rule on releasing a citizen from obligations provided for in paragraph 3 of Article 213.28 of this Federal Law does not apply. Unsatisfied claims of creditors for which the deadline for execution has arrived may be presented in the manner established by the legislation of the Russian Federation. After the completion of the sale of a citizen’s property in the case specified in this paragraph, the arbitration court issues writs of execution for unsatisfied claims of creditors for which the deadline for execution has arrived. Clause 3 amended from January 28, 2021 - Federal Law of July 29, 2021 N 281-FZ See previous edition The provisions of clause 3 (as amended by Federal Law of July 29, 2021 N 281-FZ) apply to legal facts , which are grounds for recognizing a person as not meeting the requirements for business reputation and have occurred since the date of entry into force of the said Federal Law.

3. Within three years from the date of completion of the procedure for the sale of property in relation to a citizen or the termination of bankruptcy proceedings during such a procedure, he does not have the right to hold positions in the management bodies of a legal entity, or otherwise participate in the management of a legal entity, unless otherwise established by this Federal law. For ten years from the date of completion of the procedure for the sale of property in relation to a citizen or the termination of bankruptcy proceedings during such a procedure, he has no right to hold positions in the management bodies of a credit organization or otherwise participate in the management of a credit organization. Within five years from the date of completion of the procedure for the sale of property in relation to a citizen or termination of bankruptcy proceedings during such a procedure, he has no right to hold positions in the management bodies of an insurance organization, non-state pension fund, management company of an investment fund, mutual investment fund and non-state pension fund fund or microfinance company, or otherwise participate in the management of such organizations.

FAQ

Does personal bankruptcy have consequences for relatives?

Only if we are talking about the bankrupt’s spouse. In this case, the financial manager will be involved in allocating the bankrupt’s share from the family’s common property in order to carry out its sale.

Are there any consequences of bankruptcy for relatives in case of donation of property?

If during the last three years preceding the filing of a bankruptcy petition transactions were carried out to gift property to relatives, then either the case is closed or these transactions are recognized as void.

Can a car be repossessed during bankruptcy?

They may, this property is included in the list of those that can be seized for debts. You can save it if the car costs no more than 1.2 million rubles and is used for professional activities, or if we are talking about a disabled person.

Can they take away the dacha in case of bankruptcy?

Only the debtor's only residential property is not subject to seizure. If in addition to your dacha you have an apartment, your country property will go under the hammer.

Will they give me a loan after declaring bankruptcy?

There is no prohibition on receiving credit services. The only thing is that if less than 5 years have passed since you were declared bankrupt, you are required to notify the creditor about this. In practice, bankrupt individuals may obtain approval.

Sources:

- Federal Law “On Insolvency (Bankruptcy)” No. 127.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How long does the procedure take?

How long the bankruptcy procedure for an individual lasts is stated in Law 127-FZ. The following procedure deadlines are established for the judicial procedure:

- the issue of the validity of an application to declare a citizen bankrupt and introduce restructuring of his debts is considered by an arbitration court within a period of 15 days to 3 months from the date of acceptance of the application (Part 5 of Article 213.6);

- When an individual is declared bankrupt, the court makes a decision on the sale of his property, which is imposed for a period of up to 6 months. This period may be extended by the arbitration court at the request of persons participating in the bankruptcy case (Part 2 of Article 213.24).

Thus, the maximum period for bankruptcy of an individual in court is not formally limited and depends on several factors:

- the number of creditors and the amount of obligations to them;

- sources of income and composition of the debtor’s property;

- transactions completed in the 3-year period prior to the date of application.

Practice shows that the bankruptcy procedure for a legal entity can last up to 3 years. This period can be reduced by engaging a qualified lawyer (advocate), which, of course, will entail additional costs for paying for his services.

The duration of the bankruptcy procedure under the simplified (extrajudicial) procedure is 6 months from the date of inclusion of information about the initiation of an extrajudicial bankruptcy procedure in the federal register (Part 1 of Article 223.6).

Marina Aksenova Lawyer, website author

Expert commentary