An exchange transaction contains signs of a purchase and sale transaction with all the ensuing consequences. An exchange of shares between relatives is equivalent to an exchange of shares between persons who are not related to each other. This means that if the exchange was for profit, the close relative must pay tax to the government, as opposed to a gift transaction. In this article, we will consider how to conduct an exchange transaction, how much it costs and how the inheritance can be distributed among the heirs of their choice.

Exchange methods

General data for three legally correct options for exchanging relatives' shares are shown in the table. For each item there are certain rules established by the current legislation. When studying practical issues in detail, one should not violate the rights of other owners, and also not forget about fulfilling obligations to the state in the field of taxation.

Significant savings in money when donating is a strong argument in favor of donation. Another advantage is that there is no requirement to obtain the consent of other residents. However, it should be taken into account that only close relatives do not pay the tax: spouses, children, parents, grandparents, grandchildren, brothers and sisters. But these benefits do not apply to similar property registration, for example, between an uncle and a nephew. The general parameters of the other options are equivalent. Important details are provided in the following sections.

Terms and cost of registration

The registration period is regulated by law, but according to general rules it ranges from 3 to ten days . The deadline may be extended by failure to submit certain documents, as well as complications in the form of sending requests to other regions.

In accordance with the Tax Code, this transaction is subject to 13 percent deductions in favor of the state of the total amount.

But if you decide to make an exchange through a gift, then you can certainly count on the fact that the transaction will be free due to the fact that it is carried out between relatives.

List of documents

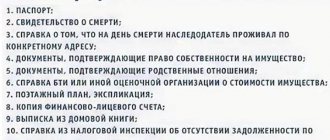

Registration of the exchange of shares by relatives is completed by changing the entries in the Rosreestr database. To complete this procedure, the following documents are submitted through the Multifunctional Center:

- an agreement between the parties with a detailed description of the essence of the transaction, technical parameters of the redistributed shares, addresses of real estate objects;

- civil passports and other documents for personal identification;

- marriage certificates, other evidence of family relationships;

- a certificate from the Unified State Register containing information about the share distribution and the absence of encumbrances;

- consent of the guardianship authorities to conduct a transaction to protect the rights of incapacitated or minor citizens (relatives, other owners);

- passport of the property with technical data;

- cash documents confirming payment of state duty at current rates.

In addition to the consent of the spouse, the other share owners will need to refuse to purchase the relevant parts - during purchase, sale and exchange. After changing the records with the exchange of shares by relatives in the state unified database, the new owners contact the management company and the homeowners’ association to adjust the accounts.

When choosing any method of related exchange, you should operate only with real estate objects that are equivalent in form of ownership. Housing is privatized in advance. It will not be possible to complete the transaction, for example, if one of the apartments is occupied by one of the parties under a social rental agreement.

The nuances of using a surcharge

Most often, an apartment is exchanged for an apartment with an additional payment, since usually relatives have apartments with different areas and other parameters. The amount of the surcharge is negotiated by the two parties independently. In this case, the following nuances are taken into account:

- Information about surcharges must be included in the drawn up agreement.

- If the process is carried out on the basis of deeds of gift, then it will not be possible to include in these documents a clause on the transfer of a certain amount of funds, so relatives must trust each other.

- Exchange of an apartment for an apartment with an additional payment assumes that one participant in the transaction has a significant income. Most often, relatives try not to advertise information about the additional payment.

It is additionally recommended that the contract include a clause related to the chosen payment method.

Preemptive right of owners

To avoid challenging a real estate transaction in court, qualified preliminary preparation is needed. When exchanging and buying and selling from other owners, they obtain written consent to carry out the transaction, which is certified in a notary office according to the standard procedure. When contacting them, they are given detailed terms of sale (exchange of relatives' shares). The law provides for a month to receive a response. If it is not there, you can attract third-party buyers.

you can here.

When making a gift, there is no need to observe the pre-emptive right - you can immediately draw up an agreement.

For your information ! The rights of minors are protected by guardianship and trusteeship authorities. Without their consent, it is impossible to reduce the child’s share or dispose of maternity capital funds. The appropriate permission must be obtained to complete the transaction with the entry of new entries into the Rosreestr database.

Share received as inheritance

If one of the parties to the exchange agreement received his part of the property by inheritance, then the transaction can be carried out only after completing the procedure for entering into inheritance rights and obtaining a certificate from a notary.

This is necessary, first of all, for the second party to the exchange agreement, since without a certificate of inheritance, other heirs of the deceased will be able to lay claim to part of the apartment. Therefore, before concluding an agreement, you will have to wait six months to comply with the legality of the procedure.

Purchase and sale

Two sets of documents in this category are drawn up and signed in triplicate for each property, certified by a notary office. Two - for the buyer and the seller. The third is transferred to Rosreestr. The main points for exchanging shares between relatives are as in a standard purchase and sale agreement. Correct descriptions required:

- parties;

- real estate object along with cost and technical parameters;

- transaction procedures;

- penalties and force majeure.

PrEP is available at this link.

Conclusion

A transaction for the exchange of real estate shares between relatives does not have any special privileges, since the procedure is no different from a transaction between strangers. When registering a deed of gift, relatives (close ones) are exempt from paying tax, but this rule does not apply to exchange agreements.

The legal consequences of the transaction are identical to those that occur when making a purchase and sale. However, if the shares are equal in value, then the exchange agreement makes sense: the parties will not be required to pay income tax, as when signing a bill of sale.

Mena

A sample document is presented below. It is used to check the text during the process of formalizing the exchange of shares between relatives. To complete the standard procedure, one copy is sufficient, which is submitted to Rosreestr.

With the help of this agreement, it is possible to clarify the special procedure when both objects are not privatized. In this case, it is necessary to prepare the following documents for subsequent transfer to the local administration of municipal authorities:

- civil passports of the parties;

- existing social rental agreements with official permissions for the right to occupy a certain living space (orders);

- certificates about the actual composition of families;

- consent of other relatives (owners) to the corresponding exchange of shares;

- standard consents of guardianship authorities (for minors and incapacitated family members, registered owners);

- written confirmation of the absence of debt for utility services.

This method is convenient because the administration does not in any way check the equivalence of the objects of exchange of shares between relatives. Responsible employees check the correctness of completion and composition of the submitted documents, but do not pay attention to the financial component of the transaction. Valid calculations can be made without notifying government authorities. The fact of payment is confirmed by a receipt. For secure transactions with wire transfers and paper bills, you should use banking services - escrow account and safe deposit box, respectively.

The legal refusal of municipal authorities is permissible in the following cases:

- the building (part of the premises) is unsuitable for habitation according to current building codes;

- during the period of the transaction, major repairs or demolition of the house are planned (performed);

- the property is registered under the “official” category, and therefore cannot be transferred to private ownership;

- one of the participants in the exchange of shares suffers from a dangerous disease, sanitary standards prohibit (limit) contacts with others.

You can download the exchange agreement using this link.

When a deal is rejected by the local administration

The procedure for exchanging municipal housing is carried out only if there is consent to this process from the municipality. Refusal may be due to the following reasons:

- The court is considering a case on the basis of which a social rent agreement with one of the parties to the transaction is terminated.

- The premises specified in the agreement are unsuitable for habitation.

- The building where the apartment is located is scheduled to undergo major renovations in the near future.

- The building is subject to demolition.

- The right of residents to use specific real estate is disputed.

- One of the participants has a chronic disease.

Under such conditions, the exchange will be refused.

Gift deed

Two documents are notarized. In this case, there is no tax base and corresponding obligations to the state. Calculations are made during the exchange of shares according to a scheme convenient for relatives. Registration is completed according to the standard procedure by registering with Rosreestr.

You can download the deed of gift here.

Other Important Aspects

If the co-owners of the property are minors, you need to very carefully prepare the related exchange transaction . Everything related to the rights of minors is supervised by the guardianship authorities. There you will need to receive a document confirming their consent to the exchange. Trustee bodies control the equivalence of the exchanged shares of property so that the interests of the child are not infringed in any way.

In modern legal practice, all of the above-described options for related exchange of shares in housing are encountered.

Such an exchange is carried out according to standard rules; no preferential treatment is provided for related persons. If a transaction results in a profit for one party or another, it becomes necessary to pay income tax. Share:

Notary, USRN, tax office

When choosing any of the options, the transfer of shared ownership is formalized through a notary office. Additional authentication of documents and confirmation of the legal capacity of the participants will prevent unnecessary problems during the consideration of the legality of the transaction in court.

After signing the certified agreement, they begin to register new rights independently (through the regional MFC), or entrust the procedure to a notary. Rosreestr will not complete the registration procedure if errors are found when registering the exchange of shares between relatives. Refusal will be received if there are prohibitions and encumbrances. To ensure that there are no limiting factors, you can receive a detailed certificate upon a standard request. Only after creating a new entry in the Unified State Register of Real Estate database, a real estate transaction is considered fully completed.

Tax on income received during the transaction is paid if relatives wish to exchange shares in apartments even with a slight difference in value. This obligation is absent if the property has been owned for less than three (five) years with registration of ownership rights before (after) 01/01/2016, respectively. The completed declaration in standard form is submitted no later than April 30. next spring after one year of completion of this operation. Tax payments can be made until July 15 inclusive.

For your information! When submitting documents for state registration to the Unified State Register of Taxes, a check is carried out to ensure that there are no tax arrears. The obligations noted above should be fulfilled before the deadlines expire so as not to delay the full completion of the transaction.

Reasons for refusal of registration

The exchange of a one-room apartment for a one-room apartment is carried out only with proper registration of this process. But often, when applying to Rosreestr, citizens have to face a refusal to register. This is usually due to the following reasons:

- Required documentation is missing.

- One of the owners does not want to draw up a written consent to the transaction.

- The papers reveal inaccurate information.

The exchange can only be carried out on the condition that each person who owns the property agrees to this process. It is impossible to forcibly move the owner of the property to another apartment, even through the courts.