A gift of money is a transaction made by agreement of two parties, in which one of them, the donor, transfers or undertakes to transfer the ownership of the other party, the donee, as a gift of funds.

Additionally

The main feature characteristic of all gift transactions is their gratuitous nature . This means that when they are committed, any counter-provision on the part of the donee is unacceptable.

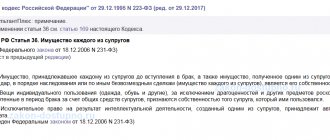

Cash is classified as movable property (clause 2 of Article 130 of the Civil Code) and is not subject to registration. They can be in the form of cash directly from their owner or at the organization’s cash desk, in non-cash form in bank accounts, and also embodied in payment and monetary documents, or in easily marketable securities.

Money, as an object of donation, must necessarily belong to the donor as a property. When making this transaction, he must clearly express his intention to make a gift to another person, since when transferring funds, his property is irrevocably reduced.

The recipient, by accepting money as a gift, on the contrary, increases his property. And this can only happen with his consent to accept the gift.

Gift agreements, the subject of which is money, are most often concluded between citizens (individuals), as well as between individuals and legal entities or individual entrepreneurs. The parties to a transaction, as subjects of civil law, must have legal capacity and capacity . In relation to some of them, the Civil Code contains a number of prohibitions and restrictions related to donations (Articles 575 and 576).

For your information

Citizens are often interested in the question of whether there are restrictions on the total amount of money that can be donated and whether they are subject to personal income tax (NDFL). In fact, the legislation does not establish any restrictions on the amount of donated amounts. Funds received in this way are not subject to taxation.

It’s another matter if the donor is a legal entity or individual entrepreneur. Then the recipient must pay the specified tax in the amount of 13 percent on the amount of donated funds exceeding 4,000 rubles (a non-taxable amount in accordance with paragraph 28 of Article 217 of the Tax Code).

How to register a donation of funds

The procedure for registering and completing agreements for the donation of property, including funds, is regulated by the rules provided for in Articles 572 - 582 of the Civil Code. Since money is classified as movable property , the same requirements apply to the registration of gift transactions with it as to contracts for the gift of movable things.

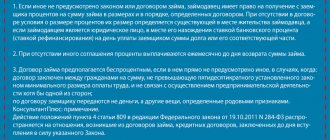

Based on Article 574 of the Civil Code, they can be carried out both orally and in writing . When the subject of a gift agreement is money, and its parties are individuals, then the law allows the completion of a real transaction by transferring (handing over) the gift to the donee without written documentation. It is advisable to do this in the presence of witnesses. But, if the donor is a legal entity, and the transferred amount exceeds 3,000 rubles, then such an agreement can only be concluded in writing.

Additionally

Similar requirements apply to the execution of consensual gift agreements containing the donor’s promise to gift a certain person with funds in the future. Failure to comply with these requirements will result in the transaction being void .

If the deed of gift is concluded in writing, then, accordingly, it must be correctly drawn up, that is, it must contain all the necessary and important information. These are, first of all, details relating to the parties to the agreement, an indication of the specific type of funds, their exact amount, the date and place of execution of the transaction, as well as the deadline for its completion, the rights and obligations of the donor and donee, and their signatures. The document is drawn up in two copies .

Regardless of the form in which the donation is made, to confirm it it is best to draw up a document that certifies the transfer of money into ownership from the donor to the donee. This may be an act of acceptance and transfer of funds or an ordinary receipt .

Donating money to buy an apartment

A money donation agreement can be concluded for the subsequent purchase of real estate, in particular an apartment. This is the so-called target deed of gift , which is most often drawn up in order to protect the property rights of the donee, who is married, from the claims of the other half. This subtype of gift is not specified in the Civil Code, but in practice it is sometimes used.

A contract for the purpose of donating money is an agreement between two parties, according to which the donor transfers or undertakes to transfer funds free of charge to the recipient for the implementation of a specific goal , in our case, for the purchase of an apartment. This transaction differs from an ordinary gift only in that the recipient must use the donated money only for its intended purpose.

Important

Note that the mere indication that money is being donated for the purchase of an apartment is not indisputable evidence that it was spent specifically for this purpose. In cases where a dispute arises over such a deed of gift, the donee will have to prove in court that the donated money was used by him for its intended purpose.

The target agreement, which contains a promise to transfer money for an apartment in the future, is drawn up exclusively in writing . Therefore, in it, in addition to indicating the specific object of the donation - a sum of money in a certain amount, the purposes for which it is transferred, it is necessary to indicate the actual moment of its transfer.

Confirmation of the execution of the gift transaction must be a receipt for the receipt of the amount of money specified in the contract for the purchase of the apartment.

Income received by the donee from a relative or other individual in the form of funds indicating the purpose of their use is exempt from personal income tax.

Deadlines for filing a tax return and paying taxes

According to the tax code, 3-NDFL must be filed no later than April 30 of the following year after receiving the gift.

After reviewing the declaration, the person will receive an answer as to whether they need to pay tax. If the result is positive, payment must be received no later than July 15 of the corresponding year.

For example, in 2015, Yu. L. Belova, I. K. Ivanov’s second cousin, gave her uncle a dorm room. Since the girl is not a close relative of the citizen, Ivanov filed a tax return with the appropriate authority by April 30, 2016 and paid a tax of 13% of the total cost of the room by July 15, 2021.

Giving money between relatives

One of the most common gifts between family members and close relatives is money. There is no need to conclude a written agreement in such cases. The form of the transaction and the amount of donated money, which is transferred to the donee by handing it over, does not affect the form of the transaction.

Based on practice, the oral form is more acceptable when donating small amounts of money. If we are talking about significant amounts and there is a possibility of problematic situations arising, therefore it is best to conclude a deed of gift in writing .

consensual requires a mandatory written form , according to which the donor promises to transfer the gift free of charge to his close relative after a certain time, timing the gift to coincide with some important event in his life, for example, a wedding, the birth of a child, graduation from an educational institution, etc. .

Attention

If the donor is married, it is necessary to obtain the consent of the second spouse to complete this transaction.

It should be noted that, in accordance with the Tax Code, when donating funds, the income that arises from the donee is not subject to personal income tax (clause 18.1 of Article 217).

Conclusion

Donating money is quite common. The agreement does not require registration, notarization, or even mandatory written form in all cases.

Transferring money to purchase an apartment is not prohibited by law. And in many cases, such an agreement can serve as evidence in the event of disputes about the division of property.

You can learn about some issues of registering a transaction for the purchase of real estate using earmarked funds received for its acquisition by watching the video:

Sources

- https://dgkh.ru/art/darenie-kvartiry/deneg-na-kvartiry.html

- https://pravopark.ru/grazhdanskoe/darenie/deneg/na-pokupku-kvartiry.html

- https://PravoZhil.com/dar/darenie/tselevoj-dogovor-dareniya-deneg.html

- https://bukvaprava.ru/2018/04/18/dogovor-dareniya-denezhnyh-sredstv-mezhdu-rodstvennikami/

- https://el-form.ru/darenie/dogovor-dareniya-deneg

- https://svoe.guru/zhilaya-sobstvennost/kvartira/darenie/dengi.html

- https://law-divorce.ru/dogovor-dareniya-deneg-na-pokupku-kvartiry/

- https://ros-nasledstvo.ru/dogovor-dareniya-deneg-na-pokupku-kvartiry/

- https://yurzona.ru/darenie/deneg-mezhdu-fizicheskimi-litsami-nuzhno-li-platit-nalog.html

- https://mylawyer.club/nedvizhimost/kvartira/kuplya-prodazha/dogovor-dareniya-deneg.html

- https://45jurist.ru/ugolovnoe-pravo/raspiska-kak-dogovor-dareniya-deneg-sovetnik.html

Notarization of donation of money

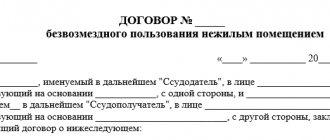

The Civil Code does not provide for mandatory notarization of gift agreements, the subject of which is money. This means that they will be considered legal even without registering with a notary office. But life is so unpredictable that in cases where we are talking about donating significant sums of money, it is reasonable to conclude transactions not only in writing, but also to have them certified by a notary .

The notary establishes the legal capacity of the parties to the gift agreement, their family ties in the event of a transaction between relatives, seeks the consent of the second spouse, since money in marriage belongs to the common property of the spouses, explains their rights and obligations under the agreement, and also checks the contents of the document for the presence of all necessary conditions to conclude a valid transaction.

This, naturally, will entail the cost of notary services, but will also provide additional guarantees to the donee for possible protection of his rights in the future.

If the agreement for the gift of money is concluded in writing and one of its conditions stipulates the mandatory notarization of this document, then in this case this action must be performed. Otherwise, the contract can be easily challenged and declared invalid due to its insignificance.

The donation agreement with the participation of a notary is drawn up in triplicate and signed in his presence.

What documents will be required?

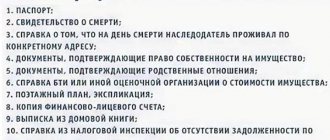

If the parties decide to draw up a gift agreement with a notary, they will need to collect and submit a certain package of documents:

- Civil passports of all participants in the transaction. If the donor is the father and mother, then documents from both of them are needed. The same applies to the recipient party.

- Documents confirming the competence of ownership and disposal of the transferred amount of money.

- Consent of the spouse (if the donor has one and the transaction is not carried out in his favor).

- Permission from the guardianship authorities if a sum of money is transferred as a gift to a minor.

- Documents confirming the degree of relationship between the parties to the transaction. If it is not possible to do this by presenting one document, for example, when a gift occurs between a grandfather and a grandson, several should be presented. Those. not only the parties’ passports, but also their own and their parents’ birth certificates.

- Payment receipt for payment of the fee for conducting a transaction by a notary.

Provided that a notary is involved in drawing up the text of the agreement, you must pay additionally. On average, the procedure will cost from 2 to 5 thousand rubles. (prices for 2021).

Judicial practice of donating money

Disputes related to the gift of funds are resolved by the parties to the transaction or interested parties in court. Judicial practice highlights several points when they are most often disputed.

The greatest difficulty arises in cases where the object of the gift is money for the purchase of certain property , for example an apartment. If the donee is married, then often during a divorce the second spouse tries to sue her part as jointly acquired property.

To prevent this from happening, it is necessary to prove in court that the property was purchased with donated funds. To do this, you will need statements from bank accounts, or donation and sale agreements, which indicate the numbers of all transferred banknotes.

Example

Citizen P. filed a claim in court for the division of a two-room apartment, acquired jointly during his marriage with citizen I. The defendant explained to the court that the housing was indeed purchased during marriage, but with money given to her by her parents as a wedding gift. She provided a notarized written agreement for the donation of a sum of money, which indicated the specific purpose where they were to be spent, and also contained the numbers of banknotes, which also appeared in the apartment purchase and sale agreement. Therefore, the court, on the basis of the evidence presented, refused to satisfy citizen P.’s claims, thereby recognizing that the apartment, acquired, although in marriage, but with money donated to citizen I., is her personal property.

When considering this type of case during court proceedings, it becomes necessary to track the intended use of the donated funds, that is, whether they were actually used to purchase the disputed apartment. Such situations arise due to the fact that there is a time gap between the actual donation of money and the purchase of an apartment.

And since, to a greater extent, in such cases, transactions are concluded orally, this leads to the fact that agreements drawn up retroactively are presented to the courts. The second party begins to challenge them as imaginary, pointing out the discrepancy between the date of the document and its actual preparation, as well as the absence of a real transfer of funds.

Additionally

Consensual agreements are often subject to disputes in court, under which money is promised to be given to the donee after the death of the donor. Such transactions are initially void on the grounds provided for in paragraph 3 of Article 572 of the Civil Code.

In cases where a donation is made under the influence of delusion, threats, violence, or is made by an incompetent person, it may be declared invalid if these facts can be proven during legal proceedings.

If compelling evidence is presented to the court, it is possible to exercise the donor’s right to refuse to fulfill the donation of money in the future or to cancel an already executed agreement.

Most cases in judicial practice show that the more persistently the plaintiff seeks to protect his rights, providing as much evidence as possible in the case, including the use of witness testimony, the greater the chance that the court will take his side.