Property division procedure

The Family Code of Russia provides for the division of property of spouses upon divorce in pre-trial proceedings. By mutual consent, a husband and wife while still married can agree on the division of jointly acquired property. The main goal of negotiations between them is an agreement that takes into account the interests of each party and eliminates uncertainties on key issues. Successfully conducted and legally competent negotiations will allow you to save on legal fees, attorney fees and other expenses.

In the process of dividing property, it should be taken into account that the court decision may differ significantly from the expectations of the divorcing spouses. The court has sufficient powers to do this.

It is not always possible to reach mutual agreement during the divorce process, especially if it is necessary to take into account the interests of not only the spouses, but also the children. In this case, a claim for division of property is filed through the court. The case is considered within three years after the divorce.

The interests of one of the spouses are given priority by the court if:

- the spouse thoughtlessly spent the jointly acquired property;

- the spouse has no income (only if the reasons are valid, for example due to health).

To divide property through the court, you must follow a similar scheme:

— it is necessary to determine the entire composition of the property with precision. It is advisable to make an inventory of things. In this case, you must indicate the year of purchase and the price of the item;

— Next you need to prepare documents for the court. Their list can be obtained from any lawyer or from the court itself;

- you will need to fill out a statement of claim confirming the division of property. A sample of filling out an application can also be obtained from a lawyer or in court;

- after this, all that remains is to submit an application to the court and take part in the trial, where a decision on the case will be obtained.

How to divide debts during divorce

Depending on whether the spouses reach a consensus or not, there are two ways to divide debts:

- Voluntarily - by drawing up an agreement and approving it by a notary.

- In court - when spouses cannot distribute acquired property and debts voluntarily.

As a general rule, the debts of spouses are divided in half, except in cases where:

- otherwise established by the agreement concluded between them;

- one of them spent property to the detriment of the interests of the family or had no income without good reason;

- there is a need to take into account the interests of minor children.

The procedure for dividing debts is as follows:

- An inventory of all existing debts is compiled with the remainder for the period of divorce.

- The spouses decide in what order they will divide the debts: they will agree and draw up an agreement or go to court.

- If we are talking about an agreement, it is certified by a notary and comes into force from that moment. If we are talking about the court, then the interested party files a claim (there may be counterclaims), after which the court makes a decision that is subject to mandatory execution by both spouses.

Spouses can not only divide debts during a divorce, but also agree on the procedure for repaying them. Here, for example, are options for dividing the debt for a mortgage:

- One spouse buys out the other spouse's share of the property and continues to pay the mortgage.

- The couple sells the apartment and divides the amount remaining after paying off the debt in half.

- The spouses sign an agreement with the bank to divide the joint debt into two individual ones.

Agreement on division of marital property

Drawing up a notarial agreement between those divorcing can significantly facilitate the process of dividing property. It helps determine the shares of the wife and husband in jointly acquired property on mutually beneficial terms.

Important!

It is necessary to have the contract certified by a notary. Without this, the document has no legal force. Moreover, in such a document all issues related to the property must be resolved, otherwise the notary will not certify this document and it will not have sufficient significance during the process.

After the spouses have discussed the details of the division of property, they need to visit a notary with the following package of documents:

— purchase and sale agreements;

— all sales and cash receipts;

— documents confirming ownership;

— certificates of registration of property rights;

— PTS (if we are talking about a car) and other documents;

- passports of husband and wife.

The cost of notary services for concluding a voluntary agreement on the division of property is 0.5% of the valued property + 5 thousand rubles. with the right to transfer ownership or 10 thousand rubles. without the right to transfer ownership.

You should not prepare the agreement document yourself. It is drawn up by a notary on a special form; the spouses are only required to present their wishes regarding the subsequent ownership of the property.

Government duty

Payment of the state fee is considered a mandatory condition for the acceptance of the claim by the judicial authorities. The plaintiff is also required to provide a receipt for payment for the service. The amount of state duty on property debt depends on the value of the claim (the share claimed by the applicant). The state duty includes a minimum amount fixed by law of 400 rubles plus an interest rate (4%). The higher the price of the claim itself, the lower the interest rate and the higher the fixed amount. The maximum amount of state duty is 60 thousand rubles.

Claimants often make the same mistake when calculating the state fee by reducing the cost of the claim by the balance of the debt. This approach is incorrect according to Letter of the Ministry of Finance of the Russian Federation No. 03-05-06-03/05. You can correctly calculate the amount of the claim, as well as obtain payment details from the court office.

An example of calculating the state duty: Plaintiff Loskutnikova A. filed a claim in court for the division of loan debts with the defendant, ex-husband - Ignatenko V. Loskutnikova A. indicated that in the last year of marriage, loans were issued for the purchase of equipment, the amount of which was 12 thousand rubles. The plaintiff provided documents confirming the fact that the loan was received for family needs. Thus, the cost of the claim is 6,000 rubles (½ share of the debt for each). The state duty was calculated as follows: Cost of claim (6000) multiplied by 4% = 240 rubles. The minimum amount is 400 rubles. As a result, you need to pay 400 rubles to file a claim.

You can pay the state mandatory fee through the court office, post office or bank office. When payment for a service is made through an online banking service, confirmation of the transaction must first be obtained from the bank. It is necessary to print out the receipt and take it to the bank for certification by an authorized employee.

According to the law, the amount of the state fee may be reduced or the plaintiff may be entitled to payment in installments. This is possible when the applicant is not able to pay the entire amount at once for a number of valid reasons (for example, dismissal, illness, difficult financial situation). Such concessions must be documented.

Peace agreement as a pre-trial stage of property division

During the negotiation process, the contracting parties make compromises that allow them to draw up a final agreement on the division of jointly acquired property, a marriage contract, etc. Such division of property can be agreed upon in marriage.

In cases where a peaceful pre-trial agreement cannot be reached, it is necessary to file a claim for division of property.

However, even in such cases, working on a pre-trial agreement can bring significant benefits. The very initiative to conduct them characterizes the contracting parties from the best side, which in court can become an additional argument in favor of each of the parties. The document itself, even if not signed by the spouses, will show the court the true motives of the parties to the property dispute. This will help the judge make the right decision when dividing jointly acquired property. In addition, the text of the agreement can serve as confirmation of the existence of property.

A peace agreement can be concluded during the divorce process during court hearings. The judge often acts as a peacemaker and helps those divorcing to reach a mutually beneficial compromise.

Counterclaim for loan division

Before the decision is made, the defendant may file a counterclaim for division of debts. This is relevant when the plaintiff wants to divide property. The cases are combined and considered within one proceeding.

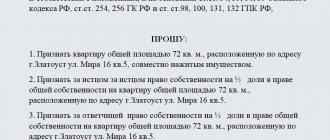

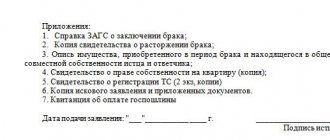

Sample counterclaim:

Sample counterclaim

Counterclaims are subject to the same rules as regular claims. It must be accompanied by documents confirming the legitimacy of the claims.

Terms of division of property

For the division of family property from the date of dissolution of marriage, the law establishes a period of three years. However, by the decision of the plenum of the Supreme Court on November 5, 1998, clarifications were given that the meaning of this article should not be taken literally and the countdown of the period for division of property should begin from the date when one of the spouses was denied access to joint property. That is, if one of the spouses uses the apartment with the consent of the other, the countdown of the statute of limitations does not begin.

After three years, the owner of the property receives the right to dispose of it at his own discretion, and it is no longer subject to division. A citizen or citizen, having received a demand for division of property, may apply to the court with a request to apply the consequences that occur after the expiration of the statute of limitations on this demand. In this case, the court is obliged to make a refusal decision on the division of the spouses’ property.

The limitation period may be suspended for the period of force majeure. But, according to Russian legislation, for this, after its completion, it is mandatory to file a corresponding statement of claim.

“The timing of filing an application for division of property is quite vague - for example, similar processes occur ten years after a divorce,” says lawyer, specialist in divorce proceedings Margarita Polyakova.

Division of spouses' debts

Any lawyer working in the field of family law dreams of clients - owners of factories, newspapers, and ships. So that in the event of divorce and division, you can divide these factories, newspapers and ships accordingly and not be left in the red. But much more often, clients ask for help sharing an apartment with a mortgage, a car with a loan, and a couple of consumer loans - for a wedding and renovations. Dividing spouses' debts is more complicated than it seems. Let's try to figure it out:

The main norm of the law regulating the “division” of the debt obligations of the spouses is paragraph 3 of Article 39 of the Family Code of the Russian Federation, which establishes that the common debts of the spouses when dividing the common property of the spouses are distributed between the spouses in proportion to the shares awarded to them.

What debts are common between spouses?

The first thing you need to pay attention to is that the division of spouses’ debts does not imply the distribution of all debts that arose during the marriage, but only common ones . For quite a long period, since the introduction of the Family Code of the Russian Federation in 1995, judicial practice has followed the path that all debts “acquired” by spouses during marriage are common. This position followed from Article 34 of the RF IC, according to which property acquired by spouses during marriage is their joint property. And based on this, the court assumed that, they say, debts acquired during marriage are common. This led to the fact that the parties often presented at the hearing all sorts of promissory notes issued to friends, acquaintances, relatives, stating that they allegedly borrowed large sums of money. Due to this, they tried to increase the share of the property due, motivating it like this: “you give me the apartment, and I will take on the debts. Otherwise you won’t be able to pay for a century.” And sometimes such unscrupulous behavior turned out to be effective. Particularly enterprising citizens, foreseeing division in the foreseeable future, made fictitious loan agreements, having them certified by a notary. The Supreme Court put an end to this issue in Review of Judicial Practice No. 1 for 2021, stating that “ if one of the spouses enters into a loan agreement or makes another transaction related to the occurrence of a debt, such a debt can be recognized as common only if there are circumstances arising from clause 2 of Article 45 of the RF IC, the burden of proof of which lies on the party applying for the distribution of the debt.” Simply put, the spouse who submits a debt document to the court and asks the court to distribute the debt must provide evidence that the funds have been spent in the interests of the family. And in the case of providing fictitious receipts, this is extremely rarely possible.

To illustrate my words, I will give an excerpt from the ruling of the appellate court, which considered the appeal against the court decision, the subject of which was the division of the spouses’ debts:

“The panel of judges cannot agree with the conclusion of the court of first instance that I.’s obligation under the above loan agreement in full is the common debt of I.’s former spouses. From the explanations of the parties, it was established that out of the loan amount (356,000.0 rubles), 230,000.0 rubles were spent on the purchase of the disputed vehicle. The case materials do not contain evidence that 126,000.0 rubles from the loan funds were spent on the needs of the family. The case materials do not contain admissible evidence of the circumstance that the sum of money in the amount of 126,000.0 rubles from the loan funds was spent on the needs of the family and the plaintiff did not present it to the appellate court. Receiving loan funds during marriage undoubtedly does not indicate that the funds were spent on the needs and interests of the family in full.”

Providing evidence of how the borrowed money was spent is mandatory when distributing spouses’ debts

The distribution of total debts depends on the division of property:

The next important point that needs to be paid attention to is that the division of the spouses' debts is made dependent on another judicial (or extrajudicial) decision related to the division of property.

Let us assume that the subject of the division is the property: - a car worth 1,200,000 rubles; - an apartment worth 3,000,000 rubles; The spouses also took out a loan for consumer needs, the balance of which at the time of divorce was 1,000,000 rubles.

As a result of the division, the court decided that the car becomes the sole property of the husband, and the apartment becomes the sole property of the wife.

Then the calculation of debt when dividing property:

The share awarded to the wife: 3,000,000 / (3,000,000 + 1,200,000) = 0.71, which corresponds to 71% The share awarded to the husband: 1,200,000 / 4,200,000 = 0.29, which corresponds to 29%

Therefore, when distributing the total debt, the division of the spouses' debts will look like this: Wife: 1,000,000 * 0.71 = 710,000 rubles Husband: 1,000,000 * 0.29 = 290,000 rubles

Everything seems to be clear, but difficulties arise and they are as follows: Since the wife was awarded property worth 3,000,000 rubles, and the husband only 1,200,000 rubles, the logical question is about applying clause 3 of Article 38 of the Family Code of the Russian Federation, which says following:

“When dividing the common property of spouses, the court, at the request of the spouses, determines what property is to be transferred to each of the spouses. If one of the spouses is transferred property, the value of which exceeds the share due to him, the other spouse may be awarded appropriate monetary and other compensation.”

Thus, following from this provision, compensation is subject to recovery from the wife in favor of the husband for the excess cost of the share in the amount of (3,000,000 + 1,200,000)/2 - 1,200,000 = 900,000 rubles.

In the appellate court decision cited above, the court did just that. Collected compensation for excess share and distributed debt obligations in proportion to the share. But is it legal? I guess not. The fact is that collecting compensation from the other side for exceeding the value of the share actually equalizes the size of the awarded shares and in this case the total debt obligations should be distributed equally. However, how to formulate claims most likely depends on the interests of the represented party.

Is it possible to divide the debts of spouses without dividing property?

Very often a situation arises when a client comes in and reports that he and his wife lived nothing in marriage and took out a loan, say 1 million rubles in his name, and his wife acted as a guarantor. And how can he make sure that half of the loan is paid not by him, but by his wife? That is, the division of property as such does not interest a person, but only debts.

It is not possible to solve this issue “head-on”. The fact is that such an action inherently leads to the fact that the bank will have two debtors instead of one, which represents a change in the loan agreement, which is permissible only with the consent of the bank. Then what should we do?

To answer this question, we must first consider how the court reflects the distribution of debts in the operative part of the court decision:

“Recognize the common duty of I.I. and I.A. promissory note I.I. under loan agreement No.___, concluded with PJSC Sberbank, in the amount of 1,000,000 rubles, determining the share of I.I. - 29%, share of I.A. - 71%." This is exactly what the division of spouses' debts is!

That is, by its decision, the court does not recover any money from the other spouse when distributing the debt! An attempt to indicate a claim for recovery will result in a refusal with the following wording:

“The consequence of recognition of the debt under the loan agreement as the common debt of the spouses is the right of I.I. raise the issue of recovery from I.P. the corresponding share of funds after their actual contribution to repay the obligation to the bank. A different resolution of the dispute over the division of debt obligations may lead to unjust enrichment on the part of the borrower who has the right to early repayment of the debt amount with recalculation of interest.”

Thus, collection of the amount of the distributed debt from the other spouse is possible only after the debt has been repaid in full or in part!

It turns out that if, after the entry of a court decision on the distribution of a debt in the amount of 1,000,000 rubles, respectively, by 29% and 71%, one of the spouses pays part of the debt in the amount of 100,000 rubles, then he will receive the right to recover from the other spouse part of the amount paid, according to the specified shares (29,000 or 71,000 rubles, respectively). Such a claim is usually made through a claim for unjust enrichment.

It is impossible to file a claim for division of debt without demands for division of property. Such a claim is considered in the manner of a claim for recognition of a debt obligation as a common debt of the spouses.

The issue of the amount of state duty when considering claims for the division of debts of spouses is also not resolved unambiguously. The most common opinion is that when filing a statement of claim containing a request for the division of the common debts of the spouses, the state duty should be calculated as when filing a claim of a property nature, subject to assessment, based on the price of the claim, which is determined by the value of each share of the spouses’ debts in the common joint property property. Thus, if the debt that needs to be recognized as common is one million rubles, then the duty is calculated based on the specified amount.