A donation agreement for a residential building with a plot of land is one of the types of lease agreements. Under such a transaction, one party transfers ownership of a piece of real estate to the other party free of charge. If the land plot on which the house is located belongs by right of ownership to the Donor, he also has the opportunity to give it as a gift.

- Form and sample

- Free download

- Online viewing

- Expert tested

FILES

The subjects under a residential house donation agreement are: the Donor - an individual or legal entity who transfers ownership of the house and land in favor of the other party, and the Donee - an individual or legal entity who accepts the specified property as a gift.

At the same time, there are certain prohibitions in Civil Law regarding the parties to such an agreement. Thus, the subjects under this agreement cannot be: commercial organizations, persons working in government bodies and institutions, and persons under the age of eighteen.

An important factor is the presence or absence of family ties between the Counterparties. So, if the parties are close relatives of each other, then the agreement is not subject to taxation. If a transaction is concluded between persons who do not have family ties, the Donee undertakes to pay a tax in the amount of 13% of the value of the non-residential premises. The donation agreement for a residential building with a land plot must be formalized in writing. Below we will look step by step at how the above-mentioned document is compiled and what aspects are worth paying attention to.

Donation agreement for a residential building

Kurgan

February 14, 2023

We are: Anatoly Anatolyevich Malikov, born 01/01/1955, living at the address Kurgan region, Kurgan city, Komsomolskaya street, building 131, apartment 313, passport XXXX XXXXXX, issued by the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan on 01/01/2021, hereinafter referred to as Donor on one side And Malikov Sergey Anatolyevich, born 01/01/1995, living at the address Kurgan region, Kurgan city, Burova street, building 232, apartment 236, passport XXXX XXXXXX, issued by the Federal Migration Service of Russia for the Kurgan region in the city of Kurgan on 01/01/2015, referred to as Subsequently, the Donee on the other hand entered into this agreement as follows:

The preamble to the treaty traditionally includes:

- type of transaction;

- place and date of conclusion of the agreement;

- names and roles of parties to the agreement;

- residential addresses and passport details of the parties.

Benefits of a gift transaction

Like any transaction involving the re-registration of real estate, the transfer of a donated apartment is carried out by drawing up an acceptance deed.

At the same time, the donation procedure has both advantages and disadvantages compared to other transactions. The benefits of donation include:

- Fast registration. If the value of the deed of gift is less than 3,000, the transaction can be concluded orally, without contacting a notary. If necessary, the agreement and transfer of real estate can be completed on the same day.

- The share of the owner of the property can be gifted to any person, that is, the rule about the advantage of another person in acquiring it when selling it does not apply here.

- The deed of gift, practically, cannot be challenged by a third party, since the owner is alive and is able to independently confirm his will. Even when faced with fraudulent schemes, the donor can challenge the deed of gift by proving fraud.

- The gift agreement can be confirmed by a notary, which ensures the “purity” of the transaction.

Item

The main essential condition in a transaction of this kind is its subject matter. The subject is the residential building itself, as well as the land plot on which the property is located. In the section where information about the item is written, a comprehensive description of the house that is being donated should be given. So it looks like this:

The Donor transfers into ownership of the Donee a residential building, which is located at the address: Kurgan region, Kurgan city, Zaozerny village, house 16. The specified house is built of log and brick material, includes 2 (Two) floors, 6 (Six) rooms including a kitchen , 2 (Two) restrooms and 1 (One) storage room. The total area is 114 (One hundred and fourteen) square meters. The property includes additional structures and structures that are attached to it: parking for two cars, a bathhouse, a summer veranda. There is a plot of land measuring 10 (ten) acres. The owner of the above real estate until the conclusion of this agreement is the Donor. The donor and the recipient are close relatives to each other, namely father and son (other family ties may be indicated).

Forms and samples of contracts

I have uploaded standard contracts for the most common cases. If your case is not there, download several samples that suit your meaning and create your own based on them.

The donor is the one who gives away his apartment. The donee is the one to whom the gift is given.

- One donor and one donee - or

- One donor and several donees (in equal or unequal shares) - or

- Several donors and one donee - or

- Several donors and several recipients (in equal or unequal shares) - or a sample

- The apartment is given to a minor child (under or over 14 years old) - or

The contract should also indicate the representative of the child-done - one of the parents, guardian or trustee Art. 26 and art. 28 Civil Code of the Russian Federation. If a child is given an apartment by one of the parents and the spouses are married, we indicate the other parent as the child’s representative under the contract. When donating an apartment by both parents, either of them can be the child’s representative. If the spouses are divorced or there is no second parent (died, not indicated on the birth certificate, etc.), then the first parent can be both the donor and the representative of his child-done - letter of the Federal Tax Service dated June 21, 2021 N 2664/ 06-08. When a child is given an apartment by, for example, a grandmother, one of his parents (guardian) may be his representative. Better mother.For a child under 14 years of age, the contract is signed by his representative specified in the contract - Art. 28 Civil Code of the Russian Federation. The presence of the child is not required anywhere. A child from 14 to 18 years old signs the contract himself + his representative signs as consent - Art. 26 Civil Code of the Russian Federation. Then both submit the agreement for registration.

- With a clause on the lifelong right of residence of the donor - or

- By power of attorney from the donor - or

- By power of attorney from the donee - or

the Donor does not have the right to sign an agreement for the donee, and vice versa - clause 4 of Art. 182 of the Civil Code of the Russian Federation. Therefore, they cannot issue a power of attorney for each other to sign. You can, for example, collect documents and submit a registration agreement.

Other articles

Tax when donating an apartment - the amount, who pays, payment procedure, when you don’t have to pay. After the donation, the new owner can safely register in the apartment.

Rights and obligations

The section on the rights and obligations of the parties is written down in the paragraphs of the document in order to indicate mutual obligations. According to the principle of freedom of contract, which is enshrined in the Russian Federation, the conditions may be different. We will indicate the formulations that are most often compiled:

The Donor has the right to: Cancel the execution of the gift agreement if the Donee has committed illegal actions against the Donor, his family or close relatives. Demand termination of fulfillment of obligations under the contract in cases provided for by the current legislation of the Russian Federation. The Donor undertakes to: Transfer ownership of a residential building with a land plot to the Donee in accordance with this agreement. The donee has the right to: Refuse to accept the above-mentioned real estate as a gift. The donee undertakes: To return the residential building with the land plot in the event of termination of this agreement.

Taxes when donating an apartment to a relative

According to the legislation of the Russian Federation, all citizens who have received income, including from the sale of real estate owned for less than a minimum period, are subject to taxation. An exception includes transactions executed by DDC between immediate relatives.

Tax Code of the Russian Federation in clause 18.1 of Art. 217 regulates that the income of individuals is not subject to taxation, regardless of the period of ownership, when registering a DDC between immediate relatives, the list of which is displayed in the RF IC.

If the parties to the agreement are not close relatives, the recipient of the gift is obliged to send a 3-NDFL declaration to the Federal Tax Service and pay a tax in the amount of 13% of the price of the property. This rate is established for residents of the Russian Federation. For non-residents, the rate for such a transaction is 30% of the value of the donated property.

How long does it take to file taxes in 2021?

The procedure and deadlines for paying taxes in the Russian Federation are regulated by clause 1 of Art. 3 of the Tax Code of the Russian Federation and depend on where they are credited:

- For federal taxes, the deadlines for transferring taxes are reflected in the Tax Code of the Russian Federation.

- For regional and local taxes, such deadlines are provided for in the regulatory documents of regional authorities.

The procedure for crediting taxes to the budget depends on the category of tax payer. Individuals can transfer taxes as follows:

- Through a bank, paying in cash or by credit card, or using a terminal. To do this, you will need a receipt received from the Federal Tax Service for tax transfer.

- Using the taxpayer’s personal account, using the Internet resource “Sberbank-Online”, going to the “Payments and Transfers” option.

- Via a smartphone, if the bank provides this service.

- Using other mobile applications at the regional level.

- Since November 30, 2016, the Tax Code of the Russian Federation has allowed the transfer of tax for third parties.

The procedure and deadlines for fulfilling obligations to transfer taxes are reflected in Art. 45 of the Tax Code of the Russian Federation, which states that the taxpayer is obliged, independently or through a third party, to credit the tax to the budget within the prescribed period. Fulfillment of the obligation to transfer tax is recognized as the absence of debt to the tax authority.

To familiarize yourself with the deadlines for transferring taxes in 2021, it is recommended to download the accounting calendar presented in the table.

Note : If the deadline for transferring taxes falls on a weekend or holiday, then the transfer must be made on the first working day (Clause 7, Article 6.1 of the Tax Code).

Final provisions

This section contains final clauses that summarize the information specified in the contract. For example:

The transaction is considered concluded from the moment it is signed by the Parties and the state registration of the Donee’s ownership of the property. For all points not reflected in the clauses of the agreement between the parties, they are guided by the current legislation of the Russian Federation. The agreement is drawn up in three copies, one of which is kept by the rights registration authority, and two by each of the parties.

Where can I register a deed of gift for a share of an apartment?

Answering the question about the place of registration, we will dwell on the methods of transferring shares in an apartment free of charge:

- On your own - draw up a deed of gift, submit a request for registration in Rosreestr, give away the property.

- Through a notary – contact a notary’s office and wait for the registration to be completed.

- Legal assistance - developing a draft deed of gift and drawing up a turnkey agreement.

Next, we will talk about independent and notarized registration of a deed of gift. After familiarizing yourself with both procedures, you can choose the most suitable one for your case.

Who can't be given a share in an apartment?

Art. 575 of the Civil Code of the Russian Federation indicates that donation is prohibited not only on behalf of children under 14 years of age, but also in other cases.

You cannot donate a share in real estate to the following categories of citizens:

- employees of medical, educational, social institutions, if the donor is a student or citizen detained there;

- persons holding municipal or government positions, if the transaction is related to their official powers.

Employees of financial, state, and municipal organizations can be given gifts of up to 3,000 rubles. as part of official events. If the value of the gift exceeds the specified amount, it becomes the property of the institution and is transferred according to the appropriate act.

Deadlines

Having figured out how to draw up a donation agreement for an apartment for your daughter, you should also talk about the timing of the procedure.

This procedure will take you several days , unless you have to perform additional steps due to the characteristics of the donee.

Review of documentation in the registry may take up to 30 days after submission of all documents. This is the longest process. But after his positive decision, the apartment immediately passes to the new owner.

You can highlight the following advantages of donating an apartment::

- after the transaction, the new owner can immediately equip his new living space;

- other relatives will not be able to apply for housing in the future;

- a simple and quick way to transfer housing to another owner;

- the contract cannot be disputed.

This procedure has many advantages due to the fact that it is free of charge. After losing your rights to living space, you are left with only joy in your soul from the gift you presented.

Taxes

When registering a donation of a share of an apartment to a relative, the citizen who transfers ownership of the property does not pay taxes in any case. The following categories of recipients are also exempt from them:

- spouses;

- parents;

- children, including adopted children;

- grandparents;

- grandchildren;

- brothers and sisters.

Must pay tax:

- daughters-in-law and sons-in-law;

- uncles and aunts;

- nephews;

- cousins, second cousins, etc. sisters and brothers;

- persons who are related to each other (for example, father-in-law and mother-in-law, father-in-law and mother-in-law, matchmaker and matchmaker, brother-in-law, sister-in-law), etc.

State duty, cost

Registration of a gift deed costs a tidy sum, especially if the share does not go to close relatives. Typically, all expenses are borne by the recipient as a beneficiary. Financial costs consist of state fees, notary services and technical work.

When contacting a notary, you will have to pay a state fee for certifying the transaction - 0.5% of the price of the donated share (the minimum payment is 300 rubles, and the maximum state fee threshold is 20,000 rubles).

Example:

Real estate in the center of Moscow costs 8,000,000 rubles. The father gives ¼ of the housing to his son, ½ goes to his daughter and grandson. The parties contact the appraisal company:

Calculations for my son: ¼ multiplied by 8,000,000 = 2,000,000 rubles (cost of share). Let's determine the state fee at the notary: 0.5% multiplied by 2,000,000 = 10,000 rubles.

Calculations for daughter and grandson (together): ½ multiplied by 8,000,000 = 4,000,000 (share price). Hence the state duty: 0.5% multiplied by 4,000,000 = 20,000 rubles (limit).

Other notary services are calculated separately - their cost depends on the region of residence. On average it comes out to 5,000 rubles.

You can find current prices for notary services in 2021 in the article “How much does a contract for the donation of a share of an apartment with a notary cost?”

The cost of state registration in the Unified State Register of Real Estate: 2,000 rubles for individuals (citizens) and 22,000 rubles for organizations. You can determine the details for paying the fee on the official website of Rosreestr by selecting the region and branch of the government body.

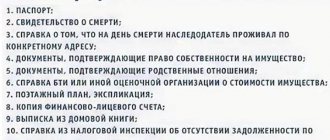

Transaction registration procedure

In order for the fact of donation of a land plot or its share to have legal force, it is necessary to register the transaction. This procedure is carried out by the relevant bodies of the Unified Rosreestr. The following package of documents is required for registration:

- written form of the relevant statements of the parties;

- passports;

- receipt for payment of registration services;

- three copies of the deed of gift, which are the originals;

- a certificate confirming the absence of debts to pay the allotment tax;

- cadastral map.

After checking the authenticity of the papers and entering the transaction data into the register, the person indicated in the deed of gift as the donee can fully dispose of the land plot or its share.

In order to avoid unforeseen nuances and draw up a donation agreement for a residential building, you can use a sample deed of gift for 2021.

Structure

The conditions for how to fill out a gift agreement are determined by the parties by mutual agreement. There is only one essential condition: the item must be specifically described so that no errors arise during identification.

Standard components of any contract:

- a cap identifying the donor and recipient, indicating their surnames, first names, patronymics and titles, dates and places of imprisonment;

- the name of the document itself;

- definition of the subject, apartment, indicating its address, area (separate living space), number of rooms;

- rights and obligations of the parties (according to the extract, for example, if the donor is still registered in the apartment);

- liability for violation of conditions;

- determining who bears the costs of registration;

- details and signatures.

Characteristics of the donation procedure

The deed of gift must be in writing. The document must necessarily contain the following information:

- information about the parties to the transaction and passport data;

- characteristics of the property subject to donation, which includes data on the location, purpose, cadastral number and presence of buildings located on the territory of the allotment;

- details of documents evidencing the donor's ownership of the specified real estate;

- data verifying the authenticity of the papers and the absence of encumbrances on the transaction.

In order to avoid challenging the authenticity of the deed of gift, you can also indicate in the document the fact of confirmation of the legal capacity of the person making the donation. Also, competent experts advise writing down a clause in the document that states that in the event of the death of the person accepting the property as a gift, the contract is invalidated and ownership rights return to the donor.

To correctly draw up a deed of gift, you need to use a sample agreement for 2021, the form of which is available.

The donation procedure itself implies a certain algorithm of actions:

- collection of all necessary supporting documents;

- drawing up a contract according to specific individual circumstances;

- registration of the document by the relevant authorities of Rosreestr.

The package of papers required for concluding and registering an agreement between relatives who are close includes the following documents:

- statements of participants and their authorized representatives;

- a receipt confirming the fact of payment for services for concluding the contract;

- identity documents (passports);

- appropriate powers of attorney, if the interests of the parties are represented by other persons;

- papers confirming the fact of adoption, guardianship or trusteeship, if the property is given as a gift to a minor child or an incapacitated person;

- originals and notarized copies of papers evidencing ownership of the property to be donated;

- notarized original and copy of the cadastral map of the land plot;

- data verifying the authenticity of accompanying documents and the absence of debts and encumbrances on the transaction;

- consent of one of the spouses to the donation of their joint property (written form).

Registration procedure

There is no transaction form specifically provided for in the Civil Code of the Russian Federation. The parties are free to develop, agree and approve the terms of the transaction, but it is prohibited to include commercial clauses in the contract - about material remuneration, the transfer of things in exchange for a house and land.

Registration of a deed of gift for a house and a land plot is permitted in accordance with the general procedure. The main thing is to clearly formulate the terms of the contract and ensure that they do not contradict the provisions of Art. 572-582 of the Civil Code of the Russian Federation and general provisions for registration of a transaction - Art. 420-431.2 Civil Code of the Russian Federation, 432-446 Civil Code of the Russian Federation.

Legal regulation

It should be noted that property transferred as a gift to a close relative is not subject to taxation (Article 217 of the Tax Code). But you need to know exactly who belongs to the circle of such persons. Otherwise, it will be an ordinary transaction, for which it is necessary not only to report, but also to pay tax on the income received to the state.

The Family Code identifies close relatives for the purpose of gifting in the circle:

- parents and adoptive parents;

- natural and adopted children;

- brothers and sisters, including step-brothers;

- grandparents;

- spouses.

A significant difference between a gift between close relatives is the lack of profitability, so the value of this property will not be subject to personal income tax.

The subject of a gift agreement can be any property benefit. Immediately after receipt, the new owner can fully dispose of it. Real estate objects are transferred after registration of rights to them in Rosreestr.

Civil Code Art. 575 and 576 limits the circle of persons who can act as a donor:

- children under the age of majority (14 years);

- citizens declared incompetent;

- representatives of incapacitated persons and minor children.

But they can receive property as a gift.

It is prohibited to donate property under an agreement:

- employees (as well as their spouses and relatives) of medical, educational or social institutions, provided that the donor is supported, educated or treated there;

- a state or municipal employee holding an official position or performing official duties;

- without the consent of other owners, if the property is jointly owned.

Civil Code in paragraph 1 of Art. 572 establishes a prohibition for the donor to demand compensation or any other property benefits from the donee in exchange for the transfer of real estate. Otherwise, the transaction will be recognized as sham in accordance with clause 2 of Art. 170 of the Civil Code, since the conditions applicable to the purchase and sale agreement are stipulated.

Do you need a notary when signing a gift agreement?

The legislator does not require mandatory notarization of the transaction. The exceptions are cases of alienation of real estate:

- belonging to a minor citizen or person with limited legal capacity;

- shares in common property (except for land), even if all participants alienate the shared property within the framework of one agreement.

However, many people prefer to contact a notary in order to subsequently eliminate the occurrence of unpleasant situations.

How much does a gift deed from a notary cost in 2021?

When drawing up a gift agreement between close relatives, a reduced notary fee is applied. The price of notary services consists of the tariff for services and the state fee.

Here are the prices in some cities:

| City | Minimum fee for the service, rub. | Notary fee, rub |

| Moscow | 5400 | 0.3% of the contract amount |

| Saint Petersburg | 6000 | |

| Omsk | 5800 | |

| Samara | 4400 | |

| Tomsk | 7100 | |

| Permian | 6500 | |

| Novosibirsk | 6100 |

For example : In Moscow, citizen Ivanov draws up a deed of gift for his son from a notary for an apartment worth 2,500 thousand rubles. The notary in this case will cost:

5400 + (2,500,000-0.3%) = 12,900 rubles.