Money, like other things, is considered personal property. By drawing up a donation agreement, a person transfers a certain amount to another person free of charge and irrevocably. How to correctly draw up a contract for donating funds to close relatives? Read the article.

What is a gift deed?

A gift agreement (or deed of gift) is an official document in which the donor expresses his will regarding the fate of his personal property and its transfer to an individual/certain group of persons.

The gift agreement has the following features:

- By notarizing the agreement for donating money to a close relative, the donor retains further ownership of the donated amount of money. In turn, the recipient receives a gift free of charge;

- If the donor transferred ownership of funds to another person, and in return received an equivalent gift, then such a process is not considered a gift;

- The age of the recipient does not matter. Thus, children from the age of six can accept funds under a gift agreement (Article 28 of the Civil Code of the Russian Federation);

- Teenagers from fourteen to eighteen years old have the right to donate funds;

Read about the validity period of the gift agreement here.

In accordance with Article 26 of the Civil Code of the Russian Federation, the amount of a gift by a minor citizen should not exceed the amount of income he receives (study scholarship, salary, etc.)

How to properly draw up a deed of land: the main steps

Registration of a deed of gift involves going through a number of successive stages, starting with the drawing up of an agreement, and ends with the re-registration of ownership rights to the new owner. Let us consider the components of the donation procedure in more detail.

Drawing up and signing an agreement

To draw up and sign an agreement, you can contact specialized companies, a notary, or use a standard form.

We can take as a basis the model proposed by the Russian Federation Committee on Land Resources back in 1994.

The contract must contain the following parameters:

- name of the parties to the transaction (donor/done);

- a detailed description of the land plot being donated (indicating its area, intended purpose, cadastral number, description of buildings);

- cadastral value (or market) of land and buildings on it;

- presence of land encumbrances and restrictions;

- obligations of the parties (transfer and accept as a gift);

- applications.

When contacting specialized law firms, you should be prepared for the fact that they will charge 5,000-10,000 rubles for preparing a document.

If land is transferred in favor of a minor or incompetent citizen, then the written consent of his guardians and parents is required. The minor himself has no right to act as a donor.

Notarization of the gift agreement

Contacting a notary office for certification of a gift agreement is an optional step. However, they should not be neglected to give the document greater legal force.

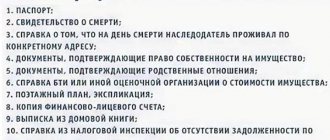

To notarize a deed of gift, you will need the following package of documents:

- passports of the parties;

- agreement in triplicate;

- cadastral plan of the site;

- a certificate confirming the absence of buildings on the land or an extract from the Unified State Register of Ownership of the building;

- conclusion on the cadastral (or market) value of the land;

- title documentation for land.

The notary will charge a certain fee for his services.

Its size will be tied to the cadastral value of the land, or to the market value obtained from licensed independent appraisers.

Tariffs for notary services also depend on the category of relationship. To register a plot in favor of a spouse, children, parents, grandchildren, they are set at the level:

- 3000 rub. plus 0.2% of the price of the plot if its value is within 10 million rubles;

- 23,000 rub. + 0.1%, but not more than 50,000 rubles

. - at a higher cost.

When donating land to other categories of citizens, increased tariffs apply:

- if the price of land is within 1 million - 3000 rubles. + 0.4%;

- up to 10 million rubles — 7000 rub. + 0.2%;

- more than 10 million - 25,000 rubles. plus 0.1%, but not more than RUB 100,000.

If certification of the spouse’s consent is required when registering a gift of land that is jointly owned, the tariff is set at 100 rubles. The cost of drawing up the contract itself with the help of a notary will cost another 1000-2000 rubles.

Notaries also charge a fee for technical and legal work . Its size is determined at the level of the regional notary chamber and averages 2000-5000 rubles.

Which relatives are considered close?

You can draw up a deed of gift for the transfer of funds between close relatives. These are considered:

- Parents and their legal/adopted children;

- Grandparents and their children/grandchildren;

- Siblings and adopted siblings;

- Guardians and their adopted children;

- Spouses;

Read here how to donate an apartment between close relatives.

Despite the fact that the spouses are not blood relatives, Article 14 of the Family Code of the Russian Federation defines them as “close relatives”.

Other relatives (uncles, aunts, cousins/second cousins/other relatives) not listed above are not considered close.

Sample consent of the second spouse to donate a land plot

The spouse's consent to the donation of land is required only when the property being donated was acquired with joint family funds. It must be notarized and executed in writing. A sample of such consent for 2021 looks like this:

Agreement

City___________, ____________region, Russian Federation

__________________________________G.

I, gr. _________________________, ______________ year of birth, living in

. _________________________ (passport series ____, N ______, issued by the Department of Internal Affairs _______________), I agree to make a donation to _______(by whom)___________, which belongs to me ______, a plot of land located at the address: ___________________________ acquired by us during the marriage, in favor of _______________________________.

Signature _______

Process Features

If you decide to give money to someone, make sure of the following:

- In accordance with Article 573 of the Civil Code of the Russian Federation, before drawing up a gift agreement, the donor must inform the recipient of his intention. There is a possibility that the recipient refuses to accept a sum of money as a gift;

Read about the procedure for donating a plot of land to a relative here.

- You can give a sum of money without drawing up a gift agreement. According to the Law, a contract for donating money can be enshrined both verbally and in writing. One condition is that you can donate funds without drawing up an agreement in an amount not exceeding three thousand rubles;

- A money donation agreement must be drawn up exclusively in writing if the transfer of money is scheduled for the future and will not be carried out in the present. The second case when a deed of gift must be drawn up only in writing is when the donor is a legal entity;

- The donation agreement must be drawn up in two copies, signed by the donor and the recipient in the presence of witnesses;

- In order to give someone a sum of money, it is not necessary to obtain the consent of your spouse. However, if there is a risk of a conflict situation, then before drawing up a gift agreement it is best to obtain the consent of the spouse, recording this in written format;

- It is recommended that the agreement for the donation of funds be certified by a notary, so that in the future no one will have concerns about the legality of the transaction;

- The mandatory presence of a notary is necessary if a large sum is planned to be transferred;

In this case, it is necessary to draw up three copies of the agreement.

Information!

When donating money, you must pay a state duty equal to 0.3% of the donation amount.

- When donating money, the agreement should not indicate for what purpose the donated money should be spent. The essence of the deed of gift is the gratuitous transfer of funds to a close relative;

- The effect of the gift agreement is irreversible. What does it mean? Having drawn up the agreement and certified it by a notary, the donor irrevocably loses his right to the donated money;

It is extremely difficult to challenge a gift agreement. To make it invalid, the person interested in receiving this money will have to prove in court that the donor at the time of drawing up the application was unable to reason sensibly (mentally unstable) or drew up the document under pressure from a third party. If one of the listed factors is proven, the gift agreement will become invalid.

Donation of an agricultural plot

The transfer of a share (agricultural land) does not have any special features. It is formalized according to general rules, but there is a law that controls the circulation of agricultural land

. It establishes that before the alienation of agricultural land, it is necessary to notify the administration of the region where it is located in advance.

In the case of a donation, there is no need to notify the authorities, since the rule established by law applies to compensated transactions.

Its compliance is necessary for the pre-emptive right to purchase land by government bodies. Since the donation is a gratuitous transaction, no special features are provided.

Thus, the preparation of a deed of gift must necessarily comply with the requirements of the law. At the same time, sometimes the consent of the spouse is required to carry out a gratuitous transaction in relation to the plot. When transferring agricultural land free of charge, it is not necessary to comply with the rules established by the relevant law on their turnover.

What information should be included?

In order for the process of donating money between close relatives to gain legal grounds, it is necessary to record the will of the parties in writing. This can be done using a special agreement, in which you need to indicate the following data:

- Last name, first name, patronymic, passport details (series and number, place of permanent residence, date of birth, marital status) of the donor and recipient;

- Item to be given as a gift. Thus, in this article, the subject of transfer under a gift agreement is funds;

- Rights and obligations of the parties;

The donor has the right to set the time when his gift will be transferred to the recipient.

The recipient has the right to receive the item donated.

The donor undertakes to transfer the item of donation free of charge and irrevocably.

The donee undertakes to receive the object of donation by recording his consent in the gift agreement.

- Terms of transfer of the object of donation to the recipient;

By mentioning all the above points in the gift agreement, it will be able to gain legal force.

A sample application for a gift agreement can be downloaded freely on the Internet or you can obtain a form to fill out directly from a notary.

Download

Sample application for donation agreement.doc

Expenses

When dealing with property, including donations, expenses should be taken into account. In addition to having the document executed by a notary, you also need to pay for its confirmation. The amount is at least 0.5% of the value of the gift. Registration of property rights is additionally paid if it is carried out by a notary. Spouses can split the cost of a lawyer equally if they do not have a common budget. The recipient must also pay a state fee.

Many people do not know whether a deed of gift between spouses needs to pay income tax. According to the law, close relatives do not pay the 13% tax, as established, if the transaction is carried out between strangers. Spouses, from a legal point of view, are close relatives, so the recipient does not pay income tax.

Gift structure

The donor can draw up a gift agreement independently, without leaving home. However, the donee and witnesses must be present nearby.

When drawing up a deed of gift for the transfer of funds to a close relative, you need to take into account the following structure for drawing up such a document:

- In the upper right part of the page you need to write down the name of the document, namely “Money Donation Agreement”;

- In the “header” of the agreement (on the left side) the city in which the donor draws up the deed of gift is written, as well as the exact date of its execution (on the right side);

The date must be written not in numbers, but in words. For example: September thirteenth two thousand and seventeen.

- The main part of the gift agreement contains the following information: last name, first name, patronymic, passport series and number, place of actual residence and place of permanent registration;

The information of the donor and the recipient is indicated here.

- Next, you should specify what is the subject of the donation. In our article we look at the process of donating money. In addition to the item of donation, it is important to indicate the exact amount;

- After this, the donor must record his responsibilities, namely the gratuitous transfer of funds to the donee (without indicating the purpose and purpose of the transferred funds);

The amount of the donation should be indicated not in numbers, but in words.

In addition, the donor must specify the currency in which the money will be transferred.

- A separate clause specifies the deadlines for the donation agreement to acquire legal force, at which time the funds are transferred to the donee;

- The agreement also states: donated funds cannot be used as collateral. In addition, donated funds cannot be seized;

- The rights of the donor and the recipient are prescribed;

Thus, the donor has the right to terminate the gift agreement due to a sharp deterioration in material well-being (needs money to pay for housing, medical treatment, etc.)

The recipient may refuse to donate money until the agreement is signed. When refusing to donate money, the recipient must record this in writing.

Read how to revoke a deed of gift here.

Obtaining a certificate of ownership

Within the established time frame, the donee can go to obtain a certificate in his name. You need to have your passport and a statement confirming the acceptance of documents received at the previous stage. Currently, the document preparation period is no more than 10 days.

After receiving a certificate of ownership of the plot, the donee becomes the new full owner of the land plot. It is important to understand that this entails not only the right to freely dispose of the received land, but the obligation to pay land tax.

When does a deed of gift become legally valid?

For a gift deed to become an official document, it must be registered. You can do this in two ways:

- Have the donation agreement certified by a notary;

- Register with Rosreestr;

Read about registering a deed of land in Rosreestr here.

Read about whether it is possible to do without a notary and Rosreestr in the next section.

Lawyer's answers to frequently asked questions

What is the validity period of the deed of gift?

The donee has the right to re-register the property in his name within 1 year. If during this time the donor dies, the obligation to transfer the gift goes to his heirs. It is better to arrange everything as quickly as possible in order to avoid litigation with them.

Is gifting possible between husband and wife?

Yes. If property was purchased before marriage by one of the spouses, it belongs to him alone and there is no need to allocate a share for alienation. To donate common real estate, a preliminary allocation of shares will be required.

I want to donate a share in an apartment and a car that belongs to me. How to calculate expenses?

An agreement for the alienation of a share is subject to notarization, and a fee is paid here in accordance with the Tax Code of the Russian Federation. The DD for a car is not certified by law, but a notary fee is paid upon certification. The amounts for each gift are calculated separately.

What value of real estate is used when calculating the notary fee: market, cadastral or inventory?

Cadastral. You can find it on the Rosreestr website.

How is the deed of gift fee calculated at the notary when donating a share in real estate?

The calculation is based on the cadastral value of the share, and not the entire property.

Is it necessary to have it certified by a notary?

Many people believe that a gift agreement cannot gain legal force without notarization and its inclusion in the Rosreestr. However, these are misconceptions.

Read about drawing up a deed of gift from a legal entity to an individual here.

According to paragraph 2 of Article 130 of the Civil Code of the Russian Federation, when drawing up a contract for donating money between close relatives, entry into a special register or notarization is not required.

Price

| Notarial action | Notary fee | UPTH |

| For certification of donation agreements, with the exception of real estate donation agreements for which the legislation of the Russian Federation does not provide for a mandatory notarial form | ||

| - children, including adopted children, spouse, parents, full brothers and sisters | 0.3% of the contract amount, but not less than 200 rubles. | 10,000 rub. |

| - to other persons | 1% of the contract amount, but not less than 200 rubles. | 10,000 rub. |

UPTH is a legal technical work approved by the Moscow City Notary Chamber.

Submitting an agreement to the MFC for registration of the transaction

This section is specially separated because... except for cases of notarization, it also implies the possibility of doing without it. But this must be considered as two separate cases.

In both options, state registration is mandatory, and a fee of 2,000 rubles will be charged for its implementation. (established by clause 22, clause 1, article 333.33 of the Tax Code of the Russian Federation).

- If the contract was certified by a notary, his responsibilities include transferring documents for registration . This service should not lead to additional costs (except for state duty), because included in the already paid package of actions. By the way, when filing electronically, the fee can be taken at a discount and amount to only 1,400 ₽.

- If the deed of gift does not require notarization, then the parties themselves apply for its registration. To do this, you need to come to the MFC with a package of documents and provide an agreement for registration.

On average, registration takes about 3 working days, but sometimes this period can be extended by a few more days due to organizational issues. The fact of confirmation of a change in ownership will be a change in the entry in Rosreestr.

Help in compiling

Below this article there is a message form. You need to write in it the basic parameters without details and personal information , for example, “I want to draw up a donation agreement for an apartment (brief description) consisting of ... shares owned by ... people, the recipient will be ... a person located in the city N.”

The application will be sent to a specialized lawyer, who will offer a price for drafting it. If you can reach an agreement, you will proceed to personal communication, and the agreement itself can be sent for signing electronically.

As an alternative, a telephone call to the numbers listed on our website can be used.

Perhaps someone used to think, well, my apartment is something I give to whoever I want. On the one hand, this is true. But on the other hand, this transaction must be registered, having first properly completed it. Of course, it would be faster and more correct to entrust the preparation of deeds of gift to professionals. This will not only save time, but also eliminate registration problems in the future.

How to carry out a transaction if there is a legal dispute in the future?

Based on our judicial practice in challenging deeds of gift, we can give the following advice:

- before drawing up a deed of gift, it is necessary to prepare a number of additional (not required by law) documents, which in the future will prove the legality of the transaction;

- after drawing up a deed of gift, if it was done urgently, it is also possible to carry out a number of procedures that will subsequently protect the deed of gift.

What documents are these? In each case - their own. Most often, this is a certificate from a psychoneurological clinic confirming the donor’s full legal capacity. But there may be many other documents. It is better to consult about this with a lawyer or lawyer who practices in matters of challenging deeds of gift.

Contact our legal center for help. We have more than 15 years of experience in preparing deeds of gift in any legal manner.