The owner has the right to dispose of his property at his personal discretion. He can donate it, sell it, bequeath it to loved ones or to complete strangers. Relatives usually enter into a gift agreement or draw up a will, assuming that the property will definitely pass into the hands of the person to whom it is “addressed.” However, in practice this does not always happen.

What is the difference between a deed of gift and a will? What are the nuances of each document? What is more profitable and reliable to apply for this year? And which of the documents cannot be challenged? Daria Morozova answered these questions to the FAN .

Photo from the personal archive of Daria Morozova /

Which is better - a deed of gift or a will?

Both documents imply that the property in question will be transferred to a specific person. However, the conditions for its transfer vary.

Will

A will implies the disposition of property, as well as rights and debts in the event of the death of the testator. For example, a grandmother has an apartment, and she wants her granddaughter to get the housing after her death. She can write a will and name her granddaughter as the sole recipient of the inheritance. The document does not come into force immediately upon signing, but only after the death of the testator. The grandmother remains the sole owner of the apartment until her last days and continues to live peacefully in it. When the grandmother passes away, her will will be carried out within the period established by law.

“When there is a will, it doesn’t matter what exactly the law says about the distribution of inheritance,” notes lawyer Daria Morozova. “It will be divided exactly as the testator wanted.”

Gift deed

This document is drawn up when they want the property to pass to the donee here and now. For example, a grandmother has two apartments, and she wants to give one to her granddaughter so that she can use the living space today. In this case, you need to draw up a gift agreement, which is signed by both parties: both the one who gives and the one who receives the gift. This agreement must be registered with Rosreestr, and from the moment of registration, the rights to the property are transferred to the donee.

If a grandmother gives her only apartment to her granddaughter, she will lose the right to own and dispose of real estate. Her further quiet life in this apartment is possible only with the consent of her granddaughter, but without any legal grounds.

pixabay.com/PICNIC-Foto-Soest

Difference between deed of gift and will

“In essence, both documents perform a single function,” clarifies Daria Morozova. — It consists of a legally justified and lawful transfer of property into the ownership of another person. But in practice, questions and nuances often arise that need to be taken into account.”

Moment of transfer of ownership

As already noted, in the case of a donation, it occurs at the time of registration of the agreement. In addition, the very fact of donation must be gratuitous, that is, the donor must not demand anything in return from the recipient.

A will is also essentially free of charge, but the owner remains with his property until the end of his days, which is much more reliable for him than relying on the will of relatives.

Availability of signature

A deed of gift is an agreement in which the donor expresses his right to transfer property and confirms it with his signature. And the recipient accepts the gift, in confirmation of which he also puts his signature. There is only one signature in a will - the testator. The person to whom the property is intended does not require consent at the time of drawing up the document.

Possibility of changing the decision

If we talk about what is more reliable—a deed of gift or a will—then the deed of gift looks more convincing. The fact is that after it is drawn up and signed, the donor loses the rights both to the property and to make changes to the agreement itself. In fact, this is the final point in his property rights: after signing the contract, he can no longer make any decisions regarding the property.

If we are talking about a will, then it can be changed countless times. Today the grandmother wants to transfer the apartment to her granddaughter and writes a document in her favor. Tomorrow she and her granddaughter quarreled, and the grandmother decided to sign over the property to her grandson. She has every right to do this, and her first will will become invalid once the second one is signed.

Opportunity to challenge in court

As for the question of what cannot be challenged in court - a deed of gift or a will - here the first document is again more reliable. Of course, relatives can go to court after the death of the property owner and demand that the court terminate the gift agreement. However, as practice shows, these requirements usually lead nowhere. But the chances of challenging a will are much greater, and such claims are brought to the courts more often.

Only taking into account all these nuances can the owner decide what to draw up: a deed of gift or a will. At the same time, the price issue is not the least important.

pixabay.com/congerdesign

Important Terms

Before moving on to the analysis of the process of preparing both documents, you need to familiarize yourself with the basic concepts:

| Gift deed | Will |

| It is a gift agreement, which is a gratuitous transfer of property belonging to the testator to a person, regardless of whether there is a relationship with them. | It is the will of the testator, in which he bequeaths his property in the event of death, indicating his heirs. |

Gift deed or will - which is cheaper and more profitable?

“If a deed of gift is issued to close relatives, no taxes are charged,” comments lawyer Daria Morozova. “We are talking about giving to children, parents, brothers and sisters, grandparents. But, if the document is issued to strangers, for example, to an acquaintance or friend, he will have to pay tax. The rate is 13%, since in this case it is assumed that income will be received by an individual.”

To make a donation, you do not need to involve a notary, which reduces the cost of the registration procedure itself. If the apartment belongs to the grandmother entirely, she can safely give it to her granddaughter by simply drawing up a gift agreement and registering it. In this case, you will only need to pay the state registration fee.

If you make a will, the registration procedure may be somewhat more expensive. A will is always drawn up and confirmed by a notary; you will need to pay for his services. The average cost of this service in Russia is 2000 rubles.

For heirs, entering into an inheritance always requires payment of tax. Its size depends on the inheritance queue. The first priority, that is, children and spouses, pay 0.3% of the value of the property, for all others the rate is twice as high and amounts to 0.6%.

Re-registration of documents will also require financial investments and, of course, payment of state fees. Its size varies depending on the type of property, for example, the state duty for changing rights to an apartment is 2,000 rubles.

“A will or deed of gift implies payment of tax,” clarifies Daria Morozova. — It is paid by the one who receives the property. The only condition under which there will be no tax is close family ties when concluding a gift agreement.”

pixabay.com/Mimirebelle

Legislative regulation

The Civil Code of the Russian Federation considers a will a unilateral transaction expressing the will of one person.

Making a death directive is a rather complex and time-consuming process. The law provides for two types of such document:

- Open, which is drawn up in the presence of a notary and certified by him.

- Closed, written personally by the testator, transferred in a sealed envelope to a notary for certification. The contents of the letter are known only to the author.

Regardless of the form of the testamentary disposition, it must be drawn up taking into account the requirements of the Civil Code of the Russian Federation:

- The document is drawn up personally. This can be done by a notary based on the words of the testator. The presence and pressure of outsiders, including relatives, is not allowed.

- The order may contain not only questions about the transfer of rights to property and contributions, but also the expected size (share) of each of the heirs.

- The testator has the right to dispose only of the property belonging to him. This could be real estate, deposits, vehicles, shares in property.

- The will of the testator must be exercised freely. If it was made under pressure, blackmail or threat, the order will be declared invalid (Article 1131 of the Civil Code).

- The testator must have full legal capacity.

- The document is personally signed by the originator, and the accuracy is certified by a notary.

A will is included in the list of documents subject to notarization. Written form is required. The order is drawn up in two copies, one of which remains with the notary.

Gift deed or will - pros and cons for the property owner

Each document has nuances both in its drafting and in defining the rights and obligations of the parties.

Legal force of deed of gift

The gift agreement is convenient from the point of view of registration. It is signed by both parties without involving a notary, after which you need to collect a package of documents to register the transaction and take it to Rosreestr. This simplified procedure applies if the property has one owner. If there are two owners, for example, both a grandmother and a daughter own an apartment, and the grandmother wants to give her share to her granddaughter, the transaction will have to be notarized.

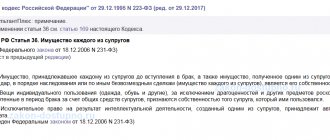

“A significant advantage of a gift agreement for someone who receives property is that it is not subject to the right of joint ownership in marriage,” clarifies Daria Morozova. “This means that in the event of a divorce, the granddaughter will not have to share the apartment given by her grandmother with her husband, even if she received this gift during marriage.”

The disadvantages of a deed of gift for the donor include the loss of the right to own and dispose of property after registration. And also the impossibility of putting forward “counter demands”. For example, according to the law, a grandmother does not have the right to demand that her granddaughter pay for her maintenance on the “account” of the apartment given to her. Such a transaction may be recognized by the court as imaginary or void and terminated.

Subtleties of making a will

If we are talking about a will, it is convenient because it can be drawn up and changed countless times. The law does not define “limits”, but it establishes that the document drawn up last has legal force.

In addition, the owner of the property retains his rights to it until his death and can use it legally until his last days. He can even donate or sell an apartment that he had previously bequeathed to someone close to him. And in this case, the deed of gift cancels the will, since, according to the gift agreement, the rights to the property are transferred “here and now.”

The testator can change his mind at any time and transfer his property to other persons. At the same time, he is not obliged to inform anyone.

“Of course, a will is much more beneficial for the testator,” the expert comments. “But it is important to understand that after his death it can cause serious conflicts between loved ones. It is also important to take into account that wills are challenged and revoked much more often than gift wills. And that there is a group of people who must receive an inheritance without fail, despite the last will of the deceased. We are talking about disabled children, parents and spouses, as well as minor children. Their share of the inheritance is determined by law.”

pixabay.com/viniciusemc2

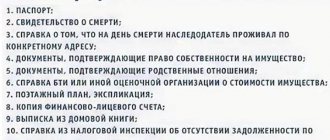

What documents are required to complete a transaction under a gift agreement?

To register a donation agreement for an apartment or residential building, the following list of documents is required:

- Passports or birth certificates of persons involved in the transaction, marriage certificate (required);

- Donation agreement () - number of copies depending on the number of persons participating in the transaction + 1 copy for Rosreestr (required);

- State payment receipt. duties for government registration of ownership of real estate (required);

- Real estate cadastral passport (optional).

- An extract from the Unified State Register of Real Estate for the object (a copy of the certificate of state registration of the donor's ownership, if the ownership is long-standing) - optional.

If the property is jointly owned by spouses, the spouse’s consent to donate real estate is additionally required. If the object of the agreement is real estate owned by minor children, permission from the guardianship and trusteeship authority is additionally required (see how to properly draw up a deed of gift).

Gift deed or will - which is better between relatives

According to Daria Morozova, when solving this issue, it is necessary to take into account the characteristics of a specific situation. Let's look at the most common ones.

The grandmother wants to transfer the apartment to her caring granddaughter, and not to her unemployed rowdy son

In this case, it is appropriate to draw up a deed of gift. Firstly, the granddaughter will be able to use the housing immediately, she will not have to wait for the death of her grandmother and enter into an inheritance for at least another six months. Secondly, the granddaughter will not have to pay any taxes, which means the gift will not cause financial difficulties for a loved one.

Grandfather wants to give an apartment to his nephew

This relationship is not close by law, but property can be transferred as a gift between relatives “along the chain” without paying taxes. For example, a grandfather can give an apartment to his sister, and she can give it to her son, for whom the housing was intended.

An elderly relative plans to transfer the apartment to his grandchildren, but does not want to lose it now

In this situation, it is wise to make a will. In this case, no one will be able to kick the old man out of his apartment, and after his death, the housing will be divided among the heirs indicated in the document.

Testator's rights

Every citizen has the right to bequeath property, regardless of place of residence. He can transfer his property to any person who is not even his heir. In this case, the principle of freedom of expression applies, as required by Article 1119 of the Civil Code of the Russian Federation. Thus, a citizen can transfer his property to his beloved grandson, relatives, adopted daughter or son, nephew or sister, as well as to a complete stranger.

The document specifies not only the heirs, but also the citizens whom the testator deprives of receiving property. The owner is not obliged to explain the reason for such a decision. The rights of the testator include canceling or changing the will, even if it has already been drawn up and certified by a notary. To do this he must:

- Draw up an order to cancel the document.

- Write another will, revoking the previous one.

Some successors cannot be deprived of property. They, according to Article 1149 of the Civil Code, claim an obligatory share and enter into its inheritance, regardless of whether the testator wishes this.

How to convert a will into a deed of gift

Even if a will has already been drawn up, no one can prevent a person from donating his property specified in the document to a relative or even strangers. An apartment, house, or land plot “described by inheritance” does not belong to the heirs while the testator is alive. Therefore, he can dispose of his property completely calmly, as if no will exists. And there is no need to redo anything: it is enough to draw up and register a gift agreement, which automatically revokes the will. The latter simply makes no sense.

If relatives do not agree with the decision of the property owner, they will have to challenge the transaction in court. And for this you need good reasons. It will be necessary to prove that the donor either did not understand the essence of his actions, or was under pressure, or that the transaction was imaginary. Most often, it is not possible to present convincing arguments in court, and the will of the donor cannot be challenged.

Therefore, it is possible to ignore the presence of a will when drawing up a deed of gift. But having donated your property, you cannot try to bequeath it to someone. By signing a deed of gift, a person loses his rights to the property and can no longer dispose of it.

conclusions

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

According to the author of the article, a will is the safest way for the owner to alienate property. Especially if the owner of the apartment or house has no other housing.

However, for the recipient of the apartment, the best option is a deed of gift. The donee bears virtually no costs (if he is a close relative). In addition, rights to the object arise within 14 days.