Marriage concept

Marriage in the legal sense of the word is a free and voluntary union of a man and a woman for the purpose of creating a family. A marriage formalized in accordance with the procedure established by law gives rise to mutual property rights and obligations for the spouses.

To enter into a marriage relationship, the legislation contains a number of requirements:

- mutual consent of persons;

- reaching marriageable age;

- absence of other marital relationships;

- lack of family relations between the bride and groom;

- the legal capacity of persons wishing to marry.

Find out how and where marriage registration can take place.

What should be in the contract

There is no standard template for drawing up a contract. But there are mandatory elements that must be present in the agreement. Thus, the contract states:

- time and place of the transaction;

- data of the seller and both spouses-buyers;

- detailed characteristics of the property being sold - an apartment, indicating its area, address, location in the house, etc.;

- cost of the apartment;

- method and procedure of payment;

- the duration of the transaction;

- rights and obligations of the seller and buyers;

- settlement of disputes;

- number of copies compiled.

The agreement can be drawn up in printed or handwritten form. At the end of the document, all participants in the transaction must put their signatures and transcript.

What is joint property of spouses

As a general rule, if you buy a home during marriage, it will be considered joint property of the spouses. This term means a regime of ownership, use and disposal of property in which it belongs to the couple equally without allocating shares to each.

Spouses can implement such objects only by mutual agreement. A co-owner cannot simply sell or donate his part of the joint property; to do this, he must first allocate his share.

Unless otherwise provided by agreement or law, spouses are considered to have equal shares.

Find out in more detail what joint property of spouses is.

Procedure for completing a transaction

The rules for purchasing a home in shared ownership are slightly different from purchasing an apartment in shared ownership. The general procedure is as follows:

- find the seller, preferably the sole owner of the property (this simplifies the sales process);

- discuss with him the terms of sale of the apartment;

- enter into an agreement specifying the shares of each future owner of the property;

- pay their shares from funds that belong personally to the spouses and are not jointly acquired;

- submit documents for state registration.

When carrying out more complex actions, many nuances must be taken into account. And if you want to make a purchase in shared ownership, then it is better to involve a professional lawyer in the transaction, and not a simple realtor.

But it’s generally easier to first buy a home in common ownership, and then, with the help of a notary, divide the shares or enter into a marriage contract.

Legislation

All issues that are in one way or another related to family and kinship relationships are regulated by family law. In addition, transactions with property are classified under civil law.

In this area, the following fundamental legislative acts can be identified:

- ;

- ;

- ;

- .

Certain nuances are regulated by special laws and by-laws.

Legal services in family law

If you are faced with the problem of allocating a share in kind, you need to divide joint property, or require any other legal services, contact Help Consulting Law Firm. Our specialists:

- will advise you on an issue that interests you;

- will help you collect the necessary documents;

- draw up a statement of claim;

- if necessary, they will represent your interests in courts of any instance.

Our company provides legal services to resolve issues related to real estate, labor and other disputes. You can contact us if you have been unfairly fired or your employer is withholding wages. Possible provision.

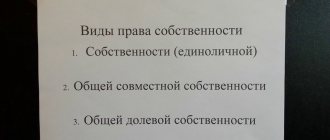

Types of property of purchased housing

When buying their own living space, many people wonder how best to decorate an apartment for spouses - for one or for two. There are several options:

- joint property

- total share,

- personal.

It is difficult to name the most suitable solution for a particular situation. Such issues are resolved individually, taking into account life circumstances.

Registration of real estate into common joint ownership

Many couples find it difficult to decide whether joint or shared ownership is better when buying an apartment. As practice shows, the first option is still the most common. In this case, the shares of each party are not allocated, and the spouses use the real estate on equal rights. In this case, the documentation lists two owners.

The division of property in the event of a divorce occurs in court if one of the parties does not agree with the established size of the share.

In addition, spouses often register housing as joint property with their children. Thus, all family members are owners of a common home.

Find out more about joint ownership of an apartment without determining shares.

Registration of real estate as shared ownership

Spouses can initially arrange the apartment in such a way as to determine the shares of each of them. It is not at all necessary that the parts of the property be equal. The purchase of an apartment in shared ownership by spouses in 2021 is possible by concluding a purchase and sale agreement, which immediately indicates the shares of the parties.

The share of each spouse is separate, due to which it can be disposed of without any restrictions. The owner can sell his part, donate it, separating it from the common property.

This is the ownership mode most often chosen by families with children. This allows the heirs to be given a legal share of the home.

As already noted, shares can be registered by concluding a purchase and sale agreement. However, this is not the only way in which it is possible to acquire shared ownership.

Shares are also determined using a marriage contract. This document can be concluded at any time in the family life of the spouses, defining all property issues in it in order to avoid disagreements in the future.

Find out more about registering shared ownership of an apartment.

Registration of real estate into sole ownership

There are often situations when an apartment was purchased during marriage, but there is only one owner. Due to the fear of losing their home, as well as the reluctance to participate in property proceedings in the event of divorce and division of common property, many seek to insure themselves.

In order not to acquire common joint or shared property between spouses, and at the same time to protect themselves, more and more Russians prefer to buy an apartment for themselves while married.

The legislation defines a category of objects that can be classified as personal property of a person, for example, gifts. Therefore, one option is not to buy a home, but to receive it as a gift.

Not everyone has relatives who can give their loved ones housing. Therefore, many are forced to look for other options.

An apartment purchased during marriage can be registered in the name of one of the spouses through the conclusion of a prenuptial agreement. Using this document, it is easy to transfer any property to one of the spouses. At the same time, the second one will not be able to lay claim to this object in the future.

How are rights distributed?

- Own. If the apartment was registered as ownership before marriage or in a civil marriage, then it is sole property and does not require any additional permits for sale. When purchased in an official marriage, the apartment is considered joint property and upon sale the notarized consent of the other half will be required.

- Common joint property. It can only be registered in an official marriage and the presence of both owners will be required during the sale. If one of the spouses cannot be present at the transaction, then a notarized power of attorney for the sale is issued. Spouses have equal rights and in case of divorce the apartment is divided equally.

- Common shared ownership. It can be formalized in both official and civil marriage. In this case, ownership arises for a certain share in the apartment, according to an agreement that is stated in the main agreement. During the sale, the presence of all participants in the transaction will be required and, according to Federal Law No. 172 of June 2, 2016, it falls under the notarial category.

The procedure for purchasing and registering an apartment

Buying an apartment involves resolving issues related not only to who to register housing for, but also where and with what documents to apply for this.

A purchase and sale agreement can be concluded either with or without the help of a notary.

The law does not require notarization of a contract, although many citizens still prefer to turn to specialists for the preparation of important documents.

Many people are interested in whether the participation of a notary is necessary when purchasing an apartment in shared ownership. As noted above, the mode of use of property is of particular importance.

As for shared ownership, changes were made to the legislation, in accordance with which the procedure for concluding civil contracts for these types of property has changed.

According to the law, from June 1, 2021, it is prohibited to sell, buy, give or change housing in shared ownership without the participation of a notary. Now a transaction with shares in an apartment must be notarized. Without this, it will not be possible to register the transaction in Rosreestr.

Spouse's consent to purchase real estate

The Family Code of the Russian Federation stipulates that all property acquired during marriage is considered the common property of the spouses, regardless of which of them it is registered in the name of.

Registering real estate for two spouses requires obtaining written consent to conduct a transaction with such property.

The consent, drawn up in writing, is certified by a notary. And although in the case of common shared property the permission of the spouse is not required, many still prefer to obtain such a document in order to avoid disputes in the future.

Find out in more detail in what cases it is required.

Procedure for concluding a purchase and sale agreement

Registration of a transaction with a notary in the case of shared ownership is becoming increasingly popular. Signing a document at a notary's office will guarantee that everything will be done correctly, and in the event of litigation or other disagreements, the transaction will have legal force.

Let us remind you: the law does not establish a requirement to contact a notary, so you can draw up a purchase and sale agreement yourself.

Check out what the purchase and sale agreement for common property looks like:

State registration procedure

The transfer of ownership of real estate is subject to state registration. To do this, you need to contact the Rosreestr branch or the Multifunctional Center with all the documents.

You can also submit your application by mail or online.

List of required documents

Those who are interested in how to buy an apartment in shared ownership must submit a whole package of documents along with the application for registration:

- the applicant's identity card;

- identification card and confirmation of the authority of the representative in the event of an application being submitted by a third party;

- documentation for the apartment;

- receipt for payment of state duty.

Payment of state duty

To register the transfer of ownership of real estate, you must pay a state fee. Its rates are established by the Tax Code of the Russian Federation.

Currently, the mandatory payment for individuals is two thousand rubles.

In what cases is a notary needed?

Notarization of a transaction requires expenses, and significant ones at that. Therefore, you should immediately understand whether a notary is needed when conducting transactions.

In accordance with the latest amendments, certification of a transaction by a notary is required only when alienating property that is in common ownership, as well as when dividing shares. When purchasing a home, no mandatory certification is required.

Therefore, spouses buying an apartment in 2021 do not need to have the transaction certified by a notary if:

- they purchase an apartment from a sole seller;

- intend to own housing as common property.

But to allocate shares, you will have to visit the notary chamber. Or if children are involved in the transaction. Or if there are several sellers .

Purchasing real estate with a mortgage

Buying a home together is not affordable for everyone, so many families take out a mortgage on square meters. Thanks to loans, an increasing number of citizens have the opportunity to acquire their own housing.

This also has its own characteristics that should be considered in more detail.

Buying a home using maternity capital

The maternity capital program was created to help families with children improve their living conditions. Of course, state aid funds will not be enough to fully purchase a home, but making a first mortgage deposit will be enough.

The legislation contains restrictions on the use of maternity capital money, so it will not be possible to spend it for any purpose.

Find out how to use maternity capital to buy a home.

Mortgage for housing in shared ownership

The legislation provides for a shared mortgage for the acquisition of property in shared ownership.

Families often resort to this method of purchasing real estate to purchase square meters in new buildings. To do this, a standard package of documents is submitted, and the sale and purchase agreement itself specifies the shares of each participant.

Find out if you can get a mortgage without your spouse’s consent.

If the share is allocated to children

Children can become homeowners in the following cases:

- if housing was purchased with maternity capital funds;

- if the parents decided to voluntarily allocate shares to them (donate them);

- if an alternative transaction is made with the allocation of a similar share to a minor.

Buying a home with children among the owners is associated with a number of features: according to the law, parents cannot take shares belonging to their children, and vice versa . Therefore, shares in the apartment being purchased must be allocated immediately. Such property cannot be shared. In addition, such a transaction takes place under the control of the guardianship authorities.

Tax deduction when purchasing real estate

According to the Tax Code, deductions for the purchase of property in shared ownership are distributed according to the amount of expenses of each spouse, confirmed by payment documents.

If the property is registered in the name of one of the spouses, then the husband and wife can independently distribute the expenses incurred based on the appropriate application.

This position of the legislator is due to the fact that, in accordance with the RF IC, both spouses participate in expenses regardless of which of them actually incurred them.

Find out more about tax deductions when buying an apartment.

The role of the marriage contract

A marriage contract drawn up between spouses is the most significant document that regulates the distribution of shares. A husband and wife can agree on how their share of property will be distributed between them in the event of a divorce. It no longer matters how the apartment was purchased, to whom it was officially registered and other factors.

The amount of shares specified in the marriage contract remains with the former spouses in the event of divorce.

Features of allocating a share in a purchased apartment

If an apartment was purchased under a sale and purchase agreement, the question arises of how to allocate the spouses’ shares in it. As a rule, the shares of the parties are specified in the text of the agreement.

You can also draw up an agreement on the allocation of a share at any time in family life and even after the dissolution of the marriage relationship.

The purchase of real estate by spouses is certified by a notary.

As a general rule, the parties have equal shares, but the agreement can also provide for a different division procedure.

If a child is involved in the transaction

If a child is involved in a home purchase transaction, the following nuances must be taken into account:

- If the child is one of the owners of the apartment being sold, permission from the local guardianship authority must be obtained for the sale (Part 3 of Article 60 of the RF IC and Part 2 of Article 37 of the Civil Code of the Russian Federation). Otherwise, according to Part 4 of Art. 21 of the Federal Law “On Guardianship and Trusteeship”, these bodies must challenge the transaction in court.

- According to § 7 of Chapter 30 of the Civil Code of the Russian Federation and the Federal Law “On State Registration of Real Estate”, children under 14 years of age do not sign an agreement. Either their parents or their substitutes act for them. After 14 years of age, they can be parties to the transaction, but only with the consent of the above persons.

How is the proportion of minors determined?

The share of children in purchased housing is determined according to the general rules of civil law . However, there is one caveat: if an apartment is purchased with money received from the sale of an apartment with a minor’s share, then he must ultimately own no less a share.

That is, relatively speaking, if a child owned 1/3 of the share in the old apartment, then it is no longer possible to indicate and register 1/4 in the agreement - the guardianship will not give its consent to the transaction.

How does home division occur during divorce?

Divorce involves resolving many issues, including property issues. In the absence of a marriage contract, which happens quite often in our country, to protect the rights of spouses to property acquired during marriage, they have to go to court.

Some citizens can find a common language and resolve everything voluntarily by concluding an agreement on the division of property.

How to divide an apartment purchased during marriage

Real estate acquired during marriage is the common property of the spouses and is divided in half. However, the agreement sometimes determines other shares of the parties.

The division of an apartment purchased during marriage will not take place if the property is considered the personal property of the person or a separate regime of use is established for it.

Read more about the division of an apartment during a divorce.

We bought an apartment with our husband’s money, and then got divorced. How to divide property - a lawyer answers

Disputes about the division of property during divorce are endless. Most of the questions that come from readers in the “Right to Defense: Advice from a Lawyer” section relate specifically to this topic. Which, however, is not surprising: if spouses whose life together has not worked out do not manage to solve the problem peacefully, legal procedures are involved. There are so many nuances and subtleties here that it’s impossible to figure it out without a competent lawyer. Specific situations will be analyzed by lawyers from the Oktyabrsky district of Grodno, Veronika Leichonok, Natalya Pigareva and Elena Bodrova.

My brother bought a one-room apartment, then got married, had children, and the family decided to expand. The real estate agency processed the sale of a one-room apartment and the purchase of a two-room apartment (house) at the same time, and reported about $2 thousand (the parents of both gave $1 thousand). Now the spouses are divorcing (this case is almost finalized, a claim for divorce is in court, alimony has already been formalized, and he is paying). Question about the house: whose is it? Is it considered jointly acquired property if it was actually purchased with the brother’s personal money? How, as a general rule, does the division of property occur in this case? What are the chances of the ex-spouse getting a larger share when dividing the house?

Property acquired during marriage, regardless of which spouse acquired it or which of them contributed money, is their common joint property. Spouses have equal rights to own, use and dispose of this property, unless otherwise provided by the marriage contract.

Since a two-room apartment (house) was purchased by spouses during marriage, in accordance with Part 1 of Art. 23 of the Code on Marriage and Family, this residential premises is their common joint property.

As follows from Art. 259 of the Civil Code, property acquired by spouses during marriage is in their joint ownership, unless an agreement between them establishes a different regime for this property. Property that belonged to each of the spouses before marriage, as well as property received by one of them during marriage as a gift or by inheritance, is his property. The rules for determining shares in common property during its division and the procedure for such division are established by the legislation on marriage and family.

In accordance with the explanation contained in paragraph 12 of the resolution of the Plenum of the Supreme Court of the Republic of Belarus dated March 26, 2003 No. 2 “On the application of legislation by courts in resolving disputes related to the ownership of residential premises,” residential property erected or acquired by spouses during marriage the premises (except for those received as a gift or by inheritance) are their common joint property, unless otherwise provided by law or agreement. When dividing the property of spouses, the size of the shares of each of them in the right of joint ownership of residential premises is determined in accordance with Art. 259 Civil Code and Art. 24 Code on Marriage and Family; If there is a marriage contract, the court proceeds from its terms.

The question posed does not specify whether a marriage contract was concluded between the spouses. There is no information whether an agreement was reached to increase your brother’s share in the disputed apartment (house) acquired during the marriage after he contributed the money received from the sale of the apartment (which is his personal property) to purchase the apartment (house). From the circumstances set out in the question, it follows that the disputed residential premises were purchased by your brother and his wife in the interests of the family, to improve living conditions.

The spouses' shares of acquired property during marriage are recognized as equal, regardless of the specific share of each spouse's contribution to the common property. At the same time, the court has the right to take into account the noteworthy interests of one of the spouses and increase his share in the disputed property.

The court may deviate from the equality of shares, taking into account the fact that before purchasing the disputed apartment, on the same day your brother sold the apartment owned by him as personal property. The fact that your brother invested the funds received from the sale of the apartment into the purchase of the disputed apartment must be confirmed by evidence. In accordance with Part 1 of Art. 179 of the Civil Procedure Code, each party proves the facts that it refers to as the basis for its claims or objections.

Thus, when dividing the disputed residential premises, your brother has the right to claim an increase in his share in the ownership of the disputed residential premises due to the fact that he invested in the purchase of this residential premises the money received from the sale of the apartment, which is his personal property.

There are two apartments. One - two rooms, the second - one room. The ex-wife and daughter live in the two-room apartment. I'm in a one-room apartment. In what cases in your practice did the courts deviate from equality of shares? I want to divide by 1/2.

The question does not specify how the spouses acquired one-room and two-room apartments (based on a purchase and sale agreement, gift, by inheritance, etc.), nor does it specify the period of acquisition of the apartments (before marriage or during marriage). When answering the question posed, it will be taken into account that the disputed residential premises were acquired by the spouses during the marriage on the basis of a purchase and sale agreement.

Taking into account the provisions of Part 1 of Art. 23, part 1 art. 24 of the Code on Marriage and Family it follows that one-room and two-room apartments are the common joint property of the spouses. In the case of division of jointly acquired property, the shares of the spouses are recognized as equal, unless otherwise provided by the marriage contract. The court may deviate from recognizing the shares as equal, taking into account the interests of minors and disabled adult children in need of assistance, or the noteworthy interests of one of the spouses.

From paragraph 18 of the above-mentioned resolution of the Plenum of the Supreme Court, it follows that if spouses own several residential premises by right of joint ownership, in the absence of an agreement on their division between the spouses, the court takes into account the size, cost of residential premises, family composition of the former spouses and other relevant circumstances has the right to divide these residential premises, allocating separate residential premises to each of the participants in the common property. In the event that one of them is given items whose value exceeds the due share, the other spouse is awarded the appropriate monetary compensation (Part 3 of Article 24 of the Code on Marriage and Family).

The spouses live separately, do not maintain a joint household, but are not divorced. Can a wife claim an apartment that her husband will buy before the marital relationship ends? How to prove that he spent his personal funds to purchase it?

If the spouses stopped running a common household before the divorce case was considered in court or a joint application was submitted to the body registering acts of civil status, then only the property that was their common joint property at the time of termination of the common household is subject to division.

The fact that the spouses live separately and have stopped running a common household for a certain time must be proven in court. This can be proven by witness testimony, the presence of other de facto marital relations (living in another actually created family), the spouse’s collection of alimony for the maintenance of minor children and for his own maintenance from the other spouse, and other written evidence. It is also necessary to confirm the fact that the spouse received a certain amount of money for the purchase of real estate after the termination of the common household (inheritance, donation, other sources of income).

Before marriage, the man formalized the privatization of the apartment and for a long time paid the funds from his personal savings. Will the wife be able to claim a share in the apartment in the event of their divorce?

In accordance with Art. 137 of the Housing Code, residential premises (share in the ownership of residential premises), privatized by spouses living together, are their common joint property if both participate in its privatization (including by investing funds belonging to them under the right of common joint ownership).

Thus, in the case of a wife moving into an apartment in accordance with the procedure established by law, living in it, running a common household, making privatization payments from common joint funds, the wife can claim recognition of her share in the ownership of the apartment in proportion to the funds contributed during the marriage .

The couple took out a loan from the bank to purchase a two-room apartment. 70% of the borrowed funds were repaid by the wife from the proceeds from the sale of her own premarital real estate (she sold her 1-room apartment). How will property be divided between spouses in the event of a divorce? Can a wife count on a larger share and how can she justify her position in court?

Residential premises erected or acquired by spouses during marriage (except for those received as a gift or by inheritance) are their common joint property, unless otherwise provided by law or agreement.

When dividing property, the size of the shares of each spouse in the right of joint ownership of residential premises is determined in accordance with Art. 259 of the Civil Code and Art. 24 Code on Marriage and Family; If there is a marriage contract, the court proceeds from its terms.

In the absence of a marriage contract or other agreement between the spouses, if the specified money was invested in the interests of the family, the shares of the spouses are recognized as equal. The court may deviate from recognizing the shares as equal, taking into account the worthy interests of one of the spouses. The share of one of them, in particular, can be increased if the other spouse avoided working or spent common property to the detriment of the interests of the family.

In relation to this situation, one should also be guided by the explanations of paragraph 14 of the Resolution of the Plenum of the Supreme Court of the Republic of Belarus dated March 26, 2003 No. 2 “On the application by courts of legislation in resolving disputes related to the right of ownership of residential premises.” In accordance with the clarifications, if the payment for the loan and other monetary obligations for the residential premises was made by one of the spouses after the actual breakup of the family from their own funds, the court has the right to satisfy his demands for an increase in the share in the ownership of the residential premises only if there is evidence that that the second spouse deliberately avoided paying these obligations.

Do adult children have a share in the division of housing purchased on credit during marriage?

In accordance with Art. 259 Civil Code, Art. 24 of the Code on Marriage and Family, property acquired by spouses during marriage is in their joint ownership, unless an agreement between them establishes a different regime for this property. When dividing property, the court also takes into account the common debts of the spouses and the rights of claim for obligations arising in the interests of the family.

Thus, when spouses purchase an apartment on credit, children do not acquire ownership rights to the residential premises.

If a gratuitous subsidy was used for the construction or purchase of residential premises, then the family members on the basis of which it was calculated may demand recognition of their right to a share in the ownership of the residential premises based on the amount of the subsidy accruing to each of them.

According to BELTA

Donation of real estate between spouses

It is not always possible to transfer housing to each other under a gift agreement, or to determine the procedure for its division in the event of divorce.

Property acquired during marriage by one of the spouses can be gifted to the husband or wife. In this case, it will be considered the personal property of the donee, and the other party will not be able to claim it in the event of a divorce.

Find out more about donating an apartment between spouses.

Content

- Concept of marital property

- Property regimes in marriage: what they are and why you need to know them

- Legal regime of property and its features

- Contractual property regime

- Types of property of spouses

- What is common joint property?

- Shared property of spouses - legal nuances

- What property is considered personal property of spouses?

- Legal services in family law

Sale of spouses' home

Throughout family life, a couple needs to improve their living conditions, especially after the birth of children. From time to time it becomes necessary to sell housing that is already owned by spouses.

Selling a home during marriage also has its own characteristics. In many ways, the procedure depends on the type of common property in which the housing is registered.

Sale of jointly owned real estate

Housing that is jointly owned by spouses is managed jointly by the couple by mutual consent. To sell it, you will need the notarized consent of the husband or wife.

The sale of real estate registered in the name of one of the spouses also has its own distinctive features.

Read how to sell an apartment in joint ownership.

Sale of real estate in shared ownership

Each owner can dispose of his share. However, the preemptive right of the remaining owners to purchase a share is of particular importance.

Before selling, a person must notify the other co-owners in writing of their desire to sell their part of the property. They are given a month to consider such a proposal.

If during this time no one volunteers to act as a buyer, the seller is allowed to sell the housing on the same terms to other persons.

Find out more about selling an apartment in shared ownership.

If you take out a mortgage

If the apartment was purchased with a mortgage, then it is registered as the joint property of the spouses. The mortgagee of the mortgaged apartment is the bank. The parties cannot allocate shares until they pay off the debt and remove the encumbrance.

After paying off the mortgage, the parties can arbitrarily distribute the shares depending on their needs - or leave the housing in joint ownership.

The situation is more complicated when the spouses divorced while the mortgage was being repaid. In this case, the issue of dividing shares and debt obligations is resolved jointly with the bank. Spouses can divide the home immediately and take out a separate loan for each share, or they can divide the property later, after paying off the entire mortgage.