How is a deed of gift for a house drawn up between close relatives? To give an accurate answer to the question, you need to consider many nuances.

Donation is one of the parts of civil transactions. It is regulated by the Civil Code of the Russian Federation. Specifically, the gift agreement is discussed in Art. 549. The gift agreement itself is described in Art. 572. According to it, the donor transfers real estate free of charge. The recipient becomes the sole owner. None of his family can claim this received property.

Issues regarding the preparation of deeds of gift are resolved in accordance with current Russian laws.

Who can legally be considered a close relative?

Who are close relatives? This concept, as well as a detailed list of those included in it, can be found in any regulatory acts of the Russian Federation. You should pay attention to some features of the interpretation of closeness among relatives.

For example, SK in Art. 14 thinks:

- Close relatives are parents and children, grandparents, grandchildren. These also include siblings and half-brothers, as well as adopted children with adoptive parents;

- Husband and wife are not considered close relatives because they are not related by blood. They are only family members. In case of divorce, this status is also lost. The Criminal Procedure Code has a slightly different attitude to the issue of kinship.

Cancellation of deed of gift

By the will of both parties, the transaction can be canceled in the following cases:

- in the event of the death of the donee, if the contract does not provide for the rights of his heirs in accordance with paragraph 1 of Article 581 of the Civil Code of the Russian Federation;

- as a result of the donee’s refusal of property (Article 573 of the Civil Code of the Russian Federation). The donor may seek compensation from the donee for damage caused by his refusal;

- when committing physical violence or an attempt against the donor or his family (clause 1 of Article 578, as well as Article 179 of the Civil Code of the Russian Federation);

- the donor survived the donee (clause 4 of article 578 of the Civil Code of the Russian Federation);

- bad attitude of the donor towards the gift, which may lead to its loss (clause 2 of Article 578 of the Civil Code of the Russian Federation);

- deterioration in the life (health, finances, etc.) of the donor; such cancellation is prescribed in Article 577 of the Civil Code of the Russian Federation.

Draw up a gift agreement in accordance with the Law

When drawing up a deed of gift, the following fundamental codes of the Russian Federation are used:

- Civil and Family;

- Land and Tax.

You should know that a plot of land and a house standing on it cannot be donated separately. You also cannot make a transaction on a house that is secured or mortgaged.

The conclusion of an agreement to donate a house is possible only in writing. There is no need to have the document certified by a notary. According to changes in 2013, land received as a gift does not need to be registered at the state level. The fact that the property now has a different owner is registered.

The agreement is drawn up in two copies; according to the rules, the donor and recipient of the deed of gift must have the originals of the document signed by both parties.

Basic principles of giving

When registering a gift, as with any legal action, there are mandatory principles that must be observed by both parties.

- Donation is made only with the consent of the parties;

- Transfer of ownership is carried out free of charge (free of charge);

- The donor does not receive ownership of any reciprocal material values or actions from the donee, and does not lay claim to them.

- The donor cannot voluntarily revoke the formalized and registered property, with limited exceptions. Each case is specified in law.

A special feature of donating a house is the obligatory transfer of ownership of the land.

Some nuances

The procedure for donating a house to a close relative in the Russian Federation has its own characteristics that citizens should be aware of.

A plot of land can also be transferred by a power of attorney certified by a notary.

It must indicate the passport details of the person to whom the gift is made, and indicate the specific site.

Please note: donating a house separately without a land plot is impossible!

You can draw up a deed of gift for a house with land in different ways:

- donate the entire property;

- allocate some part of the house and a share of the land;

- donate a share of the house, indicating specifically the premises that will go to the recipient;

- You can register a deed of gift as shared ownership by specifying several people in the agreement.

You can use other gift options that are available in the relevant legal documents.

Selected features

- Donated real estate owned by one of the spouses is not subject to division between the spouses, but remains with the donee (Clause 1, Article 36 of the RF IC).

- If all shares of the property are privatized, then one parent, without the permission of the second parent, can draw up a deed of gift for their child (Articles 26, 28 of the Civil Code of the Russian Federation).

Features of the approach to deed of gift

Samples of deed of gift have a standard form.

It contains all the necessary information:

- date and place of the transaction;

- full passport information about the donor and donor;

- cadastral data of the house and plot indicating the exact address and area, number of rooms;

- certificate of ownership of the house and land (with all details), confirming the absence of encumbrance on third parties.

People with psychological health problems (even if they are close relatives) cannot receive land as a gift.

Please note: to avoid any complications in the future, you must listen to the advice of lawyers involved in the preparation of documents.

Advantages and disadvantages

If there is a need to re-register a house to another person, most often they choose between a gift deed and a will. Before making the final choice, you need to figure out what is better: a gift or an inheritance.

The comparative table below presents the pros and cons of these legal instruments from the point of view of the donor (testator) - the one who intends to dispose of his property.

In general, when choosing a specific instrument, you need to take into account the interests of both parties. If re-registration is used as a method of influencing the future owner, then it is in the interests of the current owner to draw up a will - this way he will retain the house during his lifetime.

For the future owner of real estate, a deed of gift is a less risky and more preferable instrument. It is more difficult to challenge in court, and registration of property rights occurs during the lifetime of the former owner - immediately after signing the contract.

Attention. It is impossible to write a gift agreement that will come into force only after the death of the donor - this is prohibited by law.

You can learn more about what is better than a deed of gift and a will from our previous post.

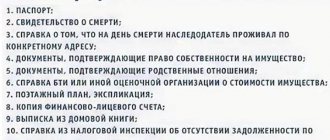

Package of documents

To carry out a transaction, you need to contact the Federal Registration Service at the location of the object. The citizen will be provided with a list of necessary documents that will be required.

The document folder is quite large:

- Passports of the donor and recipient.

- Certificate of ownership of the house and land that will be donated. You cannot do without a receipt for payment of the state duty on the right of ownership.

- The donor writes a statement that the rights will be transferred to another person. A citizen who receives a house or a share of it also needs to write an application. It concerns the registration of rights to acquired real estate.

- Gift deed for the house. When a notary helped draw up the gift agreement, then in addition to the original, a copy will be required. If the notary did not take part in the preparation of the documents, the originals are also needed, as well as the original establishing the right to the transaction.

- Cadastral passport for a house and land plot (not given separately).

- If, in addition to the donor, other relatives live in the house (joint property), then they must write a consent to the donation and have it certified by a notary.

- For an inventory assessment of the house, you will need a certificate from the BTI.

If the citizen in whose name the deed of gift is drawn up has not reached the age of majority or is incapacitated, then a guardian or trustee must be present during the transaction.

After the residential building is officially transferred to a close relative, he becomes its authorized owner, owner.

Please note: the gift agreement may be refuted. This can happen when, after transferring the property, the donor's standard of living has deteriorated. This cannot be allowed.

Place of signing the contract

There are no restrictive conditions in legislative documents regarding the procedure for concluding a deed of gift. In practice there are three options:

- At home at one of the parties, if the donor or recipient is confident that they will be able to arrange everything correctly;

- In the notary's office, who will check the correctness of registration and filling in the required details. This method will allow you to avoid mistakes, due to which the paper may later be challenged in court, but you will have to pay for notary services.

- At the office of the Federal Registration Service, where the registration of this agreement is being carried out, specialists will help you draw up the text of the agreement, or you can use information boards with samples of completion. In this case, you will have to make an appointment in advance due to queues.

In the latter case, contract drafting services are included in the registration price.

When can I pick up the documents?

As soon as the documents are verified, a receipt is issued for their receipt.

This document contains the date after which you can come for the deed of gift. And specifically the date of receipt.

Today there is no need to stand in line - by registering on the Rosreestr website, you can find out whether the gift deed is ready.

Please note: according to Russian legislation, 30 days are allotted for working with documents.

To receive the document, both parties must appear, it is possible at different times.

If the agreement is drawn up incorrectly (even one word with a mistake or typo), then it will not be registered. An unregistered deed of gift has no legal force.

When going to Rosreestr, do not forget about your passport and receipt; only with these documents will the recipient be able to receive a registered deed of gift.

Who can I apply for?

It is known that real estate re-registration procedures are not always suitable for a specific situation. In some cases, it matters greatly who the parties to the contract are. Let's figure out who can issue a deed of gift for a house.

The following restrictions are provided for the re-registration of a house under a deed of gift according to the personnel of the parties to the agreement:

- Property cannot be given to children under 14 years of age.

- It is prohibited to give gifts to employees of educational organizations (teachers, educators, head teachers, directors, etc.), medicine (doctors, medical personnel), social assistance by persons who receive these services. For example, a patient cannot donate a house to a doctor who is treating him.

- Gifts to officials are not allowed.

In other cases, you can donate a house to either your relative or any third party. Gift agreements are very popular when real estate is transferred specifically to relatives - children, parents, brothers and sisters, and so on. This is due to the highly trusting relationships built in the family.

There are several nuances that need to be taken into account when drawing up a deed of gift for a house:

- It is better to replace the gift of a house acquired jointly by spouses between husband and wife with other methods - allocating a spousal share or signing a marriage contract;

- if a minor between 14 and 18 years old receives the property, he can sign the contract himself with the consent of his parents;

- If real estate is given to a minor who has not reached 14 years of age, then the parent signs the contract for him.

Attention. There is no need to obtain permission from the guardianship authority to re-register in the child’s name.

What you need to know about taxation

Real estate of any type that is given as a gift is subject to an income tax of 13% (the market value of the house and land is taken into account). We are talking about the procedure of donating to a close relative or family member. It is they, according to practice in the Russian Federation, who participate in such a transaction.

In this case, there are special rules regarding the payment of taxes:

- If the donor and the recipient are related, then the donor does not need to pay tax for the transfer of property as a gift, in a word, personal income tax. But he is obliged to pay property tax according to the law.

- The property tax rate is determined within 2%, taking into account the inventory value of the property. It must be paid every year.

- If the real estate tax is not paid, then problems may arise for the person who received the house (part, share) as a gift through a deed of gift. The notary must mention this when signing the deed of gift, and this is noted in the document. The notary himself notifies the tax authorities that the donation has been completed. He also indicates the degree of relationship of his clients.

- In addition to the tax, you will have to pay for the services of a notary if the document is drawn up in his presence. There is no exact rate: each region has its own. The same as for individual lawyers.

Please note: citizens must understand that tax and duty are different concepts.

When registering a deed of gift for a house or part of a house, a state fee in the amount of 2 thousand rubles is paid by the donating party. The fee for a plot of land is 300 rubles.

Being closely related does not exempt you from paying these fees. They are mandatory for everyone.

How much does a deed of gift for a house cost?

The fee for a home deed can vary significantly depending on how it is executed.

The minimum amount will be obtained if you fill out all the documents yourself. In this case the price includes:

- state duty for state registration of real estate and transactions with it in accordance with Article 333.33 of the Tax Code of the Russian Federation in the amount of 350 rubles;

- bank services, if the state duty is paid at a bank branch. When transferring via Internet banking, no service fee is charged.

If a notary is involved in the preparation of the deed of gift, then a fee for notarization and services at notary rates are paid.

According to clause 5 of Article 333.24 of the Tax Code of the Russian Federation, the state duty is 0.5% of the contract amount, but the amount is limited to a minimum level of 300 rubles and a maximum of 20 thousand rubles.

In addition, there are standard tariffs for registration of deeds of gift, which are approved in the legislation on notaries. They depend on the degree of relationship between the parties to the contract and the value of the transferred object. In article 22.1. Clause 1 indicates all tariffs for certifying transactions for the alienation of real estate.

If the amount specified in the contract is less than 10 million rubles, then the next of kin pay the notary 0.2% of the total cost plus 3 thousand rubles.

For larger amounts, tariffs change. For relatives with a cost of 10 million rubles or more, the tariff = 23 thousand rubles and an additional 0.1% of the amount over 10 million rubles. The maximum limit on the amount for issuing a deed of gift is 50 thousand rubles.

For unrelated persons the rates are higher:

- up to 1 million rubles – 0.4% and 3 thousand rubles;

- from 1 to 10 million rubles – 0.2% of the amount above 1 million rubles. plus 7 thousand rubles;

- more than 10 million rubles - 0.1% of the cost above 10 million rubles. plus 25 thousand rubles.

The maximum amount for residential buildings and land plots under them is 100 thousand rubles.

In addition to these fees, notaries charge a fee for providing technical services (printing, registration). Payment amounts vary depending on the region and range from 2 to 7 thousand rubles.

Free legal consultation We will answer your question in 5 minutes!

Call: 8 800 511-39-66

At the end of the calendar year by 30.04. persons who received a house with a plot of land as a gift and who are not close relatives must submit a declaration to the tax service and pay 13% of the cadastral value of the received property by July 15. If the recipient is not a non-resident, then he pays 30% of the cost.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

This is also important to know:

Donating a share in an LLC: what is important to know when donating a share to another LLC participant, relative or third party

Close relatives, including parents, children, spouses, grandchildren, brothers and sisters, are exempt from paying personal income tax and filing a declaration.

Who can be the donor

There are no restrictions for gifts cheaper than 3 thousand rubles. As for more expensive gifts, the donor is not subject to many requirements of the Civil Code of the Russian Federation Article 575. It should be:

- As an owner of property, you cannot give someone else’s property or something that you own more than once.

- Mentally healthy and fully aware of your actions at the time of signing the contract.

Let's talk about the last point in more detail. If a person was under the influence of alcohol, drugs, or gave something under pressure, this does not count. Those who are declared incompetent by the court cannot present anything either. Moreover, this cannot be done on their behalf.

Children under 14 years of age cannot act as donors. You cannot give gifts on their behalf. That is, if a child inherited a share in an apartment from his grandmother, the parents cannot give it to someone. From the age of 14, a child can give expensive gifts with the written consent of his mother, father or legal guardian. A person receives the full package of donor rights from the age of 18, or from 16 if he is emancipated by law.

Gifts that are transferred from one company to another are also prohibited. From a legal entity to an individual and vice versa - as much as you like.

Preparation for registration through the MFC

In all branches of the MFC there are special vending machines for issuing coupons for receiving visitors on a first-come, first-served basis, but for real estate transactions it is better to choose a pre-registration. This will speed up the procedure for accepting documents.

You can make an appointment at the MFC 30 days before the transaction. Pre-registration is made by:

- personal appeal to the territorial office;

- a telephone call to the hotline or directly to the desired department (the number is publicly available);

- leaving an application on the public services portal or regional MFC websites.

In the application, the client provides the following information:

- Full name for individuals;

- name and contacts of the organization for legal entities;

- in any case, you must set the desired date and explain the reason for your visit.

Regardless of the choice of the pre-registration form, the visitor will receive a ticket indicating the time of visiting the office, the address of the MFC and the reception window number.

The coupon cannot be transferred to third parties, and this time cannot be used to resolve another issue (for example, to register not the donation of an apartment, but its purchase and sale). If for some reason clients are unable to show up on the specified date, they can notify a service employee at any time and choose a different time.

Item

The main essential condition in a transaction of this kind is its subject matter. The subject is the residential building itself, as well as the land plot on which the property is located. In the section where information about the item is written, a comprehensive description of the house that is being donated should be given. So it looks like this:

The Donor transfers into ownership of the Donee a residential building, which is located at the address: Kurgan region, Kurgan city, Zaozerny village, house 16. The specified house is built of log and brick material, includes 2 (Two) floors, 6 (Six) rooms including a kitchen , 2 (Two) restrooms and 1 (One) storage room. The total area is 114 (One hundred and fourteen) square meters. The property includes additional structures and structures that are attached to it: parking for two cars, a bathhouse, a summer veranda. There is a plot of land measuring 10 (ten) acres. The owner of the above real estate until the conclusion of this agreement is the Donor. The donor and the recipient are close relatives to each other, namely father and son (other family ties may be indicated).

Grounds for refusal of registration

According to the rules for registering a deed of gift for real estate, the donee must agree to accept the gift by signing an agreement. If the donee subsequently refuses to accept the gift, then such refusal must also be made in writing .

Important

If the transaction documents have already been submitted to the MFC or Rosreestr, then to cancel the transfer of rights it is necessary to submit a corresponding application. This must be done before the end of the re-registration process .

There are also other reasons, upon the occurrence of which the registration authority will have the right to refuse to carry out a transaction . These include:

- The donation occurs on behalf of an incapacitated person without the permission of the guardianship and trusteeship authorities.

- The gift is transferred in favor of the incapacitated person without the permission of the legal representatives.

- There is no consent of other owners to transfer the property.

- The list of documents provided is not complete.

- There are factual errors in the contract.

- The mortgagee's permission to dispose of the property was not obtained.

- The agreement contradicts the terms of gratuitousness, since it contains requirements for the donee.

- A citizen does not have the right to dispose of property.

How to donate a plot of land in 2021

To ensure that the gift agreement is not subsequently challenged in court, experienced lawyers on our site recommend that the parties adhere to the following procedure for completing the transaction:

- obtaining the consent of the donee to accept a plot of land that the donor wishes to transfer to him, realizing that in this way he will increase his property by reducing his own;

- discussing the clauses of the agreement between the parties to the transaction, collecting the necessary documents and contacting a notary for support of the transaction (not necessary, but highly recommended);

- payment of the established state donation fee in full and attaching a receipt for this to the package of documentation;

- signing of a real donation agreement by the parties;

- mandatory re-registration of ownership of donated real estate.

ARTICLE RECOMMENDED FOR YOU:

Do I need to submit 3-NDFL when donating real estate?

As we already mentioned above, you can draw up a deed of gift either independently or with the help of a notary, which, although not mandatory in 2021, is recommended by most specialists in the legal field.

Simply put, in most cases it is difficult for people without experience in conducting legal procedures to notice the pitfalls, contradictions and errors in the content of the act, which in turn acts in 95% of cases as a basis for annulment of the gift agreement.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

Therefore, if you doubt any part of the transaction or the need for it in general, be sure to get a free online consultation from the duty lawyer of our website and reduce the risks of a conflict to zero!

As our practice shows, it is almost impossible to challenge in court an agreement certified and drawn up by a specialist at a notary office!

Also, to register ownership of a land plot, both the donee and the donor must appear at the registration authority, if the transaction was not accompanied by a notary. In the latter case, this stage may be the responsibility of a specialist.

What documents are needed

Remember that when signing the deed of gift and registering it, the parties to the transaction are required to have on hand documents from the following list:

- land donation agreement between relatives or strangers, at least in 3 copies;

- passports of the parties to the transaction;

- the donor's title documents for the donated real estate;

- cadastral passport;

- written consent from other owners to conclude a deed of gift;

- certificate of plot allocation;

- all technical documentation about existing buildings erected on donated land (certificate from the BTI);

- a check confirming successful payment of the established state duty, in accordance with Article 333.33 of the Tax Code of the Russian Federation;

- certificates confirming the relationship between the donor and the recipient;

- statements about the absence of debts on this site;

- a statement of permission to carry out the transaction from the creditor, if the plot acts as collateral.

Registration of property rights, as a rule, takes in 2021 no more than 10 days from the moment of transfer of the above documentation to specialists of the registration authority (in accordance with Federal Law No. 218, regulating the procedure for state registration of real estate, adopted on July 13, 2015).

ARTICLE RECOMMENDED FOR YOU:

Donation as a gift for generally beneficial purposes

You can find out more detailed information about this from our previous articles on registering a gift agreement in Rosreestr or through the MFC.

Also, many of our regular readers asked whether it is possible to cancel a donation agreement for a land plot and, if so, how to avoid this? All gift transactions are subject to cancellation, which can, for example:

- worsen the financial situation of the donor of real estate or movable property;

- be declared invalid due to the fact that the donee has committed a moderate crime against the donor himself or his relatives (the same applies to cases where the party who accepted the gift treats the gift in bad faith, as a result of which it may lose its properties).

We will talk about this in more detail in one of the future articles - be sure to add us to your “Bookmarks” so as not to miss it!