What is part-time work

Part-time work is when an employee works in his free time from his main activity and performs additional tasks. The key here is in your free time. Here is an excerpt from the Labor Code.

An internal part-time worker is employed by one employer.

An external part-time worker works for several employers.

For an employer, part-time work is good because it allows you to fill the need for an employee without paying the full salary. For an employee, part-time work provides additional income and the opportunity to gain experience in another position.

Cleaners, cashiers, visiting accountants, lawyers, personnel and other specialists work part-time.

Ivan sells building materials. On weekdays the flow of customers is small, on weekends everyone is running for putty and new wallpaper, which means another cashier is needed. There is no point in taking on a full-time job: there will be downtime. Therefore, Ivan found Marina - an external part-time cashier, a weekend cashier. She works part-time on Saturday and Sunday. This is possible, because Marina’s main job is only busy on weekdays.

Legislative documents

The rules for part-time work, accounting and payment for such work are regulated by Ch. 44 Labor Code of the Russian Federation. Art. 282 of the Labor Code of the Russian Federation states that an external part-time worker must have at least two employment contracts; an internal part-time worker may have an additional agreement. Part 2 art. 287 of the Labor Code of the Russian Federation guarantees part-time workers the same social rights as main employees.

Letter from the Social Insurance Fund dated January 23, 2006 No. 02-18/07-541 explains the use of all types of earnings, including part-time earnings, to calculate the amount of sick leave benefits.

Federal Law No. 255 of December 29, 2006 determines the procedure for calculating and calculating disability benefits for external part-time workers.

How to register a part-time worker

Internal part-time workers do not present any new documents to the employer - you already have them, but bureaucracy still cannot be avoided.

To register an internal part-time worker:

- draw up and sign the second employment contract in two copies: keep one for yourself, give the second to the employee;

- fill out the second personal card with the data of the second employment contract;

- issue a second hiring order and familiarize the employee with it against signature within three days;

- entry in the work book - only at the request of the employee.

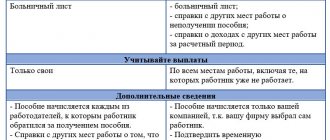

Benefits for external part-time workers who have worked for more than two years

Compensation is paid by all employers if a person worked in the same companies during the period taken for calculation (2 years) ( Part 2 of Article 13 of Law 255-FZ

).

Calculation of compensation

is carried out only upon presentation of the original certificate of incapacity for work, so the part-time worker needs to issue as many sick leaves as he has employers. Each form has its own individual number.

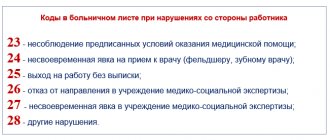

On sick leave certificates provided to enterprises in which the employee is registered on a part-time basis, the doctor puts a tick

in the appropriate field and

fills in the number

of the certificate of incapacity for work issued at the main place of work.

Attention

! Each enterprise calculates benefits based only on its own payments to the employee.

This algorithm also applies to maternity leave.

Sick leave and maternity leave for part-time workers

Part-time workers are paid sick leave, just like other employees under employment contracts.

to internal part-time employees in the same way as regular employees: to calculate, add up the remuneration for the main place and part-time position. Calculate your average daily earnings taking into account all payments.

There is a special procedure with external part-time workers. Who pays sick leave depends on where the employee works on the day the sick leave opens and where he worked during the pay period. The calculation period is two calendar years before illness. If an employee gets sick in 2021, the payroll period is 2021 and 2018.

If possible, consult with an accountant to avoid mistakes. For those who are used to relying only on themselves, we have collected all the situations in a table.

| Where does he work? | Who pays | What to consider when calculating benefits |

| With the same employers as in the billing period. | Every employer has sick leave for temporary disability and pregnancy and childbirth. One employer at the employee's choice - child care benefits. | Earnings for the pay period from the employer who pays the benefit. |

| Not with the same employers as in the payroll period. | One employer from those where the employee works at the time of the insured event - at the employee’s choice. If an employee decides to receive benefits from you, ask him to bring certificates from other places of work stating that benefits were not provided there. | Earnings for the billing period for all places of work. |

| With several employers, and in the billing period - both with the same and with other employers. | The employee chooses one of the companies in which he works at the time of the insured event. Or asks each employer to calculate sick leave for themselves. | In the first case: earnings for the pay period for all places of work. In the second case: earnings from the employer who pays the benefit. |

A one-time benefit for the birth of a child is paid by one employer. An external part-time worker is entitled to this benefit if he did not receive it at his main place of work.

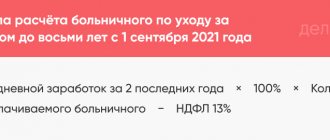

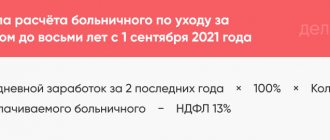

How are disability benefits calculated for part-time workers?

Let's figure out how to calculate sick leave for a part-time worker, taking into account direct payments from the Social Insurance Fund. The calculation is performed only for the first 3 days. When calculating the amount of payments, the minimum and maximum earnings limits established by law are taken into account.

IMPORTANT!

The average earnings for calculating the amount of benefits are set not lower than the minimum wage. If the employee actually earned less, it is calculated based on the minimum wage. The minimum wage should be calculated in proportion to the actual hours worked.

To calculate the maximum amount of sick leave, the following maximum bases for calculating insurance premiums are used:

- in 2021 - 865,000 rubles;

- in 2021 - 912,000 rubles.

The maximum allowable limits apply to each employer assessing the benefit. The total amount of payments taken into account for the calendar year from all places of work should not exceed the maximum base for calculating contributions to VNiM (Part 3.2 of Article 14 of Federal Law No. 255-FZ).

Let us denote the maximum and minimum values of average earnings for calculating benefits in the form of a table. The minimum wage in 2021 is 12,792 rubles.

| Limit | Amount of benefit per day, rub. | Calculation principle | Terms of payment for temporary disability certificate |

| Minimum | RUB 420.56 | Minimum wage × 24 months / 730 days 12792 × 24 / 730 | The benefit is calculated based on the employee's length of service. If an employee has worked for less than 5 years, 60% of average earnings are taken into account. Therefore, the minimum benefit amount is 252.36 rubles. in a day. |

| Maximum | 2434.25 rub. | (2021 limit + 2021 limit) / 730 days (865 000 + 912 000) / 730 | Increasing regional coefficients do not increase the maximum amount of average earnings for calculating VNIM benefits. That is, the limit is calculated without the use of territorial surcharges. |

IMPORTANT!

If your region has a territorial coefficient, then calculate payments taking into account increasing regional coefficients.

If an employee has provided a certificate of temporary disability to several employers, how to pay sick leave for an external part-time worker in 2021 - each of the organizations calculates the amount of payments in 3 days at least the minimum wage and no more than the established limit.

Dismissal of part-time workers

An employment contract can be terminated if a part-time employee is replaced by an employee for whom this position will be the main one. Companies with a small document flow often need a part-time accountant. Then the business grows, they hire a new full-time employee, and part with the part-time employee. This is fine.

Give your co-worker at least two weeks' notice. To do this, prepare a written notice and present it to the employee against signature. After this, issue a dismissal order, pay wages and compensation for unused vacation. Such dismissal is possible if the employment contract is concluded for an indefinite period. But a fixed-term employment contract cannot be terminated for this reason.

If a part-time worker resigns of his own free will, the procedure is the same as for regular dismissal. The only difference is in the work book, where the entry is made at the request of the employee.

The procedure for calculating benefits from the minimum wage

According to the general rules, temporary disability benefits are calculated based on the employee’s average earnings calculated for 2 calendar years preceding the year of temporary disability (Clause 1, Article 14 of Federal Law No. 255-FZ).

If during the billing period the employee did not have earnings or the average earnings calculated for these periods for a full calendar month are below the minimum wage, then the average earnings are taken equal to the minimum wage (clause 1.1 of article 14 of Federal Law No. 255-FZ, clause 15 (3) Regulations approved by Decree of the Government of the Russian Federation dated June 15, 2007 No. 375):

Further calculation of benefits is carried out according to general rules.

If the employee works part-time, the amount of the benefit is determined in proportion to the length of working time. If, for example, an employee works four hours instead of eight, to calculate benefits you need to take 0.5 minimum wage.

We will consider the features of each case of using the minimum wage for calculating sick leave separately. But first, we’ll tell you about the new procedure for calculating sick leave from 01/01/2021.

Common mistakes when working with part-time workers

Labor law expert, publisher of the Aktion-MCFER media holding, Veronika Shatrova, notes three common situations that can lead to serious fines from the labor inspectorate:

“Firstly, there are employees who can work part-time only with the permission of their main employer. In particular, this rule applies to the heads of the organization - Art. 276 Labor Code of the Russian Federation. At the same time, it doesn’t matter what kind of activity the manager plans to do part-time: run another company or become a teacher. Therefore, if you hire a part-time manager, be sure to require an additional document - consent. Violation of this rule will cost the company 50,000 rubles under Art. 5.27 Code of Administrative Offenses of the Russian Federation.

Secondly, if this is a former civil service employee, do not forget to notify him of his employment according to the general rules . The fact that such notice was sent during the main employment of your part-time worker does not matter. Otherwise, the company risks running into a fine of up to 500,000 rubles under Art. 19.29 Code of Administrative Offenses of the Russian Federation.

Thirdly, many companies continue to mistakenly believe that since a part-time worker works no more than half the working time and receives a proportional salary, then vacation only for half the days of the generally established number of rest days. Such a misconception threatens the company with another fine from the labor inspectorate of up to 50,000 rubles - in case of a primary violation. And up to 70,000 ₽ - if repeated. These are the sanctions established in Art. 5.27 Code of Administrative Offenses of the Russian Federation.”

Situation 1. Both sick leaves were issued due to illnesses of the employee himself.

If both sick leaves are issued to one person for two different diseases, you must first pay for all calendar days of incapacity for work for the first sick leave. The second sick leave is paid from the day following the day the first sick leave ends.

It is important to remember that in case of incapacity for work due to a general illness, that is, if the employee himself is ill, the first three calendar days are paid at the expense of the employer, and starting from the fourth, at the expense of social insurance funds.

This is what you should do when paying for your first sick leave. As for the second sick leave, the employer must pay for the first three days of the paid period of incapacity for work, which begins to run from the day following the day the first sick leave ends.

If the periods of incapacity for work on two different sick leaves coincide, the first three days are understood to be the first three days of the paid period of release from work on the second sick leave, and not the first three days of incapacity for work on it - they fall during the period when the first sick leave is still in effect.

Example. Payment for two sick leaves for different diseases when their terms overlap An employee of Volna LLC Trunov brought two sick leaves for different diseases, issued by different medical institutions: one from March 10 to March 19, the other from March 18 to March 25. Both certificates of incapacity for work were issued without violations and are subject to payment. Benefits for the first sick leave are paid:

- for March 10, 11, 12 – at the expense of the employer

- from March 13 to 19 – at the expense of the Social Insurance Fund.

For the second sick leave you need to pay:

- March 20, 21, 22 – at the expense of the employer

- from March 23 to 25 – at the expense of the Social Insurance Fund.

The period from March 18 to March 19 (overlapping periods of incapacity for work) is paid only once (for the first sick leave).

If the sick leave for one disease is not closed and you need to go to another clinic for another illness, there is no need to open a new sick leave there. Just show the doctor at the second clinic your unclosed sick leave, and he will extend it by changing the reason for the disability. Then this will be one insured event, and the employer will not have to pay for 3 days on the second sheet from his own pocket.

The legislative framework

Unlike part-time work or other similar activities, part-time work involves making all necessary contributions to various funds (for example, a pension fund), and also issuing sick leave. That is, the work is formalized officially and under a contract.

There are several types of part-time jobs:

Free legal consultation

+8 800 100-61-94

- internal;

- external.

With an internal employee, he carries out his activities in several positions in one organization. External involves official registration in different places.

Reference! The main place of work is the organization where the employee’s work book is kept and, accordingly, maintained. Enrollment is carried out on the basis of an employment contract, as well as a corresponding order.

As in the main place of work, this type of employment has its own characteristics and nuances. They also affect cases when an employee is given a certificate of incapacity for work. This issue is worth considering in more detail.

Like any labor activity, part-time work is regulated by the Labor Code (Chapter 44) . It includes all the nuances that must be taken into account when working:

- procedure for registering an employee for a position;

- Work mode;

- salary;

- vacation accrual;

- provision of compensation and guarantees.

Payment is regulated at the federal level by various laws. They depend on the cause of disability and the field in which the employee works. For example, for medical or cultural workers there is a law regulating such issues (“On the peculiarities of part-time work for teaching, medical, pharmaceutical and cultural workers”).

Important! When applying for sick leave when working part-time, you need several copies of it. The amount depends on how many jobs he works and how many employers he plans to apply to for benefits.

Let's sum it up

- The minimum wage benefit is calculated in four cases: the employee had no earnings in the billing period;

- average earnings for a full calendar month are below the minimum wage;

- the employee's insurance period is less than six months;

- if there are grounds for reducing benefits (in case of violation of the regime without good reason, etc.).

Let's sum it up

As can be seen from the presented material, the procedure for making payments for external part-time work is practically no different from the procedure for paying sick leave to any other employee. The same conditions and restrictions will apply.

However, this statement will be true only if the employee has been working part-time for the third calendar year. If during the previous 2 years the employee was not registered with the organization at all and did not provide certificates from other employers about non-receipt of benefits, then the employer has every right to refuse to pay him sick leave.

If the employee has worked only part of these 2 years, then he has a choice between the enterprises where he was employed at the time of receiving sick leave. The choice, as a rule, is made in favor of an enterprise or enterprises where the average earnings are higher.

Unlock access to the private part of Clerk with a Premium subscription. Get hundreds of webinars and online courses, unlimited consultations and other proprietary content for accountants.

Hurry up to subscribe with a 20% discount until October 15, 2021. Read more about “Premium” here.