From September 1, 2021, it will be possible to receive 100% of average earnings for sick leave to care for a child. But this will not affect all working parents, but only those who have children under eight years old.

We talked about the new rules for calculating sick leave so that you can quickly understand how much you will receive from the state. Remind your accountant of the new rules.

If you don’t have time to read the entire material, go to the “Briefly” block - there is the main thing about changes in sick pay from September 1, 2021.

What does sick leave pay look like now?

The state will pay 100% of average earnings to workers who have children under eight years of age. The new rules are enshrined in Law No. 151-FZ dated May 26, 2021. In this case, the employee’s length of service and method of treatment will not be taken into account.

Tatyana Petukhova, accountant

From September 1, an employee who has worked for five years and an employee who has only a year of experience will receive the same payment. There is also no need to confirm work experience if the young parent has switched to an electronic work record book. In addition, the amount of sick leave for caring for a child under eight years of age is not affected by how the treatment took place - outpatient or inpatient.

To receive the payment, the employee does not need to fill out additional documents—the information on the certificate of incapacity for work is sufficient. Let us remind you that from January 1, 2021, sick leave is paid directly from the Social Insurance Fund, so the expenses of business owners will not increase from September 1.

An employer can provide incentive payments for its employees in local regulations that apply at the enterprise. However, in practice such stories are extremely rare.

Important. For working parents with children over eight years old, the rules will remain the same. The basis is Article 7 of the Law of December 29, 2006 No. 255-FZ.

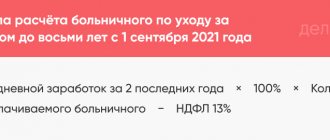

To calculate the amount of sick leave for caring for a child under eight years old from September 1, 2021, use the step-by-step algorithm.

An example of calculating sick leave in 2021

In 2021, a rule was introduced under which sick leave benefits for a full month could not be less than the minimum wage, but in 2021 it will not work. But the following will remain: the actual average daily earnings will need to be compared with the minimum wage, taking into account the regional coefficient.

In addition, the minimum wage for 2021 will change and amount to 12,792 rubles. The maximum salary for the base for contributions for 2021 is 865,000 rubles, for 2021 - 912,000 rubles. If you calculate the benefit from a larger amount, the Social Insurance Fund will not reimburse you for the costs. The number of days in the billing period is 730. Let's consider an example of calculating sick leave in 2021.

Ivanov Ivan Petrovich was ill from January 11 to January 25, 2021. His insurance experience is 7 years, the calculation period for calculating benefits is 2019 and 2021.

Step 1. We calculate Ivanov’s earnings for the previous two years. In 2021 it amounted to 720,000 rubles, and in 2021 - 850,000 rubles. Both amounts are below the permissible limits (815,000 and 865,000 rubles, respectively), which means we take the actual amounts for calculation. Thus, in the billing period his earnings are 1,570,000 rubles.

Step 2. Find the average daily earnings: divide 1,570,000 by 730. We get 2,150 rubles 68 kopecks.

Step 3. Determine the average daily benefit amount taking into account length of service. The length of service is 7 years, which means the amount of sick leave benefits will be 80% of the average daily earnings: 1,720 rubles 54 kopecks.

Step 4. Amount of benefit to be paid: multiply the daily amount of benefit by the number of days of incapacity for work: 1,720.54 × 15 = 25,808 rubles 1 kopeck.

Example. Sick leave to care for a three-year-old child

Anna has a son who is three years old. He fell ill with the flu, and Anna took sick leave to care for her son.

The duration of sick leave for a certificate of incapacity for work is 10 days. This is Anna's first sick leave this year.

Anna’s average daily earnings over the past two years are 2,145 rubles. Experience: eight years. Anna treated her son at home.

Since Anna’s son is three years old, from September 1, 2021, when calculating the mother’s sick leave, the mother’s length of stay and the method of treatment are not taken into account. Also, all sick days are paid equally if they do not exceed the limit.

Anna will receive from the state 2,145 x 100% x 10 - personal income tax 13% = 21,450 - 6,435 = 15,015 rubles.

Sick leave calculator in 2021 online

To quickly calculate sick leave, use the free online calculator from the Kontur.Accounting service. The calculations will only take a couple of minutes.

- Enter data about the period and cause of incapacity from the sick leave and check the box if a violation of the regime on the part of the employee was established.

- Indicate data on the employee’s income for the last 2 years, the regional coefficient and the employment coefficient if the employee does not work full time.

- Indicate the insurance period and receive the benefit amount taking into account the insurance period.

Calculation of maternity benefits for unemployed women

Some non-working categories of employees can also receive B&R benefits. Let's look at these categories to know how maternity payments are calculated for them:

- Women dismissed due to the liquidation of a company or the closure of an individual entrepreneur are also entitled to this benefit. This rule applies to them only if they are registered with the employment service and receive unemployment benefits there. For this category of women, starting from February 1, 2021, taking into account annual indexation, it is 708.23 rubles.

- Female full-time students receive a B&R allowance at the rate of 100% of the scholarship per month;

- female individual entrepreneurs who have independently entered into an insurance contract with the Social Insurance Fund receive benefits based on the minimum wage .

Terms of payment of maternity benefits

The amount of the B&R benefit may be influenced by length of service . This is stated in Part 3 of Art. 11 of Law No. 255-FZ. For an employee going on maternity leave with less than 6 months , the benefit should not exceed the minimum monthly wage. Therefore, even with a large salary, the benefit will still be calculated based on the minimum wage.

But after completing 6 full months of work experience, benefits for expectant mothers no longer depend on the minimum wage. For example, the calculation of maternity benefits if the employee has not worked for 2 years is 100% of the maximum benefit amount.

Part 2 of Art. 12 of Law No. 255-FZ provides for a deadline for applying for benefits. It is 6 months from the date of the end of the leave under the BiR.

Does length of insurance affect the amount of benefits?

The length of the insurance period has virtually no effect on the amount of benefits. A pregnant woman can only work for a company for a few days. The benefit will be based on the insurance premiums paid earlier.

IMPORTANT! The benefit is calculated based on the “white” salary. That is, even if a woman received 100,000 rubles, but her employment contract indicates a salary of 8,000, the amount will be calculated based on the official salary equal to the minimum wage.

The insurance period does not affect the amount of benefits only if the woman’s work experience is at least six months. If it is less than 6 months, maternity benefits will be 100% of the minimum wage.

Calculation of B&R benefits for part-time pay

The calculation of maternity benefits for part-time work generally does not differ from the calculation of benefits for full-time work.

It is important to remember here that maternity pay is calculated in proportion to the time worked. A similar proportion is used both to calculate the maximum and minimum benefits based on the minimum wage.

EXAMPLE

Cleaner Kiseleva works part-time. Accordingly, the minimum amount of her monthly B&R benefit should not be less than 1/2 of the minimum wage.

How many days of pregnancy and childbirth will be paid?

The duration of leave under the BiR is set at the following amount:

- 140 days – for a normal pregnancy that proceeds without complications;

- 156 days – for premature birth or pregnancy with complications. In this case, in addition to the usual sick leave, the mother will receive another additional one for a period of 16 days;

- 194 days – in case of multiple pregnancy;

- 70 days – when adopting a 3-month-old child or younger;

- 110 days – when adopting two or more children.

Many expectant mothers are interested in the question of how maternity benefits are calculated if an employee, having a sick leave according to the BiR, continues to work. We would like to warn you that you CANNOT receive this benefit and salary at the same time.

If a pregnant employee is active and wants to work voluntarily until she gives birth, you can enter into a GPC agreement with her, defining her income. Or, a working employee can be paid a salary until the day she voluntarily goes on maternity leave. In this case, she will receive maternity benefits only for those days when she did not work.

EXAMPLE

Manager Safronova E.P. I was supposed to go on leave according to the BiR from April 20th. However, she decided that she would close all her work and go on maternity leave 2 weeks later. How to correctly calculate maternity benefits in this case? In this situation, Safronova will receive benefits not for 140 days, but for 126 days (140 - 14). This is subject to an uncomplicated singleton pregnancy.

While on maternity leave, you don’t have to pay contributions to pension and health insurance

An entrepreneur on parental leave to care for a child up to 1.5 years old may not pay insurance contributions to the tax office, provided that he does not run a business and does not receive income. To stop paying contributions, contact the tax office with a statement and documents confirming that you have suspended your activities. The list of documents has not been approved, please check with your tax office. Here is a sample list:

— application in free form — child’s birth certificate — bank account statement

If you run a business while on maternity leave and receive income, you will have to pay insurance premiums to the tax office in full.

Changes - 2021 and 2021

In 2021, the state made a number of decisions that make changes to the existing practice of calculating benefits for expectant mothers in Russia. The mechanism itself and the calculation formulas do not change. The main innovation is the introduced rule for indexing payments.

Due to the economic situation in the country, funds paid by the state require indexation. In 2021, this also affected maternity benefits. From now on, every year on February 1, social payments will be revised upward. The coefficient is set annually. In 2021, all established social amounts should be increased by 1.054 times.

Is it beneficial to voluntarily register with the Social Insurance Fund?

It is not profitable to register with the Social Insurance Fund for the sake of receiving sick leave - voluntary contributions may turn out to be more than you will receive if you are ill. You will pay 4,451.62 rubles in contributions per year. This amount will pay off if you are on sick leave for more than 11 days a year - and this is provided that your insurance period is more than 8 years.

But if you are going to have a child, voluntary registration with the Social Insurance Fund will be useful. For 4,451.62 rubles of voluntary contributions per year, you can receive benefits for maternity leave - a total amount of about 59 thousand rubles for 140 days.

Important: benefits begin to be issued only from the next year after voluntary registration with the Social Insurance Fund. If the child is born in 2022, register with the Social Insurance Fund in 2021.

The article is current as of 02/09/2021

On what basis is the benefit calculated?

The benefit is calculated based on the total income received by the employee. It is formed from the following revenues:

- Wage.

- Vacation pay.

- Various bonuses awarded by the employer.

- Payments for business trips.

- Royalties received for copyrighted works, patents.

- Funds accrued for unused vacation.

Other payments may also be included in the amount of income.

When calculating benefits, it is important to take into account many points: the number of days worked, the amount of salary, the amount of bonuses and other accruals. An accountant handles all deductions. He is obliged to study all the nuances and make the calculations correctly.

Stages of an accountant's actions

To calculate maternity benefits, the accountant must follow the following algorithm:

- The salary for the 2 years that preceded pregnancy is calculated.

- The average daily fee is calculated. To do this, you need to divide the total amount of earnings for two years by the number of calendar days. That is, you need to divide by 731 days (365 added to 366). From this number of days the number of days that were allocated for study leave and sick leave is subtracted. The average daily wage is compared with the maximum and minimum wages.

- The amount of benefit payments is calculated. To do this, the average daily payment is multiplied by the number of days of sick leave issued in connection with pregnancy.

That is, the amount of benefits depends on the woman’s earnings and the number of days on sick leave.

Benefits for part-time workers

There are three options for part-time work, and each has its own procedure for paying benefits.

In 2021 and earlier (when direct payments from the Social Insurance Fund were carried out in certain regions as an experiment), the options looked like this.

First option

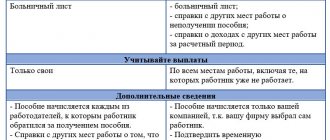

At the time of the insured event, the employee is working for the same employers as in the previous two years. Then he had to receive temporary disability benefits and BIR from each employer. To do this, the employee was required to take several original sick notes from the doctor - one for each employer. Having received their original, each employer will calculate the benefit based on the average earnings given to them.

In the first option, child care benefits can be obtained only from one employer of the woman’s choice. The selected employer must calculate the benefit based on two amounts. The first amount is the average salary paid by himself. The second amount is the average earnings paid by other employers for the period when the employee was not yet working in the place where she now receives benefits. At the same time, the woman had to take a certificate of earnings from other employers.

Second option

In the second option, at the time of the insured event, the employee is working for different employers than in the two previous years. Then he could receive benefits for temporary disability, BIR and child care from only one employer of his choice. To do this, the employee was required to take one sick leave certificate from the doctor and present it to the chosen employer. Plus, you should have taken certificates from other employers indicating the amount of earnings for the billing period. Based on these documents, the selected employer will calculate the amount of the benefit.

Third option

In the third option, at the time of the insured event, the employee works for several employers, and in the two previous years he worked for both these and other employers. Then the employee has the right to choose - to receive benefits according to the first option (from each of the last employers, taking into account earnings received only from them), or according to the second option (from one of the last employers, taking into account earnings received from all employers). The number of original sick leave certificates depended on the chosen option.

In 2021, the rules for the assignment and payment of benefits are regulated by Decree of the Government of the Russian Federation dated December 30, 2020 No. 2375, and nothing is said there about part-time workers.

Starting from 2022, amendments to Law No. 255-FZ will come into force. They will retain three options for part-time workers - depending on which insurers the employee works for at the time the bulletin is issued, and which ones he worked for in the two previous years. The options are similar to those that existed before. But there is also a difference. It lies in the fact that the benefit will be paid not by the employer, but by the Social Insurance Fund on the basis of electronic sick leave (except for the first 3 days of illness).

Determining the basis for calculating the payment

The sick leave payment base after maternity leave in 2021 includes all payments to the employee from which insurance premiums were paid in case of disability and in connection with maternity for the billing period. The amount of earnings for each year is included in an amount not exceeding the maximum payment amount for calculating contributions.

The limit is set annually by the government:

The calculation includes payments received from both current and previous employers. To confirm the income received at the old place of work, upon dismissal, a certificate is issued in the form approved by Order of the Ministry of Labor No. 182n dated April 30, 2013.

Example:

Salary of Alekseeva A.A. amounted to 400,000 rubles in 2015 (replacement instead of 2018), in 2019 – 880,000 rubles. In 2021, the income limit from which insurance premiums are calculated (RUB 865,000) was exceeded. Therefore, the calculation base will be: 400,000+865,000=1,265,000 rubles.

Results

Sick leave after maternity leave in the absence of income in the previous 2 years is calculated according to special rules.

At the request of the insured person, the periods of earnings used to calculate benefits can be replaced, but only for the years preceding the insured event. As a result of such a replacement, the employee should be in a more advantageous position. It must be remembered that the possibility of changing the billing period is only the right of the insured person, therefore it is unacceptable to change the period without a corresponding application. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reimbursement of benefits

In 2021 and earlier, rules were in force in regions that did not participate in the Direct Payments project.

The employer could reimburse the benefits (except for the first three days on the “regular” ballot) from budget funds. To do this, the accountant reflected the benefits in the reports submitted to the Federal Tax Service. If the amount of social insurance contributions was greater than the amount of benefits paid, then the employer transferred contributions minus benefits. If the amount of contributions is less than the amount of benefits, then the difference could be offset against the payment of contributions in subsequent periods. There was another option - to apply for the allocation of funds necessary to pay benefits.

Next, FSS specialists checked how justified the employer paid benefits. Inspectors looked at all the documents and recalculated the amount of benefits. If any violation was discovered (incorrect amount, lack of documents, errors in sick leave certificates, etc.), compensation was refused.

Starting from 2021, in all regions the FSS does not reimburse benefits, and pays them directly to insured persons. In this regard, employers transfer contributions in full, without reducing the amount of benefits.

In conclusion, we note that calculating benefits often causes difficulties for novice accountants. After all, for a correct calculation it is necessary to take into account many factors. Therefore, those accountants who calculate benefits using web services feel most comfortable. After all, a “smart” web service, even during the calculation of the benefit amount, necessarily points out errors, asks clarifying questions and gives tips to the accountant, referring to current legislation.

Sick leave before vacation

Pregnancy progresses differently for every woman. Some people feel great and work as usual, while others feel unwell from the first months of pregnancy. Be that as it may, any employed woman can take sick leave before maternity leave.

The number of sick days for workers in ordinary cases is limited only by the period of recovery, and the frequency of sick leave cannot be regulated, because everything is purely individual. During pregnancy, the female body is especially vulnerable, which can contribute to frequent sick leave before maternity leave.

The employer does not have the right to refuse to pay an employee for the provided ballots.

By law, a pregnant employee can count not only on receiving a ballot if she feels unwell and on payment for it, but also on a relaxation in work. The Labor Code establishes that workers who have submitted certificates from a medical institution confirming that they are pregnant must be transferred to light work if their main work involves excessive stress. The employer is obliged to take into account the employee’s condition and provide her with a different place of work before going on maternity leave or reduce physical activity at the existing workplace. The certificate of incapacity for work issued before maternity leave is paid in accordance with the general procedure.