Changes that must be taken into account when calculating sick leave

The following were added to the list of citizens who are issued a certificate of incapacity for work by order of the Ministry of Health dated September 1, 2020 No. 925n, which entered into force on December 14, 2020:

- heads of organizations who are the only participants, founders or owners of property;

- persons sentenced to imprisonment and involved in paid work.

Previously, these categories were not mentioned in the order of the Ministry of Health, but by law 255-FZ they were included in the number of insured persons.

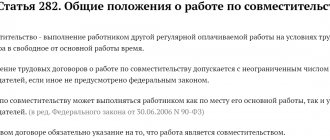

The order details the procedure for issuing electronic sick leave, including for employees working part-time. If a part-time worker is entitled to payment at different places of work, then he will be issued paper sick leave in the required quantity, but only one electronic sick leave will be generated and its number can be communicated to all employers.

New rules of the Ministry of Health:

- registration and extension of sick leave for injuries received at work or as a result of an accident;

- issuing sick leave when referred to sanatorium-resort treatment or medical treatment.

The order allows for issuing a sick leave certificate without visiting a doctor when receiving medical care using telemedicine technologies.

In this case, the procedure for calculating sick leave with direct payment will not differ from calculating benefits with an offset mechanism, but in order for the employee to receive benefits, he must provide all the necessary documents to his employer, so that he, in turn, transfers this data to the Social Insurance Fund. The list of documents is determined depending on the cause of disability; it could be illness, an accident at work or an occupational disease.

How does an employer file a work-related injury?

In the event of a work-related injury, the employer is obliged to organize the provision of medical care to the injured employee. If necessary, he is transported to a medical facility.

The following is the procedure for registering a work injury:

- After first aid is provided to the employee, measures are taken to preserve the situation at the scene of the emergency. If there are massive accidents, the authorities, the Social Insurance Fund and the trade union are informed within 24 hours.

- The employer issues an order to create a commission to investigate an industrial accident. It consists of a labor protection specialist, a trade union representative and an employer representative. The victim also has the right to take part in the investigation of the accident.

- The commission investigates the circumstances of the industrial accident, draws up an inspection report, interviews witnesses and the victim. Medical documents are also examined and a report is drawn up in form N-1. The investigation is allotted from 3 to 15 days, depending on the number of victims.

- Information about the accident is entered into the occupational injury register.

- In the event of a large-scale accident, reports on the incident are sent to the state labor inspectorate, Social Insurance Fund, prosecutor's office, and industry department.

- The victim is paid temporary disability benefits, a one-time and monthly insurance payment, compensation for additional expenses for treatment and rehabilitation, and compensation for moral damage.

Is sick leave subject to personal income tax? Calculation features

Who pays for sick leave - the employer or the Social Insurance Fund

Illness of an employee or a member of his family (child)

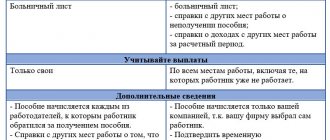

If the employee’s illness is not related to an industrial accident, then he must be provided to the organization in accordance with Part 5 of Art. 13 of the Law of December 29, 2006 No. 255-FZ, the following list of documents;

- certificate of incapacity for work;

- certificate of earnings from the previous place of work for the pay period.

In addition to the certificate of incapacity for work and certificate of earnings, it is necessary to provide additional information about the employee for payment of benefits. From this year, an employee can provide them during the period of work or at the time of employment.

The FSS information form is approved by Government Decree No. 2375 dated December 30, 2020, clause 2. Information can be submitted in the form approved by the FSS by Order No. 26 dated February 4, 2021.

The certificate of incapacity for work must be filled out according to the general rules, but with direct payments there is one feature - the employer may not fill out the lines:

- “at the expense of the Social Insurance Fund of the Russian Federation”;

- “TOTAL accrued.”

This is provided for in clause 51 of the Procedure for issuing and issuing certificates of incapacity for work approved by Order of the Ministry of Health No. 925n dated 01.09.2020. All documents must be submitted to the FSS office at your place of registration.

Please note that the fund pays sickness benefits in the usual manner; if the employee falls ill himself, the fund accrues benefits from the fourth day of illness, because the first three days of illness are paid from the employer’s own funds. This procedure is clearly stated in Art. 6 of the Law of December 29, 2020 No. 478-FZ, clause 8 of the Regulations approved by Government Decree No. 2375 of December 30, 2020. If the disability is caused by the illness of one of the family members, for example, a child, the Fund pays benefits from the first day.

Degree and grade

In total, there are two degrees - mild and severe bodily injury. A mild injury causes short-term disability, while a severe injury can lead to disability and, ultimately, complete loss of ability to work.

The severe degree is characterized by serious damage to the body, which can lead to embolism, large blood loss, and stroke. In addition, severe injuries include fractures of the skull, back, and open wounds of internal organs.

The main document, which provides a complete list of all types of injuries, is Order of the Ministry of Health N6478. The most serious would be a fatal accident. Damage assessment is a very important point in paying for sick leave for a work injury.

Types of injuries

Injuries are divided into domestic and industrial. Domestic damage is an injury sustained by an employee outside of work. For example, a man fell down the stairs during his free time and dislocated his shoulder. Such damage will be classified as a domestic injury.

Payment of sick leave for an industrial injury directly depends on length of service. Those with extensive experience (more than 8 years) are entitled to full wages throughout the entire sick leave period. If the length of service is short, then the payments will be less, but the minimum is 60% of the salary .

Attention! In case of a work injury, the payment is always 100%. Please note that unscrupulous employers may try to manipulate an employee by offering to file the injury as a domestic injury in order to reduce the amount of payments. These actions are illegal.

A special type of injury is the intentional type. If an employee intentionally injures himself and then tries to pass it off as a domestic or work injury, this can lead to serious consequences.

Conditions

There are a number of conditions and standards in order to classify an injury as a work-related injury. The most important points to begin an investigation are: the time, place and circumstances in which the injury occurred.

The accident must occur on the premises of the enterprise during working hours.

There are several acceptable deviations from this formulation:

- Regarding the time frame, an accident can occur during a lunch break or while taking a break from work. This also includes working on weekends and overtime.

- The place does not have to be the territory of the enterprise; it can also be a space associated with work activities. For example, being injured while on a traveling job would also be considered a work-related injury.

- Injury sustained on the way to work. The condition here is the use of official transport.

For correct classification, the guideline should be the existence of a connection between the job duties and the accident.

Occupational disease or accident at work

If an employee’s illness occurs due to an accident or is associated with an occupational disease, a similar procedure for processing documents for the Social Insurance Fund applies. Only their list has been increased.

It is necessary to additionally submit to the fund an accident report or an occupational disease report, as well as copies of the investigation materials. This was approved by government decree No. 2375, paragraph 3, dated December 30, 2020.

Such benefits are paid by the Social Insurance Fund in full starting from the first day of incapacity for work; the procedure for such payments is determined by Law No. 125-FZ of July 24, 1998, Art. 8 clause 1 clause 1.

Long-term illness

The attending physician alone has the right to issue sick leave for only 15 calendar days, this is clearly stated in paragraph 19 of Order of the Ministry of Health No. 925n; in the event of loss of ability to work for a longer period, only the medical commission has the right to extend sick leave. The period of incapacity for work can last up to 10 months, in case of tuberculosis - up to 12 months.

In case of a long-term illness of the patient, the commission extends the sick leave every 15 days. If there is no space for notes on the sick leave sheet, it can be closed and its continuation opens.

Also, the commission can close a long-term sick leave at the request of the employee in order to present it for payment and issue him a continuation; it is allowed to open a sick leave in paper form, and issue its continuation in electronic form and vice versa.

Procedure for calculating sick leave in 2021

Federal Law No. 478-FZ dated December 29, 2020 introduced rules for accruing sick leave. The benefit amount is paid not lower than the federal minimum wage, taking into account the regional coefficient .

When calculating temporary disability benefits, you must adhere to the following procedure.

- First of all, you need to check the employee's eligibility to receive benefits . All employees insured in the compulsory social insurance system have this right. The full list can be found in paragraph 1 of Art. 2 255 of the Federal Law, this list includes part-time workers and employees hired on a probationary period. You can also make a payment on a certificate of incapacity for work if an employee falls ill within 30 days from the date of his dismissal. After closure, sick leave must be presented for payment within 6 months.

- Next, we determine the billing period . In 2021, it is necessary to take into account the benefit recipient's earnings for 2019 and 2021. The billing period includes days for which no payment was made (these may be days without pay), or benefits were paid that were not subject to insurance contributions. The only exceptions are employees who were on maternity or child care leave in the period from 2019-2020. They have the option of replacing one or two years with previous ones if this would increase the benefit.

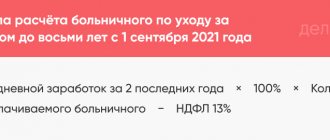

- Let's move on to calculating average earnings. To do this, we will adhere to the algorithm established in clause 3 of Art. 14 255-FZ. To calculate, it is necessary to add up all amounts of labor remuneration subject to insurance contributions and accrued for the period 2019-2020. and divide the resulting total by 730. If in any year the entire accrued salary exceeds the taxable limit established by the Government of the Russian Federation, the average salary earned within the limit should be taken into account.

- We determine the amount of monthly payment based on the average earnings received by the employee . If it exceeds the minimum wage, then you can use this value in calculations. If the salary during the calculation turned out to be less than the minimum, then the average earnings are calculated using the formula: minimum wage * 24 months / 730 days.

- We calculate the amount of the benefit. To do this, we multiply the average daily earnings by a coefficient that takes into account the length of insurance and the number of calendar days of temporary disability indicated on the sick leave.

Procedure

Since the employee is a victim, the employer and employees will have to take any action. In the event of an accident, the employee informs the enterprise administration about the injury . The first priority is to provide medical services. help.

An administration employee delivers the victim to the emergency room, where the employee receives medical treatment. help and draw up a protocol.

The doctor conducts an examination and issues the employee a certificate containing information about the nature and severity of the injury.

The course of the investigation is regulated by Article 229 of the Labor Code. In parallel with providing assistance to the victim, a special commission is being formed. It consists of at least three specialists who investigate the accident. The scene of the incident is examined, eyewitnesses are interviewed, and information is documented (video and photography is possible).

Then the commission draws up a final report, which indicates the reasons, the culprits (if any), and the report is sent to the FSS :

- For minor damage, 3 days are given for investigation.

- For severe cases – up to fifteen days.

Maximum amount of payment for sick leave in 2021

Every year, the Government of the Russian Federation determines the maximum base for calculating insurance premiums in case of temporary disability and in connection with maternity. If an employee's annual salary exceeds this base, contributions for the excess amount are not accrued.

To determine the maximum amount of sick leave payments in 2021, it is necessary to take into account the maximum tax bases established in the billing period:

- 2019 - 865,000 rubles;

- 2020 — 912,000 rub.

Wages accrued in excess of the established amounts in the billing period are not accepted into the calculation of benefits. It follows from this that the maximum amount of daily temporary disability benefits is:

- (865000 912000) / 730 = 2434.25 rubles.

In accordance with the general rules, temporary disability benefits are paid for the entire period of illness until full restoration of working capacity.

Deadlines for providing information to the FSS

It is necessary to transfer the information received from the employee to the FSS office in the form of an electronic register or on paper. You must send the data to your place of registration within five calendar days from the date of receipt of the application and other papers from the employee.

After receiving the documents, the FSS department reviews them no more than 10 calendar days.

Before the expiration of 10 calendar days, social insurance is obliged to either pay benefits or make a decision to refuse payment.

Common mistakes

Error: The employer did not pay sick leave to an employee injured at work within 10 days after receiving sick leave and a certificate recognizing the work-related injury.

Comment: Payments for work-related injuries are paid within the same time frame as sick leave benefits in the general case - within 10 days after the documents are completed and presented to the employer.

Error: An employee who broke his arm in the company cafeteria during lunch claims compensation for his work injury.

Comment: An industrial injury is considered only if it occurs during the performance of official duties.