In order to pay for an employee’s sick leave as required by law, an accountant must take into account many factors, including accurately calculating the employee’s length of service. This calculation itself is not as easy as it might seem at first glance. It, like all other sections of accounting, has its own subtleties.

The easiest way to calculate length of service is to use the length of service calculator for sick leave.

Payment of sick leave from 2021

From 01/01/2021, temporary disability benefits (for illness or injury) throughout the country are paid according to the rules of the “pilot” project:

- the employer issues benefits for the first 3 days of illness;

- The employee receives the rest from the Social Insurance Fund.

In cases of sick leave:

- caring for a sick family member;

- for quarantine of an employee, his child under 7 years old attending kindergarten, or an incapacitated family member of the employee;

- for prosthetics for medical reasons in a hospital;

- when providing follow-up treatment to an employee in a sanatorium-resort organization on the territory of the Russian Federation immediately after providing him with medical care in a hospital,

The Social Insurance Fund pays benefits in full starting from the first day.

In order for social insurance to calculate benefits, the employer must send it a register of sick leave and the documents necessary for the calculation. You will find a list of such documents for all types of benefits in ConsultantPlus. You can view the material by getting free trial access to the system.

The benefit is accrued no later than 10 calendar days from the date of receipt of sick leave from the employee. The employer issues the money on the next day after the settlement date established for the payment of wages. Social insurance pays funds within 10 calendar days from the date of receipt of documents (information) or a register of information from the employer.

For example, if an employee submitted sick leave on January 15, and the salary payment deadlines are on the 5th and 20th of each month, then the benefit must be paid no later than February 5.

Until 2021, we recall that payment for sick leave was carried out in 2 ways: by the employer with subsequent reimbursement of Social Insurance benefits or directly by the social insurance department - depending on whether the region in which the insurer operated was included in the Social Insurance pilot project.

Reduction of benefits to the minimum wage in case of violation of the regime

An employee’s behavior while on sick leave may result in a reduction in the amount of temporary disability benefits. This occurs when an employee violates the regimen prescribed by a doctor, fails to show up for medical examination, and a number of other cases.

The procedure for paying for sick leave (clause 1, part 1, clause 1, part 2, article 8 of Law No. 255-FZ, Letter of the Ministry of Labor dated 04/08/2021 No. 14-2/OOG-3149):

- until the day of the violation - in the usual manner;

- from the date of the violation of the regime - based on the minimum wage in terms of a full calendar month.

In the line “Notes on violation of the regime” on the certificate of incapacity for work, the doctor designates such violations with a special two-digit code (clause 65 of the Procedure, approved by Order of the Ministry of Health dated September 1, 2020 No. 925n).

If an employee becomes ill or injured as a result of actions related to alcohol, narcotic, or toxic intoxication, the doctor enters code “21” in the “additional code” cell of the line “Cause of disability.”

The decision to reduce disability benefits is made by the head of the company and a specially created commission (authorized) for social insurance (clause 1.1, clause 2.2 of the Model Regulations, approved by the Federal Social Insurance Fund of the Russian Federation on July 15, 1994 No. 556a).

Before making a decision, the employer requests from the employee an explanation in writing and the necessary documents (certificates from a medical institution, internal affairs bodies, etc.).

The employee's sick leave benefit will not be reduced if the reason for violating the regime is considered valid and/or a cause-and-effect relationship between intoxication and illness/injury is not identified (FSS Letter No. 02-10/07-1843 dated April 15, 2004). In the line “Accrual conditions” of the sick leave certificate in such cases, you need to indicate code “48” and attach the employee’s explanation and the order (decision) to pay benefits in full.

If you have any unresolved questions, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Types of disability and rules affecting the procedure for calculating benefits

The rules for calculating sick leave in 2021 generally remain the same as in previous years. However, they must be applied taking into account the fact that the values of the parameters influencing the determination of the maximum and minimum benefits have become different.

Let us remind you that for the calculation of benefits it matters:

- number of days of sick leave;

- average daily earnings (ADE), calculated for a certain period preceding the sick leave, and its maximum and minimum possible amounts;

- the maximum period for which sick leave can be paid;

- the presence or absence of the need to use coefficients.

Situations in which an employee is issued sick leave can be divided into the following groups, each of which has its own features for calculating the amount of benefits:

- ordinary disability of the employee not related to work-related injuries;

- incapacity for work due to caring for a sick relative;

- woman's incapacity for work caused by going on maternity leave (Maternity leave);

- disability caused by a work injury.

Recommendations from ConsultantPlus experts will help you fill out sick leave correctly. Get free access and go to the Ready Solution.

Despite the fact that the issues of providing benefits for the first three groups and the last are regulated by different laws (“On compulsory social insurance...” dated December 29, 2006 No. 255-FZ and “On compulsory social insurance...” dated July 24, 1998 No. 125-FZ), the procedure for their calculation is the same (Clause 1, Article 9 of Law No. 125-FZ). Therefore, for each of the listed situations, the general principles on which the calculation is based are valid:

- equal length of the period taken to determine the data (2 years);

- the same requirements for income (they must be subject to insurance premiums) and the actual number of days of the calculation period (not all days can be taken into account);

- the presence of restrictions on the maximum and minimum possible payment amounts.

The differences between the selected groups are due to the fact that for some of them special rules of determination apply:

- the total number of days characterizing the full billing period;

- the amount of the maximum possible benefit;

- number of paid days on sick leave;

- the magnitude of the reducing factors applied to the calculated amount.

In addition, there are differences in who (partially the employer or 100% Social Insurance Fund) pays the benefit, as well as the possibility of paying it after the employee’s dismissal and the need to withhold personal income tax from the benefit. These points do not have a fundamental impact on the calculation itself, so we will not consider them.

Read about the rules for taxation of sick leave payments with personal income tax in the material “Is sick leave (sick leave) subject to personal income tax?”

What periods are not included in the calculation of sick leave?

When determining the amount of payments made to an employee and his length of service, the following should be fundamentally excluded from the calculations:

- days when an employee is on leave at his own expense, for study, for child care;

- days on which the employee did not work due to downtime (if he got sick during the downtime period);

- days of added leave if the employee went on paid sick leave during the days of paid leave due to the need to care for a child or other relative.

Moreover, if the employee himself gets sick, the employer provides him with days of added vacation and pays for them in the amount determined by the FLN formula.

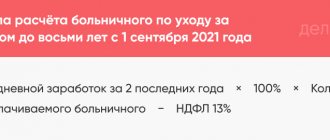

Formula for calculating sick leave payments and maximum benefit amount

How to calculate sick leave in 2021? The formula for calculating sick leave payments in 2021 is still the number of days of sick leave to be paid, multiplied by the SDZ determined for the billing period, and by a reducing factor, if its application is necessary (clauses 4, 5 of Article 14 of Law No. 255-FZ).

For each of the above four groups, the two full calendar years preceding the year of sick leave are taken as the calculation period for which the SDZ will be calculated. In general, the number of days in them is considered to be 730 (Clause 3, Article 14 of Law No. 255-FZ).

Does leap year affect the calculation of sick leave benefits? You will find the answer to this question in the Ready-made solution from ConsultantPlus. Trial access to the system can be obtained for free.

To calculate sick leave according to BiR, days will have to be counted according to the fact, i.e., taking into account the increase in their number in leap years (clause 3.1 of Article 14 of Law No. 255-FZ). And since this calculation allows (due to the lack or insufficiency of income) the replacement of one or two years from the period with the years preceding them, the duration of the calculation period for leave under the BiR may be equal to 731 or 732 days (FSS letter dated 03/03/2017 No. 02 -08-01/22-04-1049l).

To determine the value of SDZ, the income received during the billing period must be divided by the total number of days in it. But neither the income nor the number of days can include values related to payments that are not subject to insurance contributions to the Social Insurance Fund (i.e., for example, days on sick leave and payments for it will not be included in the calculation).

It should be borne in mind that payment for sick leave for an industrial injury is made at the expense of “accident” contributions, calculated according to the rules reflected in Law No. 125-FZ. That is, the list of income covered by these contributions may differ from that given in the Tax Code of the Russian Federation for contributions to insurance for disability and maternity.

The maximum amount of income taken into account in all calculations, except for that made in connection with an industrial injury, for each year is limited to the amount with which the Social Insurance Fund was required to pay contributions for disability and maternity insurance. For 2021, we will be interested in the following values:

- 2020 — 912,000 rub. (Resolution of the Government of the Russian Federation dated November 6, 2019 No. 1407);

- 2019 — RUB 865,000. (Resolution of the Government of the Russian Federation dated November 28, 2018 No. 1426).

Knowing the value of the maximum income makes it possible to determine the amount above which the SDZ cannot be used to calculate sick leave issued not in connection with a work-related injury. For 2021 it will be:

(865,000 + 912,000) / 730 = 2434.25 rubles.

The number of days for the billing period in this formula is always equal to 730, even if we are talking about vacation according to the BiR (Clause 3.3 of Article 14 of Law No. 255-FZ).

The income subject to “unfortunate” contributions is not limited. But the maximum possible amount is also established for benefits accrued in the event of a work injury. True, it is defined differently: as four times the maximum monthly insurance payment (Clause 2, Article 9 of Law No. 125-FZ). The value of the latter from 02/01/2021 is 83,502.90 rubles, and its fourfold value is 334,011.59 rubles. (in 2021 it was 79,602.38 rubles and 318,409.52 rubles, respectively).

Calculating length of service for sick leave: main points

As mentioned above, to calculate sick leave payments, you need to take into account only those periods of the employee’s work for which payments were made to the relevant insurance funds. In particular, the periods of work for:

- contract agreements;

- work book;

- employment contracts;

- individual entrepreneurship;

- public service.

In addition, when calculating the insurance period, contract service in the army military service .

An example of calculating length of service (according to a work book):

- We take all periods of work according to labor dates, starting from hiring to dismissal;

- we add them up, counting days, months and years separately;

- Now we need to convert days into months, and months into years.

For example , the amount of insurance experience according to the work book turned out to be 8 years 14 months 35 days. We convert months into years, we get: 1 year and two months, we do the same with days, as a result we have: 1 month 5 days. Now we add everything up and have the following total: 8 years + 1 year 2 months + 1 month 5 days = 9 years 3 months and 5 days.

For your information! There is no need to include time spent studying at a university or other professional educational institutions in the calculation of sick pay.

When calculating length of service, only those periods of work are taken into account when the employer contributed all due payments to extra-budgetary funds for the employee.

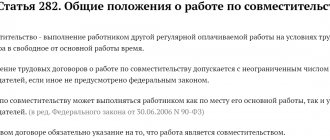

Attention! If at the same time an employee worked in two places at once, then to calculate the length of service for sick leave you need to take only one of them.

Why is it important to know the total insurance experience? The fact is that the percentage of payment from the salary of a sick employee directly depends on it.

What is the minimum amount of sick leave and what minimum wage do you need to take for it?

There is also a limitation for the minimum amount of SDZ involved in calculating benefits. Regardless of the cause of disability, it is calculated from the same value - from the federal minimum wage valid on the date of opening of sick leave (clause 1.1 of Article 14 of Law No. 255-FZ).

In what situations is the minimum wage used to calculate sick leave in 2021? They focus on it when (clause 6 of article 7, article 8, clause 3 of article 11, clause 1.1 of article 14 of law No. 255-FZ):

- the employee’s total work experience is short (less than six months);

- there is no income in the billing period or the calculation from it gives a benefit amount that is less than that calculated from the minimum wage;

- illness or injury caused by intoxication;

- while on sick leave, the regime prescribed by the doctor is violated.

The federal minimum wage for calculating sick leave in 2021 from 01/01/2021 is equal to 12,792 rubles. (Article 1 of the Law “On the Minimum Wage” dated June 19, 2000 No. 82-FZ).

We described in detail how to calculate sick leave from the minimum wage in this article.

In regions with a regional coefficient of wages, the minimum wage in the calculation should be applied taking into account this coefficient (Clause 6, Article 7 of Law No. 255-FZ).

Payment of sick leave in 2021: changes, latest news

The minimum base for calculating the amount of payment for a certificate of incapacity for work is 24 times the minimum wage. Based on the minimum established wage, sick leave should be calculated even if the employee had no earnings in the previous 24 months.

Since from 01/01/2019 the minimum wage will be 12,130 rubles, the minimum base is equal to: 12,130 × 24 = 291,120 rubles.

The maximum size of the base is limited by the maximum base for calculating the amount of social insurance contributions in the billing period, which cannot be less than 12 times the average salary in the country, multiplied by the increasing coefficient (the coefficient also increases annually, and for 2021 it will be 2.2 ). In 2021, the limit is 912,000 rubles. Therefore, when calculating in 2021, take into account 1,680,000 rubles. (865,000 + 815,000), and in 2021 - 1,777,000 rubles. (912,000 + 865,000).

Limitation on paid sick time

In terms of the terms limiting the period subject to payment, all four of the above types of disability have significant differences. Sick leave for an industrial injury will be paid in full, regardless of the duration (Clause 1, Article 9 of Law No. 125-FZ). And for the other three types of disability, despite the clause contained in Law No. 255-FZ (Clause 1, Article 6) that all days of sick leave are subject to payment, there are restrictions:

- For regular sick leave, they are established (clauses 2–4 of Article 6): for follow-up treatment at a resort (24 calendar days);

- for persons who have received disability (4 months in a row or 5 months in total in a calendar year), except for those ill with tuberculosis (the period is not limited here);

- employees registered under a fixed-term employment agreement (75 calendar days), except for those sick with tuberculosis.

- if the child is under 7 years old, then wherever he is treated, the entire period will be paid, but not more than 60 (for certain diseases - 90) calendar days per year;

Read more about the time limits for regular sick leave and sick leave for long-term care here.

- The number of days of sick leave issued in connection with BiR is established by law and depends on the number of children being carried and the presence of complications during childbirth (clause 1 of Article 10): With one child and no complications, 70 calendar days are given before and after childbirth. Complications add another 16 days to the second part.

- Multiple pregnancy increases these periods to 84 and 110 calendar days.

- If a child is adopted as an infant (up to 3 months old), then the woman will receive only the second part of such sick leave, but based on the same number of days (70 or 110).

- Residence of a pregnant woman in areas of radioactive contamination increases the first part of the leave to 90 days (Clause 6, Article 18 of the Law “On Social Protection...” dated May 15, 1991 No. 1244-I).

If a woman who has received sick leave under the BiR continues to work, then the paid period of incapacity for work for her will be reduced to the number of days of actual use of such sick leave.

For information about who has the right to benefits under the BiR, read the article “When is sick leave given for pregnancy and childbirth?”

How to determine the number of full years and months of insurance experience

Periods of insurance coverage are determined on a calendar basis based on full months (30 days) and a full year (12 months). Every 30 days are converted to full months, and every 12 months are converted to full years.

The method for converting days to months and years is as follows. Each calendar month is considered a full month, regardless of the number of days in it. For example, a full month is from February 1 to 28, from July 1 to 31, etc.

The number of days in partial months is summed up and divided by 30. For example, 25 days were worked in the first month, and 15 days were worked in the last month. Total worked in partial months - 40 days. Accordingly, this is one full month (30 days) and 10 days.

Coefficients used when calculating sick leave (by length of service and others)

The procedure for calculating sick leave in 2021 still requires the use of reduction factors in the calculation. However, they will be valid only for ordinary and sick leave issued in connection with the departure. Such coefficients do not apply to benefits for work-related injuries and employment and economics (Clause 1, Article 9 of Law No. 125-FZ, Clause 1, Article 11 of Law No. 255-FZ). The only mandatory form of reducing payments for accounting and labor is to calculate it from the minimum wage if the pregnant woman’s total work experience has not reached six months (Clause 3, Article 11 of Law No. 255-FZ).

Reducing factors are primarily related to the length of the employee’s insurance coverage. Their values applied to the amount of SDZ are as follows (Clause 1, Article 7 of Law No. 255-FZ):

- 0.6 - with less than 5 years of experience;

- 0.8 - with experience from 5 to 8 years;

- 1.0 - with over 8 years of experience.

The first of the coefficients (0.6) also applies when calculating benefits to a resigned employee who falls ill within 30 calendar days after dismissal (Clause 2, Article 7 of Law No. 255-FZ).

The duration of the insurance period when calculating sick leave in 2021, taken into account with the above values of the coefficients, also plays a role in calculating benefits for the care of children receiving treatment in a hospital, and for other family members treated on an outpatient basis (clauses 3, 4 of Article 7 of the law No. 255-FZ). A special procedure for reducing accruals applies when calculating benefits for caring for a child undergoing outpatient treatment. Here, for the first 10 calendar days of illness, accruals are made taking into account generally established coefficients for length of service, and subsequent days are paid at the rate of half the amount of SDZ (subclause 1, clause 3, article 7 of Law No. 255-FZ).

Restrictions on earnings or maximum base in 2021: employee length of service and duration of treatment

The average earnings determined for calculating sick leave should be:

- reduced to 60% if the employee’s insurance coverage at the time of going on sick leave is less than 5 years (in this case, the CST coefficient will be equal to 0.60);

- reduced to 80% if the experience is 5–8 years (KST - 0.80);

- left unchanged if the length of service is more than 8 years (KST - 1). See also the article “At what length of service is sick leave paid 100 percent?”

Read more here.

If the length of service is less than 6 months, then the amount of compensation for sick leave will in any case be calculated based on the minimum wage.

If an employee is being treated himself, then a separate paid sick leave may have a duration (DC) set based on the specifics of a particular disease. But if necessary, there can be several such sheets, and they can be issued in a row - up to 10 months (the procedure approved by order of the Ministry of Health dated September 1, 2020 No. 925n). In some cases, treatment may take longer. For example, in case of tuberculosis - up to 12 months (Clause 4, Article 59 of the Law “On Health Protection” dated November 21, 2011 No. 323-FZ).

The CR rate when caring for a child or other relative depends on:

- on the age of the child or other relative;

- limitations in the child's physical capabilities.

You can find out exactly how sick leave is paid when caring for a child or other relative in the article “Paying sick leave for caring for a sick relative .

How to calculate sick leave in 2021: examples

Let's look at examples of calculating sick leave in 2021.

Let’s assume that Semenova E. A. is an employee of Gamma LLC, has been working there since 2021, and this place of work is her first, i.e. for regular sick leave and sick leave for care, a reduction factor of 0.6 will be applied to SDZ . The regional coefficient does not apply in the region.

For sick leave issued by E. A. Semenova in 2021, the billing period will be 2021 and 2021. Income for 2021 amounted to 380,000 rubles, and for 2020 - 370,000 rubles. In 2021, she was on sick leave for 10 days, and payments for it in the total amount of income amount to 10,000 rubles. Total income is:

380,000 + 370,000 = 750,000 rub.

However, the SDZ calculation will take into account a smaller amount (minus sick leave payments that occurred in 2021):

750,000 – 10,000 = 740,000 rub.

We have already calculated the maximum possible SDZ, calculated from the 2019 and 2021 income limits limiting the calculation of insurance premiums. It is equal to 2434.25 rubles.

The minimum SDZ, calculated from the minimum wage, is 12,792 × 24 / 730 = 420.56 rubles.

Example 1

In February 2021, Semenova E.A. fell ill and went on sick leave for 12 days.

SDZ for calculating benefits will be determined as:

740,000 / 730 = 1,013.70 rubles.

This amount is less than the maximum possible SDZ value and more than that calculated from the minimum wage, i.e. it must be taken into account.

The benefit amount will be equal to:

1,013.70 × 0.6 × 12 = 6,690.42 rubles.

Example 2

In March 2021, Semenova E. A. received a work injury and was on sick leave for 12 days because of it.

The SDZ here will also be equal to 1,013.70 rubles, but the reduction factor will not be applied to it (based on length of service), i.e. the amount of the benefit will be:

1,013.70 × 12 = 12,164.40 rubles.

This amount will not exceed the maximum established for injury benefits in 2021 and therefore will not be limited.

Example 3

In April 2021, Semenova E. A. took sick leave to care for a child under 7 years of age who was receiving outpatient treatment. The duration of sick leave was 12 days, and this was the first sick leave for care in 2021.

SDZ in this situation will also be 1,013.70 rubles. And the benefit amount will be made up of two values due to the fact that the sick leave period will be divided into parts due to the application of different coefficients to SDZ (0.6 for the first 10 days and 0.5 for the last 2 days):

1,013.70 × 0.6 × 10 + 1,013.70 × 0.5 × 2 = 7,095.90 rub.

Example 4

In May 2021, Semenova E. A. goes on leave for labor and labor for 140 days (70 days before and 70 days after childbirth).

SDZ in this case will be calculated as follows:

740,000 / 721* = 1,026.35 rubles.

*When calculating benefits for employment and labor, calendar days for periods of temporary disability, leave for employment and child care, as well as the period of release of an employee from work with full or partial retention of earnings are excluded from the calculation (clause 3.1 of article 14 of law No. 255-FZ ). Because Semenova E.A. in 2021 there were 10 days on sick leave, then out of 731 (taking into account the fact that 2021 is a leap year), this period must be excluded. Accordingly, the amount of earnings should be divided not by 731, but by 721 days (731 - 10).

This figure will also not exceed the maximum and minimum possible SDZ values. The reduction factor based on length of service will not be applied here.

The benefit amount is:

1026.35 × 140 = 143,689.32 rubles.

How to determine average daily earnings

Determine the average earnings to pay for disability using the formula:

The calculation period for temporary disability benefits is two calendar years preceding the year in which the employee fell ill. That is, if an employee fell ill on January 15, 2019, then earnings received in 2021 and 2021 should be included in the calculation.

The calculation includes all payments to the employee from which insurance premiums for compulsory insurance in case of temporary disability and in connection with maternity were calculated. Payments from the previous place of work are also taken into account if the employee has recently started work. Earnings data is taken into account on the basis of a certificate issued by the previous employer and issued in accordance with Order of the Ministry of Labor No. 182n dated April 30, 2013.

Results

Calculation of sick leave in 2021 is still done according to a formula that prescribes the amount of benefits to be determined by multiplying the SDZ calculated for the billing period by the number of days of sick leave. SDZ values must be within its maximum and minimum possible values. Reducing factors may be applied to the calculated amount of SDZ in the case of regular sick leave and sick leave for care.

Sources:

- Federal Law of December 29, 2006 No. 255-FZ

- Federal Law of July 24, 1998 No. 125-FZ

- Tax Code of the Russian Federation

- Decree of the Government of the Russian Federation dated January 24, 2019 No. 32

- Decree of the Government of the Russian Federation of November 28, 2018 No. 1426

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Lower limit of sick leave (minimum compensation)

The minimum amount of sick leave by law is calculated based on the lower limit of the base for calculating temporary disability benefits. The value of the lower limit of the corresponding base is determined by the formula:

NB = minimum wage × 24,

Where:

NB - the lower limit of the base for calculating compensation for a certificate of incapacity for work;

Minimum wage is the amount of the legally established minimum wage in the Russian Federation as of the beginning of the period when the employee was on sick leave.

From 01/01/2021 the minimum wage is 12,792 rubles. and the base for calculating the minimum amount of sick leave for a certificate of incapacity for work is 307,008 rubles.

The average earnings used to determine the actual amount of compensation for sick leave will be calculated using the formula:

NW = NB / 730.

Thus, from January 1, 2021, the minimum amount of temporary disability benefits is 420.56 rubles. in a day. It should also be taken into account that for sick pay, from April 1, 2021, a procedure is in force according to which the benefit calculated for a full calendar month cannot be less than the minimum wage.

For an algorithm and examples of calculating benefits from the minimum wage, see ConsultantPlus. Trial access to the system can be obtained for free.

How to make entries for accrual of sick leave

The accountant will reflect the accrual of sick leave in accounting as follows:

Dt 20 (and other cost accounting accounts - depending on how the patient works in which department) Kt 70 - sick leave accrued for the first 3 days of the employee’s illness;

On the payment day, the accountant will make the following entries:

Dt 70 Kt 68 (subaccounts for income tax calculations) - income tax is withheld from sick leave;

Dt 70 Kt 50 (if from the cash register) or 51 (from the current account) - benefits were paid to the employee.

NOTE! Since from 2021 all employers are participants in the pilot project of the Social Insurance Fund, personal income tax must be withheld only from benefits for the first 3 days of incapacity for work (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294).

Example 1 (continued)

The amount of Ignatieva’s benefit for 10 days of illness: 1,836.68 × 10 = 18,366.80 rubles. Minus personal income tax, Ignatieva will receive 15,978.80 rubles.

The accountant will make the following entries:

Dt 20 Kt 70 in the amount of RUB 5,510.04. — sick leave accrued at the expense of the employer;

On the day of payment of wages to employees:

Dt 70 Kt 68 in the amount of 716 rubles. — personal income tax is withheld from benefit amounts;

Dt 70 Kt 50 in the amount of RUB 4,794.04. — Ignatieva’s temporary disability benefit was issued under RKO.

NOTE! In accordance with paragraph 6 of Art. 226 of the Tax Code of the Russian Federation, income tax on temporary disability benefits in 2021 - 2021 must be transferred to the budget no later than the last day of the month in which the benefit was paid.

Calculation of sickness benefits from the minimum wage: examples

Example 1

Driver Rukavishnikov Andrey Nikolaevich got a job at Company LLC on 09/01/2020. This is his first job. On April 15, 2021, an employee fell ill. The incapacity for work continued until April 19. After returning to work, a certificate of incapacity for work was submitted. Let's calculate how much the minimum wage is charged for 1 day of sick leave based on earnings for this period.

The employee's salary was accrued in 2021:

| Month | Salary |

| September | 30 000,00 |

| October | 30 000,00 |

| November | 30 000,00 |

| December | 32 000,00 |

| Total for 2021 | 122 000,00 |

As of April 15, 2021, the minimum wage is RUB 12,792. Thus, the base for calculating sick leave benefits based on earnings is 122,000 rubles, which is less than the minimum base for calculation - 307,008. Consequently, sick leave is paid based on the minimum wage. The first three days of the sick leave will be paid at the expense of the employer, and the next two - at the expense of the Social Insurance Fund.

Moreover, since Rukavishnikov is a young specialist whose insurance experience by March 15 is just over six months, he is paid sickness benefits in the amount of 60% of the calculated amount.

The amount accrued for sick days will be:

| Paid days | Calculation | Amount, rub. | |

| At the expense of the organization | 3 | 420.56 × 60% x 3 | 757,00 |

| At the expense of the FSS | 2 | 420.56 × 60% x 2 | 504,67 |

| Total | 5 | 1261,67 |

From the accrued amount, personal income tax should be withheld in the amount of 13%. Please note: tax is always calculated in whole rubles.

How to use the calculator

Instructions for using the length of service calculator for sick leave

- If you know your length of service as of a certain date, then enter in the “Experience as of date” field the specific day and the number of years, months, days of experience as of that day. These fields are optional, but if you have this data, it will significantly reduce your calculations.

- In the “Date of hiring” and “Date of dismissal” fields, enter your dates, for example, according to your work book. You must fill out at least one line of this table.

- The “Additional periods” may include such periods as: being in the state or municipal service, the period of work as an individual entrepreneur, the period of receiving unemployment benefits, caring for a disabled person or an elderly relative, and others. The full list of such periods is described below, in the paragraph “What is included in the insurance period”.

- If you have served in the military, indicate its duration in the drop-down list.

- Click "CALCULATE". You can save the result as a doc file.

Please also take into account:

- Use the Today button (circle with a dot) to quickly insert the current date.

- Use the appropriate buttons to add, delete and clear required fields for faster and more convenient entry and change of information.

How is the insurance period for a certificate of incapacity calculated?

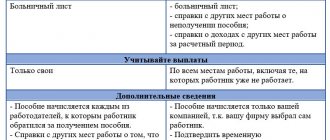

The insurance period for sickness benefits is calculated using information from a paper and (or) electronic work book. If the information is not accurate, is partially or completely missing, or there is no work book, the length of service is calculated based on other documents:

- employment contract;

- certificates from former employers about periods of work;

- extracts from orders;

- personal accounts and salary slips.

To confirm the insurance experience of an individual entrepreneur, you will need to obtain a certificate from the Social Insurance Fund confirming the payment of social insurance contributions. To confirm the insurance period when working for citizens (nanny, housekeeper, etc.), you need an agreement and a document confirming the employer’s payment of social insurance contributions.

Important! When hiring a new employee, the employer does not have the right to demand documents confirming the transfer of insurance contributions at the previous place of work. To calculate the insurance period for sick leave, you need a work book, as well as an employment contract or other specified documents.