Will sick leave be paid after dismissal?

It all depends on exactly when the person went on sick leave relative to the moment of dismissal.

Payment of sick leave after the dismissal of an employee in the same amount as if he had continued to work in the organization is carried out by the employer only if the person fell ill no later than the last day of work in the organization (Clause 2 of Article 5 of the Law “On Social Insurance” dated December 29, 2006 No. 255-FZ). Thus, the employer must compensate sick leave to an employee in an amount calculated on the basis of 100% of the average salary if his insurance experience is 8 years or more, 80% of earnings if the person’s insurance experience is 5–8 years, 60% if the employee’s insurance experience is less than 5 years.

Is it necessary to pay sick leave for caring for a sick child to an employee after his dismissal, ConsultantPlus experts explained. You can find out the opinion of experts by getting free trial access to the system.

In turn, if a person falls ill within 30 days from the date of dismissal, then his former employer also has an obligation to pay sick leave, but not in full, but in the amount of 60% of the average salary of the former employee (clause 2 of Art. 7 of Law No. 255-FZ).

We remind you that starting from 2021, the employer accrues and pays benefits only for the first 3 days of sick leave due to illness or domestic injury. The rest of the benefit amount is calculated and paid to the Social Insurance Fund employee, and some benefits are paid by the fund 100%. For more information, see our guide to direct benefit payments.

The scenarios we have considered are relevant if, by the time the illness occurs, the person has already written a letter of resignation (or the process of releasing him from his position for other reasons has begun). It’s another matter if a person initially did not plan to leave the company, but during an illness he still decided to quit.

Let's look at how sick leave is paid in this case.

Deadlines

It makes sense to talk about two terms:

- Benefit accruals.

- Pay it off.

According to current legislation, the employer must accrue temporary disability benefits no later than 10 days from the date of receipt of all necessary documents.

But the payment is made on the salary day determined by the enterprise . Taking into account the fact that wages must be paid at least 2 times a month, you will have to wait no more than 30-31 days for money. Certainly. if the employer follows the law.

How is voluntary dismissal processed while on sick leave?

Regardless of whether the employee is on sick leave or working, he can exercise his right to dismissal in accordance with the provisions of Art. 80 of the Labor Code of the Russian Federation, that is, on one’s own initiative. Therefore, if a person’s desire to quit arose while he was on sick leave, from a legal point of view this is considered in the same way as if he had done it while he was at work.

Having received a letter of resignation from an employee on sick leave under Art. 80 of the Labor Code of the Russian Federation, the employer can agree with him on the immediate termination of the contract or wait 2 weeks, during which the employee can still have time to go to work, and only after that formalize the termination of the employment relationship.

If the sick leave lasts more than 2 weeks or the date of termination of the contract by agreement has already arrived, the employee will continue to receive compensation for sick leave, while being in the status of dismissed. Thus, in this interpretation, the 2-week period after the employee submits a letter of resignation cannot always be considered as mandatory for working off. In this case, it is a formality, the observance of which is dictated by the norms of the Labor Code of the Russian Federation.

The official termination of an employment contract with an employee generally requires his or her appearance at the employer’s office. But what if a person, for example, has a high temperature and cannot come to work?

Read about the rules for filling out a resignation letter in the material “How to write a resignation letter correctly - sample?”

Procedure

To be fully eligible to receive benefits, you must:

- Provide your former employer with a certain package of documents.

- Apply for funds in a timely manner.

List of documents

Let us note that labor legislation, in general, does not give retired pensioners any special status . Any employee who leaves the organization and goes on sick leave after that will be required to:

- in fact, the certificate of incapacity for work is sick leave;

- passport;

- work book to establish that a person is not working.

Documents must be submitted within six months from the date of dismissal.

How to direct?

Probably the easiest way: contact your former employer personally. Face-to-face communication is always better than correspondence. True, you need to make sure that you have evidence of acceptance of documents on hand . You can take a certain receipt for receipt of papers. Or, make sure that information about the acceptance of documents is presented in the appropriate journal.

If a pensioner cannot come to his former employer, then he can:

- Send the papers by mail - registered mail with notification and a list of the contents.

- Issue a power of attorney for a representative who will transfer sick leave at the principal’s former place of work.

Attention : the deadline for submitting documents is 6 months from the date of termination of the employment contract.

How to terminate an employment contract with a sick employee?

The dismissal of a sick person is formalized in accordance with the general procedure. There is no need to postpone your dismissal date due to illness.

However, in this case, the employer may not be able to obtain the necessary signatures from the resigning employee and give him the work book. Therefore, an order should be issued to terminate the contract with the employee and an entry should be made in it stating that due to the absence of the employee, it is impossible to convey information to him under the order (paragraph 2 of Article 84.1 of the Labor Code of the Russian Federation).

Important! Recommendation from ConsultantPlus Do not forget to make a special note on the order and send the employee a notice of the need to appear for a work record book (if it is kept) or agree to send it by mail. If the work record is not kept... For more details, see K+. Trial access to the system is free.

Payment of sick leave after voluntary dismissal is carried out according to the same scheme as in the case of compensation for an existing employee. That is, the employee must bring to the accounting department all documents confirming the illness, after which, within 10 days, he will be assigned the appropriate compensation, which will be transferred on the day of salary payment (Clause 1, Article 15 of Law No. 255-FZ).

Documents for payment processing

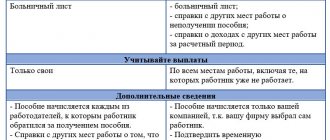

To confirm the employee’s right to payment of sick leave after dismissal, the following documents :

- Passport to confirm the employee’s identity.

- Sick leave certificate to confirm the grounds for payment of sick leave benefits (be sure to provide the original!).

- A work record book to confirm that the employee has not found a new place of employment at the time of the opening of sick leave. It is permissible to present the work record book in photocopy format.

- Certificate of income for the last two years to determine the average salary of the employee.

Calculation of sick leave: nuances

There are a number of nuances that characterize the calculation and payment of sick leave.

The maximum amount of average daily earnings that can be taken into account when determining the amount of sick leave in 2021 is 2,434 rubles. 25 kopecks This indicator is calculated based on the maximum base for insurance contributions to the Social Insurance Fund for 2 calendar years preceding the one in which the employee went on sick leave:

- 865,000 rub. — in 2021;

- 912,000 rub. - in 2021.

For an example of calculating sick leave, see the article “Maximum amount of sick leave in 2021 - 2021” .

In 2021, the benefit cannot be less than the minimum wage per full month (in 2021, the minimum wage is 12,792 rubles).

In what cases and how the minimum wage benefit is calculated, read in ConsultantPlus. Get trial access to the system for free and go to the Ready-made solution.

As we said above, an employee has the right to receive sick leave compensation from his former employer after dismissal within 30 days. But if during this time a person found another job (that is, a new employment contract was signed during this period) and fell ill after applying for it, then the obligation to pay sick leave rests with the new employer (Clause 2 of Article 5 of Law No. 255-FZ) .

It can also be noted that an employee has the right to apply for accrual of sick leave only within 6 months after recovery. If he misses this deadline, then sick leave, if there are good reasons for this absence, can be paid by the Social Insurance Fund (clauses 1, 3, article 12 of Law No. 255-FZ).

Calculation example

Manager Petrov A.A. resigned from Krug LLC on May 14, 2021. On June 16 of the same year, he brought to the accounting department of his former employer a sheet of temporary incapacity for work, from which it is clear that Petrov A.A. I was sick from June 10 to June 15 inclusive. A copy of Petrov’s work record book confirms that he was not employed at the time the sick leave was provided. A certificate from the employment center confirms that Petrov is not registered as unemployed.

Petrov’s work experience at Krug LLC is 7 years. For 2021, his earnings amounted to 750,000.00 rubles, for 2021 - 850,000.00 rubles. For 2017, the accountant will take into account the entire amount of earnings of 750,000.00 rubles (it does not exceed the base limit for Social Insurance contributions of 755.0 thousand rubles). For 2021, only RUB 815,000.00 will be taken into account. (the remaining accrued amount exceeds the limit of the base for Social Insurance contributions for 2021 of 815.0 thousand rubles).

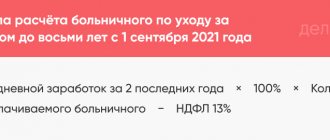

Calculation

Earnings for the billing period: 750,000.00 + 815,000.00 = 1,565,000.00. Average daily earnings: 1565000.00 /730 = 2143.84. The average daily benefit is taken in this situation at the rate of 60%, excluding length of service: 2143.84 * 60% = 1286.30.

Petrov was incapacitated from July 10 to July 15, 6 calendar days. His benefit will be: 1286.30*6 = 7717.80 rubles.

Results

Payment of sick leave after dismissal is provided for by law in 3 cases:

- if a person fell ill while he was on the payroll (in this case, compensation is assigned to him according to the general scheme);

- if his child fell ill while he was still an employee of this organization;

- if illness occurs within 30 days after dismissal (in the latter case, the employer pays the former employee sick leave in the amount of 60% of the average salary).

The fact that an employee is on sick leave is not a legal obstacle to filing a voluntary dismissal.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to pay the employment service?

The employment service does not pay for sick leave, even if the person is registered as unemployed. This department already pays social benefits to the unemployed. During illness, it does not disappear, does not change (that is, the sick person continues to receive financial resources), but it does not increase, so in fact, this department does not provide for sick leave payment.

Reference! A sick leave certificate can serve as confirmation of a valid reason why an unemployed person did not undergo the re-registration procedure or did not appear for interviews.

If a person is not registered with the labor exchange, but is looking for work on his own after leaving his previous job, then he has the right to demand payment for sick leave from his previous employer.

Types of certificates of incapacity for work

Payment for sick leave is made only in case of personal illness of a former employee. A document from the hospital confirming incapacity for work due to illness of relatives (including a child) is not accepted for payment of compensation.

The employer is obliged to accept sick leave from a dismissed employee for calculating benefits, regardless of the period indicated on it.

For a former employee, the type and duration of disability documentation presented depends on the treatment option that was assigned to him.

There may be several of them:

- If outpatient treatment is prescribed, during which he does not leave his home environment, then its duration is a maximum of 15 days.

- Observation of recovery under the supervision of a dentist or paramedic does not last more than 10 days.

- Providing medical care in a hospital setting involves issuing a sick leave certificate for the entire stay in the hospital. Moreover, if the patient also needs additional time to restore the body at home, then he is given another 10 days.

- When undergoing health procedures in a sanatorium, a document from a medical institution can be issued for a maximum of 24 days.

In difficult situations, the period for which sick leave is issued can be up to 10 months. If serious complications or tuberculosis are detected, the treatment period can be 1 year.

If the period of patient care coincides with vacation

Payment of sick leave for child care is not expected if the period of illness occurred while the parent was on vacation. During annual paid leave or leave at your own expense, a certificate of incapacity for caregiving is not issued. If the patient does not have time to recover before the date the parent (or other family member caring for him) leaves vacation, then a certificate of incapacity for work is issued from the day the employee starts work.

Extending vacation time for the period of treatment is permitted only if the employee himself becomes ill, but not when caring for the sick person.

How to apply to the FSS

In exceptional cases, the application is submitted directly to the Social Insurance Fund: during the liquidation of the employer enterprise, when conducting business activities in the status of an individual entrepreneur and self-employed. Self-employed people apply only if they pay insurance premiums.

Here are instructions on how to write a statement that I will not bring sick leave to the Social Insurance Fund:

- Download the unified form by type of insured event from Appendix No. 1 of the Order of the Social Insurance Fund No. 578 of November 24, 2017.

- Fill in the required fields - information about the insured person, type of insured event, passport, SNILS, details for transferring funds.

- Collect a package of supporting documents (birth certificate, certificate of non-receipt of benefits, etc.) and submit to the territorial office of the Social Insurance Fund along with the application.