For people who live in the northern regions of the country or in areas equivalent to them, there is a separate term for a pension, such as “northern”.

Northern are called increased pension payments in accordance with the northern coefficient (from 1.15 to 2 depending on the region).

The key aspects regarding these payments include:

- the coefficient that is used in the person’s area of residence increases the size of the basic part of the pension;

- pension benefits entitled to persons who worked in the regions of the North are retained by them when moving to other regions;

- to receive a northern pension, you must work in the specified areas for at least 20-25 years; When working in enterprises with difficult or harmful working conditions, 15-20 years of work experience is required to receive a pension.

Based on Federal Law No. 400, adopted on December 28, 2013, when calculating the amount of pension payments, the number of accumulated points is taken into account, which is the sum of the amount of wages and the number of working years.

Elena Smirnova

Pension lawyer, ready to answer your questions.

Ask me a question

Please note that citizens who have reached the preferential retirement age can retire early. It is also possible to retire early in special circumstances (for example, after the loss of a breadwinner).

All residents of the northern regions of the country have the right to retire at the age of 55 years (for men) or 50 years (for women). If the work was associated with difficult or dangerous activities, then early payments of pension savings are possible: at 45 years old and at 50 years old. As a last resort, you need to work in the North for at least 7.5 years in order to qualify for certain benefits when retiring.

In the case where a citizen has a period of official labor activity in the regions of the North and territories equivalent to them is less than 15 years, then each year of work allows him to retire 4 months earlier.

Additional information: one year of work carried out in areas with living conditions equivalent to the northern ones is considered as nine months of northern work experience.

To apply for a northern pension, citizens need to contact the regional Pension Fund with an application to establish a pension or renew its payments.

You should also take the following package of documents with you:

- papers that indicate the length of service (for example, a work book);

- other documents confirming the person’s length of service (employment contract);

- a document confirming the person’s identity (most often a passport);

- papers containing the address of the last place of work;

- a certificate from the place of permanent registration of the person at the place of residence;

- SNILS;

- a certificate indicating the average salary for the last 60 months worked;

- when moving to another place of residence, the pensioner will be asked to present his personal file.

In addition, do not forget that time spent in military service or on maternity leave is also taken into account when calculating the northern pension.

Please note that a decision on an application accepted for consideration is made within up to 10 working days. If it is accepted, then pension payments begin on the first day of the next month. In special circumstances (death of the breadwinner or receipt of any disability group), accruals will begin from the date these circumstances arise.

What areas

The Far North (FN) and the territories of the RCN equated to it are not so much a geographical concept when calculating preferences, but rather a legal one. The CS includes all areas that are located above the Arctic Circle: islands, cities, regions, territories, republics within the Russian Federation. Areas equated to the Far North include areas adjacent to the territories of the CC. A complete list of settlements and the designation of which type they belong to, KS or RKS, are prescribed in Resolution of the Council of Ministers of the Soviet Union No. 12 of January 3, 1983, which is applied in the current edition of February 27, 2021.

Before finding a job in the north, it’s a good idea to clarify what type of work experience in a given locality will be classified as. A couple of kilometers may affect the insufficiency of the “northern” experience or it will be calculated as usual without additional preferences and subsidies.

The peculiarity of the pension for northerners is that when calculating it, a multiplier is used, which varies from 2.0 to 1.15. For residents of islands in the Arctic Ocean the coefficient is 2.0, and for some Karelians it is 1.15. A fixed part, which is set by the state annually, is multiplied by this multiplier. The amount of the fixed payment from January 2021 is 5,334.19 rubles, from 2020 it is 5,686.25 rubles. This is stated in Law No. 350 of October 3, 2018.

Employers are required to independently transfer information about employees to the Pension Fund and confirm the information when requested. But for his own peace of mind, it is better for a citizen to take all supporting documents while working in these regions, with a note about the “northern” experience, drawn up in accordance with the legislation of the Russian Federation.

Regional odds

Regional and district coefficients are the values by which pension payments of citizens are increased. The rules for their appointment and execution are regulated in the RF PP No. 249 of March 18. 2015 (last revised Oct. 13, 2021).

Algorithm for using indicators: the amount of a citizen’s pension is calculated according to the basic formula (IPC * Cost of 1st pension point + Fixed additional payment), after which a regional coefficient is applied to the result obtained.

The values differ for different regions of the country. For example, for residents of the Chukotka Autonomous Okrug the coefficient is “2”, for the Murmansk region - “1.8”. A complete list of regions and the values established for them was published in the letter of the Pension Department of the Ministry of Labor of the Russian Federation No. 1199-16 dated June 9. 2003

IMPORTANT:

When applying for a “northern” pension, a citizen can receive only an increased bonus or only a payment with the applied regional coefficient. In practice, a pensioner does not have to choose. He is automatically assigned the option in which he will receive a larger pension.

Who can apply

Citizens who meet the following conditions can apply for a “northern” pension:

- women/men have reached 55/60 years of age;

- the minimum northern experience in the KS is 15 years, in the RKS 20 years;

- total experience 20/25 years for women/men.

To reduce the age for retirement before 60/65 years, persons accepted throughout the country who have a northern experience of at least 7.5 years can qualify for relief. If a citizen has worked at the CS for 7.5 years or more, and at the RCS for 10 years, he can retire earlier than his peers. Each subsequent year of work beyond 7.5 or 10 in difficult climatic conditions moves the retirement age by 4 months for KS and by 3 months for RKS. If a citizen worked for 15 and 20 years in the North, but did not live there and does not currently live there, then he has accumulated full “northern” experience and will retire at the age of 55 or 60, depending on whether he is a woman or man.

For example, Nikolai worked in the Far North for 10 years and 2 months. Given a total of 25 years of experience, we will calculate when a citizen has the right to retire:

10.2 * 4 (because KS, if RKS, then 3) / 12 (number of months) = 3.4 or 3 years and 4 months.

Nikolai has the right to retire before age 65 in 3 years and 4 months; he can become a pensioner at 61 years and 8 months.

Regulatory and legal framework

Regulation, definition of concepts and standards for the basic calculation of increased state assistance to northerners is carried out using the following policy documents:

- Federal Law No. 166-FZ of December 15, 2001, which defines the procedure for state provision of pension benefits.

- Federal Law No. 400-FZ dated December 28, 2013, establishing standards for calculating insurance pensions.

- Federal Law No. 173-FZ of December 17, 2001 on labor pension subsidies, insofar as it does not contradict Federal Law-400 of December 28, 2013.

- Decree of the Russian government No. 651 of July 14, 2013 on the rules for equating regions to the Constitutional Court and the norms regulating the age of pensioners in the north.

- Decree of the Government of the Russian Federation No. 367 of April 28, 2016 on how the fixed premium to the insurance benefit for workers of the Far North (KS) is changing.

List of regions of the Far North and areas equated to RKS

According to the Decree of the Government of the country PP-651 dated July 14, 2013, specialized indicators are established for the regions of the Constitutional Court, the size of which, depending on the territorial location of the subject of the country, can be seen in the table below:

| Names of localities in the Far North (KS) | The value of the increasing indicator |

| Islands of the Arctic Ocean, with the exception of the islands of the White Sea and Dikson Republic of Sakha (Yakutia): territories of the Deputatsky and Kular mines, Aikhal and Udachnaya deposits, Nizhnekolymsky district, village. Ust-Kuiga Sakhalin region (Kuril, South Kuril regions, Kuril Islands) Kamchatka Territory (Aleutian district on the territory of the Commander Islands) Chukotka Autonomous Okrug all | 2,0 |

| Norilsk, surrounding areas Murmansk | 1,8 |

| Republic of Sakha (Yakutia) (area of the Lensky district north of 61° north latitude) Mirny with subordinate territories The entire Magadan region Murmansk region (Tumanny town) | 1,7 |

| Vorkuta city of the Komi Republic with subordinate areas Republic of Sakha (Yakutia) (Abyisky, Allaikhovsky, Bulunsky, Anabarsky, Verkhnekolymsky, Verkhnevilyuysky, Vilyuisky, Verkhoyansky, Kobyaysky, Zhigansky, Mirninsky, Nyurbinsky, Oymyakonsky, Momsky, Srednekolymsky, Oleneksky, Suntarsky, Tomponsky, Ust-Yangsky, Eveno-Bytnaitaysky districts ) Krasnoyarsk Territory (Taimyr Autonomous District, Evenki Autonomous District north of the Lower Tunguska River, Turukhansky District north of the Lower Tunguska and Turukhan Rivers, the city of Igarka, the entire territory north of the Arctic Circle with the exception of the above entities) Khabarovsk Territory (Okhotsk region) Kamchatka Territory (remaining territory) Sakhalin region (Okha city with adjacent territories, Nogliki district) | 1,6 |

| Komi Republic (Inta city with subordinate entities) Republic of Sakha (Yakutia) (township Kangalassy) Republic of Tyva (Todzha, Kyzyl (Shynaan rural administration), Mongun-Taiga districts) Nenets Autonomous Okrug all Khanty-Mansi Autonomous Okrug (Ugra, north of 60° north latitude) Tyumen region (Uvat district) All Yamalo-Nenets Autonomous Okrug Tomsk region (cities of Kedrovy, Strezhevoy, Kolpashevo, districts Parabelsky, Chainsky, Kargasoksky, Verkhnekitsky, Aleksandrovsky) | 1,5 |

| Altai Republic (Ulagansky, Kosh-Chagaysky districts) Karelia (the cities of Kostomuksha, Kem with subordinate areas, Loukhsky, Kalevalsky, Kemsky, Belomorsky districts) Republic of Sakha (Yakutia) (remaining territories) Republic of Tyva (localities except those listed above) Primorsky Territory (mining villages Taezhny, Ternisty, Kavalerovsky district) Khabarovsk Territory (the cities of Nikolaevsk-on-Amur, Sovetskaya Gavan with subordinate areas, the districts of Ulchsky, Solnechny, Tuguro-Chumikansky, Nikolaevsky, named after Osipenko, Vaninsky, Ayano-Maisky, Verkhnebureinsky (north of 51° north latitude)) Arkhangelsk region (Severodvinsk with adjacent settlements, Solovetsky (Solovetsky Islands), Pinezhsky, Menzensky, Leshukonsky districts) Murmansk region (remaining areas) Sakhalin region (territories, excluding those mentioned above) | 1,4 |

| Republic of Buryatia (city of Severobaikalsk with subordinate areas, Muisky, Bauntovsky districts) Karelia (city of Segezha with subordinate settlements, Pudozhsky, Segezhsky, Muezersky, Medvezhyegorsky districts) Komi (the cities of Pechora, Usinsk, Ukhta, Vuktyl with subordinate areas, the districts of Izhemsky, Udorsky, Troitsko-Pechersky, Ust-Tsilemsky, Pechora) Krasnoyarsk Territory (the cities of Yeniseisk, Lesosibirsk with adjacent territories, the districts of Turukhansky (south of the Nizhnyaya Tunguska and Turukhan rivers), Motyginsky, Kezhemsky, Boguchansky, Yenisei, North-Yenisei, Evenki Autonomous Okrug) Amur region (the cities of Zeya, Tynda with subordinate entities, Selemdzhinsky district) Irkutsk region (the cities of Bratsk, Ust-Ilimsk, Bodaibo with subordinate areas, the districts of Katangsky, Kazachinsko-Lensky, Kirensky, Ust-Ilimsky, Mamsko-Chuysky, Nizhneilimsky) Transbaikalia (Tungokochensky, Kalarsky, Tungiro-Olekminsky districts) Khanty-Mansi Autonomous Okrug south of 60° north latitude Tomsk region (Molchanovsky, Krivosheinsky, Bakcharsky, Teguldetsky districts) | 1,3 |

| Buryatia (Barguzinsky, Okinsky, Kurumkansky districts) Komi Republic (remaining territorial entities) Primorsky Territory (Dalnegorsk city with subordinate entities, Kavalerovsky, Olginsky, Terneysky, Krasnoarmeysky districts (Vostok, Boguslavetskaya, Vostretsovskaya, Melnichnaya, Roshchinskaya, Izmailikhinskaya, Dalnekutskaya, Taezhnenskaya rural administrations)) Khabarovsk Territory (the cities of Amursk, Komsomolsk-on-Amur with adjacent territories, Verkhnebureinsky (south of 51° north latitude), Solnechny districts, Amursky district (the village of Elban with subordinate surroundings, Omminskaya, Achanskaya, Voznesenskaya, Padalinskaya, Dzhuenskaya rural administrations )) Arkhangelsk region (remaining entities) Perm region (districts Kochevskaya, Kosinsky, Gaininsky) | 1,2 |

| Karelia (except for the above areas) | 1,12 |

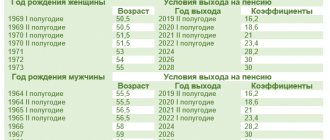

Northern experience for women

From 2023, all northern women must be 55 years old to retire. Until this year, a smooth transition with increasing age is provided.

| How it was before 2021 | Age | Exit date, as it became according to the pension reform |

| I half of 2019 | 50,5 | II half of 2019 |

| II half of 2019 | 50,5 | I half of 2020 |

| I half of 2020 | 51,5 | I half of 2021 |

| I half of 2020 | 51,5 | I half of 2022 |

| 2021 | 53 | 2024 |

| 2022 | 54 | 2026 |

| 2023 | 55 | 2028 |

From the table it turns out that women born in 1973 will retire in 2028. A man working in the North, born in 1968, will also retire in 2028.

The insurance period for women must meet the following parameters:

- Minimum 20 years of total experience, of which 12 years in CS.

- 20 years total and 17 years in RKS.

For men, the total experience is 25 years.

Calculation of the northern pension in 2021, features for working pensioners

Every year, the pension fund calculates inflation, increases the cost of living and, in connection with this, carries out indexation. In 2018, it was 3.7% for insurance benefits and 4.1% for social benefits. However, indexation applies only to non-working pensioners; indexation is not provided for working pensioners.

Inflation rate forecast

Formula for calculating the northern pension

To determine the amount received after retirement due to age or other reasons, a universal formula is used. The calculation of the northern pension in 2021 looks like this:

Benefit = coefficient * cost (currently 81.6 rubles) + fixed additional payment.

Amount of fixed supplement, minimum northern pension

A fixed supplement is an indexed amount required to adjust payments in relation to the cost of living; it is also the minimum pension. In 2021 it amounted to 4282 rubles. This coefficient increases by 50% for residents of cold regions, in addition, part of the benefit is multiplied by the regional coefficient. Additionally, the benefit includes a payment upon reaching 80 years of age (an additional double subsidy) and 1,520 rubles for each dependent.

How to calculate the regional northern pension coefficient

According to the law, based on the conditions of the region, each of the northern territories has its own coefficient, which is applied to the formula for calculating the northern pension in 2021. These indicators, if the required length of service is available, are applied to both insurance and social benefits. At the same time, upon reaching the required age, the citizen has the opportunity to choose between increasing the amount by multiplying the surcharge by a fixed indicator or setting a high level of additional charge.

What will be included in the experience and what will not

When a citizen works continuously, then with experience everything is simple. But you should know which other periods are considered labor periods, and which, on the contrary, will not be counted when calculating your pension.

Periods included in the length of service:

- periods of illness issued on sick leave issued to a working citizen;

- planned vacations from which all contributions to the Pension Fund and others are deducted;

- military service or equivalent activity;

- for shift workers, the timing between shifts and the time for arrival and departure to the place of work.

Activities that will not count towards northern experience:

- the period of registration at the labor exchange as unemployed;

- work for part of the rate, but if there is a combination of two half-time jobs, then you should collect supporting documents indicating that the total rate was received;

- training at a university, college, technical school, advanced training courses and other educational activities for which wages were not calculated and deductions were not made to the Pension Fund;

- unpaid time off, vacations at your own expense and other unpaid days off;

- the period of child care will be included in the general length of service, but not in the northern period; only sick leave issued for birth will be included in it.

Preferences

Applicants for northern pensions and benefits must contact the territorial Pension Fund, regardless of their current place of residence. If a citizen moved from the RKS or KS, this does not cancel his right to preferences. Only the regional bonus paid by local budgets is lost.

Residents of the KS who work in areas with high physical stress retained the right to retire early. These are workers in the coal mining, railway or metallurgical industries. Additional benefits will be available to mothers of disabled children and those who have given birth to or raised 5 or more children. They will retire at other times.

The following may go on vacation before the legally prescribed period:

- Women over 50 years of age who have lived on a CS for more than 15 years. With a total experience of 20 years. An additional condition is the birth of two children. Of the 20 years worked, 12 years must be in the KS or 17 years in the RKS.

- 50-year-old men and 45-year-old women who live in the KS and work in reindeer breeding, fishing or hunting for more than 25 and 20 years in gender ratio. This activity must be registered as providing an essential life activity.

Increased pension benefits when moving

When moving to the “south”, different rules are used for increased northern pension provision. Those citizens who receive an increased fixed payment will maintain their pension amount. They will need to register with the pension fund at their new place of residence and re-register the supplement.

Persons whose pension is calculated using the regional coefficient will lose the right to increased payments. This happens because the indicators are assigned to a specific region or a certain area of the subject.

Supporting documents

Before retiring, a citizen should collect a package of supporting documents at least a month before the due date:

- general passport;

- a copy of the work book, which clearly indicates the periods of service in the localities of the KS or RKS;

- documents confirming the presence of disabled persons as dependents, birth certificates, documents of kinship, certificates of recognition as incompetent, disability certificates, etc.;

- an extract confirming the citizen’s current place of residence.

The pre-retirement pensioner will write an application to the Pension Fund, which, together with a package of documents, will be considered within a month. At the end of the period, the applicant must be formally notified of the result.

The list of documents can be expanded and, at the request of Pension Fund employees, you will need to provide a military ID, marriage or divorce certificate, confirming a change of surname, or others.

To receive a pension, you do not have to go to the post office or wait for delivery people at home. It is more convenient to connect a plastic card. The current account attached to the card must be provided to the PRF. Many banks offer preferential terms for debit cards for pensioners: cashbacks, interest on account balances, and home delivery of an issued card. For another category of pensioners, credit cards with the following advantages will be useful: a grace period for lending, interest-free cash withdrawals, free service or participation in various loyalty programs with partners.

about the author

Klavdiya Treskova - higher education with qualification “Economist”, with specializations “Economics and Management” and “Computer Technologies” at PSU. She worked in a bank in positions from operator to acting. Head of the Department for servicing private and corporate clients. Every year she successfully passed certifications, education and training in banking services. Total work experience in the bank is more than 15 years. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 21

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Andrey

10/14/2021 at 09:56 Unfortunately, the article is more confusing than helpful.

Now is the transition period, provide a table of retirement ages by year of birth. Your article is rather relevant only for men of 1968 and younger, as well as women of 1973 and younger, and even then not completely. So the article does not correctly indicate what is not taken into account for the “northern” experience. For example, if the length of service was earned before 2002, then the vacation at your own expense goes into the length of service. There are many similar inaccuracies in the article. The last example, you write: “Citizens who have met the following conditions can apply for a “northern” pension: - women/men have reached 55/60 years of age;” This is already fundamentally wrong. For example, in 2021, a man born in 1966, that is, has reached the age of 55 years (not 60 years old like you), if he has fully completed his “northern” work experience and has a total experience of at least 25 years, receives the right to a preferential pension of 58 years in 2024. Rework the article, don't mislead people. Reply ↓ - Love

10/07/2021 at 23:52Good day! I really want to get qualified advice from you, since my husband and I never received it from the Pension Fund. The fact is that in the work experience calculator I calculated my husband’s total work experience and his northern work experience. The following figures were obtained: northern experience - 15 years, 8 months, total work experience - 33 years 7 months. My husband was born in 1964, he still works in the regions of the far north (Norilsk), but the Pension Fund told us that he will not retire before the age of 60. Please help us cope with this task that is incomprehensible to us. Thank you very much in advance!!!

Reply ↓

Anna Popovich

10/09/2021 at 18:16Dear Lyubov, the minimum required northern experience for early retirement is 15 calendar years in the Far North and 20 calendar years in equivalent areas. The insurance coverage requirement is 20 years for women and 25 years for men.

Reply ↓

09.25.2021 at 16:19

What is the length of service for women located in the north who have given birth to 3 children and maternity leave is included there?

Reply ↓

- Anna Popovich

09.27.2021 at 18:05

Dear Elena, women who have given birth to two or more children and have worked for 12 calendar years in the Far North and have at least 20 years of insurance experience have the right to retire early at the age of 50.

Reply ↓

06/08/2021 at 19:29

Hello! I have 31 years of experience in the north, IPC 105, I was born in the north and have lived in the north in the Murmansk region all my life. I am 50 years old (born March 9, 1971). I have one child, born in 1991. Can I retire at 50? I don’t understand how to interpret “for those who have worked in the regions of the Far North for at least 7 years and 6 months, an insurance pension is assigned with a reduction in the age established by Article 8 of this Federal Law by four months for each full calendar year of work in these areas.” Why doesn’t Article 32, Part 1, Clause 6 apply to my case?

Reply ↓

- Anna Popovich

06/10/2021 at 18:49

Dear Elena, count the number of continuously working years, then multiply this number by four - this way you will get the number of benefit months. Subtract this amount from the retirement age and then you can determine the retirement age.

Reply ↓

06/08/2021 at 19:10

Hello, I have been living in the north since 2015, namely in Norilsk, I have worked in the north for 6 years before that, as they say here on the mainland, I was born in 1961, I am 60 years old, but I work under the new pension reform, I must leave in 2024, that is, at 63 years old total experience 42 years number of points 80 but deductions started in 2004 and before that there was Soviet experience can I retire earlier

Reply ↓

- Anna Popovich

06/10/2021 at 18:50

Dear Anatoly, in your case, to calculate your retirement age, you need to contact the territorial division of the Pension Fund.

Reply ↓

06/08/2021 at 06:54

Hello! Born and lived in RKS for 37 years. Experience in RKS 14 years 8 months. Two children. Total experience 21 years. In March 2021, I submitted documents to the Pension Fund. They told me to wait for an answer within six months. I would like to know when the right to retire arises? Thank you.

Reply ↓

05/03/2021 at 18:07

Good afternoon She retired at 50 years and 4 months. My sulfur experience is 14 years 8 months and 12 days. As a result, I do not receive the northern coefficient for retirement, since I was a little short of 15 years. 1) If I go now and work for 3.5 months, can I count on an increase in my pension? 2) Is it possible to finalize the Employment Agreement (pension contributions and other taxes will be paid) or is it necessary to make an entry in the work book?

Reply ↓

- Anna Popovich

05/03/2021 at 18:50

Dear Marina, there must be an entry in the employment record, but if there is none, then a contract or similar documents can be provided as confirmation of the fact of work. Regarding the possibility of extending service after retirement, check this issue with the territorial division of the Pension Fund of Russia.

Reply ↓

04/20/2021 at 14:02

Good afternoon. My b.b. 02/04/63. Total experience over 35 years. Of these, 11 years and 6 months in areas equated to the Far North. At what age will I be eligible for a pension?

Reply ↓

- Anna Popovich

04/20/2021 at 18:36

Dear Evgeniy, if you are applying for a pension with a reduction in the retirement age in proportion to your length of service in special areas, then a Pension Fund specialist in the branch of your city will be able to advise you in detail.

Reply ↓

04/07/2021 at 21:56

I have unofficially 10 years of experience, officially seven years at one enterprise in Novy Urengoy, my labor has been lost, how to apply for a pension

Reply ↓

- Anna Popovich

04/08/2021 at 01:26

Dear Tatyana, if it is not possible to obtain copies of the work record book, then to confirm the length of service you can provide a certificate(s) from the place of work, an employment contract, salary statements and similar documents.

Reply ↓

04/04/2021 at 13:11

I have 14 years of 4 years of experience in the region equivalent to the KS (not the far north) total 32, now I am 56 years old 4 months, the pension office told me that if I continue to work, then at 61 I will be able to retire, that’s right is it?

Reply ↓

- Anna Popovich

04/04/2021 at 21:08

Dear Vladimir, the required northern experience for early retirement is 15 years in the Far North and 20 years in equivalent areas. The requirements for insurance experience do not change and are 20 years for women and 25 years for men. We recommend that you consult again with the territorial division of the Pension Fund.

Reply ↓

01/06/2021 at 15:42

Hello! Please help me figure out whether my husband is entitled to an old-age pension. He was born on June 23, 1964. The work record book was lost, but the data can be restored, the company still exists, but under a different name. But the fact is that he worked only in Soviet times with 1984 to 1994 at this enterprise in areas equated to the Far North (Sakhalin region). Then there were layoffs, perestroika and we were laid off. He no longer officially worked. Now he has already turned 56 years old in June 2021. Is he entitled to some kind of pension with 10 years of experience in Soviet times? He no longer has any years or coefficients. For some reason I think that at least the minimum pension is what he is entitled to. He himself does not want to go to the pension, because he believes that he is not entitled to anything. I ask for your advice. Thanks in advance!

Reply ↓

- Anna Popovich

01/06/2021 at 21:41

Dear Alla, the law determines the northern experience of at least 15 years. For men it is 5 years more than for women. But the law also provides for the possibility of assigning a pension with a reduction in the retirement age in proportion to the length of service. This requires at least 7 years 6 months of work in the Far North. In this case, the insurance pension is assigned with a decrease in the retirement age. You definitely need to consult a PF specialist.

Reply ↓

09.25.2019 at 21:33

Movement using Sberbank cards

Reply ↓

How are payments to northerners calculated?

Let us remember again that the calendar working year is different for workers in the Northern regions. However, this does not in any way affect those periods when there was actual unemployment in the region.

Part-time work deserves special mention (in cases where the organization, for some reason, does not work full-time), which also counts for seniority under different conditions, namely based on the time spent at work.

For those citizens who combine several types of activities, it is important that these positions allow the employee to receive full-time employment in total.

If a northerner has not fulfilled the conditions allowing him to receive insurance coverage, then he is entitled exclusively to social benefits.

The requirements of the insurance component of state provision are:

- Accumulation of minimum work experience;

- Accumulation of a set amount of pension points;

- Reaching a certain age.

“Based on the fourth paragraph of the eleventh article of Federal Law 166, there are some representatives of nationalities who have the right to early social security when they reach 50 years of age (wives) and 55 years of age (husband).”

Government Resolution number 1049 states that small northern peoples at the federal level are understood as:

- Nenets;

- Chukchi;

- Khanty;

- Aleuts and others.

Other categories of the population have the right to receive social support at the same age as all Russians, namely the female half at 60 years old, and the male half at 65 years old.

To calculate pension salaries, a special formula is used that allows you to calculate the amount of accruals:

Amount = BC + IPB * SB.

Explanation:

- BC - the base part established by the state for the year, based on last year’s inflation level;

- IPB - individual points accumulated by a citizen during his working life;

- SB - the cost of the point coefficient in the current year (81.49 rubles).