6

For a long time, mothers left with their children tremblingly awaited the adoption of a law that would increase the minimum amount of alimony to 15 thousand or at least to the subsistence level. Unfortunately, these hopes were not crowned with success - the sensational projects No. 401490-6 and No. 489583-6 never found the necessary support from deputies.

Today, the minimum amount of alimony is calculated according to the old scheme - based on the cost of living or the income of the father, including the unemployed.

In practice, the minimum amount of alimony can be completely unacceptable amounts of 400-700 rubles, but the law does not give even the slightest chance of increasing it.

What is the minimum amount of alimony in 2021?

There is no fixed amount of alimony or a specific amount established by law. There are 2 options for establishing alimony - by agreement and by court decision, and in each case, alimony can be established both as a share of all types of earnings, and as a fixed amount of funds. Let's look at each of them.

By agreement

According to Art. 103 of the RF IC, parents of a minor independently choose one of the methods for calculating the amount of alimony:

- In shares of the father's income;

- In a fixed amount with a definition of the frequency of payment;

- In other ways, including by providing a lump sum or other material assistance.

Parents should keep in mind that when a notary approves a document, he checks whether the child’s rights have been violated.

Attention! In the agreement established by the former spouses, the amount of alimony payments cannot be less than what would be due to a minor by court decision.

By court

The court, when deciding to award alimony, proceeds primarily from the man’s solvency. There are the following ways to pay money for a child:

- If the father works or receives other official income in the form of a pension (other social security) - in a share of the amount received;

- If a man does not receive an official income or his income is irregular, alimony is set at a fixed amount, tied to the cost of living in the region where the mother and the minor live.

Receiving alimony when your spouse is unemployed

The absence of work for a father or mother does not relieve them of their responsibilities to the children and payment of the established amount. Regardless of the current situation, a parent is obliged to provide for his child. If the spouse does not have a job, but does not evade paying alimony, articles of the law allow an agreement on the amount of monthly transfers to be concluded.

There is no need to be upset if the amount of transfers during the period of your spouse’s absence from work is minimal. The amount of alimony will increase over time. Concern and accusations of failure to fulfill duties on the part of the husband or wife can lead to the fact that the spouse will lose the desire to support the child, and he will begin to evade transferring money for maintenance.

Concluding a voluntary agreement between members of a couple is not always possible. In this case, alimony can be collected in a fixed sum of money or parts of earnings and a fixed sum of money.

The method of collecting funds for child support is used if the spouse:

- no official income

- income is unstable,

- earnings are paid in whole or in part in foreign currency,

- earnings are given in kind.

An obstacle to the calculation of alimony in a shared ratio may also be the infringement of the interests of one of the parties or its distress. The court changes the method of calculating the amount of funds.

Alimony according to the form of collection

As mentioned above, alimony payments can be collected through the court both in shared income and in a fixed amount.

As a share of income

Let's consider the classic version of the calculation - in proportion to the father's salary, provided for in Art. 81 of the RF IC, and we will determine the minimum amount of alimony for mothers whose ex-spouses have a job and the ability to pay money for the maintenance of the baby. Let's take, for example, the minimum wage - the minimum wage, often paid officially with wages many times higher in reality.

According to Law No. 460-FZ, the minimum salary is 7,800 rubles from June 1, 2021.

For 1 child

In accordance with Art. 81 of the RF IC, a father receiving an official salary is obliged to pay a quarter of the child’s income.

From a salary in the amount of the minimum wage, the minimum amount of alimony in this case will be 1950 rubles.

For 2 children

The father is required to give a third of his income, or 33%. Based on the salary equal to the minimum wage, this will be 2,575 rubles.

For 3 children

A man pays his mother half of his earnings (1/2 of all income), that is, 3,900 rubles if the amount of income is equal to the minimum wage.

For 4 or more children

In any case, the father is obliged to give half of his income. The court may establish other amounts of deductions if it is obvious from the case materials that one of the parties is in greater need of money. However, such decisions are rare, and they are due to exceptional circumstances.

Example of alimony calculation. Petrov (2 children) and Sidorov (4 children) work for the minimum possible salary of 7,800 rubles. If the court establishes the payment of alimony to them on the basis of Art. 81 of the RF IC, the calculation will be as follows.

- Petrov will give his ex-wife 2,600 rubles, 1,300 rubles per minor.

- Sidorov will have to pay 3,900 rubles - 975 rubles for each child

It should be noted that if a man receives more than just wages, he should make deductions for the baby from all of his income. Alimony is withheld from:

- Compensation;

- Vacation pay;

- Financial assistance;

- From money received under contracts for the provision of services, contracts, etc.

There is a relatively small list of income that a man can completely keep for himself. For example, one-time assistance from the budget, payment for therapeutic and preventive nutrition, some compensation from the employer.

Example. Ivanov, the father of 1 child, works in a minimum paid position. At the same time, he rents out an apartment for 15,000 rubles a month. The court found that the father is obliged to give his son a quarter of the income from the amount of all his income.

Thus, Ivanov Jr. is entitled to: (¼ × 7,800) + (¼ × 15,000) = 5,700 rubles.

In a flat amount

This method of calculation is established by the court if the father has an unstable income, receives money in another currency, products, or is engaged in entrepreneurial activity. In such cases, it is advisable to calculate the amount of alimony from the subsistence level (hereinafter referred to as the minimum wage) established for the region of residence of the mother and child.

However, the amount of monthly deductions rarely coincides with the monthly minimum. Judges generally assign alimony in multiples of the minimum subsistence level - 1.5 monthly minimum, 2 monthly minimum, 0.5 monthly minimum, etc. The judicial practice that has been developing over the past couple of years is still moving towards fixing the minimum amount of alimony in a fixed amount of money no less than the subsistence level.

The specific coefficient depends on the father’s income, the standard of living of the mother and child, the number of children receiving alimony, and whether the man has other dependents.

When calculating alimony in a fixed amount, it is necessary to be guided by Rosstat data on the cost of living for children for specific regions.

Example. A man has two children from different wives. One wife lives in the Magadan region, the second - in Kursk. The amount of alimony assigned to each of the children is 0.5 monthly minimum for each region.

According to statistics, in the third quarter of 2021, the monthly allowance per child in the Magadan region is 18,985 rubles. That is, a minor will receive 9,492.5 rubles. In Kursk, the PM for the same period is 8,847 rubles, therefore, the second child can only claim 4,423.5 rubles.

It is difficult to calculate the minimum amount of alimony in a fixed amount, since judges set different coefficients. We can only say unequivocally that children from the Belgorod region can get the least. For them, in 2021 the cost of living is the lowest and is 8,233 rubles.

Minimum by agreement

A voluntary agreement concluded between spouses is a document where they, by mutual agreement, can indicate any amount, procedure and method of paying alimony. But this does not mean that this document gives the right to indicate an amount of alimony that is negligible, “for show,” and cannot satisfy even the minimum needs of the child.

The Family Code is designed to insure children against such actions of unscrupulous parents. Therefore, Article 103 states that the amount of alimony specified in the agreement should not be less than that which would be assigned by a court decision in accordance with family law. That is, the minimum amount of alimony for one child cannot be less than a quarter of his monthly income, for three - less than half.

Mandatory certification of the agreement by a notary is also an additional guarantee that the interests of children will not be infringed.

If it is difficult for parents to decide what amount of child support to specify so that everyone is happy, you can use one rule. Establish what is the optimal amount of money without excesses needed to support a child (food, fees for kindergarten, sports section, seasonal clothing, etc.) every month, divide it by two (so both parents have completely equal responsibilities for the material support of their children ). The resulting figure will be the required minimum alimony required for the child on a monthly basis.

Or you need to take as an example the indicators of the cost of living or the minimum wage so that, if possible, the established amounts are due to both the child and his parent after paying alimony.

Minimum amount of child support

Unfortunately, current legislation gives unscrupulous alimony payers a lot of opportunities to reduce the amount of payments due to the child. Thus, an officially unemployed father can be registered with the Employment Center, receive a meager allowance, but at the same time work unofficially and hide his real income.

If the payer is unemployed

If the father is registered with the Employment Center and receives unemployment assistance, then depending on the number of children, he will pay his ex-wife a quarter, a third or half of the monthly benefit.

In accordance with Government Decree No. 1326 of December 8, 2016, the amount of payments for temporarily unemployed citizens ranges from 850 to 4,900 rubles.

The minimum amount of alimony, based on an allowance of 850 rubles, will be:

- 212.5 rubles – per child;

- 283.3 rubles – for two children;

- 425 rubles – for three or more children.

And these amounts are not for each child, but for everyone in general! For more information on the procedure for collecting alimony from an unemployed person and the specifics of their calculation, see this article.

The payer is working

Based on the minimum wage, the minimum amount will be:

- 1950 rubles – for one child;

- 2,600 rubles – for two offspring;

- 3,900 – for three or more minors.

The example with the minimum wage is formal. Often, unscrupulous employers set their employees a rate of 0.5 or 0.75 units, thereby further reducing the level of official payments.

As already mentioned, a different amount of deductions may be specified in the agreement or in the judge’s decision. But since alimony should be enough to provide for the children, it is unlikely that its amount will be lower than indicated.

Is it possible to increase the amount of funds received per child? Yes.

A woman has the right:

- challenge the judge’s decision if it has not yet entered into legal force;

- file a new claim to increase the amount of alimony, index it or collect a penalty in case of delay in payments;

- enter into a new agreement with your ex-spouse.

To do everything correctly and achieve the desired effect, it is recommended to contact a lawyer for qualified legal assistance or, at a minimum, free consultation from our specialists.

Do visiting pensioners receive regional supplements?

According to the law, the supplement (RSD) is provided to non-working pensioners registered at their place of residence or stay in the Moscow region. Assistance is provided to residents who receive a pension for old age or long service, disability, or loss of a breadwinner.

Also, people over 18 years of age who have lost their breadwinner and are studying full-time in educational institutions can receive additional payment (RSD). The payment will be made until the age of 23, that is, until the end of training.

“The total amount of material support for non-working pensioners, taking into account the regional social supplement to pensions in 2021, will be brought to the level of 10,648 rubles; about 171.5 thousand residents of the Moscow region will receive it,” summed up the Minister of Social Development of the Moscow Region, Irina Faevskaya.

However, in addition to this additional payment, some categories of pensioners are entitled to additional social support measures.

Salary below the minimum wage: responsibility and fines

Why is the minimum wage important? For many reasons. First of all, wages depend on it. The employer does not have the right to pay full-time employees a salary below the minimum wage, as stated in Art. 133 of the Labor Code of the Russian Federation: “The monthly salary of an employee who has fully worked the standard working hours during this period and fulfilled labor standards (job duties) cannot be lower than the minimum wage.”

Rostrud on its official website clarifies that wages may be less than the minimum wage if the employee works part-time or part-time. “The salary may be less than the minimum wage. In addition to salary, wages include compensation payments, various bonuses and incentive payments (Article 129 of the Labor Code of the Russian Federation). Thus, taking into account all salary increases or incentives, the employee receives an amount greater than or equal to the minimum wage. If the employee’s salary is still less than the established minimum wage, the employer must make an additional payment up to the minimum wage.”

Conducting business according to the law. Services for individual entrepreneurs and LLCs less than 3 months old

Details

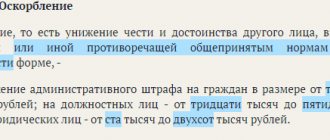

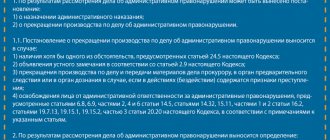

The employer must understand that he is at great risk if his employees receive wages below the minimum wage. The labor inspectorate may fine him. According to Part 6 of Art. 5.27 of the Code of Administrative Offenses of the Russian Federation, such a violation entails a warning or the imposition of an administrative fine on officials in the amount of 10,000 to 20,000 rubles; for legal entities - from 30,000 to 50,000 rubles.

For repeated violations, the fine for officials ranges from 20,000 to 30,000 rubles. or disqualification for a period of one to three years; for legal entities - from 50,000 to 100,000 rubles.

Salary is less than the minimum wage for a part-time worker

Rostrud experts draw attention to the fact that in case of part-time work, remuneration should not be lower than the minimum wage, calculated in proportion to the time worked - depending on output or on other conditions determined by the employment contract (Article 285 of the Labor Code of the Russian Federation).

Thus, the wages of a part-time worker should not be lower than the minimum wage, calculated in proportion to the time worked.

Selecting a collection method

The claimant does not have the right to determine the method of collection at will. The court a priori determines alimony payments as shares of income, and a fixed amount is assigned in the following cases:

- lack of a stable source of income and regularity of receipt;

- payment of remuneration in a form other than cash or in the currency of another country;

- the presence of instability in periods of receipt and “jumping” in size;

- violation of the interests of the parties when making payments in percentage terms.

When establishing the amount and choosing the method of collection, the court relies on the maximum possible preservation of the interests of the children and ensuring the same level of material benefits, taking into account the financial and family status of the participants in the changed circumstances.

Minimum alimony payments can vary significantly in amount depending on the method chosen. However, when reviewing in order to change the method, the indicators should be assessed based on the table:

| Indicators | Percentage | In a fixed size |

| Numerical value | Fluctuates in proportion to the “fluctuation” of income | Stable and does not change with changes in income |

| Accounting for the growth of the consumer price index | Accounted for at the source of accrual. For example, an increase in the minimum wage automatically obliges the employer to raise wages to a new minimum | Officially published indices lag behind real indicators over the time period |

| Price comparability | An increase in market prices automatically leads to a revision of wages - the basis for calculating alimony | The amount is not revised until the recipient submits a statement of claim |

| Financial risks | Loss of a source of income or a sharp decline automatically reduces maintenance payments | A sharp increase in the welfare of the alimony worker is not reflected financially in an increase in material assistance, on a par with a decrease |

Payments in a fixed amount are similar to a “bird in the hand”, since, regardless of the financial situation of the payer, they ensure the constancy of the minimum alimony until the alimony owner applies to the court with an initiative for review in the event of a sharp financial deterioration. Income share payments are linked to the amount of remuneration received, automatically falling when decreasing and increasing when increasing.

Recalculation of alimony

Standard methods of collection allow for a change in the amount of payments in either direction if the financial or marital status changes or additional significant circumstances are identified. To recalculate, it is necessary to prove that the minimum for child support has increased due to a change in the child’s consumption basket and a drop in the level of one’s own income for independent reasons.

The following are taken into account as evidence:

- expenses for treatment and rehabilitation of children based on a medical card containing anamnesis and the need for therapeutic and rehabilitation measures;

- costs of obtaining education, including contracts concluded with higher and secondary specialized educational institutions;

- concluded agreements and paid bills for general educational activities that provide for physical and intellectual development (sports sections, amateur art groups, music schools);

- certificates confirming a drop in the recipient's income for reasons independent of the individual (dismissal due to staff reduction or liquidation of a business entity, long-term illness that caused permanent disability or led to disability);

- change in marital status due to the appearance of additional dependents (the birth of children, the need to care for a sick relative);

- price list of goods necessary for a child of a given age group, including clothing and essentials.

When making payments in a fixed amount, the claimant must provide evidence of the objective impossibility of paying half when assigning based on the minimum amount of child support or its sharp increase.