If you are reading this article, it means that difficult times have come and filing for personal bankruptcy does not seem like an absurd idea to you. This right is used by citizens who cannot pay off their creditors. Thanks to the opportunity to file for bankruptcy, individuals have a chance to legally write off debts.

What is it - bankruptcy or financial insolvency? This is a legal way to get rid of debts, regulated by No. 127-FZ On Insolvency (Bankruptcy). In fact, rehabilitation for large debts. Debtors get the opportunity to free themselves from unaffordable loans and start their financial history from scratch.

Interestingly, until 2015, only companies and individual entrepreneurs had the right to file for bankruptcy. However, since October 1, 2015, the situation has changed, and now not only legal entities, but also individual debtors can get rid of the debt burden legally.

How does the Federal Law on bankruptcy of individuals No. 127-FZ work?

When it comes to large debts, it is necessary to understand what rights and obligations the law establishes for a bankrupt. The right to write off debts is regulated by the Federal Law on Bankruptcy of Individuals, more precisely, by Chapter X of Federal Law No. 127 “On Insolvency (Bankruptcy)”.

(60.5 KB)

The text of the law regulates the following points:

- The procedure for bankruptcy of individuals . Citizens can go bankrupt through the Arbitration Court. Or out of court - through the MFC. A bank, tax office or other person cannot declare a person bankrupt;

- Signs of bankruptcy of an individual. The law clearly establishes that signs of a citizen’s insolvency are a debt of 500,000 rubles or more, and a delay of 90 days on loans. Banks can file for bankruptcy of their client if the amount of the principal debt (without interest) is more than half a million rubles. The debtor himself - and for a smaller amount, if it is obvious to him that there are no funds to pay off the debts.

He can file for bankruptcy even in advance, before the delays begin, if the debtor understands that he will not be able to pay off his obligations. What these circumstances are is not specified in the bill. This is decided by the court based on the specific situation: for example, the establishment of disability, deprivation of a breadwinner - a situation where it is obvious that the loans will not be repaid and they can be written off immediately;In practice, based on the results of already held trials, it is clear that the court considers cases with a debt amount of 350 thousand rubles.

- Consequences of bankruptcy .

The consequences are listed in the legislation, this includes, in particular, the impossibility of re-recognizing insolvency for 5 years (or 10 years - if an individual was declared bankrupt in a simplified manner through the MFC), a ban on being a founder or general director in legal entities. Temporary restrictions have also been established that occur when the fact of financial insolvency is established, from the moment of the first hearing in the case - this is the suspension of court decisions made earlier, the termination of accrual of interest on loan obligations; - Responsibilities and powers of financial managers .

Financial managers prepare reports for the court, file petitions, and manage the financial affairs of debtors. They also check the case for good faith, fictitiousness, collect creditors, search for property and conduct auctions for the sale of the debtor’s property. The current version of the law on bankruptcy of citizens No. 127-FZ provides for 25,000 rubles as a fixed remuneration for the financial manager. In addition, the manager has the right to 7% of the value of the bankrupt’s sold property - if an auction was held.

Bankruptcy of a legal entity

Bankruptcy of a legal entity is the termination of the activities of an organization by decision of an arbitration court in connection with the recognition of financial insolvency.

The following may file an application to court to initiate bankruptcy proceedings:

- debtor;

- creditors;

- authorized bodies (Federal Tax Service, prosecutor's office, Ministry of Finance and government organizations).

Important! The applicant has the right to nominate an arbitration manager who is empowered to manage the debtor company during the bankruptcy procedure. Based on this provision, in certain situations it is advantageous for the first to file an application for arbitration.

The law determines the debtor’s obligation to file a claim in arbitration to declare himself bankrupt within one month from the moment signs of financial insolvency are identified.

FAQ

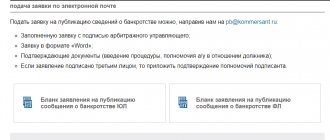

Is it possible to file for bankruptcy online?

Can. The application is submitted through the official portal of the Arbitration Courts my.arbitr.ru. To submit an application remotely, an electronic digital signature is required. This can be done at any Certification Center.

Can a pensioner become bankrupt?

Yes maybe. Retirement may even become a kind of mitigating circumstance, explaining the inability of a citizen to repay his debts in the same amount. A similar procedure is applied to pensioners, with a small exception - they are often granted requests to defer or installment payment for the services of a financial manager and keep the entire pension during the sale.

Is it possible to become bankrupt on your own?

Yes, you can. But remember that your creditors will have experienced lawyers on their side, and it will be difficult to compete with them. Without legal training, you risk spending significantly more time and money on the procedure than with the help of a lawyer.

The bank filed for bankruptcy: what should I do?

The main thing is not to panic and not take rash actions. For example, you should not hastily get rid of your property by selling it at bargain prices or transferring it to relatives. It is better to immediately contact a lawyer to choose the optimal defense strategy.

But it is better not to bring the situation to the point where the bank itself sues you. If the initiator of the process is a creditor, then he will take care of appointing a financial manager loyal to the credit organization. This will make bankruptcy more difficult for a person who is already overwhelmed by debt.

Bankruptcy procedure for individuals faces becomes popular

If you are unable to pay your debts, then it is time to consider bankruptcy. This is the only legal way to start your financial life from scratch.

You can declare yourself bankrupt once every five years

The Federal Law of the Russian Federation On Bankruptcy allows citizens of the country to use the opportunity to cancel debts by declaring themselves bankrupt. The creditor has the right to demand bankruptcy of the debtor in order to compensate for losses incurred. A person declared bankrupt retains this status for a period of 5 years.

You can declare yourself bankrupt once every five years. Left bankrupt and without property, it will be difficult for the former debtor to restore financial well-being. If he lacks a specialty or work experience in another field, he may decide to take a second chance in life by re-accepting loan obligations. An unsuccessful investment or improper management of funds will again lead to the formation of an outstanding loan. The very fact of the accumulation of repeated debt during the five-year period will be investigated more carefully in order to avoid unfair application of the law.

Changes and amendments from 2015 to 2021

The popularity of bankruptcy among individuals is growing every year. Uniform judicial practice is developed, and the legislator adjusts the provisions of the law to make the judicial process clear and transparent, and the result fair. Let's take a closer look at the changes to bankruptcy legislation.

When the law on bankruptcy of individuals came into force, and this was October 1, 2015, the amount of remuneration for the financial manager

was 10,000 rubles. Already in June 2021, a change was adopted - the amount increased to 25,000 rubles for one procedure as part of a personal bankruptcy case. When selling property, the manager began to receive not 2%, but 7%.

Since January 2021, amendments have been made to the law on bankruptcy of individuals and the Tax Code of the Russian Federation - state duty for individuals

ceased to be 6,000 rubles. Now you only need to pay 300 rubles for it.

A new norm has already been introduced in 2021 - a moratorium on bankruptcy

. It did not affect citizens, but it protected individual entrepreneurs whose business belonged to the affected industries. Banks and suppliers, as well as the Federal Tax Service, did not have the right to sue to collect debts from such an individual entrepreneur during the moratorium period. This time could have been used to rebuild the business. But this rule was introduced only during the coronavirus pandemic. The moratorium ended on January 7, 2021.

If there is no prospect of recovery, we recommend that you consider declaring insolvency in order to write off loans and debts to counterparties. Read more about individual entrepreneur bankruptcy in this article.

Judicial practice has shown that it is difficult for people to file a bankruptcy petition on their own and collect enough evidence. Debtors, knowing about the possibility of legally writing off loans, still preferred to suffer from calls from banks and visits from collectors.

However, the crisis has made people bolder. Moreover, the President of the country called bankruptcy a normal and legal solution to get out of a difficult financial situation.

But the problem with judicial bankruptcy is the cost. On average, the price of a lawyer's services in bankruptcy is about 80,000 - 100,000 rubles, and a debtor who is up to his eyeballs in loans and debts simply does not have that kind of money to resolve a bankruptcy case in court. We talked about mandatory expenses and prices for legal services in this material.

Consequences of bankruptcy of a legal entity

A positive aspect of completing bankruptcy for the debtor is release from monetary obligations. Negative sides:

- loss of finances;

- loss of reputation as a reliable business partner;

- close supervision by the judiciary.

Since fictitious bankruptcy, despite serious penalties, is still a common phenomenon, the management of debtor organizations is carefully checked for possible fraud and financial irregularities.

If facts are confirmed against the debtor, administrative and criminal penalties are provided. Creditors who have not received their money often go to court to accuse management of illegal actions if there is documentary evidence of the guilt of those responsible.

Even if bankruptcy was not intentional, litigation is stressful for the defendant, especially since decisions are not always objective. The area of responsibility includes:

- founders;

- general director, financial director, chief accountant;

- persons who disposed of shares and property of the enterprise.

Thus, declaring an organization bankrupt is not always the end of litigation.

Insolvency (bankruptcy) law: what to expect in 2021?

The legal literacy of the population has increased, and bankruptcy is becoming more popular. People want to write off loans and microloans through the court, but the cost of expenses for bankruptcy services is not always adequate to the situation. If there is no money, then there is no money for bankruptcy. And people are forced to hide their income, receive a gray salary, so that the bailiff does not resume enforcement. production, and the bank did not write off old debts without acceptance.

The state concluded that if the costs of bankruptcy for individuals were reduced, it would give a large number of taxpayers a chance to start living again - legally and without debt.

Article 223.4. Consequences of including information about a citizen who has filed an application for declaring him bankrupt out of court in the Unified Federal Register of Bankruptcy Information

- From the date of inclusion of information about the initiation of an extrajudicial bankruptcy procedure for a citizen in the Unified Federal Register of Information on Bankruptcy, a moratorium is introduced on satisfying the claims of creditors for monetary obligations, for the payment of mandatory payments, with the exception of:

- claims of creditors not specified in the application for declaring a citizen bankrupt out of court;

- claims for compensation for harm caused to life or health, in cases of reclaiming property from someone else’s illegal possession, for removing obstacles to the ownership of said property, for recognition of ownership of said property, for payment of wages and severance pay, for compensation for moral damage, collection of alimony, as well as other claims inextricably linked with the identity of the creditor, including claims not stated when filing an application to declare a citizen bankrupt out of court.

Read completely

Source

Simplified bankruptcy in the MFC

The bill on simplified bankruptcy has been discussed since 2021. Taking into account the crisis and discontent of the population, the State Duma adopted amendments on out-of-court (simplified) bankruptcy in July 2021. The law came into force in September 2021.

The essence of the law on extrajudicial bankruptcy of individuals is as follows:

- the process is carried out out of court through the MFC;

- it's free;

- procedure duration is 6 months;

- They write off the debts of citizens if the amount of all arrears is from 50,000 to 500,000 rubles. The main calculation is made on the fact that enforcement proceedings are closed due to the impossibility of collection. That is, the bailiff has already analyzed the debtor’s financial situation and concluded that there is no property or income.

Then repeating the same analysis in a paid bankruptcy procedure is irrational. If creditors do not file any objections within 6 months while the out-of-court bankruptcy is underway, the debts will be written off without the participation of the Arbitration Court - as a result of the work of the FSSP.If, within the six months allotted for simplified bankruptcy, bailiffs or creditors find the debtor’s property (for example, he gets a job or suddenly receives an inheritance), then the bankruptcy procedure will be transferred to the court at the initiative of the creditor. In this case, the creditor is obliged to pay for the services of the financial manager.

The free, simplified bankruptcy procedure without court is suitable only for the poorest people. We examined in more detail the mechanism and risks of out-of-court debt write-off in this article.

Sale of the only home

By law, the debtor’s only apartment or house is considered inviolable, and the sale of housing through judicial proceedings is prohibited. Even if the debt is a billion rubles, and the debtor owns the only luxury mansion, they do not have the right to seize it for sale.

These conditions do not apply to mortgaged property - by law it is subject to sale for settlements with the creditor - the mortgagee, even if it is the debtor's only home.

Some legislators considered this situation unfair. Amendments are being considered on the sale of luxury real estate and the purchase of housing for the debtor and his family in accordance with the standards for the area of residential premises in the region. The price difference could help satisfy lenders' demands.

The idea has not yet been formalized into a full-fledged bill and has not been considered at State Duma meetings. Perhaps someday a procedure for the seizure of expensive single housing will be adopted, but what this will look like has not yet been clarified.

Positions of the Constitutional and Supreme Courts of the Russian Federation regarding the seizure of the only housing

At the end of April 2021, the Constitutional Court (CC of the Russian Federation) decided that if the bankrupt’s housing belongs to the category of luxury, with excess space (the case involved an apartment with a square footage of more than 100 meters with one tenant), then it can be sold. The Constitutional Court required the courts to make decisions on the sale of the only home in the bankruptcy procedure of an individual, especially if the individual. the person managed to “get into debt” before bankruptcy, and bought the only home after accruing these debts.

But selling a single apartment or house is allowed only if in return the debtor is allocated new housing that meets social standards. That is, creditors must agree at a general meeting to jointly purchase a cheaper apartment for the debtor. Housing must be purchased in the same locality where the property that the court will decide to sell is located. Unless the debtor himself declares his readiness to move.

The Constitutional Court also demanded urgent changes to the laws of the Russian Federation, which stipulate the inviolability status of the only home, and reminded that it has been demanding such amendments from legislators for 9 years, but “things are still there.”

On August 4, 2021, the Supreme Court of the Russian Federation confirmed the opinion of the Constitutional Court from the end of April and ruled that housing that falls under the “luxury” category can be confiscated from an individual declared bankrupt, even if it is the only one the debtor has. Moreover, according to the Supreme Court, not only the creditor, but also the financial manager who is appointed to conduct the bankruptcy procedure has the right to seize housing.

Funds for the purchase of alternative living space for the bankrupt are allocated from the bankruptcy estate. And the decision on the advisability of confiscating the only home should be made at a meeting of creditors, the Supreme Court decision says.

Stage I. Collection of necessary documents

Website of the authors of the article : https:/iwp.su/

Federal Law No. 127-FZ provides a list of mandatory documents that are required to file bankruptcy of an individual. But in each specific case this list can be changed or supplemented.

It is important that the documents submitted fully confirm the impossibility of the debtor fulfilling its obligations to creditors. And what is equally important - they corresponded to reality. Otherwise, it threatens with administrative or even criminal punishment.

Personal documents for bankruptcy:

- copy of the passport,

- TIN,

- SNILS,

- certificate of absence of registration as an individual entrepreneur,

- certificates of marriage and divorce, birth of children,

- copy of spouse's passport,

- marriage contract, property division agreement concluded within the last 3 years.

Documents about the existence of debt:

- agreements with banks, microfinance organizations, etc.,

- receipts for loans from individuals,

- certificates confirming the formation of debt, payment schedules,

- court decisions, orders to initiate enforcement proceedings by bailiffs,

- claims, statements of claim from creditors,

- payment requests from government authorities, for example, the tax office, the Pension Fund or the traffic police.

Documents confirming the availability of property and income

- certificate from place of employment in form 2-NDFL,

- employment history,

- extract from an individual personal account,

- certificates from the Pension Fund and Social Insurance Fund on the assignment of pensions, benefits, and other social benefits,

- certificate from the employment service about the status of unemployed,

- certificates of accounts and deposits, bank account statements, certificates of electronic money balances and their transfers,

- certificate of state registration of ownership of real estate, certificate of state registration of a vehicle,

- information about the presence of a share in the authorized capital, an extract from the register of shareholders.

Documents on completed transactions over the last 3 years:

- copies of agreements on transactions with property, securities, shares in the authorized capital, including purchase and sale agreements, donations, pledges, etc.

Documents confirming the existence of circumstances preventing the fulfillment of financial obligations (if any):

- certificate of incapacity for work, disability,

- information about losses incurred, etc.

To submit an application you will also need:

- receipts for sending copies of statements to all persons participating in the case,

- receipt of payment of state duty,

- a receipt for depositing money with the court to pay remuneration to the financial manager,

- application for declaring a citizen bankrupt.

It is necessary to dwell on the last document separately, since it is of great importance for starting the personal bankruptcy procedure.

[to contents