Today, the popularity of bankruptcy procedures for individuals continues to gain momentum. More and more people are seeking to write off their debts in a legal way and, of course, one of the most pressing issues for them is the cost of the bankruptcy procedure.

Today, the market for services to support bankruptcy procedures includes both companies providing the so-called “turnkey bankruptcy” service and companies that calculate the final cost of the bankruptcy procedure based on the complexity and duration of the case. In order for you to get an idea of the approximate cost of the bankruptcy procedure and choose the most profitable option for cooperation with a company providing bankruptcy support services, read our new article, in which we talk about which expenses in the bankruptcy procedure are mandatory and which may arise based on the specifics of the case.

What does the price consist of?

All issues regarding the insolvency of individuals are disclosed in Federal Law No. 127. It also states that the total amount consists of the following waste:

- payment of duties to the state;

- remuneration for the work of the financial manager (FM);

- payment of expenses incurred by the financial institution.

To say more precisely how much bankruptcy proceedings cost an individual, we will consider each type of waste separately. Let's start with the state fee. This amount is considered the only fixed amount. For 2021 it is equal to 300 rubles. The citizen must pay it immediately when filing a claim. Sometimes it is possible to apply for an installment plan for the state fee. The citizen submitting the application (the debtor, his FU) pays the fee.

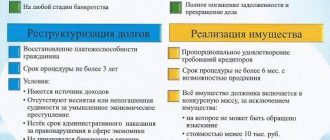

Then there are the costs of the procedure itself. During this process, it will be necessary to pay for the work of legal entities, inclusion in the unified register of Kommersant, sale of property, postal and office expenses. You also need to pay for the work of independent appraisers. This law (Part 3, Article 20.6) determines the amount of remuneration for the FU as twenty-five thousand rubles. The applicant deposits the amount with the court. They are paid to the specialist after the process is completed. Amount 25 thousand rubles. established by law for each procedure separately (restructuring, implementation).

Payment for FI work differs in each individual case. The specialist must complete several publications for the EFRSB and Kommersant (newspaper). Hiring lawyers also requires additional expenses. Let us describe in detail each of the types of expenses included in the cost of bankruptcy of individuals for a more convenient understanding.

How to find a bankruptcy announcement on the official website?

If you know the number of the case in court, the date or week of the event, it is more convenient to search for announcements of the debtor’s insolvency in the archive of the electronic version of the Kommersant.ru newspaper. Flipping through a binder is a labor-intensive and time-consuming task.

First, you should go to the website of the newspaper kommersant ru. Checking for bankruptcy of a legal entity begins by going to the “Bankruptcy” tab - it is located in the upper right part of the screen, the second in line.

The next step is to view the page that opens. Among the options offered, you need to find a rectangle with the inscription: “Search for bankruptcy announcements.”

It should be noted that the site design has been updated and has become much more convenient than the old version.

Next, everything is very simple. After entering the TIN, OGRN or advertisement number, it is necessary to confirm that the user is not a robot, and the information (if it is available in the database) will be provided.

If it is difficult to find out the indicated numbers or there is no time for this, you should do this:

- Leave the required field blank.

- Check the "I'm not a robot" checkbox.

- Click the “Find” button.

- Close the "Search Error" pop-up window.

- Click on the final phrase of the text below (link “...in the appropriate section”).

After this, the advanced search page kommersant.ru/Search will automatically open. In the empty field you should enter the name of the company of interest or the surname of the individual.

As a result of these actions, the user will receive all information about the subjects with the data he specified. The disadvantage of this search method is that there may be too many options. In order to limit the search area, you can use filtering by marking the desired region, time interval and source (Kommersant newspaper).

The more accurately the information is presented, the faster and easier it is to find an advertisement relating to the subject of interest.

Publication in the unified register of Kommersant

Federal Law (No. 127) clearly defined the rules and responsibilities of the financial manager in an insolvency case in Parts 7, 8 of Art. 213.

Legislation provides citizens with provisions describing the types of expenses that can be attributed to payment for the work of financial institutions.

These include:

- costs associated with mailing notices;

- publication of information on the EFRSB;

- involvement of independent experts in the conduct of the case;

- waste related to the sale of property;

- implementation of publication for the Kommersant newspaper.

Cost of financial manager services

The duration and success of the case being conducted depends on the FU. You can choose a specialist yourself. The candidacy is approved by the court. The cost of bankruptcy for individuals also includes the financial institution's fee. The hired specialist is an intermediary between creditors and the debtor. It is impossible to write off a loan without it.

According to the Insolvency Law, financial institutions must pay only RUB 25,000. To this amount is added 2% of the creditor's satisfied claims. They may also add 2% of the amount received after the sale of the property of the bankrupt person. The citizen initiating bankruptcy must deposit a fixed portion of the remuneration into the court deposit. It is 10,000 rubles.

The procedure for declaring the insolvency of an individual is more simplified than the bankruptcy of legal entities. But the FU still needs to carry out a large amount of work. Do not forget about the civil, criminal, and administrative liability of this specialist. He will bear it in case of non-fulfillment or improper fulfillment of the obligations assigned to him. For violating the provisions of the insolvency law, he is given a fine of 25,000 rubles. This is the minimum amount of the fine.

Also, financial institutions will have to pay such expenses as regular contributions to their self-regulatory organization. He is obliged to insure his liability and pay salaries to his assistants.

To hire a competent FI to successfully complete the insolvency process, you need to negotiate an additional fee. No one will agree to work for 25,000 rubles. The specific amount is negotiated between the financial institution and the citizen filing an application for recognition of his insolvency. The price varies between 100 - 150 thousand rubles. If we take into account the sale of the property of the bankrupt, this amount will be even greater.

Who is cheaper to go bankrupt, the debtor or the creditor?

Of course, if the creditor initiates the procedure, the procedure may cost him less, since he can pay for at least part of the procedure at the expense of the debtor. But this is only if he has them, which cannot always be predicted.

On the other hand, the debtor is unlikely to file for bankruptcy in the absence of funds for the procedure - since, in their absence, the procedure will simply freeze. And it will not lead to the result he expected.

We talked about developing a bankruptcy strategy in a previous publication.

As a conclusion , we can say that it is only possible to calculate the cost of the procedure without first studying documents, balance sheets, and reporting. A more or less accurate price will be obtained only after a detailed analysis of the debtor.

And finally, the creditor does not need to start the procedure if he knows that the debtor has no money at all. You will have to pay for it out of your own pocket, and whether it will be possible to bring the management and owners of the debtor company to subsidiary liability is far from certain.

Expenses for the sale of property

In case of bankruptcy of individuals in the federation, the cost of the process includes the costs of selling property. This item is the most expensive. If the bankrupt person has property, it will need to be sold through electronic trading. The funds raised in this way are used to pay off debts.

When selling property, the following types of costs arise:

- implementation of publications for the EFRSB. You will need 2 of them, and this costs from 800 rubles;

- payment for services provided by the electronic trading platform. You will need about 7,000 rubles.

To conduct bidding, the financial institution must correctly assess the property of the debtor. For this purpose, he turns to independent experts. The financial manager pays for the services of appraisers taking into account the presented value of the property.

What is the advantage if we accompany the bankruptcy?

- All costs for the arbitration manager’s remuneration are already included in the cost of the service. You don't need to worry about this.

- We optimize costs during bankruptcy. We have a staff of lawyers, accountants, auditors, and appraisers. And you will not need to compensate for the costs of attracting these specialists and their work. And the sums accumulate there are large.

- Business Garant has built an entire ecosystem for entrepreneurs, allowing them to quickly and comfortably open a new business after bankruptcy. You can register a company, open a bank account, rent an office, buy or sell commercial real estate, residential real estate, and a ready-made business.

See how we can help you.

Payment for legal entities

When conducting an insolvency case, you need the help of a lawyer. This specialist cannot replace the FU. His role is to prepare documentation. He familiarizes the client with the nuances of the case and defends interests in court. Lawyers help you select an SRO and check all transactions for the last 3 years.

The cost of legal services for bankruptcy of individuals differs in each case. It depends on the tasks that the specialist has to solve. On average, the price of services is from 10 thousand rubles.

Conclusion

Thus, at the moment, the cost of the bankruptcy procedure starts from 50,000 rubles. The final amount depends on the duration of the case, the complexity of the procedure, the number of creditors, the need for bidding, appraisal examination, etc.

In order to make a preliminary calculation of the cost of your bankruptcy procedure, it is necessary to conduct a thorough analysis of your specific situation. In any case, it is worth understanding that there is no need to pay for the procedure immediately and in full; it is possible to finance the procedure “in installments,” that is, as the need arises.

In order to find out the exact cost of your bankruptcy procedure, it is best to consult with a specialist - a lawyer involved in supporting bankruptcy procedures.

Postage and office expenses

To publish data on the case in Kommersant, you will need 7,000 rubles. This is the price of one publication. If the court decides to restructure and subsequently sell the property, 2 publications will be required. In this case, in case of bankruptcy of individuals, the cost of publishing the newspaper is 14,000 rubles.

Publication to the EFRSB must be carried out if the following nuances are present:

- decision to introduce restructuring;

- approval of the plan for the upcoming restructuring;

- recognition of the debtor as bankrupt, appointment of the sale of property;

- absence/detection of signs of a fictitious fact of insolvency;

- failure to accept or cancel the restructuring plan by the court;

- receipt by the court of claims from creditors;

- meeting of creditors;

- completion of the process of property sale;

- completion of restructuring;

- filing a petition regarding completion of the implementation;

- any communication that is directly related to a judge-led insolvency proceeding.

According to the legislation, one publication in the EFRSB costs 402.5 rubles. If the ledger is simple, about 5 - 7 messages will be required. In more complex cases, there will be much more publication.

Postage costs include the funds necessary to correspond with each of the creditors. Notification by mail to government agencies regarding insolvency proceedings. Citizens will not be able to avoid this type of expense. even a meeting of creditors is held after their prior notification by mail. When conducting one procedure, it costs about 4 thousand rubles to pay for postal services.

Step-by-step instruction

The publication order is as follows:

- Go to the Kommersant website in the “Bankruptcy” section.

- Choose how you will apply - via email or online.

- If via email, fill out the form, attach the necessary documents in the form of scans and send them by email.

If the application is submitted through the Kommersant online system, select the type of application “On declaring the debtor bankrupt” from the drop-down list.

Study the set of documents, the necessary data and examples of completion.

Fill out the form and at the very end confirm the method of submitting the message.

Pay for your application in a way convenient for you.

Total amount

Let’s summarize to tell you how much personal bankruptcy costs in 2021. So, the cost of an insolvency case, when they immediately proceed to the sale of property, includes the following expenses:

- state duty (300 rubles);

- payment to the financial institution will be 25 thousand rubles;

- award to a lawyer - 10 thousand rubles;

- publication in Kommersant, EFRSB will cost 7 and 1.8 thousand rubles;

- expenses for postal services - 1.1 thousand rubles.

As a result, we get the amount of 36 thousand rubles. When property is sold, there are guarantors and pledges, the case can cost 200 - 400 thousand rubles.

Partner: professional support for bankruptcy of citizens and individual entrepreneurs

Legal service "Partner" is a team that provides comprehensive support to citizens and individual entrepreneurs in matters of debt. Our tasks include the following:

- protection of debtors from collectors and attacks from debt collectors;

- representing the client’s interests in court and other government agencies;

- preservation of property in bankruptcy proceedings;

- compliance with all requests and interests of the bankrupt;

- mitigation of consequences from the introduction of bankruptcy.

We achieve maximum satisfaction of the interests and rights of the debtor through the court. Thanks to knowledge of the specifics of bankruptcy of citizens and merchants, the legal service “Partner” has helped more than a dozen clients in their struggle for their own property. If you want to get rid of unsustainable debt once and for all and start leading your financial life anew, then contact us - we are ready to help in any matter.