In what cases are regressive claims possible?

Regressive claims are made in cases that are not recognized by insurance companies as insurance, i.e. The accident occurred as a result of the intentional unlawful actions of the culprit.

When demands for the return of compensation are made by the culprit:

- The vehicle insured provided false information when concluding the contract, which led to a reduction in the amount of the insurance premium;

- The person responsible for the accident did not have the right to drive a car, including if the driver’s license seemed expired;

- If there is no power of attorney to drive someone else’s vehicle;

- The cause of the accident was alcohol, drugs or other intoxication of the perpetrator;

- If the culprit fled the scene of the car accident;

- The culprit does not have the right to drive a vehicle, i.e. he was not included in the MTPL policy;

- If it is proven that the culprit deliberately provoked the accident;

- If the accident did not occur within the period specified in the insurance policy;

- If the culprit began repairing his damaged vehicle earlier than 15 days after the accident, when registering under the European protocol, and did not present the car to the insurer for inspection;

- If at the time of the accident the diagnostic card has expired;

- When a truck with a trailer was involved in an accident, but the MTPL agreement does not contain information about this possibility.

A regressive requirement for a service station is made in the case where it is proven that the diagnostic card did not include information about a vehicle malfunction that led to an insured event, if they could have been identified during a technical inspection.

It turns out that the service station will have to pay if the inspection was performed poorly.

The Supreme Court did not allow a recourse claim to arise on the basis of repealed provisions of the law

The Supreme Court, in Ruling No. 11-КГ21-21-К6 of July 20, clarified whether an insurance company has the right to bring a recourse claim against the culprit of an accident, during which a European protocol was drawn up, if it unconditionally accepted the terms of payment provided by the party.

On November 14, 2021, an accident occurred, the participants of which drew up a European protocol, in which it was noted that the culprit of the incident was Roman Gerasimov.

The insurer of the victim, JSC SO Talisman, paid for the repair of his car and additional expenses in the amount of more than 56 thousand rubles. On March 19, 2021, Roman Gerasimov’s insurance company, Renaissance Insurance Group JSC, reimbursed the specified amount to the victim’s insurance company, and on April 18, 2021, sent a pre-trial claim to the culprit of the accident to recover the insurance compensation from him by way of recourse.

Since the claim was not satisfied, Renaissance Insurance Group filed a lawsuit against Roman Gerasimov to recover the insurance compensation, since he did not send the insurer a copy of the accident notification form completed together with the victim within 5 working days.

The court, having found that the defendant did not send the notification form about the accident in the absence of valid reasons, came to the conclusion that there were grounds for applying subsection. "g" clause 1 art. 14 of the Law on Compulsory Motor Liability Insurance (as amended in force at the time of the traffic accident) and recovered from Roman Gerasimov the amount of insurance compensation paid. The appeal and cassation agreed with the conclusions of the trial court.

Roman Gerasimov appealed to the Supreme Court, which considered his complaint justified. Having studied the materials of the case, the Supreme Court referred to the Determination of the Constitutional Court of May 25, 2021 No. 1059-O, according to which, within the meaning of paragraph 2 of Art. 11.1 of the Law on Compulsory Motor Liability Insurance in conjunction with clause 3 of the same article, the need to send an accident notification form to insurers within 5 working days is associated with the obligation of drivers, at the request of insurers, to provide vehicles for inspection and (or) independent technical expertise within 5 days from the day of receipt of such a requirement, and also to ensure these goals, do not begin their repair or disposal until the expiration of 15 calendar days from the date of the accident. Subclause “g” of clause 1 of Art. 14 of the Law on Compulsory Motor Liability Insurance on the right of recourse of the insurer is intended to ensure a balance of interests of the insurer and the policyholder. The requirement for each participant in the incident to send a completed form for notification of an insured event when preparing documents without the participation of police officers is aimed at ensuring that both the insurer who insured the liability of the victim and the insurer who insured the liability of the tortfeasor had the opportunity to verify the accuracy of the information about the accident and the information received. resulting in damage to vehicles. For the same purposes, liability for failure to fulfill this requirement was established in the form of the possibility of making recourse claims against the causer of harm who failed to fulfill such an obligation.

The Supreme Court indicated that on March 19, 2021, Renaissance Insurance Group reimbursed the corresponding amount to the victim’s insurance company. At the same time, a copy of the victim’s notice was recognized by the insurance company as a sufficient document for making payment; the circumstances of the accident, the fact and amount of damage caused were not called into question. At the same time, Renaissance Insurance Group, when making a decision on insurance compensation, did not exercise the right to familiarize itself with the case materials and assess the validity of the fact and the amount of payment made to the victim. The request for inspection of the culprit's vehicle was not sent to the defendant.

In addition, the Supreme Court noted, the plaintiff, having one of the two notification forms submitted by the injured party, did not prove a violation of his interests on the part of the perpetrator of the event by failure to submit his notification form, since the available documents were sufficient for him to make a decision on compensation for the insurance payment.

Correct actions for regressive requirements and common mistakes

If the insurance company has made regressive claims against you, proceed as follows:

- Make sure your case allows this by law;

- Check the correspondence of the amounts, how much was paid to the victim and how much the insurance company requires to be reimbursed in the order for payment;

- If you do not agree with the amount of payment, send a substantiated return claim to the insurer;

- Do not sue the insurance company yourself, wait for the insurance company to do it.

It is a mistake to try to ignore what is happening. If you do not fully understand the current situation, do not act on your own; it is better to contact professional lawyers for advice.

How insurance companies deceive drivers during recourse

The classic scheme by which insurance companies deceive their clients looks like this. To make it clearer, let's introduce several characters.

Alisher is an insurance client.

Boris is an insurance client.

The accident was the fault of Alisher, and he was drunk at the time of the accident.

After the accident, Boris contacted his insurance company. He was paid insurance - 30 thousand rubles. Boris did not agree with the amount of compensation and turned to an independent expert, who confirmed that the damage caused to the car was estimated at 50 thousand rubles.

Through the court, Boris received the missing 20 thousand rubles from Beta.

After Beta paid Boris the first 30 thousand, it sent Alpha a demand to return the money. Since the accident was the fault of Alisher, Alpha returned the money.

When Beta paid Boris another 20 thousand, she sent information about the payment to Alpha. Moreover, according to the law, “Alpha” no longer has to return these 20 thousand to “Beta”. Insurers do not have the right to underestimate payments to clients, and if they did underestimate and the client was able to prove it, the insurance company must pay the rest of the money out of its own pocket.

And then the fun begins.

“Alpha” sends Alisher a demand to return the 50 thousand that “Beta” paid to the victim. Attached to the request are all receipts confirming that Beta returned exactly 50 thousand. Of course, the insurance company modestly keeps silent about the fact that Alpha itself paid Beta only 30 thousand.

Since Alisher was drunk at the time of the accident and knew that he absolutely fell under the article of recourse, he, without any doubt, pays 50 thousand to Alpha.

Result: Alisher paid Alpha 20 thousand more than he should have, and did not even realize that he had been deceived. Satisfied, Alpha credited the money to their accounts and continued to steal from unsuspecting clients.

In the newsletter we teach readers what other ways to protect themselves from the insurance company. To subscribe, enter your email on our website. Once a month we review one request, provide detailed advice and send action instructions by e-mail. Only for subscribers.

Answers on questions

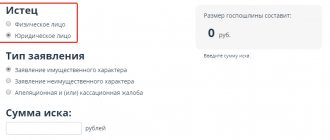

| How much regressive claims can the insurance company make? | Recourse claims are made in the amount paid as damages. |

| Is it possible to file an objection to a recourse claim, to challenge the calculation of losses under compulsory motor liability insurance? | Yes, in a lawsuit. |

| Is it possible to partially waive the claim? | If the amount of claims is overestimated, or the calculation provided by the insurance company was made in violation of the methodology of the Central Bank of the Russian Federation, the claim can be recognized only in the justified part. This is proven in court. |

What happens if I just don't pay?

In short, from nothing to visits from bailiffs to your home or even debt collectors. There is no administrative liability for failure to pay a fine, a double fine - this does not exist in debt collection. But there are measures to influence debtors.

Seizure on a car

If your debt exceeds 3,000 rubles, then the bailiff may, at the request of the creditor or on his own initiative, seize your car. This is done for:

- safety of property that will be transferred to the claimant or sold,

- execution of a court decision on confiscation of property,

- execution of a judicial act on seizure.

In our case, point 1 applies. The car can be seized in order to be preserved for later sale. A few words about what specific measures and actions are hidden under the word “arrest.”

Basically, this is a ban on using a car. That is, it can neither be sold nor given away. In some cases, restrictions on the right of use and seizure of property from the debtor may be applied.

Can there be a fine or deprivation of rights?

I already wrote about the fine above, but in this case there will be none. Unless an enforcement fee is added to the amount of collection, it will be 7% of the amount of the required recourse.

The debtor does not face deprivation of rights, or rather suspension (temporary restriction) of the use of a special right. This is due to the fact that driving license is limited only in some cases, and recovery of damages from recourse is not included there.

But if everything is in order with your driver’s license, this does not mean that, for example, you will be able to travel by car. For cases where other debts are collected, like ours, there is a ban on leaving the Russian Federation, but for this, the amount of debt under the compulsory motor liability insurance recourse must be more than 30,000 rubles.

What if I don’t have bank cards or property?

The lack of funds in bank accounts and property that could be sold makes your debt to the insurance company almost irrecoverable. If you have nothing to take from you, then you won’t have to pay recourse under OSAGO.

However, if all your property belongs to relatives, and your salary is in cash, then at least you won’t be able to go on vacation abroad. Some still pay off their debts for this purpose.

What is regression

In fact, the recourse claim is a rule of law that relates to the insurance and financial fields. The person or organization that compensated for the damage caused has the right to demand that the culprit compensate them for the costs.

This rule is usually used by insurance companies when collecting money paid from those responsible for the accident. A direct claim directly to the court is a component of recourse.

The scope of a recourse claim is limited to the amount paid by the company. An amount higher than that which was transferred upon direct demand cannot be recovered. However, the insurance company, in addition to the direct costs of paying compensation, may also require payment of compensation for the losses it incurred, for example, to pay for the services of a representative, or to attract an expert in court, or when considering an insured event.

Such compensable losses may be incurred as a result of traveling to another city or engaging a specialist or lawyer on a contractual basis. This compensation can be recovered in court in addition to recourse claims.

How to recover damages from a pensioner who caused an accident without an insurance policy

You need to get all the documents about the accident from the traffic police, make an assessment of the damage and sue him; if they prove that he works, they will deduct 50% from all income, if he does not work, then they will deduct 50% from his pension.

Hello, there was an accident between my car and a minibus, the culprit was a minibus without insurance, the driver was a pensioner, the traffic police only issued him a fine of 500+800 rubles, he did not give way to me. So it didn’t work out to come to an agreement, he says there is no money, can I count on payment from him? My next steps? Damage approximately 80 thousand

Recourse Under OSAGO Defendant Pensioner No Property

6. We were able to prove that the insurance company sent the vehicle for repairs without conducting a preliminary examination. In this case, it is not possible to reliably calculate real costs. The service may charge inflated prices for spare parts. Then, with the participation of a good lawyer, you can achieve a complete denial of recourse.

1. Keep track of the validity period of the policy; as you understand, upon its expiration you have the right to demand compensation. Check whether you are included in the policy form, which lists the drivers for the vehicle (does not apply to cases where the policy is unlimited).

Can an insurance company recover money under CASCO?

With CASCO there are no grounds for recourse to the guilty party. But the culprit of the incident may be held liable through subrogation. He will answer if the limit for compulsory motor vehicle liability insurance (DSAGO) is not enough to cover the damage or if there is no car insurance policy.

Until the maximum amount is reached (400 thousand rubles), liability to the injured party, and in the event of transfer of rights to the insurer under CASCO, is borne by the company that insured the civil liability of the culprit driver. Only compensation for property damage can be recovered under CASCO insurance.