July 21, 2020

The insurance company is a commercial organization, but unregulated expenses hit the wallet. Repairs under compulsory motor liability insurance do not always cover the limited payment of expenses, and insurers will try to benefit at the expense of clients. If the auto insurance does not cover the losses, the injured participant can take advantage of additional terms of the contract.

Cash payment for an accident

If the MTPL agreement of the tortfeasor was concluded after April 27, 2017, then for the victim, in general, insurance compensation is carried out through mandatory restoration repairs of the car.

Payment is due in the following cases:

- if the victim does not agree to make an additional payment for repairs, but the insurance company did not consider it enough;

- if the cost of repairs exceeds the limits under compulsory motor liability insurance or all participants are found responsible for the damage caused - that is, a smaller amount is due according to the degree of innocence in the accident, and the victim himself is not ready to pay extra for repairs;

- in case of complete loss of the vehicle (remember that for the purposes of compulsory motor liability insurance, total loss occurs when the cost of repairing the vehicle is equal to or exceeds the market value of the car on the date of the accident, or when repairs are impossible);

- death of the victim;

- when the health of the victim in an accident has been caused severe or moderate harm, and he himself has chosen in the application to pay the insurance compensation in cash;

- if the victim is a disabled person who has a vehicle for medical reasons and the monetary form of compensation is also indicated in the application for payment;

- the car is not older than 2 years, it is under warranty, and the insurer does not have repair contracts with official dealer stations;

- The car has a warranty of more than 2 years, but the insurer does not send it to the dealer’s service station for repairs during the warranty period;

- there is no service station closer than 50 km (on public roads) from the place of residence or from the scene of the accident (chosen by the victim), and the insurer is not ready to organize delivery of the damaged vehicle to the station and back;

- if the insurer cannot organize repairs at the car service center that the victim chose when concluding the MTPL contract and the victim does not agree to have the car repaired at another station;

- the repair period at the service station exceeds 30 working days;

- if you agreed to an additional payment, but during the diagnosis it turned out that you need to pay even more, but the victim is not satisfied with this;

- if the insurer did not issue a referral for repairs within the period of 20 days established by law;

- when the car was accepted for repair, but it becomes clear that the repair will not be completed within the agreed period (30 working days) or has not yet been properly started;

- if the victim signs an agreement with the insurer to provide insurance compensation in cash.

It is worth noting that some of the stated reasons for paying money are directly stated in the Law on Compulsory Motor Liability Insurance, and some are dictated by established judicial practice and the position of the Supreme Court, so it is possible that you will have to sue for the right to receive money for an accident.

Be careful, if you sign an agreement with the insurer without looking, you can deprive yourself of the right to further challenge the amount of payment if the insurance company has counted little money (more about this has already been discussed in the article about applying for insurance compensation under MTPL).

Rights and obligations of the parties

If the contract is not signed, and the company or service station demands money, you should not pay it. The difference in payment is the relationship between the auto insurer and the client, but not the service center. Any threats, blackmail and attempts to evade responsibility are resolved through the justice system.

By law, you have 30 days to repair your car. If the vehicle is not returned during this period, the owner can write an appeal to the prosecutor's office. Car insurers have no reason to force compensation. For everything to go legally, the driver needs to take into account all the nuances:

- conduct an independent assessment of damaged vehicles;

- refuse to sign additional papers;

- consult with a legal entity;

- monitor changes in regulations.

If the auto insurer managed to get the client to sign questionable papers, the outcome depends on the complexity and timing of the process. You can try to increase the amount of accrual through an independent examination and make claims to the service station. When signing a dubious contract, the applicant is unlikely to be able to resolve the issue in his favor.

After a collision, the injured party has the right to demand full compensation for damage. The policy does not always cover the damages caused, and the agent can take advantage of the car owner's naivety by covering the shortfall from his pocket.

If the vehicle owner completes the documentation correctly, the organization will cover the shortfall and transfer the vehicle to a service center, where employees will have to replace the damaged parts with new spare parts within a specified period of time.

The payment has arrived, but it’s not enough – what to do?

The first thing you need to understand is what is associated with such a small payment; for this you need to contact the insurer in writing with a statement in which you demand to familiarize yourself with the results of the inspection and (or) independent technical examination, independent examination (assessment), and also issue a copy of the certificate insured event. A copy of the act must be issued within three days from the date of receipt of the relevant application.

From these documents it will be possible to conclude whether it is the insurer’s fault that little was paid for the damage received or not. After all, the payment amount may be less than the cost of repairs for reasons beyond the insurer’s control, for example, a large difference between the cost of spare parts in the RSA directory, which is mandatory when calculating the cost of repairs under OSAGO, and the market value of parts in stores.

Repairs cost more than insurance

If the price of special repairs exceeds the specified amount of insurance, the victim can take advantage of Article 1064 of the Civil Code, Part 1. The difference will be paid by the delinquent.

The actions should be as follows:

- Conduct an autonomous peer review.

- Send a pre-trial request to the delinquent. The claim must indicate the missing amount.

- If the responsible participant refuses to pay the costs, send a statement to the court.

The procedure allows the situation to be resolved peacefully. Problems arise if the responsible party refuses to pay. Only through the court can the issue be resolved.

Arbitrage practice

The courts are considering hundreds of thousands of cases involving disputes between victims and insurers and, of course, a certain practice has already been formed. The Supreme Court of the Russian Federation and the Constitutional Court of the Russian Federation also spoke out on controversial issues.

From the latter, this is the Supreme Court's ruling that the victim, under certain conditions, has the right to challenge the agreement on monetary payment concluded with the insurer and declare it invalid. In this case, you have the right to demand payment in full, but, as you understand from this article, this path is not easy.

We hope that the article will be useful to you and will help you defend your rights in cases where the insurer calculates and pays too little money for an accident.

Is it worth entering into an agreement with the insurance company on payment under compulsory motor liability insurance?

Insurance companies try to save money on every insurance claim. Therefore, at the stage of filing an application for compensation for damages under OSAGO, you may be asked to enter into some kind of agreement. It can be called differently.

But its essence is that the insurer offers you payment in money and sets a specific amount. Almost always lower. For example, if the damage is estimated at 70 thousand rubles, you will be offered 50 thousand, or even 2 times lower. Having received the money under the agreement, you will not be able to demand any additional payments from the insurance company in excess of this amount. For example, if repairs suddenly turn out to be more expensive (in 99% of cases this happens).

Should I sign this agreement or should I refuse it? Here everyone decides for himself. If you urgently need money under compulsory motor liability insurance, you can enter into an agreement. In other cases, it is better to wait for an assessment of the damage or a referral for repairs to a service station.

But what if you have already signed such an agreement. Is it possible to challenge it somehow? You can challenge it, but to do this you will have to follow the mandatory pre-trial procedure. First, of course, submit an application for termination of the agreement to the insurance company. Further, in case of refusal by the insurance company, contact the financial insurance company, and only then go to court. But at the same time, it is extremely difficult to prove that the transaction was made under the influence of a misconception in 2021. Without this, neither the ombudsman nor the court will take your side in a dispute with the Investigative Committee.

Appeal period

The Civil Code of the Russian Federation establishes the general limitation period for compulsory motor liability insurance; it is 3 years. The law also establishes:

- the statute of limitations for claims related to property insurance is two years;

- The statute of limitations for claims related to harm to the life, health or property of others is three years.

Thus, the appeal period is quite long, but you should not delay it if you want to cover your expenses after an accident.

How to collect the missing part: features

- To receive funds from the culprit if the payment from the insurance company is not enough, you need to follow the algorithm given above.

- An independent examination is mandatory, since only on its basis the amount of damage is established.

- Compliance with the pre-trial procedure for resolving the problem remains at the discretion of the insured. If recovery is made from the culprit, you can immediately file a lawsuit.

- It is mandatory to go to court if not only material, but also moral damage (causing harm to life and health) has been caused. According to judicial practice, such requirements are almost always satisfied.

Instructions for receiving the full amount of insurance compensation.

Now let's take a closer look at each of the points.

Step 1.

Request for expertise from an insurance company.

If the insurance company has underestimated the amount of payment, then you can demand justification for this amount, i.e. you need to get a copy of the expert’s opinion, and you also need to familiarize yourself with the materials of the payment case; when familiarizing yourself with the case, it is necessary to photograph all documents.

However, you will not receive a copy of the expert’s opinion from the insurance company, because No one conducted an examination, and after reading the case materials you will be convinced of this.

Step 2.

Conducting an independent examination

If you do not agree with the amount of the insurance premium, then you need to determine what amount will be objectively sufficient to restore the car; for this you need to independently conduct an independent examination. In this case, it is necessary that the expert, when determining the cost of restoration repairs, be guided by the rules established by the Central Bank of the Russian Federation and current legislation.

Step 3.

Pre-trial claim against the insurance company for illegal reduction of insurance payment

It is necessary to draw up a competent claim to the insurance company and send it to the legal address or hand it in person at the office of the insurance company against signature and seal; be sure to attach a copy or a second copy of the expert’s opinion to the claim, as well as account details for transferring the insurance payment.

Why does the insurance company underestimate the payment and not increase it on the claim?

Everything is very simple, according to statistics, out of 10 people who were dissatisfied with the underestimated amount of insurance payment, only 1 will go to court. And insurance companies know this, which is why the likelihood of receiving the entire insurance payment after filing a claim is extremely low, because The insurance company will not be subject to any sanctions for an unreasonable refusal. And only when you go to court, certain financial risks arise for the insurance company, which usually force it to pay the remaining amount.

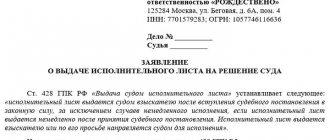

Step 4.

A lawsuit against the insurance company to appeal the understatement of insurance compensation and to recover the uncollected amount

A claim in court against the insurance company that paid the under-insurance is the most effective tool to protect your rights.

How it works? When you file a claim in court, your case is automatically transferred to the insurance company's legal department and reviewed by the legal director. Lawyers assess the prospects of this case and develop a vector in which the insurance company will come out with the least losses.

In such a situation, you will no longer have to talk with managers “girls” and “boys” in company offices; your business will be handled by adequate people who understand the legal and financial consequences of violating your rights.

This occurs due to the fact that in the statement of claim the amount of claims consists not only of the amount of insurance compensation, but a number of other legal instruments are also used.

If the amount of insurance payment is underestimated, a claim for recovery is filed:

- underpaid amount of insurance compensation

- compensation for moral damage caused

- interest on the use of other people's money

- expenses for drawing up documents and paying for representative services

- expenses for conducting an independent examination

- expenses for drawing up a power of attorney with a notary

- a fine of 50% of the total amount awarded

Separately, I would like to say about the last point, the fine is collected from the insurance company in favor of the policyholder, i.e. in your favor.

(If the court satisfies the consumer’s demands, the court collects from the executor for failure to voluntarily satisfy the consumer’s demands a fine in the amount of fifty percent of the amount awarded by the court in favor of the consumer.)

This measure of liability is established by Art. 13 Federal Law of the Russian Federation “On the Protection of Consumer Rights” format as a quotation

That is, from the entire amount that the court awarded to you, a fine is still collected for the fact that the insurance company underestimated the insured amount and did not pay it voluntarily on your claim.

It is thanks to all these tools that very often insurance companies, immediately after receiving a subpoena, try to conclude a settlement agreement with the policyholder, or voluntarily fulfill the requirements contained in the claim.

A big plus is the fact that the insurance company has already paid part of the amount, thereby confirming that the case is recognized as insured and the policyholder has completed all the necessary actions provided by law to receive the insurance payment; all that remains is to resolve the issue only with the amount of compensation, this significantly simplifies the task.

Step 5.

Actual receipt of the insured amount

When you file a claim in court, the case may end with a court decision, a settlement agreement, or voluntary fulfillment by the insurance company of its obligations.

A settlement agreement and voluntary fulfillment of obligations involves the voluntary, actual payment of funds making up the difference between the underestimated payment and the amount actually necessary to repair the car after an accident.

The most interesting thing begins when the court made a decision to recover money from the insurance company due to an illegal reduction in the amount of insurance compensation and you have to receive your money.

- filing a writ of execution with the Federal Bailiff Service (FSSP)

- submitting a writ of execution to the bank in which the insurance company has accounts.