Overtime concept

Let us immediately clarify that not all types of overtime can be subsumed under the concept of “overtime.”

This term is applicable only in cases where the manager asks the employee to stay after his shift to perform some work. Please note that the employer must be the initiator. There are situations when an employee is delayed on his own initiative, for example, to prepare an urgent project for delivery. Such activity is not considered overtime work, so management is not obligated to pay for it.

What happens to an employer for not paying for overtime?

The employer is responsible for processing without registration or payment. May apply to:

Moreover, if the violations are significant in terms of quantity and duration, the perpetrator who committed such abuse risks having the right to hold administrative positions and carry out activities limited for a period of one to three years.

Labor regulations

According to labor legislation, overtime work is carried out only with the written consent of the employee. This document does not have a set form, therefore it is compiled in any form.

Next, the boss is obliged to record the fact that work was performed in excess of the established norm by issuing an order for the enterprise. There is also no mandatory form to fill out, but the document must reflect the following points:

- the reason that served as the basis for performing work overtime;

- date and time of work completion;

- time of end of work: if this period cannot be predicted in advance, in addition to the order, an act confirming the duration is drawn up;

- surname and initials of the employee, indication of position;

- a note that the employee agrees to work overtime.

This order must be communicated to the employee and contain his signature.

Registration procedure

When processing processing, you can use the following algorithm:

- Obtaining consent in writing . It is advisable to obtain it before issuing an order on overtime work, since the worker may well refuse the manager. In this case, if the order has already been drawn up, you will have to edit it. How to obtain consent? To do this, you can write a notice that sets out the duration of the overtime work, as well as the start date. You can also prescribe forms of compensation for overtime to choose from - money or additional vacation days.

- Making an order . Its form is not established by law, and therefore the document is drawn up in free form. The document indicates the reason for overtime, the full name of the employees, and the start and end time of overtime service. It is advisable to refer to notices in which the consent of employees is given.

- Familiarization by the employee with the order . Each person involved in processing puts his signature.

- Entering data into the accounting sheet . In this case, according to Goskomstat Resolution No. 1, forms No. T-12 or T-13, codes “C” and “04” are used. It is imperative to record the exact number of hours that the employee worked overtime.

IMPORTANT! The information indicated in the time sheet must be similar to the information set out in the order on overtime service.

Payment order

This point is regulated by Article 152 of the Russian Federation. It is directly stated here that the first 2 hours worked in excess of the established norm are paid at one and a half times the regular salary. Subsequent time is paid double . We add that the amount of material compensation can be established by an order for the enterprise, an employment contract or other regulations. Please note that overtime work performed during holidays or weekends and paid at an increased rate will not be taken into account when calculating as hours worked in excess of the norm.

How is overtime compensated?

According to Article 152 of the Labor Code of the Russian Federation, overtime service is compensated in two ways:

- In cash.

- Additional days of rest.

Payment of money is the “default” form. Additional days of rest are assigned only if the worker wishes. The amount of compensation is determined depending on the duration of processing:

- The first 2 hours are at one and a half rate.

- Subsequent hours are at double rate.

The duration of overtime work is calculated for each day.

ATTENTION! The law does not specify the time frame during which an employee can choose one of the forms of payment. Therefore, he can do this even after the money is issued. To avoid confusion, it is advisable to discuss this issue in advance.

How are additional days of rest processed?

How to register rest days established as compensation for overtime? It makes sense to fit these days into your work schedule. If there is no schedule, an order is issued with the employee’s full name and the reason for providing the rest. The employee must be familiarized with the document against signature. In the accounting sheet, rest days are marked with the code “NV” or “28”.

IMPORTANT! During the period of additional rest, salary will not be maintained.

Who should not be asked to work overtime?

There is a category of workers who cannot be employed in excess of the norm. These include:

- women during pregnancy;

- employees under 18 years of age (in exceptional cases does not apply to athletes and creative workers);

- trainees subject to a student agreement;

- parents with dependent young children.

In addition, the list can include employees who have contraindications to overtime work.

How long can wages be delayed?

In accordance with the Labor Code of the Russian Federation, the employer does not have the right to delay wages. By law, he is obliged to pay wages to employees twice a month with an interval of fifteen days. The payment date is agreed upon at the time of concluding the employment contract. Thus, a delay in payment of wages by 1 day is already considered a violation.

In cases where wages are delayed for up to 15 days, the company is obliged to pay financial compensation for each day of delay. In addition, the company calculates compensation independently; to receive it, you do not need to contact government agencies. And non-payment of wages for more than 15 days, according to the Labor Code of the Russian Federation, is an administrative and even criminal violation.

Compensation

For late payment of wages, the employer pays monetary compensation for each day of delay. In accordance with Article 236 of the Labor Code of the Russian Federation, the amount of the penalty is 1/150 of the key rate of the Central Bank of the Russian Federation, which is calculated on the amount of debt. At some enterprises, the amount of the penalty may be higher; this is indicated in the employment contract.

Compensation for late payment of wages is accrued on both holidays and weekends. It does not matter whether the delay was due to the employer’s fault or not. The presence or absence of funds in the company’s account is also not taken into account.

If the salary was paid in part, compensation is calculated for the remaining amount. The amount of the penalty can be calculated as follows: amount of debt x Central Bank rate x 1/150 x number of days of delay. The debt period is calculated starting from the day following the date of payment of the salary and ending with the day the debt is repaid.

Please note that in accordance with Letter of the Federal Tax Service dated June 4, 2013 N ED-4-3/10209, personal income tax is not withheld from the compensation amount. In addition, based on Letter of the Ministry of Labor No. 17-3/OOG-692 dated April 28, 2021, all insurance premiums are calculated on the amount of compensation.

If wages were not paid on time and compensation was not accrued, you must file a complaint with one of the government bodies listed above.

Is it possible to be required to work overtime without consent?

This possibility really exists. The employee's consent is not required in the following situations:

- preventing an accident or disaster;

- the introduction of martial law or the occurrence of emergency situations: epidemics, natural disasters or other situations that create danger for the population;

- necessary for the normal functioning of any systems or production lines, for example, the supply of water, gas or electricity.

In other cases, written consent is required.

When is refusal to recycle allowed?

As a rule, overtime work is voluntary. If an employee refuses it, the manager does not have the right to apply sanctions to him. However, there are exceptions. Under certain circumstances, an employee is required to come to work:

- There is an emergency in the company, or if processing is needed to prevent a disaster.

- Restoration of life support systems for the population (gas, water, etc.).

- Execution of work related to the introduction of martial law.

- Work related to preventing or eliminating the consequences of situations that pose a threat to the lives of the population.

Legislators respect the personal will of the worker, but it should not endanger the lives of other people.

What to do if overtime hours are not paid

It should be noted that employers often engage staff to work beyond the prescribed hours without having any documented basis for this. Of course, if the order is given only in words, it will not be possible to prove the fact of processing. How to act in such situations?

Order

If your boss requires you to stay after work, you must write a statement demanding that an order be issued for the enterprise to involve you in work activities in excess of the established hours. It is better to prepare the document in two copies: one is given to the manager, on the second you need to put a mark of acceptance. Such a note includes the date, signature with transcript and position of the employee who accepted the document.

Payment

If the employer is in no hurry to pay for overtime hours, he is also sent an application in duplicate with a requirement to pay a monetary remuneration in the established amount or provide additional rest time. The second copy must be endorsed by the responsible person and kept with you.

Where to go

If the employer does not intend to compensate for overtime work, you can file a complaint with the following authorities:

- trade union organization;

- labor dispute commission;

- Labour Inspectorate;

- court.

It should be clarified that for delay in payment for hours worked in excess of the norm, you can demand financial compensation.

[youtube id=»o1Y2gsFsEuk» title=»Watch the video about Article 152 of the Labor Code of the Russian Federation»][/youtube]

What is recycling?

First, let’s look at what does not belong to the concept of “recycling” to avoid confusion. According to Article 97 of the Labor Code of the Russian Federation, there are two types of labor organization: irregular working hours and overtime work. If an employee carries out his activities according to the first scheme, the concept of processing will not apply to him. This rule is also set out in a letter from Rostrud dated June 7, 2008. That is, if an employee with irregular working hours is late in the evening, he is not entitled to any additional payments for this. Compensation for overtime is provided by additional vacation days.

Another case when work beyond the schedule is not paid additionally: the employee decided, on his own initiative, to stay in the office in order to complete tasks that were not completed on time. This is relevant if a worker is given a task and adequate deadlines to complete it, but he does not have time. The lack of compensation in this case is regulated by a letter from Rostrud dated March 18, 2008.

ATTENTION! The above rule does not give the employer the right to artificially create conditions in which the employee does not have time to solve the problem. For example, if a manager gives a task that requires 5 hours to complete, an hour before the end of the shift, this will be considered an abuse of the law.

All other work in excess of the established standards, according to Article 99 of the Labor Code of the Russian Federation, relates to processing and is compensated. Overtime hours must be taken into account.

The legislative framework

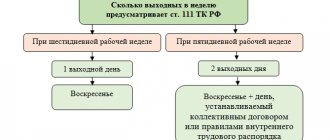

The concept of overtime work is closely related to working time standards. According to Part 2 of Article 91 of the Labor Code of the Russian Federation, the length of the work week should not exceed 40 hours. For some specialists (according to Articles 92, 173, 174, 333 of the Labor Code of the Russian Federation), a shortened working week is relevant. Every week, the employee must be provided with uninterrupted rest of a minimum duration of 42 hours (Article 110 of the Labor Code of the Russian Federation).

Anything that goes beyond the specified standards is recycled. Article 99 of the Labor Code of the Russian Federation sets out the conditions for engaging in overtime work:

- There is an emergency or a threat to property in the company (other reasons for engaging in overtime work are also allowed).

- The employee agreed to overtime (this is a mandatory condition for disabled people and young mothers).

Even overtime has its limits. In particular, the total duration of processing should not exceed 120 hours per year and 4 hours over a continuous two days. The employee’s work must be compensated at one and a half or double rates. The specifics of payments are regulated by Article 152 of the Labor Code of the Russian Federation.

ATTENTION! For some types of work (for example, on shifts), it is impossible to ensure a standard working day. In this case, the actual number of working hours is checked against quarterly or monthly standards (according to Article 104 of the Labor Code of the Russian Federation). In this case, the employer needs to issue a local act indicating the working time schedule, and also include the corresponding clause in employment contracts with employees. Overtime will be labor in excess of the standards established by the internal regulations of the enterprise.

What should an employee do if they are not paid for overtime?

First, there is no need to start working overtime without an appointment. If this happens, but the payment has not been made, you should:

Directly contacting the employer may not achieve anything, but this can help resolve the attempt to resolve the conflict peacefully. After filing a complaint with the State Information Technology Inspectorate or the prosecutor's office, an inspection will be carried out, and if any signs of violations are found, a decision will be issued. As a result, the employer will pay the debt and pay any interest due. At the same time, fines may be imposed on him, and evidence of more serious crimes may be transferred to investigative authorities.

This process is a last resort, takes longer and requires additional testing. It is best to hire a competent lawyer. Consequently, in addition to debt and sanctions, it will be possible to demand compensation for moral damage. Moreover, only the court has the right to initiate criminal proceedings.

Flexible work schedule

In addition to classic employment contracts, relations between an employee and an employer can also be regulated by civil contracts - this should also not be forgotten. In one of our articles we already wrote about how they can be useful for both parties. Our topic today can also be attributed to the advantages of GPC agreements. Let's start with the fact that, unlike classic employment contracts, GPC contracts do not oblige the employer to assign allowances, bonuses, or paid leave to its performers. As a “compensation”, employees are allowed not to obey the internal rules established by the company, and also to perform their work duties at the time when it is convenient for them. Consequently, it is impossible to track where the performer is working “within normal limits” and where he is working “overtime.” In general, “overtime” work under the GPC agreement is not provided for by definition. If an employer wants to save money not only on paid leave, but also on the additional work of his employee, it makes sense for him to remember the GPC agreement. True, there is one significant drawback - when creating a description for an open vacancy, for example, all this will need to be written down in it, so as not to mislead applicants. It may turn out that they simply do not want to cooperate with the director on such a basis - without sufficient social guarantees, as well as an entry in the work book (civil employment agreements exclude this). In the case of working employees, their transfer to a new form of business relationship is also possible only with the mutual consent of the parties. Such a unilateral transfer is a direct violation of not only the provisions of the Labor Code, but also the Civil Code.

The essence of the conflict

There would be no need to write this material if not for the word “initiative” - it was this that became the primary source of the conflict between an employee and his employer within the framework of our topic. Many employees and even directors (inexperienced, let’s make a reservation) are inclined to believe that if he (an employee), working the classic hours from 09:00 to 18:00 with a lunch break of 1 hour, five days a week, decided overnight to work during the week, and even several times until 19:00 a day, then for this he is entitled to a salary increase. This is not entirely true... Let's first figure out who exactly initiated these delays. If we are talking about the employer’s initiative, then, in theory, there should be a corresponding paper that will spell out: a) production necessity as the reason for working overtime; b) the amount of time required to satisfy this production need; c) the amount of payment for additional hours worked. With this document, the relationship between the two parties should become more transparent. Let’s imagine a situation where such a document is not available, and there is no agreement between the employee and his manager that he will work beyond the established working hours. In this case, the employee can hardly count on an increase in his salary, because in this case, there is not only an additional agreement to the employment contract, but also, most importantly, the initiative of the employer. Without it, the act of “high performance”, at best, will be regarded by the director as the employee’s responsible attitude towards the performance of his official duties. He can reward his subordinate with a bonus, but only if he wishes. By the way, the director has the right to pay bonuses exactly as many times and in as many quantities as he pleases, but that’s a completely different story.