“Do you want to quarrel your relatives forever? Leave them an inheritance! A joke, of course, but not without some truth.

When making a will, a person certainly wants it to serve as reliable protection for his loved ones in the future. But this does not always happen, unfortunately.

Recently, both in legislation and in judicial practice, there have been changes that clearly lead to this conclusion: obtaining an inheritance under a will is now becoming even more difficult. Let me explain what's going on:

Explanation of the concept of obligatory share in inheritance

This term refers to the share of inherited property that is due to a certain circle of persons in the event that there is a will. In this case, the presence of a will is a prerequisite.

An obligatory share in an inheritance is something of a restriction on the testator’s right to dispose of his property. The restriction is imposed in order to protect the interests of an unprotected category of persons. That is, if there is a will in which a certain group of persons is not specified, their interests are protected by the law.

If there is no will, inheritance by law is carried out in order of priority in accordance with Art. 1141 of the Civil Code of the Russian Federation. Persons entitled to receive a compulsory share, in this case, receive an inheritance on an equal basis with the queue that is called for inheritance.

Order of succession

The logic of inheritance by law is approximately the same in all countries. This is a kind of “ladder” - the closer the relationship, the greater the chances of becoming the heir of this or that person. If there are no close relatives, distant ones are sought. Sometimes even those who do not suspect the existence of the testator.

In Russia, there is no such practice - if the heirs themselves do not show up within six months, the inheritance will go to the state. But Western notaries can really “scour the whole world” in search of distant branches of the family tree. And people sometimes receive an inheritance without having any idea who it is from. But such situations belong rather to the category of mythical ones. Let's return to earth and to Russia.

The legislation of the Russian Federation provides for seven lines of inheritance, plus a conditional eighth - “disabled dependents of the testator.” The last line is not related. A dependent, that is, a person whom the testator fed and supported, can be anyone. Related queues are as follows:

- First: husbands/wives, fathers/mothers, children. Children are considered to be everything that exists - from all marriages, illegitimate, “abandoned”, those for whom the testator was deprived of parental rights, adopted, unborn. Husbands and wives - only relevant ones. Parents are both natural and adoptive parents. The exception is for parents deprived of parental rights. Along with parental rights, inheritance rights are lost.

- Second: brothers/sisters, parents of parents on both sides (grandparents)

- Third: siblings of parents (in other words, aunts and uncles of the testator)

- Fourth: parents of grandparents (that is, great-grandparents, which does not happen often, but is possible with a “generation shift” - when in one of the related tribes siblings or children from different marriages have an age difference of 20 years or more)

- Fifth: cousins/granddaughters and grandparents (that is, siblings of grandparents or grandchildren of siblings)

- Sixth: cousins, nieces/nephews, uncles/aunts (that is, children of cousins/brothers or cousins of parents)

- Seventh: not blood, but “social” relatives - stepmother/stepfather, stepsons/stepdaughters (that is, spouses of parents who did not adopt the testator and children of the testator’s spouses who were not adopted by him)

Thus, family ties are practically exhausted. If the heirs of the current line died before the testator, their right to receive the inheritance upon presentation passes to their heirs.

That is, grandchildren, great-great-grandsons, great-nephews, and so on can receive the inheritance.

Who has the right to an obligatory share in the inheritance?

Legislation protects people who are in a helpless position and, without a share in the inheritance, will not be able to independently ensure a decent standard of living. An exhaustive list of persons entitled to receive such preferences is specified in Art. 1149 of the Civil Code of the Russian Federation. Among them:

- Minor children of a deceased citizen.

- Disabled children, spouse, parents.

- Disabled adopted children, as well as adoptive parents of a deceased citizen.

The legislation also adds two categories of dependents to these persons (Article 1148 of the Civil Code of the Russian Federation). The first category includes heirs by law who were dependent on the deceased for at least one year on the day of his death. It makes no difference whether the testator lived with a dependent or not.

The second category is persons who are not heirs by law, but who are dependent on the deceased citizen for at least one year at the time of death, and who live together with him. The period of cohabitation is identical to the duration of the heir's dependent status - one year.

All of the listed persons inherit a part of the inheritance, as well as a share of bequeathed and intestate property, if the part due to them is less than half of what they would receive if inherited by law. Heirs in this category perform duties on an equal basis with all other heirs: they bear the costs of burying the deceased, and are also responsible for his debt obligations - outstanding loans, unfulfilled contracts, etc. In this part, general rules apply to all citizens (Articles 1174, 1175 of the Civil Code of the Russian Federation).

Hereditary transmission

Another legal basis for extending the inheritance period is the so-called hereditary transmission - the heir dies later than the testator, but before he enters into the inheritance. In such cases, the property passes to his heirs, who, in theory, should also enter into an inheritance before the end of the six-month period from the date of death of the first testator.

But if, when the first heir died, less than half of the legal period (3 months) remained, it is extended for another 3 months. During this time, the next heirs must have time to take over their rights. Or they will also have to pass the inheritance period through the court.

The size of the obligatory share in the inheritance

In the absence of a will, the estate is divided among the heirs by law in equal shares in order of priority. Heirs of the same line receive inheritance in the same amount, with the exception of those who are called to inherit in the order of presentation. A will violates this balance - the testator decides independently what share of the property each heir will receive.

The size of the obligatory share should not be less than half of the amount of property that would be due to a person upon inheritance by law. To determine the size of the obligatory share, it is necessary to take into account all heirs, including those who inherit by right of representation. Calculation example:

- A mother bequeaths an apartment to one son, leaving the second (disabled) without an inheritance.

- The family has no relatives, therefore, if inherited by law (without a will), both sons would receive ½ share in the apartment.

- If there is a will, the disabled son has the right to a compulsory share - at least half of what is due upon inheritance by law.

The calculation of the obligatory share in the inheritance in a will is carried out according to the described example: initially the property is divided among all heirs, then half is calculated from one separate part. According to the law, half of the share of the inheritance is a mandatory share. From the above example it follows that the disabled heir will receive an inheritance of ¼ share in the mother’s apartment.

Will as a document

A will is qualified by law as a “unilateral act of expression of will.” The owner of the property expresses his desire as to who, after his death, will own all the property earned and accumulated by him during his life. And if, in the absence of a will, everything passes to the legal heirs in shares determined by law, then the will can be drawn up for any individual or legal entity. With some reservations, which we will discuss below.

The will is personally drawn up by the citizen and notarized. In some cases, a notary can draw up a will himself using dictation. At the same time, he is obliged to make sure that the citizen is in a capable state, understands the meaning of his actions and is able to bear responsibility for them.

After drawing up a will under dictation, the testator must read its text and put his signature. Only after this the notary certifies the signature, affixes a seal and enters the document into the register. After the death of the testator, his will is executed in accordance with the requirements of the law.

How is the obligatory share allocated from the common property?

When calculating the share, the value of all bequeathed and intestate property, including home furnishings, is summed up. As a rule, the obligatory share is allocated from the untested part of the estate. That is, if the heir is entitled to ¼ of the apartment, but in addition to the bequeathed apartment, for example, a car is left, then the vehicle is used as a mandatory share. It is important that the share in the apartment and the cost of the car are commensurate in monetary terms.

There is not enough untested property to allocate the obligatory share, then it is allocated from part of the bequeathed property. In this case, the right to the obligatory share can be challenged by other heirs through the court: it is reduced or completely eliminated. Its increase is not allowed.

Duty amount

Inherited property is not subject to tax. But the notary fee for the state fee, which is charged for carrying out the procedure and issuing inheritance certificates, can be quite high.

The duty amount is calculated based on:

- Degree of relationship between the testator and the recipient of the inheritance

- Total value of inherited property

Heirs of the first two stages, namely, children and parents, spouses, siblings, pay a duty of 0.3%, but not more than 100 thousand rubles.

Heirs of other orders and persons not related to the testator by blood ties - 0.6%, but not more than 1 million rubles.

In some cases, inherited property does not require payment of a fee at all. For example, an apartment, if the heir lived in it until the death of the testator and continues to do so.

How the right to an obligatory share in the inheritance is contested

Such a restriction in relation to the testator in most cases becomes the cause of disagreements between the heirs. The persons specified in the will, through the court, can reduce the size of the obligatory share or completely deprive the person of the inheritance. Considering that we are talking about disabled citizens, it is very difficult to achieve a positive decision in court: in practice, courts rarely take the side of the plaintiff in this category of cases.

Deprivation of the right to receive an obligatory share in the inheritance, as well as a reduction in the size of this very share, are possible only in certain cases. In accordance with Art. 1149 of the Civil Code of the Russian Federation, the following cases are recognized as such:

- The heir under the will used the property until the death of the testator, but the heir with the obligatory share did not use it - the allocation of a share will lead to the impossibility of further use for living by the heir under the will.

- The heir under the will used the property as the main or only source of livelihood - when the share is allocated, the heir under the will loses the opportunity to earn a living.

In the first case: the implementation of the provisions on compulsory share may lead to the fact that the heir under the will will end up on the street, since the housing included in the inheritance mass is the only one suitable for him to live in. If a disabled citizen has housing, the court may deprive him of the right to receive an inheritance without fail.

In the second case, we are talking about property with which the heir under the will earns his living - a tool, a store, a creative workshop. The division of this property will lead to the impossibility of its further use.

An important condition: one heir used the property, the other did not. When considering such issues, the courts take into account the property status of the heirs entitled to the obligatory share. These are disabled citizens, the infringement of whose rights is allowed in the most extreme cases.

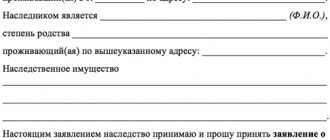

Where to contact legal successors

The place of opening of the inheritance is the notary office at the place of residence of the deceased subject. The registration address is indicated in the will.

Therefore, heirs should not have problems finding a notary office. If the testator has repeatedly changed his place of residence, then applicants for property may encounter certain difficulties.

What to do in such a situation? The law provides several options. If there is real estate, the applicant can submit an application at its location.

If the testator did not have housing or land, then the connection goes to the most valuable movable property (Article 1115 of the Civil Code of the Russian Federation).

Can multiple inheritance cases be opened? No. The law provides for the opening of one case after the death of the testator. The link goes to the residential address of the deceased citizen.

To avoid mistakes, the notary usually requires documents from the heirs confirming this fact. These include an extract from the house register or a certificate from the local management company.

The place where the inheritance case is opened can be found on the website of the Federal Notary Chamber.

Waiver of the obligatory share in the inheritance

The law does not oblige a person to receive an inheritance without fail. In the case of a compulsory share, everything is purely voluntary: the person himself decides whether or not to accept the inheritance. The right to refuse is enshrined in Art. 1157 Civil Code of the Russian Federation.

It is impossible to refuse the obligatory share in favor of another heir. Also, the heir will not be able to refuse part of the share due to him. Part of the inherited property is accepted for inheritance or not accepted. As a result of non-acceptance, the shares of the heirs under the will will increase: each of them will receive the same part of the “abandoned” inherited property.

Individuals refuse inheritance when it comes to possible claims from the testator's creditors. In accordance with Art. 1175 of the Civil Code of the Russian Federation, all heirs who inherited property are liable for the debts of the testator. Heirs entitled to an obligatory share are no exception.

The incapacity to work of the person who has received a share in the inheritance does not exempt him from fulfilling the claims of creditors. Therefore, in certain cases, citizens refuse to accept an inheritance.

about the author

Irina Rusanova - higher education at the International East European University in the direction of "Banking". Graduated with honors from the Russian Economic Institute named after G.V. Plekhanov with a major in Finance and Credit. Ten years of experience in leading Russian banks: Alfa-Bank, Renaissance Credit, Home Credit Bank, Delta Credit, ATB, Svyaznoy (closed). He is an analyst and expert of the Brobank service on banking and financial stability. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

How not to be left with nothing

Follow the regulations prescribed by law and immediately contact a notary. Consistency and timeliness of actions ensures that your rights are respected. An experienced specialist will help you prepare the documents correctly and take into account all the formalities and nuances. The success of the event directly depends on how complete the package of papers you have and how quickly you collect it. Even if disputes and litigation arise regarding inheritance rights, do not be at a loss, consult with a lawyer. With the right approach, you will get what is due to you.

Comments: 2

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Catherine

09.28.2021 at 20:11 My father-in-law died. There is no will. A widow and two children remained. How is the inheritance divided in this case?

Reply ↓ Anna Popovich

09/29/2021 at 02:01Dear Catherine, after the death of a spouse, the marital share must first be allocated, and only then the remaining part of the property must be divided among all heirs.

Reply ↓