First priority of heirs by law

According to paragraph 1 of Art. 1141 of the Civil Code, inheritance by law is carried out in order of priority, between eight groups (queues) of heirs. The assignment of a specific legal successor to one of the queues occurs in accordance with the will of the law, depending on the degree of kinship of the heir in relation to the deceased. Each subsequent line receives the right to inheritance only in the case when representatives of the previous line are absent , refused or excluded from inheritance, did not accept the inheritance, etc.

For your information

So, according to paragraph 1 of Art. 1142 of the Civil Code, to the first stage of legal successors, the legislator includes the children of the testator, including those adopted (Article 1147 of the Civil Code) and those born after his death, but conceived by him (clause 1 of Article 1116 of the Civil Code), his spouse and parents (adoptive parents).

In addition, it is necessary to take into account the peculiarities of inheritance of each of the categories of heirs of the first stage, in particular:

- Children born to unmarried persons inherit from each of the parents whose paternity and maternity have been duly established. Similarly, inheritance occurs by children whose parents’ marriage is declared invalid by the court - this does not affect the inheritance rights of children (clause 3 of Article 30 of the Family Code). Even if the parents have been deprived of parental rights, their child retains the right to receive an inheritance from both of them.

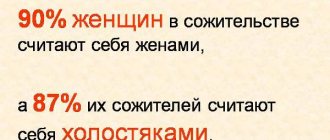

- Along with children, the spouse of the testator is also recognized as legal successors. , was married to him, registered in the registry office, has the right to claim the inheritance (clause 2 of article 1 of the IC). Actual marriage relations and their registration in any other way, including religious rites, do not give rise to inheritance legal relations.

- If spouses divorce, each of them loses the right to inherit from their former spouse. However, according to paragraph 1 of Art. 25 of the Family Code, the moment of divorce is considered to be the moment the corresponding entry is made in the Register of Deeds or the moment the corresponding court decision comes into force. Thus, if the death of a spouse occurs after the filing of the relevant application, but before entering it into the Registration Book, or after a court decision, but before it enters into force, the marriage is considered not dissolved, and therefore, the surviving spouse has the right to inheritance .

- Parents are also full-fledged equal heirs of their children, regardless of their age and ability to work. However, parents, at the time of opening the inheritance, deprived of parental rights or maliciously evading the obligation to support their children, are considered unworthy heirs (Article 1117 of the Civil Code) and may be deprived of the right to receive an inheritance.

The procedure for accepting an inheritance

Algorithm of actions of heirs:

- The emergence of grounds for receiving an inheritance (death of the testator).

- Submitting an application to open an inheritance to a notary.

- Collection of necessary documents.

- Payment of state duty.

- Waiting six months from the opening of the inheritance.

- Obtaining a notarial certificate.

- Re-registration of property rights.

Deadlines for opening an inheritance

Six months from the date of death of the testator is the general period during which claims for inherited property can be made. This period is extended to 9 months when transferring property through hereditary transmission. The statute of limitations for such disputes is 10 years from the date of discovery of the violation.

The legislation establishes the possibility of restoring the lost period of inheritance if there are sufficient grounds. The interested person prepares a statement of claim to the court, which is supported by documents confirming good reasons for missing the inheritance deadline.

These include:

- illness with inpatient treatment;

- long stay outside Russia;

- business trip;

- lack of contact with the testator and his relatives.

The judge considers the claim and decides on the advisability of restoring the lost time. When the terms are restored, the court decision is transferred to a notary, who restores enforcement proceedings and redistributes property.

Proof of relationship

As proof of relationship, heirs of the second stage present:

- brothers and sisters - their birth certificate, the deceased’s birth document, their civil passport;

- grandparents - civil passport, birth certificate of the deceased’s parent, birth certificate of the deceased;

- nephews - civil passport, birth certificate of the deceased, parent and their own.

Application for acceptance of inheritance

An application for acceptance of inheritance is prepared in free form.

Sample application

Application form for a second-order heir to accept an inheritance

The following information is required:

- Full name of the testator;

- Full name of the heir;

- the testator's last residential address;

- degree of relationship;

- desire to receive property (you don’t have to indicate the name of the objects that the person is applying for).

List of documents

Mandatory documents provided to the notary along with the application:

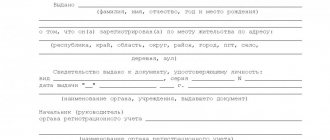

- death certificate;

- certificate from the deceased’s last place of registration;

- property list;

- valuation of each type of property;

- property documents;

- title documents for property;

- heir's passport;

- document confirming the relationship.

Expenses

The amount of state duty for heirs of the 2nd stage is:

Reason: Art. 333.24 Tax Code of the Russian Federation

- brothers and sisters – 0.3% of the value of the property received;

- grandparents and nephews – 0.6% of the value of the inheritance.

Heirs are exempt from paying state duty in the following cases:

In accordance with Art. 333.38 Tax Code of the Russian Federation

- for land and housing, if they lived together with the deceased;

- when inheriting deposits;

- minors and incompetent heirs (suffering from mental disorders).

Disabled people of groups 1 and 2 are entitled to a 50% discount.

Inheritance is not subject to personal income tax. An exception is the situation when the heir sells the property before the expiration of 3 years from the date of inheritance.

Second stage

If there are no successors of the first stage, or for some reason did not accept the inheritance, refused it or were deprived of it in accordance with the established procedure, the heirs of the second stage have the right to be called to inherit. According to paragraph 1 of Art. 1143 of the Civil Code, its representatives should include siblings and half- siblings , as well as grandparents on both sides of the parents.

Attention

Let us note that the inclusion of half-brothers and sisters who do not have common parents, as well as brothers and sisters of more distant degrees of kinship (cousins), as second-order successors is excluded, since this would infringe on the rights of closer relatives.

In relations between adoptive parents and adopted children, their equation to blood relatives is carried out not only between themselves, but also in relation to their relatives. Thus, even a person adopted by one of the parents of the deceased can act as an heir in relation to the deceased. In addition, about inheritance within the second stage, you need to know that:

- Siblings and siblings are persons who have common parents . Half-siblings are brothers and sisters who have a common mother or a common father . Both categories of relatives are representatives of the first collateral line of the second degree of kinship and equal heirs in relation to each other, and are called to inherit simultaneously .

- When brothers or sisters are adopted into different families, which is permissible in exceptional cases (clause 3 of Article 124 of the Family Code), they lose any natural, legally defined family ties. Based on this, they also lose the ability to inherit from each other by law.

- To call the testator's grandparents to inherit, it is necessary to determine their relationship with the grandson-testator. Thus, the parents of the testator’s mother will always have the undisputed right to inheritance. The father's parents in this case will have inheritance rights only if the paternity of their son in relation to the testator is established in accordance with the law.

- In accordance with the rules of adoption, the parents of the adoptive parents of the testator or the adoptive parents of the children of their adopted children can also inherit from deceased grandchildren.

In what cases do they come into force?

Now let’s figure out when it’s time for second-degree relatives to enter into an inheritance?

Heirs of the 2nd stage accept the inheritance if:

- no claimants of the first degree of kinship were found - parents, children and spouse of the deceased;

- all candidates of the previous line refused the inheritance;

- the inheritance was not accepted by them within 6 months;

- parents, children or spouse are recognized as unworthy heirs and cannot inherit.

Following the provisions of the law, the right to inheritance will pass to the next line - the heirs of the second line of consanguinity (sisters, brothers, grandparents).

Third line of heirs by law

The provisions of Art. 1144 of the Civil Code of the Russian Federation, the legislator includes the testator’s . These persons, based on the general principle of inheritance by law, receive inheritance rights only in cases where there are no successors of the first and second categories, refused the inheritance, did not accept it, were removed or found unworthy.

Information

According to paragraph 1 of Art. 1144 of the Civil Code, both full and half-brothers and sisters of the testator’s mother or father are recognized as uncles and aunts of the testator. What is noteworthy is that the uncle and aunt, based on the norms of family law, are not close relatives of their nephews.

The legislator classifies cousins as the third line of heirs who have the right to inherit the property of the testator only by right of representation - in the event of the death of their parent, who is the uncle or aunt of the testator (clause 2 of Article 1144 of the Civil Code). It is noteworthy that by right of representation, cousins can be called upon even if they are not children of the testator’s aunt or uncle.

In addition, it is necessary to remember that:

- The relationship of uncles and aunts, as well as cousins of the testator, is determined according to the rules provided for brothers and sisters, children and parents, etc. Since there is no direct relationship between these relatives, it is proven by submitting documents indicating the relationship between the legal successors and the testator's parents .

- The legislator does not establish any priority of inheritance rights of full and half brothers and sisters of the testator's parents - they are all called to inherit at the same time and inherit equally.

- The testator's cousins, called to inherit by right of representation (clause 2 of Article 1144 of the Civil Code), inherit the share of the inheritance that was due to their deceased parents (uncle or aunt of the testator). Children and other relatives of cousins who inherit by right of representation cannot be called upon to inherit in the same manner - this right is established exclusively for the above-mentioned heirs.

How is the inheritance divided between second-order heirs?

The procedure for dividing property depends on the method of accepting the inheritance - in our case, inheritance by law. Applicants will receive equal shares , regardless of their status. As we noted above, this may also include compulsory heirs from among the testator’s dependents.

However, another division option is also possible - the heirs of the 2nd stage have the right to enter into an agreement on the division of the property mass. In this case, the shares are distributed by agreement and may be unequal. It is appropriate if there are people in need among relatives.

Example:

After the death of the testator, the 2nd room remained. apartment and deposit of 1 million rubles. The cost of housing was 3 million rubles. There were no primary heirs - all of them had already died. The composition of the second-line heirs according to the law is a sister, two brothers and a maternal grandmother. The relatives of the deceased citizen declared their rights, but decided to agree among themselves on the division of the inheritance. Considering that there were four claimants to the inheritance, it was agreed that an agreement would be drawn up. The grandmother immediately stated that she did not need a share due to her advanced age. Instead, she decided to give up her part of the property in favor of her needy sister - the woman was on maternity leave and raising two sons. The brothers declared their rights fully. The total amount of the inheritance is 4 million rubles, which means that each heir’s share was 1 million rubles. The sister received 2 million rubles (her share + the grandmother’s share), the older brother - 1 million, the younger - also 1 million rubles. By exchanging housing, the heirs were able to divide the inheritance in monetary terms.

Subsequent lines of heirs

The provisions of Art. 1145 of the Civil Code, the legislator determines the circle of persons included in the 4th–7th order of heirs by law. The legislator also clarified the principle by which a particular successor belongs to the appropriate category - according to the degree of relationship, determined by the number of births separating the testator and the potential heir, despite the fact that the birth of the deceased himself is not taken into account in this case.

Important

The relationship of representatives of subsequent lines of heirs in relation to the testator can only be confirmed by a body of evidence confirming the origin of the entire chain of relatives between them.

When indicating subsequent lines of inheritance, the legislator also determines their degree of relationship, which is due to the need to simplify the procedure for determining the circle of relatives who may, in one case or another, be called upon to inherit. Thus, the subsequent queues of legal successors include:

- Heirs of the fourth stage. They are considered relatives of the third degree of kinship in a direct line - the great-grandparents of the testator - the grandparents of the parents of the deceased.

- Heirs of the fifth stage. These are considered relatives of the fourth degree of collateral lines - cousins, grandparents of the testator. The specified categories of heirs are, respectively, children of natural nephews and brothers and sisters of their own grandparents.

- Heirs of the sixth stage. They are considered relatives of the fifth degree of kinship of lateral lines - great-great-grandsons, nephews, uncles and aunts. The heirs of these categories include, respectively, the children of first cousins, first cousins, and great-uncles and great-grandmothers.

- Heirs of the seventh line. According to paragraph 3 of Art. 1145 of the Civil Code, these are considered relatives - stepfather and stepmother, stepson and stepdaughter of the testator. These persons are not relatives ; for them to be called to inherit, the fact of their relationship with the testator at the time of opening of the inheritance is sufficient (provided there are no previous queues), regardless of the presence of dependency or alimony obligations.

- Heirs of the eighth stage. They can be disabled dependents of the testator, however, only if there are no representatives of all other heirs (clause 3 of Article 1148 of the Civil Code). Please note that these persons, if there are other heirs, are called to inherit along with the line called up.

Inheritance by disabled dependents

Citizens who are disabled dependents are conventionally divided into two groups.

- Disabled relatives of the testator, who are included in the number of heirs by law from the second to the seventh stage.

- Disabled citizens who are not related to the testator, but are supported by him.

This category of citizens is called upon to inherit in a manner consistent with the provisions of Art. 1148 of the Civil Code of the Russian Federation.

For disabled dependents of the first group, the right to inherit does not depend on their cohabitation with the testator . If such disabled dependents are included in the circle of heirs according to the law of the third priority, then, in the event of the death of the testator, they are called to inherit at the same time and on equal terms with the heirs of one of the previous orders, which is called to inherit at that time. When there are no heirs according to the law of the first two lines, such disabled dependents are called upon to inherit at the same time and on equal terms with other heirs of this line.

In order to be called to inherit, the second group of disabled dependents must necessarily live together with the testator for at least one year before his death and, accordingly, the opening of the inheritance. Disabled dependents of this group, who are not included in the circle of heirs by law in any of the first to seventh queues, in the event of the death of the testator, are called upon simultaneously and on equal terms with the heirs of the queue that is at that moment called to inherit.

For disabled dependents of both groups, when calling for inheritance, it is mandatory to confirm the facts of dependency and their disability at the time of opening the inheritance.

Citizens of this category have equal rights when inheriting, regardless of whether they belong to the heirs of the same or different lines.

Disabled dependents can inherit after the death of the testator, who was their breadwinner, while citizens who had disabled testators as dependents cannot inherit by law after their death .

Heirs by right of representation

According to paragraph 1 of Art. 1146 of the Civil Code, in the event of the death of an heir before the death of the testator or simultaneously with him, then the share due to him in the inheritance upon the death of the testator passes by right of representation to the descendants of such heir . The right of representation applies only to the descendants of the first three lines of heirs, as is directly stated in this article - this right does not apply to the remaining lines of inheritance, as well as to the ancestors of these heirs.

For your information

The grandchildren of the testator and their descendants (clause 2 of Article 1142 of the Civil Code), nephews (clause 2 of Article 1143 of the Civil Code), as well as cousins (clause 2 of Article 1144 of the Civil Code) can receive an inheritance by way of presentation. If there are several similar legal successors, they divide the share due to them by right of representation equally.

The right of representation for the descendants of the heir arises in order of priority - only when the heir, if he were alive, was called to inherit . The right of representation has many other features:

- Legal successors by right of representation cannot claim a share in the inheritance recognized as mandatory (Article 1149 of the Civil Code). This conclusion follows from the fact that only persons who are directly indicated in the law can claim it - those who inherit by right of representation are not included in the circle of such persons.

- By right of representation, according to paragraphs. 2.3 tbsp. 1146 of the Civil Code, the descendants of legal successors who, for one reason or another, were deprived of the inheritance (deprived of it by will (Article 1119 of the Civil Code) or were declared unworthy (Article 1117 of the Civil Code)) cannot receive an inheritance. What is noteworthy is that these descendants may also be deprived of rights to inheritance, if appropriately indicated in the will or if they are recognized as unworthy.

- The transfer of inheritance rights by right of representation to the descendants of the heir is carried out immediately after his death - the rules of succession are not applicable here, and the share in the inheritance entitled to the deceased heir is not included in his inheritance mass . Thus, the descendants of the successor who receive the inheritance by right of representation cannot in all cases lay claim to the inheritance of the deceased heir himself.

- The specified order of succession in the order of presentation is subject to the rules of Art. 1116 Civil Code. Thus, by right of representation, successors born after the death of the testator , but born after it, can inherit.

Example

After the death of G, his wife, son from his second and daughter from his third marriage were called to inherit him by law as heirs of the first line. Since the son from his first marriage died in a car accident, his right to inherit after his father, according to Art. 1146 of the Civil Code, passed to his daughter - the granddaughter of the late G, by right of representation. According to paragraph 2 of Art. 1142 of the Civil Code, grandchildren inherit by right of representation as heirs of the first turn. Thus, G’s wife, his children from his second and third marriages, received ¾ of the inheritance left by G, and the granddaughter, since there were no other heirs according to the proposal, also received ¼ of the inheritance.

The procedure for dividing property between heirs

Inherited property is divided equally between recipients of the 3rd stage. If the object of inheritance is not subject to division, then the property is registered as shared ownership.

The right to a preferential share in the inheritance is vested in the citizen who used the property during the life of the deceased owner. For example, the inheritance includes the apartment in which the uncle lived. Or the car that my aunt used for work.

They may ask other recipients to give them a larger share. If other heirs do not mind, then they must enter into a written agreement.

In case of disputes regarding the division of property, the issue will be resolved in court.

Inheritance by adoptive parents and adopted children

According to Art. 1147 of the Civil Code, the adoptive parent and the adopted child, as well as their relatives and offspring, in matters of succession to each other, have the same legal capacity as blood relatives by origin. However, upon adoption, the adopted person loses the legal ties directly provided for in the law with his actual blood relatives (clause 2 of Article 137 of the Family Code).

The relationship directly between the adoptive parent and the adopted child is regarded as a relationship between children and parents. Thus, the adoptive parent and the adopted child are among the representatives of the first line of inheritance. Their relatives and descendants also inherit from each other in order of priority, depending on the degree of relationship in relation to the adoptive parent or adopted child, respectively.

Let us pay attention to some features of inheritance by adopted children:

- Due to the fact that the adopted person loses any legal ties with his relatives by origin (including his natural parents), according to paragraph 2 of Art. 1147 of the Civil Code, he, like his offspring, also loses the possibility of inheriting them . Likewise, his parents and other relatives by descent cannot be the legal successors of the adopted person and his descendants.

- An exception to this rule is provided for in paragraph 3 of Art. 1147 of the Civil Code, according to which, in cases where the adopted person retains any family relations with relatives by origin in accordance with a court decision, he has the right to inherit from such relatives, just as they inherit from him. What’s interesting is that if an adopted child maintains a relationship with one of the parents, then he maintains relationships with all of his relatives .

- Based on this, an adopted person can equally inherit property from both the adoptive parent and his relatives, and from his blood relatives with whom he maintains relations. However, after the death of an adopted person, not only his descendants, but also the adoptive parent and his relatives, as well as other blood relatives, can inherit his property.

Answers to frequently asked questions

I am the heir of the second stage.

The heir of the 1st stage was declared incompetent. Can I count on an inheritance? No. Incapacitated and minor citizens apply to receive property on a general basis. The interests of the incapacitated relative will be represented by his guardian.

Is it possible to accept an inheritance if I am a second-stage heir, but there are also first-stage heirs who do not enter into the inheritance?

If the heirs of the first priority have abandoned the property or are found unworthy, then they can lay claim to the property.

Can I claim an inheritance while being in the second stage if the heirs of the first stage write a waiver of the inheritance in my favor?

Yes. The refusal must be formalized properly.

Responsibilities for debts and responsibility for accepted inheritance

Inheritance is not always represented only by values. Often, along with material goods, debt obligations are included. The distribution of financial obligations can occur as follows:

- equal distribution among all heirs;

- entrustment only to those candidates who receive property encumbered with monetary debts and loans.

Important! Inheritance is allowed only for all property due. You cannot refuse financial obligations and receive only valuables.

If the heir has become the owner of an apartment that is under a mortgage or has received the obligation to repay a separate consumer loan, then after assuming the rights of inheritance, the citizen must inform the creditor about this. The borrower draws up a new agreement, which states that further payments fall on the shoulders of the newly-minted heir.

In case of late payments or evasion of their execution, the heir will be subject to sanctions provided for in the contract. Therefore, you need to be prepared to strictly comply with the signed contract.

Equality of shares

How the inheritance is divided between the heirs of the second stage: representatives of each stage inherit at the same time and equally. If there is one person at the next level, then he receives everything from the mass of the deceased’s property.

The successors enter into an agreement among themselves on the division of property (if things are indivisible). Inherited property becomes common property.

The co-heirs have no obligation to make a division. But the heirs prefer to end the community. They have the right to agree on the distribution of property taking into account compensation.

Challenging the right of inheritance of the second priority

Any heir can challenge the right to inheritance, regardless of his or her priority. Situations often occur when the heirs of the second circle of priority do not inform other heirs about the death of the testator in order to avoid competition. Also, the cause of disputes can be legal illiteracy, in the case when relatives are involved in the division of property that should not belong to them.

Expert commentary

Gorbunova Olga

Lawyer

If the heir has learned about the concealment of the death of the testator or any other circumstances have arisen that do not allow the property to be distributed peacefully, it is necessary to go to court. However, it must be taken into account that it is imperative to provide evidence of illegal actions on the part of relatives. To prove that you are right and restore your rights to inherited property, you need to involve a lawyer in the case who will understand the problem and help restore justice as soon as possible.

Confirmation of relationship

In order to assume rights, heirs of the 2nd stage according to the law of the Civil Code of the Russian Federation must:

- Prove your relationship with the deceased: provide birth papers so that the relationship can be traced. For example, the niece of the deceased must include her, her parent’s and the testator’s birth certificates in the file. It will be clear from them that her parent and testator were relatives (brothers and sisters), born of the same parents.

- If the last names do not match, you need a certificate of change of last name with the reason (was married and divorced) or a marriage certificate.

All these papers can be obtained through the registry office. Everything lost is restored; for each document you will have to pay from 200 to 500 rubles.

In order for the inheritance to pass to a person in the second order, he must open a case with a notary. Usually this is done by the closest relatives, but if there are none, this responsibility is transferred to the next in line.

Otherwise, the procedure for assuming the rights of heirs does not depend on the order of priority. Objects are also divided in equal shares, with the allocation of an inalienable part, if any, to whom. Relatives can also agree on division not in shares, but in kind. For example, three heirs are divided into three objects of different values, but they do not want to leave the property in use and are ready to divide it into unequal shares.