A certificate of inheritance rights is an official confirming document that proves the rights and obligations of citizens when the property they inherited from the testator comes into private ownership. The paper does not give new rights (they arise for the successors after the opening of the inheritance), but is only a path to their further legal confirmation. The certificate proves the legality of the inheritance received and the fact of its acceptance.

Receiving the document is not the responsibility of the heir, but only his right.

The grounds for issuing a certificate are the death of the testator and the membership of persons in the circle of legal successors under a will or law, and the presence of inherited property.

To obtain a certificate confirming the rights of the heirs, the successor must demonstrate his will and desire to acquire the property of the testator. He states this unequivocally to the notary.

It happens that after receiving the document, the heirs still have some part of the property that is not mentioned in the text. Then the notary issues an additional certificate for the unaccounted part of the inheritance, clause 2 of Art. 1162 Civil Code (Civil Code) of the Russian Federation.

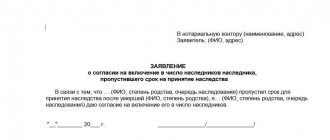

After completing the document, an heir may also be discovered who was not aware of his right . If he is interested in acquiring the inheritance, he must file a claim in court. The judicial authority cancels the issued certificate and the partition must take place anew.

Grounds for issuance and registration procedure

A certificate of the right to inheritance, obtained both by law and on the basis of a will, is a document confirming the transfer of inherited property, including bank deposits, land, pensions, scholarships from the deceased owner to his relatives and close people. In addition to the transfer of the inheritance to the heir, the document confirms the latter’s consent to accept it, since in the event of refusal of the inheritance or its non-acceptance, there are no grounds for issuing a certificate. The fact of acceptance of the inheritance is important when issuing a certificate.

The issuance of a certificate of the right to inheritance is carried out if there are legal grounds and in the form prescribed by law. According to civil law, property owned by citizens (apartments, houses, pensions, cars, money), as well as their property rights, for example, the right to lease a plot of land, after their death are transferred to their heirs by law, taking into account the rules of order of succession. The same rule applies to the inheritance of deposits, scholarships and land.

At the same time, the Civil Code of the Russian Federation guarantees the right of a person to make a will, by which he can express his will regarding the further disposal of property.

There are two categories of heirs (by law and by will) and, accordingly, two categories of grounds for their entry into inheritance and receipt of a certificate of the right to inherit.

To be able to dispose of property, both categories of heirs must enter data on the received certificate into the state register, having previously paid the state duty (tax), which is also of no small importance. The amount of state duty (tax) for issuing a certificate is established by tax legislation.

A certificate of the right to inheritance under a will, as well as a corresponding document confirming the rights of heirs under the law, is issued in writing by a notary at the place of opening of the inheritance. According to the law, this is the last registered place of residence of the testator. If there is no information about the last place of residence of the deceased, all notarial actions regarding the disposal of his property are carried out at the location of the majority of the inheritance mass.

According to what legal principles does inheritance occur abroad?

In the case of receiving an inheritance abroad, various legal norms may apply to the inheritance matter:

- The personal law of the heir or the law of the country in which he permanently lives . For an heir from Russia, the process is regulated on the basis of the Civil Code.

- The law of the location of the testator's property . This situation may arise if the testator was not only abroad, but also owned property outside his country of residence. For example, real estate.

- The law of the place of death of the deceased testator . Most often it applies to cases where the testator’s property is located in the territory of the country where he lived and died.

In situations where an inheritance case is opened for objects of movable property, the person responsible for carrying out the procedure for transferring inheritance follows personal law. In most European countries, property is transferred to heirs according to similar patterns of action. However, local nuances should be taken into account so as not to encounter obstacles when opening a inheritance case abroad.

Features and conditions for issuing a certificate to heirs by law

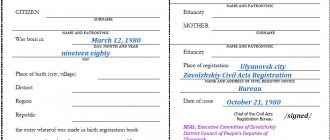

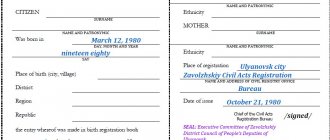

To obtain a certificate of right to inheritance, according to the law, heirs are required to provide the notary’s office with the necessary documents confirming the following facts:

- time and place of opening of the inheritance. This information contains the death certificate of the testator;

- the presence of family ties between the deceased and the person applying for inheritance (copy of birth certificate, copy of marriage certificate, copies of judicial acts confirming adoption, recognition of paternity, etc.). Persons who have not provided originals or copies of documents certifying the presence of both blood and marital ties with the testator will be able to inherit only with the consent of the remaining heirs. Also, as confirmation of family ties, you can use certificates indicating marriage or blood ties, which officials at the place of work or residence of the interested persons have the authority to issue;

- the location of objects from the hereditary mass (real estate, car, money) and its composition. To do this, you must submit title documents for the property and property rights of the deceased (documents confirming ownership of apartments and houses, the availability of money in the form of bank deposits, a land lease agreement, confirmation of copyright);

- passport and identification number of the applicant.

If the above documents are available, which are the basis for issuing a certificate, the applicant has the right to receive the document six months after the death of the testator and enter data about it into the state register.

How to restore land documents

December 22, 2018211 read 1 min. publications Unique visitors to page 211 read to the end This is 66% of those who opened the publication 1 minute - average reading time Lost land documents can be restored. Just be puzzled by the goal of obtaining duplicate documents from the organizations in which you prepared them. For this procedure, you must present your identification card and a statement from the owner or tenant of the land plot. Also, do not forget to pay the state fee when restoring land documents.

This is a must! If your land is currently leased and you have lost the lease agreement, you need to contact the land committee in the local administration.

But first obtain a cadastral extract from the Federal Office for the registration of the land plot. At the administration, prepare your passport and write an application for restoration of land documents. Since the second copy is always kept in the district municipality, upon your request the committee will issue you a duplicate of the agreement. If the cadastral passport or plan is lost, contact the Federal Office for Unified Land Registration and receive an extract from the cadastral passport and a copy of the cadastral plan. If you find that your land is not registered on a single register, submit an application to the Federal Administration, they will survey the site for you, draw up technical documents on the basis of which a cadastral plan and passport of the site will be drawn up. If you lose such a land document as a certificate of ownership of a land plot, contact to the registration center of the Federal Office.

How to obtain a certificate of inheritance under a will

The issuance of a certificate of the right to inheritance under a will is carried out on the basis of the following documents:

- death certificate of the owner of property and property rights, as well as copyrights, who made a will in favor of the applicant;

- directly the will itself, drawn up in accordance with the form established by law;

- date of death of the testator;

- place of opening of inheritance;

- a list of objects included in the estate: real estate (houses, apartments, land), movable property (the testator owns a car, civilian and hunting weapons), property rights (deposits, pensions, scholarships). If there is a transfer of the right to lease a land plot, it is necessary to provide information about the lease agreement, in particular about its validity period. The transfer of copyright to the heirs of the testator is carried out in accordance with the rules of inheritance, and recording of this fact in the state register is not required;

- passport and identification number of the applicant.

Having received the above documents from applicants for bequeathed property, the notary proceeds to establish the circle of persons who are entitled to an obligatory part in the inheritance. In the absence of such, the heirs will be able to receive bequeathed property in the amount specified in the will, as well as a certificate of the right to inheritance under the will 6 months after the death of the person who made it.

Do you need the help of an inheritance lawyer?

We will advise you on all your questions!

+7

Scammers

In matters of inheritance, extreme caution should be exercised, especially if the news was received by unknown persons, and not through official means of notification. For example, many scammers can simply come to your home and introduce themselves as lawyers dealing with the issue of obtaining a foreign inheritance. They also offer their services in registering this inheritance and require a monetary reward in advance for the work.

The main difference between lawyers and scammers is the lack of time, especially for a personal visit to each presumptive heir. Therefore, the heirs are notified either by telephone or by mail with notification in the established form.

Since registering an inheritance abroad can bring with it some difficulties, it is better to consult with an experienced lawyer on procedural issues.

Features of state registration of ownership of inheritance

However, in order to become the full owner of inherited property, it is necessary to go through the procedure of state registration of the received certificate of inheritance with the authorized bodies:

- registration of ownership of apartments and houses is carried out by employees of the Federal Registration Service, who enter data on the transfer of ownership into the register. You should also contact here to register and enter into the register information about the heir’s receipt of the right to land;

- vehicle registration is carried out at the traffic police by entering data into the register;

- As for weapons, registration of ownership of them as acquired by inheritance is not required. However, you will still have to obtain permission to use and own such an object of inheritance. The exception is short-barreled and combat types of weapons. According to the law, such types of weapons after the death of the testator are subject to voluntary surrender to the regional police authorities;

- Registration of copyrights received by inheritance is not provided for by law. The concept of copyright should not be confused with the right to the result of intellectual property, since in the first case the heir does not receive any financial benefit, only the opportunity to publish the contents of the deceased’s works under his own name;

- If the deceased has funds in the form of a monetary contribution, the heirs will be able to receive them in full only after receiving a certificate of the right to inheritance and in accordance with the order of the testator regarding the contributions. It should be noted that the relatives of the deceased can receive part of the funds from the bank deposit earlier than the established period if the funds are needed for the funeral of the owner of the deposits. The basis for the issuance of funds is the corresponding decree of the notary.

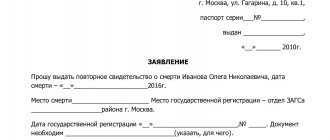

A sample certificate of inheritance can be obtained from a notary office. As a rule, the content of the sample includes the following data:

- time and date of issue;

- where and by whom it was issued (address of the notary’s office, full name of the notary who compiled and certified the document);

- personal data about the person in whose favor the document was drawn up;

- information about the testator;

- date of opening of inheritance;

- information about the inherited property and the size of the recipient’s share of the certificate in it. This should include information about real estate objects (apartments, houses), which, according to the issued certificate, become the property right of its recipient, as well as, if any, about movable property and property rights, such as the right to lease a land plot, the right to receive deposits, pensions, scholarships and other funds of the deceased. The transfer to the recipient of the copyright certificate is also recorded in the text of the document;

- the cost of part of the inheritance mass, the right to dispose of which is acquired by the person who received the certificate (the cost of an apartment, the cost of a car, the cost of a land plot, etc.).

Why might you need a certificate for an apartment?

A certificate of ownership is a form containing the seal of an authorized registrar and security marks that are designed to protect the document from forgery. The certificate is a strict reporting form and is issued exclusively to those persons who have the right to receive it. Who can apply for this document?

- Persons who have the right to purchase housing in a new building;

- Participants of housing cooperatives who have paid contributions in full;

- People who bought an apartment from another person - an individual or a legal entity;

- Citizens who inherited an apartment, as a result of a court decision or by gift.

An authorized person can also receive a document if they have the appropriate permission certified by a notary.

A certificate for an apartment may be needed in a variety of situations, so every owner should have it in hand so as not to waste time collecting documents and obtaining a duplicate if necessary. The most common certificates required are:

- To rent out an apartment and conclude an agreement, the tenant has the right to look at the document;

- For resale, it will not be possible to issue a DCP without a certificate;

- During the donation procedure, it does not matter whether the transaction is between relatives or strangers;

- For redevelopment, the paper is included in the list of documents that must be presented to the government agency.

In addition, the certificate will be required when there is a change of owner, alienation of property by other means, or in a situation where you want to leave the apartment as collateral.

Sources

- Glushkov A.I. Ensuring the rights and legitimate interests of minor victims in criminal proceedings; Prometheus - M., 2012. - 168 p.

- Practical accounting. Official materials and comments (720 hours) No. 6/2013 / Absent. - Moscow: Mir, 2013. - 521 p.

- Elena, Mikhailovna Deryabina Sources of law of the European Union: theoretical and legal research. Monograph / Elena Mikhailovna Deryabina. - M.: Prospekt, 1990. - 619 p.

- Shastitko A.E. Trading durable goods: object set and antitrust limits; Synergy - M., 2015. - 310 p.

- Insurance of expenses for legal assistance: comparative legal research: monograph. ; Prospect - M., 1996. - 597 p.

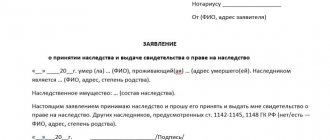

Procedure for issuing a certificate of inheritance

Requirements for registration and issuance of documents, features of the procedure

- a certificate of the right to inheritance is issued at the place of residence of the testator;

- the document must be in writing and notarized. Oral form is not acceptable;

- Errors and inaccuracies in the text of the document are not allowed. If there are errors in the information about the recipient of the certificate or in the information about the inherited property (incorrect indication of the amount of the testator's monetary contribution, his pension, errors in the details of the agreement confirming the right to lease a land plot and other shortcomings), the validity of the document can be challenged in court by the claim of interested parties ;

- the document is issued to the heirs by law or by will after six months from the opening of the inheritance;

- in case of loss of the certificate, the notary issues a duplicate;

- the certificate must contain adequate information about the property;

- the document is issued at the request of interested parties;

- at the request of the heirs, one document may be issued listing the shares of each heir and indicating which objects were transferred to which of them, or several - for each heir separately.

Cost of issuing a certificate

To obtain a document confirming a citizen's right to inheritance, he must pay a fee established by the state. Its size depends on the degree of closeness of the family relationship with the testator.

For persons who are direct relatives of the deceased, assigned to the first and partially to the second priority group, it is 0.3% of the value of the property inherited by the citizen accepted for calculating the value. The maximum amount of this duty should not exceed 100 thousand rubles. For categories of more distant relatives, it is set at 0.6% of the estimated value of the property accepted for inheritance. The upper limit on the amount of such a duty is indicated by one million rubles.

For the calculation, one of the following estimates of the value of inherited property can be used:

- inventory;

- cadastral;

- market;

You can present the notary with the lowest of these estimates; he does not have the right to refuse to accept it. The cost of the appraisal work is paid by the heirs themselves. If there are several of them, then they pay equally or assign payment to one heir by agreement with him.

Expert commentary

Kireev Maxim

Lawyer

Some categories of citizens are exempted partially or completely from paying the fee. For example, persons with disability status of group 1 or 2 pay a fee of half the amount required by law.

There is a whole list of citizens who are completely exempt by law from paying fees when receiving an inheritance. These include:

- participants in the Second World War, heroes of Russia and the Soviet Union;

- heirs living together with the testator, if they lived with him before his death;

- heirs of citizens who died in the performance of state interests, performing civic duty to save other people's lives and other heroic deeds;

- heirs of deposits in banks, cash payments due to the testator;

- minor children, as well as incapacitated citizens who were in the care of the deceased person before his death.

In addition to the fee, heirs often have to pay for the technical preparation of the document. The exact amount of such services is not regulated by the state and cannot be imposed on citizens without fail.

Validity period of the certificate of inheritance

The validity of the certificate of the right to inheritance is not limited by any period; the heir who received the document has the right to register his rights at any time convenient for him. However, it should be remembered that the lack of state registration limits the rights of the heir and deprives him of the opportunity to dispose of the received property. To receive the property of a deceased owner (apartments, cars, land) into ownership, it is necessary to register a certificate of inheritance with the relevant authority.

As for property rights, namely the right to receive money, pensions, stipends of the testator, the right to lease a land plot, as well as property the right to inherit which is not subject to registration (weapons), they can be used and disposed of after 6 months from the date of opening of the inheritance .

If you lose the certificate confirming your entry into inheritance, you must contact a notary for a duplicate.

How to avoid inheritance fraud?

Fraudsters make good money from people’s desire to get easy income from the inheritance of foreign relatives, since it is precisely on this issue that one can get rich well at the expense of naive heirs.

But how can you avoid falling for scammers? To do this, you need to know how they work. Most often, law enforcement agencies have to deal with the following situations. People ring at the door of the presumptive heir and introduce themselves as employees of the notary company in which the deceased foreign relative made a will. They report that he left an inheritance abroad. But to receive it you must deposit a certain amount.

To avoid becoming a victim of scammers, you should not succumb to provocation and make payments. Lawyers and notaries are such busy people that they will not travel to another country to inform the heir about the property left behind. They will do it in a different way. For example, they will notify you by sending an official document by registered mail, or they will call you, confirming your words with evidence, which scammers will never do.

It is for this reason that, without evidence available to such persons, you should not believe in a mythical inheritance, otherwise it will lead to loss of time, money and nerves.

Is it possible to challenge the legality of a certificate of the right to inheritance in court?

In order to challenge a certificate of non-inheritance in court, it is necessary to establish and prove the existence of reasons confirming its invalidity. The availability of documentary evidence is of great importance during a dispute.

A certificate of the right to inheritance can be invalidated through a court on the following grounds:

- the presence in the document of errors and unreliable information about the property and funds of the deceased person (pension, scholarship, cash contribution);

- if the certificate confirms the transfer of rights to an apartment, car or land that is common joint property;

- non-compliance of the document with the established form, lack of notarization;

- the person who received the document had no rights to the inherited property. A complete list of such persons is established by the Civil Code of the Russian Federation;

- if the appeal of the certificate was preceded by the invalidation of the will through the court.

Recognition of a certificate of inheritance as invalid with the subsequent application of all the consequences of invalidity is possible only through a court located at the place of residence of the defendant. In relation to appealing a certificate, the general limitation periods apply.

What to do with the document after receiving it?

Since the certificate is not a document of title, the next step that the heir must take is to re-register the property to the new owner, that is, to himself.

The choice of organization for treatment depends on the type of property received by the heir:

- If the inheritance is a bank deposit, you should go directly to the bank.

- If real estate was inherited, re-registration is carried out in Rosreestr.

- If the object of inheritance is a car, the heir needs to contact the traffic police.

- Re-registration of shares and other securities is carried out by the issuing joint-stock company.

Attention!

The inheritance certificate is just one document from an extensive package of papers required for re-registration. A complete list of documents is established for each specific case on an individual basis.

Grounds for cancellation of a document

A notary has the right to annul or cancel a certificate issued by him without going to court under the following conditions:

- the presence in the document of errors regarding the property (real estate, vehicles, weapons) and means of the deceased, clerical errors;

- The consent of the heirs to perform this notarial act is of great importance. Consent must be in written form only.

After canceling the certificate of inheritance, the notary must make a corresponding decision, on the basis of which he will subsequently make a new sample of the document.

Dates of issue

According to paragraph 1 of Art. 1163 of the Civil Code of the Russian Federation, a certificate is issued to heirs after the six-month period for entering into inheritance rights has expired. The heir will be able to receive it at any time, but only in the absence of legal disputes within the framework of the inheritance case.

The certificate can also be issued ahead of schedule, but under exceptional circumstances. For example, if there is a court decision on early entry into an inheritance, or the inheritance is carried out according to a will, and the list of persons indicated there has already declared their rights.

According to statistics, in most inheritance cases, a certificate is issued only six months after the death of the testator. This period is necessary so that all heirs have time to declare their inheritance rights.

In some cases, the issuance of a certificate is delayed for some period of time:

- If one of the heirs was not born within the established period.

- If there is a court decision to suspend the issuance of a certificate for certain reasons.

- Litigation is ongoing within the framework of an inheritance case.

This list of reasons, which is prescribed in Art. 1163 of the Civil Code of the Russian Federation is exhaustive and is not subject to an expansive interpretation.

If the six-month deadline for filing an application has expired, the heir loses the right to submit a petition for the issuance of a certificate to a notary. Even if he declares his desire to enter into an inheritance, the notary will legally refuse him.

The heir will have to go to court to restore the missed deadlines. But this will require a valid reason: illness, being outside the Russian Federation, etc.

Conditions for restoring the certificate, obtaining a duplicate

If the certificate of inheritance is lost or damaged, the notary who issued the document restores it and issues a duplicate that looks identical to the original source. A duplicate can be issued by one of the heirs in whose name the certificate of the right to inheritance, which is subject to restoration, was issued.

The basis for restoring a document is a corresponding statement on behalf of the person who lost it. All you need to do is apply for a duplicate and pay the tax.

Author of the article

Refusal of inheritance

If inheriting the property of a relative abroad for some reason is not included in the plans of the heir, he may refuse this opportunity, as well as according to the laws of his country. When drawing up a waiver of inheritance, a number of features should be taken into account:

- The refusal must be carried out before the inheritance is entered into . If the heir has valid reasons, the period of entry into inheritance rights can be extended.

- The refusal should be addressed to the notary opening the inheritance . If you are unable to complete the paperwork yourself, you can use the services of an official representative. But to do this, you must draw up a power of attorney, which will stipulate the ability of the representative to formalize the refusal on behalf of the heir.

- Cancellation of a refusal is not possible . You can't take it back either. The refusal occurs in favor of the heirs by will or heirs by law, with the exception of those who were indicated in the will as deprived of the right to inherit.