Where should an application for acceptance of inheritance be submitted?

The right to enter into an inheritance is vested in the citizen to whom the testator bequeathed it.

At the same time, any person can become such a citizen, regardless of family relations, if the testator considered him worthy to inherit property. Sometimes an inheritance can pass to a legal institution, for example, if the testator wanted to transfer his property to a children's institution as a charity.

To acquire an inheritance, the heir is required to submit a statement of readiness to enter into the inheritance to the notary who opened the will or other responsible person located in the area of the final place of residence of the deceased person.

He can submit a petition at will, either to a private notary or to a state notary who has opened a case for the acceptance of property. At the same time, he has the right to freely choose to perform certain actions.

These include:

- Acquisition of inheritance.

- Rejection of heritage, no matter the circumstances.

In both options, the heir is required to submit an application to the notary outlining his decision. Usually, the place of acquisition of the inheritance is located at its location.

What data and documents does the notary not have the right to demand from the heirs?

The notary is required to request some information on his own. For example, about encumbering the cadastral value of real estate.

Information that the notary independently requests about real estate.

According to Article 47.1 of the “Fundamentals of the Legislation of the Russian Federation on Notaries”, in cases where information contained in the Unified State Register of Real Estate is required to perform a notarial act, notaries have no right to demand the provision of such information from a citizen, his representative or a representative of a legal entity who has applied for this notarial act. faces.

To perform this notarial act, a notary in the manner and methods established by Federal Law of July 13, 2015 N 218-FZ “On State Registration of Real Estate”, within three working days from the date of application of a citizen, his representative or representative of a legal entity, requests and receives within the time limits established by the specified federal law, the information contained in the Unified State Register of Real Estate is provided to the rights registration authority.

From the Unified State Register of Real Estate the notary requests:

- information about the rights of the testator to real estate objects, information about the recognition of the copyright holder as incompetent or partially capable, generalized information about the rights of the testator to real estate objects available to him in connection with the opening of an inheritance;

- information about the rights to real estate objects, information about the recognition of the copyright holder as incompetent or partially capable and (or) copies of title documents in connection with the request for information and documents necessary to perform a notarial act, including information about the rights of the mortgagee to the subject of mortgage and (or ) copies of title documents, information about the content of title documents in connection with the notary’s verification of the conditions for making an executive inscription.”

In addition, in accordance with the norms of subparagraphs 5, 8 of paragraph 1 of Article 333.25 of the Tax Code of the Russian Federation, when calculating the amount of the state duty for issuing certificates of the right to inheritance, the value of the inherited property is taken, determined in accordance with subparagraphs 7 - 10 of paragraph 1 of Article 333.25 of the Tax Code of the Russian Federation. The cost can be determined by appraisers, legal entities who have the right to enter into an agreement to conduct an appraisal in accordance with the legislation of the Russian Federation on appraisal activities, or by organizations (bodies) for recording real estate objects at their location. issued by the persons specified in subparagraphs 7-10 of this paragraph, may be submitted to calculate the state duty Notaries and officials performing notarial acts do not have the right to determine the type of property value (valuation method) for the purpose of calculating state duty and require the payer to submit a document confirming this type of property value (valuation method).

If cadastral registration of real estate has been carried out, it is possible to calculate the notary tariff using the cadastral valuation. The provisions of Article 47.1 of the Fundamentals of the Legislation of the Russian Federation on notaries oblige the notary to independently request and receive, within the time limits established by the federal law, from the rights registration authority, the information contained in the Unified State Register of Real Estate. The notary has no right to demand the provision of such information from a citizen or his representative applying for this notarial act.

Taking into account the above provisions of the current legislation, in order to calculate the notary fee, the notary is obliged to independently request information about the cadastral value of the inherited property.

Other information that the notary requests independently.

Information about encumbrances, seizures of inherited property in relation to movable property (vehicles) - based on information from the register of notifications of pledge of movable property in the UIS. The notary receives information about encumbrances on securities from legal entities authorized to take into account encumbrances on securities in accordance with the legislation of the Russian Federation.

What is the application deadline?

The acquisition of property from a deceased person must be carried out by the heirs within the time limits established by law.

The specific time for acquiring the right to the deceased's real estate is determined by regulations to protect both public and personal rights. Approved norms of Art. 1154 of the Civil Code provides for a general time period for most heirs during which they can enter into an inheritance, equal to six months. The beginning of the countdown of the established time is determined by the date of opening of the inheritance case (Article 1114 of the Civil Code of the Russian Federation), which occurs depending on the circumstances that became the reason for its initiation.

All other terms for acquiring an inheritance are regulated by Art. 1154 Civil Code, among which stand out:

- A special time for accepting an inheritance is equal to 6 months, the countdown of which begins from the date of entry into force of the decision of the judge who recognized the person as dead. (Article 1114 of the Civil Code).

- The special time for accepting the inheritance of a missing person is equal to 6 months, the countdown of which begins from the date of entry into force of the judge’s decision establishing the expected date of death (clause 1 of Article 1154 of the Civil Code).

- A special time for accepting an inheritance, equal to 6 months, is provided for other citizens who have the right to inherit as a result of the refusal of the inheritance of other heirs or their removal if recognized as unworthy (clause 2 of Article 1154 of the Civil Code)

- A special time for accepting an inheritance, equal to 3 months, established for persons who acquire the right to real estate as a result of non-acceptance by other heirs (clause 3 of Article 1154 of the Civil Code). Such time is counted after the completion of the generally accepted 6-month period, application from the date of opening of the heritage.

If the time established by law is missed, the testator still has a chance to acquire the inheritance if valid reasons for the missed time are given. The missed time may be returned by the court. With the consent of other heirs who did not miss the deadline, the citizen who missed the time can receive a share of the property without filing a claim with the judicial authorities (Article 1155 of the Civil Code).

Submission methods and costs

Depending on where to apply for an inheritance and where the applicant is located, you can independently determine a convenient way to submit documents. In accordance with the law, an application for acceptance of an inheritance is submitted to the notary office at the place where the inheritance case was opened:

- Through personal contact. The method is convenient for heirs living in the same region as the testator, since it allows them to receive information and consulting services and have documents verified by a notary on the spot.

- By post. If living in different regions or lacking time, the applicant can send documents by registered or certified mail with a list of attachments.

- Through a representative. If it is impossible, due to health reasons or due to inconvenience, to visit a notary, the candidate for inheritance can choose a representative of his interests, indicating the appropriate powers in a notarized power of attorney.

Each notarial act is accompanied by a fee. The state fee for filing an application for inheritance is 100 rubles. When sent by mail, the sender's signature requires certification by a notary or authorized person, and actions through a representative must be certified by a notary.

Procedure for filing an inheritance application

Legal methods for acquiring heritage, as well as the procedure for its registration, are regulated by paragraph 1 of Art.

1153 of the Civil Code of the Russian Federation. In accordance with it, the heir has the right to write a statement at the place of opening of the inheritance to a notary or other responsible person with similar powers (Article 1115 of the Civil Code). The established documents submitted by the heir have equal procedural effect for the acquisition of inheritance. When submitting a request for inheritance, you need to know that:

The legislation provides for 3 options for submitting a request - in person, through the post office or through an authorized representative.

When sending a request through a proxy or post office, an indispensable condition of the request is notarization of the authenticity of the heir's signature.

According to Art. 62 of the law on notaries, a request from heirs to acquire an inheritance must be provided in writing. It needs to display complete information:

- About the testator and the testator.

- Date of death and place of residence at the date of death.

- Availability of other heirs.

- Property location address.

- Indicating the date the request was filled out, etc.

The duty of the notary is to explain to the heir his rights and obligations arising as a result of the acquisition of the inheritance. At the same time, the heir has the right to refuse the inheritance, even after submitting a request for its acceptance within the specified time.

How to accept an inheritance?

Actual topic

Even if you inherited not a luxurious apartment of a foreign aunt, but just a modest one-room apartment on the outskirts of your hometown, in order to accept the inheritance you must follow a certain algorithm of actions. Read more about this in our article.

***

As a general rule, in order to acquire an inheritance, the heir must accept it within six months from the date of opening of the inheritance (clause 1 of article 1152, clause 1 of article 1154 of the Civil Code of the Russian Federation). There are two ways to accept an inheritance (Article 1153 of the Civil Code of the Russian Federation):

- submit an application to a notary (the most common method);

- perform actions indicating the actual acceptance of the inheritance.

Let's consider these methods in more detail.

The “ABC of Law” of the ConsultantPlus legal reference system provides up-to-date answers to everyday questions, spells out the procedure with references to laws

The procedure for accepting an inheritance by submitting an application to a notary

To accept an inheritance by submitting an application to a notary, we recommend following the following algorithm.

Step 1. Prepare an application for acceptance of inheritance and submit it to a notary

To accept an inheritance, within six months from the date of death of the testator, you need to submit to the notary at the place of opening of the inheritance (last place of residence of the testator) an application for acceptance of the inheritance or an application for the issuance of a certificate of the right to inheritance (Articles 1113, 1115, paragraph 1 Article 1153, Article 1154 of the Civil Code of the Russian Federation).

In advance, you can check whether the inheritance case has been opened by other heirs on the official website of the Federal Notary Chamber using the “Search for Inheritance Case” service in the “Reference - Search for Inheritance Cases” section. The request must contain the last name, first name, patronymic (if any), date of birth and date of death of the testator (Part 5 of Article 34.4 of the Fundamentals of the Legislation of the Russian Federation on Notaries).

When submitting an application, you will need a passport (another identification document) (clause 10 of the Regulations, approved by Order of the Ministry of Justice of Russia dated August 30, 2017 N 156; clause 5.18 of the Methodological Recommendations, approved by the Decision of the FNP Board of March 25, 2019, Protocol No. 03/ 19).

In the absence of an identification document, or if there are doubts about the identity of the applicant, the notary has the right to establish your identity through a unified biometric system, provided that your biometric personal data, as well as your mobile phone number, are contained in the specified system (Part 5 of Article 42 of the Fundamentals legislation of the Russian Federation on notaries; clause 10.1 of the Regulations; clause 1, Procedure, approved by Order of the Ministry of Justice of Russia dated September 30, 2020 N 228).

The notary is obliged to explain to you what documents still need to be submitted to obtain a certificate of inheritance (clause 4.5 of the Methodological Recommendations).

The application can be submitted by the heir in person, by the heir's representative, by another person, or by mail. In the last two cases, the heir's signature must be properly witnessed. In this case, a power of attorney to transfer the application to another person is not required.

Acceptance of an inheritance through a representative is possible if the power of attorney specifically provides for the authority to accept the inheritance. To accept an inheritance by a legal representative, a power of attorney is not required (clause 1 of Article 1153 of the Civil Code of the Russian Federation; clauses 5.18, 5.19, 5.23, 5.24 of the Methodological Recommendations).

Step 2. Prepare documents to obtain a certificate of inheritance and present them to the notary

You will need to prepare an application for a certificate of inheritance rights if you have not previously submitted one. You will also need to submit documents specified by the notary confirming, in particular, the grounds for the call to inheritance and the fact of your acceptance of the inheritance (part 1 of article 72, part 1 of article 73 of the Fundamentals of the legislation of the Russian Federation on notaries; clause 48, of the Regulations N 156; clause 4.5 of the Methodological Recommendations).

If the request for the issuance of a certificate of the right to inheritance was stated in the application for acceptance of the inheritance, then an additional application for the issuance of this certificate is not required, provided that the composition of the inherited property is indicated in such an application (clause 13.1 of the Methodological Recommendations).

For the issuance of a certificate of inheritance by a notary, you need to pay a state fee (or a notary fee - when contacting a private notary) (Parts 1, 2 of Article 22 of the Fundamentals of the Legislation of the Russian Federation on Notaries).

| Reference. Amount of state duty (tariff) The amount of the state fee (notary fee) for issuing a certificate of inheritance by a notary:

In particular, heirs who have not reached the age of majority on the day of opening of the inheritance, as well as persons inheriting an apartment if they lived together with the testator on the day of his death and continue to live in this apartment after his death are exempt from paying the state duty (clause 22 p. 1 Article 333.24, paragraph 5 Article 333.38 of the Tax Code of the Russian Federation). |

In addition, if necessary, a private notary is paid for legal and technical services in accordance with established tariffs (Parts 7, 8 of Article 22 of the Fundamentals of the Legislation of the Russian Federation on Notaries; Clause 17 of the Review of Judicial Practice of the Supreme Court of the Russian Federation No. 2 (2021), approved. Presidium of the Supreme Court of the Russian Federation 06/30/2021).

Previously we told you how to correctly draw up a will in order to express your will as accurately as possible and deprive unwanted claimants of the inheritance of the opportunity to challenge it .

Step 3. Obtain a certificate of inheritance

Upon inheritance, the heir is issued a certificate of right to inheritance.

As a general rule, you can receive it after six months from the date of opening of the inheritance. If there is reliable information that, apart from the persons who applied for the issuance of a certificate, there are no other heirs entitled to the inheritance or its corresponding part, the certificate may be issued before the expiration of the six-month period (clauses 1, 2 of Article 1163 Civil Code of the Russian Federation).

A certificate of the right to inheritance issued on paper from December 29, 2020 must have machine-readable markings, with which you can check its accuracy (Article 5.1, Part 2, Article 45.1 of the Fundamentals of the Legislation of the Russian Federation on Notaries; Part 1, Article 6 of the Law dated 12/27/2019 N 480-FZ).

Rights to certain types of property received by inheritance are subject to state registration with the relevant authorities, for example, ownership of an apartment. The received certificate of the right to inheritance is one of the grounds for such registration (clause 1 of article 131 of the Civil Code of the Russian Federation; part 2 of article 14 of the Law of July 13, 2015 N 218-FZ).

After issuing a certificate of the right to inheritance, the notary is obliged to submit to Rosreestr an application for state registration of the right and the documents attached to it (parts 3, 4 of article 72, parts 3, 4 of article 73 of the Fundamentals of the legislation of the Russian Federation on notaries).

The completed state registration of property rights is certified by an extract from the Unified State Register of Real Estate (Part 1, Article 28 of Law No. 218-FZ).

The procedure for actual acceptance of inheritance

To actually accept the inheritance, we recommend following the following algorithm.

Step 1. Take actions that indicate your actual acceptance of the inheritance

The heir is considered to have accepted the inheritance when he performs actions indicating its actual acceptance, in particular actions to manage, dispose and use the inherited property, maintaining it in proper condition, in which the heir’s attitude towards the inheritance as his own property is manifested.

So, you can move into the testator’s apartment, make repairs there, install new locks and a security alarm. It is also possible to pay the testator's debts or receive money owed to him or her from others. You can perform these actions yourself or entrust them to other persons, but it should be obvious that it is you who intend to accept the inheritance (clause 2 of Article 1153 of the Civil Code of the Russian Federation; clause 36 of the Resolution of the Plenum of the Supreme Court of the Russian Federation of May 29, 2012 N 9).

These actions must be completed within the six-month period established for accepting an inheritance (clause 1 of Article 1154 of the Civil Code of the Russian Federation).

Note! Receiving compensation for funeral services and social benefits for burial does not indicate actual acceptance of the inheritance (clause 36 of Resolution of the Plenum of the Supreme Court of the Russian Federation No. 9).

Step 2. Submit an application to the notary for a certificate of inheritance and supporting documents

Documents confirming the actual acceptance of the inheritance are, for example: receipts for payment of taxes, utility bills, contracts for repairs in the apartment. If it is not possible to submit such documents, you have the right to apply to the court to establish the fact of acceptance of the inheritance, and if there is a dispute about the right, with a corresponding claim (clause 1, part 1, article 262, clause 9, part 2, article 264, Article 265 of the Code of Civil Procedure of the Russian Federation; paragraph 36 of the Resolution of the Plenum of the Supreme Court of the Russian Federation No. 9).

You must submit the specified documents, as well as an application for the issuance of a certificate of the right to inheritance, to the notary at the place of opening of the inheritance (last place of residence of the testator) (Articles 1113, 1115, paragraph 1 of Article 1162 of the Civil Code of the Russian Federation; paragraph 52 of Regulation No. 156).

The state duty is paid in the same amount as in the first case.

Step 3. Obtain a certificate of inheritance

The procedure for obtaining a certificate upon actual acceptance of an inheritance is similar to the procedure for obtaining it when submitting an application to a notary and is set out in step 3 for the first case.

Electronic magazine "ABC of Law"

Questions and answers – SPS ConsultantPlus information bank, containing answers from government agencies and independent experts to questions from taxpayers.

How to correctly write an application for inheritance?

A probate purchase application refers to a document confirming the testator's desire to purchase property under a will.

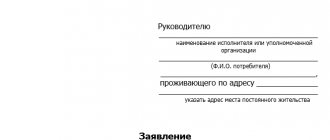

At the same time, this document must be submitted in a timely manner. To draw up an application, take a sheet of paper in A-4 format. When drafting it, you must follow the rules for writing such official letters. A sample application can always be found at the notary, in addition, such a sample can be downloaded on the Internet, as well as at the end of this article.

The application for acceptance of inheritance must show:

- Detailed address of the notary's office, indicating the full name of the notary

- FULL NAME. the applicant, stating his residential address

This data is filled in in the upper right part of the sheet.

- Below, in the center of the line, fill in the name of the form and justification - “Application for acquisition of inheritance and...”

- Next, fill out the text of the application, which details the circumstances relating to the essence of the submitted form containing the information:

- about the deceased:

- Date of death.

- Place of residence.

- Other possible contenders.

- Grounds for inheritance:

- Will.

- According to the law.

If by law, then it is required to provide links to documents certifying the right to inheritance (marriage or birth certificate).

- A complete description of the inherited property.

- Requirement:

- Opening an inheritance case.

- Extract of certificate.

- Finally, the date of filling out the form and the signature of the testator are indicated.

Note. The application must be completed and submitted by the heir in person. A power of attorney is unacceptable in this situation.

In addition, you need to know that if there is more than one heir, then everyone must submit an application for inheritance.

If any of the heirs does not want to accept the inheritance, he is also obliged to submit a petition for refusal.

Acceptance of inheritance before registration

The Ministry of Justice recalled that Art. 1153 of the Civil Code of the Russian Federation allows for the acceptance of an inheritance through its actual acceptance (in particular, actions to manage, dispose and use inherited property, maintaining it in proper condition). At the same time, the commission by a person of actions aimed at accepting inherited property intended for another heir does not entail the emergence of inheritance rights to this property for this person.

Heirs living together with the testator are recognized as having actually accepted the inheritance, which is confirmed by documents on registration at the place of residence issued by civil registration authorities, management organizations, and local government bodies. “Such heirs are recommended, upon expiration of the restrictive measures introduced in connection with the spread of the new coronavirus infection, to contact a notary at the last place of residence of the testator to register inheritance rights,” the Ministry of Justice explained.

Information about an open inheritance case can be found using the public service “register of inheritance cases”, located on the official website of the Federal Notary Chamber in the Public Registers section. Also on the same website there is information about the addresses of duty notary offices.

How to submit an application

When a loved one dies, relatives are forced to start registering an inheritance. This process is not complicated, but you need to write a statement no later than 6 months after the death of a relative. Art. 115 of the Civil Code of the Russian Federation regulates that the inheritance is formalized at the place of residence of the heir.

- Registration of inheritance can be done through a notary or through a judicial structure. Registration through the judicial structure is carried out if the notary, for some reason, does not issue a document on the right to inheritance.

- Registration through a notary is carried out as follows:

- Within 6 months after the death of the testator, you must submit a request for inheritance to the notary. Documents certifying the right to receive it are attached to the application.

- After a 6-month period, you need to visit the notary again to complete the paperwork and purchase an inheritance document, which is subject to mandatory registration with the federal registration service in the event of receiving real estate.

- If the place of residence of the heir is unknown or the property is located in different places, then the documents are drawn up where the more valuable property is located.

- If the heir lives far away and is not able to personally submit the application, then he can send the application by mail or pass it through a trusted person. In this option, his signature must be certified by a notary.

- If the testator did not have time to formalize the inheritance in six months, then he will have to send a claim to the judicial authorities.

- When contacting a notary or judicial authorities, in addition to the application, the heir is obliged to provide documents (copy and original):

- Document confirming the death of the testator.

- Passport.

- A certificate from the place of residence of the heir (an extract from the house register is possible).

- Marriage certificate for the spouse of the deceased(s).

- Birth document.

- Certificate of change of surname for children and parents of the deceased.

- Documents related to ownership of real estate, a plot of land, a car and securities.

How to submit an application to a notary?

The choice of a notary office depends on a number of conditions.

An inheritance case is opened at the place of last residence of the deceased citizen. If the address is unknown, then you need to contact the location of the real estate included in the inheritance estate. When there are several of them, they choose a notary office in the area where the most valuable property is located. If the official refuses to accept the documents, then you can go to court to determine the place of opening the inheritance case. There are several ways to submit an application to a notary.

personally

The heir can personally visit the notary’s office within the established time frame with all the necessary documents and write an application.

by mail

Russian Post is used to submit the application. This method is used if the heir lives in another city. The application and documents attached to it are sent to the office by registered mail with notification. In this case, the applicant’s signature must be certified by another notary.

through a representative

The application can be submitted through a representative. A citizen must have a notarized power of attorney to perform actions on behalf of the testator.

Writing an application: expert advice

The text should be “dry”, short, concise. Free form is called such only because there is no unified form. But there are generally accepted norms that state the following: in order for a paper to have legal force, it is necessary to use mandatory attributes. Required:

- city and date of compilation;

- addressee (location of the notary office);

- applicant's details;

- personal, contact information;

- handwritten signature.

When writing, use business language. To present a requirement coherently, start with a description of the situation. There are three thematic parts of the statement:

- Introduction . The background is described, the fact of death and the existence of an inheritance are indicated. Inherited objects are listed.

- Motivation . Articles of regulations are given that speak about the legality of requirements to enter into an inheritance upon application.

- Proof . Refer to documentation supporting each argument stated in the application.

The list of attached documents is a required section if you do not want to become a victim of a situation where they are lost and you have to spend time and money on restoring and obtaining duplicates.

When it comes to court (especially in a dispute with other heirs), it is recommended to hire a lawyer. In the struggle for inheritance, everyone wants to enlist the support of a professional. Duties, hidden taxes, and attorney fees are not the only costs. Add travel costs and time costs. But the main thing is to remember the debts of the testator.

According to the legislation of the Russian Federation, the debt obligations of the testator are transferred along with the property. Lenders will not begin to demand them immediately after writing the application. You can first register an inheritance, and then run into a problem when people call and demand the money back. It will not be possible to get rid of creditors. A claim must be filed within three years.

Creditors will demand more than just debt. As an example, banks will calculate late fees. And if the testator is a persistent defaulter, the amount will be huge. There is a way out - to file a counter-application demanding that fines and penalties be recognized as an illegal way of enrichment. The court will not cancel the loan body, but this will be the only payment. The repayment schedule and method are agreed upon with the debtor.

Therefore, before you sit down to write an application at a notary’s office, think about how advisable it is to enter into an inheritance. Try to find out if there are any debts and in what amount. Only after this write a statement and formalize the inheritance. Some people believe that selling the inheritance is enough. This will be enough to both earn money and pay off debts.

Receiving an inheritance is a free transaction. Therefore, the legislation does not require the payment of taxes. But there is a hidden fee called a fee. Close relatives will pay 0.3% for registration. Others are twice as much. The sale involves additional costs. In this case, we are talking about a transaction with a monetary profit, which means that you will have to pay income tax on the inheritance.

The size differs depending on nationality. If the application was written by a Russian, 13% is assigned (standard rate). When the inheritance was registered by a foreigner (non-resident), 30% is required to be paid. The percentage is calculated based on the value of the inheritance being sold, specified in the sales contract.

There are also a few things you need to know about property valuation. All rules apply to movable and immovable property, including:

- cars;

- motorcycles;

- apartments;

- Houses;

- dachas;

- land;

- agricultural land;

- garden plots;

- garages;

- parking places.

Valuing property is extremely important. Please indicate the cost in your application. If you have to share material wealth with other heirs, you may encounter a situation where the object cannot be divided into shares in kind.

The competitor is paid the cash equivalent of his share. Attempts to artificially reduce taxes and duties are illegal. And if the court discerns a deliberate conspiracy in the actions, the fact will be recognized as fraud. Such a crime is punishable by imprisonment.