It's sad to know, but quarrels over inheritance are a fairly common occurrence. Moreover, regardless of whether there is a will or inheritance by law. Sometimes even the closest people come into conflict because they feel deprived or deceived.

The law cannot prohibit relatives from quarreling. But it can establish a fair order that reduces the likelihood of conflicts with an adequate attitude to the issue.

In Russia, there is a procedure for distributing inheritance according to queues.

In this article we will look at how the inheritance is divided between the primary heirs who make up the closest family circle of the deceased person.

Inheritance by law. Order of heirs

Ancient wisdom says that in a good way, an inheritance should be shared with “warm hands.” That is, it is better to divide the future inheritance while the person is still alive and can come to an agreement with his relatives about what will go to whom after his death. The family finds compromises together, after which a will is written that suits everyone.

Unfortunately, this does not happen often, largely because it is not customary in our culture to talk openly about impending death. And after the death of the testator, the family begins to sort things out on their own.

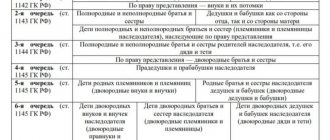

If a will is not drawn up, the inheritance is distributed according to the law. 7 lines of inheritance have been defined in descending order of degree of kinship (and a special category: disabled citizens who lived as dependents of the testator). The principle is this: the entire inheritance goes to the first priority heirs.

If there are none (for example, they died earlier), the right of inheritance passes to the second. If there are also no heirs of the second stage, or they do not declare their rights to the inheritance, the right passes to the third stage, and so on.

In this article we consider the situation when there are heirs of the first priority and are ready to enter into inheritance rights. We will discuss all aspects of this process.

What documents will you need?

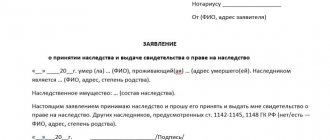

The heir must attach the following documents to the application for acceptance of the inheritance (for the issuance of a certificate of the right to inheritance):

- passport;

- certificate of death of the testator;

- a document confirming the relationship of the heir with the deceased, for example, if the heir is the son of the testator, you need a birth certificate of the heir);

- an extract from the personal account (house register) about the last place of registration of the testator;

- documents on the property of the deceased.

The question is often asked whether a certificate about the circle of heirs is needed to enter into an inheritance. It is not needed, especially since such a document does not exist.

Heirs of the first stage. Division of inheritance

The first line of heirs are the people closest to the testator. Natural children and parents (consanguinity), plus spouses, adopted children and parents (the role of consanguinity in this case is played by legal, social and emotional ties).

So, the list of heirs of the first stage:

- Surviving spouse

- Children (blood, adopted/unborn)

- Parents (natural or adoptive parents)

The inheritance is divided equally among all claimants.

Husband wife

Only spouses officially registered in the registry office have the right to inherit from each other. A “civil” or church marriage, no matter how many years it lasts, does not serve as a basis for inheritance. Joint farming as well. Even if a divorce after a long marriage took place the day before the death of the testator, the husband/wife is excluded from the list of heirs.

ATTENTION! The widespread belief that the testator's spouse receives a larger share of the inheritance than other family members (more than half of the total property) is erroneous. This impression is created because people overlook one legal aspect of marriage - joint ownership of property.

The common property of the spouses is the so-called “jointly acquired property”, everything that they acquired while married. Before proceeding with the division of the inheritance, the share that legally belongs to the second spouse is allocated from the entire property. This happens according to the same principle by which property is divided during a divorce.

And after this initial division, that part of the property that is recognized as the share of the deceased is divided equally between all representatives of the first priority. The spouse participates in this division on an equal basis and receives the same amount as the others.

In other words, the spouse first receives 50% of the common property, and then an equal share of the testator’s personal property.

Difficulties (from the point of view of other heirs) may arise with different methods of registering property rights to objects that both spouses used.

For example, if the apartment in which the family lived was registered as the personal property of a living spouse, it is considered personal property and will not be divided among the heirs.

If the car was purchased in the name of the wife, then, despite the fact that the husband used it, after his death the car will not be considered an object of inheritance. It is the personal property of the deceased's wife.

An example of dividing an inheritance in the presence of common property

At one time, a husband and wife purchased a house that was jointly owned by them. The man has three children. After the death of the husband, the wife receives 1/2 share of the house. The remainder will be divided into 4 equal shares: one for each child and wife. Thus, the wife owns 5/8 of the share of the house, and the children own 1/8 each. All other property will be divided in the same way.

Children

All children of the testator enjoy equal rights when dividing the inheritance:

- Children born in an official, valid marriage

- Children born in previous marriages

- Illegitimate children of any age, provided that paternity is recognized or established

- Born after the death of the testator (within ten months)

Parents

Citizens who survive their children have the right to inherit after them as part of the first line.

Adoptive parents who have officially adopted the testator have the same rights as blood parents. Parents who are unmarried or divorced have equal rights, regardless of whether they lived with the testator or not.

A parent who has been deprived of parental rights to a given child by a court at one time is deprived of the right to inherit. If parental rights have not been restored during the life of the testator, his father or mother does not have the right to inherit from his child.

Other heirs of the first stage. Right of representation

The list of first-priority heirs does not include one category of close relatives – grandchildren. Since she is not in other queues, this often raises puzzling questions: “Can’t grandchildren inherit from their grandparents at all? After all, these older relatives inherit from their grandchildren in third place.”

In fact, grandchildren can directly inherit from their grandparents only by will. According to the law, they receive the inheritance of their grandparents after their parents. When, for example, father and mother received shares of their parents' inheritance. And then, in turn, they inherited the combined property of generations to their children.

But there are cases when the grandchildren of the testator are included in the first priority of inheritance. True, with certain reservations. This occurs if their parents (children of the testator) died before him, and is defined as “inheritance by right of representation.”

Grandchildren can inherit from their grandparents only by right of representation (excluding cases where they were adopted last after the death of their parents or deprivation of their parental rights).

Inheritance through the right of representation has one peculiarity: the heirs do not always receive an equal share with other heirs of the first priority. Their share is the share to which the person they represent was entitled.

That is, if there are more heirs by nomination than there were direct heirs of the first stage, then the share of each will be proportional to their number.

Example of inheritance by view

The deceased man has a living father and mother, a wife and three children together. But two children died in a car accident shortly before the death of the testator himself. Both left children: one has two, the other has one.

The inheritance (after allocating the marital share) is divided into six equal parts: father, mother, wife, and each of the three children. The shares of the deceased children of the testator pass to their children. One grandchild receives the full share of his parent, which is 1/6 of the inheritance. The two grandchildren receive their parent's share (1/6) and divide it in half. Everyone gets 1/12.

Inheritance by right of representation is a legal norm. An heir by nomination cannot be deprived of his share, except by the will of the testator, or in cases provided for by law (for example, declaring the heir unworthy).

Dependents

This is a special category of heirs, inheriting simultaneously with representatives of the current (called for inheritance) line. Family or legal connection in this case is an optional condition. “Common-law” husbands and wives who do not have the right to inherit can inherit if they are also dependents of the testator.

A citizen is recognized as a dependent if the following conditions are met:

- He must be disabled (for example, disabled)

- Have no other sources of income other than financial assistance from the testator

- Live with the testator until his death

- Live with the testator for a year or more before his death (this condition is not mandatory if the dependent was a blood relative of the testator)

Even if there is no first-priority heir, a disabled dependent cannot receive more than 1/4 of the first-priority share of the inheritance. The rest will “go down” in queues.

Second stage

Next come the grandparents and siblings of the testator.

Siblings are all children of the same parents. The right of inheritance is enjoyed by both full-born (siblings) and half-born (half- or uterine) siblings who have a different father or mother.

ATTENTION! The main basis for second-order inheritance is family ties. Half-brothers and sisters (if the parents marry having children from previous marriages) are legal heirs only if adopted by the parent for whom they were not relatives. In this case, the family relationship is replaced by a legal one. Officially, non-adopted half-siblings do not have the right to inherit from each other.

The same goes for grandparents. If they were not the blood parents of the testator’s father or mother, they will be second-order heirs only if they are officially adopted.

If the brothers and sisters have already died, the inheritance passes to their children by right of representation.

Distribution of inheritance among first-degree heirs. Shares

We have already touched on this issue in previous sections. Now let’s summarize all the information about legislative norms and summarize:

- The inheritance is divided equally among all representatives of the first stage

- If the testator’s spouse is among the first-priority heirs, first the “marital half” is allocated from the entire property (relatively speaking, the part that the spouse would receive in the event of a divorce). After this, the spouse participates in dividing the remaining part of the inheritance on an equal basis with the rest of the heirs

- If there is only one heir of the first stage, he inherits solely, completely

- If there are no first-line heirs, a disabled dependent may claim 1/4 of the inheritance

- Heirs by right of representation receive the share of the direct heir of the first stage who died before the testator. The only heir by right of representation has the right to a share the same as that of all heirs of the first priority. If there are several of them, they divide the share of the direct heir equally.

ATTENTION! Despite legal requirements, heirs of the first stage are not obliged to equally divide each object included in the inheritance. They can draw up an agreement on the basis of which, for example, one takes the car, the second garage, the third and fourth own the dacha in half, and so on. If an agreement cannot be reached, the division of property can be carried out through court proceedings.

Transfer of inheritance to the state

Inherited property passes to the state by right of inheritance:

- if the property is bequeathed to the state;

- if the testator has no heirs either by law or by will;

- if all heirs are deprived of the right of inheritance by the testator;

- if none of the heirs accepted the inheritance.

If one of the heirs refuses the inheritance in favor of the state, then the share of the inherited property due to this heir passes to the state.

If, in the absence of heirs, only part of the property is bequeathed by law, the rest goes to the state.

Not only property, but also debt obligations are transferred to the state.

Inheritance by will. Mandatory share

It is clear that if there is a will, the order of inheritance changes. A citizen has the right to bequeath his own property to whomever he finds necessary, even to a complete stranger or legal entity. In common parlance this is called “disinheritance,” and everyone has the right to do this to their relatives.

However, some categories of priority heirs do not lose the right to receive a certain share of the inheritance even in such a situation. The obligatory share of the inheritance is legally assigned to:

- Disabled husband or wife (pensioners and disabled people)

- Disabled parents (retired and disabled)

- Disabled children (pensioners and disabled people)

- Minor children (under 18 years of age at the time of death of the testator)

The obligatory share is half of the share to which the first priority heirs would be entitled in the absence of a will.

An example of obtaining a mandatory share

The woman bequeathed all her property to a charitable foundation. However, she has an elderly mother and a disabled husband. Without a will, the husband would have received the “marital half” and would have shared the other half with his mother. Since there is a will, the spouse’s share of the property acquired during the marriage is allocated (to which he is entitled regardless of the will), and then the mother and husband divide 1/2 of the remaining inheritance in half. The rest goes to the heir named in the will.

Heirs of the first stage after the death of the grandmother

According to the current law, the heirs of the first priority are:

- official spouses;

- children;

- parents.

Official spouses receive a share of the property regardless of their cohabitation. First, the grandfather's marital share is allocated, and then the grandmother's property is divided in equal shares among the remaining claimants.

The parents of the deceased testator (great-grandparents) extremely rarely act as participants in legal relations, since they simply do not live to see the day of distribution of the inheritance. But if there are any, then they also receive property in the first place.

Children of grandparents, that is, parents of grandchildren, can receive part of the property even if the grandmother was deprived of parental rights in relation to the child.

Article 1146 of the Civil Code of the Russian Federation provides that grandchildren can inherit property in the first place, but only with the rights of representation.

Inheritance terms for the first stage

The generally accepted period for entering into inheritance rights is 6 months. The countdown begins from the day of death of the testator, or from the date of the court decision declaring the citizen dead. There are a number of exceptions to this rule:

- The six-month period may be extended for valid reasons.

- An unborn heir of the first priority (a child of the testator who was not born at the time of his death) enters into the inheritance after his birth, even if 6 months have already expired.

- If there are no heirs of the first stage, the right to inherit passes to the second stage, and so on. After each transition, the six-month period starts anew.

You will find more detailed information about this in the article “The order of inheritance by law” posted on our website.

How to inherit

There are two ways to inherit property after death:

- Apply with an application, accompanied by evidence of relationship (marriage, birth, adoption certificates), to a notary.

- Perform actions that mean the actual acquisition of an inheritance.

These actions include:

- payment of debts left by the testator;

- taking measures to ensure the safety of things;

- taking possession of property;

- incurring expenses related to the maintenance of an inheritance, etc.

You should contact a notary with documents confirming these actions.

A lawyer's answers to questions about inheritance by grandchildren after the death of a grandmother

Can grandchildren claim their grandmother's inheritance while their parents are alive?

Yes. Grandchildren can receive property on the basis of a will or inheritance agreement. Additionally, their parents can register with a notary a waiver of property in favor of their children.

Can grandchildren claim their grandmother's inheritance when their father has died?

Yes, in this case the grandchildren receive the property by representation. Each of them receives a part of the property based on the share that the deceased father would have received at one time.

Can a grandson claim his grandmother’s inheritance if the children refused?

Yes, but only if the parents abandoned the property in favor of their children.

Can grandchildren claim their grandmother's inheritance if the mother does not accept the inheritance?

It all depends on the reason why the mother does not accept the inheritance. If a woman refuses it and wants to pass it on to her children, then yes. If the mother does not submit an application in a timely manner due to her unwillingness to accept the property, then the inheritance passes to the representatives of the next line.

Results

ATTENTION! By law, grandchildren are not direct heirs in the first place. Therefore, they can receive an inheritance only by the direct will of the testator (testament), or subject to certain conditions regulated by the civil legislation of the Russian Federation.

- So, the simplest and most common way to receive an inheritance after grandparents is to become the subject of their will.

- In second place after a will is inheritance by representation. Grandchildren receive inheritance instead of their parents (legal heirs of the first stage), if they died before their parents.

- Inheritance by transmission occurs much less frequently. First of all, because, fortunately, two deaths in the same family within a few months of each other are not the norm.

- Difficulties most often arise when proving the right to a mandatory dependent share. The easiest way is when we are talking about a minor child and guardianship by a grandparent is formalized. It is usually quite difficult for adult disabled grandchildren to prove the fact that they are dependent on their grandparents.

If you still have questions on this topic, the experienced lawyers of the Prav.io portal will be happy to help you resolve them.