How the inheritance is divided between legal heirs How the inheritance is divided after the death of the husband between the wife and children Exclusion of the spousal share from the inheritance estate Division of the inheritance in case of divorce Inclusion of the spousal share in the inheritance property Inheritance in a civil marriage Mandatory share in the inheritance Agreement between heirs on the division of inherited property

Inheritance in our country is carried out in two ways : by law and by will.

The inheritance opens with the death of the testator, that is, the day of his death is the moment the inheritance is opened, and not the moment when the notary opens (starts) the inheritance case, as many people think. These two concepts should not be confused.

Civil legislation contains the concept of “inherited mass”, it includes all movable and immovable property owned by the testator on the day of his death, including his cash savings, obligations to third parties (loan, credit, etc.), as well as property rights of the testator, including those based on contractual relations with third parties (the right to receive accrued wages, repayment of debt, the right to compensation for property damage, etc.)

We described in detail the procedure for entering into an inheritance established by law, within what time frame it must be accepted, and other aspects related to accepting an inheritance in a separate article on entering into an inheritance.

Lawyer (advocate) for the division of inheritance. Tel.+7 Telephone consultation

One of the most pressing issues is the division of inherited property .

The most frequently asked questions from our clients:

- Is inherited property subject to division?

- How to divide an inheritance

- Is inherited property subject to division during divorce?

- How is the division of inherited property carried out?

- How to dispute an inheritance

- How is the inheritance divided between the wife and children from the first marriage?

- How to divide an inheritance

- How to challenge an inheritance under a will

- How to allocate a marital share after the death of a husband

- How to divide an apartment by inheritance

- How to allocate your share of the inheritance

Disputes between heirs arise both during inheritance by law and in the presence of a will. The reasons may be different, for example, a dispute arises in connection with the allocation of a mandatory or spousal share in the inheritance, the inclusion of property in the inheritance mass, or in connection with the restoration of the deadline for accepting the inheritance to one of the heirs, which entails a redistribution of shares in the inheritance, etc.

Of course, the heirs can peacefully agree on how to divide the inheritance among themselves, but in order to legally secure such a distribution, they will need to enter into an agreement on the division of inherited property .

Unfortunately, not everyone succeeds in coming to an agreement and peacefully dividing the inheritance, and then the inheritance dispute can only be resolved in court.

So, division of the inheritance is possible:

- By agreement of the heirs on the division of the inheritance

- By the tribunal's decision

Who gets the inheritance after the death of the husband?

The death certificate indicates the day of death of the citizen, which is recognized as the day of opening of the inheritance. From this moment, within six months, applicants for the inheritance can submit an application for acceptance of the inheritance and the issuance of a certificate of right to inheritance. This process is carried out according to the general rules of inheritance, taking into account the specifics that are regulated by the rules of family and civil law.

There are three possible grounds for inheritance by will, by inheritance agreement and by law (clause 1 of Article 1111 of the Civil Code of the Russian Federation). The heir must accept the inheritance due to him on one of these grounds, on several of them, or on all grounds.

Let's consider how the division of property occurs, depending on what basis the inheritance occurs.

Instructions for entering into inheritance

After the death of the father or husband, heirs who wish to take possession of their share should follow the following steps in order:

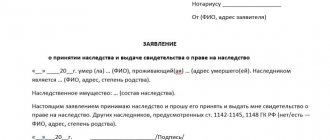

- Contact a notary and notify him of the death of a relative. In this case, it is worth submitting the will, if it was discovered, and the death certificate of the citizen.

- Write a statement confirming the person’s desire to inherit.

- The notary will then conduct a small investigation to determine the rights of additional heirs, and, if any, send them notices by mail.

- Everyone wants to write an application to establish their rights to property. At the same time, they present various documents to confirm their identity, these rights and relationship with the deceased: certificates, certificates, passports.

- The notary verifies the data in the papers and establishes their authenticity.

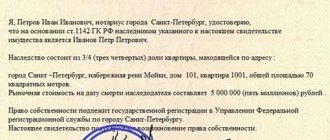

- After which the shares are distributed in accordance with the law and the will and certificates of receipt of inheritance items are issued.

Read more about the list of documents for entering into an inheritance after the death of your mother here, and in this material read about how to enter into an inheritance after the death of your father.

So, if you know your rights and are able to defend them in court if necessary, the inheritance procedure will not require a significant expenditure of nerves from a person. It will go smoothly, painlessly and quite quickly.

The procedure for dividing property by will

A will is a document in which a citizen gives instructions regarding his property in the event of death. The will is drawn up in writing and certified by a notary. The contents of the will must be clear, understandable, and the meaning clear.

The procedure for dividing property by will

- if a citizen makes a will for all of his property in favor of several persons, without indicating their shares in the inheritance, then these heirs have the right to an equal share in the property;

- if the testator indicated the heirs and determined their shares, then each of them will have a share in the inherited property equal to the share specified in the will. If the heir specified in the will does not enter into the inheritance, his share passes to the heirs by law;

- if a citizen distributes property between heirs indicating a specific object, then during inheritance the equivalence of the objects is not taken into account, and the division occurs according to the instructions in the testamentary document. For example: an apartment for my wife, a car for my son. If the heir does not accept the property bequeathed to him, it passes to the heirs by law.

If there is a will drawn up in favor of the surviving spouse and there are no heirs entitled to an obligatory share, the spouse receives all the property. If there are heirs entitled to the obligatory share, he will receive the property with the exception of the obligatory share.

The testator can bequeath property to any persons, determine the shares of heirs, cancel or change the will, and disinherit a person entitled to an obligatory share in the inheritance.

The right to an obligatory share in the inheritance

The provisions of Article 1149 of the Civil Code of the Russian Federation are aimed at protecting the property interests of minors and disabled citizens, as well as disabled dependents of the testator.

The following have the right to a compulsory share:

- minor children;

- disabled children of the testator;

- disabled parents;

- disabled spouse;

- disabled dependents of the testator.

Regardless of the contents of the will and the consent of other heirs, this category of citizens inherits at least half of the share that would be due to each of them if inherited by law.

The procedure for dividing property according to law

In cases where there is no will, it is declared invalid, or the heirs have abandoned the property, the heirs by law are called upon to inherit in order of priority.

The legal spouse and children are included in the circle of first-line heirs and inherit in equal shares.

In what cases does inheritance take place by law? Read more in the article:

Inheritance by law: order of succession (scheme)

Normative base

There are two options for entering into an inheritance - by will and by law.

In the first case, it is important to draw up the document correctly and include persons who are entitled to a mandatory share. In this case there are usually no problems. If there is no will, according to Art. 1142 of the Civil Code of the Russian Federation, the inheritance is distributed by a notary taking into account incapacitated and minor persons and the presence of jointly acquired property. The first priority includes not only the wife and children of the testator, but also his parents.

The Civil Code of the Russian Federation establishes the following norms:

| Art. 1152 | Regulates the procedure for entering into inheritance. |

| Art. 1153 | Determines the procedure for accepting inheritance. |

| Art. 1154 | Determines the period of time when you can submit documents for inheritance. |

| Art. 1157 | Provides for the possibility of refusing to accept the testator's property. |

Division of inheritance during marriage and after divorce

Property acquired by spouses during marriage is their joint property. If the husband and wife were legally married, the surviving spouse is entitled to a spousal share of the property.

If spouses are divorced and have not divided common property and debts, controversial situations may arise.

Division of inheritance between wives

If a citizen has been married more than once, after his death a dispute may arise about the division of property between his wives.

Each woman has the right to claim a spousal share only in the property that was acquired during her marriage to the deceased.

Rights of a wife after the death of her husband:

- A woman who, at the time of death, was officially married to the deceased is the heir of the first priority and has the right to a spousal share in the common property.

- The ex-wife may demand the allocation of the marital share in joint property if, after the divorce, there was no division of property acquired during the period of marriage with the deceased. She can also apply to the court to recognize the personal property of the deceased as her own if she can document that during the marriage she invested her money and labor in this property, which led to a significant increase in its value.

Is the ex-wife the heir?

Property rights of unmarried spouses

Living together between a man and a woman and running a common household is not the basis for the emergence of conjugal rights and obligations. Relations not registered with the civil registry office are not regulated by law. Therefore, in the event of the death of one of the spouses, the other has problems with inheritance. Family law only protects the rights of minor children in such families.

But in some cases, a cohabitant has the right of inheritance:

- if the testator indicated his common-law spouse among his heirs, assigned him a share or bequeathed all property;

- if at the time of death of the testator he was dependent on him. In court it will be necessary to prove that the common-law spouse lived with him for at least a year before the death of the testator and was his dependent;

- if the common-law spouse is a disabled dependent, he has the right of inheritance as an independent heir of the eighth order, if the heirs of the previous orders:

- absent;

- refused the inheritance;

- found unworthy.

If the court recognizes the cohabitant as a disabled dependent, then she inherits according to the law in equal shares with other heirs and at least half the share when inheriting under a will.

Rights of the official spouse during inheritance

The rights of the official spouse during inheritance depend on the presence of a will and its contents, as well as the number of first-line heirs - in case of inheritance by law.

What can an official spouse claim:

- Obtaining a share by law:

- In the case of inheritance by law, the spouse inherits in equal shares with other first-degree heirs.

- Receiving a spousal share in jointly acquired property:

- The spouse has the right to receive a spousal share in the community property. To do this, an application is submitted to the notary for the allocation of a spousal share in the inheritance.

- Receiving a share from the testator's personal property:

- In court, you can obtain a share from the testator’s personal property if you can prove your personal contribution and a significant increase in the value of the property.

- Receiving a mandatory share in an inheritance under a will:

- If at the time of the death of the testator the spouse is disabled, she has the right to an obligatory share in the inheritance under the will.

Inheritance of debts of deceased citizens

The main feature of the situation when an inheritance is divided is the need to accept debt obligations for loans if ownership of the loan property is registered. Alimony and other obligations are eliminated. The wife does not pay them, because legally there is no cause-and-effect relationship for this. When there are several heirs, debts are divided among them in shares proportional to the shares of the accepted property.

When an inheritance is divided, the example situation looks like this. My husband takes out a loan, for example, for a car. For two years, payments were made on time and would have been transferred further if death had not overtaken the debtor. Considering that the heirs are the wife and child, the loan debts are divided into 3 parts. The wife takes over the management of the son's (daughter's) share. This means that the entire debt on the loan becomes her responsibility. The share of the wife's inheritance after the death of the husband is doubled on the basis of a certificate issued by a notary office.

If this happens, make sure that you have insurance and that the company that issued it will pay off the debt to the bank. When an inheritance is divided, there is no point in delaying it. There is a month for the party accepting the inheritance to contact the insurance agent, present the policy and receive money to pay off the loan obligations. But suicide or death as a result of alcohol or drug intoxication are not an insured event and you will not be able to receive money. In other cases, the situation is resolved favorably.

How is the inheritance divided between children?

The children of the deceased are considered heirs regardless of whether they were born in the first marriage or in subsequent ones. Children born out of wedlock also have the right to inheritance if paternity is documented.

The right of children born in marriage to inheritance

If a child was born in an official marriage or within 300 days after a divorce, he receives rights to the inheritance of the deceased father.

In cases where the child is not by blood and the testator has not challenged paternity, the child retains his rights to inheritance.

The child is an heir to the property of the father who has been deprived of parental rights. This right does not apply to a child if he was adopted by another man.

The right of illegitimate children to inheritance

If the testator has confirmed his paternity in the registry office or paternity is established through the court, the child has the same rights as children born in marriage.

If for some reason paternity was not established during the life of the testator, the child or his legal representative may apply to the court after his death with an application to establish paternity.

Paternity can be proven based on the results of a DNA examination or the relationship between the deceased and the child can be confirmed through documentation and testimony. Before death, the testator communicated with the child, raised him, and supported him financially. From the moment the court decision enters into legal force, the child can claim a share in his property.

The right of adopted children to inheritance

Adopted children are equated to relatives by origin (Article 137 of the RF IC) and inherit as first-degree heirs.

If the adoptive parent filed a claim to cancel the adoption of the child, then from the moment the court decision enters into legal force, the child cannot claim the inheritance.

After the adoption is canceled, the child can receive an inheritance if he is included in the heirs in the will.

After the adoption is cancelled, the man is obliged to pay child support. If at the time of death the testator had a debt for alimony, it is paid from the estate.

If a child was included in the heirs in the will, then the right to receive alimony debt does not apply.

If the child died before the father

If an adult child dies before his father, then the right to receive his share of the inheritance passes to the grandchildren and is divided equally between them. Grandchildren inherit by right of representation. If there were no children yet, then his share is divided among other heirs according to the law.

What rights do common-law spouses have?

The most difficult case is when the inheritance left by a common-law husband is divided. If you find yourself in such a situation, contact a lawyer for advice. Only they can help achieve justice. No one shares with his common-law wife. According to the law, people living together outside of marriage are not relatives. This fact means that there are no rights of inheritance between a common-law wife and husband. As a result, the property is divided without the participation of the woman.

A similar situation arises in relation to ex-spouses. The dissolution of a marriage leads to the elimination of inheritance rights. Having children together is another matter. The fact of paternity is confirmed by making appropriate entries in the child’s passport and birth certificate. If this requirement is not met, it is extremely difficult to prove the fact of relationship, and in some cases it is impossible. When something is divided after the passing of loved ones, you cannot do without lawyers in court. You will have to collect evidence, write demands, file a statement of claim, participate in court proceedings, and seek execution of the decision.

When division has to be made, the jointly registered child is the heir. In this case, the property is divided between him and the other children. The wife also has the right to share, even if the spouses do not live together. Having a marriage certificate is a leading document that determines the right not to share with anyone unless there are special conditions. A will is the only reason to deprive the formal wife of the right to participate in the process when the time comes for division.

How is the inheritance divided between the wife and children?

There are several options for dividing inherited property between a wife and children:

- in equal parts;

- for the shares provided for by the will;

- by agreement;

- through the court.

It is very important to rationally distribute all inherited property, taking into account the interests of each heir.

Example. After the death of her husband and father, she was left with an apartment and a car. There was no will and the property was distributed between the wife and son by agreement. The wife inherited the apartment, the son got the car.

If the parties cannot agree, a decision on the division of the estate can be made by the court within the framework established by law or by will.

Example. After the death of the testator, an apartment, a dacha and a car remained. The heirs under the will were the wife of the deceased and the son from his first marriage. The son refused to enter into an agreement on the division of property, according to which half of the apartment would become the property of the widow, and the dacha and the car would become his. The widow filed a lawsuit demanding that her interests be taken into account and that she be awarded the second half of the living space. The basis was the following facts:

- the plaintiff lived in the testator's apartment for nine years before his death and continued to live there after his death;

- she had no other place to live;

- My son owns an apartment in which he lived.

Based on the above arguments and documented evidence, the rights to the apartment passed to the widow of the deceased, and the son inherited the dacha and car. Since the value of his son’s property was less than expected, he also received monetary compensation. The distribution of property was made taking into account the established size of the inherited shares, that is, equally.

Lawyer's answers to citizens' questions

My husband and I live in the house that his father gave him before our marriage. In the event of the death of a spouse, how will the house be divided if he has children from his first marriage?

Since your husband received the house as a gift before marriage, it is considered his personal property and you have no right to the marital share. When your husband dies, you and his children will inherit the house in equal shares.

My husband died. During marriage we purchased an apartment and a house. Now the husband’s adult children from his first marriage are demanding a share of the inheritance. Do they have the right to inheritance?

The apartments were purchased during marriage, so 1/2 of the property belongs to the husband. And this share of his will be divided equally between you and his children.

I am 64 years old, group 2 disabled. A man with whom I lived in a civil marriage for 7 years died. During this time, a house was purchased. I'm just registered in this house. How will the house be divided between me and his daughter from his first marriage?

Since you are disabled, were dependent on the testator, lived together for at least a year before his death and now live in this house, you inherit together and equally with his daughter. You will need to provide the notary with a certificate confirming your disability, a house register with a note about your registration and testimony of witnesses about cohabitation with the testator.

What is joint property of spouses?

The RF IC speaks about this, in particular, Art. 34, paragraph 2. Note that this is not only real estate, which is most often divided between heirs, but also deposits. Deposits are divided according to the same principle as real estate. But there are certain nuances here.

Heirs up to the 6th stage specified in the Civil Code of the Russian Federation can claim funds on deposit.

If the deposit is inherited by a spouse, then the date of its opening is of primary importance. If the bank account was opened on the date when people were married, then it is recognized as their joint property. Therefore, the surviving spouse owns 50 %, and the rest is divided equally between her and the children of the deceased. That is, the algorithm is similar to real estate. The deposit can be withdrawn (up to 40,000 ) up to 6 months from the date of death of the person. The law allows not to comply with the deadline for accepting an inheritance if it is necessary to bury a person with this money, or add it to existing finances.

Deposits are property that is not subject to tax, but the heirs will be required to pay a notary fee. The heirs do not have to withdraw funds from the deposit opened during the life of the testator. You can continue to leave them on your account.

As for the debts of the deceased, these are usually loans taken from banks or microfinance organizations. The person who will receive most of the property from the testator must be aware that he will basically have to cover most of the financial obligations. And this follows from the fact that financial obligations are distributed among the heirs in proportion: everything depends on the size of the share they receive.

Maintenance obligations, as well as compensation for harm, are not subject to inheritance.