4

Inheritance represents various material assets: houses, apartments, cars, securities, deposits, books, antiques, collections and other property. It is logical that after acquiring property rights, misunderstandings arise between the heirs. Applicants are forced to decide questions: who will get the property, how to divide it, to whom and what share to allocate, and if this is impossible, what is the amount of compensation?

Conflicts can be resolved in two ways:

- draw up an agreement on the division of inherited property between the heirs;

- go to court for forced division.

It is advisable to draw up an agreement - it is faster, easier and less expensive. The agreement allows the heirs to eliminate all contradictions and dispose of the property taking into account the interests of the co-owners. All that remains is to figure out how to correctly draw up an agreement and what to include in it? Read the instructions in our material.

Features of the division of inherited property

Divide property or leave it indivisible? This question worries many heirs - by law and by will.

Most often, the issue of division arises between legal heirs. Especially if the property is large and there are few applicants - or, on the contrary, there is one object and many successors.

Conditions for the division of inherited property:

- Registration of certificates of inheritance rights.

- Participation of several applicants - from 2 people or more.

- The property is in shared or joint ownership.

- The testator did not indicate the shares that would go to the candidates.

Options for dividing property are entirely at the discretion of the heirs. The most important thing is to reach agreement and take into account the interests of low-income family members: elderly parents, disabled people, incapacitated people and minors.

Let's look at the features of the division of property using specific examples:

If there is one property, and there are several applicants, the object is divided into equal (without agreement) or unequal shares (by agreement).

Example:

The brothers inherited their father's car and began dividing the property. The older brother already owned a personal vehicle, so he did not need a car. The younger brother started a family and was in dire need of a means of transportation. The heirs agreed that the car would go to the younger brother, and in return the elder would receive monetary compensation as part of his share. The brothers notified the notary in advance of the decision, so the certificate of inheritance indicated one recipient of the vehicle - the younger brother. He later registered the title to the car with the local traffic police.

If the deceased left several objects to two or more heirs, the recipients can draw up an agreement on the division of property.

Example:

After his death, the father left a 3-room apartment, a car, a plot of land and a cash deposit in the amount of 400,000 rubles. The notary accepted applications from four heirs: son, daughter, mother + grandmother of the deceased, who was his dependent. The heirs decided to enter into an agreement on the division of assets. The daughter and mother received a 3-room apartment on the basis of common shared ownership - the son and grandmother received monetary compensation in exchange for their shares in the apartment. The son bought a car, and the grandmother bought the entire plot of land (instead of the required 1/2 part). The heirs agreed that no compensation would be paid for these objects. The contribution was divided equally - each heir received 100,000 rubles.

If the property cannot be divided, the preemptive right to an indivisible thing applies - it is received by the co-owner or user of the property of the deceased (Article 1168 of the Civil Code of the Russian Federation).

Example:

Sofronov and his mother cultivated a plot of land in the Moscow region. Soon Sofronov was diagnosed with cancer, and six months later the man died. Property composition: cash contribution, share in LLC and land plot. The division of the inheritance will take place taking into account the mother's preemptive right to an indivisible thing - a land plot that cannot be allocated in kind. The basis is the use of the plot during the life of the testator and until the opening of the inheritance. It is the mother who will receive the land as part of her share. The heirs decide among themselves whether to pay compensation or not.

Results

An agreement on the division of inherited property is concluded only with the consent of all heirs participating in the transaction. If there are any disputes between them, the problematic issue is resolved through the court. The property bequeathed to the successors by the testator is divided between them in equal shares. If one of the heirs receives the majority of the property benefits, then he pays the remaining heirs compensation in cash equivalent or transfers to them his share in another type of property.

Inheritance cases and related issues are a complex category of inheritance law with many pitfalls. Therefore, if disputes arise between heirs and it is impossible to divide the property bequeathed to them by agreement, it is best to seek help from lawyers.

Read: Registration of inheritance under a will

When can a separation agreement be executed?

Inheritance of the assets of a deceased person occurs by will, and in the absence of one, by law. Having a will somewhat simplifies the distribution of property between heirs. However, the order does not always contain provisions on the size of the shares of each applicant. Additionally, difficulties arise in relation to an indivisible thing (clause 1 of Article 133 of the Civil Code of the Russian Federation). In this case, disputes can be resolved through a separate agreement or in court.

Expert opinion

Stanislav Evseev

Lawyer. Experience 12 years. Specialization: civil, family, inheritance law.

The basic condition for the division of inheritance is the participation of heirs of one line of kinship , regardless of the method of entry into rights (for example, father, mother, son, daughter, spouse - for primary heirs).

If relatives do not conflict with each other regarding specific property or its share, then they can use the property of the testator (for example, live in his apartment until they receive an inheritance certificate). If the heir is a co-owner of the property, then he can dispose of his part of the property, regardless of the wishes of the relatives of the deceased person. However, when alienating property, difficulties may arise - the pre-emptive right of redemption belongs to the co-owners. The remaining heirs enter into property rights only after the assets are registered as property.

When should you not draw up an agreement?

Despite the freedom to draw up an agreement, there are cases when it is impossible to draw up an agreement:

- if among the heirs is a conceived but not yet born baby , in this case you will have to wait for the child to be born, and only then divide the property of the deceased (Article 1166 of the Civil Code of the Russian Federation);

- if the obligatory share in the inheritance is not taken into account, it is received by disabled members of the testator’s family + dependents, subject to financial dependence on the deceased and living with him during the last year of life (Article 1149 of the Civil Code of the Russian Federation, as well as the provisions of Article 1167 of the Civil Code of the Russian Federation);

- if the inheritance was distributed unevenly.

Concluding an agreement under such conditions is a clear violation of property rights. If this is discovered, the victims can contact the guardianship authorities and file a claim to declare the contract invalid (void).

Do I need a notary?

Current legislation provides for oral, written and notarized agreements.

However, the law does not oblige it to be concluded with a notary - this is done at the choice of citizens, with one exception.

If household items are divided: household appliances, furniture, kitchen utensils, where re-registration of property rights is not required, then the heirs can divide it orally, taking into account everyone’s opinion.

Provided that we are talking about real and movable property, a written form is required here with subsequent state registration in Rosreestr.

When the parties decide to give the agreement additional legal force, it can be certified by a notary. This will minimize the risk of litigation initiated by one of the parties, since the notary will act as a guarantor of the legality of the conclusion of the contract.

How to correctly draw up an agreement on the division of inherited property?

An agreement is a multilateral document that affects the interests of heirs and third parties. The fate of property, interests of the parties and financial losses depends on the correctness of the drafting. Let's figure out how to correctly draw up an agreement, what to include in it, and does it need to be registered with a notary?

Form and content

The law is not limited to one form of agreement on the division of inheritance. Relatives may not draw up a written agreement at all, but agree verbally. For example, if the transaction includes property worth up to 10 minimum wages - the minimum wage (clause 1 of Article 161 of the Civil Code of the Russian Federation). If the price of the inheritance is higher or it is real estate, the agreement is drawn up in writing .

What must be specified in the agreement between the heirs:

- Title of the document;

- date and place of drawing up the agreement;

- information about the parties to the transaction (full name, registration address, passport details);

- reference to the provisions of the Civil Code of the Russian Federation;

- mention of a certificate of inheritance;

- list of inherited property;

- the procedure for distributing assets between heirs;

- mention of the number of copies of the agreement;

- warning about the impossibility of unilateral refusal to fulfill the contract;

- mention of subsequent registration of ownership;

- details of the parties to the agreement;

- heirs' signatures.

Relatives can determine the size of each of them's share or the type of property that will go to a particular claimant. Additionally, the agreement can display the amount of compensation for a disproportionate increase in the share of property of one of the parties to the transaction.

Sample agreement on division of inherited property

When dividing an inheritance, you can use the following sample agreement:

Procedure for drawing up an agreement

The process is not fraught with any particular difficulties, but you need to follow the following steps:

Stage No. 1 . Enter into inheritance.

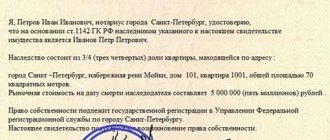

Stage No. 2 . Obtain a certificate of inheritance.

Stage No. 3 . Discuss the nuances of a future property division agreement.

Stage No. 4 . Contact a notary and draw up a draft agreement.

Stage No. 5. Register ownership or make changes to shared ownership.

Documentation

When contacting a notary, the heirs must prepare the following documents in the form of a package:

- Russian Federation passports - for heirs over 14 years old, as well as certificates for children under 14 years old and passports of their parents;

- agreement on the division of the inheritance mass (when drawn up);

- certificates of inheritance;

- receipt of payment of state duty.

Further registration of shares occurs in accordance with the notarial agreement. Please note that the basis is a certificate of inheritance - a title document. However, the final registration is based on these agreements, which indicate the shares or the entire property that needs to be registered. Even if the information from the contract and the certificate do not match, Rosreestr, the Federal Tax Service or the State Traffic Safety Inspectorate do not have the right to refuse state registration.

State duty amount

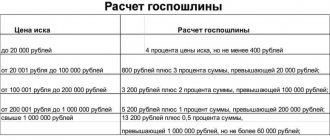

Agreements on the division of inheritance are subject to mandatory notarization. A state fee is charged for performing notarial acts. Its size is determined by the Tax Code of the Russian Federation. However, the law does not provide for a fixed fee amount for this category of agreements - situations are individual.

How to determine the amount of tax? According to the explanations of the Ministry of Finance, the amount must be calculated at the rate established for the registration of other contracts, the subject of which is subject to assessment. The state duty for certification of such agreements is 0.5% of the agreement amount , but not less than 300 rubles and not more than 20,000 rubles (Article 333.24 of the Tax Code of the Russian Federation).

An interesting point: payment is made by all participants in the agreement, depending on the size of their shares. If there is no share, the heir does not bear financial expenses. And, on the contrary, the larger the share or amount of compensation, the higher the state duty.

Cost and terms

The cost of concluding an agreement depends on the price of the part of the property received by clients:

- 0.5% of the transaction amount (minimum 300 rubles, 20,000 rubles - maximum), if the cost is less than 1,000,000 rubles;

- 0.3% - if the value is estimated at 10,000,000 rubles;

- 0.15% - if the valuation is more than 10,000,000 rubles.

The specialist’s services themselves are paid separately and also depend on the price of the residential premises and other property involved in the transaction: 7,000 - 39,000 rubles varies.

Acceptance of the inheritance should be made six months after the date of death of the testator. It is then that the notary opens the case and identifies the participants. The missed deadline can be restored through the court, providing compelling arguments.