Mothers may often not know how to obtain alimony from their former entrepreneurial spouse. Problems arise with how to calculate alimony under a certain taxation system, what amounts are taken into account when calculating financial assistance, whether the entrepreneur’s expenses are taken into account when calculating profit, and more. These questions will be answered in this material.

Bankiros.ru

Alimony from entrepreneurs: features of collection

An individual entrepreneur is recognized as a citizen registered with the Federal Tax Service in accordance with the established procedure. In fact, he is his own employer, so when collecting alimony, a number of difficulties may arise:

- Individual entrepreneurs, depending on the chosen taxation system, submit tax returns once a quarter or year, but tracking income from them is problematic.

- Some entrepreneurs hide their real earnings, which is why the alimony collected in shares is significantly reduced.

- It is impossible to obtain information about the income of individual entrepreneurs on UTII, because when choosing this system, the tax is calculated taking into account the expected earnings. Alimony can be calculated based on the average earnings in the country.

- Bailiffs may request a book of income and expenses when the payer uses OSNO, simplified tax system or unified tax. You will also need documents regulating the costs of business needs.

When collecting alimony for the maintenance of a former spouse or a disabled adult child, payments are assigned in a fixed amount, and here the amount of the payer’s earnings does not matter much - only the minimum subsistence level (ML) and the financial situation of the parties are taken into account.

Forms for collecting alimony from individual entrepreneurs

According to Art. 81 and 83 of the RF IC, alimony can be collected in different forms depending on the possibility of confirming the individual entrepreneur’s earnings and other nuances:

- As a share of income.

- In a fixed amount of money.

- In a mixed form.

Let's consider each option in detail.

As a share of income

For one child, 25% is withheld, for two – 33%, for three or more – 50%. The maximum amount of deductions, taking into account the payment of possible debt, cannot exceed 70% (Article 99 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings”). The collection of alimony as a percentage of earnings implies that the payer’s earnings can be confirmed by certificates.

An example of recovery as a percentage. Maltseva I.I. filed an application with the magistrate’s court to collect alimony from her ex-spouse, an individual entrepreneur, for the maintenance of a common child. She did not receive information about the defendant’s income, but he submitted declarations in court. According to the documents, it is established that the average amount of his earnings is 50,000 rubles. per month.

With such a salary, he will have to pay the following amount:

50,000 x 25% = 12,500 rub.

In a fixed amount of money

To assign such payments, the alimony payer is not required to provide information about income. This option is relevant if the payer receives money in foreign currency or has unstable income

An example of recovery in TDS. The couple divorced in 2021, after the divorce the woman was left with a common daughter. To collect alimony, she filed a lawsuit in the magistrate's court, presenting as demands the withholding of 1 monthly salary. At the time of application, the PM is equal to 11,280 rubles.

At the meeting, the defendant did not provide information about his earnings. The claim was satisfied, payments were assigned for the child in the amount of 11,280 rubles.

Learn more about alimony in a fixed amount.

Mixed alimony

A mixed form of alimony is beneficial when the payer has two types of income at the same time - permanent and “floating”.

An example of a mixed recovery. The person obligated to pay alimony is registered as an individual entrepreneur, his income is unstable. Additionally, he rents out his own apartment for 15,000 rubles. monthly.

The ex-wife collected alimony from him: 25% is paid for the child from business activities, and 5,000 rubles from rental earnings.

Alimony for an adopted child

Alimony for four children

Indexation of alimony from individual entrepreneurs

According to Art.

117 of the RF IC, indexation of alimony in a fixed monetary amount is done by the bailiff quarterly in accordance with changes in the cost of living. You can find out this data on the official website of Rosstatistics. If the monthly minimum is reduced, the amount of alimony remains the same. It cannot be reduced, it simply does not increase again. When paying money as a share of earnings, indexation is not carried out. It is believed that the individual entrepreneur receives income taking into account the coefficients for increase, and it is impossible to index alimony from it.

How to collect alimony from an individual entrepreneur through the court

The best option for the claimant is to demand payment in TDS and not worry that the payer will have little money next month. The fixed amount is only indexed and does not depend on income.

To apply for alimony, you need:

- File a claim.

- Send one copy of the claim to the defendant and wait for notification of delivery.

- Submit the claim with the attached documents to the court and wait for a decision on acceptance of the materials for production.

- Receive a notice with a court date.

- Appear for the preliminary hearing.

- Receive a determination to assign the case to trial.

- Participate in other meetings.

- Receive a court decision and writ of execution.

The claimant has the right to contact the payer’s employer or the FSSP with a copy of the decision and the writ of execution. The bailiff draws up a resolution to initiate enforcement proceedings and sends a copy to the debtor. The document indicates the period of voluntary repayment.

In case of systematic non-payment, various measures are applied to the alimony obligee:

- Seizure of bank accounts.

- Ban on leaving the Russian Federation.

- Search for property for forced seizure.

- Prohibition on performing registration actions with property.

- Restriction on the use of a special right (driver's license).

If payment is not made for more than 2 months, administrative liability arises. In the future, in case of repeated violations, the debtor may be charged under Art. 157 of the Criminal Code of the Russian Federation.

Contents and sample of the statement of claim

When drawing up a statement of claim, you must be guided by Art. 131 of the Code of Civil Procedure of the Russian Federation, according to which it must contain the following information:

- Name of the court.

- Full name, registration address, date of birth of the plaintiff and defendant.

- Date of divorce.

- Full name, date of birth of the child.

- Claims: collection of alimony in shares of income, in a fixed amount, etc.

- Description of the attached documentation.

- Date and signature of the plaintiff.

The claim is drawn up in three copies: one each for the defendant, the court and the plaintiff (the form is returned to him with a note of acceptance by the court).

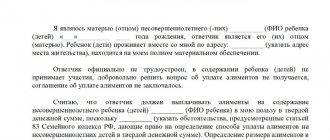

Sample application for the collection of alimony from an individual entrepreneur in the TDS with UTII

Sample claim

Sample claim

Sample application

Where to contact

According to Art. 29 of the Code of Civil Procedure of the Russian Federation, plaintiffs can appeal to the courts at their place of residence or the address of the defendant. Since 2021, such cases are considered by district courts.

You can also apply to the magistrate’s court to collect alimony in shares by filing an application for a court order. But there you will need certificates of the payer’s income.

Documentation

When filing a lawsuit, the plaintiff presents:

- Statement of claim.

- Passport.

- Child's birth certificate.

- Certificate of marriage or divorce.

- Information about the defendant’s earnings (if any).

- Notice of service of the application to the defendant.

To change the method of collection, you will need a previous court decision, IL and substantiation of the claims: receipts for payment for the child’s clubs, information about the plaintiff’s salary, checks for the purchase of clothing, etc.

State duty

Art. 333.36 of the Tax Code of the Russian Federation, plaintiffs are exempt from paying state fees in cases of alimony collection. 150 rub. then collects the damages from the defendants.

Penalties

For evading payment of security in the absence of income, an individual entrepreneur may be brought to administrative or criminal liability (in this case we are talking about committing a crime). As a preventive measure, the businessman will have to pay a fine of 2,500 rubles. In case of repeated violation, criminal liability arises, which provides for doubling the above fine, as well as restriction of freedom for up to 15 days.

Arbitrage practice

Alimony from individual entrepreneurs is collected in the same way as from other citizens:

- The plaintiff collected from the defendant-IP alimony in TDS for her minor daughter. By decision No. 2-1046/2020 2-1046/2020~M-524/2020 M-524/2020 dated May 26, 2021, in case No. 2-1046/2020, the man was obliged to pay 55.8% of the monthly subsistence minimum, taking into account indexation.

- The woman, through the court, determined the place of residence of the children with her, collected from the man alimony of 0.5 monthly minimum for each child, divided the loan debt (Decision No. 2-558/2020 2-558/2020~M-180/2020 M-180/ 2020 dated May 27, 2021 in case No. 2-558/2020).

- The plaintiff recovered from the defendant alimony in the TDS and the costs of paying for the services of a representative (Decision No. 2-250/2020 2-250/2020~M-122/2020 M-122/2020 dated May 27, 2021 in case No. 2-250/ 2020).

The legislative framework

When calculating alimony from individual entrepreneurs, they are guided by the following legislative acts:

- Family Code - articles 80, 81, 83, 100, 103, 104, 105, 117;

- Civil Procedure Code - articles 122,126;

- Tax Code - articles 346.16, 347;

- Government Decree No. 841 (as amended on January 17, 2013);

- Government Decree No. 17-P;

- Order of the Ministry of Finance No. 86N;

- Order of the Ministry of Finance No. 135N;

- By Order of the Ministry of Finance, Ministry of Labor and Ministry of Education No. 703Н/112н/1294;

- By Order of the Ministry of Taxes No. BG-3-04/430.

Lawyer's answers to private questions

What to do if the income of an individual entrepreneur is unstable?

Collect payments from him on the basis of Art. 83 of the RF IC, which allows this to be done if the payer has unstable income. If alimony was previously assigned in shares, an application is submitted to the court to change the form of payment from shares to TDS.

Is it possible to somehow find out the income of an individual entrepreneur for alimony?

Only courts and bailiffs can request information about payers’ earnings. The recipient of alimony can also ask for a certificate, but the alimony payer is not obliged to report his income to him.

How is alimony paid from an individual entrepreneur to the simplified tax system for the maintenance of his ex-wife?

Only in a fixed amount of money (Article 90 of the RF IC). When determining the amount of payments, the court takes into account the level of the minimum wage and the financial situation of the parties.

How to avoid alimony as an individual entrepreneur?

No way. Even if payments are collected in shares of income and zero declarations are submitted, a debt is formed, and the bailiff will then make a calculation based on average earnings and PM. In addition, the claimant can change the form of payment from equity to TDS.

Is it possible to recover alimony from an individual entrepreneur during a divorce?

Yes. Simultaneously with the demand for divorce, you can file a demand for alimony. But the divorce in this case will take longer. If you need a divorce faster, it is better to first get a divorce through the magistrates' court in one month, and then resolve other issues.

Is the maximum amount of alimony from an individual entrepreneur established by law?

No. The minimum and maximum amounts of alimony are not determined by any law. Even if an individual entrepreneur earns 500,000 rubles monthly. and pays 25% of the income for the child, and at the same time believes that 125,000 rubles. too much for his maintenance, it is unlikely that the court will award smaller payments. When determining the amount of alimony, it is always important to maintain the minor’s previous standard of living.

Zero declaration as a way to avoid paying alimony

Some individual entrepreneurs try to avoid paying alimony by hiding their income. Leaving aside the legal aspects of this method, it is worth noting that in this way he is unlikely to be able to avoid paying alimony, because, as mentioned above, he will still have to pay alimony, which is equal to the average Russian salary. Thus, this is only relevant if the father does not want to pay a large percentage of the net profit to the child.