Collectors were prohibited from calling relatives, colleagues and acquaintances of debtors. The law has not yet entered into force, but there is no doubt that the document will help people when communicating with representatives of creditors.

On Wednesday, June 16, the State Duma, in the third and final reading, adopted a bill that will allow Russian debtors to breathe more freely - as soon as the document comes into force, collectors will be prohibited from calling acquaintances, friends and harassing the debtor’s relatives, unless the latter independently gives permission to do so.

Do banks have the right to call the debtor’s relatives?

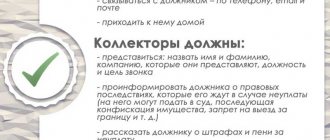

Federal Law No. 230 “On Collectors” establishes the rules for carrying out actions aimed at collecting debt from an individual. It applies to the activities of bank collection departments. Part 5 of Article 4 of this law establishes the conditions for the interaction of collectors with third parties: relatives, acquaintances, persons living together or neighbors.

The legislator allows for the possibility of communication between the bank and the debtor’s relatives. But this communication is possible if two conditions are simultaneously met:

- The debtor agreed in writing to this interaction. A clause on such consent is contained in the loan agreement.

- The third party with whom the claimant communicates should not express objections to this matter. If a relative or friend of the debtor, in a conversation with the bank, openly expresses disagreement with continuing to call him, the calls must be stopped.

Even if the relative has not expressed disagreement with communication with the bank, there are strict restrictions for such communication, both in the number of interactions and in their content:

- telephone calls should be no more than once a day, twice a week and eight times a month;

- You can call from 8 a.m. to 10 p.m. on weekdays, and from 9 a.m. to 8 p.m. on weekends;

- Threats, obscene language, insults, blackmail, misrepresentation, and psychological pressure are unacceptable in a conversation;

- Any misleading of the interlocutor regarding the legal nature of the debt, the consequences of its non-repayment, and possibly criminal liability for the debtor or the interlocutor himself is unacceptable.

Arrange trips without warning (for example, come to work)

In order to search for a borrower, collectors may come to his place of work. Here they are obliged to follow the same rules of conduct - not to disclose credit information about the debtor to strangers, not to insult him, etc. They can ask colleagues about his whereabouts, and if the borrower is present at the workplace, talk with him, but without the participation of third parties. The debtor's employer is not required to provide debt collectors with personal information about its employee.

In most cases, collectors do not warn the borrower about their visit, wanting to take him by surprise.

Why do banks call relatives?

The main goal of the bank’s actions is to return the money loaned, as well as interest, penalties and fines. Calls to family and friends are used to increase pressure on the debtor and force him to pay the debt.

Note!

Banks do not have the right to disclose the details of the loan agreement to anyone, including close relatives of the debtor. If, in a conversation with a relative, the bank mentions the amount of debt or the terms of the agreement, there is every reason to complain about a violation of bank secrecy.

Contact details of relatives are requested by banks when drawing up an agreement. In some cases, passport information is also required. This is done “just in case” if the bank needs to contact the debtor, but he is unavailable. In fact, relatives whose details are indicated in the agreement are contacted if the debtor stops paying the loan.

What to do if collectors call your friends

If you are trying to figure out how to stop debt collectors from calling friends and relatives, try collecting information. An agency operating in accordance with the rules will most likely accommodate you if you contact its representatives and indicate your desire to cooperate. You may be offered a flexible repayment schedule or forgiveness of part of the debt. For example, this is what EOS does, acting solely in the interests of the client.

When are bank calls to third parties legal?

Calls to relatives and friends are legal if they meet the requirements provided by law and if the relative has not expressed disagreement with contacting the bank.

Note!

The bank has the right to call a relative, but does not have the right to be intrusive, call too often, at night, or intimidate, pressure or threaten - these are grounds for a complaint to the police or prosecutor's office.

There are also a number of cases when the bank is legally forced to interact with a relative or loved one of the debtor:

- if the debtor does not repay the debt, but the loan agreement specifies a guarantor for the loan. Calling the guarantor, in this case, is legal;

- Calls to heirs are legal if the debtor has died.

Can a relative or friend be responsible for the loan?

A call from an agency, even if you are the parent or child of the borrower, does not mean an obligation to answer for debts that do not belong to you. Unscrupulous collectors may try to convince a person of the opposite, but such behavior is contrary to the law, while conscientious organizations, on the contrary, are interested in legal ways to release a person from obligations. However, there are also cases in which third parties are indeed liable, but there are not many of them.

Guarantee.

A loan guarantor is a person who agrees to assume financial obligations if the borrower himself is unable to repay the funds for some reason. Usually the guarantor is a close friend or relative. If you did not take on this responsibility and did not officially confirm this by concluding an agreement with a bank or collection agency, then you are not responsible for the debt of another person.

Marriage.

Spouses may be responsible for each other's loans, and these obligations are divided upon divorce along with marital property. Each case in the family sphere is quite complex: usually in such situations it is better to seek legal advice.

Inheritance.

By inheriting the property of a person burdened with debts, the person also takes on his obligations. If you refuse the inheritance or are not an heir at all, the financial burden does not pass to you.

Calls to guarantors and heirs

A guarantor is a citizen participating in a loan agreement as a person insuring the bank in case of failure to fulfill obligations by the debtor. The guarantor enters into the contract of his own free will. Therefore, if the debtor does not repay the loan, the bank reasonably addresses the demands to the guarantor. After the guarantor fulfills the obligation to repay the debt, the right to claim the debt from the original debtor passes to him.

Note!

The bank must formally demand repayment of the debt from the guarantor, and not through calls. Until a formal written request is received demanding repayment of the debt, the guarantor is not required to transfer anything.

But even if such a request has been received, the bank is obliged to comply with the requirements for the quantity and quality of interactions. Even the official guarantor, the bank has the right to call a strictly defined number of times and adhere to communication rules that do not allow intimidation or blackmail.

Note!

The heir who enters into the inheritance accepts his debts along with the property of the deceased. If there is only one heir, then he accepts the debts in full; if there are several heirs, the debts are divided in proportion to the property received.

The bank has the right to call the heir after the death of the debtor, including to clarify the situation with the inheritance, but the bank must remember that:

- the heir who entered into the inheritance is liable for the debts of the testator to the extent of the value of the property he received. If the value of the property does not cover the debt to the bank, the bank has no right to demand the return of funds from the heir’s personal pocket.

Note!

If an heir inherited a car worth 500,000 rubles and a debt to the bank in the amount of 1,000,000 rubles, the bank has the right to demand only 500,000 rubles, covering the cost of the car;

- If the heir has not entered into the inheritance or, moreover, has officially refused it, it is impossible to make demands on him for the repayment of the debt - it has nothing to do with the loan of the deceased.

What to do if you receive a call regarding a loan from a friend or relative

Keep calm. You have no debt and do not have to answer for it. If you want to help a friend who finds himself in a difficult life situation and is unable to pay the funds, respond to the collection agency. A conscientious organization that conducts itself in accordance with the NAPCA Code of Ethics has an interest in helping the individual free himself from obligations. Make inquiries and, if debt collectors behave in accordance with the law, contact your loved one and notify them. If the person is unfamiliar to you (for example, you received the number recently, and they are calling you instead of the old owner), inform the collection agency about this. You should be removed from the call list.

How to dialogue with bank employees

When communicating with a bank representative regarding a relative’s debt, you must remain calm, composed and remember the following points:

- At the beginning of the conversation, the bank representative must introduce himself and indicate on behalf of which organization he is acting. If this is not done, you need to ask for information and write it down.

- Organize the recording of the dialogue on a voice recorder.

- In the conversation, adhere to neutrality: do not be rude or attack the caller, but also do not promise him that the debtor will fulfill his obligations to repay the debt.

- If a bank representative offers or insists that a relative repay the debt instead of himself, this can be regarded as extortion. You should correctly remind your interlocutor that extortion is a criminal offense.

- Calmly and clearly express your disagreement to continue communicating with the bank regarding this debt. It is necessary to say it very clearly, in phrases that do not allow ambiguity.

Calls that, despite refusal to communicate, continue or their number exceeds acceptable standards are grounds for contacting the police or prosecutor's office, as well as the FSSP, if we are talking about debt collectors.

Collection agencies break the rules

Many people are wondering what to do if debt collectors do something they have no right to do:

- they call too often or after a request to remove the number from the database;

- provide false information, are rude, threaten;

- disclose information protected by bank secrecy;

- They contact you using numbers you shouldn't know.

In this case, you should contact the authorities that regulate the activities of collection agencies. Conscientious agencies loyal to the law will never do this: they will act only in accordance with the law to help a person pay off debt and get rid of obligations.

How to stop calls

Everything is simpler with banks. Most often, they do not contact black collectors at all, but enter into agreements only with decent collectors. In the field of microcredit, everything happens a little differently.

As you go, a relative who is beginning to be bothered by collectors can contact a credit institution and write a statement refusing to cooperate. Similarly, you can contact the collection agency itself. After this, the calls should stop. And if they start again, file a complaint.

Where to complain about calls from collectors:

- in the FSSP. It is the bailiff service that is the supervisory authority over debt collectors. The complaint can be submitted online to the Internet reception. You can also get a preliminary consultation by phone 8 800 250 39 32;

- to the Central Bank of the Russian Federation, it also has an Internet reception. This complaint can push all the others, although the Central Bank of the Russian Federation itself does not deal with collectors, the FSSP does this;

- to the prosecutor's office if the law is violated regarding the time and number of calls from collectors;

- contact the police if threats or insults are made;

- to the public reception of Roskomnadzor if collectors disclose personal information about the borrower or his relatives to third parties. There is also an internet reception here.

But please note that all complaints and statements must be supported by something. This could be a recording of telephone conversations, unpleasant SMS, call details. They will not take the word of the service.

Calculate interest and penalties

According to Art. 384 of the Civil Code of the Russian Federation, the borrower’s debt is transferred to the new creditor on the same terms as before the moment of its transfer. In other words, the collection agency has the right to charge interest and penalties provided for in the agreement in the event of late payment of the next payment.

If the amount of the accrued penalty is disproportionate to the violations committed or is greater than the amount of the principal debt, then the borrower has the right to demand its reduction in court on the basis of Art. 333 Civil Code of the Russian Federation. The court in most cases takes the side of the debtor.

Therefore, if fines and penalties continue to accrue on your debt, then your best option would be to take the case to court. In this case, the final amount payable will be fixed.

What if a relative acts as a guarantor?

If the relative the bank calls is a guarantor, he is as responsible a person as the debtor. Accordingly, the financial institution has the right to provide him with all the necessary information regarding the debt.

Bank employees can talk about the amount of debt, put forward demands for loan repayment instead of the debtor, threaten termination of the loan agreement and penalties. In addition, the bank has the right to sue the guarantor because he is responsible for the debt.

Note!

After the trial, the guarantor may be required to pay all or part of the debt. Bailiffs can seize his property and accounts.

If you have signed a guarantee agreement, you will not be able to do anything about calls from a financial institution. All that remains is to either demand that the relative pay off the debt or do it for him.

Can MFOs call when considering an application?

Sometimes relatives are called not at the stage of collection, but at the stage of consideration of the application. Banks do this much more often - this serves as an additional check on the borrower. MFOs can also resort to this, although in fact they do this extremely rarely.

Calls can be made to all persons whom the borrower indicates in the application form as contacts. Usually relatives and close friends are brought there. When considering an application, the lender has the right to call all specified telephone numbers in order to verify the information.

For example, the contact person may be asked where the potential borrower works, whether he lives in his own home or in a rented one. This is a method for detecting fraudulent data. If inconsistencies are identified, the loan will be refused.

But if you apply for an urgent online loan, which is issued around the clock, usually you will not receive any calls during processing. The automatic system makes a decision in a couple of minutes based on the data provided in the application form.

If you are taking out a long-term loan for a significant amount for the MFO industry, be prepared for calls. They can really sound.

If you are planning to apply for a microloan, it is better to immediately notify the contact persons indicated in the application that they may be called. They must not “say too much,” otherwise they will refuse you.

Resell debt

Art. 382 of the Civil Code of the Russian Federation allows the creditor to resell the debt to a third party without the consent of the debtor. He is only obliged to notify the latter about the completion of such a transaction. The collection agency may, if it wishes, transfer the borrower's loan to another collection agency.

But in practice, such resale does not occur. If debt collectors cannot force the borrower to repay the debt, they sue him. It makes no sense to transfer the case to other creditors, because they use the same methods to return the debt.

Comments: 25

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Irina Rusanova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Irina

10/04/2021 at 12:53 Lenders call not only me, but also colleagues. One of them has had her phone locked since Friday. Nobody can get through. Only calls from microfinance organizations are accepted. What should I do?

Reply ↓ Anna Popovich

04.10.2021 at 14:04Dear Irina, MFOs do not have the authority or technical capabilities to block debtors’ numbers. This is probably a technical problem. You need to contact the nearest branch of your mobile operator.

Reply ↓

08/30/2021 at 18:32

Can I ask for a sample withdrawal of consent to interact with 3rd parties? zI sent by e-mail a withdrawal of consent to the processing of personal data .. and this is what they answered “”””” In accordance with clause 5 of Part 1 of Art. 6 of the Federal Law of July 27, 2006 No. 152-FZ “On Personal Data” (hereinafter referred to as Law No. 152-FZ), the processing of personal data is permitted if it is necessary for the execution of an agreement to which the subject of personal data is a party. In accordance with Part 2 of Art. 9 of Law No. 152-FZ, if the subject of personal data withdraws consent to the processing of personal data, the operator has the right to continue processing personal data without the consent of the subject of personal data if there are grounds specified, including in paragraph 5 of Part 1 of Art. 6 of Law No. 152-FZ, that is, when the processing of personal data is necessary for the execution of a contract. Based on the foregoing, we notify you that Akademicheskaya MCC LLC will continue to process your personal data until you fully fulfill your obligations under the Loan Agreement. At the same time, we inform you that the Company reserves the right to involve third parties in collecting your debt, as well as to go to court to protect your violated rights. Do I understand the contract correctly?

Reply ↓

- Anna Popovich

08/31/2021 at 21:48

Dear Love, unfortunately, yes.

Reply ↓

08/25/2021 at 16:27

Hello ! Can they be fired from work if they call from a microfinance organization?

Reply ↓

- Anna Popovich

08/25/2021 at 19:10

Dear Nina, no, this contradicts Article 81 of the Labor Code of the Russian Federation dated December 30, 2001 No. 197-FZ (as amended on June 28, 2021), which lists all the grounds for termination of an employment contract at the initiative of the employer.

Reply ↓

08/14/2021 at 17:40

Hello, if the application form indicates a work phone number and another phone number, but the agreement on interaction with 3 persons contains only one number, that is, not a work number. Can microfinance organizations call at work in this case?

Reply ↓

- Anna Popovich

08/17/2021 at 01:29

Dear Elena, in this case, they can, since you indicated your work number as one of the main ones.

Reply ↓

08.08.2021 at 13:50

My son took out a microloan and provided my details. In the event that my son is unable to pay his dues, can I be forced to pay for him? Svn requested a microcredit and provided my details. They called me and said that my son was asking for a loan, they asked me if I would help him pay if he had difficulties repaying the loan, and I said that I wouldn’t help MSU, I didn’t have that opportunity. And the mench has a question: if the friend is still given a microloan and he cannot pay, can the mench be involved in the payment if they have my I.F.O and Yadate of birth.

Reply ↓

- Anna Popovich

08/08/2021 at 23:35

Dear Alla, no, you cannot be forced to repay the loan instead of the borrower.

Reply ↓

07/20/2021 at 03:26

Tell me, does the MFO Moneyman have the right to call at work?

Reply ↓

- Anna Popovich

07/20/2021 at 14:56

Dear Nadezhda, MFOs have the right to call third parties only if you gave your consent to this when receiving a loan or loan. But you have the right to revoke it by sending a written refusal to the creditor by registered mail with return receipt requested.

Reply ↓

07/15/2021 at 18:01

Good afternoon Please tell me, do employees of a microfinance organization have the right to call parents and demand repayment of the debt?

Reply ↓

- Anna Popovich

07/15/2021 at 18:59

Dear Alim, such behavior is contrary to the law if you did not give voluntary consent to interact with third parties.

Reply ↓

07/10/2021 at 01:50

Hello. Tell me how I can refuse calls from MFO collectors to third parties and at work before they start calling

Reply ↓

- Anna Popovich

07/13/2021 at 00:10

Dear Ekaterina, you can revoke your consent by sending a written response (refusal) to the creditor by registered mail with return receipt requested.

Reply ↓

07/07/2021 at 19:02

Hello. If I took out a loan and don’t pay it off, can collectors somehow find my parents if I don’t live with them and am not registered with them?

Reply ↓

- Anna Popovich

07/08/2021 at 02:37

Dear Maria, such measures of pressure on the debtor are illegal.

Reply ↓

05/20/2021 at 23:07

I paid off a loan from a microfinance organization for my son based on a letter from them. I have a check order, which indicates that I am the payer, and my son’s contract number. The MFO refuses to confirm receipt of the payment, arguing that he himself must talk to them. But he didn’t call them, neither after the loan, nor now. I can’t contact him by his phone number; he is not at his registered address. Will my payment be credited?

Reply ↓

- Anna Popovich

05/21/2021 at 03:36

Dear Marina, yes, funds can be used to pay off a third party’s debt.

Reply ↓

04/06/2021 at 19:40

thanks for the info

Reply ↓

03/31/2021 at 21:15

Good afternoon. I have a debt with a microfinance organization. I don’t refuse the debt, but I lost my job and can’t pay it. I understand. And collectors call not only me and contact persons. Somehow they found my sister’s phone number and place of work. They call her work constantly. The other day they started calling her colleagues. They have been calling since the morning non-stop. The number is not determined. They call and hang up. They tell me that until I pay they will call non-stop. Are their actions laws? They tell the sister to pay then. Are they right, are they allowed to do this? Is it possible to somehow stop calls to third parties unfamiliar to me?

Reply ↓

- Anna Popovich

04/01/2021 at 02:10

Dear Maria, no, such actions are illegal. We recommend that you read our articles on this topic to understand the correct tactics for communicating with debt collectors and their rights - the legality and limits of debt collectors’ actions and issues of legal regulation of telephone calls.

Reply ↓

03/09/2021 at 14:18

Can microfinance organizations call third parties not specified in the contract? If possible, article and part.

Reply ↓

- Anna Popovich

03/09/2021 at 14:45

Dear Maxim, no, in accordance with the position of the Central Bank, directly announced in court decisions, as well as taking into account administrative fines for failure to comply with orders to eliminate violations.

Reply ↓