As a result, no matter what the alimony debt arises - for a good reason or in the absence of one - the debt will still have to be repaid. But before paying alimony debt, its amount must be calculated. If you follow the provisions of the law, this should not be difficult. The methods are simple, clear and accurate.

Debts on alimony arise if the alimony payer does not pay at all for several months in a row, or pays less than prescribed by a court order, court decision or alimony agreement (notarized or approved by the court). The reasons are:

- Intentional, willful, malicious evasion of payments

- Temporary financial difficulties of the payer (illness, loss of work, events requiring unexpected expenses)

- Accounting errors when deducting alimony from wages

- Changing the details or address of the alimony recipient

- And other, less common events that have one result - money does not flow to the child or children for some time.

For almost every case, the law provides for its own method of calculating debt. They are regulated by the RF IC, the Law on Enforcement Proceedings (Federal Law No. 229), and some other legislative acts

How is alimony arrears calculated?

The need to legally calculate alimony debt for subsequent collection arises only in two cases:

- If the debt has arisen for alimony ordered by the court

- If the voluntary alimony agreement of the former spouses approved by the court or notary is violated

Otherwise, the very concept of “debt” is absent, since there are no debt obligations as such. The following happens quite often. During a divorce, the husband and wife verbally agree on the father's voluntary financial assistance to the children, without drawing up an agreement or filing alimony in court.

Everything goes as planned for a while, and then the father stops paying. For some more time (its duration varies depending on material wealth and patience), the mother tries with persuasion and ultimatums to return everything to normal. When it becomes clear that voluntary payments cannot be achieved, he files a lawsuit.

And, naturally, she wants not only to receive alimony consistently in the future, but also to collect “arrears” for the period during which she unsuccessfully tried to claim the money.

In theory, if she can provide convincing evidence that she has been trying to obtain payment for a certain time (correspondence, telephone or video recordings, witness testimony), the court will be able to collect alimony retroactively. In practice this happens extremely rarely.

Another important point. In the vast majority of cases, alimony arrears are collected only three years prior to the application for payment. Even if the writ of execution is five or six years old, the bailiff will calculate the debt only for the last three years.

However, if the court decides that the alimony payer is recognized as a persistent defaulter who evades payment of alimony, the debt will be calculated in full for the period of evasion.

Interpretation

Alimony is the periodic provision of assistance (cash, in kind) to minor children and close relatives who have lost their ability to work. The legislative framework determines the equality of parents and children in the fulfillment of child support obligations. That is, the father and mother may require financial assistance for the maintenance of the child and vice versa. Equally, any adult child is responsible for providing support to the parents when necessary.

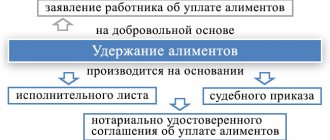

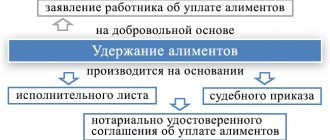

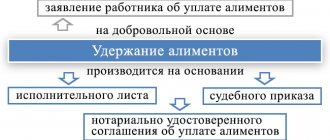

The procedure for providing assistance to a child or parent can be determined by three methods:

- Oral agreement: the parties independently discuss the terms, agree on the amount of payments, no written forms are issued. It is important that such an agreement has no legal force. If a conflict arises, the recipient has the right to demand through the court to re-calculate the amount of alimony for the past period, despite the fact that payments were made on time.

Therefore, the payer must keep copies of payment documents on cashless transfers or require written confirmation from the addressee of the delivery of cash. Only then, during court proceedings, will it be possible to prove the fact of assistance and not have to pay debts.

Both parents and children are required to pay child support when necessary.

- Notarial agreement: the procedure is regulated by the provisions of Articles 99-101 of the RF IC, characterized by determining the amount of obligations, the nuances of payments peacefully in writing. The document is drawn up by the parties in the presence of a notary, who must certify it. It is possible to make changes when specific circumstances arise, but only in a similar way, that is, through a notary’s office.

- Court decision: the debtor is forced to fulfill alimony obligations (section 5 of the RF IC), the amount and procedure for payments are established on the basis of legal norms. The parties have the right to challenge the arbitrator's determination by filing a motion if they become aware of a violation of legal rights. When a person cannot protect his interests on his own, he has the right to use the services of a lawyer.

Deduction is made from the following income of an individual:

- Wages, remunerations, additional payments for professionalism in the performance of job duties.

- Monetary allowances for civil servants, military personnel, and police officers.

- Average earnings during vacation and illness.

- Government subsidies (pension, scholarship, unemployment benefits).

- Income from mining activities.

- Net profit from business.

- Payments under civil contracts.

- Dividends.

- Payment for the rental of property of the alimony.

- Monthly subsidies for doctoral students, etc.

The amount of maintenance is calculated after deducting all taxes.

To pay arrears of alimony, collections may be made from the debtor’s income

Reasons for debt formation

The debt is considered from the moment of violation of the established deadline for the transfer of funds (no later than three working days after the payment of the employee’s salary) or in case of incomplete payment of the required assistance. We can talk about alimony payments only if the citizen does not live with a minor child, maintains a separate household with his parents, that is, does not participate in the maintenance or provision of the person for whom the claim is made.

The main reasons for the formation of alimony debts are identified:

- Temporary disability due to injury or illness.

- Death of loved ones.

- There is no or reduced stable income in the event of dismissal, layoff, or transfer to another position.

- Intentional non-fulfillment of payments.

- The accountant erroneously made a smaller deduction.

- The listing is done incorrectly.

- Bankruptcy, insolvency of the alimony employer.

- The number of dependents supported by the debtor has increased.

- The payer and his employer do not have the details for making alimony payments.

- The recipient of the payment refuses to receive the money.

- Other life and family circumstances.

For each case, a separate procedure for calculating the amount of alimony debt is applied, determined by the regulatory legal acts of the Russian Federation. You need to understand that debt can only be related to alimony approved by a notarial agreement or a court decision. In other cases, the obligation is not defined by law and is not confirmed by relevant documents.

The formation of debt may be due to a decrease in income due to various circumstances

For example, if several years have passed since the dissolution of the family union, the child has not yet reached the age of majority, and the mother has decided to collect alimony for previous years. Then we are not talking about debt, but about another collection. That is, the parent did not take any action earlier to receive financial assistance and lost the opportunity to claim it beyond the deadline.

For debts for the maintenance of children and parents, the generally accepted statute of limitations is set at three years. That is, the claimant has the right to demand forced fulfillment of obligations if no more than thirty-six months have passed since the filing of the claim, regardless of the date of issue of the writ of execution by the court. The only exception is the debtor's deliberate evasion of alimony payments.

Methods for calculating alimony debt

The debt, as a rule, is calculated in a way that corresponds to the method of calculating alimony. Regardless of whether the method of payment is determined by a court decision or a voluntary agreement between husband and wife during a divorce. Each calculation method is based on one or another legal norm.

The calculation is made:

- Based on the income of the alimony payer

- Based on the regional or general national subsistence level (ML)

- Based on the minimum wage (SMW), the indicator can also be regional or general

- Based on average salary in the region

Collection procedure

There are two types of alimony payments subject to collection for the past period:

- Debt incurred during enforcement proceedings. This debt arises when the payer does not transfer funds to the recipient of alimony in violation of the terms of the concluded peace agreement, a court order, or a court decision.

- Debt recognized during legal proceedings. In this case, the recipient of the payments files a lawsuit in order to recognize the existence of a debt and its subsequent forced collection from the debtor.

The procedure for calculating alimony debt based on the debtor’s income

This method is used to calculate the debt if the alimony payer has a permanent, stable income, but for some reason alimony was not withheld from the salary for several months.

The procedure is simple: the bailiff determines the average monthly income, guided by documents on the salary of the alimony payer. From this amount, 13% of income tax is deducted, then the percentage of alimony is calculated -25%. 33% or 50% (in other words, a quarter for one child, a third for two and half for three or more). The result obtained is multiplied by the number of months during which the debtor did not fulfill his alimony obligations.

Example

A citizen’s salary is 32,000 rubles, of which 25% is withheld as alimony for one child. For five months, the accounting department for some reason did not make alimony payments. The bailiff calculates the amount of debt using the following formula:

(Income - personal income tax) X % of deductions X months of non-payment

(32000 – 13%) X 1/4 X 5 months

27840: 4 X 5 = 34800 rubles

Consequently, such an amount will be withheld from the alimony payer to pay off the debt. Either he must transfer it to the alimony recipient at a time, or it will be withdrawn from the account or deducted from the salary, along with monthly alimony payments for the current period.

ATTENTION! When bailiffs withhold from wages a large amount of alimony debt that exceeds the payer's monthly income, they do not have the right to take all the money. Throughout the entire period of debt repayment, the alimony payer must receive no less than the minimum wage. The rest can be withheld to pay off the debt.

Recalculation of alimony for the past period: procedure

How to proceed if you intend to recalculate amounts for the previous period depends on the specific circumstances:

- If there is a writ of execution, but the alimony payer did not fulfill his duties, contact the FSSP service to adjust the amount to be collected taking into account the changed situation (for example, the amount of money in rubles has depreciated as a result of high inflation and does not allow for the proper level of child support).

- If there is a court decision that was not executed on time, the recipient of alimony has the right to apply to the judicial authority with a request to order the payment of a penalty and take action against the person who is evading the execution of the court document.

Appeal to the bailiffs

The FSSP employee is vested with broad powers to collect and determine the amount of transfers. If the debtor does not pay the money, the bailiff notifies him of the need to fulfill his obligations and calculate the exact amount of the debt. The terms of reference allow the FSSP to:

- identify the sources of income of the defaulter;

- impose fines for non-payment;

- bring to administrative, criminal liability;

- seize the debtor's accounts and property, etc.

When new sources of income are identified, the bailiff has the right to recalculate and assign a larger payment amount, including previous periods.

If an employee of the collections department fails to cope with his duties or shows negligence in relation to his work, the recipient of alimony has the right to request a recalculation and bring the amount of alimony payment into line with the actual identified income.

For the payer, the basis for contacting the bailiff may be confirmed facts of misappropriation of funds previously allocated for the child, when the legal representative embezzles amounts, ignoring the needs of the minor.

: Application to the bailiff service for recalculation of alimony debt (29.0 KiB, 299 hits)

Filing a claim with a judicial authority

A writ of execution is based on a court order, which determines the procedure for calculating and paying alimony. According to clause 4 of Art. 102 of Law No. 229FZ, the bailiff carries out work on organizing payments in strict accordance with the court order that has entered into force. If the original document from the court no longer corresponds to the changed situation, the interested party has the right to apply to the judicial authority to review the amount.

In the claims of the application for recalculation of alimony, the applicant asks the court to determine the amount of the debt taking into account the facts presented.

The procedure for calculating alimony debt based on the cost of living

It is logical to assume that if before the debt alimony was collected in a fixed amount, the debt should be calculated by multiplying this amount by the number of months when alimony was not received. But it is not so.

Fixed alimony is assigned when it is impossible to determine the exact monthly income of the debtor. In this case, its approximate order is determined (the alimony payer does not work at all, or receives a fairly high income, but in foreign currency or a natural product).

Based on this, a fixed amount of alimony payments is assigned, “tied” to the PM. “Solid alimony” is a multiple of the minimum subsistence level and can be 1-2 or 0.5 - 0.1 subsistence minimum.

And since the PM is indexed quarterly, the amount of alimony changes accordingly once a quarter. When calculating the debt, the current monthly income figure for a given quarter of a given year is taken as a basis.

Example

In the third quarter of 2021, the Ministry of Labor reported that the amount of PM in Russia is equal to 12,130 rubles. The bailiff calculates the alimony debt in a fixed amount of 5,580 rubles, which is equal to 0.5 monthly wages, and has not been paid during the year. Alimony payments were assigned in the 2nd quarter of 2021. Consequently, at the moment their size no longer corresponds to 0.5 PM.

The following formula is used for calculation:

0.5 of the currently relevant PM X for the number of months of overdue contributions

6,065 X 12 =72,580 rubles

The procedure for determining the amount of payments

You can carry out the calculations yourself or seek help from bailiffs. If the question arose during the court hearing, then representatives of Themis will help calculate the value of the debt. The procedure involves, most often, an appeal to the FSSP: alimony is assigned, a writ of execution or a bilateral agreement between the parties is notarized, but the payer violates the terms of a judicial act or agreement.

Application to bailiffs (sample)

To calculate the debt, it is enough to submit an application to the bailiffs. Based on a written request, they will carry out calculations as soon as possible. The application must indicate:

- Enforcement case.

- The reason for the application is lack of payments, debt.

- Please calculate the debt at the time of application.

You can read more about writing an application to the bailiff for the calculation of alimony debt in a special article prepared by our editors.

The amount of alimony, the terms of its payment and other information may not be indicated. All this data is in the file of enforcement proceedings, the details of which are indicated in the application. document can be found here.

The procedure for calculating arrears of alimony based on the average salary

Child support arrears can be calculated based on the average salary in the country. This occurs in cases where the debtor is unable or unwilling to provide documents confirming his income. And at the same time, there are reasons to believe (for example, based on the application of the alimony recipient) that he has income, but it was received unofficially (“in an envelope”).

The calculation is based on the official national average salary. The percentage corresponding to the alimony deductions determined in the agreement or ordered by the court is calculated. The resulting figure is multiplied by the number of months in which alimony was not paid.

Since the average salary in the country, like the minimum wage and minimum wage, is a moving indicator and is updated once a quarter, the alimony debt must also be recalculated every quarter.

Example

The alimony awarded by the court to the father of two children amounted to 33% of his monthly salary. However, for 7 months the alimony payer did not make transfers and refused to provide the bailiff with a certificate of income.

When calculating the debt, the bailiff has the right to rely on the official indicator of the average salary in the Russian Federation (for the second quarter of 2019 it is 47,700 rubles) or a similar regional indicator (which may be more or less).

If the all-Russian indicator is taken as a basis, the formula is similar to that used when calculating debt for official salaries, with the exception of the deduction of personal income tax. That is:

Average salary X % of deductions X months of non-payment

47,700 X 1/3 X 7 = 110,187 rubles

Reasons for debt

Any debt cannot arise out of nowhere; there are always certain reasons. Thus, the accumulation of debt for alimony payments can occur:

- Due to the payer's fault.

- Not through the payer's fault.

So, in the first option, the debtor knows and understands perfectly well that he has an obligation to pay alimony, which must be carried out according to the established rule. Nevertheless, it consciously takes actions to evade this responsibility. For example, a person may hide his real address of residence, as well as his official place of work, from the executive authorities and the collector.

Naturally, for such behavior a person will be held accountable in the future, in accordance with current legislation. Thus, persistent non-payers of alimony may well be subject to criminal liability.

As for the reasons belonging to the second group, they are not so common. We are talking about those circumstances that occur through no fault of the person. These could be, for example, mistakes made by an accounting employee. In this case, all responsibility will rest with the accountant. It is also quite possible that the person who is charged with paying alimony is seriously ill, and therefore all financial resources are spent on treatment, and not on the maintenance of the child.

Another reason could be the death of the person paying the alimony. However, if there is a payment debt, the heirs of the deceased debtor are obliged to pay it. This is carried out only if a corresponding court decision is made in the case.

There is also an option in which arrears in alimony payments arise due to the claimant. This can happen if the recipient of alimony untimely provided the bailiff with a document for collection. In any case, no matter what causes the accumulation of arrears in child support for a minor child, the debtor is obliged to pay it off in any case.

Application for arrears of alimony. Sample application

The point of monthly alimony is precisely its regular payment. Therefore, as soon as the month has ended, during which the due payments have not been received, we can already talk about debt.

The only exceptions are cases specifically stipulated by the parents in a voluntary agreement. According to the general rule, the legal concept of “delay in payment of alimony” does not exist in Russia. If they are not paid on time, it is a debt.

However, in practice, neither bailiffs, nor even alimony recipients themselves are in a hurry to act in the first month or two. And in vain. Because the more the debt grows, the more difficult it is to collect it in practice. Therefore, if the bailiff conducting your enforcement proceedings does not take his own steps to settle the debt, you should “push” him. That is, write a statement demanding to do this.

The filing of such an application is regulated by Article No. 50 of the Federal Law-229. There is no special form provided. The application should be written in free form in accordance with the requirements for business documentation:

- “Header” at the top of the page on the right, where it is indicated to whom and from whom the application is being submitted

- Heading by

- Below is a summary of the essence of the case (when the receipt of alimony stopped and your demand to calculate the resulting debt)

- Submission date and personal signature

The document itself can be printed, but the signature must be written by hand. However, you can write the entire statement by hand, directly in the presence of the bailiff. He will tell you what and how to write.

If it is more convenient for you to prepare everything in advance and come to the FSSP with a ready-made “paper”, find a sample on the Internet or go to the Prav.io portal.

Prepare two identical copies. One will remain with the bailiff, the second will be returned to you with a note that the application was accepted on such and such a day.

Arbitrage practice

The case was heard in the Teuchezhsky District Court of the Republic of Adygea in November 2021.

The plaintiff put forward the following demands to the court:

- Admit that the decision made by the defendant is unreliable, since the calculation of the debt was carried out on the basis of false information.

- Cancel the resolution and oblige the bailiff to conduct a recalculation.

The defendant stated that the calculation was made correctly, and the plaintiff did not provide documents that would confirm the timely payment of alimony.

During the hearing, the judge found out:

- The magistrate, who decided to collect alimony from the administrative plaintiff, ruled that it should be paid in a fixed amount equal to 2,700 rubles monthly.

- The defendant violated the applicant’s rights by calculating his debt using a different calculation method, namely as a share of the applicant’s salary.

- The ex-wife (claimant) submitted 2 applications to the court, which indicated different amounts of the administrative plaintiff’s debt, which suggests that she does not know about the actual amount of the debt.

- The defendant did not take into account the fact that the plaintiff provided him with a bank statement clearly proving that alimony had been paid.

- The plaintiff has evidence that he transferred alimony to the account indicated to him by the bailiff.

This evidence was sufficient for the defendant's arguments to be rejected and the case to be resolved in favor of the plaintiff.

Calculation of debt by a bailiff. Resolution on debt calculation

The FSSP bailiff is obliged to process your application within 10 days. And issue a decree on collection. He must provide information about the amount of debt to both the alimony recipient and the alimony payer. And also send copies of the resolution to both parties. No later than the next day after it is issued.

The amount of the debt may be indicated in the resolution, or it may be drawn up in the form of a separate additional document (appendix). The resolution itself contains the following information:

- Full name and other necessary data of the alimony payer and alimony recipient

- On what basis was the debt calculated (for example, an application from the recipient of alimony)

- The period during which payments were not made and for which the calculation was made

- The method by which the amount of debt was calculated (from among those that we wrote about in previous sections)

- The total amount of alimony debt incurred

Copies of the decision received by both parties can be used by each of them to apply to the court.

The recipient of the alimony can attach it to the claim for debt collection (this is not necessary, but will serve as indisputable evidence of the existence of the debt). And also demand from the court to increase the amount of recovery by paying a penalty or additional indexation, if during the trial the “moving” indicators have changed upward.

The alimony payer, in turn, can go to court with data on the calculation of the debt and a request to reduce its size, and the amount of alimony payments in general, if he has legal grounds for this. These may be loss of incapacity (disability) or a serious change in financial situation (for example, the birth of a disabled child or the need to support elderly parents).

Regulatory framework

| Laws | Articles |

| Family code | Article 113 describes the methods by which alimony debt is determined. Article 114 establishes the grounds on which a defaulter may be exempt from paying alimony debt. Article 115 establishes the forms of liability of the defaulter to the alimony recipient. Article 117 establishes the rules for indexing alimony benefits in a fixed amount. |

| Code of Administrative Procedure | Chapter 22 describes how a citizen can appeal the actions of a bailiff in court. |

| Tax Code (Part 2) | Article 333.19 establishes the amount of state fees that the plaintiff must pay before going to court. |

Release from alimony debt

The law provides for the possibility for the debtor to reduce the amount of alimony debt, or to be completely released from it. We have already briefly described in the previous section what may be the reasons that the court will consider convincing and valid. Let's sum them up:

- Serious illness or disability

- Change in marital status involving additional dependents

- Difficult financial situation of the alimony payer (resulting from the above events)

If there are circumstances insurmountable for the alimony payer that prevent him from fulfilling his alimony obligations to the same extent, the court may write off the debt, in whole or in part. And also reduce the amount of previously assigned alimony.

If the court makes such a decision, a new writ of execution is sent to the FSSP, and the bailiffs must review the amount of the debt in accordance with the court decision.

Possibility of reduction, cancellation of obligation

In relation to alimony for the maintenance of a former spouse, the court has the right to impose a limit on the amount and period of payment, as well as completely cancel the assistance if the following conditions are met (Article 92 of the RF IC):

- The recipient's crisis situation has developed as a result of alcohol abuse, drug abuse, and the commission of an intentional crime.

- If the family union was short-lived.

- When the claimant, while married, led an immoral lifestyle and caused harm to the life and health of the spouse.

According to Art. 114 of the RF IC, the debtor may be fully or partially released from the alimony obligation, including debt, by agreement of the parties to the relationship. The exception is child support for minor children. The debtor has the right to petition the court to cancel the existence of the debt in full or its share if he proves the absence of intent and personal interest.

The debtor can count on cancellation of debt payments subject to certain conditions

For example, the defaulter lost his job, got sick and stopped paying current alimony payments. The wife turned to the bailiff and demanded that the debt be accrued for the period of lack of payments based on the average earnings in the region. The debtor applied to the court to review the debt due to his inability to work and was released from a significant part of the obligation.

We list several possible reasons for revising the amount of alimony arrears:

- Significant deterioration in the debtor’s health, up to the assignment of disability.

- A child who has reached the age of sixteen receives income from independent labor or entrepreneurial activity.

- When a minor owns property received by inheritance or gift, and rents it out for temporary use to other persons for a fee.

- An additional dependent appears in the debtor's family (a child is born, a spouse or parents become disabled).

- Total demands for similar penalties lead to a reduction in the minimum income of a citizen to a critical level.

- The debtor's innocence in the formation of the debt has been proven.

- The amount of the obligation was determined in violation of the law.

- The minor has been transferred to state support, etc.

There are predisposing situations that give the right to reduce the amount of payments

Appealing a decision on the calculation of alimony arrears

Also, both parties can appeal the bailiff’s decision on the calculation of alimony by filing a complaint with his superiors (senior bailiff). This must be done within 10 days from the moment it became known about a particular violation.

Most often, alimony payers who have reason to believe that the calculation was made incorrectly resort to the appeal procedure. Or those in respect of whom the bailiffs committed one or another illegal action in the process of debt collection.

But in principle, any interested party has the right to appeal the actions or calculations of the bailiff - both the alimony payer and the alimony recipient.

If you still have questions about calculating alimony debt, qualified family lawyers of the Prav.io portal will answer them at any time.

If you need “live” legal assistance for debt collection in court, on the portal you will find a lawyer who has judicial experience in this area and can help you achieve your goal.

Document requirements

Depending on the chosen path for resolving claims against the amount of debt, the requirements for documents and applications will be different, depending on the place where the appeal is filed.

Application for recalculation of alimony (sample)

: Claim for recalculation of alimony debt for the past period (29.5 KiB, 425 hits)

Statement of claim to change the procedure for paying alimony and collecting alimony in a fixed amount (43.5 KiB, 252 hits)

The procedure for contacting a bailiff is of a declarative nature. For a sample application for recalculation of alimony debt, there are standard requirements for the execution of written documents to official bodies indicating the official to whom the interested party is applying and the presence at the end of a signature with the date of preparation.

A sample application for recalculation of alimony must contain:

- Information about the employee the applicant is contacting.

- Details of the person who applied.

- Information about the issuance of the current writ of execution.

- Description of the circumstances under which the rights of the applicant were violated.

- The wording of the requirements to recalculate alimony payments, with documentary evidence of the right to do so.

The bailiff considers requests not only from recipients of payments, but also from payers, if they do not agree with the current collection procedure. This happens if there are errors in the work of the bailiff, when an inflated amount is assigned for write-off, which does not comply with the norms of the law on maximum permissible deductions.

Work on recalculating new amounts is carried out quarterly, and the result of such a calculation will be a resolution to determine the current payment amount.

Complaint about the bailiff's work

Sometimes the work of FSSP employees causes complaints from both sides of the collection. Recipients complain about incorrect calculations and lack of proper attitude towards the work being performed. The payer can appeal the actions of the bailiff, qualifying them as a violation of legal human rights.

The requirements for a claim to hold a bailiff accountable for negligent attitude towards work comply with the norms of the Code of Civil Procedure of the Russian Federation, indicating the details of the parties, a description of the situation and the formulation of requirements based on the law. A complaint against a bailiff must include information about the official’s unlawful actions or refusal to recalculate alimony for the past period within its competence.

The actions of the FSSP representative can be challenged if no more than 10 days have passed since the decision was made. Since the places of residence of the recipient and the payer of alimony often do not coincide, it is necessary to take into account the place of application - this should be the district court at the location of the FSSP department where the defendant works. The trial takes quite a long time - consideration of the claim takes up to 2 months, and if new circumstances are discovered, the period is extended to 3 months.

Application for recalculation of alimony in court (sample)

In preparation for the trial, the plaintiff draws up a statement, adhering to the sample provided in court, based on the main requirements for such documents.

: Claim for recalculation of alimony debt for the past period (29.5 KiB, 425 hits)

According to Art. 131-132 of the civil procedural legislation, the mandatory details of the document are:

- exact name of the court;

- details of the parties (plaintiff and defendant);

- cost of claim;

- document's name;

- main content describing the reasons for the revision;

- clarification of the circumstances that affect the need and right to change the amounts;

- references to legislation;

- the wording of the plaintiff’s demands to determine the amount of alimony with recalculation;

- list of applications;

- signature with transcript and date.

Success in the consideration of the case depends on the competent substantiation of the claim and the provision of legislative references. The documents attached to the claim are no less important, because the court, when considering the case, will rely on the presented documentary base for a specific case.

Attached documentation

Along with the claim, a list of attached documentation is submitted to the court:

- a copy of the statement of claim for the defendant;

- a check or other payment document confirming payment of the state duty;

- a copy of the document being executed by the FSSP department;

- salary certificates from both sides;

- documents on marital status and family composition;

- the current resolution of the FSSP on calculating the amount of alimony debt;

- other documentation confirming the plaintiff’s position.

When submitting prepared documents along with the claim, you must be prepared to request additional information, as well as to present evidence from the defendant, on which the court will rely when hearing the positions.